Everything you need to know about the applications of marginal costing.

Marginal costing is the most powerful and popular technique in aid of managerial decision making. It reveals the cost, volume profit relationship in all its ramifications which is useful in profit planning, selling price determination, selection of optimum volume of production, etc.

Marginal costing, with its focus on variability of costs and avoidance of overhead apportionment, is so versatile that it is applied in varied circumstances and to tackle diver’s problems by those in charge of such situations.

The applications of marginal costing are:-

1. Optimum Sales Mix 2. Market Expansion 3. Make or Buy Decision 4. Product Mix 5. Sales Mix 6. Increase in Level of Activity 7. Dropping a Product 8. Suspension of Activities

9. Sales Channel 10. Sales Promotion Scheme 11. Profit Target 12. Best Level of Activity 13. Introducing New Line of Product 14. Discontinue of a Product 15. Price Change and a Few Others.

Applications of Marginal Costing: Optimum Sales Mix, Market Expansion, Product Mix, Sales Mix and a Few Others

Applications of Marginal Costing – 15 Important Applications: Optimum Sales Mix, Market Expansion, Product Mix, Sales Mix, Profit Target and a Few Others

Marginal costing is taking a significant place in the total cost of Management Accountant. It is widely used for planning and decision making.

There are many managerial problems, and marginal costing will be helpful to solve those problems. The main managerial problems are indicated below which may help in taking business decisions.

Managerial Problems:

Various important managerial problems are as under:

(1) Optimum Sales Mix

(2) Market Expansion

(3) Make or Buy Decision

(4) Product Mix

(5) Sales Mix

(6) Increase in Level of Activity

(7) Dropping a Product

(8) Suspension of Activities

(9) Sales Channels

(10) Sales Promotion Scheme

(11) Profit Target

(12) Best Level of Activity

(13) Introducing New Product

(14) Discontinue of a Product from the Market

(15) Change in Price.

Application # 1. Optimum Sales Mix:

When a company is engaged in a number of products, there, may arise a problem of selecting most optimum product mix which would maximise the profit of the concern. Under such situation, profitability will improve by economising the scare resource known as key factor.

The product giving highest contribution per unit of key factor should be considered and then all products are put in ranks in order of priority. Selection of products will offer optimum product mix or which the profit will be maximum.

The following guide lines will be helpful in this direction:

(i) Calculate contribution per unit of key factor.

(ii) Assign ranks as per highest contribution per unit of key factor.

(iii) Available key factor is to be utilised in the manufacture of first rank and so on.

Application # 2. Market Expansion:

Sales volume can be increased by taking new territories or by extending its own marketing organisation. It will require an extra expenditure. Marginal costing will be helpful in providing adequate and relevant data for taking a decision in this regard.

Application # 3. Make or Buy Decision:

The nature of decision regarding make or buy may be of the following types:

(A) Every businessmen has to take a decision whether to manufacture the component in the factory or to buy it from the market. In such cases a comparison of marginal cost with that of buying price is to be made. Here only marginal cost is the relevant factor which is to be considered.

If the marginal cost is less than buying price, additional requirement of component is to be made by making rather than buying it from the markets. Similarly, if buying price is less than the marginal cost, it will be advantageous to purchase it from the market.

If the market price is less than the production cost, then the component should be purchased from the market.

A decision has to be taken whether a component should be purchased from the market or it should be produced in the factory.

If additional costs are less than the buying price, the component should be manufactured and vice versa.

Application # 4. Product Mix:

When any company produces a number of products, then a problem may arise of selecting most optimum product mix which would provide the maximum profits.

Before taking decision in product mix, the following principles are taken into account:

(i) Available key factor should be utilised.

(ii) Calculate contribution per unit of key factor.

(iii) Assign ranks on the basis of highest contribution per unit of key factor.

Application # 5. Sales Mix:

Problem of sales mix arises when a business concern is producing more than one product. Each product might be yielding different amount of contributions. The management goal is only to get maximum profit. The ratio of quantities to be sold various products in such a manner as to earn maximum profit. It is known as optimum sales mix.

It is ascertained with the help of contribution per unit. The product which gives the highest contribution is given the highest priority. Out of the various sales mix, that sales mix is selected which provides the maximum profits.

Application # 6. Increase in Level of Activity:

If any concern is not making adequate profit, the level of activity may be increased by reducing the price and removing the shortage of materials; shortage of skilled labour or market situations etc. In all these positions, marginal costing is taken into consideration.

Application # 7. Dropping a Product:

The businessmen want to earn maximum profits out of his limited resources. It requires to fix priorities for various products. The management would like to drop the production of unprofitable product. It will based on the comparative study of contributions made for each product.

For this purpose, marginal contribution statement is prepared. In this connection the following points are taken into consideration:

(i) If any production is dropped, the contribution should be expressed in terms of per unit of key factor.

(ii) The left unused capacity should be used in the production of other products.

(iii) Production having highest contribution should be accepted top priority in production.

(iv) If case of positive contribution, the, product should not be dropped.

(v) Least contribution product should be dropped.

Application # 8. Suspension of Activities:

Sometimes due to competition or other reasons, the business concern may not be in a position to carry out its trading activities. Thus trading activities are suspended.

These suspension may be of two types as under:

(i) Temporary Suspension – During off season, trading activity is closed temporarily for short period. It is known as temporary suspension.

(ii) Permanent – But when on account of depression, in case of continuous loss, the trading activity can be suspended permanently.

Application # 9. Sales Channel:

Sometimes the trader is faced with the problem of selecting the most profitable channel of distribution. With the help of marginal costing technique, the contribution may be ascertained and correct decision may be taken in time. Under it, that channel of distribution should be selected which may provide maximum contribution. Selling and distribution expenses should be considered as a part of marginal cost for calculating contribution.

Application # 10. Sales Promotion Scheme:

The management has to evaluate the profitability of various sales schemes which may cover trade discount free gifts, extra commission and price reduction etc. In all these cases, marginal costing will help in assessing the profit through contribution analysis. If goes to increase the total contribution, the profit in that case will be maximum.

Application # 11. Profit Target:

Marginal costing is used by management in profit planning.

A profit target is fixed and management tries to achieve it by making changes in the factors given below:

(i) Quantity sold

(ii) Variable cost per unit

(iii) Sales mix

(iv) Selling price

(v) Total fixed costs.

With the help of marginal costing, the management can easily evaluate the desired profit and can examine the improvement in profit position.

Application # 12. Best Level of Activity:

Level of activity of business is expanded or contracted according to the market conditions. Management selects that level of activity which would provide maximum profits. The level of activity is optimum, where marginal cost equals to marginal revenue. The level of activity can be expanded up to the level where sales exceeds marginal costs.

Application # 13. Introducing New Line of Product:

Whenever a new product is to be added the problem may arise that whether a new product is to be added or the new shape or new model is to be added. If there are many model then the management has to decide that which model should be selected.

In such situation, the marginal cost of new product of all models should be considered. Some additional investment may be required which may increase the fixed cost.

The following guiding points are to be taken into consideration in making any decision:

(i) Contribution and profit for the new product and of all models should be considered.

(ii) Return on additional investments regarding new products is to be compared with the old product.

Application # 14. Discontinue of a Product:

Marginal cost will help the management in taking a decision regarding continuance of a product from the market. Besides marginal cost, the other expenses are selling expenses, salesman commission, distribution expenses, advertisement etc. The selling price may differ from market to market. Discontinuance of a market will eliminate variable expenses but selling and distribution expenses are to be compared with the fixed expenses. Till any market yields contribution, it should not be discontinued.

Application # 15. Price Change:

It is contended that price in short term should cover total cost and profit. But in a competitive market, price is determined by the market forces. In this connection, marginal costing is helpful in price determination in short run.

Price in long run should be as much as to cover total cost and normal profit. But in the competitive world, minimum price has to be determined. If any item of cost seems to be irrelevant, it should be ignored and should not be taken into account in determining the price.

Under certain special circumstances price may be fixed as below cost. But this price should cover all variable costs and some part of fixed cost.

In fixing the price, marginal cost, fixed cost and price are more important points. Price changes may hike in price or reduction in price. In both the cases, the quantity sold will be affected and it may affect the profit position. Management may be forced to take a decision, that how much quantity to be produced and sold, if price is reduced by certain amount. Similarly, it is to be decided that what production technique should be applied to reduce the burden of fixed costs.

Application of Marginal Costing – 21 Vital Areas: Make or Buy Decision, Expand or Buy, Comparing Machines and Hand Labour and a Few Others

Marginal Costing helps the management in decision-making in respect of the following vital areas:

1. Make or Buy decision:

In the case of a make or buy decision, the following factors are considered-

(a) Plant capacity- (i) capacity available to produce the product, i.e., there is a shortage of work; (ii) capacity available but only to a limited extent; or (iii) capacity being a limiting factor.

(b) Special finishing by outside specialist organization.

(c) Nature of product or component.

(d) Regularity of supply by outside agencies and quality maintenance.

(e) Cost factor.

(f) Profit maximisation.

Then, the decision is to be taken whether to manufacture a product or component within the organization or buy it from outside supplier.

2. Expand or Buy:

When capacity is limited, additional machinery is acquired and component is produced, if it is cheaper compared to buying it from outside.

3. Comparing Machines and Hand Labour:

Products manufactured by hand labour may be cheaper. But, Machines may produce the products on a mass scale. Taking the interest as opportunity cost and depreciation into consideration, the total cost per unit of output may still be lower than that of the hand product. Then, installation of machines will be profitable. Likewise, decisions may be taken by the management.

4. Replacement of Existing Machinery by New and Improved Ones:

The differential cost or savings in the cost and incremental revenue will play an important role in taking such decisions.

5. Alternative use of plant facility or alternative use of production facilities.

6. Diversification of Products:

Management may think of introducing a product to utilise the idle capacity or capture a new market provided it fetches the profit after meeting the variable cost and specific fixed costs, if any, relating to the new product.

7. Product-Mix, Profit Planning and Profit Maximization:

A product which is incurring losses or having low p/v ratio is discontinued and another product with high p/v ratio is introduced so that such product-mix will improve the probability. In similar manner, profit planning is done with an objective of profit maximization. To achieve this objective, the factors, such as, selling price, sale volume, cost control, product-mix, etc., are to be studied carefully and decision is to be taken.

8. Profitability of the Departments.

9. Selling at or below Marginal Cost:

The circumstances under which the products are sold at or below marginal cost are already discussed at 23.21 above.

10. Determination of selling price and volume of output.

11. Determination of sales volume for a desired profit.

12. Determination of optimum output level.

13. Submitting tenders or quotations.

14. Acceptance or rejection of a special order within the country.

15. Acceptance or rejection of an offer from foreign market at lower price compared to indigenous price:

In order to earn foreign exchange and goodwill in the foreign market, any price over and above the marginal cost is generally accepted though it is very much lower than the indigenous prices.

16. Differential pricing decisions in the different markets for the same product, pricing in depreciation or recession and various other pricing decisions.

17. Suspending activities, i.e., closing down the factory for a temporary period or to run the operations at a loss.

18. Alternatively, decision regarding the complete close-down and sale of the plant.

19. Decision-making and profit maximisation based on the key factor.

20. Cost Control.

21. Finally, to find out Break-Even Point.

Applications of Marginal Costing- Top 6 Applications: Profit Planning, Presentation of Cost Data for Control Purposes, Make or Buy Decisions and a Few Others

Marginal cost is essentially a technique of decision-making.

Following discussion will reveal how it is used in solution of managerial problems:

Application # 1. Profit Planning:

Normally, a company carries on its activities for the year long and at the end of the year an exercise of accounts closing is carried out to compute profit for the year. Under profit planning this order is reversed. Profit planning involves forecasting activity level in order to gain or maintain specified amount of profit. Under profit planning start is made from the end result. Profit figure is planned and activity level necessary for yielding that profit is attempted.

It should be noted that determination of required activity level will involve working out how that level will yield specified profit. In this exercise, sale, cost and production activities are all reviewed in harmony with each other to determine how they will yield the desired profit figure. Marginal costing technique helps in profit planning, because it is based on behavioural study of cost.

Application # 2. Presentation of Cost Data for Control Purposes:

Marginal costing can be called a distinctly fine method of cost analysis and cost presentation. Under marginal costing, cost data is presented in such a way that it conforms to all the requirements of management to effect control. Data presentation is based on the behavioural study of cost.

This leads the management to exercise relatively better control over cost. An effort has been made to illustrate this point by the following example. Readers should note how marginal costing helps the management to grasp the actual state of affairs by better presentation. Under absorption costing, cost data may be misleading for the purpose of decision-making.

Application # 3. Make or Buy Decision:

Sometimes, a company has to decide, whether it should make the component of its product or it should buy it from the market. On the face of it, decision to make or buy should involve comparison of seller’s price with marginal cost of that component. But this approach will lead to wrong conclusion. When a component is produced, a part of plant capacity is utilized, i.e., some contribution is earned. If a company is running at its full capacity the contribution thus earned will be lost by not manufacturing the component.

Of course, if company is not working at its full capacity the question of lost contribution will become irrelevant. Thus this “lost contribution” becomes another factor of consideration in taking decision, whether to manufacture a component or to buy it from outside. This factor of ‘lost contribution’ will assume importance only when the company is running at its full capacity.

Following point will be the main considerations in deciding whether company should manufacture the component of its product or it should buy it from market:

(i) Seller’s price.

(ii) Marginal cost of producing the component.

(iii) Lost contribution – This point will gain importance only when company is running at full capacity. It will not be out of place to mention here that in a make-or-buy decision certain other factors sometimes gain importance.

(iv) Company may not like to depend on contractor for supply of component. In a situation like this, company will only like to make the component.

(v) Government policy etc. may influence the decision of the company.

Application # 4. Optimising Product Mix:

When a concern manufactures a number of products, a problem arises as to which product or sale mix will yield maximum profit. Such a problem can be solved by marginal contribution analysis. Product mix, which gives the maximum contribution, will be the optimum mix.

Application # 5. Alternative Use of Production Facilities:

When an alternative method of manufacturing a product or alternative is available, marginal contribution analysis should be made to arrive at the decision. The alternative yielding the highest contribution will be selected.

Application # 6. Evaluation of Performance:

A company may have different departments or product lines. All these departments and product lines may have different revenue earning potential. A company always concentrates on the departments or the product-lines which yield more contribution than others. The relative performance of each department or product is studied by marginal contribution analysis. This analysis will help the company to take decision that will maximise the profits.

Application of Marginal Costing: 10 Popular Applications of Marginal Costing

Marginal costing is the most powerful and popular technique in aid of managerial decision making. As already seen, it reveals the cost, volume profit relationship in all its ramifications which is useful in profit planning, selling price determination, selection of optimum volume of production, etc. Marginal costing, with its focus on variability of costs and avoidance of overhead apportionment, is so versatile that it is applied in varied circumstances and to tackle diver’s problems by those in charge of such situations.

The following are some of the more popular areas of application of marginal costing:

(i) Key factor (or) limiting factor

(ii) Make or buy decision

(iii) Fixation of selling prices

(iv) Export decision

(v) Sales mix decision

(vi) Product elimination decision

(vii) Plant merger decision

(viii) Plant purchase decision

(ix) Further processing decision

(x) Shut down decision

The above list is not exhaustive. There are numerous situations suitable for applying the principles of marginal costing and the situations chosen above are only a few of the popular areas of application of marginal costing.

Applications of Marginal Costing – 3 Main Applications of Marginal Costing: Cost Volume Profit Analysis or Break even Analysis, Cost Control and Decision Making

The main applications of marginal costing are in areas of:

1. Cost-volume-profit analysis or Break-even analysis

2. Cost control, and

3. Decision making.

Application # 1. Cost-Volume-Profit Analysis or Break-even Analysis:

Cost-volume-profit (CVP) analysis or break-even analysis is an important application of marginal costing.

It analyses the relationship among cost, volume and profit and can be used for the following purposes:

(i) To ascertain the amount of profit (or loss) at any level of activity.

(ii) To determine the selling prices/sales volume which will give the desired amount of profit.

(iii) To ascertain the selling price/sales volume, which will yield the desired return on capital employed.

(iv) To determine costs and revenues at various levels of activity.

(v) To ascertain the effect of change (increase or decrease) in fixed costs, variable costs, selling price, production/sales volume on profit.

(vi) To suggest the change in sales/product-mix for obtaining maximum profits.

(vii) To compare profitability among products and firms.

However, the cost-volume-profit analysis is based on a number of assumptions which also act as limitations of cost-volume-profit analysis.

These assumptions are:

(i) All costs can be segregated into fixed and variable components

(ii) Fixed costs will remain static at all levels of output

(iii) Variable costs will vary in direct proportion to the volume of output

(iv) Selling price will remain unchanged

(v) Only one product is produced; in case of multiple products, the sales mix of various products will remain unchanged

(vi) Production and sales will synchronise

(vii) The general price level will remain unchanged

(viii) The productivity of each worker will remain constant.

The analysis of the relationship among cost-volume-profit is based on the following equation:

Sales – Variable costs = Fixed cost + Profit.

The above equation has four variables. If at any given time, we know three of the above variables, the fourth one can be found. Thus, with the help of the above equation, profit or loss can be easily predicted at any level of output.

Application # 2. Cost Control:

Marginal costing can be of great help in cost control. Under this technique, costs are segregated into fixed and variable components. The classification enables the management to know the exact behaviour of various items of cost. In practice, we have most of the costs semi-variable in nature, which are split into fixed and variable elements.

In marginal costing, we can compare the behaviour of all items of costs with past data. The comparison enables the management to control actual costs with past data. The comparison enables the management to control actual costs with past data. The comparison enables the management to control actual costs if they are found to be at variance with past costs.

The management can analyse the reasons for variations. For example, suppose that in a firm, fixed production overheads in the past were Rs. 20,000 and variable production overheads per were Rs. 10. Suppose further that the actual production is 20,000 units. Then the total production overheads would be Rs. 2,20,000.

In case, the actual production overhead costs are more, the management can analyse the situation to find out the reasons for this variation and take appropriate measures to control these costs. Thus marginal costing provides an effective tool in the hands of the management to control costs.

Variable costs can also be expressed as constant percentage of sales. This also provides a basis to keep an eye on costs. If at any time there is a fall in contribution to sales ratio, it would mean that variable costs as a percentage of sales have risen. This would provide a clue to the management for immediate action to rectify the situation.

Application # 3. Decision-Making:

Marginal costing is a very useful technique of decision-making for management. Any decision which involves consideration of variable cost and revenue requires application /use of marginal costing.

Some of the important decisions taken with the help of marginal costing technique are:

1. Fixation of selling price

2. Decision relating to the most profitable product mix

3. Decision in case of key factor or limiting factor

4. Decision relating to make or buy

5. Exploring a new market

6. Shut down or continue

1. Fixation of Selling Price:

The marginal costing technique helps in determining the selling price in normal and special circumstances.

In normal circumstances, every firm would like to sell its products at a price which covers the total cost and yields reasonable profit. There can be a situation when a firm may find it beneficial to sell below total cost, at marginal cost or even below marginal cost.

The determination of selling price in various circumstances is explained below:

(i) Selling Price in Normal Circumstances:

In normal circumstances, to determine the selling price of a product, a firm has first to ascertain the variable cost and desired P/V ratio. Thereafter, the selling price of the product can be determined by dividing the variable cost by (1- P/V ratio).

(ii) Selling Price for Special Market (Export Market) or for a Special Customer:

If a company has some idle capacity, it may develop special markets to utilize the idle capacity by selling goods at a price which covers the marginal cost, but not the total cost. Thus, if a firm has surplus capacity, it may offer a confessional price to a special set of customers.

Since the price of the additional goods will be higher than the marginal cost, the firm will be able to increase its total profits because there will not be additional fixed expenses for the extra output. A firm may export goods at a price less than the total cost or it may sell to a special class of customers at a concessional price.

In doing this differential selling, two precautions are necessary. Firstly, prices for normal sales should not be adversely affected by the concessional price. Secondly, extra sales should be limited only upto the idle capacity, otherwise the fixed overheads will rise and reduce the profit instead of increasing it.

(iii) Selling Price during Recession:

During a recession or a depression, a concern may decide to continue to produce and sell at a price, which is below the total cost. In such a case, the principle followed should be that as long as the price is above the marginal cost, production and sale would continue.

It is obvious that selling in such a situation would give at least some margin to meet the fixed costs and therefore the losses of the firm would be lower than that had production been stopped altogether. However, in this case, one should not sell below the marginal cost because that will only increase the losses.

(iv) Selling Price at Marginal Cost or Below Marginal Cost:

A firm may sell at marginal cost or even below marginal cost merely to keep the machines in running condition or to retain high skilled workers. Similarly, if the raw materials are perishable or when the raw material prices have fallen considerably, a firm may sell the finished product at marginal cost or at a price which is less than the marginal cost to avoid or to reduce total losses.

A firm may also do so to meet acute competition, to introduce a new product, to obviate shut-down costs, to push up the sale of another highly profitable product, to retain future market, or to capture foreign markets. Selling at marginal cost or below marginal cost can be for a limited period only, that too keeping in view the long-term interest.

It may be noted that the situations (ii), and (iii) are those situations when selling price below total cost is justified and circumstances mentioned in situation (iv) may justify selling price at marginal cost or even below marginal cost.

2. Decision Relating to the most Profitable Product Mix:

Normally a product which yields the maximum contribution is considered to be the most profitable. However, when a factor of production is in short supply, popularly called key factor or limiting factor, a product that yields the highest contribution per unit of key factor is considered the most profitable.

3. Decision in Case of Key Factor or Limiting Factor:

Every entrepreneur, left to him, would like to produce and sell unlimited quantity of the product(s). In practice, it is not so. There is always a factor that limits the activity level of a firm. Such factor is known as the key factor, limiting factor, governing factor or principal factor. Generally, in most cases, sales operate as the key factor and determine the volume of output to be produced.

However, there may be cases where demand for the product may be very good but some other factor such as labour, machine capacity, material, finance, etc., may be available to a limited extent. In such situations, any factor that limits the quantum of activity of a firm will be known as the key factor because the decision how much to produce, will be governed by such factor.

In case of sales being the key factor, the profitability of the product is measured by computing its P/V ratio. When any other factor is the key factor, the most profitable product will be that which yields the highest contribution per unit of key factor. The profitability of any key factor than sales can be ascertained by the following formula –

4. Decision Relating to Make or Buy:

A decision whether a component should be produced in the factory or bought from outside is taken by comparing the marginal cost of production with the cost of buying the concerned part. In the make or buy decision, only marginal (variable) cost of manufacturing or special additional cost, if any, are relevant.

Fixed costs which have already been incurred are sunk costs and irrelevant for the decision as they cannot be avoided (saved) if it is decided to buy the concerned part. However, the decision will be influenced by the fact whether or not the capacity released by non-manufacture of the part can be used profitably somewhere else. If yes, the contribution from the use of released capacity will also be considered as opportunity cost in taking a make or buy decision.

5. Exploring a New Market:

Many times a firm has unutilized capacity. It can use such capacity to tap a new market at a lower selling price, if existing market is not going to be affected. In new market, domestic or foreign, product can be sold at any price exceeding marginal cost of production.

However, if any specific expense is to be incurred in connection to meet the additional order, such expenses should also be covered in the price to be quoted for the new order. In such a situation existing fixed costs are not affected and hence are not considered in deciding whether the new order should be accepted or not.

6. Shut Down or Continue:

A firm can continue working till the sales revenue is sufficient to cover the variable cost plus a part of the fixed overheads, i.e., excess of fixed costs over shut down costs. Shut down costs are those costs, which a firm is, bound to incur even if the plant is closed down. Any part of such fixed costs recovered will reduce the losses of the firm, which it is otherwise bound to suffer.

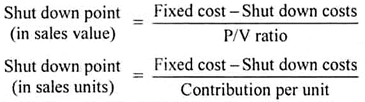

The shutdown point can be determined with the help of the following formula –