The theoretical business valuation models include the following: 1. Dividend Growth Valuation Model 2. Walter’s Share Valuation Model 3. Modigliani and Millers’ Dividend Irrelevancy Model 4. Capital Asset Pricing Model.

1. Dividend Growth Valuation Model:

The dividends of most companies are expected to grow and the value of shares ascertained is based on dividend growth. Dividend valuation model assumes a constant level of growth in dividends in perpetuity. This model is known as ‘Gordon dividend growth model’.

The value of share under ‘dividend growth valuation model’ can be ascertained with the help of the formula given below:

Where, Pe = Market price per share (ex-dividend)

Do = Current year dividend

g = Constant annual growth rate of dividends

Ke = Cost of equity capital (expected rate of return)

Assumptions:

The dividend growth model using dividend capitalisation is based on the following assumptions:

1. Retained earnings represent the only source of financing.

2. Rate of return is constant.

3. Growth rate of the firm is the product of retention ratio and its rate of return.

4. Cost of capital remains constant and is greater than growth rate.

5. The company has perpetual life.

6. Tax does not exist.

The implications of the model is that when the rate of return is greater than the discount rate, the price per share increases as the dividend ratio decreases and if the return is less than discount rate it is vice versa. The price per share remains unchanged where the rate of return and discount rate are equal.

In fact some companies, although earning profits, elect not to pay dividends. This is a matter of deliberate financial policy, not a measure forced upon them by financial difficulties. The above theory of share valuation can still be applied to these companies, since one day presumably they will start paying dividends.

This is the only basis on which shareholders can obtain any returns from the company. The reason the price of shares rises is that with retention policies of the company, the rapid growth alters investors’ expectations about the future size of dividends.

At some time in the future, large dividends can be paid. It can be said that dividends determine the company’s share price.

2. Walter’s Valuation Model:

Prof. James E. Walter argued that in the long-run the share prices reflect only the present value of expected dividends, retentions influence stock price only through their effect on future dividends. Walter has formulated this and used the dividend policy to optimize the wealth of an equity shareholder.

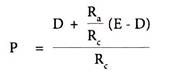

His formula in determination of expected market price of a share is given below:

Where, P = Market price of equity share

E = Earnings per share

D = Dividend per share

(E-D) = Retained earnings per share

Ra = Internal rate of return on investment

Rc = Cost of capital

If Ra is greater than 1, lower dividend will maximize the value per share and vice versa.

Assumptions:

The Walter’s model is based on the following assumptions:

1. All financing is done through retained earnings and external sources of funds like debt or new equity capital are not used.

2. With additional investment undertaken, the firm’s business risk does not change. It implies that firm’s IRR and its cost of capital are constant.

3. The firms has an infinite life and is a going concern.

4. All earnings are either distributed as dividends or invested internally immediately.

5. There is no change in the key variables such as EPS and DPS.

In view of Prof. Walter, in the long-run, the relationship between the rate of return on retained earnings or return on investment and the rate of market expectation is important to the investors.

We can summarise his idea into the following:

1. In a company where the rate expected by investors is higher than market capitalisation rate, shareholders would accept low dividends, and

2. In a company where return on investment is lower than market capitalisation rate, shareholders would prefer higher dividend so that they can utilize the funds so obtained elsewhere in more profitable opportunities.

According to Walter, the investment policy of a firm cannot be separated from its dividend policy and both are inter related. The choice of an appropriate dividend policy affects the value of an enterprise.

Retentions influence the share prices only through their effect on further dividends. Walter’s formula is criticized for the reason that it does not consider all the factors affecting dividend policy and share prices.

3. Modigliani Arid Miller’s Dividend Irrelevancy Model:

The traditional theories rely on dividend policy which determines the ultimate distribution of firm’s earnings and retention of part of earnings. Retained earnings are assumed to provide investors with a source of potential future earnings growth and it is determinant of share value or market price of a share.

MM argue that dividend policy does not have a significant effect on a firm’s value or on its share price. MM asserts that a firm’s value is determined solely by its investment decisions and that the dividend payout ratio is a mere detail.

MM claim that changes in firm value as a result of dividend policy is only due to the informational content or signaling effects of dividend policy.

According to MM model the market price of a share, after dividend declared, is ascertained as follows:

Where, P0 = Prevailing market price of a share

P1 = Market price of a share at the end of period one

D1, = Dividend to be received at the end of period one

Ke = Cost of equity capital

MM dividend irrelevance model holds good in a world of certainty and confirms to conditions of symmetric market rationality.

4. Capital Asset Pricing Model:

The capital asset pricing model (CAPM) is a theory that can be used to determine required rates of return on financial and physical assets. The model provides a strong analytical basis for evaluating risk-return relationship. The model asserts the risk factor in a portfolio is a combination of systematic and unsystematic risks.

Systematic risk refers to that portion of the variability of an individual security’s returns caused by factors affecting the market as a whole and cannot be eliminated by diversification of portfolio. The unsystematic risk is unique or specific to each firm which can be eliminated by having efficiently diversified portfolio.

CAPM shows the risk-return relationship of an investment in the formula given below:

E(Ri) = Rf+βi(Rm-Rf)

Where, E (Ri) = Expected rate of return on individual security or portfolio of investments

Rf = Risk free return

Rm = Expected rate of return on market portfolio

Rm – Rf = Risk premium

βi = Beta of investment i.e. market sensitivity index of a security or portfolio of securities.

Beta is a measure of volatility of a security’s returns relative to the returns of a broad-based market portfolio ‘m’. Beta is the ratio of the co-variance (or co-movement) of returns on security ‘I’ and market portfolio ‘m’ to the variance on the market portfolio.

CAPM suggests that the prices of securities are determined in such a way that the risk premium or excess return are proportional to systematic risk, which is indicated by the beta coefficient.