After reading this article you will learn about the export procedure for goods in India.

1. Receipt of an Indent or Order:

This is the first step in the procedure of exporting goods. Order may be received either directly from the importer through some specialised agency like indent houses.

The indent will contain details regarding:

(i) Quality of the goods,

(ii) Quantity of the goods,

(iii) Price of the goods,

(iv) Nature of Packing,

(v) Insurance,

(vi) Mode of payment,

(vii) Method and Time of Delivery,

(viii) Means of Transport, etc.

Indents may be either open or closed. In the case of open indents, all the necessary facts are not given by the importer and the exporter has the discretion to complete the formalities with his own skill. In the case of closed indents, full particulars of goods are given.

2. Credit Enquiry:

After receiving the order, the exporter should thoroughly verify the credit-worthiness of the importer. The exporter must ensure about the payment. Usually, the exporter asks the importer to send a ‘Letter of Credit’.

The importer usually may be requested to open an account with the bank in the form of letter of credit. By issuing the letter of credit, the bank agrees to accept the bills of exchange drawn by the exporter upto a specified amount.

3. Export Licence:

Export of goods from India is controlled by Import and Export (Control) Act, 1947. Having received the confirmed order, the exporter will apply to the Chief Controller of Exports for granting him a export licence. If there is no restriction upon the export of such goods, an export licence will be issued in favour of exporter and he can then export the goods to the importer.

4. Collection of Goods:

After receiving the export licence the exporter will collect the goods mentioned in the indent. The goods must be according to the instructions given in the indent regarding the quality of the goods, quantity of the goods, price of the goods, etc.

5. Packing and Marketing of the Goods:

Having collected the required goods, the exporter takes necessary steps in regard to the packing and marketing of the goods. Packing is of special importance in foreign trade. Goods must be securely packed to ensure safety to the goods and economy in freight charges.

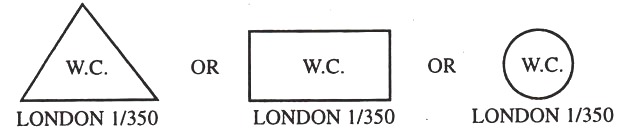

The instructions given in the indent must be taken into consideration while packing the goods. Packed goods are required to be marked suitably for the purpose of identification. It consists of names of the importer and the port of destination written within symbols like triangles, rectangles or circles.

6. Appointment of a Forwarding Agent:

Packed goods may be despatched to the port directly by the exporter or through a forwarding agent. If the exporter lives in the interior, he may appoint a forwarding agent who will perform all the formalities on behalf of exporter in consideration of some commission.

A forwarding agent is an intermediary who renders numerous services to the exporter by way of lifting the goods from the place of business and placing them on board the ship. Forwarding agents attend to all customs details, meet packing requirements, and relieve the exporter of the complications in foreign trade.

7. Despatch of Goods by Rail:

After appointing the forwarding agent, the exporter will despatch the goods by rail to the port town. The exporter will send the R/R (Railway Receipt) to the forwarding agent along with other instructions. The forwarding agent will then take the delivery of the goods and ship them to the importing country having completed necessary formalities.

8. To Obtain the Custom Permit:

The forwarding agent will proceed to obtain the custom permit. He will apply to the custom office giving full details about the goods and also their place of destination for granting him the custom permit. If the goods can be freely exported, then custom permit will be issued to him by the custom office.

9. To Obtain the Shipping Order:

Having received the custom permit, the forwarding agent will like to have a talk with a shipping company of a good repute. If the shipping company agrees to carry the good, then a contract will be entered into between the company and the forwarding agent. The shipping company will now issue to the agent a document, known as Shipping Order which will enable him to put the goods on board the ship.

Shipping order may be of the following kinds:

(i) Ready Shipping Order:

In the case of ready shipping order the name of the ship and the date of departure are given.

(ii) Forward Shipping Order:

In the case of ready shipping order, only the date of departure is mentioned.

10. Export Duty and Shipping Bill:

After receiving the shipping order, there is a provision for payment of export duty. For this, the forwarding agent will fill in three copies of shipping bill of different colours and submit them to the custom house.

These copies contain full description regarding the quality of the goods, quantity of goods, value of the goods, name of the ship, port of destination, marks and numbers, measurement, etc. The custom authorities will calculate the duty charges. On payment of these duties, the custom authorities will return two copies (original and third) of the shipping bill to the forwarding agent.

11. Payment of Dock Dues:

Having made the payments of export duty, the arrangement for carrying the goods to the dock is made. For this purpose, two copies of ‘Dock Challan’ will be filled in and will be submitted to the dock authorities along with one copy each of shipping bill and shipping order.

The dock charges will be charged by the dock authorities. Dock authorities retain one copy of dock challan with them and return second copy duly signed to the exporter or his agent.

12. Loading the Goods:

The dock authorities start loading goods in the ship when it touches the port. Before the goods are actually loaded, some official of custom house will verify the goods and their quantities, etc. The captain of the ship or mate, who is his assistant will receive the goods on board of the ship only when one copy of the shipping bill and one copy of shipping order has been produced before him.

13. Mate’s Receipt:

When the goods have been loaded, the captain of the ship or mate will issue a receipt known as ‘Mate’s Receipt’.

This receipt will contain the following particulars:

(i) Quantity of goods,

(ii) Number of packages,

(iii) Condition of packing, etc.

Mate’s receipt may be of the following two types:

(i) Clean Receipt:

If the mate’s receipt does not contain any adverse remark, it is known as clean receipt. In other words, if there is no defect in packing, a clear receipt will be issued.

(ii) Foul Receipt:

If there is any defect in packing, the mate will note this fact on the mate receipt and such a receipt is known as foul receipt.

14. Bill of Lading:

Having received the mate’s receipt, the forwarding agent will present this mate’s receipt at the office of shipping company and in exchange will get a document called ‘Bill of Lading’.

The forwarding agent has to fill in three blank forms of bill of lading in which he gives the details regarding goods, as:

(i) Name of the ship,

(ii) Place of loading,

(iii) Details regarding goods,

(iv) Destination,

(v) Date,

(vi) Name and address of the person to whom delivery is to be made,

(vii) Freight, etc.

15. Charter Part:

If the goods are to be sent in bulk quantity, then the consignor hires the complete ship. The document issued in relation to such consignment is called Charter Party. Charter Party is an agreement whereby the entire ship or a substantial part of it is hired.

16. Insurance:

In order to safeguard against the marine-risks, it is-necessary to insure the-goods. Insurance should be done according to the instructions of the importer, if any, given in the indent. If there is no such instruction, the exporter himself should insure the goods.

Insurance is usually done for a greater amount than the actual cost of the goods and generally includes a margin of profit (generally 10 per cent of the value of the goods). The insurance policy is sent to the importer along with bill of lading and other documents.

17. Advice to the Exporter:

After performing all the necessary formalities, the forwarding agent will inform the exporter about the shipment of the goods and other things. The forwarding agent will send the insurance policies, bill of lading, shipping bill, etc, to the exporter alongwith a statement showing ‘expenses incurred by him’ and ‘remuneration’.

18. Preparation of Export Invoice and Consular Invoice:

Now, the exporter prepares the invoice of goods sent. This invoice is generally in triplicate according to the terms and conditions of the sale, i.e., on the basis of price quotation sent to the importer. Customs regulations of many countries require Consular Invoice for the purpose of easy clearance of goods at the port of destination in the importing country.

The exporter obtains a special form from the office of consul of the importing country stationed in the exporter’s country. In this form, all the particulars of the goods are entered. The exporter certifies the value of goods and then gets it duly certified by the consul. The custom authorities accept such invoice as a true statement of the value of the goods. The custom authorities charge import duty on this value.

19. Payment:

The exporter can receive the payment for the goods in the following three different ways:

(i) Documentary Bills of Exchanges:

Under this method, the exporter of the goods draws a bill of exchange upon the importer and sends it along with other shipping documents to a banker in the importing country for presenting the bill to the buyer of goods. This bill may be either a D/P or D/A bill of exchange.

In case of D/P (Documents against Payment) bills, documents are to be released by the banker on payment of bills either at the time of presentation or within a specified period. If the buyer fails to make the payment, the banker is authorised to sell the goods on behalf of the exporter.

In case of D/A (Documents against Acceptance) bills, the banker is instructed to hand over the shipping documents to the importer when he gives requisite acceptance on the bill of exchange.

(ii) Bank Advances under Hypothecation of Shipping Documents:

Under this method, the exporter of the goods can get either the whole or an agreed percentage of the value of a shipment by pledging or hypothecating the documents with a banker having branches in the importing and exporting countries. This arrangement amounts to advances made by the banker who realises the amount from the importer.

To cover the risk of non-payment on the part of importer, the banker obtains a letter of hypothecation which gives power to the bank to sell goods in the open market, if required.

(iii) Direct Draft on Bankers:

Under this method, the banker accepts the bill, drawn by the exporter of goods, on behalf of the importer. After acceptance the bill is returned to the exporter who can discount the bill easily.

20. Advice to Importer:

Having handed over the documentary bills to the bank, the exporter of the goods will write a letter to the importer informing him about the despatch of goods and documents of title. A copy of invoice is also enclosed with this letter.