After reading this article you will learn about the proforma of balance sheet.

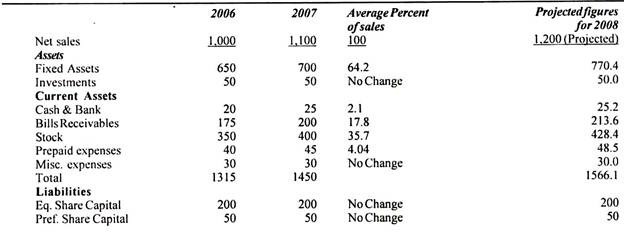

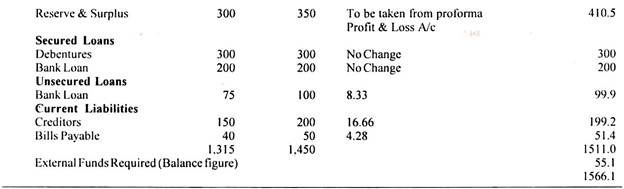

The various items in the balance sheet are also to be projected by either of above two methods but both the methods are to be used in combination.

For example:

(a) Percent of sales method may be applied for all the assets except investments and miscellaneous expenses and losses.

(b) For investment & misc. expenses, the information available is to be followed

(c) Percent of sales may be employed for all the current liabilities.

(d) Reserves and surplus may be projected by adding projected reserve and surplus to previous year’s amount.

(e) Generally the value of equity and preference capital is not to be changed. It remains same in proforma balance sheet.

(f) Loans etc. also remain same in the proforma balance sheet. These are to be changed only if some additional information is given.

(g) If the assets side of proforma balance sheet exceeds the liability side, the balancing item will be shown as ‘external funds required’. If the liabilities exceed assets, the balancing item would be ‘surplus funds available.

This may be made clear by the following example:

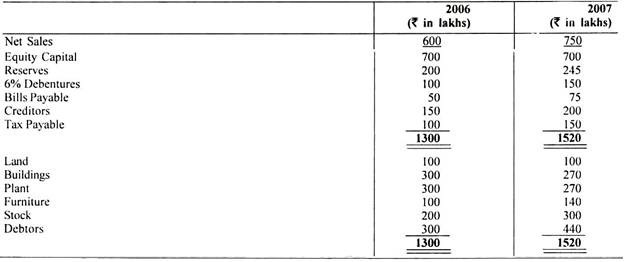

Illustration 1:

Prepare Proforma Balance Sheet from the following information for the year 2008:

Additional Information:

(a) Reserves to increase by Rs. 15 lakhs in the next year.

(b) Sales for 2008 are expected to increase by Rs. 50 lakhs from the sales of last year.

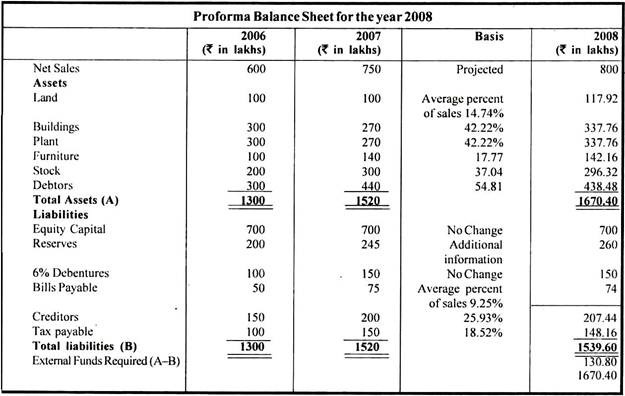

Solution:

Working Notes:

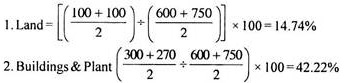

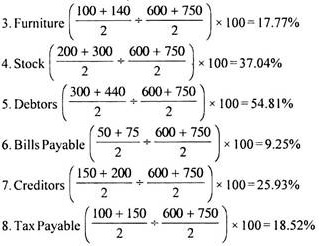

Average Percent of Sales: