This is the most widely used measure of return on bonds.

It may be defined as the compounded rate of return an investor is expected to receive from a bond purchased at the current market price and held to maturity.

It is really the internal rate of return earned from holding a bond till maturity.

YTM depends upon the cash outflow for purchasing the bond, that is, the cost or current market price of the bond as well as the cash inflows from the bond, namely the future interest payments and the terminal principal repayment.

YTM is the discount rate that makes the present value of cash inflows from the bond equal to the cash outflow for purchasing the bond.

The relation between the cash outflow, the cash inflow and the YTM of a bond can be expressed as:

Where,

MP = Current market price of the bond

Ct = Cash inflow from the bond throughout the holding period.

TV = Terminal cash inflow received at the end of the holding period.

The yield to maturity is the annual return annual rate (discounted) earned over a bond kept until maturity. The yield to maturity is the discount rate estimated mathematically that equals the cash flow of payment of interest and principal received with the purchasing price of the bond.

This term is also referred to as internal rate of return or as the expected rate of return of the bond and it is the yield in which most bond investors are interested in.

The yield-to-maturity depends on two assumptions:

i. The bonds are held to maturity

ii. The interest payments received are reinvested at the same rate as the yield-to-maturity

Methods for Calculation of YTM:

1. By Trial and Error Method:

Where the left hand side of the equation should be equal to right hand side.

Example 1:

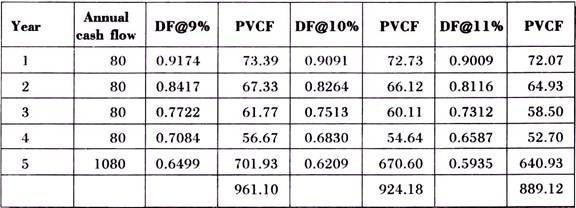

A five year coupon bond with 8% coupon rate and maturity value of Rs.1000 is currently selling at Rs.925.

Its YTM would be calculated as follows:

Bond value at 9% discount rate = 961.10

Bond value at 10% discount rate = 924.18

Bond value at 11% discount rate = 889.12

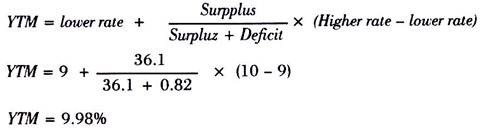

The present market value of the bond is Rs.925, which lies between Rs.961.10 and Rs.924.18, therefore, by interpolation,

This method is time consuming because it may take too much time to locate the start (lower) and end (higher) rate. This limitation is overcome by the formula method.

2. By Formula Method:

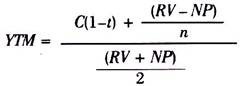

The following formula can be used to find out YTM:

Where,

C = Coupon Interest

t = Tax rate

RV = Redemption Value

NP = Net Proceeds

n = No. of years

Example 2:

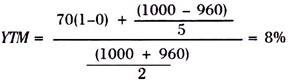

Suppose an investor is considering the purchase of a 5 year Rs.1000 bond bearing a coupon rate of 7% and the current market price of the bond is Rs.960, then the investors required rate of return would be

But, though the formula method is not as time consuming as Trial and error method, it does not give answer as accurate as Trial and Error method.

Yield to Call:

The yield-to-call is the annual rate of return that bondholders receive at a date on which the bond is called. When a bond has a call feature, the bondholder can estimate the yield-to-call by substituting the call price for that of the maturity price in the equation shown above in the yield-to-maturity section. Both, the yield-to-call and the yield-to-maturity should be determined because if the bond is called the yield-to-call will be the annual overall return that the bondholder will receive over his bonds.