In this article we will discuss about the process of mergers and acquisitions in a company.

Mergers and Acquisition:

The combining of two or more entities into one, through a purchase acquisition or a pooling of interests is called as merger.

Acquisition:

When one company takes over another and clearly establishes itself as the new owner, the purchase is called an acquisition. From a legal perspective, the target company ceases to exist, the buyer “swallows” the business and the buyer’s stock continues to be traded.

When two firms, often of about the same size, agree to go forward as a single new company rather than remain separately owned and operated, this is called as merger or merger of the equals. “Both companies” stocks are surrendered and a new company stock is issued in its place. For example, both Daimler-Benz and Chrysler ceased to exist when the two firms merged, and a new company, DaimlerChrysler, was created.

But when the deal is unfriendly – that is, when the target company does not want to be purchased – it is always regarded as an acquisition.

Whether a purchase is considered a merger or an acquisition really depends on whether the purchase is friendly or hostile and how it is announced. In other words, the real difference lies in how the purchase is communicated to and received by the target company’s board of directors, employees and shareholders.

Takeover:

Acquiring control of a corporation, called a target, by stock purchase or exchange, either hostile or friendly.

i. Hostile Takeover:

A takeover attempt that is strongly resisted by the target firm.

ii. Friendly Takeover:

Target company’s management and board of directors agree to a merger or acquisition by another company.

Types of Mergers:

1. Horizontal Mergers:

The consolidation of firms that are direct rivals — i.e. firms that sell substitutable products or services within the same geographic market.

Examples:

(a) Daimler-Benz and Chrysler

(b) Lipton India and Brooke Bond

(c) Bank of Mathura with ICICI Bank

(d) BSES Ltd. with Orissa Power Supply Company

(e) Associated Cement Companies Ltd. and Damodar Cement

(f) HDFC Bank and Centurion Bank of Punjab

2. Vertical Mergers:

The consolidation of firms that have potential or actual buyer-seller relationships.

Examples:

(a) Pixar – Disney merger.

(b) Time Warner Incorporated, a major cable operation, and the Turner Corporation, which produces CNN, TBS and other programming software.

3. Conglomerate Mergers:

A merger between firms that are involved in totally unrelated business activities.

There are two types of conglomerate mergers:

(a) Pure conglomerate mergers involve firms involving nothing in common.

(b) Mixed conglomerate mergers involve firms that are looking for product extensions and market extensions.

Examples:

(a) Walt Disney Company and the American Broadcasting Company.

(b) Hindustan Sanitary Ware industries Ltd. and Associated Glass Ltd

4. Concentric Mergers:

It occurs where two merging firms are in the same general industry, but they have no mutual buyer/customer or supplier relationship, such as a merger between a bank and a leasing company. That is the companies are into similar type of business.

Example:

(a) Prudential’s acquisition of Bache & Company.

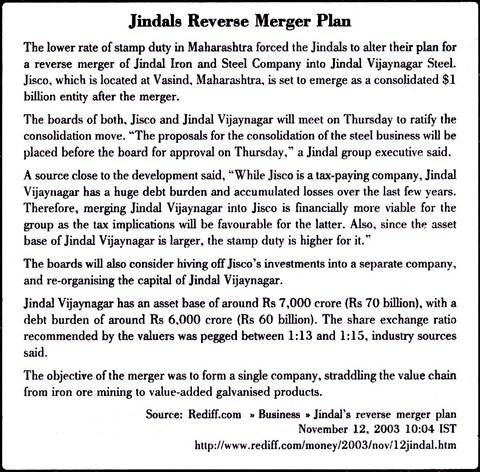

Reverse Merger:

Reverse merge happens when a private company merges with a publicly traded one. In the case of a reverse merger, the new entity becomes public, but the private company still has a say in it. In other words, reverse merger is a way to grow with the help of a public company while surrendering some powers and keeping the rest.

Advantages of Going Public through a Reverse Merger:

(a) Initial costs are much lower and excessive investment banking fees are avoided.

(b) The time frame for becoming public is considerably shorter.

(c) There is no significant regulatory review or regulatory approval for the transaction.

(d) It is relatively easier to raise capital as investors now have a clearly defined exit strategy through the public markets (i.e. stock exchanges on which the Public Ltd. company is listed).

Limitations of Reverse Merger:

(a) There is no capital raised in conjunction with going public.

(b) The stock has limited sponsorship generally trades on a lower level exchange- i.e. may be the OTCEI (Over the Counter Exchange, India) or local stock exchanges.

Joint Venture:

Two or more businesses joining together under a contractual agreement to conduct a specific business enterprise with both parties sharing profits and losses. The venture is for one specific project or period only, rather than for a continuing business relationship as in a strategic alliance.

Examples:

(a) Sony-Ericsson is a joint venture by the Japanese consumer electronics company Sony Corporation and the Swedish telecommunications company Ericsson to make mobile phones

(b) Hero Honda Motors Ltd. is a joint venture between India’s Hero Group and Honda Motor Company, Japan

Reasons for the Failure of Merger:

1. Lack of human integration

2. Mismanagement of cultural issues

3. Lack of communication

4. The value of synergy is overestimated

5. Overvaluation of target company leading to excess payments

6. Poor post-merger integration

Demerger:

Demerger means splitting off a part of an existing company to form a new company, which operates completely separate from the original company.

Example:

Cement division of L&T was demerged into a new company.

Divestiture/Divestment:

Divestiture is the reduction or release of assets for either financial or ethical objectives or sale of an existing business by a firm. A divestment is the opposite of an investment.

Example:

(a) Eastman Kodak, Ford Motor Company, and many other firms have sold various businesses that were not closely related to their core businesses.

(b) Gillette disposed-off its “Geep” carbon zinc battery business, exited the Braun range of appliances and discontinued low-contribution products within its core businesses.

Demerger or Divestiture may take place in the form of spin off, split up or sell off.

i. Spin Off:

When a division or a business of a company becomes an independent business, it is known as spin-off. The independent company takes assets, intellectual property, technology etc. from the existing company. After spin off, the existing company may continue as a holding company and the new company as the subsidiary company.

Example:

Pantaloon retail Ltd. spin off Future Ventures

ii. Split Up:

When a single company is carried into two or more separately run companies, it is called as split up.

Example:

Cabletron Inc. was split into four separate companies:

(a) Enterasys Networks,

(b) Riverstone Networks,

(c) Aprisma,

(d) Global Network Technology Services.

Each would have its own name and chief executive and be independent of others.

iii. Sell Off:

When a company sells its (often non-profit making) divisions, its called as sell off.

Example:

Scooters India and HMT Bearings

Amalgamation:

It is the process where two or more companies dissolve their identity to form a new entity. For example, merger of Brooke Bond and Lipton has formed a new entity called Brooke Bond Lipton India Limited.

Leveraged Buy Out:

It involves takeover of a company or controlling interest in a company, using a significant amount of borrowed capital, say 80-90% of purchase consideration is raised from borrowings.

Example:

Tata & Tetley

Management Buy Out:

In case of management buy-out, the existing management itself purchases the company from the owners of the company.

Example:

Blackstone and Intelenet BPO

Defence against Hostile Takeovers:

A company could opt and implement following defense strategies against unfriendly takeover as listed below:

1. Poison Pills (Shark Repellent):

It is an attempt to discourage an acquisition by making it more expensive to acquire a company, or by reducing the value of the acquired business.

Poison pills may take the following forms:

(a) Issuing convertibles at very low prices to be converted into stocks at below market prices, to be exercised in case of a takeover

(b) Issuing ESOPs to employees and directors immediately exercisable on a takeover

(c) Agreements with customers that include compensation in the event of a takeover (for example, Peoplesoft when subject to a bid by Oracle – ostensibly to compensate customers for the risk that a new owner would discontinue products, forcing an expensive migration to new software).

2. Super Majority Clause:

These clauses require shareholder approval by at least two thirds vote and sometimes as much as 90 percent of the voting power of outstanding capital stock for transactions involving change of control. Because of this provision, an acquirer cannot control the target even after acquiring 51 per cent stock because he cannot change the board. Such types of takeover defense are not very common.

3. Golden Parachute:

When lucrative benefits are given to top executives of the company in the event of being taken over by another corporation, it is termed as Golden Parachute. This can be in the form of cash, equity, or stock options.

4. Pacman Defense:

This defense, named after the videogame, consists of a counter-purchase by the target of the shares against its attacker. In some cases it will suffice to buy even a small fraction of shares of the attacker to be able to initiate legal claims against the attacking company in the capacity of minority shareholder.

5. Greenmail:

If the acquiring company is on the verge of a controlling interest, they might offer the target the option to buy their stock back at a premium price. Sometimes, acquisition isn’t the goal — the acquiring company is just buying stock so they can sell it back and make a profit on the greenmail payment.

6. Litigation:

A target of a hostile offer should search for any regulatory, securities law against its attacker. By bringing some type of court proceedings against the raider, the target company can considerably lengthen the period of time needed to complete the takeover and reduce its chances of success by increasing the cost and by allowing time for the target to solicit competing bids or put up defenses.

7. White Knight:

A White Knight is a company that gallops to rescue the company that is facing a hostile takeover from another company (a “Black Knight”) by making a friendly offer to purchase the shares of the target company. The target may seek out a white knight by itself or with the help of investment bankers. In case of a hostile takeover of Gesco Corporation, a real estate company by Dalmia, Sheth-Mahindra came up as a White Knight to buy the stake in Gesco at a substantial premium over Market price (financed by HDFC).

Valuation of Target Companies in Case of Mergers and Acquisitions:

There are many ways in which a company can be valued.

Some of them are listed below:

(a) Price Earnings Ratio:

An acquiring company makes an offer to the target company based on the P/E ratio, after considering the P/E ratios of the similar type of firms in the same Industry.

(b) Price to Sales Ratio:

An acquiring company makes an offer the target company based on the Price to sales ratio, after considering the Price to sales ratios of the similar type of firms in the same Industry.

(c) Replacement Cost:

Here the acquiring company will consider the equipment and staffing costs that it will have to spend if it replaces the target company. But this method of establishing a price certainly wouldn’t make much sense in a service industry where the key assets – people and ideas – are hard to value and develop.

(d) Discounted Cash Flow:

This is the most commonly used method of valuing a business. Here, the acquiring company will discount the estimated future cash flows of the target company’s business. It can use the Weighted Average Cost of Capital (WACC) as the discounting factor.

Steps in Mergers and Acquisitions:

1. Investigation of Merger Proposal:

Before giving an offer to the target company, the acquirer studies the prospects of gain from the merger from different perspectives, like management growth, financial growth, technological and research development. Once, the proposal of merger with target company suits the strategic objectives of the acquiring company, it will place an offer with the target company.

2. Offer:

Before giving an offer, the acquiring company starts purchasing the shares in the open market. But, as per norms of SEBI, it has to restrict itself to 5% or it has to disclose its holdings in that company to the company and to the stock exchanges where the shares are listed at five stages of acquisition 5%, 10%, 14%, 54% or 74%. This creates a time consuming activity and also speculation in the market. So the acquiring company gives an open offer to the target company.

3. Response of Target Company:

The target company has three options, accept the terms of the offer, negotiate for a better offer or opt for a takeover defence.

4. Purchase Consideration:

The method of discharge of consideration will be decided by the target and acquiring company mutually. It may be fully in cash, fully in equity shares or a combination of cash, equity or debentures.

5. Meeting Legal Requirements of Governments and Approval from Financial Institutions:

In many cases, if the deal is a cross border deal, it becomes necessary to fulfill the legal requirements of both the countries. In case of borrowings from financial institutions, approval from such institutions is also required

6. Post-Merger:

After the merger takes place, it is very important that the integration of the structural and cultural aspects of the two firms take place. It becomes more important in case of cross border deals.

Mode of Payment of Consideration for Mergers and Acquisition:

The consideration for the transfer of the business/undertaking can take any one of the following forms:

1. Shares:

In case of issue of only shares, there is no effect in the liquidity of the acquiring company. In case of merger of Centurion bank of Punjab with HDFC Bank, the swap ratio was 1:29 (one share of HDFC Bank for every 29 shares of Centurion Bank of Punjab held),

2. Cash:

When the deal is done completely in cash, it drains the cash reserves of the acquiring company. In case of Bharti acquiring the African Business of Kuwait based Zain Telecom Company; it paid the amount of $10.7 billion in cash. Bharti had to finance its deal through borrowing from banks

3. Shares, Bonds and Cash:

It involves a combination of shares, bonds (convertible or non-convertible) and cash.

Tax Implications of Mergers and Acquisition:

i. Capital Gains in the Hands of Transferor:

The provisions of Section SOB of the Income Tax Act, 1961 provide for the computation of Capital Gains in case of slump sale.

If the undertaking or division has been held by the transferee for more than 36 months, any gains arising from the slump sale taken place in the previous year shall be chargeable as long term capital gains and shall be deemed to be the income of the previous year n which the transfer took place.

If the undertaking has been owned and held by the transferor for not more than a period of 36 months, the capital gain arising out of such a slump sale shall be treated as short term capital gains.

ii. Accumulated Loss/Depreciation:

In case of slump sale the unabsorbed depreciation or losses can be carried forward only in the hands of the transferor and unlike in the hands of the transferee in case of demerger.

Advantages of Mergers and Acquisitions:

1. Staff Reductions:

To avoid duplication of duties and responsibilities, reduction of staff members from accounting, marketing, human resources and other departments is done. This will lead to cost savings.

2. Economies of Scale:

A bigger company can save costs by all means, whether it is placing order or production cost per unit. Large scale operations lead to economies of scale, in terms of lower fixed cost per unit.

3. Acquiring New Technology:

By buying a smaller company with unique technologies, a large company can maintain or develop a competitive edge.

4. Improved Market Reach and Industry Visibility:

Buying companies with greater market reach leads to greater market share and thus revenue growth. A merger may expand two companies’ marketing and distribution, giving them new sales opportunities.

5. Competition:

Mergers will lead to elimination of competition.

6. Borrowing Cost:

The borrowing cost of large companies (merged companies) is small as compared to smaller companies.

7. Research and Development:

When a company merges with another business with good R&D capability, it can help improve its R&D facility and prove beneficial to its growth.

8. Exit Opportunity:

After being acquired by a large company or conglomerate, the small business gets the worth of its market value which allows its promoter to exit from the venture and look for new opportunities.

Disadvantages of Mergers and Acquisitions:

(a) If business becomes too large, diseconomies of scale take place, which leads to higher unit costs.

(b) Clashes of culture between different types of businesses can occur, reducing the effectiveness of the integration, especially in case of cross border mergers and acquisitions.

(c) Often, a lot of the workers lose their jobs when mergers or acquisitions take place, giving negative effect to it.

(d) Sometimes it may lead to conflict of objectives between different businesses.