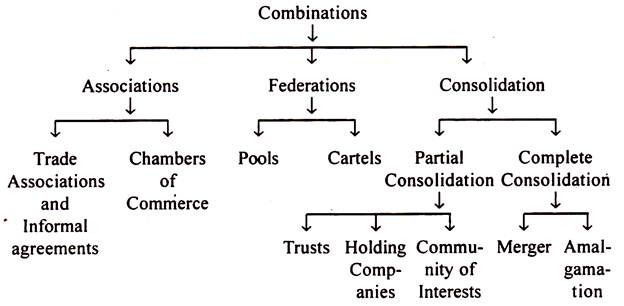

This article throws light upon the three main forms of business combinations adopted by firms. The forms are: 1. Associations 2. Federations 3. Consolidation.

Form # 1. Associations:

These are voluntary organisations of traders and businessmen formed to protect and promote their common interests through collective efforts. They act as self- regulators of trading policies and practices. They act as spokesmen of commercial interests in representation to the Government on all vital matters affecting trade.

Associations are of two categories:

ADVERTISEMENTS:

(A) Trade Association; and

(B) Chambers of Commerce.

Trade associations and chambers of commerce are necessarily the outcome of developments in the field of trade, commerce and industry after the Industrial Revolution.

A. Trade Associations:

“Trade Association may be defined as voluntary organisation for mutual protection or advantage of independent enterprises producing or distributing similar goods or services.” It is an organisation formed to promote the mutual interests of individuals or companies engaged in the same kind of business. Members of a trade association are usually competitors.

ADVERTISEMENTS:

It is a non-profit organisation which attempts to promote the interests of its members. It does not enter into any business transactions on its own account. The name of the association is usually after the nature to business conducted by its members.

It tries to enroll as members all those engaged in the same line of business in a particular region. It does not involve loss of independence of its members who are free to conduct their business as they please.

No member can interfere with the working of other members or member- units. It is essentially “educational in character”.

Thus, it may be defined as a non-profit voluntary organisation of business competitors operating in the same line of business for the promotion of their common economic interests.

ADVERTISEMENTS:

Functions:

Functions of trade associations are usually determined by their constitution embodied in their Memorandum and Articles of Associations. They vary from country to country.

They may be listed as follows:

1. Provision of market information to its members.

ADVERTISEMENTS:

2. Supply of legal advice to its members in matters like customs regulations and factory legislation.

3. Safeguarding of credit and strengthening the hands of their members in collective bargaining.

4. Maintaining technical staff who are constantly engaged in research, testing and standardising the various processes of production.

5. Maintaining trade missions. These trade missions explore the possibilities of new markets and study the causes of the loss or relative decline of old markets in different parts of the world.

ADVERTISEMENTS:

6. Most of these associations form special committees to study the employment situation. These committees scrutinise demands put forth by the trade unions, enforce the agreements reached between employers and employees and undertake survey of ‘labour efficiency throughout the industry’.

7. They collect, compile, analyse and disseminate business and technical information.

8. They engage themselves in legislative lobbying and try to influence legislation by educating public opinion in various ways.

9. Some of the large associations maintain their research sections. The work of the Ahmedabad Textile Research Association (ATRA) deserves special mention.

ADVERTISEMENTS:

10. They supply legal, economic and technical information to their members.

11. They send their representatives to serve on various statutory boards and committees.

12. They try to bring uniformity into the system of cost accounting.

13. It is always advantageous to exchange information about the creditworthiness of customers served by various undertakings. A large number of associations undertake this work.

ADVERTISEMENTS:

14. It is necessary for the manufacturers, wholesalers and retailers to know the changes in the tastes, fashions or buying habits of the consumers.

15. Many trade associations set up central selling agencies and debt collection departments for the benefit of their members.

Organisation and Working:

Trade associations may be registered under the Companies Act or the trade Union Act. They may be formed with or without share-capital. Usually they are formed on the principle of liability limited by guarantee.

In case of an association without share capital, payment of entrance and subscription fees is necessary to become a member. If it is formed with share capital, persons intending to become members have to purchase its shares.

For the regulation of its working Memorandum and Articles of Association of bye-laws are prepared. The Articles of Association or the bye-laws lay down the powers and duties of the office-bearers of the association.

ADVERTISEMENTS:

The administrative set-up of a trade association is similar to that of an ordinary company form of business organisation. The members of the association elect a Board of Directors to supervise the management of the association. The board appoints officers to execute the policies adopted by the association.

Usually, these office-bearers include a president, a vice-president, secretary, and treasurer. The president and vice-president retire at the annual general meeting, but are eligible for re-election. The president usually presides over the meetings. Secretary is the most important executive officer. Generally he is a full-time salaried official.

B. Chamber of Commerce:

A Chamber of Commerce is an association of merchants, financiers, manufacturers and others engaged in business in a particular locality or region for promoting the general commercial interests of all the members.

Chambers of commerce work to protect the interests of their members and foster the growth and development of commerce and industry of the respective regions in which they operate. They are formed to promote and protect general trade interests of all the members irrespective of the kind or class of trade they are engaged in.

Organisation:

In regard to the formation of a chamber of commerce, there is some difference between some of the European countries on the one hand and countries like India, England, the U. S. A. etc. on the other. For example, in France, a chamber of commerce is established by the law and is subject to government control. It is financed by government subsidy or special tax payable by all traders of the district of the region covered by it.

ADVERTISEMENTS:

Contrary to this, in India, England, U. S. A., etc. it is the creation of private initiative and is “purely a private and voluntary institution”. It has no financial resources other than collections through membership dues and small incidental earnings.

Voluntary chambers of commerce are formed in the same way as trade associations. They elect a Board of Directors in the annual general body meeting of the members. The Board elects from among its members a president and a vice-president. The Board also forms various sub committees in charge of different functions or to look after the interests of different traders.

Thus the administrative set-up and working of the chambers follow more or less the same pattern as that of the trade association.

Functions:

Functions of chambers of commerce may be broadly divided into two groups:

(a) Technical and administrative services for the members and the commercial class in general.

ADVERTISEMENTS:

(b) Representation of the business community before the government.

a. Technical and Administrative Services:

It has been said above that in some of the European countries like France chambers of commerce are semi-official organizations whereas in our country and in England, the USA, etc. they are voluntary associations. This difference gives rise to some variation in the functions of the two kinds of chambers as well.

In France, chambers of commerce perform the following technical and administrative functions:

(i) They manage and own stock exchanges, employment exchanges, docks, warehouses, commercial schools, museums and libraries.

(ii) They prepare reports on the development of trade.

ADVERTISEMENTS:

(iii) They issue export certificates and certificates of origin.

(iv) They appoint experts, inspectors, accountants and commercial arbitrators.

Functions of chambers in England, the USA, India etc. are limited in nature, their functions may be summarised as given below:

(i) They provide information on traffic routes and methods of packing for foreign shipping.

(ii) They collect and disseminate information on general trade conditions and the existing and potential markets.

(iii) They help the members in exchanging notes on the credit-worthiness of their customers.

ADVERTISEMENTS:

(iv) They try to secure for the trade improved transportation at lower freight rates.

(v) They act as centres for collecting claims.

(vi) Many of them maintain research establishments.

(vii) They make arrangements for labour supply.

(viii) They try to introduce standardised methods of trade.

(ix) They undertake general publicity work like advertising etc.

(x) They provide for commercial arbitration.

b. Representation of business community before the government:

In France they have “formal contacts” with the government. They send their representatives on the legislative council and other official committees. Government receives from the chambers reports, advice and proposals for enacting any law.

In England, the USA, India etc. chambers approach the government unofficially. They engage in lobbying, try to bring political pressure, send representations and give general publicity to their views on matters pertaining to the commercial interests. All these activities are directed to get a favourable budget, laws etc. passed, or to see that unfavourable legislation does not get the support of the legislature. Thus they function outside the ordinary legislature to influence legislation.

Apart from lobbying and bringing political pressure on the government they perform the following functions:

1. They act as spokesmen of the business community and express their views on such policies of the government as are likely to affect their interests.

2. They make representation to the government against an existing piece of legislation or a proposed legislation and make suggestions for legislation necessary for the promotion and development of commerce and industry.

3. They support candidates for elections to the legislatures.

Special Features of Trade Associations and Chambers of Commerce:

Trade Associations and Chambers of Commerce possess some distinct features of their own.

These distinct features are:

1. Their membership is voluntary.

2. They are non-profit organisations.

3. They do not run any business of their own.

4. Their activities are financed mainly out of the entrance fees and annual subscription fees collected from members.

5. They do not interfere with the internal administration or working of the member-concerns.

Form # 2. Federations:

Federation means association of firms engaged in the same business with a formalised agreement to follow certain policies in common so as to reduce the intensity of wasteful competition in the respective business line. It is, in other words, an alliance of competing firms into a federal framework.

The principle of federation means the federating units, while retaining their identity and autonomy, are bound by a common agreement on one or some aspects of their business policies. In their internal structure, each of the units has full autonomy, independence of decision and action. But in some of their external transactions, they agree to abide by commonly carved out policies or decisions in the collective interest of all of them.

A central organisation is constituted on which certain agreed rights of decisive action are conferred. They may agree to charge uniform price or stick to some price range, or allocate the markets among the members or to regulate production of output by assignment of quotas to the firms so that there will not be over production.

Avoidance of competition, monopolistic control over market, realisation of economies of scale and adjustment of output to demand are also the prime objectives of federal combinations. The rights and obligations of members and powers of the central body of the federation are governed by a definite agreement.

Federations are of two types:

(A) Pools and

(B) Cartels.

A. Pools:

Pool is a horizontal type of combination intended to regulate the market price by collective agreement on factors that influence the price. It is a federal union of competing units handling the same business created and operated in accordance with a specific agreement for mutual benefit. Each firm retains its separate entity. Its autonomy is recognised. But the pool agreement envisages certain working arrangements for the set purposes, such as to share the markets, to restrict the output, control the prices, etc.

The objectives are therefore mainly to exert control over price, regulate production, equitably apportion the market and maximise the profit.

Characteristics of Pools:

1. Union of firms operating in the similar field of business.

2. A written agreement binding on all the federating firms.

3. Retention of distinct identity of the combining firms and autonomy in their internal management.

4. Collective regulation of output or market or centralised disbursement of income or profits.

5. Administrative arrangement through a central organisation to pursue or manage the objectives underlined in the pool agreement.

Types of Pools:

Pools are of different types and may be organised on local, regional, national and world-wide basis. We discuss here some of the main types of pools depending on the nature of the terms contained in the pool agreement.

1. Output Pool:

It is an agreement whereby each member firm is expected to limit its output to a pre-determined quota. The pool organisation estimates the aggregate demand and calculates the necessary output to be produced. Then quotas are allotted to each firm in the pool. No firm is permitted to produce more than the output quota fixed for it. Quota is fixed according to the capacity of the firm, past sales, probable future trends in the market etc.

The basic objective of output pool is to avert over-production and consequent depressing effect on market price. If any firm produces more than the percentage permitted under its quota it has to pay an agreed sum for the excess output into the common pool.

The amount so collected is distributed among those who might have produced less than their quota. Thus the firms are forbidden to increase their output at the expense of the other firms and invade their markets.

Competition is thus eliminated by tailoring of output in respect of every firm. As Beacham puts it “the aim is to restrict aggregate output to a sufficient extent to permit sales at remunerative prices”.

2. Market Pool:

Market pool is concerned with equitable allocation of market territories to the member firms with a view to maximise benefit for each of them.

No firm will be allowed to encroach on the markets of other firms. Thus competitive scramble for markets trying to undercut the other is sought to be avoided by clear- cut assignment of sales jurisdiction to each firm.

Market may be divided product-wise, area-wise or customer-wise. Pool organisation has to carefully and objectively fix the market areas to different firms depending on their past performance, goodwill, nature and quality of their output, proximity of customers, etc.

Unhealthy competition between the firms for capturing wider market at the cost of each other is avoided. Advertising, selling and distributing expenses are reduced. This enable the firms to reasonably increase their selling price and provide better services to customers. Intensive exploration of markets by the respective firms is made possible.

Strong bargaining position almost amounting to monopoly is envisaged for each firm exclusively operating within its market territory. In short, highest net returns are possible to be earned by eliminating cut-throat competition and by well defined working market arrangements.

3. Income or Profits Pool:

The profit or income pool is an agreement whereby the members undertake to contribute to the common pool the profits earned by them. The minimum price is specified as to cover the normal costs of production. The difference between the selling price and minimum price is paid into the central pool. The profits or earnings so pooled are distributed among members after deducting expenses of the pool, in agreed proportion usually based on capital or output.

Since common price is fixed, there would be no severe competition. Even the average and below average firms are assured of some income out of the surplus or profits earned by efficient firms.

4. Traffic Pool:

It is an agreement among transport companies under which certain fare and freight concessions are granted to those who use the transport services of the pool members.

Traffic pools are common mostly among shipping companies. Shipping companies form their “conferences” to fix uniform rates for the cargo of different types. The objective is to avoid undesirable competition.

Association of shipping and transport companies follow another method of assuring themselves of regular clientele under the method known as Deferred Rebate System. Shippers or users of transport services are allowed a specified percentage of rebate, off the freight paid by them during a given period.

This rebate, however, payable only if they continue to use the vehicle of the pool members for a further specified period, i.e., rebate is credited to the shipper’s or user’s account but its actual settlement is deferred to a prescribed period in future. During the period they should have dispatched their cargo by the vessels or vehicles of the pool members to qualify themselves for the rebate.

Thus the transport companies are able to secure ready demand for their fleet because the customers or users tempted by the rebate continue to patronise the services of the pool members. Unhealthy competition is avoided, steady larger demand reduces the overhead costs per operational unit and facilities to customers are better. Traffic pool agreement also implies laying down of common freight and equitable distribution of voyages, flights, etc.

Advantages of Pools:

1. Full internal autonomy is assured to members of the pool while eliminating wastes of competition.

2. They are simple to be formed and flexible in operation.

3. Pools ensure stability in industry and trade by avoiding the tension of competition and uncertainties of markets.

4. Pools enable the members to concentrate on improving the quality of their products or service because they need not be unduly worried about markets, price, profits, etc., as they are governed by common agreement.

Disadvantages of Pools:

1. Output pools may often result in artificial restriction on output to the detriment of customers.

2. Pools have the scope for exploiting the consumers by charging excessive prices and arbitrary curtailment of output flowing into the market.

3. The pool agreements often provide shelter to inefficient firms in the name of avoiding the competition.

4. Pools block the growth or adoption of inventions in order to keep up their strong hold on the market.

5. Management of pool agreement may not be effective as members may clandestinely violate the critical provisions of the agreement.

6. Vigorous competition by the firms which are not the members of the pool may defeat the objectives of the pool agreement.

B. Cartels:

A cartel is an association of independent firms agreeing amongst themselves to regulate their output, divide the market, centralise the sales and determine common pricing policies that would be of maximum benefit to all the members.

Its members are engaged in the same type of business and hence it is formed primarily to root out or limit the inter-firm competition in the particular line of business. It can be described as a syndicate for centralised marketing with the pooling of output contributed by members as per the (cartel) agreement.

Cartels are thus combinations of producers established with a view to moderate the individual risks involved in their business activities by controlling the markets of their products.

Features of Cartels:

1. It is a horizontal business combination, i.e., union of firms engaged in the same business.

2. Its members retain their identity and autonomy in their day-to-day operations.

3. It has a federal character whereby its members agree to abide by common decisions on specified matters taken by the central organisation,

4. Cartel agreement may provide for regulation of output to be produced by the members as per estimated demand potential.

5. Systematic allocation of market on agreed basis among the members.

6. Formation of central agency, that is, syndicate to assemble the output of the member firms and sell them at remunerative prices.

Types of Cartels:

Cartels are associations of firms bound by agreement as to collective regulation of output, pricing, trading terms, marketing methods etc. They have taken different form s ranging from simple price agreement to elaborate centralised selling syndicate. We will briefly deal with the main types of cartels.

1. Term Cartel:

Term cartels refer to agreement between the members for selling the products on uniform terms to be adopted in common. Very often competition between firms becomes keener on the basis of attractive terms quoted for executing the bulk orders from the customers. The terms of sale refer to discount, credit, dispatching, transportation expenses, etc.

Under the simple form of cartel, firms agree to follow commonly arrived at terms of sales so that unnecessary competition between the firms in the same industry is avoided. Avoidance of unfair competition, prevention of under-cutting of prices and possibility of securing remunerative prices for all are the motives behind this type of cartel.

2. Price Cartel:

This agreement provides for fixation of uniform or common prices of goods dealt in by the members. All the member firms agree to follow common price policies so that competition based on price-differential is averted. The entire cartel is likely to get prominent position in the market and may gain monopoly profits.

3. Output Cartel:

This type of agreement aims at limiting the aggregate output to the level of expected market demand. Firms agree to desist from producing more than the specified output so that there will be least possibility of over production. Balance is sought to be established between demand and supply.

Undue price fluctuations are ironed out and firms may concentrate on improvement of quality of the products. There is however the danger that such cartels may deliberately restrict the output and create a scare of scarcity pushing up the market prices arbitrarily to the disadvantage of the consumer.

4. Territorial Cartel and Consumer Assignment Cartel:

Under some cartel agreement, firms may be assigned specific territories for selling their products, or particular categories of consumers may be assigned to certain firms. Thus firms are assured of adequate sales without the fear of competition from other member firms in the line.

5. Syndicate:

The elaborate form of cartel implies the formation of central agency or syndicate for marketing the produce turned out by the members. Each firm has to contribute its output to the syndicate attached to the cartel for a fixed price. The syndicate pools the output and sells the merchandise in the market on remunerative terms.

The syndicate being the bulk-seller with least competition may fix higher prices, discriminate in its price between different markets for the products and thus ensure maximum possible revenue from the sale proceeds. Each member firm is assigned a trade share up to which it can contribute its output to the syndicate.

If a firm has exceeded its trade share, it has to pay a fine and if a firm has fallen short of its share it is given due compensation. But if the firm is totally unable to produce or deliberately refuses to contribute then compensation is not payable.

The syndicate operates in as a wider market as possible. The profits earned by the syndicate are distributed among the members as per their trade share or the proportion of output contributed by them respectively.

Advantages of Cartels

1. Economies in large-scale marketing such as, reduced costs of handling and transporting.

2. In syndicate type of cartelling, bargaining influence in the market is higher. Therefore higher prices and profits may be secured by centralised selling. The desire to reap the advantages of facing buyers with a single seller lies at the root of cartelisation.

3. Since market is guaranteed, the member firm need not bother about sales promotion which is the lookout of the syndicate. It can however focus its efforts on quality improvement.

4. Minimum margin for profit is assured for all the member firms.

5. Adjustment of supply to demand avoids over production and consequent price effects.

6. There is comparatively greater resistance power among the cartel members to withstand the risks of trade cycles.

Disadvantages of Cartels:

1. Cartels tend to purposely restrict the output and starve the market. This creates difficulties for the consumers.

2. The cartels abuse their position and rig up the prices to exploit the consumers.

3. Cartels, under the pretext of eliminating competition, give shelter to inefficient firms.

4. Cartels are reluctant to incorporate new inventions and pass on the consequent benefits to consumers.

5. Cartel being a loose form of federation, its members may violate the terms of agreement and sabotage the agreement.

6. Cartels have also to face competition from firms which are not the members of the cartel.

Form # 3. Consolidation:

Consolidation are of two types. They are:

(A) Partial consolidation and

(B) Complete consolidation

A. Partial Consolidation:

Partial consolidation means coming together of firms under formalised common ownership and control while retaining their separate entity. Obviously their objective is to avoid competition by integrated management of the firms as one unit. We study briefly three types of partial consolidation, viz., Trusts, Holding Companies and Community of Interests.

i. Trust:

Trust is an attempt to evolve a more stable and effective form of business combination to supplant cut-throat competition in different spheres of business. Pools and cartels are loose forms of business combinations wherein autonomous members may at any time withdraw from the agreement or violate the terms of agreement on common policies.

In the USA, the trust movement originated in 1880s as a device to check cutthroat competition and avoid depression arising out of over production in industry. The first trust formed in 1882 was the Standard Oil Company. Similar trusts were formed in sugar, lead, whisky, etc.

Meaning of Trust:

A trust is the partial consolidation of firms either horizontally or vertically or both in order to obtain the benefits of integrated management and centralised control. Trust is usually registered as a general association under Trust Act. Under the trust arrangement, the shareholders of different companies agree to transfer their shares to a Board of Trustees in exchange for trust certificates issued by the Board. These trust certificates represent the equitable interests of the holders in the property, assets and profits of the business entrusted to the charge of the Board of Trustees.

In a simple ‘voting trust’ only the voting rights of shareholders of the companies are transferred to the trustees. But in a ‘combination’ trust all the legal and equitable rights of the shareholders of constituent companies are surrendered to the trustees.

Shareholders in different companies part with their controlling rights and vest them in the hands of one or very few individuals known as trustees.

The trust issues trust certificates to those erstwhile shareholders in recognition of their share in the business. The trust appoints its own representatives on the Boards of Directors of different companies under their charge. The trust chalks out common production, pricing and marketing as well as financial policies for all the companies combined in the trust.

The trust also collects the dividends formally declared by the companies and after deducting the ‘trust expenses’ disburses the net pooled profits to the trust certificate holders in the ratio of values of certificates held by them.

Features of Trusts:

1. Separate identity of companies is formally maintained.

2. Controlling interest of central companies are transferred to a Board of Trustees. This Board actually acts as the top management of the constituent companies.

3. Trusts are registered bodies and they issue trust certificates to the shareholders of the companies who agree to part with their shares.

4. Dividends declared by the companies are pooled together and the net proceeds are distributed among the trust certificate-holders in proportion to their holdings.

5. Trusts may be organised horizontally to avoid competition or vertically to be self-sufficient in all the requirements for keeping up the continuity in production.

Benefit of Trusts:

1. Trusts are more stable form of business combinations to combat competition of wasteful character. “They are meant to strengthen and unify joint action among firms.”

2. Unified management of constituent companies by the Trust leads to scientific planning of production, sales, finance, etc. and more effective control of business operations.

3. Efficient managerial coordination and control are facilitated with all the commercial advantages without affecting the separate legal entity of the component concerns and the dividend rights of the shareholders turned trust certificate holders.

4. Union of several companies under the trust gives wider scope for realising economies of large-scale operations in respect of centralised purchase, bulk-selling, integrated management etc.

5. The trust can scrap the inefficient plants owned by any component unit thus reducing the burden of overhead costs and superfluous installed capacity.

6. Trusts can select and assign standard plants to superior production. Thus quality of product is improved while supply is adjusted to the expected level of demand.

7. Benefits of economies in production and management can be passed on to the consumers in the form of reduced prices and improved quality of the goods.

Limitations of Trusts:

1. There may arise friction and tussle within the trust, i.e., among the constituent firms. Unresolved continuous in-fight may lead to collapse of the entire trust.

2. Trusts lead to concentration of economic power and wealth in few hands.

3. Trusts tend to exploit the consumers by restricting the output and raising the prices without rhyme or reason.

4. It may become hard to effectively manage the business of several component companies,

5. The government is very often compelled to interfere in the business for controlling the trust to protect the interests of consumers. Shermon Anti-Trust Laws in the USA, Monopoly Control in the UK, Monopolies and Restrictive Trade Practices Act in India, etc. are some of the examples.

ii. Holding Companies:

Holding company is a more integrated form of business combination whereby control of several companies is vested in one company through transfer of ownership rights.

Holding company is a company which acquires controlling interest through transfer or direct purchase of shares in other companies. Such other companies are called subsidiary companies.

As per Indian Companies Act, 1956, holding company is one which has its subsidiary. A company is subsidiary of another company (holding company) if that another company controls the composition of its Board of Directors and holds more than half of nominal value of its equity capital. Thus holding company is that which controls the composition of the Boards of Directors of other companies or which holds more than 50 per cent of share capital of other companies.

Types of Holding Companies:

a. Primary Holding Company:

It is at the apex of a complex of different subsidiary companies. It is not however a subsidiary of any other company. In other words, it is not controlled by any other company.

b. Parent Holding Company:

It is an existing undertaking which seeks to consolidate other competing units by organising subsidiaries.

c. Consolidated or Offspring Holding Company:

It is a new company to which a group of existing companies has proposed to transfer bulk of their shares carrying controlling right in exchange of shares allotted by the new company.

d. Intermediate Holding Company:

It is a holding company of another but at the same time it is a subsidiary of some other holding company, i.e., it holds controlling interest in the capital of some companies and its own shares are held by some other holding company.

e. Pure Holding Company:

Its main purpose is to invest in and control the affairs of the other companies. Associated Cement Co. in India is an example.

f. Mixed Holding Company:

It is engaged in some business operations and at the same time holding majority of voting power in the share capital of other companies.

g. Proprietary Holding Company:

It is one which acquires whole of the share capital of the subsidiary company or companies.

iii. Community of Interests:

Community of interests is an arrangement under which control over different companies is exercised by the same group of directors, managers, shareholders without any formal central organisation. Different companies appear to be under separate control but in effect their business policies are all shaped and executed by common directors, managers, etc.

Features of the Community of Interests:

(a) Separate identity of the companies is retained.

(b) The management of the different companies is formally vested in respective Boards of Directors.

(c) Uniform decisions, policies or plans are all made and acted upon for the companies by common managers, directors.

(d) There is no central organisation to control the functioning of the companies, unlike pool or cartel.

Community of Interests is brought about mainly by three devices:

i. Managerial integration

ii. Administrative integration

iii. Financial integration

i. Managerial Integration:

It occurs when a large number of companies are under the same group of managing agents, managers, secretaries and treasurers. Managing Agency System which prevailed in India for several decades was a peculiar form of vertical arid horizontal combination.

A few managing agents promoted, financed and managed numerous companies with assets and business worth crores of rupees. It was revealed that a group of managing agency could control 479 industrial companies.

Twelve Foreign Managing Agents like Birds, Andrew, Nickod, Duncan, Martin Burn, etc. controlled 282 establishments in India. Similarly, leading Indian Managing Agents like Tatas, Birlas, Goenkas, Bangurs also managed a variety of industrial concerns-textiles, tea, sugar, cement, paper, wholesale trade etc. “Institution of Managing Agency afforded a type of organisation which could secure for all the individual limits under its jurisdiction the economies of vertical and horizontal form of expansion without depriving them of their legal and functional independence.”

