If the shareholder, who is offered right shares, does not want to purchase further shares, he can renounce or sell his rights within the specified period. As, generally, the rights shares are offered to the existing shareholders at a price lower than the market price of shares, the right to purchase these shares is valuable.

The value of the rights can be found as follows:

1. Find out the market value of shares which an existing shareholder is required to have so as to get right shares.

2. Add to the market value of shares the price to be paid for new or right shares.

ADVERTISEMENTS:

3. Calculate the average value of the existing and new shares.

4. Deduct the average price as calculated in 3 above from the market price of the share.

The difference thus obtained is the value of the right.

The value of the right can also be found with the help of the following formula:

ADVERTISEMENTS:

V = M – S/N + 1

Where;

V represents the value of the right

M represents the market price of shares

ADVERTISEMENTS:

S represents the price offered for right shares and

N represents the number of shares to get one right share.

The valuation of right can be explained with the help of the following examples:

Illustration 1:

ADVERTISEMENTS:

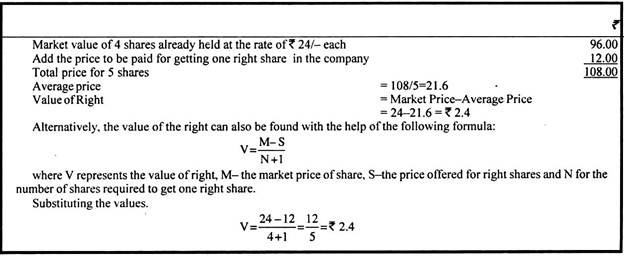

A public limited company offers to its existing shareholders the right to buy one share at the rate of Rs. 12 per share for every four shares of Rs.10 each held in the company. The market value of the shares on the date of such offer is Rs.24 per share.

Calculate the value of the rights.

Solution:

Illustration 2:

ADVERTISEMENTS:

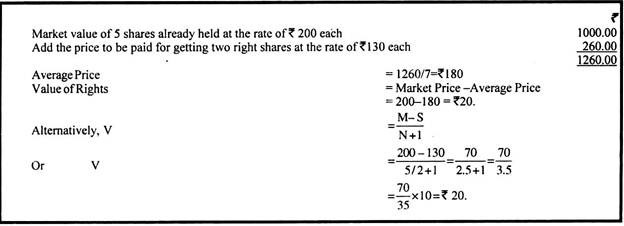

A company offers to its shareholders the right to buy 2 shares at Rs. 130 each for every 5 shares of Rs. 100 each held in the company. The market value of the shares is Rs. 200 each.

Calculate the value of right.

Solution:

Illustration 3:

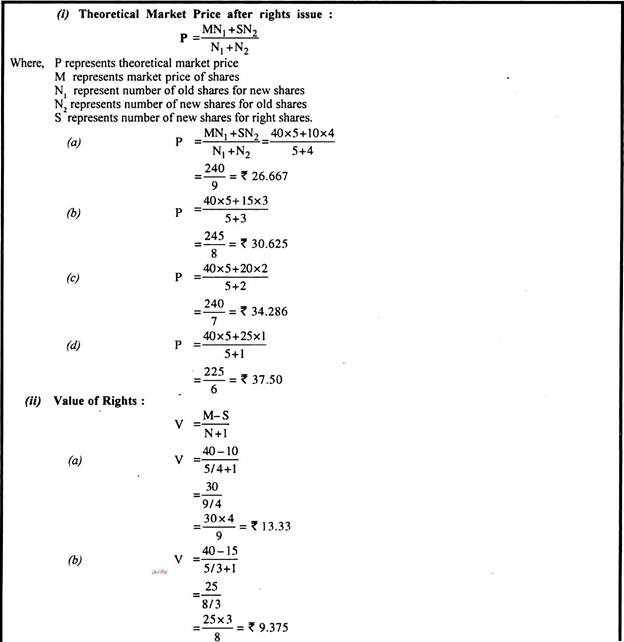

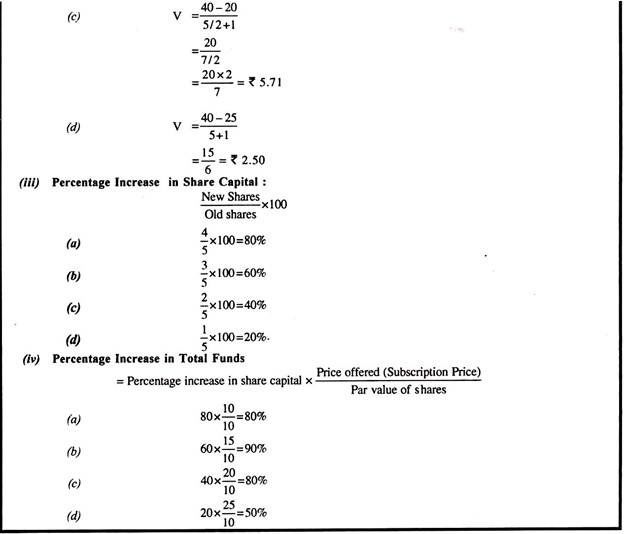

Progressive Corporation is planning to raise funds by making rights issue of equity shares to finance its expansion. The existing ordinary share capital of the company is Rs.1 crore. The par value of its shares is Rs. 10 and the market price is Rs. 40.

The alternatives under consideration before the management for making rights issue are given below:

(a) 4 new shares for 5 old shares at par.

ADVERTISEMENTS:

(b) 3 new shares for 5 old shares at Rs. 15

(c) 2 new shares for 5 old shares at Rs.20

(d) One new share for 5 old shares at Rs. 25

You are required to analyse for each alternative:

(i) Theoretical market price after rights issue;

(ii) Value of rights;

ADVERTISEMENTS:

(iii) Percentage increase in share capital,

(iv) Percentage increase in total funds.

Solution:

Illustration 4:

ADVERTISEMENTS:

AXLES Limited has issued 10,000 equity shares of Rs. 10 each. The current market price per share is Rs. 30. The company has a plan to make a rights issue of one new equity share at a price of Rs 20 for every four shares held. You are required to.

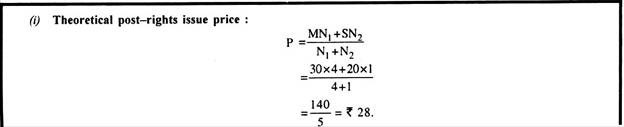

(i) Calculate the theoretical post-right price per share;

(ii) Calculate the theoretical value of the rights alone;

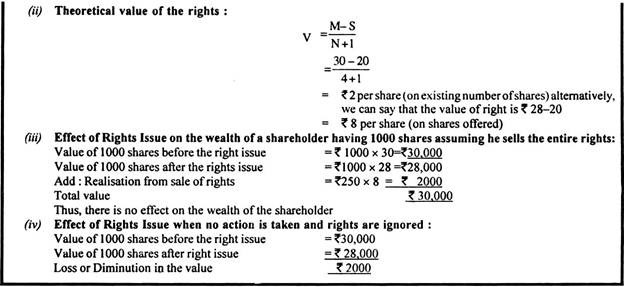

(iii) Show the effect of the rights issue on the wealth of a shareholder who has 1,000 shares assuming he sells the entire rights; and

(iv) Show the effect if the same shareholder does not take any action and ignores the issue.

Solution: