Variance means the deviation of actual from standard. In other words variance is the difference between the actual performance and standard performance.

A variance is said to be controllable if it can be identified at the primary responsibility of a specified person, the size of controllable variance reflects the degree of efficiency of the person concerned. It is the Controllable. Variance with which the management is concerned.

Variance may be analyzed for every element of cost and with respect to sales.

The types of variances can be studied under the following heads:-

ADVERTISEMENTS:

1. On the Basis of Control 2. On the Basis of Impact 3. On the Basis of Nature 4. On the Basis of Elements of Cost.

Some of the types of variance are:-

1. Controllable Variance 2. Uncontrollable Variance 3. Favourable Variances 4. Unfavourable Variances 5. Basic Variances 6. Sub-Variance 7. Method Variance 8. Revision Variance 9. Material Variance 10. Direct Labour Variance 11. Overhead Variance 12. Calendar Variance 13. Sales Variance.

Additionally, learn about the formulas used to calculate different types of variances.

Types of Variance: Method Variance, Revision Variance, Material Variance, Direct Labour Variance and Others..

Types of Variance – Classified on the Basis of Control, Impact, Nature and Elements of Cost

A variance is the variation of actual from standard. The difference between the actual cost and standard cost is recorded and it is known as variance. The variance indicates the extent to which standards have been achieved. Analysis of variance involves the segregation of total cost variance into different elements.

ADVERTISEMENTS:

In addition to comparison of actual costs with standard costs, variances are traced to their root causes. For cost control, a knowledge of correct variances is very essential. The causes of responsible for these variances should be brought to the notice of the management.

Variance analysis is the process of analysing variances by sub-dividing the total variance for assigning responsibilities. It is a useful means of interpreting operating results. Analysis of variance is made to indicate the measurements of variances, location of their root causes, measuring their effects and their disposition. There are various process of variances.

The various types of variances are as under:

ADVERTISEMENTS:

1. Favourable Variances:

When actual cost is less than the standard cost, the difference is known as favourable variance. On the contrary, when actual cost is more than the standard cost, the difference is known as unfavourable variance. A favourable variance is a sign of efficiency and an unfavourable variance is a sign of inefficiency.

2. Controllable and Uncontrollable Variances:

A variance is said to be controllable if it can be identified at the primary responsibility of a specified person, the size of controllable variance reflects the degree of efficiency of the person concerned. It is the Controllable. Variance with which the management is concerned.

ADVERTISEMENTS:

If the variance is beyond the control of the concerned person, it is said to be uncontrollable.

Classification of Variances:

The basis of classification are discussed below:

(A) On the Basis of Control:

On this basis, variance may be divided into two categories as under:

ADVERTISEMENTS:

(i) Controllable variance

(ii) Uncontrollable variance.

(i) Controllable Variance – According to I.C.M.A. London controllable cost variance, is a cost variance which can be identified as primary responsibility of a specified person. Thus when a person is held responsible for a particular variance, it is known as controllable variance. All basic variances arising due to non-monetary factors, come under this category.

(ii) Uncontrollable Variance – Variances for which a particular person is not held responsible, is known as uncontrollable variances. External factors are responsible for such variances. All variances on account of monetary factors are called uncontrollable variances.

ADVERTISEMENTS:

(B) On the Basis of Impact:

On impact basis variances are of two types as under:

(i) Favourable variances

(ii) Unfavourable variances.

ADVERTISEMENTS:

(i) Favourable Variances – When actual costs are lower than the standard cost it is known as favourable variance. It is considered that favourable variance is always good and it is an indicator of business efficiency.

(ii) Unfavourable Variances – When actual cost are more than the predetermined standard costs, it is known as unfavourable variances. It is known as negative variances also. It indicates the inefficiency and needs a close down.

(C) On the Basis of Nature:

On this basis, variances are of two types as under:

(i) Basic Variances

(ii) Sub-variance

ADVERTISEMENTS:

(i) Basic Variances – These variances arise on account of monetary rates such as price of raw materials and labour rates. These variances are due to monetary factors such as material price variance, labour rate variance etc.

(ii) Sub-variance – Variances arising due to non-monetary factors, are classified as sub- variances. Thus material quantity variances may be divided into material usage variance and material mix variance and material yield variance.

(D) On the Basis of Elements of Cost:

The most relevant classification of variances is according to elements of costs.

It may be grouped into three categories as under:

1. Material Cost Variance (MCV),

ADVERTISEMENTS:

2. Labour Cost Variance (LCV),

3. Overhead Cost Variance (OCV).

Types of Material Variances:

Material Variances may be various types as under:

i. Material Cost Variance.

ii. Material Price Variance.

ADVERTISEMENTS:

iii. Material usage Variance.

iv. Material yield Variance.

v. Material Mix Variance.

vi. Material Revised (Sub usage) Variance.

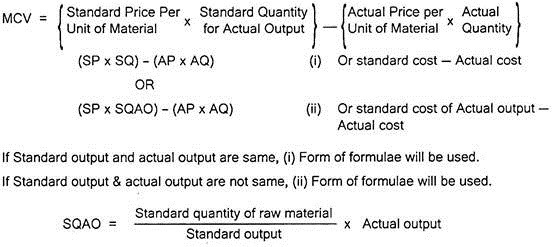

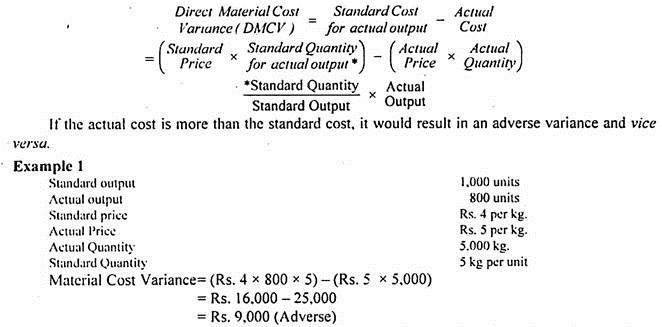

1. Material Cost Variance:

It is the difference between the standard cost of materials and the actual cost. If actual cost is less than the standard cost, it is a favourable variance and vice versa.

ADVERTISEMENTS:

Formula:

MCV = Standard cost-Actual cost

or = (SQ x SP)-(AQ x AP)

Here,

MCV = Material cost variance

Standard Cost = Actual Output x Standard Rate

ADVERTISEMENTS:

Actual Cost = Actual Quantity x Actual Rate

Verification:

Cost Variance = Price Variance + Usage Variance

Usage Variance = Mix Variance + Revised Usage Variance or Mix Variance

Cost Variance = Price Variance + Mix Variance + Revised Usage Variance or Yield Variance.

ii. Material Price Variance:

It arises when the price paid of materials is different from the pre-determined price. It is calculated by multiplying the actual Quantity with the difference between standard and actual price.

MPV = AQ(SP-AP)

Here,

MPV = Material Price Variance

AQ = Actual Quantity

SP = Standard Price

AP = Actual Price

If the actual price is less than the standard price, then it is favourable and Vice Versa.

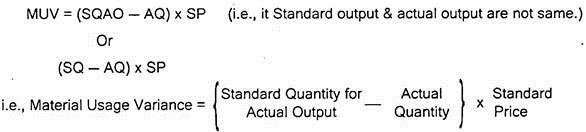

iii. Material Usage Variance:

It measures the difference in material cost arising, from higher of less consumption of materials than the standard consumption. It is calculated by multiplying the Standard Price with the difference between the standard quantity and actual quantity.

Formula:

MUV = SP(SQ-AQ)

If the actual quantity is less than the standard quantity, it is favourable variance and Vice Versa.

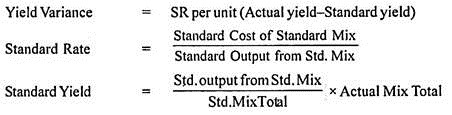

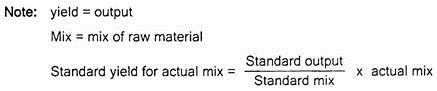

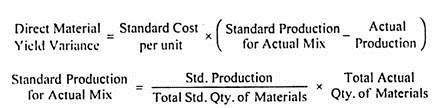

iv. Material Yield Variance:

It is that portion of direct material usage variance, which is due to the difference between standard yield and actual yield.

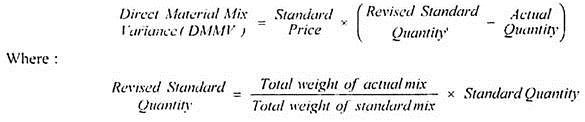

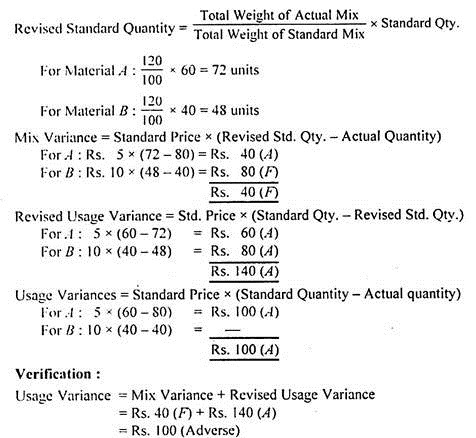

v. Material Mix Variance:

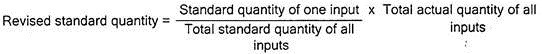

This variance arises when more than one type of materials are used in manufacturing the product and the quantities of materials issued are not in predetermined proportion. It is that part of direct material usage variance, which is due to difference between the standard and actual composition of a mixture. It is obtained by multiplying the standard price of materials with the difference between revised standard quantity and the actual quantity.

If actual quantity is less than revised standard quantity, it is favourable variance and Vice Versa.

vi. Material Revised (Sub Usage) Variance:

Revised usage variance = SP (SQ-RSQ). If revised standard quantity is less than standard quantity, it is a favourable variance and Vice Versa.

Where weights of Standard Mix and Actual Mix are the same.

2. Direct Labour Variances:

Labour variances are of various types as under:

i. Labour cost variance

ii. Labour rate variance

iii. Labour efficiency

iv. Revised variance

v. Idle item variance

vi. Calender variance.

Formulas:

i. Labour Cost Variance = Standard Cost – Actual Cost

Where SC = Actual output x Standard Rate

= Standard hours for Actual Production x Standard Hourly Rate.

AC = Actual Hours x Actual Hourly Rate.

Verification:

LCV = LRV + LEV + L. Rate Revised + Variance.

Idle Time Variance + Labour, Calender Variance.

ii. Labour rate Variance = AH (SR-AR)

Here,

AH = Actual hour

SR = Standard Rate

AR = Actual Rate

SC = Standard Cost

AC = Actual Cost

iii. Labour efficiency variance = SR (SH – AH)

iv. Labour Rate Revised Variance = SH (SR-RSR)

or

Labour Rate Variance = AH (RSR-AR)

Labour Efficiency Variance = R Standard Rate (SH-AH)

v. Labour Idle time Variance = Idle hours x S Rate

vi. Labour Calendar Variance = SR (Actual working days-Budgeted working Days)

or

Holidays x Standard Daily Rate

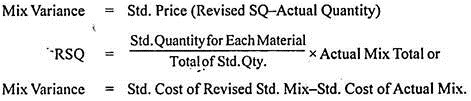

Classification of Labour Efficiency Variance:

Labour efficiency variances is of the following types:

3. Overhead Variances:

Overhead variances are of two types as:

i. Variable overheads

ii. Fixed overheads.

i. Variable Overhead Variance:

The variable overheads are those cost which tend to vary in proportion of Volume of Production. The standard cost per unit will remain the same.

The various variances are as under:

a. Variable Overhead Expenditure Variance:

= Standard Cost-Actual Cost

Where,

SC = Actual output x Standard Rate

If Actual Cost is less, it is Favourable and Vice Versa.

b. Variable Overhead Cost Variance:

= Standard Cost-Actual Cost

SC – Actual output x Standard Rate

SVOR = Budgeted overhead/Budget output

Cost Variance = Expenditure Variance + Efficiency Variance.

c. Variable Overhead Revised Expenditure Variance:

= Revised Budgeted Cost-Actual Cost

RBC = AH x Standard Rate or

d. Variable Overhead Efficiency Variance:

= SR(SH-AH)

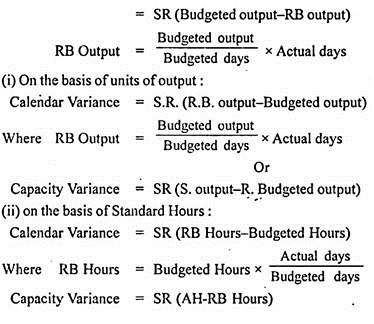

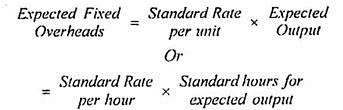

ii. Fixed Overhead Variances:

The various types are as under:

a. Overhead Cost Variance:

= Standard Cost – Actual Cost

(i) On the Basis of Units of Output:

SC = Actual output x Standard Per unit

SR = Budgeted Fixed overhead/Budgeted output.

