Some frequently asked exam questions on strategy identification are as follows:

Q.1. Identify the most important pitfalls that ought to be avoided in starting and doing strategic planning.

Ans. The issues in a corporate strategic planning involve judgments, values, passions, and perceived consequences. So, irrationality cannot be avoided.

Major pitfalls that should be avoided in starting and doing the strategic planning may be listed as follows:

1. Failure to develop throughout the company an understanding of what strategic planning really is, how it is to be done, and the degree of commitment of top management in doing it well.

2. Failure to accept and balance interrelationships among intuition, judgment, managerial values, and the formality of the planning system.

3. Failure to tailor and design the strategic planning system to the unique characteristics of the company and its management.

4. Failure to encourage managers to do effective strategic planning by basing performance appraisal and rewards solely on short-range performance measures.

5. Failure to modify the planning system as conditions within the company change.

6. Failure to understand the analytical tools used in different parts of the planning process.

7. Failure to balance and link appropriately the major elements of the strategic planning and implementation process.

8. Failure to secure in the company a climate for strategic planning that is necessary for its success.

9. Failure to understand the importance of strategy implementation and how to make that process efficient and effective.

10. Failure to mesh properly the process of management and strategic planning.

Q.2. How does strategic planning in a small company differ generally from that in a large company?

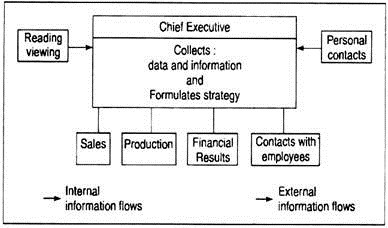

Ans. Strategic planning, irrespective of being formal or informal, of a small company is much less complex than in a larger company. The diagram below illustrates a typical planning model for strategic planning in a small company.

Q.3. What types of plans and planning systems would you expect to find in a large decentralised company?

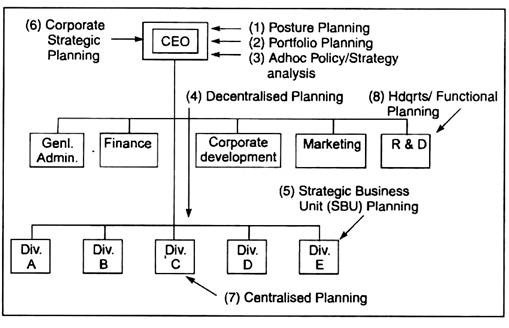

Ans. The diagram below illustrates the types of plans normally found in a large company.

The above diagram identifies eight different plans serially numbered from (1) to (8).

Posture plans concern the company’s basic missions, purposes and underlying aims. Portfolio plans represent resource allocation among the divisions, affiliated companies or projects , Adhoc policy/strategy analysis identifies top management activities to help in making policy/strategy decisions.

The plans above (numbered 1, 2 and 3) are prepared by the CEO with the help of managers and staff specialists. For decentralised planning, the divisions A, B, D and F are asked to prepare comprehensive strategic plans covering their operations. This results in the SBU plans, where SBUs are distinct business with their own set of competitors.

On the basis of the divisional plans, the company prepares the Corporate Strategic Planning. Centralised planning is pursued for Division C and for the major functions (e.g. corporate development, marketing, R&D, general administration, finance) at the company headquarters.

Planning within each of the divisions is usually centralised so far as the division is concerned. Finally, the corporate headquarters prepare strategic plans in consideration of probable events that can open up great opportunities or pose serious threats. They also ask themselves some ‘what-if questions and then try to sketch out responses appropriate in the event that the contingency takes place and draw contingency plans.

Q.4. What are the aspects that should be considered in the initial selection of project ideas out of several alternatives?

Ans. The following aspects need consideration in the initial selection of project ideas:

1. Compatibility with the Organization:

The project idea must be compatible with cultural values and resources of the organisation.

A real opportunity has three characteristics:

(i) Fitness to the organisational culture,

(ii) Accessibility to an organisation, and

(iii) Prospect of rapid growth and high return on investment.

2. Consistency with Government Priorities:

The project idea must be consistent with:

(i) National goals and priorities; and

(ii) Governmental regulatory framework, e.g. environment laws.

3. Availability of Inputs:

A project must have reasonable supports in respect of resources and inputs such as capital, technical know-how, raw materials, power, and transportation and communication network.

4. Adequacy of Market:

The following factors need evaluation about this:

(i) Total present home market,

(ii) Export market,

(iii) Competitors and their market shares,

(iv) Own products (quality, price, etc.) vs. competitive products,

(v) Sales and distribution system,

(vi) Patterns of consumption including projections,

(vii) Barriers to the entry of new units,

(viii) Patent protection, and

(ix) Economic/social/demographic trends.

5. Cost Structure:

The proposed project must be able to realise an acceptable profit with a competitive price. Apart from sustaining a cost advantage, the economics of scale need careful evaluation.

6. Acceptability of Risk Level:

The risk characteristics associated with a project idea must be weighed and assessed in the light of business cycles, technology change, competition from substitutes, competition from imports /foreign investors, and governmental controls.

Q.5. What are the various aspects that are to be considered in a SWOT analysis by an existing enterprise while seeking to identify new project opportunities?

Ans. An existing firm which seeks to identify new project opportunities should undertake SWOT analysis with respect to the following strategic issues:

1. Internal financial resources—extent of availability after meeting essential commitments.

2. External financial resources—types, and nature of sources that are most suitable.

3. Production facilities, technological capabilities, in-house R&D efficiency, feasibility of technical collaborations, etc.

4. Situations regarding raw materials, power, and infrastructural facilities.

5. Corporate image before the ‘four publics’, market share—existing and projections.

6. Government regulations—present impact and impact on the foreseeable future.

7. Likely growth in world economy/national economy and impact on the sectors to be chosen.

8. Competition, substitution of products, shifts in consumers’ preferences, etc.

Q.6. “The range of alternatives open to managers in identifying policies and strategies is very wide. The range covers a spectrum from solely intuitive various bases and approaches to highly systematised processes.” Identify and list down the various bases and approaches used in identifying strategies.

Ans. The choice of strategies is almost endless. The bases and approaches used in identifying strategies are many and varied. Neither of them is superior to the others. The approaches are not mutually exclusive but may be the subsets of one another and they can be used in various combinations.

However, a list is made as follows:

(1) Situation analysis (SWOT),

(2) Situation audit,

(3) Policy/Strategy profile,

(4) Gap analysis,

(5) Competitive strategy,

(6) Product/Market matrix,

(7) Product portfolio matrix (also known as Growth/Share matrix or BCG matrix,

(8) Product life cycle analysis,

(9) PIMS (profit impact of market strategies),

(10) Learning curve,

(11) Computer models,

(12) Invention,

(13) Intuition,

(14) Synergy effect analysis,

(15) Brainstorming,

(16) Delphi technique,

(17) Dialectics,

(18) Game playing,

(19) Scenarios analysis,

(20) Impact analysis, etc.

Strategy identification is not a single and discreet step in management. It involves considerations of various aspects such as cognate thought processes, managerial values, organisation structures, company life cycles, and interpersonal relationships. It is iterative with many other parts of the strategic decision-making process.

Q.7. The ‘situation audit’ differs from company to company and from time to time depending upon many factors- Discuss.

Ans. The situation audit should contain all information of importance to a company in formulating strategy and determining whether it can be implemented properly.

This involves, of course, both formally and informally accumulated information. Even though the strategists mostly agree with the conceptual content of the situation audit, there is little consensus about what is and should be done in practice. This is because very few companies can analyse all information envisaged by the very wide dimensions of this situation audit.

As a result, the following types of differences in the approaches of this audit are found:

(i) Selective Process:

Every company must choose carefully: what will be examined and how deep will be the analysis in any particular part of the audit. This is, all the more, a necessity as a company may miss an important element in its environment or may become bogged down in staff reports.

(ii) Personal Source of Information:

A part of the typical situation audit may not contain the decisive criteria. Personal sources of information through acquaintances and reflections about the environment play a great role in strategic decisions.

(iii) Formalisation:

Large corporations will mostly have voluminous reports and studies concerned with past performance, current situation and future prospects and environments. The more formal the strategic planning system the more formalised will tend to be the making of situation audit.

(iv) Organisational Level:

A situation audit for a SBU will, of course, differ from one made by a centralised Company. It will also differ from the situation audit made by the central headquarters of a decentralised company.

(v) Accumulation Scheme:

A situation audit is not made by one staff group. For instance, a corporate planner of a large, decentralised company may make a general economic forecast to be used as a frame of reference by all the divisions.

The divisions prepare economic forecasts of markets for their products. Similarly, the public relations staff may make forecasts of changing social and political environments. All these require accumulation and introduction into the strategic planning process by the planning staff.

(vi) Degree of Examination:

Some large companies may make systematic examination of various interests and managerial values, while most other companies concentrate on information in the data base without any consideration to other issues.

Q.8. Prepare a conceptual classification of information in a Situation Audit.

Ans. The conceptual classification of information in a Situation Audit:

1. Expectations from Outside Constituents:

Stockholders, Suppliers, Customers, Government, Community, Creditors, Intellectuals, etc.

2. Expectations from People inside the Company:

Board of directors. Managers, Staff, Workmen.

3. Past Performance:

Sales, Profits, Return on Investment, Managerial skills, Labour relations, Product development capability, Public relations, Productivity, Marketing capability, etc.

4. Current Situation:

Financial: Profitability, sales, debt, liquidity, ROI, etc.

Resource use efficiencies: Sales per employee, Profit per employee, Investment per employee, Plant utilisation, Human resource use, Managerial capabilities. Staff capabilities, etc.

Employee evaluation: Skills, Productivity, Turnover, Workmen’s satisfaction, Attitudes, etc.

Products/Markets: Share, Strengths, Weaknesses, etc.

Technology assessment: Technical strengths/weaknesses, Impact on community. Present state-of-art.

Competition: Price, Product, Market, Technology, etc.

Social policies: Corporate image, Socially desirable items, Social programmes, Adherence to pollution standards, etc.

Organisation structure: Strengths, weaknesses, suitability, etc.

5. Forecasts:

Economic: Projected sales, GNP, Inflation rate, Market potential, etc.

Competition: Price, Product, Technology, etc.

Social forces: Values, Attitudes, Consumers’ forum, Political trends.

6. SWOT Analysis:

Strengths and Weaknesses (Internal), Opportunities and Threats (External).

Q.9. What are the factors and characteristics needed to be adequately considered as a part of operational exercise in situational analysis?

Ans. The following factors and characteristics are needed to be adequately considered as a part of operational exercise in situation analysis:

1. Key Success Factors:

Secrets of success, break-even charts, contribution margins.

2. Market Characteristics:

Segments, growth trends, customer identification, consumer attitudes, buying habits, pricing.

3. Competitive Profiles:

Identification, market shares, typical responses, specific comparisons.

4. Product/Market Comparisons:

Products, promotion, distribution.

5. Manufacturing Factors:

Process descriptions, inputs, capacity, competitive comparisons, other uses, planning and control systems.

6. Technology Factors:

Materials, processes, products, customers, and others.

7. Economic, Social, Political, Governmental Factors:

Economic and demographic forecasts, probable effects of social and political changes, government budgets and fiscal measures, legislated controls and restrictions.

8. Internal Assumptions.

9. Planning Gaps Now Foreseeable:

Life cycle analysis; size of sales, profits, assets gap; rationale of acquisitions versus internal development; divestment possibilities.

10. SWOT items:

Strengths, weaknesses, opportunities, problems, and threats.

Q.10. Explain policy-strategy profile and their role in strategy identification.

Ans. A policy-strategy profile is a systematic examination and assessment of a company’s present policy or strategy—explicit and implicit. Such profile recognises the principal policies or strategies in each major area such as competition, finance, marketing, pricing, production, distribution, and so on.

For example, a company may have a policy not to allow one customer to buy more than 15 per cent of the total sales of a firm. Excessive concentration of sales and profits in one customer may have the effect of a sudden drop in the purchases of that customer.

So, if it is found that one customer buys more than 30 per cent of the total output of a company, one of two things or a combination of both should be done:

(i) The policy should be revised, or

(ii) New policies and strategies should be devised to reduce concentration.

There may be many other possibilities such as: a strategic decision by a bank to have a conscious reduction of large credits to the customers, an acquisition of another firm by itself will reduce dependence on the supplier, or an aggressive campaign to penetrate new markets to raise total sales, or opening retail outlets instead of depending on the distributors, etc.

Q.11. Explain the concept of product-market matrix.

Ans. The product-market matrix shows the strategic alternatives available to an organisation for achieving its objectives. It indicates that an organisation can grow in a variety of ways by concentrating on present or new products and on present or new customers.

1. Market Penetration Strategies:

They focus on improving the position of the organisation’s present products with its present customers.

For example:

(i) A Brewer concentrates on getting its present customers to purchase more of its product.

(ii) A charitable institution seeks ways to increase contributions from present contributors.

(iii) A Banking company concentrates on getting present depositors to use additional services.

Such a strategy may involve devising a marketing plan to encourage present customers to purchase more of the product or a production plan to produce the present product more efficiently. In other words, it concentrates on improving the efficiency of various functional areas in the organisation.

2. Market Development Strategies:

They focus on finding new customers for the organisation’s present products.

For example:

(i) A manufacturer of industrial products may decide to develop products for entry into the consumer products’ market.

(ii) A social institution may seek individuals and families who have never utilised its services.

(iii) A manufacturer of adult’s health care products decides to enter children market because of relatively high birth rate in a country.

3. Product Development Strategies:

They focus on seeking new products to be developed by an organisation for its present customers.

For example:

(i) A cigarette manufacturer may decide to offer low-tar cigarette.

(ii) A social service agency may offer additional services to the present client— families.

(iii) A university may develop graduate programmes for socially backward students.

4. Diversification Strategies:

An organisation diversifies when it seeks new products for customers that are not being served at present.

For example:

(i) A cigarette manufacturer diversifies into real estate development.

(ii) A management institute establishes a cell to find commercial uses of the results of faculty research efforts.

On what basis does an organisation choose one or more strategies? Management will select those strategies that capitalise on the organisation’s distinctive competencies and are consistent with its mission.

Q.12. ‘Porter’s framework is not an automatic formula for strategic choice. It is an analytical approach, a framework a device for narrowing the search, in industry analysis’. Identify the data categories for ‘industry analysis’ recommended by Porter.

Ans.: Data Categories for Industry Analysis:

In his book ‘Competitive Strategy: Techniques for analysing industries and competitors’, Porter laid out the vast majority of really significant forces with which the managers should be concerned in formulating their competitive strategies. These not only act as a frame of reference for managers but a check-list by means of which strategies can be identified, and once the strategies are identified, the list can serve as a basis for suitability of a particular strategy.

After assessing the forces operating in an industry, the strategist is in a position to protect the company from hostile environmental forces or to take advantage of them, whichever is most appropriate. Such a study, when carefully done, opens up all sorts of possibilities from which the strategist must choose.

According to him, the critical data to be collected in relation to industry analysis are tabulated below:

1. Product lines

2. Buyers and their behaviour

3. Complementary products

4. Substitute products

5. Growth: Rate/Pattern (seasonal, cyclical)/Determinants

6. Technology of production and distribution: Cost structure/Economies of scale/Labour/ Value added/Logistics.

7. Marketing and Selling: Market segmentation/Marketing practices

8. Suppliers

9. Distribution channels (if indirect)

10. Innovation: Types/Sources/Economies of scale/Rate

11. Competitors: Strategy/Goals/Strengths and weaknesses/Assumptions

12. Social, political, and legal environment

13. Macro-economic environment.

Q.13. What are the various factors having strategic implications?

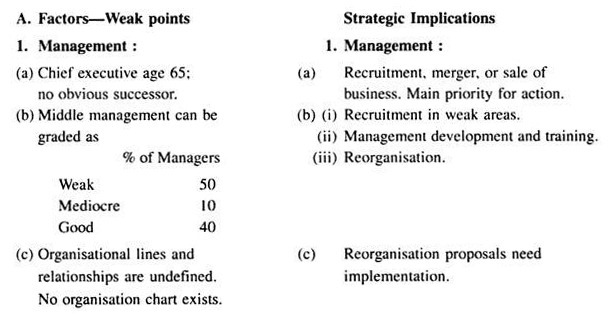

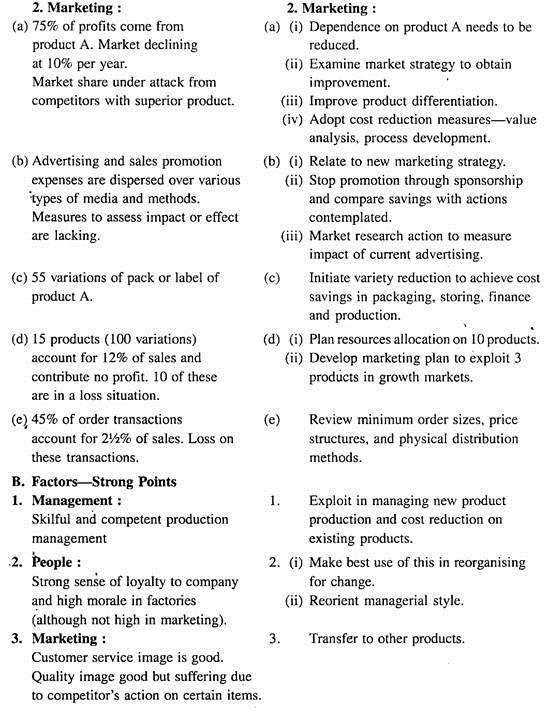

Ans. Corporate appraisal of long- established management procedures covering various functional elements, when undertaken by conscientious managers, provides a host of factors of strategic importance—some of them are strong points which are needed to be properly exploited to a firm’s advantage and some are weak ones needing rectification.

This exercise, according to Denning, leads to formulation of a ‘capability profile’ for each of a firm’s activities. This relates a firm’s particular strengths and weaknesses to the businesses it is in, thus providing a basic guide for further action through strategy identification and implementation for the ultimate goal of business success.

However, a hypothetical list is given below:

Q.14. What do you understand by corporate capability profile?

Ans. Corporate capability profile refers to the state of present position obtained after due assessment and evaluation of corporate strengths and weaknesses. According to Denning, a capability profile of a firm for each of its activities can be prepared by means of corporate appraisal.

This relates a company’s particular strengths and weaknesses to the businesses it is in, and thus, providing a basic guide for further action. For capability profile, strong and weak points should be identified where possible—using market research, internal opinion, and company results as the sources of data.

For example:

One company may be particularly effective in its customer service, another may be excellent at physical distribution. It may be possible for one company to utilise design skills more skilfully than its competitors. Another may have a particular or unique marketing flair.