Pre-Shipment Inspection & Quality Control:

Important Abbreviations:

(i) AWB: Airway Bill.

(ii) B/L: Bill of Lading.

(iii) CRF: Clean Report of Findings.

(iv) FCL: Full Container Load.

(v) LCL: Less than Container Load.

(vi) NNRF: Non-Negotiable Report of Findings.

(vii) RFI: Request for Inspection.

(viii) SGS: Society General de Surveillance.

(ix) QC: Quality Control.

(x) NTH: National Test House.

(xi) EEPC: Engineering Export Promotion council.

(xii) IPQC: In-Process Quality Control.

(xiii) PSI: Pre-Shipment Inspection.

(xiv) QDC: Quality Development Center.

(xv) SC: Self-Certification.

(xvi) CWI: Consignment Wise Inspection.

(xvii) EIC: Export Inspection Council.

(xviii) EIA: Export Inspection Agency.

(xix) EPZ: Export Processing Zone.

(xx) EOU: Export Oriented Unit.

(xxi) ISO 9000: International Standards for Quality System.

(xxii) IAPSIC: International Association of Pre-shipment Inspection Companies.

General Understanding:

What is PSI?

Pre-shipment Inspection or PSI in short is a trade facilitating service employed by the Govt., and industry to speed up systematic clearance of the goods at the loading port which indirectly helps in the speedy clearance at the unloading port.

Why it is Required?

To avoid unlawful activities in pricing, payment, exchange control, and to verify the perfect compliance between the contract terms and delivery terms which includes items like type of goods, quality standards, price and custom valuation of goods.

Where it is carried out?

It is carried out at the place of origin of the goods destined for the exports.

Which are the countries where Law Enforce it?

The governments of the developing countries enforce PSI through specialized agencies as a pre-requisite for getting export clearance.

Is it Compulsory?

Yes it is, but if the importer wants to waive it and submits letter of authority to the exporter, than it is waived. The exporter has to submit this letter of authority to the customs together with the shipping documents for getting customs approval for exporting the goods without PSI.

Under such situations the importer imposes some other form of inspection procedure to avoid his risk on the goods to be shipped like 3rd party inspection or the in-house inspection based on his (importer’s) format.

What is ISO 9000 System?

It is a series of international standards for quality system major exporting nations, which number over 100 uses it. In USA it is not being used since their contention is that the relevant American standards are more stringent than the provisions of the ISO 9000 series.

For exporting organizations the ISO 9000 certification provides them with a sense of authentication for their quality setup and standards and thus making it easy to access the world markets. Each major industrial country has developed their own equivalent standards like in India it is IS-14000, UK it is BS- 5750, and EU it is EN-29000.

There are three sub-divisions under this series:

ISO 9001: For Self-Certification (SC)

ISO 9002: For In-Process Quality control (IPQC)

ISO-9003: For Consignment Wise Inspection. (CWI)

Which is the Apex World Body for PSI?

Originally PSI was included in the Uruguay Round of Multilateral Trade Negotiations under GATT. With the emergence of WTO in January 1994 the work has been carried over and ratified by the entire member forum including especially from the developing countries.

What are the Areas Covered Under WTO for PSI?

The major areas are the verification of:

i. Quality.

ii. Quantity.

iii. Price including exchange rates and financial terms.

iv. Customs classification of the goods to be exported from and to the developing countries.

What are the Basic Guidelines of WTO for PSI?

That it should be,

i. Non-discriminatory.

ii. Transparent of actions and applications of laws governing the PSI.

iii. Protective of the trade related confidential information, which if leaked directly or indirectly, may damage the business interests of the exporters.

iv. Avoidance of undue or un-reasonable delays in processing of documents/certifications.

v. Universal in application of the verification guidelines.

vi. Avoidance of conflicts of interests of similar agencies.

How the Disputes are Resolved?

In the event of a dispute arising due to or on account of the provision of PSI and an exporter, than the procedure as laid down under Article 4 of the WTO provisions, should be followed.

This provides for an independent review procedure administered by an independent entity under the joint supervision of the International Chamber of Commerce (ICC) and the International Association of Pre-Shipment Inspection Companies (IAPSIC).

The independent entity sets up a panel to review the request and give binding decision within eight working days from the date of the request.

Commentary on Pre-Shipment Inspection:

Your future in the international market would depend on your quality. How you can determine your quality is as good as you say or as good as the foreign importer wants it to be? This is done through the process of inspection.

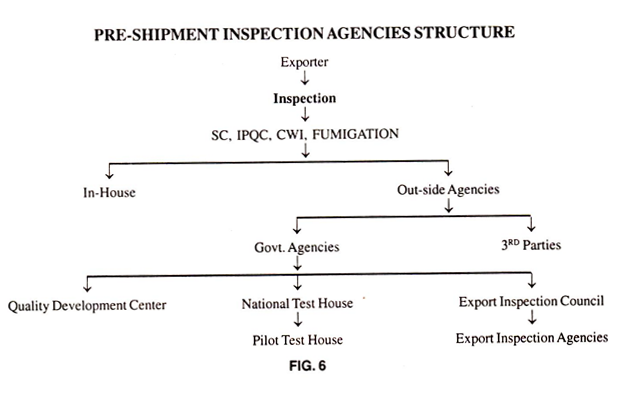

The various agencies involved in the pre-shipment inspection is illustrated in the following structure:

(i) There are two types of inspection, one which is carried out in-house and the one which is carried out by out-side agencies. In the case of the outside agencies again there are two types, one which is mandatory under the trade laws and is conducted on notified exportable goods by the Government Appointed Inspection Agencies, and the other one is the Independent Inspection Companies called as the 3rd Party Inspection Agencies.

The in-house inspection is based on the quality control manual of the organization. This document clearly defines the areas subjected to inspection and the scope of inspection including sampling system to determine the uniformity and reproducibility of the specified quality levels.

This document also shows the inter-dependence of the various tests levels and the acceptance and rejection standards. The scope may include the raw material, components, sub systems, and complete unit.

In the case the exporter buys the raw material from outside mills than the mill’s test certificate becomes the first and the most authentic test report document and is always enclosed with the shipping documents as a proof of the quality and test of the raw material used.

In case the importer is satisfied with the quality standards as mentioned in the said manual, than he may waive any out-side inspection and will accept the test report submitted by the exporter as sufficient proof of the quality.

It must be noted that the in-house inspection is a must for any organization but especially for those, which intend to enter or stay in the world markets.

But the presence of the in-house inspection and quality control does not give automatic export clearance to an exporting unit; it is still subject to the provisions of the inspection and authorization by the Government inspection agencies, unless otherwise waved by the importer in writing.

(ii) However if the importer is not satisfied with the QC manual of the exporter or the manufacturer supported by the exporter, or he wants to have second opinion, or when there is no such manual due to any reasons, than the importer may insist upon out-side inspection. There are two options with him. One is to let the Government appointed export inspection agencies do their job or he can appoint a 3rd party inspection.

(ii-a) Inspection by the Government Appointed Inspection Agencies:

1. Under the Quality Control and Inspection Act of 1963 it is compulsory for the exporting units/exporters to subject the contracted goods, if they are under the notified list of goods where such inspection is compulsory or otherwise, for inspection and clearance for export. There are various agencies involved both at the center and the state level to assist the exporters.

The Quality Development Center (QDC) at Chennai is responsible to train officials from the Export Inspection Agencies and the quality control officials from the industry. The main objective and emphasis of this training is maintenance of the quality control of products, in-process products, and the use of statistical data analysis for improvement of the product quality.

The Pilot Test House (PTH) at Chennai in Tamil Nadu and Mumbai in Maharashtra serves the manufacturers/exporters of engineering goods under the category of Small Scale Industries.

The advisory committee of this PTH consists of representatives from govt., bodies like the National Test House, Indian Institute of Technology (IIT), Engineering Export Promotion Council (EEPC), and the private bodies like the Tata Engineering, Crompton & Greaves etc.

The Export Inspection Council (EIC) is the apex body, and its various agencies called the Export Inspection Agencies (EIA) are the main operatives for conducting the required inspection. They are also actively involved in popularizing the ISO concept of quality amongst the manufacturing/exporting units in India.

2. Exemption of PSI:

The PSI can be waved on units falling under the following seven categories:

(i) Export Houses including the Star and Super Star category.

(ii) 100% Export Oriented Units (EOU)..

(iii) Units located in Export Processing Zone (EPZ).

(iv) By virtue of a waiver from the Importer.

(v) Units approved by Export Inspection Agency (EIA) which can issue Self-Certification (SC).

(vi) Those manufacturers and exporter whose turn over exceeds 15 million rupees.

(vii) The producers of ISI and Ag-mark products.

3. The types of inspection required for goods earmarked for export.

There are four categories of pre-shipment inspection:

(i) Consignment wise Inspection:

In this case each consignment earmarked for export is subjected inspection. The inspection procedure is based on sampling technique. The extent of sampling has to be pre-determined between the contracting parties and notified to the inspecting agency, failing which random sampling technique will be used.

(ii) In-Process Quality Control:

In this case the scope of inspection is spread over from the raw materials, and processing to the finished goods including the packing. The manufacturing units adopting these criteria have well-developed in-house quality controls and standards. The Export Inspection agencies do extensive inspection of the process and the controls before approving the unit under this scheme.

This approval is product based. If the unit is manufacturing many products than approval for each product is required. There after the agency conducts periodic inspections. The unit under IPQC issues their own inspection certificate.

(iii) Self-Certification:

Such manufacturing units which have developed in-house high standards in quality control and audit, R&D facilities, process controls, maintenance and calibration of production tools, systematic documentation etc. are given the facility of self-certification.

This is valid for one year and can be renewed provided the unit keeps high standards in the said facilities. They have to pay a nominal fee to the concerned Export Promotion Council for using the SC facility.

(iv) Fumigation:

Agro based products which are prone to insect infestation in storage (land, air, and sea) are subjected to this process by specialized agencies.

4. Procedure for PSI:

(i) Export Units under IPQC and SC:

Send intimation to the concerned inspection agency on a prescribed form, the approval is automatic. In some cases the inspection agency might conduct spot tests for verification.

(ii) Export Units subjected to CWI have to notify EIA and EIC within 7 days prior to shipment on prescribed form and have to pay the inspection fee also.

(iii) Export Units dealing with Agro based products, which call for, fumigation has to notify the concerned authorities for readiness of the consignment for fumigation. The fumigating agency than issues certificate based on which the consignment can be exported.

5. Rejection of the Export Consignment:

The export inspection agencies, if not satisfied, by the results can reject any consignment. The exporter has the right to file counter appeal within 10 days from the date of rejection, against the concerned EPA to the related EPC.

EPC will take a decision through appellate panel, and also hear the exporter’s point of views. If the appellate panel can call for necessary re-examination of the rejected consignment. Thereafter give their decision, which is binding on both the exporter and the EIA.

(ii-b) 3rd Party Inspection:

Despite above systems of pre-shipment inspections, the importer may impose 3rd party inspection either as additional or exclusive to the above two types. In this case the importer will nominate an independent inspection agency to do pre-shipment inspection on his behalf, and for specific inspection points.

The 3rd party will carry out the inspection and issue certificate for approval, which is binding on both the exporter and the importer. In this case it is advisable for the exporter to get confirmation/clarification as to who will pay for the inspection fee. Generally the importer pays for this inspection.

However if the exporter has to pay for this fee than he selects and negotiates for the fee to be paid. In some cases the importer may ask the exporter to let the 3rd party conduct the inspection on their behalf but the payment is made by the exporter on reimbursement basis, meaning the importer reimburses the inspection fee to the exporter on presentation of the inspection agency’s invoice.

Documentation:

(i) In international trade documents play an important role on two accounts, firstly they assist in the proper movement of the contracted cargo, and secondly they assist the transmission and realization of the payments. These set of documents gain further importance when the payment is conditional upon the production of certain documents.

(ii) The set of documents, which help the exporter to move the contracted cargo out of the country of origin, and help the importer to take delivery in the country of destination, are called the shipping documents.

(iii) The shipping documents contain enough information as required by the statutory laws of the country of origin and destination. To begin with two important documents are the Purchase order from the importer, The L/C established by the importer and the shipping mark of the importer for identification of the cargo for carriage and at the destination port.

(iv) These documents are of two types, the commercial and regulatory. The commercial documents contain information enough for affecting the physical transfer of goods from exporter to the importer including its title.

The regulatory documents are those prescribed by different govt., bodies like RBI, customs, export inspection agency, central excise, port authorities. These two types of documents are clubbed together to form the practical set of shipping document.

(v) What type of documents are required and their dispatch destinations are all mentioned in the contract and both exporter and the importer are bound by these set of documents.

(vi) In India the shipping documents are governed by the guidelines as mentioned in the Customs Act Section 40 and 50. Section 40 deals with the permission part of the regulation, the carrier of the goods to be exported will not accept the goods unless formal permission from the proper customs authorities is obtained by the exporter.

The customs authorities need to ensure that the goods presented for export are same as mentioned in the export order, all duties and taxes as applicable have been paid, and the exporter has complied with the provisions of

i. The Foreign Exchange Regulation Act

ii. Quality Control and Inspection; and

iii. The relevant provisions under Export Control Order as applicable at the time of shipment.

Section 50 deals with the set of required documents. It expects the exporter to comply with the required documentation, certifications and declarations under the contract and Customs act, the port authority and if and where applicable, the export promotion councils and export assistance schemes of the center and the state governments.

(vii) The standard shipping consists of following:

1. The purchase order or the contract (number and date),

2. Bill of Lading (B/L) issued by the shipping company,

3. The invoice,

4. The Packing list,

5. Certificate of Origin of the goods,

6. Inspection report,

7. Insurance certificate (depending on the delivery terms), and

8. Shipping advice (to the importer).

(viii) Each of the above documents contains specific information, most important of which is as follows:

The Bill of Lading (B/L):

Name and address of the importer, name of the carrier, vessel name, date, goods on board confirmation, freight payment confirmation. Each B/L has a unique number specific to the carrier (like 098-36879-98234) this number and the B/L date has to use for all communication for the cargo on board the vessel.

Bills of Lading:

This is the most commonly used and important international trade document. It links the physical possession of the contracted goods with the exporter, importer, delivery and the payments terms. International sales involve transportation of the goods, often over large distances.

This means that either the seller or the buyer needs to make arrangements relating to the transportation, insurance and the delivery of goods under specific contract. The exporter and the importers are not only located in different countries, the exporter is not having the physical possession of the goods while in transit.

The physical possession is generally in the hands of the carrier which may be of another country not necessarily that of the exporter and/or importer. The global trade thus poses different challenges for the governing laws of the trade as applicable in exporting and importing nations. The bill of lading is one such document that provides protection not only to the exporter but also to the importer.

There are basically two of Bill of ladings the Negotiable and the Non-Negotiable Bill of Ladings, other variants include the Straight Bill of Lading, the Seaway bill, the Free Shipping Bill or the Export Bill, the Dutiable Shipping Bill, the Drawback Shipping Bill, and the Shipping Bill for Shipment Ex- Bond. In the following lines the main attributes of both are explained.

Negotiable Bill of Lading:

(a) It is a documentary proof for the agreement between the carrier and the importer and exporter.

(b) It is issued by a carrier upon shipment of goods. It is a receipt and an evidence for the contracted goods.

(c) It indicates that the contracted goods are in the physical possession of the carrier.

(d) It indicates that the contracted goods are ready for shipment and delivery to the consignee,

(e) It indicates the destination port or as defined in the contract.

(f) It is used for the recovery of the goods in the event the goods are short delivered, damaged or lost in transit.

(g) It is made out to “named consignee or order”.

(h) It is also a transferable instrument giving the right to the holder for the recovery and/delivery of the contracted goods from the earner.

(i) It is made out “to order”.

(j) It has the title of the goods and is marked negotiable,

(k) It implies the delivery of the contracted goods against the surrender of the document.

The Rights under A Negotiable Bill of Lading:

(a) Right to demand delivery of goods may be transferred by endorsement/transfer of the document.

(b) Only lawful holder of the document can demand delivery, i.e. document provides security,

(c) Carrier is only entitled to release the goods against surrender of the document.

(d) Property in the goods may be transferred by endorsement/transfer of the document.

(e) Goods may be sold in transit.

Governing International Laws:

The Hague rules of 1947 (Minimum standards of liability); The Hague-Visby Rules 1968 and 1979.

Advantages:

(a) The major advantage is for the security of the “receipt” of the goods. When the goods are carried under bills of lading, the terms of the contract are contained in it. It is a standard form document issued and signed by the carrier. The terms are generally favourable to the carrier.

But when the contracted goods are intended for sale in transit, the need for protection of a third-party consignee becomes particularly urgent. In international trade on shipment terms, risk usually passes on shipment and the final endorsee will have to sue the carrier in case of loss of or damage to the goods on the terms of the bill of lading.

(b) When freight time is extended (long) and there is possibility for the change in the ownership of the goods while in transit. The exporter can pass on the possession and property (title) in the goods to a subsequent importer simply by passing on the negotiable document of title. The negotiable document can be pledged to a bank and thus may be used as a security to raise finance.

Disadvantage:

The disadvantage is mainly the time and cost factor.

Non-Negotiable Bill of Lading:

A non-negotiable bill of lading document also functions as a receipt for the shipment and as an evidence of the contract of carriage. But in this case the delivery of the contracted goods from the carrier is not subject to the presentation or against documents. The most common non-negotiable B/L is a Seaway Bill.

Preferred Usage:

(a) Where transit times are short and the transport documents may arrive later than the carrying vessel, e.g., coastal traffic and short sea voyages.

(b) Also in connection with feeder services or where a document is issued by a connecting carrier or freight forwarder,

(c) Wherever a freight forwarder is issuing his own house bill.

(d) Multinational companies that export/import from their subsidiaries overseas.

(e) Where Letters of Credit are not required and the goods are not intended for sale in transit”.

(f) Regular sales between companies well known each other and suppliers of big firms,

(g) Short sea trades.

(h) Inter-company shipments,

(i) Ongoing business between one shipper and one receiver.

(j) Where there is absence of a need for a document of title.

(k) The procedures associated with the discharge of the cargo are simple speedy and cost-efficient, since problem of the delayed arrival of documents does not arise.

(l) It facilitate open invoice trade between the exporter and the importer,

(m) It eliminates the bank’s pre-financing since L/C is not required,

(n) Where the contracted goods are intended for a declared consignee,

(o) In cases where there is short transit phase like; interoffice stock transfer; shipment to distribution centers; agent to agent shipments.

(p) It helps in reducing costs against documentation and potential demurrage or quay rent at the port.

(q) The associated customs clearance is speedy.

Limitations:

(a) These documents do not provide constructive possession of the contracted goods.

(b) The document itself cannot be used to transfer possession and property,

(c) If sale of the goods in transit is envisaged, this type of document is not sufficient.

(d) Documentary security is required by the importer or by the corresponding bank involved in a letter of credit or other financial arrangements,

(e) Moreover the documents may not attract the mandatory application of the Hague Visby rules.

Straight Bill of Lading:

These are the Bills of lading made out to a named consignee and are also called the “straight” or “straight consigned” bills of lading. These are not transferable and cannot be “negotiated” as in the case of the negotiable bills of ladings.

These are similar to the seaway bills (also referred to as Data Freight Receipt) such bills are also not suitable for the sale of the goods in transit. However these types of documents can be produced to obtain delivery of the cargo if they are considered as the document of title under the national laws.

If a straight bill of lading is a “non-negotiable document of title,” it may be used to transfer ownership form an exporter to an importer but only on one occasion. At the same time, it also provides independent documentary security to exporter importer or a bank.

Whenever and where ever if it is recognized as a document of title, a straight consigned bill of lading also attracts application of The Hague and Hague-Visby Rules.

The term “straight bill of lading” was first used under the US laws to identify a bill of lading made out to a named consignee and marked non-negotiable; the carrier was entitled to deliver the goods to the named consignee without production of the document. On the other hand under the British laws a bill of lading made out to a named consignee is regarded similar to a non-negotiable seaway bill.

It is also possible to attach a rider clause in the straight bill of lading, for the surrender of the bill of lading, to get the delivery of the goods from the carrier. Under such circumstances the bill of lading is considered as a document of title and not a negotiable documents. As such a straight bill of lading is required to be produced to obtain delivery of the goods.

The straight bill of lading can also be used to transfer possession and ownership in the goods to the named consignee and offers limited security in the financing of a sale contract. However, in contrast to negotiable bills of lading, straight bills of lading cannot be transferred to any other party but the named consignee and are thus not suitable for use in a succession of sale contracts.

Unique features of the Bill of Lading:

A bill of lading has certain data that make it a unique document. It has a name and address…………………. on board the vessel.

(rest same as the book para name and address……………………….. the vessel)

There are four other forms of the bill of lading, they are situational types as describes under; (same as given in the book at item i to iv)

Types of B/L:

There are four different forms of the shipping bills depending on the nature of the goods and associated customs regulations:

(i) Free Shipping Bill or Export Bill:

Used when no customs duty and duty drawback is involved,

(ii) Dutiable Shipping Bill:

Used when goods are subjected to export duties/taxes. It may or may not be entitled for duty draw back,

(iii) Drawback Shipping Bill:

It is used when the exported goods are entitled for duty drawback facility.

(iv) Shipping Bill for shipment Ex-Bond:

It is used for those imported goods, which are kept in the bonded warehouse for re-export only.

Combined Transport Document:

In case the shipment is by using Multimodal transport especially in the containers which are stuffed and customs sealed inland and moved through the rail/road system up to the loading port, a different set of document is used, it is called Combined Transport Document. It differs from the B/L or in other words it is used in place of B/L to avoid multiple use of B/L for each mode of transport up to the loading port.

Multi Modal Transport of Goods (MMT):

The United Nations Convention on International Multimodal Transport of Goods in 1980 and the UNCTAD/ICC Rules for Multimodal Transport Documents in 1992 are the two international forums that organized the multimode transport as a separate identity in the international trade.

The reason for this exercise was the growing need of the international business community to have door to door pickup and drop facility. It is true that even earlier to this mode of transport there was in existence the rail, road and the sea transport system at the regional levels but all such activities were de-linked from the international freight market.

The documentation was limited to the “receipts” issued by the transporter and as such they were not the documents of title. And even when the load was transferred to the vessel/agent there was no role for the local transport segment.

But with the introduction of the MMT system has given rise to an increasing use of Multimodal Or Combined Transport Documents which are generally designed to be used both for transport from receipt to delivery for carriage of goods up to the loading port to the discharging port and further down to the final recipient.

The most important thing in this case is that the documents for MMT can be made out in negotiable form. Thus making is as a negotiable document of title.

In the case of shipment by MMT especially in the containers which are stuffed and customs sealed inland and moved through the rail/road system up to the loading port the Combined Transport Documents are used. This document differs from the B/L or in other words is used in place of the B/L to avoid multiple use of the B/L for each mode of transport; up to the port and from the port.

The Invoice:

There are different kinds of invoices but the Commercial Invoice is the most important. The invoice in general is the confirmation of sale by the exporter to the importer. Value of the goods mentioned in it is used calculation of the import/export duty and other taxes. Like the B/L it is also identified by its unique number and date.

Basically it gives the name of the importer, Shipping mark, Purchase Order number and date, Letter of Credit (L/C) number and date, Unit Price, quantity, total value, terms of export, export license number and date, marine insurance number and date, Customs declaration reference, country of origin and port of dispatch.

Other types of invoices are the Customs invoice, consular invoice, and legalized invoice, their use is limited to country specific. Thus the exporter must clarify from the importer, at the time of signing the contract as to which type on invoice would be required.

Packing List:

Name of the importer, description of the goods, number of boxes, contents of each box, shipping identification mark, arrangement of the goods and/or boxes in the container – the container number: if the shipment is by containers.

Certificate of Origin:

This document issued by the respective chamber of commerce or any other legal authority of Government of India, certifying that the goods covered under PO are manufactured in India or contain enough indigenous components to qualify as made in India.

Inspection Report:

Depending on the terms of the contract, a set of inspection report duly authenticated that goods covered under invoice (No: — & Date—) have been inspected and found in order or approved for exports.

Insurance Certificate:

If the contract is on CIF terms than the exporter has to arrange insurance cover for the goods Shipping advice: This is a short telegraphic, telex, fax message to the importer that the goods have been shipped.

Mate Receipt:

As the name suggests it is the receipt issued by the Master of the vessel after the cargo has been lifted on board. The information contained in this document consists of vessel name, port and wharf, date of shipment, package description, special shipping marks of the importer and most important of all the condition of the cargo when it was loaded on board.

Generally the exporter need not include it in the list of the shipping documents unless specified by the importer.

Shipping Advice:

This document is used by the exporter to notify the importer that the contracted goods have been shipped. This advice is usually sent by fax and/or e-mail.

The information contained in it is the B/L no and date, Invoice no and date, Vessel name, shipment date or estimated date, order no and date, description of the goods shipped. This advice is some time critical for the importer if he has to arrange the insurance cover for the shipped goods.

(viii) The shipping documents contain one original set (negotiable) and many copies (non-negotiable) depending on the destination. Negotiation with the bank and clearance from the customs is done on the basis of these documents. The operative side of the documents is decided depending upon the delivery and payment terms incorporated in the contract.

Force Majeure Hardship and Termination Clauses:

Any business—domestic or international consists of integration of various activities where each element, if left to it, would tend to go in a direction of its own and not where you intended it to go. When two parties agree to perform certain actions of mutual benefit, than both are exposed to distracting forces, each try its best to remain on the right and the least path.

Despite of these good intentions what happens if due to certain unforeseen circumstances one party is not able to perform its contractual obligations? Such circumstances are covered under three different clauses, the Force Majeure, Hardship and Termination clauses.

1. Force Majeure Clause:

This clause is basically intended to take care of delayed deliveries under a contract. It is based on the standard form of exemption clause of the International Chamber of Commerce and Article 79 of the UN Convention on Contracts for the International Sale of Goods (CISG).

There is a provision of 30 days grace period, unless otherwise stated by the contracting parties to the contrary, for the exporter to ship out the goods. Failing which the exporter has either to face the cancellation of the contract or delayed shipment penalty.

The imposition would be implemented if the exporter fails to invoke the force majeure clause before the due date of the expected shipment. The conditions under which this clause is enforced are:

Labour strike, which starts after the contract, comes in to force; Fire; Plant breakdown; Natural clematis like earthquake, floods, riots; Civil war; War likes situation; Govt., laws enforce in general public interest.

These situations are just an example, the contracting parties mutually define the conditions, which can be termed as “force Majeure” and such mutually agreed terms and conditions are mentioned in the body of the contract and are binding on both the sides.

It is the contractual obligation of the party enforcing this clause to escape penalty, to inform the other party to the contract for its enforcement. This action helps the other party to make contingency plans to arrange urgently required supplies from other sources.

2. Right to Terminate the Contract:

In the event of default, the right to terminate the contract is linked to the concept of Fundamental Non-Performance (FNP) of the contract or the breach of the contract terms. FNP is the failure by a party to the contract to perform any of its obligations including defective performance or the late performance.

In the case of the FNP the suffering patty can terminate the contract and recover the damages and/or take contingency measures to recover the losses resulting from the default by the other party.

The non-performance by a party is excused if that party proves that the non-performance was due to an impediment beyond its control provided they did not know the impediment at the time of contract formation. In the event the impediment is of temporary nature then the time laps covered under the impediment is excused for the performance of the contract.

The existence of an impediment is not sufficient reason for delay in the performance; the party involved must give written notice to the other party of the impediment and its effect on its ability to perform the contract. This notice must be given to the other party in sufficiently enough time so that the other party has reasonable time to counter check and/or take contingency measures to meet the crises.

If a party willfully fails to notify the other party for the expected delay in performing their contractual obligations then the suffering party has the right for damage recovery resulting from the resultant delays. One of the measures is the risk purchase, meaning the suffering party can procure the material from third sources and claim the price difference from the defaulting party.

Under a contract there are several activities, which are considered as fundamental to the performance of the contract. A suffering party has the right to terminate the contract when the other party fails on the fundamental performance responsibilities.

Such situations (right to terminate) can arise under following headings:

1. The non-performance substantially deprives the aggrieved party of what it was entitled to expect under the contract. But this point cannot be applied if the other party did not foresee and/or could not reasonably have foreseen such results.

2. The non-performance is intentional or reckless.

3. The suffering party has reasons to believe that it cannot depend on the defaulting party’s future performance.

4. The part falling under non-performance is essentially the core activity expected from the defaulting party.

5. The non-performing party will suffer disproportionate loss as a result of the preparation or performance if the contract was to be terminated.

6. The right to termination of the contract is exercised through a written notice to the other party in sufficient clarity and in time.

7. The termination of the contract releases both the parties from their obligations to effect and to receive future performance.

3. Hardship Clause:

This is a typical and highly sensitive clause. These are very few instances of its usage but still provision is there for redressal if one of the contracting parties finds itself under conditions that can be termed as hardship conditions. The Japanese organizations have used it to their advantages on many occasions especially those dealing with minerals and other bulk raw materials.

According to the “UNDROIT principles of the International Commercial Contracts” refers to a situation where the performance of a contract becomes more onerous for one of the parties, that party is nevertheless bound to perform its obligations subject to the provisions of the hardship.

There is hardship where the occurrence of events fundamentally alters the equilibrium of the contract either because the cost of a part’s performance has increased or because the value of the performance a party receives has diminished, and,

(a) The events occur or became known to the disadvantaged party after the conclusion of the contract;

(b) The events could not reasonably have taken into account by the disadvantaged party at the time of the conclusion of the contract;

(c) The events are beyond the control of the disadvantaged party; and

(d) The disadvantaged party did not assume the risk of the events.

Effects of Hardship:

1. In case of hardship the disadvantaged party is entitled to request renegotiations. The request shall be made without delay and shall indicate the grounds on which it is based.

2. The request for renegotiation does not itself entitles the disadvantaged party to withhold performance.

3. Upon failure to reach agreement within a reasonable time either party may resort to the court of law.

4. If the court finds hardship it may, if reasonable

(a) Terminate the contract at a date and on terms to be fixed; or

(b) Adapt the contract with a view to restoring its equilibrium.

Penalties and Compensation on Account of Non-Performance:

This condition can arise due mainly to following reasons:

(a) Delayed or non-deliveries,

(b) Under or over shipment,

(c) Quality, and

(d) Late payment.

Whatever be the reason for the above situation the net sufferer is the exporter. The root cause of such situations is non-performance of the contractual obligations on the part of the exporter and/or the importer.

It could be due to many reasons but most important of all are the negligence and poor planning and coordination amongst the different departments of the exporting and importing organization. Poor monitoring of the contract could also be another reason.

The importer especially suffers a lot under these conditions so that he insists upon the inclusion of certain conditions in the contract to safe guard his interests. Similarly there are provisions for the safeguard of the interests of the exporter. There are specific standard terms and some just application of commonsense.

At times the importer may put them as pre-condition for acceptance of the contract and at times these are subjected to negotiation process. In both the cases the other party has to evaluate the pros & cons of the implications before accepting them.

It must be clearly understood by both the importers and the exporters that there are standard provisions for coverage of the liquidated damages under ICC, CISG etc. but what they negotiate and put into the body of the contract is the final settlement and can override any other provisions contained in the articles of the international organizations (ICC, CISG etc.).

Following are some of the main clauses for protection and compensation.

(A) Delayed or Non Delivery:

1. The compensation to the effected party would depend upon the extent of damage caused by the late delivery. In the case of components, which go directly into the production line the importers generally demand “Right on dot delivery”.

In such cases the extent of the liquidated damages is considered to be high, how much high will depend upon the negotiation process which includes the capacity and consistency of the exporter and the contingency arrangements of the importer.

In the case of perishable goods which deteriorate in couple of days and which constitute a part of further processing by the importer, here again the extent of the liquidated damages would depend on the two factors stated earlier and the extent of damage is again a matter of mutual negotiation. In any case it is in the interest of the exporter to honour his commitments if he/she wants to remain in the export market.

2. The standard clause for liquidated damages is “.5% of the FOB value of the goods per week with maximum of 5 to 10% thereafter the importer has the right to cancel the order”. In many government and private organization there is provision for “risk purchase” but this clause is more common amongst the domestic buyers rather than the overseas importers.

In case of non-delivery the importer may opt for judicial proceedings (Litigation, Conciliation and Arbitration) against the exporter and/or inform the commercial attache of the concerned embassy for intervention.

3. If the payment is by way of L/C then this document contains clause for shipment and negotiation period of the documents. If the exporter fails to ship the goods in time than he goes back to the importer for the extension of the L/C.

The importer has the right to refuse the extension or impose penalty as per the above clause (or any other similar clause agreed upon amongst them) and/or ask the exporter to bear the L/C extension charges.

4. However if the shipment is delayed and the L/C is still valid, then the importer’s banker will deduct automatically the net amount commensurate with the delayed period as per the contract and notify the importer and the exporter for the same, unless otherwise waived by the importer.

(B) Short Shipment:

1. The importer can cancel the order for the portion short shipped or ask for compensation covering freight insurance and local transportation when the balance goods are shipped later on. There could be justifiable reasons for the importer to procure balance quantity from 3rd source and ask the exporter for price difference. This portion is rarely used for the international business but the fact is that such situation can occur.

Normally the importer will have alternative sources of supply to compensate the shortfall from one source from the other source. But if the deal is on exclusive bases than 3rd party procurement can happen.

The importer will duly notify the exporter for such drastic action in advance and if exporter has objection than dispute settlement procedure is applied for settling the dispute unless otherwise the objection can be mutually settled between the importer and the exporter.

2. Excess Shipment:

The importer can refuse payment for the excess quantity or allow the exporter to short ship in the next shipment. The normal problem with the importer is inventory and costs. In the case of the Japanese importers they are very specific on the quantity & delivery as they work on zero inventory philosophy and delivery on demand basis.

(C) Quality:

The importer will mention a clause in the contract for free replacement for the quantity rejected by him during inspection at his end. This clause will be operative even when the contract mentions that “Mill’s inspection is final”.

It is better to mention in the body of the contract that in the event of quality problem, the importer will inform the exporter with a specified period the inspection report and causes for rejection and the extent of the rejection.

Upon receipt of this inspection report the exporter has to conduct his own investigation to verify the authenticity of the importer’s report, if acceptable, than accept the claim and suggest the remedy which could be

i. Free replacement in the next shipment.

ii. Can ask the importer to ship back all the rejected quantity for rectification and re-export, either as an individual shipment or include in one of the future shipments. In such cases the exporter bears all the transportation and insurance cost from the port of dispatch to the production premises of the exporter and back to the unloading port of the importer.

iii. In many cases especially when the importer is importing for the first time or when the interrelationship between the importer and the exporter is not very firm than in that case the importer may insist on putting a conditional clause in the L/C making payment in two lots, for instance,

a. 80% after shipment

b. 20% after acceptance of the goods at the importer’s premises.

iv. If any rejections are found in the lot then equivalent amount of the rejected goods is deducted from the balance L/C and the exporter negotiates the net amount thus left. In this case the importer informs the exporter the inspection report based on which the rejections were made.

The exporter has the right to challenge the inspection report and asks for third party inspection of the rejected lot. Decision of the third party is binding on both the importer and the exporter.

Provision for above conditions must be included in the body of the contract for better understanding of the extent & scope of the risks and countermeasures. In the event these situations are not stipulated in the contract than in such event, the importer exerts his rights as per the agreed terms and conditions of the contract covering quality quantity and delivery of the goods.

(D) Late Payment:

In this case the exporter is entitled to compensation in the form of interest. This interest is generally considered as the average bank short term landing interest rate as prevailing in the currency of payment.

However it must be noted that the exporter’s entitlement to interest for late payment does not affect his/her right to terminate the contract in accordance to article 61-65 of the CISG or similar provisions in the ICC terms.

This article also provides the period (30 days) after the expiry of which the exporter may terminate the contract. Notwithstanding these provisions the contract must contain provisions for these eventualities for the right impact.

If despite all the precautions still the dispute arises on account of the contractual conditions than there is well-organized legal machinery for redressal of such disputes. The judicial proceedings pertain to Litigation, Conciliation, and Arbitration. In addition The International Chamber of Commerce and The Economic Commission for Asia and Far-East (ECAFE) also help in solving the commercial disputes.

Effective Period for the Completion of the Contract:

The effective period of a contract is the time spread between the date of the contract and/or the date of the payment receipt/issue till the time the contracted goods are shipped out by the exporter. The general practice is to tie up the delivery period with the date of receipt of the L/C from the importer.

However if the importer/exporter have long established relationship than the importer may count the effective period from the date of the order commitment. The Effective Period case is not so simple as it might look like. In the commentary following hereunder you will soon realize the pitfalls associated with this term.

While entering into contract with a foreign buyer make sure when the contract comes into force and when it expires so that the areas of your responsibilities and their termination is well defined. In the case of spot transactions this clause is irrelevant because the total lot is tied up with one delivery period and that is the effective period of the contract.

But in the case when the contract is for bulk supplies and spread over a longer period say one year or more, consists of multiple shipments at regular intervals and for a fixed export price, than you have to be careful in defining the boundaries of the contract. It is because due to the extended period many variables put their weight in different directions and may cause disruption during execution phase.

The foreign buyers who are importing from a specific exporter a specific commodity generally tend to take him for granted and increase and/or decrease the contracted quantity depending of the market situation at their side of the world. With the long association they develop mutual trust and business keeps on moving smoothly.

But there are cases when the importer suddenly imposes brakes to any further movement of the contracted goods due to reasons of government-regulations, competition, technological innovation etc. Under such conditions the situation of the exporter who normally stocks inventory for the importer will face difficulties.

These difficulties are of two types:

i. One created due to the imported raw materials against the export contracts.

ii. Financial burden due to the piled up inventory and the infrastructure.

There is no way out. If the exporter takes to the legal route to the dispute settlement he loses the trust and the foreign buyer, so he had to evaluate what is good for his business: to cooperate or to fight out on legal terms. In both the cases the financial risk is there.

On the cooperation side he has the goodwill and support of the foreign buyer and with his other overseas operations may be he can assist you to offload your piled up inventory. On the other hand if he decides to take to the legal rout than in that case too he faces financial crises minus the cooperation and support of the overseas buyer. This is not so easy decision yet at times one has to take it one way or the other.

The best solution is by way of judicial planning. As said earlier for spot transactions there should be no problem, but in the case of the long-term contracts, the exporter has to consider,

Raw material requirements, domestic and imported, total and shipment wise; Price movement of the imported raw material, short terms and long terms; Payment terms from the overseas buyer; Frequency of each shipment; Material in stock and in the pipeline for keeping the production line running.

There is no optimum solution. Each exporter will take decisions depending on his market situation and relationship with the overseas buyer.

But in general for a long term contract, make sure the payment terms gives you enough funds at a given point of time to cover your raw material requirements for at least four shipments and finished goods for at least two shipments coupled with firm assurance for inflow of further credit to cover the export obligations.

Under such conditions even if the overseas buyer put sudden brakes you have funds available to meet current needs and can afford to stop further processing of the order till the time situation clears up with the overseas buyer. In certain situations there is stipulation of the penalty clause.

The exporter has to take into consideration the implication of facing penalty for delaying shipment (under unclear circumstances) or going ahead with the shipment and facing financial problems later on account of sudden brakes by the overseas buyer.

As such the best solution for defining the service period for a long term contract is to have firm indications on following indicators:

Total period say 12 months; Total quantity involved; Total value; Total shipments; Value of each shipment; Payment terms; and Penalty clause.

Once you take up a long term contract or the so called yearly contracts, evaluate your position against the above indicators and take the safest rout of keeping the minimum of inventory with forward financial cover and move from shipment to shipment basis or at the most couple of shipments at one production planning stage.

In addition to the above measures there are many schemes available from the government institutions for export financial risk coverage, make use of such schemes for your safety.

Finally than what should be the effective period of the contract? Hypothetically the effective period of the contract should be the one covered under physical availability of the payment from the importer.

For long term contracts the price is usually fixed say for a year, the exporter can agree to keep the price effective for one year but should have the right to suspend the contract if the importer fails to back up his order with suitable credit.

Applicable Laws Taxes and Duties:

Any contract, which is not enforceable by set laws, cannot be implemented. Each country has its rules and regulations for the conduct of international business. The basic purpose of these regulations is to regulate the international trade and realization of the export proceeds. In India the foreign trade is governed by

The Customs Act; The Foreign Exchange Regulation/Management Act; The Import and Export Policy of the Govt., of India, and; The Incentive Management.

For export cargo the laws of the country of origin are most important, the importer may inform the exporter for adherence to specific laws for import of specific cargo in the country of destination. In such situation the exporter has to fulfill the conditions set by the importer.

These conditions are in addition to the set laws of the destination country for import or inward cargo. In general such restrictions are limited to foodstuff, hazardous chemicals and explosives, environmental protection, labeling and packaging, classified cargo especially for atomic energy and/or military use and/or dual use type, carnage restrictions etc.

The importer has to have full knowledge of such limiting factors and is duty bound to inform the exporter for strict adherence failing which the cargo may not be allowed to be landed in the destination country.

Therefore while entering into export contract pay attention to the rules and regulations governing to the export trade and get specific confirmation from the importer for the types of supporting documentation required for hindrance free entry of the contracted cargo in the destination country.

Such additional documents form part of the shipping documents. Remember this is a two way process, what is applicable to the exporter has to be compatible to the importer and wise versa.

Lastly when framing up an export contract, or even import contract, categorically mention that the exports/imports are subject to the prevailing laws of the country of origin/destination as the case may be.

1. The Customs Act:

The international trade is carried out from following entry and exit points:

i. Sea Ports;

ii. Air Ports

iii. Dry Ports specific to containerized terminals

iv. Frontier Posts

v. Foreign Post Office.

The Customs Act of 1962 provides for the inspection of both the inward and outward flow of the goods and services through the above-notified points. This is the administrative arm of the government to regulate the foreign trade.

It functions on two platforms, one devoted to authorized cargo which is as per the provisions of the laws (examination and appraisement) and the second is which is not as per the provisions of the laws (smuggling). The government has set up systematic machinery for the imposition of the customs duty on the exports and imports.

The shipping documents, mentioned earlier, serve the purpose of inspection and clearance of the goods. It also provides statistics of the foreign trade to the govt. An exporter (or an importer) has to have thorough knowledge of this act and must comply with the rules. There is a set procedural format for the calculation and deposition of the duties.

For all types of the delivery terms for which the ownership point of changeover falls under any of the above listed points of entry/exit the exporter/importer is directly responsible and answerable.

However where the delivery points are a distance away from the said 5 points (example: Ex-Works, High Seas etc.) than the party (importer/exporter), which brings the cargo at these points, takes the responsibility for doing the customs formalities including the payment of the duties etc.

2. (A) THE FOREIGN EXCHANGE REGULATION ACT (FERA) AND EXCHANGE CONTROL MANUAL FERA stands for the Foreign Exchange Regulation. It was inacted in 1973 to control the scare foreign exchange reserves of the Indian Government. The inflow and outflow of foreign exchange from and to India was governed by this act which was administered by the Reserve Bank of India (RBI).

RBI acts as the apex body under which there are several institutions like the Commercial Banks, Cooperatives, Authorized dealers, Money exchangers etc. They must get permission from RBI for dealing in foreign exchange.

As long as the export/import contract involves the out flow or inflow of foreign exchange, strict adherence to the rules and regulations of FERA had to be followed.

The application of FERA act was highly dependent on three factors:

The Trade Policy of the Government; The Investment Policy of the Government; The Industrial Policy of the Government

These factors collectively influenced the application part of the FERA Act. The regulatory provisions under this act had been greatly made simpler since 1990-91 for attracting foreign direct investment in India, yet the exporter/importer was governed under the provisions of FERA.

This act clearly mentioned the time limits for realization of export proceeds and payments towards commission in foreign exchange. Any default by the exporter/importer usually attracted sever regulatory punishment which could be detrimental for the future business transactions.

The students are well advised to have first-hand knowledge of this act for better understanding of the rights and duties when dealing in contracts involving foreign exchange inflow/outflow from/to India.

Besides the FERA act, RBI has brought out a manual called the Exchange Control Manual (ECM). It deals with the code of conduct for the foreign exchange dealers besides it elaborately explains the documentation side of the exchange control.

In its revised form since 1990-91 it had become much exporter friendly in nature and the govt., of India had made persistent efforts in introducing constant revisions to make it more and more liberal as far as the exporter’s export promotion and Direct Foreign Investment were concerned.

The main features of FERA are following:

(i) Policy side:

The trade policy of the Government of India and provisions of FERA are complementary to each other. The Director General of Foreign Trade regulates the physical exports of the commodities.

(ii) The Documentation side:

GR:

Exchange Control Declaration form, PP and VP/COD forms. SOFTEX form for export of computer software. Export proceeds realization time limits. All these forms are made available by RBI; Permitted methods of payment against exports and imports; Shipping document submission time limits; Routing of the shipping documents; Defaulters List also called the “Cox Circular” for defaults on exchange realization by RBI; Agency commission payments to foreign traders/contractors in foreign exchange; Payment of services rendered outside India and payments thereof in foreign exchange; Export claims; Advances against imports; EEFC A/C facility to the exporters (Export earners Foreign Exchange A/C).

The limitations of FERA:

Its objective was control and consolidation under the scarce foreign exchange reserves; Imports and exports were regulated by numerous controls; It emphasized total state control or the regulatory part; Violations of FERA were regarded as criminal offence and attracted imprisonment of minimum 6 months and maximum 7 years; It was applicable to the citizens of India; It was a deterrent to the industries and the captains of the industry; The application part of the law had too many clauses (81) resulting in highly complicated format for adherence.

2. (B) FEMA:

Since 1991 when the FERA terms were liberalized. Indian Government has constantly tried its best to ease up the rules and regulations to boost the expansion of the foreign trade. The government had been thinking in terms of Foreign Exchange Management instead of the regulation as was the case so far and as mentioned earlier in this part.

Thus on 2nd December 1999 the parliament of India passed the bill replacing the traditional control act (FERA) by a new act called the Foreign Exchange Management Act or FEMA. It has brought tremendous changes over the fiscal and monetary policies of the Govt.

The major attraction, coverage and purpose of the new act are as follows:

i. To facilitate, promote and maintain the foreign exchange market in India; To pave the way to integrate the Indian economy with the world; Facilitate external trade and payments; The state instead of regulatory controls assumed the role of the promoter of the economic growth; It is applicable to the Indians committing offences outside India but residing in India, and also those Indians residing outside but committing offences in India; It covers any person resident in India for 182 days during the preceding financial year; It also covers the organizations registered or incorporated in India even if a foreigner or non- resident holds their entire share capital; It also covers any office branch or agency in India even if it is owned or controlled by a person resident outside India; It also covers any office branch or agency controlled or owned by a person resident in India; This act defines the Imports & Exports and services.

It states “Exports” to mean the taking out of the goods (and services) out of the Indian national boundaries, to a person or place outside India. The “Imports” to mean bringing-in into India goods and services to a place or to a person.

“Service” to mean service of any description which is made available to potential users and includes the provisions facilities inclusive of banking, insurance, medical assistance, legal assistance, etc. (FEMA does not elaborate on the status of Information technological services); The violation of the provisions of the revised law is treated as civil offence and does not attract threats of prosecution and the police have no role to play; The violation of the provisions attracts penalties three times the amount involved for contravention.

However if the amount is not quantifiable the penalty can be up to Rs. 200,000; In the case of persistent offences under the provisions of FEMA, the penalty is fixed at Rs. 5,000 per day of the contravention; Under FEMA there is provision for confiscation and for compounding of the offence.

3. Import & Export Policy of the Government of India:

This is the foreign trade policy book of the govt., of India Ministry of Commerce. In its present form it is valid for five years. It came into force on 1st April 1997 and will remain in force till 31st March 2002.

Objectives:

The principal objectives are:

(i) To accelerate the country’s transition to a globally oriented vibrant economy with a view to derive maximum benefits from expanding global markets opportunities.

(ii) To stimulate sustained economic growth by providing access to essential raw materials, intermediaries, components, consumables and capital goods required for augmenting production.

(iii) To enhance the technological strength and efficiency of Indian agriculture, industry and services, thereby improving their competitive strength while generating new employment opportunities, and encourage the attainment of internationally accepted standards of quality.

(iv) To provide consumers with good quality products at reasonable prices.

The objective will be achieved through the coordinated efforts of all the departments of the government in general and the Ministry of Commerce and the Directorate General of Foreign Trade and its network of regional offices in particular, with a shared vision and commitment and in the best spirit of facilitation, in the interest of export promotion.”

4. Export Incentive Management:

The road to international trade may look easy to you but the road to govt.’s various incentive schemes and required documentation is like a spider’s web. In nutshell it simply states what incentives are available to you as an exports and as an importer.

Every country of the world has some form of incentives to their exporters, some are visible and some not so visible like a floating iceberg. The best thing is to have bird eye view of them and focus on the ones that affect your global business.

There are three types of incentives available to the exporters:

i. Duty Entitlement Passbook Scheme (DEPB); Duty Draw back (DDB); Special Import License. (SIL).

The incentives in general are of two types:

1. Cash Incentives:

These incentives include following areas of export promotion:

i. Marketing Development Assistance; Airfreight Assistance For horticulture and floriculture; Financial Assistance Scheme for agro Horticulture Meat and Marine Products; Jut Development and Marketing Scheme; Deemed Export Scheme; Duty Drawback Policy and Procedures; Financial Assistance for Marine Products Export; Spices Export Promotion Schemes.

2. Tax Incentives:

These are basically for Income tax relief and sales tax exemption for items earmarked for exports.

In addition to the above two types the Indian Government also extends assistance for export finance and credit, export production, overseas marketing, investments by the non-resident Indians, special assistance to the small scale sector producers, and lastly in the case of international dispute arising due to non-payment & non-shipment, quality claims and disputes etc., the govt., machinery (Embassies, Trade Commissioners, Director General of Foreign Trade, specialized sections in the Ministry of Finance etc.) is available to the exporters for recovery & compensation.

Warranty and Guarantee:

The exporter/manufacturer has an obligation to the importer/user to offer satisfaction on the goods to be supplied on performance and safety. The importer has to confirm on these two accounts before signing the contract.

In case of the international business it is very customary to have the samples of the goods to be contracted and in the absence of samples the product/model catalogues and technical literature are considered to be sufficient and has to be incorporated in the body of the contract.

The exporter/manufacturer generally provides a limited period to the importer to check, test and use the products. This period generally is referred to as the guarantee/warranty period.

The commencement of this period is defined by the exporter/manufacturer in his offer and/or the product literature. In case any defects is noticed by the importer during this period the exporter has to compensate the importer to the extent covered under the warranty/guarantee clause or as agreed between the two contracting parties.

There are two terms difference between them must be understood by the students, the product liability and the product warranty. Liability is associated with direct and/or indirect losses or damages caused by the use of the products, (use as understood and/or implied and/or suggested by the manufacturer).

Product warranty (explicit or implicit) is a promise by the manufacturer that the product will give performance as stated in its published literature. The warranties are explicit when contained in a documentary form, implicit when no such document is available but manufacturer simply states that the goods are under his warranty.

1. The Right of Rejection:

The importer has the right to reject part or whole of the consignment if during the period specified in the contract, or where no such period is specified, then within such reasonable period as will allow inspection, the importer shall be entitled to reject goods which do not conform with the conditions as mentioned in the contract (excepting any defect caused after the passage of risk).

This provision is subject to the condition that the importer has to give an opportunity to the exporter to make good any default at his expense within a reasonable period. The importer’s right of rejection shall also apply to goods which, although delivered and accepted, cannot be properly used without the additional goods/ services not intimated by the exporter to the importer at the time of signing the contract.

2. Guarantee:

i. The exporter shall undertake to remedy any defect resulting from faulty design, materials or workmanship. This liability is limited to detects which appear during the period (called “the guarantee period”) commencing on the passage of risk and continuing for the period specified in the specific guarantee clause which is generally for a specific period from the sale of the goods.

In the absence of express specification in the body of the contract or elsewhere the periods shall be twelve months from the date of the export. In respect of such parts of the goods as are expressly mentioned in the contract, the guarantee period shall be for such other period (if any) as is specified in respect of each of such parts.

The contracting parties may specify in the contract that the exporter assumes no liability other than that for gross misconduct as defined in the following paragraph. Where the importer wishes to avail himself of the guarantee, he shall notify the exporter in writing without delay of any defect that has appeared.

On receipt of such notification the exporter shall (if the defect is one that is covered by this clause at his option):

(a) Repair the defective goods in site; or

(b) Have the defective goods or parts returned to him for repair;

(c) Replace the defective goods; or

(d) Replace the defective parts in order to enable the importer to carry out the necessary repairs at the exporter’s expense.

ii. Where the exporter has returned to the importer defective goods or parts for replacement or repair, unless otherwise agreed, the importer shall bear the cost and risk of carriage.

iii. Unless otherwise agreed, the return to the importer of goods or parts sent by way of replacement or of repaired goods or parts shall take place at the cost and risk of the exporter.

iv. Defective goods or parts replaced in accordance with this clause shall be placed at the disposal of the exporter. When the exporter fails to fulfill his obligations under this clause within a reasonable period after receipt of notification the importer may proceed to have the defect remedied at the exporter’s expense, provided that he does so in a reasonable manner and under intimation to the exporter.

v. The exporter’s liability shall apply only to defects that appear under the conditions of operation provided for by the contract and under proper use. It does not cover defects arising from faulty installation, maintenance or repairs, carried out by a person other than the exporter or his agent, or from alterations carried out without the exporter’s consent in writing, nor does it cover normal deterioration.

vi. The exporter shall be under no liability in respect of defects after the expiry of the risk period in the goods has passed without any adverse report being made by the importer (during the risk period), even if such defects are due to causes existing before the risk passed from the exporter to the importer.

vii. The importer shall have no claim in respect of personal injury or of damage to property or of loss of profit unless it is shown/proved from the circumstances of the case that the exporter has been guilty of “Gross Misconduct”.

viii. “Gross Misconduct”: It means an act or omission on the part of the exporter/manufacturer implying either a failure to pay due notice with regard to serious consequences which a conscientious manufacturer/exporter would normally foresee as likely to ensue, or a deliberate disregard of any consequences of such act or omission.

3. Relief:

It refers to any circumstances beyond the control of the contracting parties intervening after the formation of the contract and impeding its reasonable performance shall be considered as cases of relief. For the purposes of this clause circumstances not due to the default of the party invoking them shall be deemed to be beyond the control of the parties.

The party wishing to claim relief shall notify the other party in writing without delay on the intervention and on the cessation thereof.

When the performance of the contract within a reasonable time becomes impossible, either party shall be entitled to terminate the contract by notice in writing to the other party and in that event there shall be such restitution (if any) whether by way of repayment of money, return of goods, or otherwise as shall be just and as the circumstances demand.

4. Warranty Disclaimer:

The manufacturers/exporters give warranty/guarantee only in those areas or markets where they have after sale service. This is of much importance for the consumer and consumer durable goods manufacturer.

Therefore in areas where the manufacturer/exporter is not able to provide warranty/ guarantee service for the products as mentioned earlier, than it should be specified in the product literature and/or in the contract.

In such cases, implied warranty/guarantee would be considered and the importer can approach the court of law for redressal. In general the cost of the goods involved is the detrimental factor for the litigation decision of the importer.

5. Protection against the Product Liability:

The product liability follows the goods. The manufacturers must ensure that the product installation and usage is properly documented in a language, which can be understood by majority of the consumers in the world markets. In case the target market is such that requires different language than it is better for the manufacturer to provide translated version with every product.

This is again true in the case of the consumer and consumer durable goods. For the industrial products the contracting parties well define the extent of the warranty and guaranty in the body of the contract and the manufacturer can further supplement it with written format.

It is advisable for the manufacturers who venture in the overseas markets to protect their goods against the claims by providing product liability insurance cover.

Trade Disputes Settlement:

There is always an urge to get something for nothing or to chase the treasure over the horizon like a dear in the hot desert running after the apparent water but getting nothing and in many cases the death. The global frauders have used this common weakness to the hilt.

They use privacy and the confidentiality of the International business and the secrecy code of the banks to their nefarious intentions of depriving you of your hard-earned money. They manage the show so well and after finishing their job, they just disappear.

You may take the case to the international laws law but chances for redress are almost negligible unless you have the financial muscle. In many cases the legal costs are more than the financial hit that you have suffered.

When dealing at the international level counter check each piece of information from at least two sources and never accept” credibility” if it is sold to you by the overseas counterpart, rather establish it through your own resources direct and/or indirect.

Your bankers and business associates can be of great help. Once you are 100% convinced about the level of the credibility of the overseas party than only accept the credibility as sold by the other party. The trade disputes cannot be eliminated altogether but they can be minimized to a great extent if you are a bit more careful.

1. The Trade Disputes are of Two Types:

(a) Those arising due to the contract between the importer and the exporter.

Such disputes relate to:

(i) Quality

(ii) Quantity

(iii) Delivery

(iv) Payment

(v) Packing

(vi) Insurance

(vii) Commission realization

(viii) Compensation realization

(ix) Patent infringement.

(x) Technology and royalty related disputes

(xi) Counterfeiting.

(xii) Miscellaneous issues.

These disputes are generally between the importer and the exporter, which may also include the traders, manufacturers, and the ultimate consumers depending on the type of the products involved.