Five forces model of Michael Porter is a powerful and widely used tool for systematically diagnosing the significant competitive pressures in the market and assessing their strength and importance.

The model holds that the state of competition in an industry is a composite of competitive pressures operating in five areas of the overall market.

Michael Porter has identified five competitive forces faced by a firm operating in a particular industry. The interaction of these forces play an important role in determining the profitability in any industry.

These five competitive forces are:

1. The Threat of New Entrants 2. The Threat of Substitute Products or Services 3. The Bargaining Power of Customers 4. The Bargaining Power of Suppliers 5. The Rivalry amongst Current Competitors in the Industry.

Michael Porter’s Five Forces Model of Competitive Analysis

Porter’s Five Forces Model of Competitive Analysis (With Pros and Cons)

Michael Eugene Porter born May 23, 1947 is a leading authority on competitive strategy, the competitiveness and economic development of nations, states, and regions, and the application of competitive principles to social problems such as health care, the environment, and corporate responsibility.

Professor Porter is generally recognized as the father of the modern strategy field, as has been identified in a variety of rankings and surveys as the world’s most influential thinker on management and competitiveness.

Michael Porter has identified five competitive forces faced by a firm operating in a particular industry. The interaction of these forces play an important role in determining the profitability in any industry.

These five competitive forces are:

1. The threat of new entrants

2. The threat of substitute products or services

3. The bargaining power of customers

4. The bargaining power of suppliers

5. The rivalry amongst current competitors in the industry.

Whatever the industry, these five competitive forces are central to formulating and implementing business strategy. The relative strength of each competitive force tends to be a function of industry structure i.e. its underlying economic and technological characteristics. This can change overtime, with the result that the relative strength of competitive forces will also change, hence the industry’s profitability.

The basic way an enterprise might seek to achieve above average returns in the long-term via sustainable competitive advantage. The Porter’s five competitive forces model is powerful and widely used tool for systematic diagnosis of principal competitive pressures prevailing in the industry and assessing the strength and importance of each such force on the particular firm in the industry.

Each of the above forces are discussed below:

1. Threat of New Entrants:

The new entrants represent the firms that are outside the particular firm’s industry and contemplating entry into the industry. A new entrant will bring extra capacity into an industry. This poses a threat to established firms because they may lose market share with a consequent potential loss of economies of scale. The threat of entry will place a limit on prices and shapes the investment requirement to deter entrants.

Porter list main barriers to entry as:

(a) Economies of scale

(b) Product differentiation

(c) Capital requirements

(d) Switching costs

(e) Access to distribution channels

(f) Government policy.

The new entrant firm may bring with it new technology, innovative ideas, substantial resources, new and quality products. The greater the power and resources the new entrant has, the greater will be the probability that it will eat away the market share of existing firms.

The strength of the threat from new entrant depends on the strength of the barriers to entry and the likely response of existing competitors to the new entrants. The entry barriers are not static. They can be raised by a number of measures and also might be lowered by changes in the environment.

Threat of new entry is high when:

(a) Capital requirements to start the business are less

(b) Few economies of scale are in place

(c) Customers can easily switch (low switching cost)

(d) Your key technology is not hard to acquire or isn’t protected well

(e) Your product is not differentiated

There is variation in attractiveness of segment depending upon entry and exit barriers. That segment is more attractive which has high entry barriers and low exit barriers. Some new firms enter into industry and low performing companies leave the market easily.

When both entry and exit barriers are high then profit margin is also high but companies face more risk because poor performance companies stay in and fight it out. When these barriers are low then firms easily enter and exit the industry, profit is low. The worst condition is when entry barriers are low and exit barriers are high then in good times firms enter and it became very difficult to exit in bad times.

2. Threat of Substitute Products or Services:

The products or services that are produced in one industry are likely to have substitutes that are produced in another industry which satisfy the same customer need. Substitute products or services are those that apparently are different, but satisfy the same set of customer needs. The availability of close substitutes constitutes a negative competitive force in an industry. In other words, those industries which have no close substitutes are more attractive than those that have one or more such substitutes.

When firms in an industry are faced with threats from substitute products they are likely to find that demand for their products is relatively sensitive to price. Substitutes limit the potential returns of an industry by placing a ceiling on the prices firms in the industry can profitably charge. The substitute products offering a price advantage and/or performance improvement to the consumer can significantly affect the competitive character of an industry.

Porter suggests that those substitutes which should be monitored most closely are:

(a) Those products which are providing a better performance/price standard than the industry standard.

(b) Products produced by industries earning high profits.

Threat of substitute is high when:

(a) There are many substitute products available

(b) Customer can easily find the product or service that you’re offering at the same or less price

(c) Quality of the competitors’ product is better

(d) Substitute product is by a company earning high profits so can reduce prices to the lowest level.

Customer can easily switch to substitute products. So substitutes are a threat to your company. When there are actual and potential substitute products available then segment is unattractive.

Profits and prices are affected by substitutes so, there is need to closely monitor price trends. In substitute industries, if competition rises or technology modernizes then prices and profits decline.

3. Bargaining Power of Customers:

Customer requires better quality products and services at a lower price. If they have the power to get what they want, they will force down the profitability of an industry and it is, therefore, dependent very much on the consumers’ bargaining power.

The strength of the threat from the bargaining power of customers will depend on a number of factors including the level of differentiation amongst products in the industry, the cost to the customer of switching from one supplier to another and whether a customer’s purchases from an industry represent a large or small proportion of the customer’s total purchases.

Porter identified that power of customers seems to be strongest when the following conditions apply:

(a) The concentrated purchase of large volumes relative to seller sales.

(b) The products it purchases represent a significant fraction of the buyer’s cost of purchases.

(c) The products it purchases from the industry are standard or undifferentiated.

(d) It faces few switching costs.

(e) It earns low profits.

(f) The buyers will pose a credible threat of backward integration.

(g) The industry’s product is unimportant to the quality of the buyer’s product.

(h) The buyer has full information.

Buyers must be willing to pay a price for a product that exceeds the sellers’ cost of production, otherwise the industry cannot survive in the long-run. On account of competition, users of industrial products may come together formally or informally and exert pressure on producer in matters such as price, quality and delivery.

A high buyer bargaining power constitutes a negative feature for existing firms or new entrants of an industry. The more powerful buyers from an industry are, the greater will be their influence on the industry in general and its profits in particular.

Buyers have more bargaining power when:

(a) Few buyers chasing too many goods

(b) Buyer purchases in bulk quantities

(c) Product is not differentiated

(d) Buyer’s cost of switching to a competitors’ product is low

(e) Shopping cost is low

(f) Buyers are price sensitive

(g) Credible Threat of integration

Buyer’s bargaining power may be lowered down by offering differentiated product. If you’re serving a few but huge quantity ordering buyers, then they have the power to dictate you.

4. Bargaining Power of Suppliers:

The bargaining power of suppliers determines the cost of raw material and other inputs. The business of a firm is to a great extent dependent upon its suppliers who supply it with resources like raw materials, spare-parts, equipments, machineries, labour and other supplies.

The ability of suppliers to get higher prices depends on a number of factors including the number of suppliers in the industry, the importance of the supplier’s product to the firm, the cost to the firm of switching from one supplier to another and the case with which the supplier could integrate forward.

According to Porter, the main determinants of suppliers having power over an industry occur when:

(a) It is dominated by a few companies and is more concentrated than the industry to which it sells.

(b) It is not obliged to contend with other substitute products for sale to the industry.

(c) The industry is not an important customer of the supplier group.

(d) The supplier’s products are differentiated or it has built-up switching costs.

(e) The supplier poses a credible threat of forward integration.

Bargaining Power of Suppliers:

Bargaining Power of supplier means how strong is the position of a seller. How much your supplier have control over increasing the Price of supplies.

Suppliers are more powerful when:

(a) Suppliers are concentrated and well organized

(b) A few substitutes available to supplies

(c) Their product is most effective or unique

(d) Switching cost, from one suppliers to another, is high

(e) You are not an important customer to Supplier

When suppliers have more control over supplies and its prices that segment is less attractive. It is best way to make win-win relation with suppliers. It’s good idea to have multi-sources of supply.

5. Rivalry among Existing Firms:

The intensity of rivalry among existing competitors will influence prices as well as certain other areas like advertising, sales promotion, product development etc. The intensity of competitive rivalry within an industry will affect the profitability of industry as a whole.

According to Porter, rivalry is intensified by the following factors:

(a) Numerous or equally balanced competitors

(b) Slow industry growth

(c) High fixed or storage costs

(d) Lack of differentiation or switching costs

(e) Capacity augmented in large increments

(f) Diverse competitors

(g) High strategic stakes

(h) High exit barriers

The intensity of rivalry plays a major role in determining whether existing firms will expand capacity aggressively or choose to maintain profitability. Although rivalry can be beneficial in helping the industry to expand, it might leave demand unchanged. The intensity of competition will depend on a number of factors including the rate of growth in the industry and whether there is a large number of equally balanced competitors.

Industry rivalry is high when:

(a) There are number of small or equal competitors and less when there’s a clear market leader

(b) Customers have low switching costs

(c) Industry is growing

(d) Exit barriers are high and rivals stay and compete

(e) Fixed cost are high resulting huge production and reduction in prices

These situations make the reasons for advertising wars, price wars, modifications, ultimately costs increase and it is difficult to compete.

The intensity of competition depends on several factors as mentioned below:

(a) Where large number of equally balanced competitors exists, in situation of intense competition, firms may try to avoid competing on price.

(b) Where the growth rate of the industry is slow or stagnant, rivalry may intensify and the firms may indulge in competing with each other for a greater market share.

(c) Ease of switching will encourage suppliers to compete.

(d) Competitors may guess each other intentions and this may lead to uncertainty because of competitive strategy.

(e) Industries, characterized by economies of scale from substantial capacity increase, may face recurring periods of overcapacity and price-cutting.

(f) High fixed costs and relatively low variable costs tempt the firms to compete on price and sell at prices above marginal costs. As a result, there may be a failure to recover fixed costs.

(g) A firm putting in high capital funds and extensive efforts to achieve targets and making success (a strategic action), is likely to be more proactive and competitive to attain further high targets.

The collective strength of the above mentioned five forces determines the ultimate profit potential of an industry. A company’s competitive strategy is increasingly effective to the degree it provides good defences against the five competitive forces, influence the industry’s competitive rules in the company’s favour and helps create a sustainable competitive advantage.

The strategist’s goal should be to find a position in the industry where his company can best defend itself against these five forces or can influence them in his company’s favour. Such a strategic fit obviously require a proper understanding of the objectives, the ever changing environment and the organization. These five competitive forces will influence price, cost, investment, return on investment etc. Firms through their strategies can influence these five forces.

The basic assumptions of the model are:

(a) Constant return to sale, rationality of each operator in the business.

(b) The stronger each of these forces, the more limited is the ability of any operator to raise prices and earn greater profitability.

But, these assumptions do not hold good in all industry situations. The relative strength of each competitive force tends to be a function of industry structure i.e. its underlying economic and technological characteristics. This can change overtime, with the result that the relative strength of competitive forces will also change, hence the industry’s profitability. The basic way an enterprise might seek to achieve above average returns in the long-term via sustainable competitive advantage.

Pros and Cons of the Five Forces Model:

Pros:

1. The model helps to understand how value is shared among actors, and provides insight into redistribution of profits.

2. The model takes a broader view on competition than only a firm’s existing competing firms.

3. The business unit level provides a context beyond a single product or range of products.

4. Porter’s model emphasises an outside analysis of the organisation’s environment over an internal focus.

Cons:

1. The model assumes a given state of affairs, and does not apply well to industries in turmoil.

2. The analysis is reactive and does not include other perspectives such as the resource based view in which organisations can reshape an industry based on existing core competences and intrinsic will power.

3. The analysis is based on the assumption that firms strive only for a competitive advantage over their rivals and exclude other motivations.

4. The analysis is based on the assumption that firms strive only for a competitive advantage over their rivals and exclude other motivations.

Porter’s Five Forces Model of Competitive Analysis

Five forces model of Michael Porter is a powerful and widely used tool for systematically diagnosing the significant competitive pressures in the market and assessing their strength and importance. The model holds that the state of competition in an industry is a composite of competitive pressures operating in five areas of the overall market.

These five forces are:

1. Threat of New Entrants:

New entrants are always a powerful source of competition. The new capacity and product range they bring in throw up new competitive pressure. And the bigger the new entrant, the more severe the competitive effect. New entrants also place a limit on prices and affect the profitability of existing players.

2. Bargaining Power of Customers:

This is a phenomenon seen in industrial products. Users of industrial products come together formally or informally and exert pressure on the producer. The bargaining power of the buyers influences not only the prices that the producer can charge but also influences in many cases, the costs and investments of the producer because powerful buyers usually bargain for better services which involve costs and investment on the part of the producer.

3. Bargaining Power of Suppliers:

Suppliers too exercise considerable bargaining power over companies. The more specialised the offering from the supplier, the greater is his clout. The bargaining power of suppliers determines the cost of raw materials and other inputs of the industry and, therefore, industry attractiveness and profitability.

4. Rivalry among Current Players:

The rivalry among existing players is quite obvious. This is what is normally understood as competition. For any player, the competitors influence strategic decisions at different strategic levels. The impact is quite evident at the functional level in the prices being changed, in advertising, and in the pressures on costs, product and so on.

5. Threats from Substitutes:

Substitute products are a major source of competition in an industry. Substitute products offering a price advantage and/or performance improvement to the consumer can drastically alter the competitive character of an industry.

Porter’s Five Forces Model of Competitive Analysis

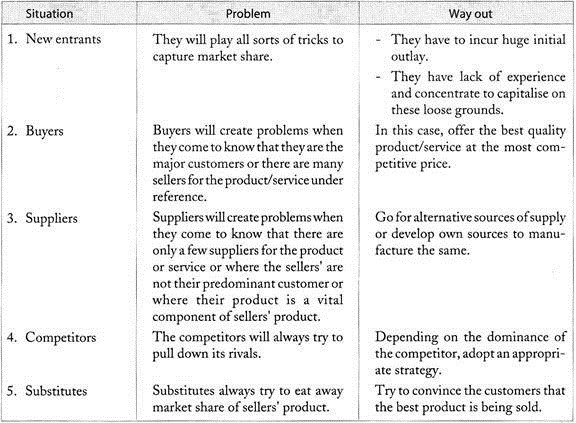

Before a company enters a market or market segment, the competitive nature of the market or segment is evaluated. Porter suggests that five forces collectively determine the intensity of competition in an industry- threat of potential entrants, threat of potential substitutes, bargaining power of suppliers, bargaining power of buyers, and rivalry of existing firms in the industry. By using the model, a firm can identify the existence and importance of the five competitive forces, as well as the effect of each force on the firm’s success.

Five Forces Analysis assumes that there are five important forces that determine competitive power in a situation. Porter argues that there are five forces that determine the profitability of an industry.

They are:

1. Threat of industry,

2. Bargaining power of suppliers,

3. Bargaining power of buyers,

4. Rivalry among existing players and

5. Threat of substitute products.

Porter contends that “The collective strengths of these forces determines the ultimate profit potential in the industry, where profit potential is measured in terms of long run return on investment capital”.

Each of them are discussed in detail below:

1. Threat of New Entrants:

New entrants to an industry typically brings to it new capacity and desire to gain market size and substantial sources. They are therefore threats to established corporations. Threat of entry depends on the entry barriers and the reaction that can be expected from the existing companies. An entry barrier is an obstruction that makes it difficult for a company to enter into an industry.

Major entry barriers include:

i. Economies of Scale- These exist whenever large volume firms enjoy significantly lower production cost per unit than smaller volumes operator do. This discourages new firms, which have less volume and high production cost from entering into the market.

ii. Cost disadvantage Independent of Scale- Established competitors may have cost advantage even when the new entrant has comparable economies of scale. This advantage may include proprietary product knowledge such as patents, favourable access to raw materials, favourable locations, government subsidies etc.

iii. Product Differentiation- Differences in physical or perceived characteristics must make incumbent’s product unique in the eyes of customer and force customers to overcome existing brand loyalty.

iv. Capital Requirement- If the amount of investment required to enter into an industry is high, the number of entrants who could afford it would be less.

v. Switching Cost- Sometimes the cost that would be incurred by the customers to switch from one supplier to another supplier makes it difficult for the new entrants to gain market share.

vi. Access to Distribution Channel- Existing relationship and agreements between manufacturers and key distributors in a market may also create barriers to entry. Companies aspiring to enter a market may look for unique distribution channel to provide access as well as to differentiate their products. Finally in addition to these barriers firms may also deter entrants by harsh retaliation.

2. Bargaining Power of Buyers:

Buyers can exert bargaining power over a supplier industry by forcing its prices down, by reducing the amount of goods they purchase from the industry or by demanding better quality for the same price. Here the questioned to be asked is how easy it is for buyers to drive prices down.

Again, this is driven by the number of buyers, the importance of each individual buyer to his/her business, the cost to them of switching from a company’s products and services to those of someone else, and so on. If one deals with few, powerful buyers, they are often able to dictate terms.

Factors that Makes the Buyer More Powerful:

i. Undifferentiated or standard supplies- If the product being supplied is a commodity good or service then customers can shop around for the most favourable terms.

ii. Credible threat of backward integration- Backward integration involves a buyer moving to an earlier stage of manufacturing or distribution, thus becoming a competitor for the supplier’s business.

iii. Accurate information about the cost structure of the supplier- This allows the customers to exercise more precision in negotiating the price of the supplier.

iv. Price sensitivity- Buyers are likely to be more price-sensitive if- a) Suppliers represent the significant fraction of the total cost incurred by the buyers, b) The supplier product is unimportant to the overall quality or cost of the buyer’s final product and c) The buyers already earn a low profit.

