After reading this article you will learn about:- 1. Elements of Cost 2. Nature of Cost 3. Types.

Elements of Cost:

The costs of an industrial enterprise may be divided into three principle elements, namely:

1. Material.

2. Labour.

3. Expense.

1. Material Cost:

It is the cost of commodities supplied to an undertaking.

It is of two types:

(a) Direct material cost.

(b) Indirect material cost.

(a) Direct material cost:

A direct material is one which goes into a salable product or its use is directly essential for the completion of that product, e.g., a H.S.S. bit for making a turning tool for lathe; Fe, Ni, Cr. etc., to make alloy steels. The amount paid for or the money spent on direct materials is known as direct material cost. Since, direct material used can be traced to a specific product and its cost becomes part of the prime cost, the direct material cost can be controlled in a positive way.

(b) Indirect material cost:

An indirect material is one which is necessary in the production process but is not directly used in the product itself, e.g., it does not become an integral part of the product, e.g., cotton waste, greases, oils, sandpaper, etc. The costs associated with indirect materials is called Indirect material cost. The same material may be a direct material for one producer and an indirect material for another.

Some direct materials are in certain cases, used so little that it is not worth-while to identify and charge them as direct materials. Nails, glue and sometimes paints, are a few examples. Under such conditions, these materials are generally charged as indirect materials, or overheads.

2. Labour Cost:

It is the cost of remuneration (Wages, salaries, commissions, bonuses, etc.) of the employees of a concern or enterprise.

Like material cost, labour cost is also classified as:

(a) Direct labour cost.

(b) Indirect labour cost.

(a) Direct labour cost.

The direct labour cost is the cost of labour that can be identified directly with the manufacture of the product and allocated to, cost centres or cost units. A direct labourer is one who converts the direct material into salable products; the wages, etc. of such employees constitute Direct labour cost. The wages of a welder fabricating a structure form a part of the total direct labour cost. Direct labour cost may be apportioned to the unit of cost or job either on the basis of time spent by a worker on the job or as a price for some physical measurement, (e.g., quantity) of the product.

(b) Indirect labour cost:

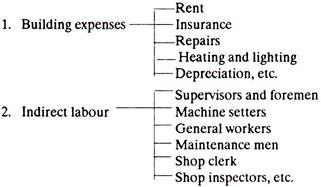

It is that labour cost which cannot be allocated but which can be apportioned to, or absorbed by, cost centres or cost units. This is the cost of the labour that does not alter the construction, conformation, composition or condition of the direct material but is necessary for the progressive movement and handling of the product to the point of despatch. Examples of Indirect or non-productive workers are: maintenance men, helpers (in a machine shop or foundry), machine setters, supervisors and foremen, etc.

3. Expense:

It is a collective title which refers to all charges other than those incurred as direct result of employing workers or obtaining material. Expenses include the cost of services provided to an undertaking and the notional cost of the use of owned assets.

Expenses may be of two types:

(a) Direct expenses.

(b) Indirect expenses.

(a) Direct expenses:

These are the expenses which can be identified with, and allocated to, cost centres or cost units.

The following examples of direct expenses will clarify the idea:

(1) Costs of special layouts, designs or drawings produced for a specific job are the direct expenses of such a job, provided, layouts, designs or drawings are totally consumed on the job, or though they can be used again but there are hardly any chances of their being used again.

(2) Hire of special or single purpose machine tools or other equipment for completing a particular production order.

(b) Indirect expenses:

These are the expenses which cannot be allocated but which can be apportioned to, or absorbed by, cost centres or cost units.

Examples of indirect expenses are:

a. Rent of the building.

b. Insurance premium.

c. Telephone bill, etc.

(i) Fixed expenses:

Fixed expenses are those costs that tend to remain relatively constant regardless of the volume of production.

Examples of fixed expenses are:

a. Taxes on land and building.

b. Depreciation arising from time.

c. Rent.

(ii) Variable expenses:

Variable expenses are those which tend to vary directly with the volume of production,

Examples of variable expenses are:

a. Royalties paid on a volume basis (as in case of gramophone records),

b. Depreciation arising from use.

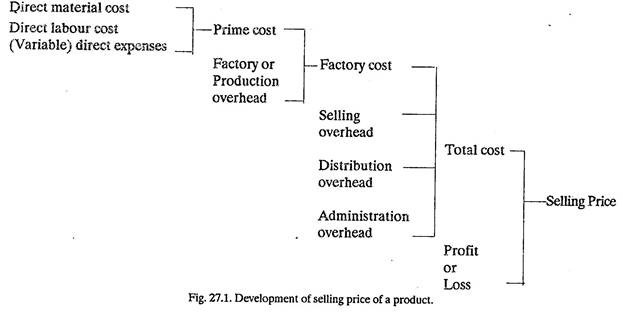

Prime Cost:

Prime cost = Direct material cost.

+ Direct labour cost.

+ (Variable) direct expenses.

Prime cost is limited in its use to the manufacturing division of a business concern.

Indirect costs, Overheads, On cost and Burden are synonymous terms. Overheads are all expenses other than direct expenses. Overhead is defined as the cost of indirect material, indirect labour and such other indirect expenses, including services, as cannot conveniently be charged direct to specific cost units.

The main groups into which overhead may be subdivided are:

(a) Production or manufacturing overhead, including services.

(b) Administration overhead.

(c) Selling overhead.

(d) Distribution overhead.

(e) R & D overhead.

(a) Production or manufacturing overhead:

It includes all indirect expenses incurred by the concern from the receipt of the production order until its completion, i.e., it being ready for dispatch to the customer.

Topical manufacturing overhead costs are:

3. Water, Fuel and Power (steam, gas, electric, pneumatic, hydraulic).

4. Consumable stores such as cotton waste, grease, etc.

5. Plant maintenance and depreciation.

6. Sundry expenses such as those of:

i. Employment office,

ii. Security,

iii. All forms of welfare,

iv. Recreation and rest rooms, etc.

(b) Administration overhead:

Administration overhead consists of expenses incurred in the direction, control and administration of an enterprises. Administration overhead is the expense of providing a general management and clerical service.

Examples of administration overhead:

i. Office rent.

ii. Salaries and wages of clerks.

iii. Director’s, general manager’s fees.

iv. Insurance

v. Legal costs.

vi. Rates and Taxes.

vii. Postage and telephones.

viii. Audit fees.

ix. Bank charges, etc.

(c) Selling overhead:

Selling overhead consists of expenses in order to maintain and increase the volume of sales. Selling overhead covers all expenses direct or indirect which are necessary to persuade consumers to buy.

Examples of selling overhead:

i. Advertising.

ii. Salaries and commission of sales managers, travellers and agents

iii. Rent of sales-rooms and offices.

iv. Consumer service and service after sales, etc.

(d) Distribution Overhead:

1. Distribution overhead covers all expenses connected with transporting products to customers and storing them when necessary.

2. Examples of distribution overhead:

i. Warehouse charges.

ii. Cost of transporting goods thereto.

iii. Loading and unloading charges.

iv. Upkeep and running of delivery vehicles.

v. Salaries of clerks and labourers.

vi. Depreciation, etc.

(e) Research and Development Overhead:

1. Much depends upon the nature of product or service being produced.

2. R & D overhead is proportional to the size of R & D department.

Factory Cost:

Factory cost = Prime cost + Factory overhead

= Direct material cost

+ Direct labour cost

+ (Variable) direct expenses

+ Factory overhead.

Total Cost:

Total cost = Factory cost + Selling overhead

+ Distribution overhead

+ Administration overhead.

Selling Price:

Selling price of a product

= Total cost ± Profit or loss

Fig. 27.1 shows the development of selling price of a product.

Nature of Cost:

(a) Fixed Costs:

Fixed costs, policy costs or period costs are those which tend to remain constant irrespective of the volume of output or sales.

Examples of fixed costs:

i. Staff salaries.

ii. Administration expenses.

iii. Rent and establishment charges.

iv. Depreciation, etc.

(b) Variable Cost:

Variable costs tend to vary directly with the volume of output.

Examples of variable costs:

i. Direct productive labour.

ii. Direct materials.

iii. Direct expenses.

(c) Semi-Variable Costs:

These costs are partly fixed and partly variable. Semi-variable costs vary with changes in output but the variation is irregular.

Examples of semi-variable costs are:

i. Indirect hourly labour which varies more less with output but not in direct proportion to it, for example, wages of maintenance men.

ii. Grease and oil.

iii. Water and electricity, etc.

(d) Controllable Cost:

Controllable cost is one which can be influenced by the action of a specified member of an undertaking.

(e) Uncontrollable Cost:

Uncontrollable cost is one which cannot be influenced by the action of a specified member of an undertaking.

Types of Cost:

(a) Predetermined Cost:

Predetermined cost is one which is computed in advance of production on the basis of a specification of all the factors affecting cost.

(b) Standard Cost:

Standard cost is a predetermined cost which is calculated from management’s standards of efficient operation and the relevant necessary expenditure. Standard costs are built upon a theoretically desired standard that is capable of attainment under practical operation conditions. Standard cost is estimated cost per unit of output for labour, materials and overheads, based on a prediction of material prices, labour rates and overhead expenses for a given future period.

Standard costs represent the best estimate that can be made of what cost should be for material, labour and overhead after eliminating inefficiencies and waste. Any deviation from the standard of materials used will tend to produce a deviation from the standard cost. Variations from predicted performance can be accurately determined and action taken to prevent their recurrence.

Advantages of establishing standard cost:

1. Standard costs tend to bring about a more systematic and thorough analysis of costs and discourage reliance on separate job-by-job studies as a basis for cost estimation for new products.

2. Standard costs tend to reduce to a minimum the variations in price.

3. Standard costs represent management’s best measure of efficient plant operation.

Standard costs may be used as a basis for price fixing and for cost control through variance analysis.

(c) Marginal Cost, Differential Cost, Incremental Cost:

Differential costs, also frequently described as marginal costs and incremental costs are the increase or decrease in total costs that result from producing and distributing an additional or fewer unit of a product, a product, a sales territory, etc.

If it is assumed that fixed costs remain unchanged by increasing output by one more unit, the marginal cost of a product will consist of the variable cost only. These are anticipated costs and refer to future operations. These costs are not entered in general accounting records, but may be incorporated in budgets.

Uses of differential costs:

1. In determining selling price of the products.

2. In making decision regarding replacement of machinery.

3. In accepting an offer.

4. In submitting a bid.

(d) Process Cost:

It is the cost for each, of a number of distinct stages or processes which are performed to make a product. The total time spent and materials used on each process, as well as services such as power, light and heating are all charged in calculating the process cost. For this purpose, a process cost sheet may be made use of.

Process costs are usually applied in industries where the final product has passed through a number of distinct stages or processes; for example, in textile mills, gas, chemical and paper mills, breweries, etc. An important objective in process costing is the evaluation of wastage.

(e) Cost of Production or Production Cost:

It is the cost of the sequence of operations which begins with supplying materials, labour and services and ends with primary packing of the product.

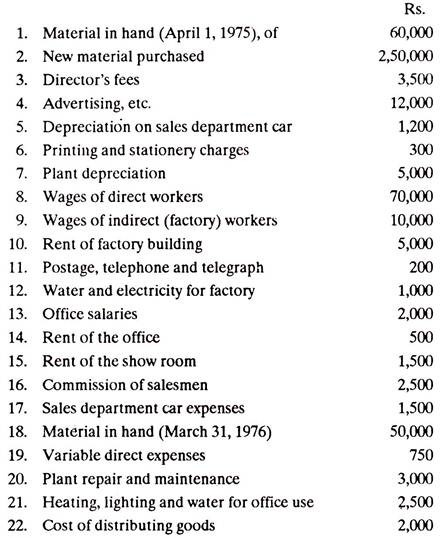

Examples 1:

From the following data, find:

(a) material cost,

(b) Prime cost,

(c) Direct cost,

(d) Factory cost,

(e) Administrative overheads,

(f) Cost of production,

(g) Selling and distribution overheads,

(h) Total cost or cost of sales, and

(i) Selling price. Assume a net profit of Rs. 10,000.

Solution:

(a) Material Cost:

= Cost of material in hand on April 1, 1975

– Cost of material in hand on March 31, 1976

+ Cost of new material purchased

= 60,000-50,000 + 2,50,000 = Rs. 2,60,000

(b) Prime Cost:

= Direct material cost

+ Direct labour cost

+ (Variable) direct expenses

= Rs. 2,60,000 + 70,000 + 750 = Rs. 3,30,750

(c) Direct Cost:

It is same as Prime Cost.

(d) Factory Cost:

Factory cost = Prime cost + Factory or Production overhead,

Whereas Factory overheads include Serial Nos. 7, 9, 10, 12 and 20.

Factory cost = Rs. 3,30,750 + 5,000 + 10,000 + 5,000 + 1,000 + 3,000

= Rs. 3,54,750.

(e) Administrative Overheads:

Administrative overheads include Serial No. 3 ,6, 11, 13, 14 and 21 and are

= Rs.3,500 + 300+200 + 2,000 + 500 + 2,500

= Rs. 9,000

(f) Cost of Production:

Cost of production = Factory cost + Administrative overhead

= Rs. 3,54,750 + 9,000

= Rs. 3,63,750.

(g) Selling and Distribution Overheads:

They include Serial Nos. 4, 5, 15, 16, 17 and 22 and are

= Rs. 12,000 + 1,200 + 1,500 + 2,500 + 1,500 + 2,000

= Rs. 20,700.

(h) Total Cost or Cost of Sales:

Cost of sales = Cost of production + Selling and Distribution overheads

=Rs. 3,63,750 + Rs. 20,700

= Rs. 3,84,450.

(i) Selling Price:

Selling price = Cost of sales + Profit

= Rs 3,84,450 + 10,000

= Rs. 3,94,450.

Example 2:

A factory producing 150 electric bulbs a day, involves direct material cost of Rs. 250, direct labour cost of Rs. 200 and factory overheads of Rs. 225. Assuming a profit of 10% of the selling price and selling on cost (overhead) 30% of the factory cost, calculate the selling price of one electric bulb.

Solution:

Factory cost = Direct material cost+ Direct labour cost + Factory overheads

= Rs, 250 + 200 + 225 = Rs. 675.

Total cost = Factory cost + Selling overhead (i.e., on cost)

= Rs. 675 + Rs 675 x 30/100

Also, Total cost = Selling price – Profit

= S.P. – S.P x 10/100

Equating (i) and (ii) above 10

S.P.– S.P. x 10/100 = Rs. 877.50

... Selling price, S.P. = Rs. 975

Hence the selling price of one electric bulb

= Rs. 975/150

= Rs 6.50

Example 3:

A cast iron foundry employs thirty persons. It consumes material worth Rs, 25,000, pays workers at the rate of Rs. 10 per hour and incurs total overhead of Rs, 10,000. In a particular month (25 days) workers had an overtime of 150 hours and were paid at double their normal rate. Find (i) the total cost; and (ii) the man hour rate of overheads. Assume an eight hour working day.

Solution:

Labour cost = (Number of working hours pre months) x (Rate of payment per hour) = (25 x 8 x 30) x (10)

= Rs. 60,000.

Overtime expenses=Rs. 150 x Rs. 20

= Rs. 3000

Thus, total labour cost = Rs. 60,000 + Rs. 3000 = Rs. 63000.

(i) Total cost = Total labour cost + Material cost + Overheads

= Rs. 63,000 + Rs. 25,000 + Rs. 10,000

= Rs 98,300

(ii) Man hour rate of overhead

Total overheads / Number of total man hours put

Total overheads/ Regular man hours + overtime man hours

= 10,000/25 x 8 x 30 + 150

= Rs. 1.627

Examples 4:

Two molders can cast twenty-five gears in a day. Each gear weight 3 kg and the gear material costs Rs. 12.50 per kg. If the overhead expenses are 150% of direct labour cost and two molders are paid Rs. 70 per day, calculate the cost of producing one gear.

Solution:

Total cost = (Material cost) + (Labour cost) + (Overheads)

= (25 x 3 x 12.5) + (Rs.70)+(70 x 150/100)

= Rs. 937.5 + 70 + 105 = Rs. 1112.5

Cost per gear = Total cost/No. of gears = Rs. 1112.5/25

= Rs. 44.50