List of ten commonly asked question of micro credit with answers.

Q. 1. What is Micro Credit?

Ans. Micro Credit is defined as provision of thrift, credit and other financial services and products of very small amount to the poor in rural, semi-urban and urban areas for enabling them to raise their income levels and improve living standards. Micro Credit Institutions are those which provide these facilities.

Q. 2. What are the interest rates applicable?

Ans. The reform of the interest rate regime has constituted an integral part of the financial sector reforms initiated in our country in 1991. In consonance with this reform process, interest rates applicable to loans given by banks to micro credit organizations or by the micro credit organizations to Self-Help Groups/member-beneficiaries has been left to their discretion. The interest rate ceiling applicable to direct small loans given by banks to individual borrowers, however, continues to remain in force.

Q. 3. What are the terms & conditions for accessing micro credit?

Ans. Banks have been given freedom to formulate their own lending norms keeping in view ground realities. They have been asked to devise appropriate loan and savings products and the related terms and conditions including size of the loan, unit cost, unit size, maturity period, grace period, margins, etc. Such credit covers not only consumption and production loans for various farm and non-farm activities of the poor but also include their other credit needs such as housing and shelter improvements.

Q. 4. What is a Self-Help Group (SHG)?

Ans. A Self-Help Group (SHG) is a registered or unregistered group of micro entrepreneurs having homogenous social and economic background voluntarily, coming together to save small amounts regularly, to mutually agree to contribute to a common fund and to meet their emergency needs on mutual help basis.

The group members use collective wisdom and peer pressure to ensure proper end- use of credit and timely repayment thereof. In fact, peer pressure has been recognized as an effective substitute for collaterals.

Q. 5. What are the advantages of financing through SHGs?

Ans. An economically poor individual gain strength as part of a group. Besides, financing through SHGs reduces transaction costs for both lenders and borrowers. While lenders have to handle only a single SHG account instead of a large number of small-sized individual accounts, borrowers as part of a SHG cut down expenses on travel (to & from the branch and other places) for completing paper work and on the loss of workdays in canvassing for loans.

Q. 6. What role does a Non-Governmental Organisation (NGO) play in provision of Micro Credit?

Ans. A Non-Governmental Organisation (NGO) is a voluntary organization established to undertake social intermediation like organizing SHGs of micro entrepreneurs and entrusting them to banks for credit linkage or financial intermediation like borrowing bulk funds from banks for on-lending to SHGs.

Q. 7. What are the latest Micro Credit disbursement indicators?

Ans. With a view to facilitating smoother and more meaningful banking with the poor, A pilot project for purveying micro credit by linking Self-Help Groups (SHGs) with banks was launched by NABARD in 1991-92 with a view to facilitating smoother and more meaningful banking with the poor. RBI had then advised commercial banks to actively participate in this linkage programme. The scheme has since been extended to RRBs and co-operative banks.

The number of SHGs linked to banks aggregated 4,61,478 as on March 31, 2002. This translates into an estimated 7.87 million very poor families brought within the fold of formal banking services as on March 31,2002. More than 90 per cent of the groups linked with banks are exclusive women groups. Cumulative disbursement of bank loans to these SHGs stood at Rs. 1026.34 crores as on March 31,2002 with an average loan of Rs. 22,240=00 per SHG and Rs. 1,316=00 per family.

As regards model -wise linkage, while Model I, viz. directly to SHGs without intervention/facilitation of any NGO now accounts for 16%, Model II, viz. directly to SHGs with facilitation by NGOs and other formal agencies amounts to 75% and Model III, viz. through NGO as facilitator and financing agency represents 09% of the total linkage.

While 488 districts in all the states/UTs have been covered under this programme, 444 banks including 44 commercial banks (including 17 in the private sector), 191 RRBs and 209 co-operative banks along with 2,155 NGOs are now associated with the SHG-bank linkage programme.

While the SHG-bank linkage programme has surely emerged as the dominant micro finance dispensation model in India, other models too have evolved as significant micro finance purveying channels.

The other successful models that have emerged are:

(a) An Intermediate Model that works on banking principles with focus on both savings and credit activities and where banking services are provided to the clients either directly or through SHGs;

(b) There is also a Wholesale banking Model where the clients comprise NGOs, MFIs and SHG Federations. This Model involves a unique package of providing both loans and capacity building support to its partners; and

(c) Further, there is an Individual Banking-based Model that has its clients as individuals or joint liability groups. While programme management and client appraisal in this Model may be a challenge, it is best suited to lending to enterprises.

Keeping these validated models for delivery of credit to the poor and the unorganized sector in view, RBI is moving towards a systems perspective for providing effective policy support not only because a number of different institutions, viz. banks, MFIs, NGOs & SHGs are involved, but also because these institutions have very different institutional goals.

With this in view, a series of initiatives is being planned in the coming months for putting in place a more vibrant micro finance dispensation environment in the country where complementary and competitive models of micro finance delivery would be encouraged to co-exist.

Q. 8. Is Foreign Investment allowed in Micro Credit projects?

Ans. Govt. of India vide their notification dated August 29,2000 have included ‘Micro Credit/Rural Credit’ in the list of permitted non-banking financial company (NBFC) activities for being considered for Foreign Direct Investment (FDI)/Overseas Corporate Bodies (OCB)/Non-Resident Indians (NRI) investment to encourage foreign participation in micro credit projects. This covers credit facility at micro level for providing finance to small producers and small micro enterprises in rural and urban areas.

Q. 9. What is the Micro Finance Development Fund?

Ans. There is an urgent need for micro credit providers to shift from a minimalist approach – that is offering only financial intermediation – to an integrated approach to poverty alleviation taking a more holistic view of the client including provision of enterprise development services like marketing infrastructure, introduction of technology and design development.

In this context, the setting up of the Micro Finance Development Fund marks an important step. Pursuant to the announcement of Union Finance Minister in his budget speech for the year 2000-01, this Rs. 100 crore Fund has been created in NABARD to support broadly the following activities: (a) giving training and exposure to self-help group (SHG) members, partner NGOs, banks and govt. agencies; (b) providing start-up funds to micro finance institutions and meeting their initial operational deficits; (c) meeting the cost of formation and nurturing of SHGs; (d) designing new delivery mechanisms; and (e) promoting research, action research, management information systems and dissemination of best practices in micro finance.

This Fund is thus expected to address institutional and delivery issues like institutional growth and transformation, governance, accessing new sources of funding, building institutional capacity and increasing volumes. RBI and NABARD have contributed Rs. 40 crore each to this Fund. The balance Rs. 20 crore were contributed by 11 public sector banks.

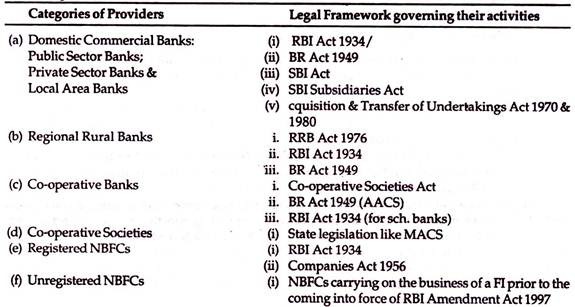

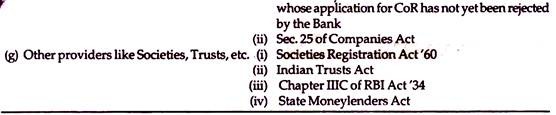

Q. 10. How many types of micro credit providers are there in India and what is the present legal framework governing them?

Ans. The position is as under: