This article throws light upon the top six forms of financing a merger. The forms are: 1. Cash Offer 2. Equity Share Financing 3. Debt and Preference Share Financing 4. Deferred Payment 5. Leveraged Buy – Out 6. Tender Offer.

Financing a Merger: Form # 1. Cash Offer:

After the value of the firm to be acquired has been determined, the most straight forward method of making the payment could be by way of offer for cash payment. The major advantage of cash offer is that it will not cause any dilution in the ownership as well as earnings per share of the company.

However, the shareholders of the acquired company will be liable to pay tax on any gains made by them. Another important consideration could be the adverse effect on liquidity position of the company. Thus, only a company having very sound liquidity position may offer cash for financing a merger.

Financing a Merger: Form # 2. Equity Share Financing:

It is one of the most commonly used methods of financing mergers. Under this method shareholders of the acquired company are given shares of the acquiring company. It results into sharing of benefits and earnings of merger between the shareholders of the acquired companies and the acquiring company.

The determination of a rational exchange ratio is the most important factor in this form of financing a merger. The actual net benefits to the shareholders of the two companies depend upon the exchange ratio and the price-earning ratio of the companies.

Usually, it is an ideal method of financing a merger in case the price-earning ratio of the acquiring company is comparatively high as compared to that of the acquired company.

When the shareholders of the acquired company receive shares in exchange in the acquiring company, they are not liable to any immediate tax liability.

Illustration 1:

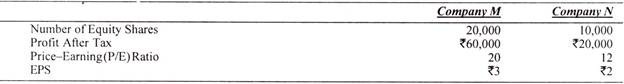

The following data relates to two companies M and N:

Company M is considering the purchase of company N in exchange of 1 share in ‘M’ for every 2 shares held in ‘N. You are required to illustrate the impact of merger on earnings per share assuming that there would be synergy benefits equal to 25 percent increase in the present earnings after tax due to merger.

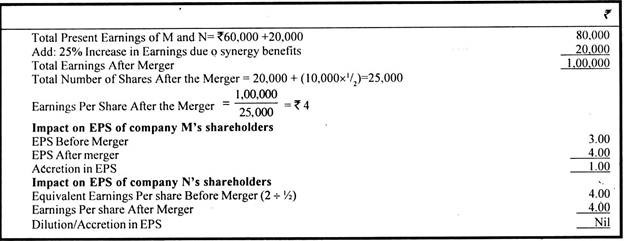

Solution:

Illustration 2:

Company B is being acquired by company A on share exchange basis. The relevent data for the two companies are given below:

You are required to determine (a) pre-merger market value per share; and (b) the maximum share exchange ratio that company A should offer without the dilution of (i) EPS, (ii) market value per share.

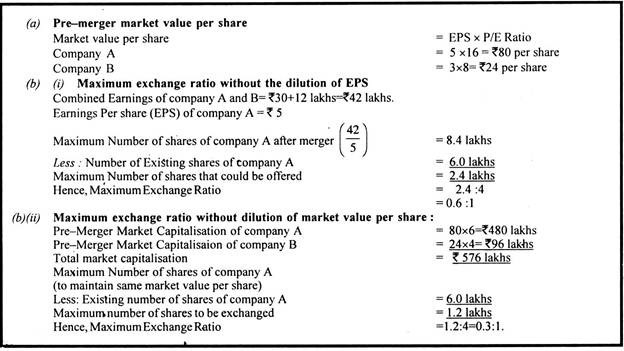

Solution:

Illustration 3:

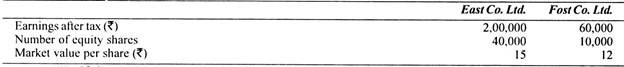

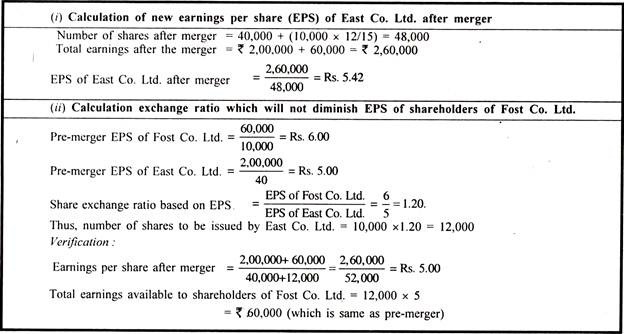

East Co. Ltd. is studying the possible acquisition of Fost Co. Ltd. by way of merger. The following data are available in respect of the companies:

(i) If the merger goes through by exchange of equity share and the exchange ratio is based on the current market price, what is the new earnings per share of East Co. Ltd.?

(ii) Fost Co. Ltd. wants to be sure that the earnings available to its shareholders will not be diminished by the merger. What should be the exchange ratio in that case?

Solution:

Financing a Merger: Form # 3. Debt and Preference Share Financing:

A company may also finance a merger through issue of fixed interest bearing convertible debentures and convertible preference shares bearing a fixed rate of dividend. The shareholders of the acquired company sometimes prefer such a mode of payment because of security of income along with an option of conversion into equity within a stated period.

The acquiring company is also benefited on account of lesser or no dilution of earnings per share as well as voting/controlling power of its existing shareholders.

Financing a Merger: Form # 4. Deferred Payment:

Deferred payment also known as earn-out plan is a method of making payment to the target firm which is being acquired in such a manner that only a part of the payment is made initially either in cash or securities. In addition to the initial payment, the acquiring company undertakes to make additional payment in future years if it is able of increase the earnings after the merger or acquisition.

It is known as earn -out plan because the future payments are linked with the firm’s future earnings. This method enables the acquiring company to negotiate successfully with the target company and also helps in increasing the earning per share because of lesser number of shares being issued in the initial years.

However, to make it successful, the acquiring company should be prepared to co-operate towards the growth and success of the target firm.

Financing a Merger: Form # 5. Leveraged Buy – Out:

A merger of a company which is substantially financed through debt is known as leveraged buy-out. Debt, usually, forms more than 70 percent of the purchase price. The shares of such a firm are concentrated in the hands of a few investors and are not generally, traded in the stock, exchange.

It is known as leveraged buy out because of the leverage provided by debt source of financing over equity. A leveraged buy-out is also called Management Buy-Out (MBO). However, a leveraged buy-out may be possible only in case of a financially sound acquiring company which is viewed by the lenders as risk free.

Financing a Merger: Form # 6. Tender Offer:

Under this method, the purchaser, who is interested in acquisition of some company, approaches the shareholders of the target firm directly and offers them a price (which is usually more than the market price) to encourage them sell their shares to him. It is a method that results into hostile or forced take-over.

The management of the target firm may also tender a counter offer at still a higher price to avoid the take over. It may also educate the shareholders by informing them that the acquisition offer is not in the interest of the shareholders in the long-run.