This article throws light upon the top seven credit instruments of a bank. The instruments are: 1. Cheque 2. Hundi 3. Bank Draft 4. Bill of Exchange 5. Promissory Note 6. Trade Bills 7. Accommodation Bills.

Credit Instrument # 1. Cheque:

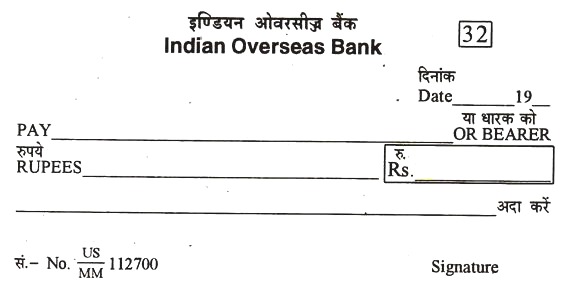

According to Section 6 of the Negotiable Instrument Act, 1881, “A cheque is a bill of exchange drawn upon a specified banker and payable on demand.”

From this definition, it is clear that a cheque is a bill of exchange, but it has the following two additional qualifications:

(i) It is always drawn on a specified banker, and

ADVERTISEMENTS:

(ii) It is always payable on demand.

In essence, a cheque may be defined as a written order, signed by a customer of a bank, directing the bank to pay on demand out of his (the customer’s) account a stated sum of money to or to the order of a specified person, or to bearer.

Essentials/Characteristics of a Cheque:

1. A cheque must be in writing.

2. Cheque is an order on a specified bank to pay the amount.

ADVERTISEMENTS:

3. The order to pay the amount must be an unconditional order.

4. A cheque is always drawn on a banker.

5. It must be signed by the drawer.

6. The amount ordered to be paid by the bank must be certain.

ADVERTISEMENTS:

7. It is always payable on demand without any days of grace.

8. A cheque requires no acceptance.

9. A cheque to be valid must be made payable to, or to the order of a certain person or to the bearer of the instrument.

10. A cheque may be crossed.

ADVERTISEMENTS:

Parties to a Cheque:

There are three parties to every cheque: (i) drawer, (ii) drawee, and (iii) payee.

i. Drawer:

The drawer is the person who signs the cheque ordering the bank to pay the amount.

ADVERTISEMENTS:

ii. Drawee:

The drawee is a bank on which cheque is drawn.

iii. Payee:

The payee is a person to whom the sum of money expressed in the order is payable. Sometimes drawer and payee are the same person.

ADVERTISEMENTS:

Dishonour of a Cheque:

The banks may refuse payment or may dishonour a cheque in the following cases:

1. When there are insufficient funds to the credit of the drawer.

2. When the cheque is post-dated and is presented before the date it bears.

ADVERTISEMENTS:

3. When a cheque is not duly presented, e.g. presented after banking hours.

4. When the signatures of the drawer do not tally with the specimen signatures.

5. When the cheque is presented at a branch where the customer has no account.

6. When the amount in figures and in words does not tally.

7. When the cheque is mutilated, ambiguous, irregular or otherwise materially altered.

8. When the cheque is not presented within 6 months of the issue of the cheque.

ADVERTISEMENTS:

9. When some persons have joint account and the cheque is not signed by all jointly or by the survivors of them.

10. When a cheque is crossed and not presented through a bank.

Types of Cheque:

There are two types of cheques:

(i) Open cheque, and

(ii) Crossed cheque.

(i) Open Cheque:

ADVERTISEMENTS:

A cheque, which is payable in cash across the counter of the bank, is called an open cheque. If its holder loses it, its finder may go to the bank and get the payment. In order to avoid the losses incurred by open cheques getting into the hands of wrong parties the custom of crossing was introduced.

(ii) Crossed Cheque:

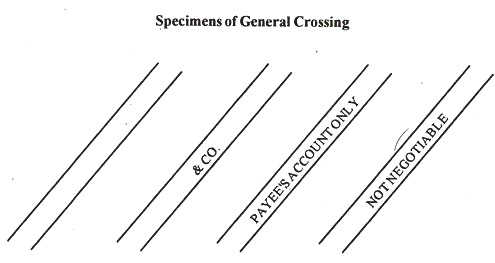

A crossed cheque is one on which parallel transverse lines with or without the words ‘& Co.’ are drawn. A crossing is a direction to the paying banker to pay the money generally to a banker or a particular banker, as the case may be, and not to pay to holder across the counter. The crossing provides a protection and safeguard to the owner of the cheque. Crossing does not affect the negotiability of a cheque, except where the words ‘not negotiable’ are added.

Types of Crossing:

There are two types of crossing:

ADVERTISEMENTS:

(a) General Crossing, and

(b) Special Crossing.

a. General Crossing:

General crossing implies simply putting two parallel transverse lines on the face of a cheque. Some words like ‘& Co.’, ‘Not Negotiable’ may be inserted in these lines. If a cheque is crossed generally, the paying banker shall pay only to a banker.

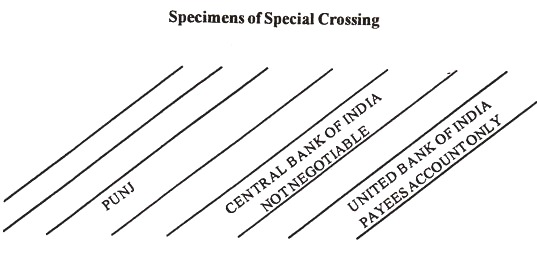

b. Special Crossing:

ADVERTISEMENTS:

Where a cheque bears across its face an addition of the name of a banker, either with or without the words ‘Not Negotiable’ the cheque is deemed to be crossed specially. The payment of a specially crossed cheque can be obtained only through the particular banker whose name appears between the lines. Transverse lines are not compulsory in case of a special crossing.

Endorsement of a Cheque:

Endorsement means signing at the back of instrument for the purpose of negotiation. The act of signing a cheque, for the purpose of transferring it to someone else, is called the endorsement of cheque. Under the Negotiable Instruments Act, the term endorsement means writing the name of a person on the back of the instrument with the intention of transferring the rights therein.

The person who endorses the cheque is called endorser. The person to whom the cheque is endorsed is called endorsee.

The endorsement is usually made on the back of the cheque. If no space is left on the cheque, the endorsement may be made on a separate slip to be attached with the cheque.

Kinds of Endorsement:

ADVERTISEMENTS:

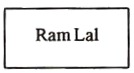

1. General or Blank Endorsement:

An endorsement is said to be general or blank if the endorser simply puts his signature on the instrument without specifying the endorsee. For example, if a cheque is payable to Ram Lai or order and Ram Lai endorses the cheque by simply putting his signature, it is a general or blank endorsement, as:

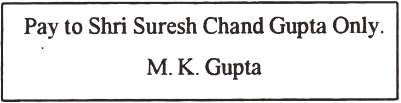

2. Complete or Special Endorsement:

When the endorser adds a direction to pay the amount mentioned in the instrument to, or to the order of a specified person and signs it, the endorsement is said to be ‘complete’ or ‘special’.

For example:

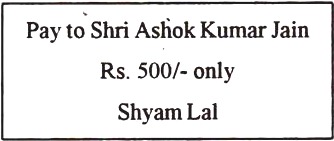

3. Restrictive Endorsement:

A restrictive endorsement is one where the endorser restricts further negotiation of the instrument.

For example:

4. Partial Endorsement:

A partial endorsement is one where the endorsement is made for a part of the amount of instrument.

For example:

5. Sans Recourse Endorsement:

If the endorser wants to avoid his liability as endorser he can do so by adding appropriate words at the time of endorsement.

For example:

(i) ‘Pay X or order sans recourse’, or

(ii) ‘Pay X or order without recourse to me’, or

(iii) ‘Pay X or order at his own risk’.

6. Conditional or Qualified Endorsement:

A conditional endorsement is one when the endorser inserts some condition in his endorsement.

For Example:

‘Pay A or order on his marriage’ is an example of conditional endorsement.

Bearer Cheque:

A ‘bearer cheque’ is one which is payable to its bearer or holder who presents it to the bank for the payment. In such cheques, the word ‘bearer’ is written after the name of the payee. A bearer cheque is transferable merely by delivery. The drawee bank need not take any pains to get the identification of person to whom the payment is being made. It need not be endorsed.

Order Cheque:

An ‘order cheque’ is one which is payable to the person named in the cheque or to his order. In such cheques, the word ‘order’ is written after the name of the payee. It is not transferable merely by delivery.

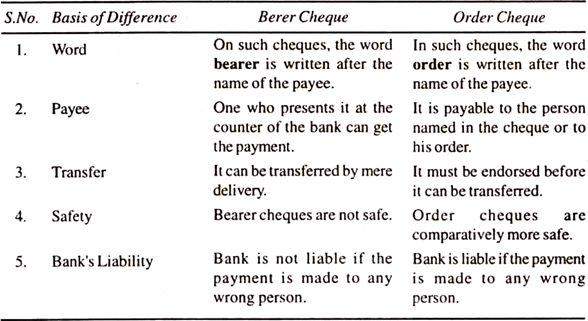

Difference between Bearer Cheque and Order Cheque:

Credit Instrument # 2. Hundi:

A hundi is almost an Indian bill of exchange, which has been in use since time immemorial. It is the oldest surviving form of credit instrument in India.

A hundi may be defined as “A written order, usually unconditional, drawn by one person on another for payment on demand or after a specified time of a certain sum of money, to a person named therein.”

A bill of exchange is always unconditional, but a hundi is sometimes conditional, e.g., Jokhami Hundi.

Types of Hundis:

Some of the important hundis used in India are discussed below:

1. Namjog Hundi:

A hundi payable to a specified person named in the hundi is known as Namjog Hundi. It can be negotiated by endorsement and delivery.

2. Shahjog Hundi:

A shahjog hundi is one which is payable to or through a Shah. Shah means a respectable person in the market. It is like a crossed cheque.

3. Dhanijog Hundi:

A dhanijog hundi is one which is payable to the person who holds or to the bearer thereof. The word ‘Dhani’ means owner.

4. Firmanjog Hundi:

A firmanjog hundi is one which is payable to order.

5. Darshanhar Hundi:

A darshanhar hundi is one which is payable to bearer.

6. Darshani Hundi:

A darshani hundi is one which is payable at sight or on demand. Darshani hundi is similar to a demand bill.

7. Muddati Hundi:

A muddati hundi is one payable after the expiry of a certain period. This is also called ‘Miadi Hundi’ or ‘Thavani’.

8. Jawabi Hundi:

A jawabi hundi is used for remittance of money from one place to another. It is similar to a money order. The person receiving the money has to send a Jawab (answer) to the remitter showing that he has received the money.

9. Jokhami Hundi:

A jokhami hundi is one which is drawn against goods shipped on the vessel named in the hundi.

According to Justice Baley, “A Jokhami Hundi is in the nature of a policy of insurance, with the difference that the money is paid before hand to be recovered if the ship is not lost.”

It is payable only when the goods reach safely at the destination.

10. Nishanjog Hundi:

This type of hundi is payable only to the person who presents it.

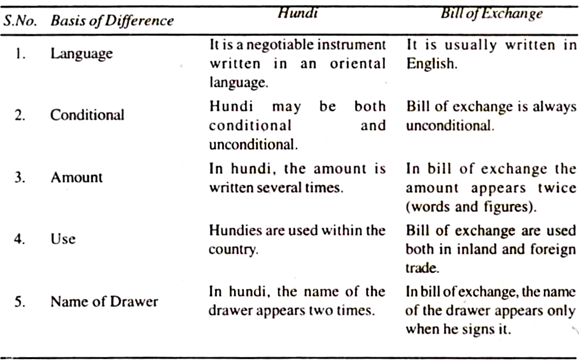

Difference between Hundi and Bill of Exchange:

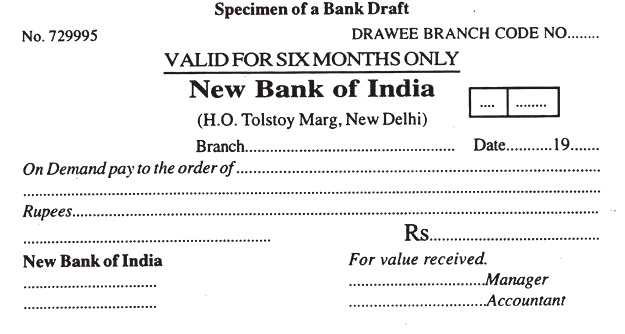

Credit Instrument # 3. Bank Draft:

It is usually drawn by one branch of a bank upon its another branch, instructing the latter to pay a specified amount to payee named therein or to his order. There cannot be any bearer draft. Bank drafts are always payable to a certain payee named in the draft or to his order. They may be crossed like a cheque. Bank drafts are called ‘Demand Drafts’ as they are payable on demand without any days of grace.

Bank draft is the most convenient and economical method for sending money from one place to another. A person who wants to send money, obtains the draft from the bank by paying the necessary amount and the bank commission. He sends the draft to the payee by post. He (payee) presents the draft in the concerned branch and get the payment.

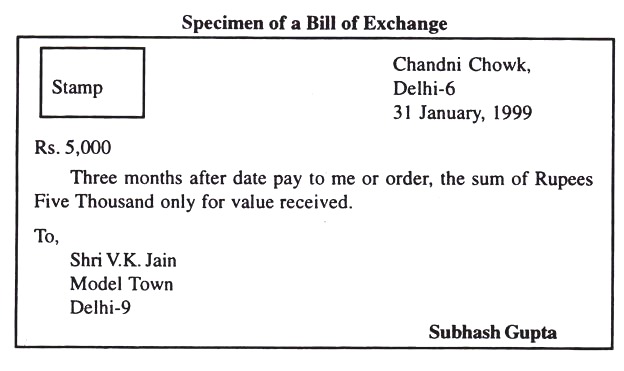

Credit Instrument # 4. Bill of Exchange:

It is an important part of negotiable instruments used both in inland and overseas trade. Its use has increased manifold due to expansion of trade and commerce.

According to Negotiable Instruments Act, 1981, “A ‘bill of exchange’ is an instrument in writing and containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.”

Characteristics/Essentials of a Bill of Exchange:

1. It should be in writing.

2. It should contain an order to pay

3. It should have unconditional order.

4. It must be signed by the drawer.

5. It must contain amount of money.

6. All the three parties-drawer, drawee and payee must be mentioned.

7. The bill may be made payable on demand or after specified period of time.

8. It must bear the required revenue stamp.-

Parties to a Bill of Exchange:

There are three parties to a bill of exchange:

1. Drawer:

The maker/writer of the bill is called Drawer. He is generally the creditor.

2. Drawee:

The person on whom the bill is drawn is called Drawee. He is normally the debtor.

3. Payee:

The person who is entitled to receive the amount of bill on its maturity is called Payee. Writer of the bill can be drawer as well as payee of the bill.

Advantages of a Bill of Exchange:

The main advantages of a bill of exchange are:

1. Helps in Enhancing Business:

Those persons who are not in a position to run their business due to scarcity of funds, can run their business by obtaining credit through bills or by discounting the bills from bank.

2. Legal Document:

It is a legal document under Negotiable Instrument Act. And if, after accepting the bill, the drawee fails to pay the amount, the dishonoured bill is sufficient proof for court to decide the liability of the drawee.

3. Negotiable Instrument:

A bill of exchange is a negotiable instrument. So, it can be transferred from one person to another in the settlement of debts.

4. Discounting:

If the holder of the bill needs funds before the due date, he can get money readily by discounting the bill with a bank.

5. Foreign Payments:

The difficulties in payment of foreign debts are also removed by bill of exchange and now trader of one country can very easily make payment to his foreign counterpart.

6. Credit Facility:

A bill of exchange enables a person to buy goods on credit.

7. Easy Transfer of Money:

A bill of exchange provides an easy way of sending money from one place to another.

8. Exact Date of Payment:

By drawing a bill on drawee, the drawer knows that when he is going to receive certain payment. The drawee is also certain about the time of making the payment.

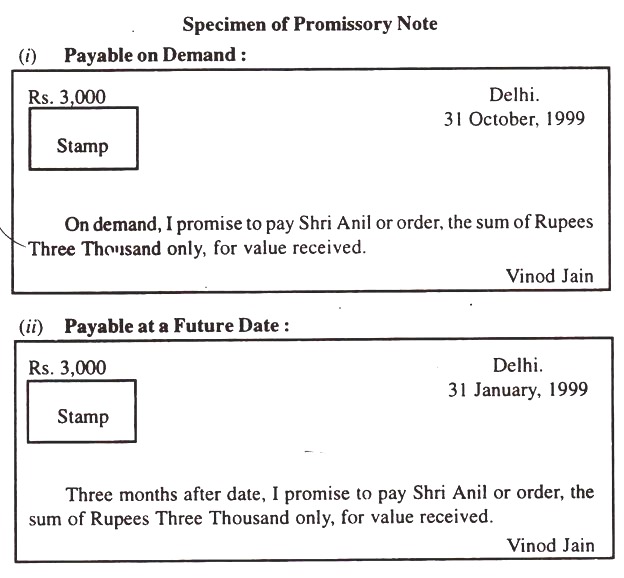

Credit Instrument # 5. Promissory Note:

According to Negotiable Instrument Act, 1881, “A promissory note is an instrument in writing (not being a bank note or a currency note) containing an unconditional undertaking signed by the maker to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.”

Essential Characteristics of a Promissory Note:

1. It should always be in writing.

2. It is always unconditional.

3. It is a promise by debtor to pay.

4. The promise is always for payment of money.

5. It must be signed by the maker.

6. The maker must be a certain person.

7. The payee must be a certain person.

8. The amount of payment under promissory note must be certain.

9. A promissory note must be stamped as prescribed by the Indian Stamp Act.

10. The place, time and date of payment are not essentials of a promissory note.

But usually these are also given in a promissory note.

Parties to a Promissory Note:

1. Drawer/Maker. Drawer is a person who promises to pay the amount stated in the promissory note. He is the debtor.

2. Payee is the person to whom the promise is made for the payment. He is the creditor.

Kinds of Promissory Note:

A promissory note may be made or drawn by one or more than one person and thus it is classified as given below:

1. Simple or Single Promissory Note:

When a promissory note is made or drawn by one person, it is called a simple/single promissory note. The maker of this promissory note is individually liable for the amount.

2. Joint Promissory Note:

When a promissory note is made or drawn by two or more persons, it is called a joint promissory note. The makers of this promissory note are jointly liable for the payment.

3. Joint and Several Promissory Note:

When a promissory note is made by two or more persons and the makers of the promissory note are liable jointly and severally, it is called a joint and several promissory note.

Credit Instrument # 6. Trade Bills:

Ordinarily bills are drawn and accepted for the purpose of receiving or making payments of goods sold or purchased on credit. Such bills, which are drawn for consideration, are known as Trade Bills.

1. Purpose:

It is drawn and accepted for any business transaction.

2. Proof:

It is a proof of debt.

3. Consideration:

Trade bill is drawn and accepted for some consideration.

4. Dishonour:

If this bill is dishonoured, payment can be taken with the help of court.

5. Discounting of the Bill:

If such a bill is discounted with the bank, the whole amount of bill remains the drawer.

Credit Instrument # 7. Accommodation Bills:

Sometimes a bill is drawn and accepted without any consideration. It is drawn and accepted just to help the drawer or both the drawer and the acceptor or raise funds temporarily by getting the bill discounted. A bill drawn without any consideration is known as Accommodation Bill. It is also termed as ‘Kite Bill’ or ‘Fictitious Bill’.

1. Purpose:

It is drawn and accepted to raise funds temporarily.

2. Proof:

It is drawn and accepted for financial help.

3. Consideration:

Accommodation Bill is drawn and accepted without any consideration.

4. Dishonour:

If this bill is dishonoured, payment cannot be taken with the help of court.

5. Discounting of the Bill:

If such a bill is discounted with the bank and the money received is distributed between the drawer and drawee.