In this article we will discuss about:- 1. Meaning of Bonds 2. Bond Value 3. Theorems 4. Computation of Future Cash Flows.

Meaning of Bonds:

Bonds are negotiable promissory notes that can be used by individuals, business firms, governments or government agencies. Bonds issued by the government or public sector companies in India are generally secured. Private sector companies may issue secured or unsecured bonds. In case of the bond, the rate of interest is fixed and known to investors.

A bond is redeemable after a specific period. The expected cash flows consists of annual interest payments plus repayment of principal. The value of an asset is the present value of the expected returns from the asset during the holding period. An investment in stocks is expected to provide a stream of returns during the holding period and it is necessary to discount this stream of expected returns at the expected rate of return to determine the value of the securities.

Bond Value:

To determine the fair price of a bond, we have to appreciate the fact that the market interest rate for the term to maturity (or the residual term to maturity) of a bond keeps changing in the real world. Although the coupon of a bond is never changed, as the market interest rate changes, adjustments will have to be made in the price of bonds to reflect the on going market interest.

Thus, when the market rate and the coupon rate for a given maturity are the same, the bond will, obviously, trade at par. When the market interest rate rises beyond the coupon of the bond, the price of the bond will have to be lowered so that the income from the bond is in line with market rates. Conversely, if the market interest rate goes below the coupon of a bond, its price will have to be higher to reflect the lower market interest rate.

Thus the valuation of a bond, fundamentally, rests on the movement in market interest rates. The valuation of bond is easier than the valuation of common stock because the pattern of returns and repayment period is known beforehand.

What we mean by value of a bond is the present value of all its future cash flows. The sum of all the present value of all future cash flows of a bond is its fair value. Let us take the example of an 8% bond with a residual maturity of exactly five years from today with the assumption that the coupon is paid annually on this bond.

If the present market interest rate for five years maturity is say 9%, then the value of this bond is given by the total present value of all the five annual coupon payments of Rs.8 each and the face value of Rs.100 payable at maturity.

Mathematically:

The cash flows on account of coupon payments are uniformly Rs.8 for five years at annual installments. This is nothing but an annuity for five years. The face value of 100 payable on maturity is a single cash flow.

So in order to find the present value of this series of cash flows we may rewrite the above equation as:

Total P.V. = [Rs.8 x P.V. annuity factor at 9% for 5 years] + [Rs.100 x P.V. factor at 9% at the end of 5th year]

These factors as observed from the PV annuity table and PV single cash flow tables are 3.8897 and 0.6499 respectively. Therefore, the Total P.V. of the bond = [Rs.8 x 3.8897] + [Rs.100 x 0.6499] = Rs.96.1076

Problem 1:

Mr. Rohit is willing to purchase a 5 years Rs.1,000 par value PSU bond having a coupon rate of 9%. His required rate of return is 10%. How much Mr. Rohit should pay to purchase the bond if it matures at par?

[Given: PVIFA (10%, 5 years) = 3.791 and PVIF (10%, 5 years) = 0.621]

Solution:

If the bond matures at par Bn = Rs. 1,000

Interest each = Rs. 1,000 x 9/100 = Rs.90

Required rate of return on debt (Kd) = 10%

B0 = (Rs.90 x 3.791) + (Rs. 1,000 x 0.621) = 341.19 + 621.00 = 1962.19

Theorems in Bond Valuation:

Theorem 1:

The price of a bond is inversely related to the yield to maturity.

The YTM or the ruling market interest rate has an inverse impact on bond prices. When the interest rate goes up, bond prices come down and vice versa. Let us take a bond with a coupon of 8% maturing exactly in 10 years.

When the market interest rate is 9%, its price would be:

Price = Rs.8 x 6.4177 + Rs.100 x 0.4224 = Rs.93.58

When the market interest rate goes up by say 1% to 10%, the price of the bond would be:

Price = Rs.8 x 6.1446 + Rs.100 x 0.3855 = Rs.87.71

We notice that the price of the bond has fallen to 87.71 when interest rate has risen to 10% from 9%.

When the market interest rate goes down from 9% to 8% the price of the bond would be:

Rs.8 x 6.7101 + Rs.100 x 0.4632 = Rs.100

We notice that the price has gone upto Rs.100 from Rs.93.58. Thus we conclude that bond prices and yield are inversely related. An interesting observation that can be made from the above discussion is that the price of the bond is Rs.100 (par) when the market rate and the coupon of the bond (8%) are the same.

Theorem 2:

The increase in the price of a bond when the interest rate goes down by a certain percentage is greater than the decrease in its price when the interest rate goes up by the same percentage.

In other words, given the same level of say 1 % change in interest rate, the price appreciation on account of interest rate going down by 1 % is greater than the price depreciation on account of interest rate going down by 1%.

This is amply illustrated in the example we worked out earlier for theorem 1 in which we saw the appreciation in price when interest rate fell from 9% to 8% at Rs.6.4184 x 100/93.5816 = 6.858% whereas the depreciation was 5.8748 x 100/93.5816 = 6.277% when the interest rate went up from 9% to 10%.

This property of a fixed income security whereby the bond suffers lesser depreciation on account of rise in interest rate than the appreciation it enjoys for the same degree of fall in interest rate is called it Convexity.

Theorem 3:

Longer the term to maturity of a bond, higher will be its price sensitivity.

If we have two bonds of same coupon say 8% one maturing in 10 years and the other maturing in 7 years, the 10 years bond will experience more price sensitivity than the 7 years bond. In the example we worked out (for theorem 1) we have seen the price depreciation of the bond maturing in 10 years with a coupon of 8% when the interest rate went up from 9% to 10% is Rs.5.8748 and the change in price = 6.277%.

If we calculate the price of the 7 years bond at 9% and 10% we find the depreciation is Rs.4.697, as shown below:

Price at 9% = 8 x 5.0330 + 100 x 0.5470 = Rs.94.964

Price at 10% = 8 x 4.8684+ 100 x 0.5132 = Rs.90.267

The percentage change in price = [(94.964 – 90.267)/94.964] x 100 = 4.946%

The depreciation in the price of the 10 years bond is obviously more than the depreciation in the 7 years.

Theorem 4:

Between two bonds of same maturity but different coupons, the bond with the lower coupon will experience more price sensitivity than the one with higher coupon.

Let us say there are two bonds of ten years maturity with coupons 8% and 6% respectively. When the market interest rate is 9%, the price of the bond with coupon 8% is 93.5816 and the price of the bond with coupon 6% is 80.7462. If the market interest rate changes to 10% from 9% the prices of the bonds are 87.7068 and 75.4176 respectively.

The percentage changes in the price of these bonds (6.277% and 6.60% respectively) clearly indicate the higher price sensitivity of the bond with the lower coupon (i.e. 6%).

Theorem 5:

Between two bonds of same coupon and same maturity but differing coupon payment intervals, the bond with higher frequency of coupon payment is less sensitive to price changes when market interest rate changes.

Let there be two bonds of 8% coupon and of 10 years maturity. Bond A pays coupon semi annually and Bond B pays annual coupons. We can observe that the bond A which pays semi annual coupons is less price sensitive to interest rate changes.

Computation of Future Cash Flows of a Bond:

The valuation of Bond is explained with the help of the following illustrations:

Problem 2:

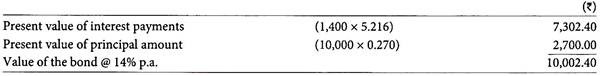

In 2015, Jeevan Dhara Ltd. has issued bonds of Rs.10,000 each due in the year 2025 with a 14% p.a. coupon rate payable at the end of each year during the life of the bond. Calculate the present value of the bond.

Solution:

Yearly receipt of interest = Rs.1,400. Present value of Rs.1 received annually for 10 years @ 14% p.a. is 5.216.

Problem 3:

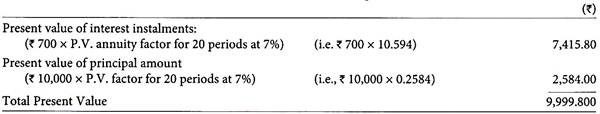

Suppose, the bonds issued in above illustration, on which interest is payable half yearly. Then calculate the present value of the bond.

Solution:

Half yearly receipt of interest = Rs.700

No. of periods = 20 at half interest @ 7%

Most large and medium sized companies finance some portion of their fixed assets with long-term debt. This may be in the form of either secured bonds or unsecured debentures. The term bond is often used to denote any type of long-term debt security. The valuation of bonds by ascertaining its future cash flows which includes the interest payments as well as principal repayment.

V = Present value of bond

I = Annual interest payment

n = Numbers of years to maturity

F – Face value of bond

The formula can be summarized as follows: