Here is a compilation of top five problems on bonus issue of shares with their relevant solutions.

Bonus Issue of Shares: Problem with Solution # 1:

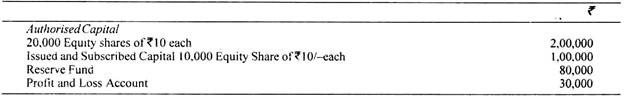

The following are the extracts from the draft Balance Sheet of A Ltd., as on December 31,2010

A resolution was passed by the company declaring bonus of 25% on equity shares to be provided as to Rs 15,000 out of reserve fund and the balance out of profit and loss account. The bonus was to be satisfied by issuing fully paid equity shares.

ADVERTISEMENTS:

You are required to make necessary journal entries and show the effect on the Balance Sheet of the company.

Solution:

Bonus Issue of Shares: Problem with Solution # 2:

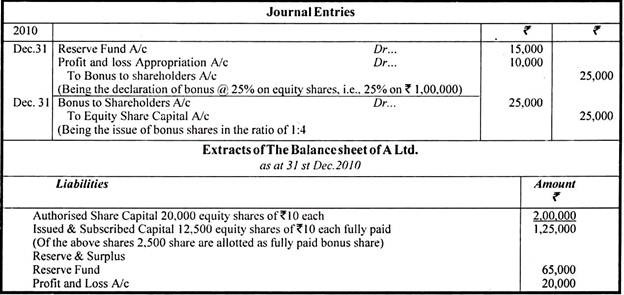

A company has a share capital of 5,00,000 equity shares of Rs. 10 each, Rs. 6 per share paid. It has a balance in the Reserve Fund Account amounting to Rs. 50,00,000. The company has decided to pay bonus to shareholders by making the partly paid share as fully paid. Make necessary journal entries to record the same.

ADVERTISEMENTS:

Solution:

Bonus Issue of Shares: Problem with Solution # 3:

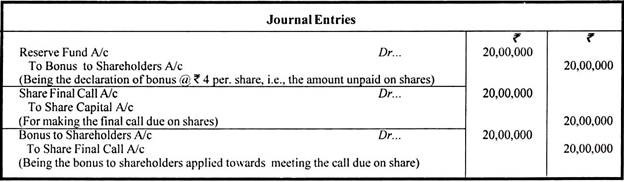

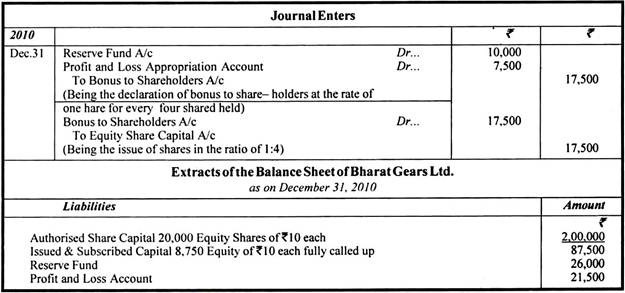

The extracts are given from the draft Balance Sheet of Bharat Gears Ltd. as on 31st December 2010:

The Board of Directors pass a resolution to capitalise a part of existing reserves and profits by issuing Bonus Shares. One bonus share is being issued for every 4 equity shares held at present. For this purpose, Rs. 10,000 are to be provided out of Reserve Fund and the balance out of Profit and Loss Account.

ADVERTISEMENTS:

Set out the journal entries to give effect to the resolution and show how they would affect the Balance Sheet of the Company.

Solution:

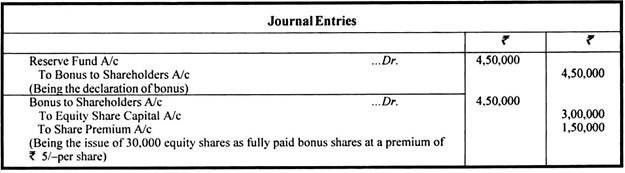

Bonus Issue of Shares: Problem with Solution # 4:

A company has a share capital of 1,00,000 equity shares of Rs. 10 each fully paid. The company has a reserve fund of Rs. 10,00,000 and declares a bonus of Rs. 4,50,000. This bonus is to be paid by issue of fully paid equity shares at a premium of Rs. 5 per share. Shares are quoted at Rs. 20 per share on the date of allotment of bonus issue.

ADVERTISEMENTS:

Solution:

Note:

ADVERTISEMENTS:

The market price of shares, i.e., Rs. 20/- per share is not to be taken into consideration.

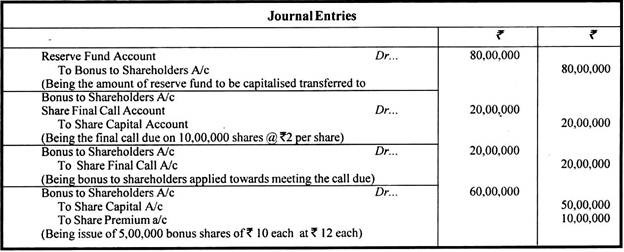

Bonus Issue of Shares: Problem with Solution # 5:

A company has a share capital of 10,00,000 equity shares of Rs. 10 each, Rs. 8 per share paid up.

It has a reserve fund of Rs. 80,00,000. If is decided to utilise the whole of the reserve fund in the following manner:

(a) The existing shares to be made fully paid up without the shareholders having to pay anything and

ADVERTISEMENTS:

(b) Each shareholder is to be given proportionate to his holdings, bonus shares for the remaining amount in the Reserve Fund, the shares to be valued at Rs. 12 each.

Pass the necessary journal entries to record the above deal.

Solution: