Accordingly, where two or more products are manufactured jointly from the same input factors and the cost of input cannot be identified with or traced to the individual products, the products produced are known as ‘joint products.’

According to CIMA Official Terminology, joint products are “two or more products separated in processing, each having a sufficiently high saleable value to merit recognition as a main product.” Thus, when multiple products are simultaneously produced, and each product has, relatively, a significant market value, they are called joint products.

Kohler defines a by-product as “a secondary product obtained during the course of manufacturing, having a relatively small importance as compared with that of the chief product or products.”

The CIMA Official Terminology defines a by-product as “output of some value produced incidentally in manufacturing something else (main product).”

ADVERTISEMENTS:

Accordingly, a by-product emerges as a result of processing operation of another product. It may also be produced from waste or scrap of materials of a process. It is thus, a secondary or subsidiary product that emerges incidentally from the production of the chief or major product. It has a minor sales value. It may be sold in the condition in which it emerges, or it may be made to undergo further processing to make it marketable.

Joint Product and By Product Costing: Introduction, Definitions, Features, Differences, Merits, Demerits, Methods of Apportionment, Problem, Solutions and Important Terms

Joint Product and By Product Costing – Introduction

In manufacturing industries the input factors are usually processed at different stages before getting the end product. In some processes several products are produced jointly.

In such cases one product cannot be produced without the production of other product or products and the management has no control over the ratio in which the different end products come out of the process.

The products arising out of the common process can be classified into:

ADVERTISEMENTS:

(A) Joint products, and

(B) By-products.

Joint Product and By Product Costing – Definitions

Definition of Joint Product:

ADVERTISEMENTS:

Normally, a process or a manufacturing operation converts input into output by changing the form, shape, size and such other attributes of the input. The output or the end product, also known as a finished product may be a single article or a number of similar articles.

There may be a situation in which the same input results in more than one article as the output. The products that emerge from the same input and from the same operation may be of equal importance or unequal importance. In other words, multiple products characterise some industries or manufacturing operation.

Accordingly, where two or more products are manufactured jointly from the same input factors and the cost of input cannot be identified with or traced to the individual products, the products produced are known as ‘joint products.’

According to CIMA Official Terminology, joint products are “two or more products separated in processing, each having a sufficiently high saleable value to merit recognition as a main product.” Thus, when multiple products are simultaneously produced, and each product has, relatively, a significant market value, they are called joint products.

ADVERTISEMENTS:

Emergence of multiple products is common in the case of industries such as agricultural products, extractive, chemical and dairy products.

For instance, in the case of oil refining industry, output consists of petrol, diesel, kerosene, lubricants, paraffin, etc. In the case of mining, both copper and silver may be produced from the same ore. In the case of dairying, milk, butter, cream, cheese, etc., are together produced. Production of coal gas results in the emergence of products such as coke, tar, benzol, sulphate of ammonia, etc.

Definition of By-Products:

Like joint products, even by-products are the result of joint processing. Both joint products and by-products arise in a situation where the production of one product automatically results in the production of other products.

ADVERTISEMENTS:

In fact, multiple products characterise modern processing operations. One product cannot be produced without the production of other products. These products may be classified as joint products, co-products and by-products.

Kohler defines a by-product as “a secondary product obtained during the course of manufacturing, having a relatively small importance as compared with that of the chief product or products.”

Accordingly, a by-product emerges as a result of processing operation of another product. It may also be produced from waste or scrap of materials of a process. It is thus, a secondary or subsidiary product that emerges incidentally from the production of the chief or major product. It has a minor sales value. It may be sold in the condition in which it emerges, or it may be made to undergo further processing to make it marketable.

The CIMA Official Terminology defines a by-product as “output of some value produced incidentally in manufacturing something else (main product).” Accordingly, a by-product is that which comes out in the course of manufacturing the main product.

ADVERTISEMENTS:

It is, thus, incidental to the production of the main product. By itself, a by-product cannot be produced. Further, when compared to the main product, the by-product has only a low commercial value.

Thus, the term ‘by-product’ is used to refer to the residual material which is incidentally recovered from the production of a major or main product. It has relatively a small sales value when compared with the main product.

Examples of by-products are: benzene, naphthalene, wax, bitumen, etc., in the case of conversion of coal into coke; furnace slag in the case of manufacture of iron and steel; saw dust, off-cuts, chippings, etc., in case of wood working; oil cake in the case of extraction of edible oil, molasses in the manufacture of sugar, and glycerin in the manufacture of soap.

Joint Product and By Product Costing – Features

Some of the essential features of Joint Products as presented below:

ADVERTISEMENTS:

1. Equal Importance – Only the products which are having more or less equal importance are considered as Joint Products. As is known, importance of Joint Products is measured in terms of their sales value,

2. Production Simultaneously – The fact that the Joint Products are obtained simultaneously implies the obtaining of all the products at the same time but not one after another, and

3. Same Set of Inputs – All the Joint Products are obtained from the same manufacturing process and from the same set of input factors. That means, a set of input factors introduced into a manufacturing process results in the production of two or more products.

For example, in the case of Petroleum Refining Industry, raw material is the crude petroleum. If this is processed, a number of products such as – Asphalt, Crude Oil, Diesel and Fuel Oil, Gasoline, Kerosene, Paraffin, Petrochemicals, Synthetic Rubber and Tar are obtained.

Another important feature of Joint Products is the inability of the management to exercise control over the output of Joint Products. That means, the output of one Joint Product cannot be increased by decreasing the output of another Joint Product.

If at all the company wants to increase the output of a Joint Product, it has to increase the quantity of input factors. This results in more number of units of not only the Joint Product whose output the company wishes to increase but also the output of other Joint Products.

ADVERTISEMENTS:

That means, Joint Products are obtained in some fixed proportion and this proportion is normally an uncontrollable one from the point of view of management. This feature distinguishes the Joint Products from the Co- products.

Of course, the Co-products also use, to a greater extent, the same input factors. Further, the manufacturing processes differ slightly from one Co-product to another Co-product. They are usually produced one after another in the same manufacturing process.

Sometimes, they are also produced simultaneously using multiple sets of the same manufacturing processes. But the most distinguishing feature of Co-product is that the quantity of each of Co-products is within the control of the management.

A simple example may be taken to understand all these aspects. In the case of Hotel Industry, among other items, the beverages like Coffee, Tea, Milk (sold by hotels), etc., are served to the customers.

For the purpose of preparing these beverages, Milk (purchased by the hotels) is the input factor. This Milk is used for the purpose of preparing all the three beverages mentioned above. These beverages can be prepared one after another or simultaneously using different stoves, utensils, etc.

Further, the output of one beverage say, Coffee can be increased by decreasing the output of another beverage say, Tea. Further, it may be noted here that, for all the beverages, most of the input factors are common.

ADVERTISEMENTS:

Of course, different units of input factors are used. For example, a spoon of sugar, if used for Coffee, is not available for Tea. Another spoon of sugar shall be used for Tea. Automobile Manufacturing Industry, whose final products are Cars, Jeeps, Trucks, etc., provides another example of Co-products.

Besides the Joint Products, the companies also obtain a number of By-products. By-product represents, as defined by White, any saleable or usable value, incidentally produced in addition to the main product.

Two important features of By-products as mentioned below:

1. By-products are not produced deliberately by the companies but they are produced incidentally to the production of Main Product or Joint Products.

2. These By-products have either the use value or the sale value or both. A By-product may be used as raw-material in the production of another product. Hence, the By-product has use value. The same By-product or another By-product may be having a sale value. That means, the Byproduct may be sold for some price to outsiders in the market.

Dairy Industry provides a good example to By-products. If milk is put to the manufacturing process, it yields Butter (Main Product) and Butter-milk (By-product). In the case of Sugar Industry, sugar cane is the raw-material and the outputs are, Sugar (Main Product), Molasses and Bagasse (By-products).

Principal Objectives of Analysis of Costs and Accounting of Joint Products and By Products

The principal objectives of analysis of costs and accounting of joint products and by-products are:

ADVERTISEMENTS:

(i) To determine the unit cost of joint products and by-products.

(ii) To determine the profit or loss on each line of product.

(iii) To assist in the proper inventory valuation.

(iv) To determine the pattern of production and the most profitable sales-mix.

(v) To study the effect on costs and profits due to change in the production of joint and by-products for the ultimate aim of price fixation.

Difference between Joint Products and Co-Products

In the context of joint products, it is necessary to distinguish between joint products and co-products. Ordinarily, both are considered to be the same. The terms ‘joint products’ and ‘co-products’ have also become interchangeable.

ADVERTISEMENTS:

But yet, joint products differ from co-products. Joint products arise simultaneously, from the same raw material, and in the same process. However, co-products are produced together; but not from the same material and from the same process.

There is also one more difference between the two. Till the point of separation, joint products are indivisible. On the other hand, co-products are divisible. Further, the quantities of joint products are fixed and unalterable.

Those of co- products, however, are within production control. Rice and sugarcane, which are co-products, produced on different portions of the same land, and by different processes of cultivation, may be altered with regard to quantities produced.

Joint Product and By Product Costing – Methods of Apportionment of Joint Costs (with Problems, Solutions, Merits, Demerits and Formulas)

Main objective of joint product costing is determining the cost of production of joint products. This involves apportionment of joint costs more accurately over the joint products.

The following are the various methods used for apportionment of joint costs:

ADVERTISEMENTS:

1. Physical unit’s method

2. Average unit cost method

3. Survey method

4. Contribution margin method.

5. Standard cost method.

6. Market value method-

i. At the point of separation

ii. After further processing

iii. Net realisable value (or) relative sales value

iv. Net value or reverse cost method

1. Physical Units Method:

This method is used when all the products absorb the same amount of raw materials and processing costs. Total joint expenses is divided by total number of units to ascertain cost per unit. To calculate the total cost of each joint product, cost per unit is multiplied by number of units produced in each joint product.

Merits:

This method is easy to understand and to apply.

Limitations:

i. The joint products may vary in quality but cost per unit is the same.

ii. It does not help in fixing the correct selling price for the different joint products.

iii. The products may be in different physical forms. So it is difficult to apportion the cost using same measurement unit.

iv. It does not help the management in cost control and in decision making.

Illustration:

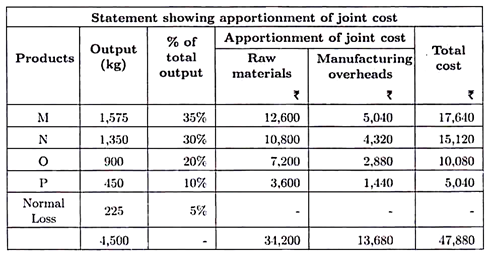

Products M, N, O and P are produced from a common raw material. 4,500 kg of raw materials were used at a cost of Rs.34,200. Manufacturing overheads amounted Rs.13,680. The quantity of products produced are M – 1,575 kg, N – 1,350 kg, O – 900 kg, P – 450 kg and 225 kg were lost in processing.

Calculated materials, manufacturing and total cost of each product.

Solution:

2. Average Unit Cost Method:

Under this method total joint cost is divided by total number of units of all joint products. It gives average cost per unit of all joint products. The result obtained under this method is similar to the result obtained under physical unit’s method. The merits and demerits of this method are similar to that of physical unit’s method.

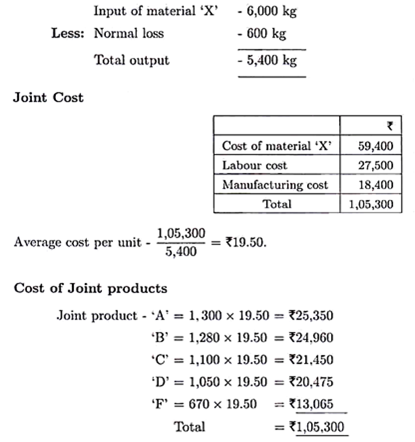

Illustration:

Raw material ‘X’ is introduced into a process. It yields five products which are almost equal in their value. During a period 6,000 kg of raw material ‘X’ was introduced in a process at a cost of Rs.59,400. 10% of materials put in is lost in the process. The output of various products are A – 1,300 kg, B – 1,280 kg, C – 1,100 kg, D – 1,050 kg and E – 670 kg. Labour cost and manufacturing cost in the process are Rs.27,500 and Rs.18,400 respectively.

Calculate the cost per unit and total cost of each joint product.

Solution:

3. Survey Method:

Under this method a detailed survey is conducted to find the value of materials consumed, labour time expended and other production expenses incurred for each joint product and weights are assigned to each product.

By considering number of units produced and weights assigned for each joint product, weighted average cost of each product is found. The weight assigned for each product is to be reviewed periodically since various factors of production may change.

Merits:

i. This method helps in accurate apportionment of joint costs over various joint products.

ii. It also helps in correct price fixation.

iii. It enables the management in decision making.

Demerits:

i. More time and effort is required for assigning weights for each product.

ii. When various factors of production expended per product cannot be ascertained, weights are given arbitrarily.

iii. Using arbitrariness results in inaccurate allocation of joint cost.

iv. This also distorts the correctness of the decision taken by the management.

Illustration:

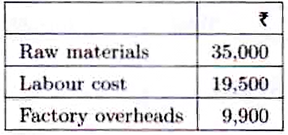

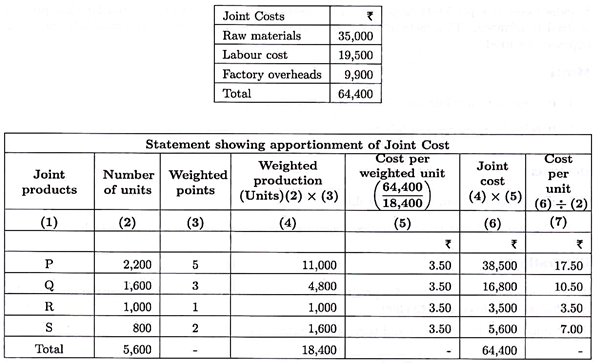

A company produces four products in its manufacturing process – P, Q, R and S.

The various expenses in common process during a period are:

Number of units produced during the period are – P – 2,200, Q – 1,600, R – 1,000 and S – 800.

The following weights are assigned after a detailed survey – P – 5 points, Q – 3 points, R – 1 point and S – 2 points. Required – Apportion the joint costs using weights assigned.

Solution:

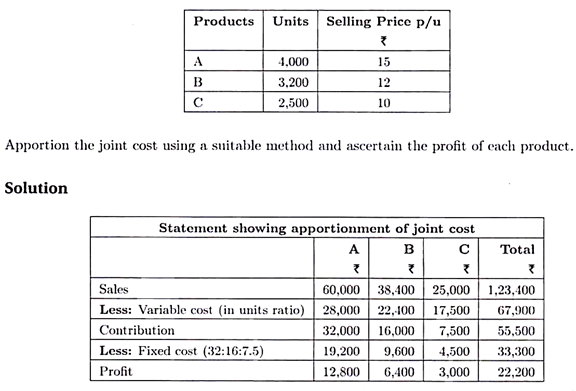

4. Contribution Margin (or) Gross Margin Method:

Total joint cost is grouped as variable cost and fixed cost. Variable costs are allocated on the basis of physical units. Fixed costs are apportioned in the ratio of contribution margin. Contribution margin is the excess of sales over variable cost. Therefore –

Contribution = Sales — Variable cost

Merits:

i. Apportionment of joint cost on behaviour basis is more appropriate.

ii. Since marginal cost approach is followed, it helps the management in taking correct decisions.

iii. It also helps correct measurement of profitability of each product.

Demerits:

i. There is difficulty in dividing the joint costs into variable and fixed costs.

ii. Incorrect apportionment of joint cost will distort the entire decision making process.

5. Standard Cost Method:

Standard cost is a predetermined cost. The reasonable expenses to be incurred for each product is fixed in advance. This method helps in controlling cost and in fixing responsibility for excess expenses incurred.

Merits:

i. It helps in controlling cost and avoiding wastages.

ii. It helps in fixing responsibility.

Demerits:

i. Fixing the standard cost is very difficult.

ii. The standard cost becomes useless when rates of various expenses change widely.

Illustration:

A company produces 3 grades of a product in a common process. The costs incurred are – Variable cost Rs.67,900 and Fixed cost Rs.33,300.

The number of units produced and their selling prices are –

6. Market Value Method:

Under this method ability to pay is the criterion used to apportion the joint cost. The product bringing more sales revenue is allotted more cost. This method is considered to be more appropriate over other methods. There are three variants of this method.

They are:

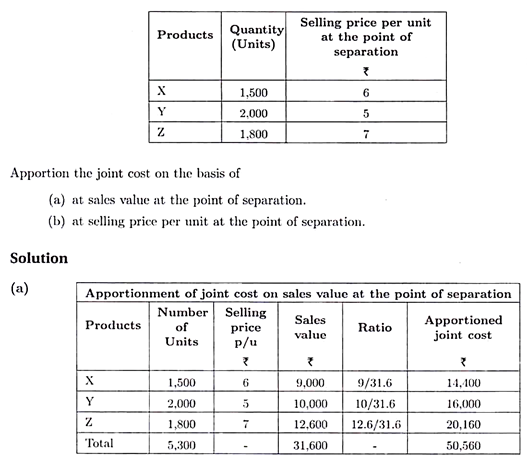

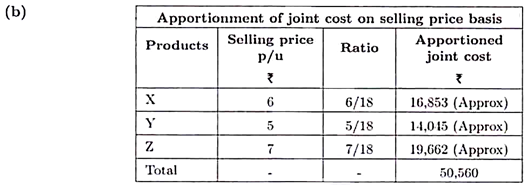

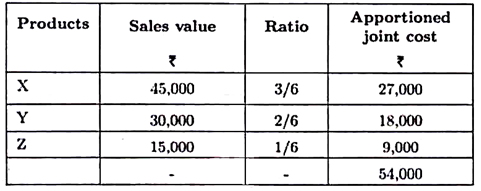

i. Market Value at the Point of Separation:

Sometimes products produced in a common process may have market immediately after separation. Sales value at the point of separation is used as the basis for apportionment of joint cost. When quantities of products produced are more or less equal, selling price per unit is used as the basis for apportioning joint cost.

Problem:

Three products X, Y and Z are produced at a joint cost of Rs.50,560. These products does not require further processing.

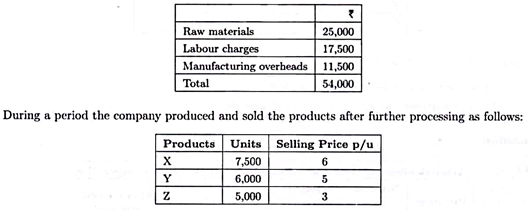

ii. Market Value after Further Processing:

Sometimes joint products at split-off point may not have market. So it is difficult to ascertain the market value of joint products at split-off point. In such cases, the other alternative available to apportion the joint cost is using the market value of products after further processing. But this method is not logical because the expenses incurred in further processing may be in different proportions for different products.

Problem:

A Ltd produces three products in a joint process.

The expenses incurred up to separation point are:

Solution:

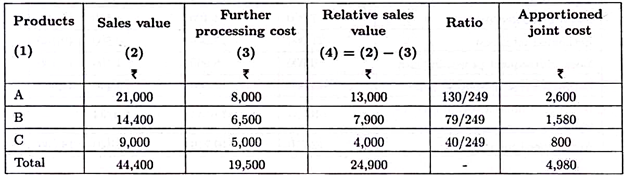

iii. Net Realisable Value (or) Relative Sales Value Method:

In this method further processing cost is deducted from the sales value after further processing. It is a better method over market value after further processing. Net realisable value is the market value after further processing less far processing cost.

Illustration:

PQR Ltd produces three joint products A, B and C and sells them at Rs.14, Rs.12 and Rs.9 respectively. Number of units produced are 1,500, 1,200 and 1,000 respectively. The total joint cost incurred during a period is Rs.4,980. Processing cost incurred after split-off point are Rs.8,000, Rs.6,500 and Rs.5,000 respectively. Apportion the joint cost using relative sales value.

Solution:

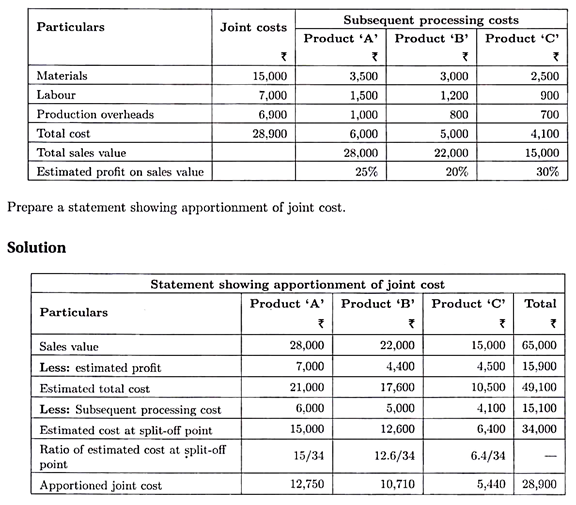

iv. Net Value or Reverse Cost Method:

In this method estimated cost of production at the split-off point is calculated by deducting the estimated profit, selling and distribution expenses and expenses incurred after separation from the final sales value of the joint products. Joint cost is apportioned on the estimated cost (net value) basis over the joint products.

Illustration:

A factory produces three products which originate from a joint process.

Costs incurred and other relevant details are:

By-Products Accounting:

Products emerging from common processes which are of smaller value are called by-products. Joint costs are to be apportioned over main products and by-products.

The following methods are used for apportionment of joint costs:

1. Non-Cost Methods (or) Sales Value Method:

This method is further sub-divided into following methods:

i. Miscellaneous income or other income method.

ii. Total sales less total cost method.

iii. Total cost less sales value of by-product method.

iv. Sales value of by-product less selling expenses credited to process account are deducted from total cost.

v. Sales value of by-product less selling expenses and further processing cost credited to process account.

vi. Reverse cost method.

2. Cost Method:

This method is further subdivided into the following methods:

i. Replacement or opportunity cost method.

ii. Standard cost method.

iii. Apportionment on suitable basis.

1. Non-Cost Method or Sales Value Method:

i. Miscellaneous Income or Other Income Method:

Income from the sale of a by-product is credited to profit and loss account as other income or miscellaneous income. This method is followed when the quantity and sales value is very small.

Stock of by-product is valued at nil cost and it will not appear in the balance sheet. So stock reporting is not accurate. By-product produced in one period may be sold in the next period. This distorts income reporting also.

ii. Total Sales Less Total Cost Method:

Sales value of by-product is added to the sales value of the main product. Total cost of the process is deducted from the total sales to arrive at the profit. Stock of by-product is valued at nil cost and will not appear in the balance sheet.

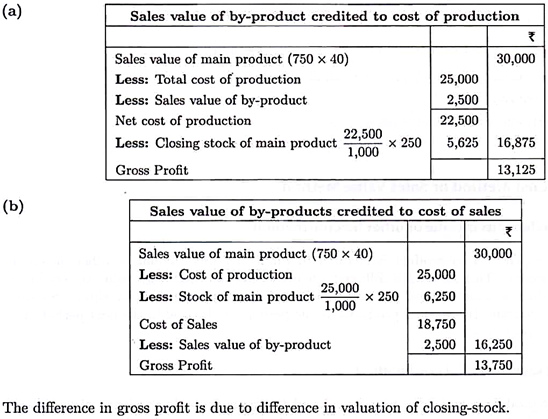

iii. Total Cost Less Sales Value of By-Product Method:

Under this method sales value of the by-product is deducted from total cost of production or cost of sales. By-product stock is valued at nil cost. The stock of the main product is valued on the total cost basis.

Problem:

During a certain period 1,000 units of main a product are produced and out of this 750 units were sold at Rs.40 per unit. The by-product emerging from the process is sold at Rs.2,500. The total cost production of 1,000 units is Rs.25,000. Calculate the amount of profit after crediting the sales value of the by-product –

(a) To cost of production and

(b) To cost of sales.

Solution:

iv. Sales Value of By-Product Less Selling Expenses Credited to Process Account or Deducted from Total Cost:

Under this method sales value of by-product less selling expenses is either credited to process account or deducted from total process cost. Closing stock of the by-product is valued at selling price less a reasonable expenses to be incurred for selling the stock.

v. Sales Value of By-Product Less Selling Expenses and Further Processing Cost Credited to Process Account:

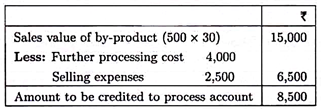

Under this method selling expenses and further processing cost of by-product is deducted from the sales value of by-product. Net sales value of by-product is credited to process account.

Problem and Solutions:

In the course of manufacturing a main product, 500 units of the by-product were produced. Sales value of by-product was Rs.30 per unit. Further processing cost incurred for the by-product was Rs.4,000 and selling expenses incurred for sale of the by-product was Rs.2,500.

Find the amount to be credited to the process account in respect of the by-product:

Solution:

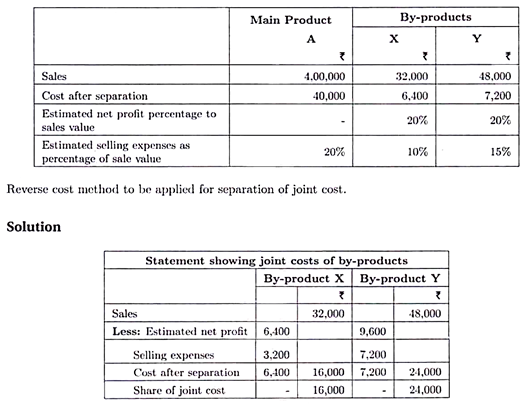

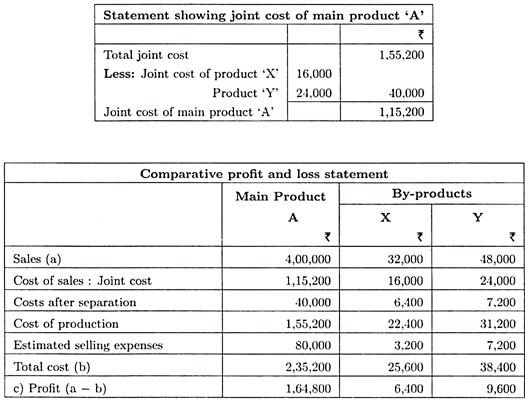

vi. Reverse Cost Method:

Under this method, estimated profit, selling expenses and further processing cost of the by-product is deducted from the sales value of the by-products to get the joint cost of the by-product.

Problem and Solutions:

In manufacturing the main product ‘A’, a company processes the incidental waste into two byproducts X and Y. From the following data relating to the products you are required to prepare a comparative profit and loss statement showing the individual costs and other details. The cost up to separation point was Rs.1,55,200.

2. Cost Methods:

i. Replacement or Opportunity Cost Method:

This method is followed when the by-product obtained from the process can be reused as raw materials in some other process of the company. The market value of materials which are similar to the by-product is the replacement price. The replacement price of the by-product is credited to the process account.

Illustration:

In the production of a main product, a by-product Y is obtained. In a certain period 500 units of the by-product are produced which are transferred to another process where the by-product is consumed. If the by-products were purchased from the market, the price would have been Rs.8 per unit. Calculate the amount to be credited to the main product in respect of the by-product under the replacement cost method.

Solution:

Amount to be credited in respect of by-product is 500 units x Rs.8 = Rs.4,000

ii. Standard Cost Method:

This method is followed when the by-product is consumed within the same company and the market price of similar products are changing frequently. A standard cost is fixed for the by-product. The standard cost of by-product is credited to the process account. This method helps to exercise control over the cost of the main product.

iii. Apportionment on Suitable Basis:

This method is applied when value of by-products are of considerable value. By-product is treated like a joint product. Joint cost is apportioned between the by-product and main product on some suitable basis after carefully evaluating the various factors of production consumed by each product.

Difference between Joint Products and By Products

The main points of difference between the two are listed below:

Joint Products:

1. Joint Products are more or less of equal economic importance.

2. Joint products are produced simultaneously in a process.

3. Joint products are not produced just incidentally, their production is definite.

4. Joint products require further processing.

By-Products:

1. By-Products are of lesser importance.

2. By-products are produced from the scrap or the discarded material of the main product.

3. By-products emerge incidentally from the production of the main products.

4. By-products generally do not require further processing.

Joint Product and By Product Costing – Split-off Point or Separation Stage

In certain industries the raw materials introduced in a production process will give rise to two or more products. Raw materials after undergoing manufacturing operations up to a certain stage splits into two or more products of more or less of equal value and/or importance. The point at which the raw material splits into two or more products is called the split-off point or separation stage.

These products are called either as main products, joint products or by-products. Same raw materials and same manufacturing operations are involved up to split-off point. The expenses incurred up to split-off point is called joint cost. Joint cost is the cost incurred for all the products produced in the process.

Joint Product and By Product Costing – Important Terms

Let us discuss first the various important terms involved:

Term # 1. Joint Products:

Two or more products produced in a process which are almost of equal value and importance are called joint products. Joint products usually require further processing before sale. Production of any one of the joint product cannot be avoided or cannot be increased without corresponding increase in the production of other products. These products are the result of the same raw materials and manufacturing process.

Term # 2. Main Product:

If any one of the products produced is of higher value than other products, it is called the main product. It may also be called major product or prime product. Production process is set-up to produce the main product.

Term # 3. By-Product:

When a product produced in a process is of smaller value or is insignificant value it is called a by-product. The production of by-products are incidental to the production of main product. So the emergence of by-product cannot be avoided.

For example, oil cake obtained in vegetable oil production, molasses and bagasse in sugar industry and gas obtained in Coke making process are by-products. By-products are usually sold without further processing.

Term # 4. Joint Costs:

Expenses incurred in the common process axe called joint costs. Expenses like raw materials, labour and other manufacturing expenses incurred up to separation or split-off point is called joint costs.

The joint costs are the expenses incurred for the production of all products (main product, joint product and by-products) in a process. Apportionment of joint costs accurately over the various products is important in determining the cost and profit of each product.

Term # 5. Split-Off Point:

Raw materials introduced in a process pass as a single product up to a certain stage. Thereafter it splits into two or more products. The point at which raw materials splits into two or more products is called split-off point or separation point. All the products may emerge at a single split-off point. Sometimes there may be more than one split off point.

For example in Sugar industry bagasse emerge in crushing process and molasses emerge in refining process. Split-off point is important in determining joint cost and its apportionment over various products.