A growing trend among small businesses is to augment their bargaining power as customers through joining or forming buying groups.

3. Bargaining Power of Suppliers:

Suppliers can affect the industry through their ability to raise price or to reduce the quality of the purchased product and services.

Following are the conditions that make suppliers powerful:

i. Dominance by few players and lack of substitutes- A few players might become strong enough to dominate the suppliers industry. Substitutes might not be readily available as well. These two factors limit customer’s option and increase the supplier’s power.

ii. Greater concentration among suppliers than among buyers- A concentrated industry is one in which only a few large firms dominate. Firms in highly concentrated industry that supply material to highly fragmented industry can exert power over the buyer.

iii. Relative lack of importance of the buyer to the supplier group- Some customers are more important than others because of their size of their purchase or the prestige that comes from supplying them.

iv. High differentiation by the supplier and high switching cost- A buyer could be tied to a particular supplier if other suppliers can’t meet his requirements. Any switching that might be incurred by the buyer will strengthen the position of the suppliers.

v. Threat of forward integration- Forward integration involves a supplier moving into a later stage of the manufacturing process or distribution i.e. moving into direct competition with its customers.

4. Threat of Substitute Products:

Substitute products are those products that appear to be different but can satisfy the same need as another product. The availability of substitutes places a ceiling on price limit of an industry product. When the price of the product rises above that of the substitute product customers tend to switch over to the substitutes. Deregulation and technology revolution has given rise to a lot of substitutes.

5. Competitive Rivalry:

What is important here is the number and capability of a company’s competitors – if it has many competitors, and they offer equally attractive products and services, then the company will most likely have little power in the situation. If suppliers and buyers don’t get a good deal from the company, they’ll go elsewhere.

On the other hand, if no-one else can do what the company does, then it can often have tremendous strength. In most industries individual firms are mutually dependent. Competitive moves by one firm can be expected to have noticeable effects on its competitors and cause retaliation or counter efforts. Competition can be in the form of pricing, product differentiation, product innovation etc.

Factors that increase competitive rivalry are:

i. Equally balanced competitors- The most intense competition results from well- matched rivals in a situation that doesn’t allow any particular firm to dominate.

ii. Slow industry growth- In slow growth markets, growth has to come by taking market share from rivals.

iii. High fixed cost- Additional sales volume can help to offset high fixed cost. Hence, competitors might be willing to fight for any possible sales.

iv. Lack of differentiation or lack of switching cost- These two factors ensure that customers can easily switch over to a rival product and to retain them is a constant struggle.

v. Large increase in manufacturing capacity- If a manufacturer can increase capacity by a large increment, by building a new plant, it will run it at full capacity to keep the unit cost less – thus producing so much that the selling price falls throughout the industry.

vi. High strategic stakes- The market is well worth fighting for because of its profit potential or the opportunities it creates elsewhere.

vii. High exit barriers- For economic, strategic or emotional reasons, individual players might consider it difficult to leave the industry.

Porter’s Five Forces Model of Competitive Analysis

Michael E. Porter, the renowned author of Competitive Strategy, Competitive Advantage and Competitive Advantage of Nations. It has provided a structural analysis of industries. Advantages of nations, has provided a structural analysis of industries. According to this analysis, which has gained great popularly, the state of competition an industry depends on five basic competitive forces, viz., –

1. Rivalry among existing firms.

2. Threat of new entrants.

3. Threat of substitutes.

4. Bargaining power of suppliers.

5. Bargaining power of buyers.

Porter’s analysis shows that competition an industry goes well beyond the established players. “Knowledge of these underlying sources of competitive pressure highlights the critical strengths and weakness of the company, animates its positioning in its industry, clarifies the areas where strategic changes may yield the greatest payoff, and highlights the where industry to hold the greatest significance as either opportunities or threats. Understanding these sources will also prove to be useful in considering areas for diversification, though the primary focus here is on strategy in individual industries, Structural analysis is the fundamental underpinning for formulating competitive strategy”.

1. Rivalry among Existing Competitors:

Rivalry among exiting competitors is often the most conspicuous of the competitions. Firms on an industry are “mutually dependent”- competitive moves of a firm usually affects others and may be retaliated. Common competitive actions include price changes, promotional measures, customer service, warranties, product improvements, new product introduction, channel promotion, etc.

There are a number of factors, which influence the intensity of rivalry.

These include:

1. Number of firms and their relative market share, strengths etc.

2. State of growth of industry- In stagnant and to some extent slow growth industries, a firm is able to increase its sales only by increasing its market share, i.e., at the expense of others.

3. Fixed or storage costs – When the fixed or storage costs are very high, firms are provoked to take measure to increase sales for improving capacity utilization or reducing storage costs.

4. Indivisibility of capacity augmentation – Where there are economies of scale, capacity increases would be in large blocks necessitating in many cases, efforts to increase sales to achieve capacity utilization norms.

5. Product Standardization and Switching Costs – When the products of different firms are standardized, price, distribution, after-sales service, credit etc., become important strategic variables of competition. Absence of switching costs makes firms more vulnerable.

6. Strategic stake – Rivalry in an industry becomes more volatile if a number of firms have high stakes in achieving success there. For example, Firm which regards a particular industry as its core business will give great importance to success in that industry.

7. Exit Barrier – High exit barriers (for example, compensation for labour, emotional attachment to the industry etc.,) end to keep firms competing in an industry even though the industry is not vet attractive.

8. Diverse Competitors – Rivalry becomes more complex and unpredictable when competitors are very diverse in their strategies, origins, personalities, relationships to their parents etc.

9. Switching Costs – in some cases a berries to entry is created by switching costs (i.e., high costs facing the buyer of switching from one supplier’s product to another’s) such as costs of retraining the employees, costs of new ancillary equipment etc.

10. Expected Retaliation – the potential entrants’ expectations about the reactions of the existing competitors may also sometimes deter entry.

2. Threat of Entry:

A prospective industry often faces threat of new entrants that can alter the competitive environment. There may, however, be a number of barriers to entry.

Competitive Analysis and Strategies:

Potential competition tends to be high if the industry is profitable or critical, entry barriers are low and expected retaliation from the existing firms is not serious.

Following are some of the important common entry barriers:

i. Government Policy:

In many cases governmental policy and regulation are important entry barriers. For example, prior to the economic liberalization in India, government – dictated entry barriers were rampant, like reservation of industries/products for public sector and small scale sector, industrial licensing, regulations under MRTP act, import restrictions, restrictions on foreign capital, and technology etc.

ii. Economies of Scale:

Economies of scale can be entry in two ways- it keeps out small players and discourages even potentially large players because of the risk of large stakes.

iii. Cost Disadvantages Independent of Scale:

Entry barrier may also arise from the cost advantages, besides that of economies of scale, enjoyed by the established firms which cannot be replicated by new firms, such as proprietary product technology, learning or experience curve, favourable access to raw materials, favourable location government subsides etc.

iv. Product Differentiation:

Product differentiation characterized by brand image, customer loyalty, product attributes etc., many form an entry barrier forcing new entrants to spend heavily to overcome this barrier.

v. Monopoly Elements:

Proprietary product/ technology, Monopolization/effective control over raw material supplies and distribution channels etc., are entry barriers which are difficult to overcome.

vi. Capital Requirements:

High capital incentive, nature of the industry is an entry barrier to small firms. Further, the risk of huge investment could be a discouraging factor even for other firms.

3. Threat of Substitutes:

An important force of competition is the power of substitutes “Substitutes limit the potential returns in an industry by placing a ceiling on the price, firms in the industry can profitability charge. The more attractive the price performance alternative offered of substitutes, the firmer the laid on industry profits”.

Firms in many industries face competition from those e marketing close or distant substitutes. Porter points out that substitute products that deserve the most attention are with that are – (i) subject to trends improving the price-performance trade-off with the industry’s product. (ii) Produced by industries earning high profits.

4. Bargaining Power of Buyers:

For several industries, buyers are potential Competitors – they may integrate backward. Besides, they have different degrees of bargaining power. “Buyers compete with the industry by forcing down prices. Bargaining for higher quality or more services and plying competitors against each other – all at the expense of industry profitability.”

Important determinants of the buyer power, explained by Porter, are as following:

1. The volume of purchase relative to the total sale of the seller.

2. The importance of the product to the buyer in terms of the total cost.

3. The extent of standardization or differentiation of the product.

4. Switching costs.

5. Profitability of the buyer (low profitability tends to pressure costs down).

6. Potential for backward integration by buyer.

7. Importance of the industry’s product with respect to the quality of the buyer’s product or services.

8. Extent of buyer’s information.

5. Bargaining Power of Suppliers:

The important determinants of supplier power are the following:

1. Extent of concentration and domination in the supplier industry.

2. Importance of the product to the buyer.

3. Importance of the buyer to the supplier.

4. Extent of substitutability of the product.

5. Switching costs.

6. Extent of differentiation or standardizations of the product.

7. Potential for forward integration by suppliers.

Structural Analysis and Competitive Strategy:

The purpose of the structural analysis is to diagnose the competitive forces and to identify the strengths and weakness of the firm vis-a-vis the industry, to help formulate an effective competition that “takes offensive or defensive action in order to create a defendable position against the five competitive forces”.

Structural analysis would enable a firm to answer such questions as:

1. How vulnerable is the firm against potential entrants? In other words, are there or how insurmountable are the entry barriers? Or, what measures can it take towards off new entrants?

2. How serious is the threat of substitutes? What strategies should be the firm employ against them?

3. What is the nature of supplier power? How to combat it?

4. How powerful are buyers? How to deal with their bargaining power?

5. What are the strengths and weakness and strategies of the established competitors and how to cope with them?

In order to create a defendable position against the five competitive forces, Porter suggests the following competitive strategies:

1. Positioning:

This means making such positioning of the firm that its capability provides the best defence against the existing array of competitive forces. This strategy can take the form of building defence against the competitive forces, of finding positions in the industry were the forces are weakest.

2. Influencing the Balance:

The strategy here is to improve the firm’s relative position through strategic moves that influence the balance of forces. As against positioning, where the strategy is basically defensive, here the strategy is offensive. In other words, this strategy seeks to do more than merely cope with the forces themselves; it is meant to alter their causes. For example, capacity expansion and scale expansion can enhance entry barriers.

3. Exploiting Change:

The approach is to adopt appropriate strategy for the changing environment ahead of the rivals.

Porter’s Five Forces Model of Competitive Analysis

Porter (1980) proposed a five-force model to analyze the competition in a business. The five forces are the – (i) intensity of rivalry among current competitors, (ii) threat of potential new entrants, (iii) threat of substitutes, (iv) bargaining power of suppliers, and (v) bargaining power of buyers.

Diversity among competitors, slow growth of industry, high fixed investment costs, low perceived product differentiation and high exit barriers tend to depress industry profitability, thereby increasing rivalry among competitors.

1. New Entrants:

New entrants represent a threat to existing firms in an industry. Threat of entry is moderated by industry barriers to entry and possible retaliation from existing firms. Barriers to entry arise from six major sources – (i) economies of scale, (ii) product differentiation, (iii) capital requirements, (iv) buyers’ switching costs, (v) access to distribution channels, and (vi) absolute cost advantage.

2. Suppliers:

The impact of suppliers on the profitability of the industry depends on their bargaining power over the industry participants. Supplier bargaining power is the highest when – (i) the buyer group (retailers) is more fragmented than the supplier group, (ii) there are no substitutes for the product offered by the supplier group to the buyer group, (iii) the buyer group is not a major customer of the supplier group, (iv) the product offered by the supplier group is an important input for the product offered by the buyer group, (v) the supplier group’s products are differentiated so that the buyer group cannot play one supplier group against another, and (vi) the supplier group can integrate forward into the buyer group.

3. Buyers:

Buyers’ influence depends on factors such as – (i) the number of buyers and the volume purchased by them from the industry, (ii) the product differentiation offered by the industry to buyers, (iii) the profitability potential of buyers, (iv) the threat of backward integration into the industry from buyers, (v) the importance of the industry’s product to buyers, and (vi) the influence of buyers on the ultimate consumers.

4. Substitutes:

Industries producing substitute products can cut into the profit of a business. Substitute products can depress industry profits if they – (i) are similar to the product offered in the industry, (ii) offer better price/performance to their buyers, and (iii) offer higher profit margins to their manufacturers.

Companies in an industry can be grouped into various strategic groups based on certain criteria. For example, in the fertilizer industry, gas-based plants and naphtha-based plants form two separate groups. In the toothpaste market, those making chemical-based pastes and medicated/herbal pastes form distinct groups.

These groupings can be based on one or more factors such as product differentiation, extent of vertical integration, leader/follower classification, investment, size of plant, and geographic scope. Two-dimensional maps are commonly used to identify strategic groups. Different groups experience different levels of competitive pressure as also profitability.

Porter’s Five Forces Model of Competitive Analysis

An industry is a group of firms that market products which are close substitutes for each other. Some industries are more profitable than others. Why? The answer lies in understanding the dynamics of competitive structure in an industry.

The most influential analytical model for assessing the nature of competition in an industry is “Michael Porter’s Five Forces Model”, which is described below:

Porter explains that there are five forces that determine industry attractiveness and long-run industry profitability.

These five “competitive forces” are:

1. The threat of entry of new competitors

2. The threat of substitutes

3. The bargaining power of buyers

4. The bargaining power of suppliers

5. The degree of rivalry between existing competitors.

The explanation of the above mentioned five “competitive forcer” is as follows:

1. Threat of New Entrants:

New entrants to an industry can increase the intensity of competitiveness among firms, thereby reducing its attractiveness. The threat of (e.g.,-ship building) constraints the entry of newcomers whereas other industries are very easy to enter (e.g.,-estate agencies, restaurants).

Key barriers to entry include:

i. Economies of scale.

ii. Capital/investment requirements.

iii. Customer switching costs.

iv. Access to industry distribution channels.

v. The likelihood of retaliation from existing industry player.

vi. Strong customer loyalty.

vii. Strong brand preferences.

viii. Government regulatory policies, tariffs etc.

Despite of numerous barriers to entry, new firms sometimes enter industries with higher quality products, lower prices and substantial marketing resources. The strategists job therefore is to identify potential new firms entering the marketing, to monitor the new rival firm’s strategies, to counterattack as needed, and to capitalize on existing strengths and opportunities.

2. Threat of Substitutes:

In many industries, firms are in close competition with producers of substitute products in other industries.

Competitive pressures arising from substitute products increases:

i. As the relative price of substitute products decline, and

ii. As consumer switching costs decreases.

The presence of substitute products can lower industry attractiveness and profitability.

The threat of substitute products depend on:

i. Buyer’s willingness to substitutes

ii. Relative price of substitutes

iii. Performance of substitutes

iv. The cost of switching to substitutes.

The competitive strength of substitute products is measured by the market share obtains by those products and those firm’s plans for increased capacity.

3. Bargaining Power of Suppliers:

Suppliers are the businesses that supply materials and other products into the industry.

The cost of items bought from suppliers (e.g., raw materials, components) can have a significant impact on a company’s profitability. If suppliers have high bargaining power over a company, then in theory the company’s industry is less attractive.

The bargaining industry power of suppliers affects the intensity of competition in an industry and it will be high when:

i. There are many buyers and few dominant suppliers

ii. There are undifferentiated, high valued products

iii. Suppliers threaten to integrate forward into the industry (e.g., brand manufacturers threatening to set up of their own retail outlets)

iv. Buyers do not threaten to integrate backwards into supply

v. The industry is not a key customer group to the suppliers.

It often is in the best interest of both suppliers and producers to assist each other with:

i. Reasonable prices

ii. Improved quality

iii. Development of new service, e.g., JIT (Just in time approach of inventory management)

iv. And reduced inventory costs.

4. Bargaining Power of Buyers:

Buyers are the people/organizations who create demand in an industry.

When customers/buyers are concentrated or large or buy in large volume, their bargaining power represents a major force affecting intensity of competition in an industry.

The bargaining power of buyers is greater when:

i. There are few dominant buyers and many sellers in an industry.

ii. Products are standardized.

iii. Buyers threaten to integrate backward into the industry.

iv. Suppliers do not threaten to integrate forward into the buyers industry.

v. The industry is not a key supplying group for buyers.

Rival firms may offer extended warranties or special services to gain customer loyalty whenever the bargaining power of buyers is substantial.

5. Intensity of Rivalry:

This force is the most powerful of the five competitive forces. The strategies pursued by one firm can be successful only when they provide competitive advantage over the strategies pursued by rival firms.

Changes in strategy by one firm may be met with counter moves such as:

i. Lowering prices

ii. Enhancing the quality

iii. Adding more features

iv. Providing services

v. Increasing Advertising.

The intensity of rivalry between competitors in an industry will depend on:

i. The structure of competition – For example, rivalry is more intense where there are many small equally sized competitors, rivalry is less when an industry has a clear market leader.

ii. The structure of industry costs – For example, industries with high fixed costs encourages competitors to fill unused capacity by price cutting.

iii. Degree of differentiation – Industries where products are commodities (e.g.- steel, coal).

iv. Switching costs – Rivalry is reduced where buyers have high switching costs, i.e., there is a significant cost associated with the decision to buy a product from an alternative supplier.

v. Strategic objectives – When competitors are pursuing aggressive growth strategies, rivalry is more intense where competitors are “milking” profits; in a mature industry, the degree of rivalry is less.

vi. Exit barriers – When barriers to leave an industry are high (e.g., the cost of closing down factory), then competitors ten to exhibit greater rivalry.

Porter’s Five Forces Model of Competitive Analysis

An industry consists of a group of companies offering products or services, which are similar and serve as substitutes for each other. Strategists analyze competitive forces within an industry to identify opportunities and threats facing a firm. A model for analyzing the industry environment is developed by Michael. E. Porter, an authority on competitive strategy. This model is known as Five Forces Model and it helps managers to identify and analyze the competitive forces in an industry environment.

The five forces, which are focused in this model, are as follows:

1. Threat of New Entrants

2. Bargaining Power of Suppliers.

3. Bargaining Power of Buyers

4. Threat of Substitutes

5. Rivalry among Existing Firms.

The collective strength of the five forces determines the ultimate profit potential in the industry. If the forces are stronger, then the ability of company to raise price and earn high profits is limited. Hence, a high competitive force can be regarded as a threat and a low competitive force can be considered as an opportunity as it allows a company to earn high profits. The strategists should recognize opportunities and threats and formulate suitable strategies. In addition, the company should influence one or more of such forces in its favour through appropriate strategy.

The essence of strategy formulation is coping with competition. Usually the term ‘competition’ is viewed in a superficial and narrow sense. It is viewed as being manifested in other players in the same industry. According to Porter, competition is rooted in its underlying economics.

Every industry has an underlying economic and technical characteristics, which gives rise to competition and the role of a strategist is to understand, cope up with industry environment and influence the environment to the firm’s favour. Each competitive force has certain underlying characteristics.

The impact of the five competitive forces on industry is tremendous:

1. Threat of New Entry:

Entry of potential competitors to an industry is a threat to the profitability of established players. In any industry, new entrants bring in new capacity, substantial resources and aggressiveness to gain market share. The established companies try to discourage potential competitors from entering to an industry by raising the height of barriers and this obstruction makes it difficult for a new company to enter an industry. The concept of barrier implies a significant cost of joining an industry. The high cost keeps away potential competitors from entry even when the industry returns are high.

Sources of possible barriers to entry are identified as follows:

i. Economies of Scale:

Economies of scale in production and sales give a significant cost advantage for existing players over a new rival. Economies of scale is obtained through cost reduction and mass production, discount on bulk purchase of raw materials and advertising. If these cost advantages are significant, the new entrants are discouraged to enter because they will have to take a high risk. Established companies, with economies of scale, have less threat of new entry. Intel has a significant cost advantage over its new rivals due to scale economies in production and sale of microprocessors.

ii. Product Differentiation:

A company creates brand loyalty through continuous advertising of brand, product innovation, customer service and high product quality. Heavy advertisement has been done for toilet soaps such as Liril, Lux and Lifebuoy to build brand loyalty. The task of breaking down customer loyalty is too costly and reduces threat of new entrants.

iii. Cost Advantage:

Established firms often acquire cost advantages due to their access to raw materials, cheaper funds, superior production techniques, patents, secret processes, managerial skill, government subsidies, assets acquired in pre inflation prices and advantages arising from learning curve effects. The cost advantages of established companies reduce the threat of new entrants.

Microsoft’s MS-DOS Operating System for IBM type PCs gave a key advantage to Microsoft over its potential rivals.

iv. Capital Requirements:

The necessity to invest substantial resources for creating infrastructure facilities, inventories and to wipe out preliminary expenses in industries is a barrier to new entrants. Massive investment required in industries such as aircraft and mineral extraction prove to be a significant barrier for new entrants.

Xerox created a capital barrier by offering to lease its copiers. So new entrants had to face the problem of maintaining huge sums of cash to finance the leased copiers.

v. Access to Distribution Channels:

Small firms often find it difficult to acquire shelf space for distribution of their products because large retailers often give preference to established firms. The established firms are prepared to pay for advertisement needed to create customer demand.

TIMEX created its own distribution channels for its watches, as it was not able to get shelf space among established players.

vi. Government Policy:

The government can limit entry into an industry through licensing requirements, air and water pollution standards and safety regulations. The mandatory requirement of effluent treatment plant in sugar mills, soft drinks units, milk processing units and plastic manufacturing units has escalated the cost of production in India. This has restricted the entry of potential competitors.

vii. Brand Identity:

Building a favourable brand image is tough for new comers. Hyundai, Telco spent heavily on advertising to overcome consumer preference for Maruti passenger cars.

2. Bargaining Power of Suppliers:

The bargaining power of suppliers is considered a threat to new entrants. Suppliers enjoy bargaining power by raising the price or reduce the quality of purchased goods and services and thereby reduce the profitability of the company. If the suppliers are weak, it is an opportunity for the company to force down prices and demand higher quality.

According to Porter, a supplier is said to be powerful, if the following conditions prevail:

i. The supplier industry is dominated by a few companies selling to many as it happens in petroleum industry.

ii. The product or service is differentiated, unique where it has built up switching costs. (Word processing software)

iii. Substitutes are not easily available (Electricity)

iv. Suppliers can threaten with forward integration and compete directly with the existing firms. (Raymond, ITC, Grasim)

v. A purchasing firm buys a small quantity of the supplier’s goods and services and it is unimportant to the supplier.

3. Bargaining Power of Buyers:

Buyers are viewed as a threat when they force the companies to charge low prices or demand higher quality and better service with their bargaining power. Buyers can be viewed as weak, if they give the company the opportunity to raise prices and make more profits.

According to Porter, the buyers are powerful in the following circumstances:

i. The suppliers are more in number but the buyers are few

ii. The buyers buy in large quantity

iii. More number of alternative suppliers and their products are not standardized and undifferentiated (Automakers get attractive discounts from steel suppliers).

iv. The cost of changing supplier is not much.

v. The supplier depends on the buyer for a large percentage of their total orders.

vi. The purchased item is not important to the final quality or price of buyer’s product.

vii. The buyer has the potential to integrate backward by producing the product itself.

viii.The buyers can use the threat of vertical integration as a measure for forcing down prices.

4. Substitute Products:

Substitutes are those products, which satisfy similar needs though appear to be different. Tea is a substitute of coffee, water is considered a substitute of soft drinks and saccharine is viewed as a substitute for sugar. According to Porter, ‘substitute products limit the potential returns of any industry by placing a ceiling on price, firms in the industry can charge’.

The existence of close substitutes poses a threat, by limiting the price and profitability of a company. Availability of few substitutes provides opportunity for the company to raise the price and get higher profit.

5. Rivalry among Existing Players:

When the intensity of rivalry is weak among established players within an industry, companies can raise prices and earn greater profits. If the rivalry is strong among other players, price competition and price war may result and it will reduce the profit margin.

The intensity of rivalry among established players is mainly due to three reasons:

i. Industry competitive structure (ICICI Bank vs SBI) (Duracell vs Eveready)

ii. Demand conditions

iii. The height of exit barriers in the industry.

i. Competitive Structure:

Competitive structure is concerned with size and number of companies in an industry. The structure may be classified as fragmented and consolidated structure. In consolidated structure, a small number of large companies dominate. In fragmented structure, a large number of small companies or medium sized companies are found but nobody dominates. Low entry barriers characterize many fragmented industries and new entrants enter easily when the demand is strong. It leads to building excess capacity, price war and business failures. A fragmented industry structure is a threat than an opportunity.

The nature and extent of competition is difficult to predict in consolidated industries where the interdependence between firms is quite perceptible. Hence, the competitive action of one company affects the profitability of other firms. The aftermath of such competitive interdependence can be a dangerous competitive spiral, with rivals undercutting each other’s price and profit.

ii. Demand Conditions:

The growing demand gives a company an opportunity to expand its operations. It can increase profits without fighting a share from other’s market. Thus a growing demand moderates competition and results in low intensity of rivalry. Under conditions of declining demand, a company can attain growth by taking a share from other companies. This intensifies rivalry and constitutes major threat of entry.

iii. Exit Barriers:

Exit barriers are serious threats when the demand is dwindling. Exit barriers are economic, strategic and emotional factors which make the companies compete though return is low.

Common exit barriers are as follows:

i. Investment in plant and machinery has no alternative use and cannot be sold off.

ii. The cost of exit is high. The terminal benefits of redundant workers are high.

iii. Strategic interrelationship between business units could be the reason. A low return unit may provide input for high-return units so the firm may not like to quit low-return business.

iv. Emotional attachment to the business may ruin if the company does not exit the business for sentimental reason. The companies resort to price war to utilize its capacity and secure orders.

v. The rivals are varied with respect to strategies, origin and personalities and they have different ideas about how to compete and continuously run head-on into each other in the process.

Finally the intensity of rivalry is determined by the interaction between competitive structure, demand conditions and exit barriers and it may constitute a threat or opportunity.

Porter’s Five Forces Model of Competitive Analysis

An industry refers to a set of organizations that deliver a similar product or service. Different organizations in a particular industry compete with one another to gain a bigger market share. For example, some of the strongest players in the Indian IT industry are Infosys, TCS, HCL, Wipro, and Mahindra Satyam.

Industry also includes different stakeholders such as – the buyers and the suppliers. In order to formulate a competitive strategy, an organization needs to analyze the industry in which it operates. In addition, before entering any particular industry, the organization needs to analyze the profitability in the industry.

Harvard University professor, Michael E. Porter developed an effective model for industry analysis. The model is known as the Porter’s Five Forces Model. In this model, Porter argued that profitability depends on the level of competition in an industry. Therefore, the organizational strategists need to analyze the different factors that shape industry competition.

Porter published an article in the Harvard Business Review, named “How Competitive Forces Shape Strategy”. In this article, Porter mentions the five competitive forces that determine the intensity of competition in an industry.

These forces are threat of new entrants, bargaining power of the suppliers, bargaining power of the buyers, threat of substitute products, and competitive rivalry among the existing competitors. In Porter’s words, “The collective strength of these forces determines the ultimate, profit potential of an industry.”

The five forces of the model are discussed as follows:

1. Threat of New Entrants:

It refers to the ease with which potentially new entrants can enter an industry. The degree of threat of new entrants in an industry depends on the entry barrier of the industry. The lower the entry barrier, the higher is the threat of new entrants, and vice versa. Low entry barrier attracts new players to enter an industry, which, in turn, puts a pressure on the price level. Therefore, a low entry barrier limits the profit potential of an industry.

2. Bargaining Power of the Suppliers:

It refers to the ability of the suppliers to manipulate the price of the products supplied to an organization. If the suppliers have a high bargaining power, the profit potential of the industry would be relatively low. The suppliers enjoy a high bargaining power if there are a few suppliers catering to a large number of organizations in the industry. In addition, if the product or service is unique in nature, and there is no other substitute of the product; even then the suppliers have an upper hand.

3. Bargaining Power of the Buyers:

It affects the profitability of an industry substantially. Bargaining power of the buyers refers to the ability’ of the buyers to bring down the price of products and services offered by an organization. If the bargaining power of the buyers is high, the profitability of the industry is adversely affected. Buyers enjoy a high bargaining power if they purchase a significantly large portion of the product or service of the organization. In addition, bargaining power of the buyers is high if a similar product is available with other organizations.

4. Threat of Substitute Products:

It plays a vital role in determining the profitability of an industry. Substitute products refer to the products which satisfies the same need of customers as other products. For example, laptop is a substitute of the Personal Computer (PC). Availability of substitutes limits the profit potential of an industry as the organization cannot charge a higher price for its product. For example, if the prices of Pepsi increase, consumers would easily switch to Coke.

5. Competitive Rivalry among Existing Competitors:

It refers to the intensity of competition among different organizations in an industry. According to Porter, the intensity of competition within an industry depends on a number of factors. These factors are the number of competitors, growth rate of the industry, nature of the product or service, product diversity, and exit barriers. Higher the intensity of competition; lower the profitability of an industry.

Therefore, we can see that Porter’s model is a very effective tool for analyzing the profitability of an industry.