But due to the malevolent role of managing agents exploiting the workers, consumers and shareholders of the companies under their charge, their desire for tightening their hold over large companies and grabbing excess-remuneration, the system became unpopular. It was totally abolished in 1970.

ii. Administrative Integration:

It means the existence of common directors on the Boards of Directors of several companies. Administrative Policies thus have a common touch to the overall benefit of all the companies comprising the group. This integration is brought about by multiple directorships and interlocutory directorship.

Multiple directorship obviously means that a group of persons holds directorships in many companies. Interlocutory Directorship means interlinking of two or more firms by virtue of common directorships. Due to influence exerted by common directors, concerned companies tend to blend into one another in respect of policies of common interests.

iii. Financial Integration:

It is common that leading industrial houses hold controlling interests in financial institutions like banks, insurance companies, investment trusts, etc. These financial institutions are eventually persuaded or led to lend or invest in allied concerns.

Financial integration is also brought about by inter-corporate investments. Integration of this type in Indian industry is found between different firms engaged in the same business, or firms belonging to different groups or between manufacturing, marketing and financing companies.

iv. Evaluation of Community of Interests:

Community of Interests has helped in plugging the gap of industrial leadership in the country. Existing directors serving on old and new undertakings would solve the immediate problem of finding industrial entrepreneurs.

It ensures autonomy to the concerned units while at the same time economies of large-scale operations through central control are sought to be realised by multiple directorships, financial interlocking, etc. But this system leads to acute concentration of economic power within a handful of directors, managers etc. and the shareholders of the constituent of companies. Monopolistic practice and financial manipulation would also get scope under the devices of community of interests. It acts as a block to the rise of new class of dynamic competent entrepreneurs.

B. Complete Consolidation:

Complete consolidation occurs when two or more concerns combine to transfer their assets and liabilities to a new company or when one company absorbs another concern by outright purchase of its business. Complete consolidation thus means end of separate identity of constituent units and their amalgamation into a single unit.

Complete consolidation is brought about in two forms:

(i) Merger; and

(ii) Amalgamation.

i. Merger:

In merger one company absorbs another company or companies. The absorbing company takes over the assets of the absorbed company and often assumes its liabilities. The identity of the absorbed company is lost since its assets from the property of the absorbing company. The shareholders of the absorbed company are compensated in the form of cash, shares in the absorbing company, etc.

ii. Amalgamation:

It means formation of a new company to take over the assets and liabilities of two or more existing companies. All the constituent companies lose their separate identity and their members get allotment of shares in the new company.

Merits of Mergers and Amalgamations:

(1) This type of business combination achieves total integration of interests with transfer of ownership and management of constituent units. No scope for internal rivalries and frictions is left. Thus complete integration facilitates efficient working of the entire enlarged undertaking. “The combined assets will be managed in such a way as to promote the most efficient working of the whole.”

(2) Unified management results in realisation of administrative economies. There is no need for maintaining separate books, documents, accounts, registered offices and the corresponding separate administrative personnel. Thus expenses of management are saved with mergers of different companies into one unit.

(3) Due to enlarged size, operational economies in respect of production, marketing, financing, etc. are also available.

(4) Duplication of plant, productive equipment etc., is avoided by closing down superfluous plants.

(5) Shareholders of the constituent companies may get higher dividend after merger due to increase in efficiency and economical working of the enlarged undertaking.

Drawbacks/Limitations/Demerits:

1. With the elimination of separate identity of the constituent units, the goodwill associated with their names is lost.

2. Compensation payable to the units absorbed or amalgamated may be high compared to the worth of the assets taken over. This results in over capitalization, watering of stock and financial burden.

3. The increase in the size of the business consequent to consolidation may make the effective management difficult and unwieldy.

4. The spate of mergers and amalgamations spells the danger of monopolistic power leading to exploitation of consumers.

5. Formation of merger depends on the consent of the members of the concerned companies. Terms of valuation of assets, fixation of purchase price, etc. would be difficult to settle.