This article throws light upon the seven main types of business function of a manufacturing undertaking. The types are: 1. Purchase Function 2. Productivity Function 3. Distribution Function 4. Accounting Function 5. Personnel Function 6. Research and Development 7. Financial Management and Economics.

Type # 1. Purchase Function:

Materials required for production of commodities should be procured on economic terms and should be utilised in efficient manner to achieve maximum productivity. In this function the finance manager plays a key role in providing finance.

In order to minimise cost and exercise maximum control, various material management techniques such as economic order quantity (EOQ), determination of stock level, perpetual inventory system etc. are applied. The task of the finance manager is to arrange the availability of cash when the bills for purchase become due.

Type # 2. Productivity Function:

Production function occupies the dominant position in business activities and it is a continuous process. The production cycle depends largely on the marketing function because production is justified when they are resulted in revenues through sales.

Production function involves heavy investment in fixed assets and in working capital. Naturally, a tighter control by the finance manager on the investment in productive assets becomes necessary. It must be seen that there is neither over-capitalisation nor under-capitalisation. Cost-benefit criteria should be the prime guide in allocating funds and therefore finance and production manager should work in unison.

Type # 3. Distribution Function:

As goods produced are meant for sale, distribution function is an important business activity. It is more important because it provides continuous inflow of cash to meet the outflow thereof. So while choosing different distributing channels, media of advertisement and sales promotion devices, the cost benefit criterion should be the guiding factor.

If cost reduction in distribution function is effected without compromising efficiency, it will lead to increased benefit to the enterprise in the form of higher profit and to the consumers in the form of lower cost.

As every aspect of distributory function involves cash outflow and every distributing activity is aimed at bringing about inflow of cash, both the functions are closely inter-related and hence should be carried out in close unison.

Type # 4. Accounting Function:

Charles Gastenberg visualises the influence of scientific arrangement of records, with the help of which inflow and outflow of funds can be efficiently managed and stocks and bonds can be efficiently marketed. Moreover, the efficiency of the whole organisation can be greatly improved with correct recording of financial data.

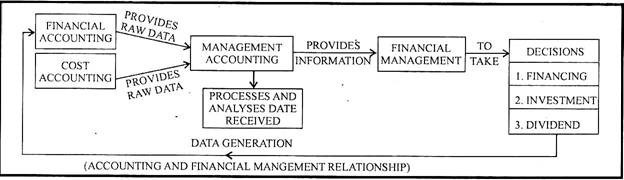

All the accounting tools and control devices, necessary for appraisal of finance policy can be correctly formulated if the accounting data are properly recorded.

For example, the cost of raising funds, expected returns on the investment of such funds, liquidity position, forecasting of sales, etc. can be effectively carried out if the financial data so recorded are reliable. Hence, the relationship between accounting and finance is intimate and the finance manager has to depend heavily on the accuracy of the accounting data.

Type # 5. Personnel Function:

Personnel function has assumed a prominent place in the domain of business management. No business function can be carried out efficiently unless there is a sound personnel policy backed up by efficient management of personnel. Success or failure of every business activity boils down to the efficiency of otherwise of the men entrusted with the respective function.

A sound personnel policy includes proper wage structure, incentives schemes, promotional opportunity, human resource development and other fringe benefits provided to the employees. All these matters affect finance. But the finance manager should know that organisation can afford to pay only what it can bear.

It means that expenditure incurred on personnel management and the expected return on such investment through labour productivity should be considered in framing a sound personnel policy. Therefore, the relation between the finance and personnel department should be intimate.

Type # 6. Research and Development:

In the world of innovations and competitiveness, expenditure on research and development is a productive investment and R and D itself is an aid to survival and growth of the firm. Unless there is a constant endeavour for improvement and sophistication of an existing product and introduction of newer varieties, the firm is bound to be gradually out marketed and out of existence.

However, sometimes expenditure on R and D invovles a heavier amount, disproportionate to the financial capacity of the firm in such a case, it financially cripples the enterprise and the expenditure ultimately ends in a fiasco.

On the other hand, heavily cutting down expenditure of R and D blocks the scope of improvement and diversification of the product. So, there must be a balance between the amount necessary for continuing R and D work and the funds available for such a purpose. Usually, this balance is struck out by joining efforts of finance manager and the person at the helm of R & D.

Type # 7. Financial Management and Economics:

Financial management draws heavily on Economics for its theoretical concepts. The development of the theory of finance began as an offshoot of the study of economics. A finance manager has to be familiar with the two areas of economics, i.e. microeconomics and macroeconomics.

Microeconomics deals with the economic decisions of individuals and firms, whereas macroeconomics looks at the economy as a whole in which a particular business unit is operating.

The concepts of microeconomics help a finance manager in developing decision models like fixation of prices, cost volume profit analysis, break even analysis, inventory management decisions, long-term investment decisions called capital budgeting, cash and receivables management models or working capital management decisions etc.

A firm is also influenced by the overall performance of the economy as it is dependent upon the money and capital markets for the procurement of investible funds. The finance manager should, thus, recognise and understand the macroeconomic theories, monetary and fiscal policies and their impact on the economy as a whole and the firm in particular.