(ii) On the Basis of Standard Hours:

SC = Standard Hour x Standard Rate Per hour

SR = Budgeted Fixed overhead/Budgeted Hours

Verification:

Total overhead Variance = Expenditure Variance + Volume Variance

b. Fixed overhead Expenditure Variance:

= Budgeted Cost-Actual Cost.

c. Fixed overhead Volume Variance:

(i) On the Basis Units of Output:

= SR Per unit (Actual output-Budgeted output)

or Standard Cost-Budgeted Cost.

(ii) On the Basis of Standard Hours:

Volume Variance = SR Per hour (SH-BH)

Where SH = Actual output/Standard output per hour

Classification of Volume Variance:

Volume Variance = Efficiency Variance + Capacity Variance + Calendar Variance.

(1) Efficiency Variance:

(i) On the Basis of Units of Output:

Efficiency Variance = Standard Rate (Actual output-Standard output)

Where Std. output = A.H. x S output per hour

(ii) On the Basis of Standard Hours:

Efficiency Variance = S.R. (S.H. – A.H.)

(2) Capacity Variance:

(i) On the Basis of Units of Output:

Capacity Variance = SR (Standard output – Budgeted output)

(ii) On the Basis of Standard Hours:

Capacity Variance = Standard Rate (AH-Budgeted Hours)

(3) Calendar Variance:

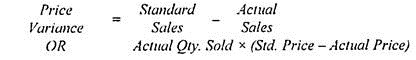

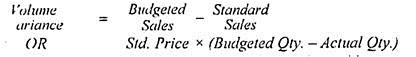

Sales/Marketing Variances or Sales Variance:

(1) Turnover Method

(2) Profit or Sale Margin method.

(1) Turnover Method:

(i) Value Variance = Actual Sales – Budgeted Sales

(ii) Price Variance = AQ (Actual Price – Bud. Price) or Actual Sales – Standard Sales

(iii) Volume Variance = Bud/Std. Price (AQ – Bud. Quantity) or Standard Sales – Budgeted Sales

(iv) Quantity Variance = Std./Bud. Price (RSQ – Bud. Qty.) or Revised Standard Sales – Budgeted Sales

(v) Mix Variance = Std./Bud. Price (AQ-Revised Std. Qty.) or Standard Sales – Revised Standard Sales

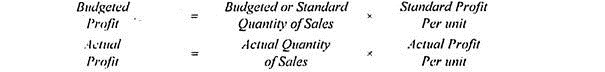

(2) Profit Method:

(i) Value Variance = (Actual Profit – Budgeted Profit)

(ii) Price Variance = (Actual Profit – Standard Profit)

(iii) Volume Variance = Std. Profit Rate (AQ-Bud. Qty.) or Standard Profit – Budgeted Profit

(iv) Quantity Variance = Std. Profit Rate (Revised Standard Qty.- Bud. Qty.) or Revised Standard Profit – Budgeted Profit

(v) Mix Variance = Standard Profit Rate (AQ – Rev. Std. Qty.) or Standard Profit – Revised Std. Profit

(2) Profit and Loss Variance:

It is the difference between the budgeted Profit and the Actual Profit. It is the total of all Variances. In this variance, budgeted and actual profits are reconciled by showing all cost variances and sales variances.

The difference between budgeted and actual profit may be on account of:

i. Change in Sales quantity

ii. Change in selling price

iii. Change in Sales Mix.

Types of Variance – Top 8 Types: Method Variance, Revision Variance, Material Variance, Direct Labour Variance, Overhead Variance, Calendar Variance and a Few Others

Variance means the deviation of actual from standard. In other words variance is the difference between the actual performance and standard performance. The variance may be –

Favorable Variance – When actual cost is less than the standard cost. It will result into, favorable variance. (F)

Unfavorable Variance – When actual cost is more than standard cost the variance will be un favorable or adverse. (A)

In standard costing, variance analysis is very useful. For the purpose of cost control and cost reduction. This technique is also known as Management through exceptions the reason being that management has to concentrate only on the points of unfavorable variances.

Variances may be analyzed for every element of cost and with respect to sales.

Type # 1. Controllable & Uncontrollable Variance:

Controllable variance which can be controlled arises due to in efficiency of an individual, thus it can be controlled. E.g., purchase of defective material is the responsibility of a purchase manager.

Variance which arises due to external factors thus cannot be controlled e.g., increase in prices of raw material responsibility of purchasing it cannot be given to purchase manager.

Type # 2. Method Variance:

Method variance arises due to use of methods of production other than specific one.

According to CIMA, London – “Method Variance is the difference between the standard cost of a product performed by the normal method and by the alternative method actually employed”.

Type # 3. Revision Variance:

Revision Variance arises due to revised standard cost due to unavoidable changes in prices of material, wages etc. It is the difference between original standard cost and revised standard cost.

Accordingly it is calculated as:

(Original standard cost of actual output) – (Revised standard cost of actual output)

Type # 4. Material Variance:

Material Variances may be further classified into:

In Short:

MCV = MPV + MUV

MUV = MMV + MYV

i. Material Cost Variance (MCV):

Material cost variance arises due to difference between standard cost of material (for actual output) and actual cost of direct material.

ii. Material Price Variance:

It is that portion of the material cost variance which is due to the difference between the standard price of material and the actual price paid for it. If Actual price > Standard price, there MPV will be adverse. If Actual Price < Standard price, MPV will be favorable.

It can be calculated as:

MPV = (SP – AP) x AQ

i.e., (Standard Price – Actual Price) x Actual Quantity.

The reasons for occurrence of Material Price Variance may be –

(a) Change in market price of material.

(b) Purchase of substandard quality.

(c) Error in standard setting.

(d) High or low freight charges.

(e) Purchase in off season.

(f) Emergency purchase at higher prices.

(g) Loss of Discount.

iii. Material (Usage) Quantity Variance:

It is that portion of material cost Variance which is due to the difference between standard quantities used at standard price.

It can be calculated as:

Note:

i. If standard output & actual output differs then in MCV & MUV standards will be revised by use of revision formulae –

ii. The total of material cost variance should be equal to the sum of material price variance and material usage variance.

MCV = MPV + MUV

iv. Material Usage Variance:

Material usage variance is further classified into:

a. Material Mix Variance

b. Material Yield Variance.

a. Material Mix Variance:

Material mix variance is that portion of material usage variance which is due to the difference between standard & actual composition of mixture of material. It is calculated when more than one material are mixed to produce a product. Standard mix way be changed from actual mix due to unavailability of any component of mix.

It may be calculated as:

i. If total weight of standard mix & total weight of actual mix is equal.

Material mix variance = Standard price (SQ – AQ)

ii. If total weight of standard mix & total weight of actual mix is not equal.

MMV = SP (Revised standard quantity – Actual quantity)

Note – Input means raw material.

b. Material Yield Variance (MYV):

In production, same normal loss is unavoidable Material yield variance is that portion of material usage variance which arises due to difference between actual yield obtained and standard yield specified. Standard yield may be specified in advance due to normal loss in production.

i. If standard input and actual input are same.

MYV = Standard rate per unit (Actual yield – Standard yield)

ii. If standard input and actual input are not same, Revision Variance will be computed.

MYV = Standard rate per unit (actual yield – Standard yield for actual mix)

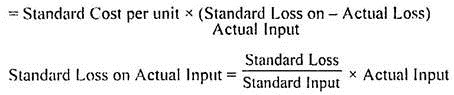

Type # 5. Direct Labour Variance:

The types and computation of labour variances can be computed on the same pattern and techniques of material variances.

Types of Labour Variance:

The various types of Labour variances are:

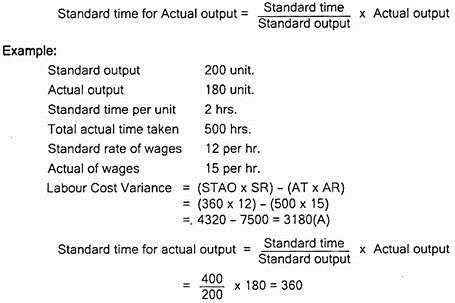

i. Labour Cost Variance (Wage Variance):

LCV is the difference between standard cost of labour (wages as per standards) and actual cost of labour.

This variance may be computed as:

LCV = (Standard rate x Standard time) – (Actual rate x Actual time)

Or

Standard Cost – Actual Cost If standard output and actual output are not same.

LCV = (Standard Rate x Standard time for actual output (STAO)) – (Actual rate x Actual time)

ii. Labour Wage Rate Variance:

LRV is that portion of labour cost variance which arises due to difference between standard rate of wages specified and actual rate of wages paid.

Its computation is:

LRV = (Standard rate – Actual rate) x Actual time

iii. Labour Efficiency (Time) Variance:

(LEV) is that portion of labour cost variance which arises due to difference between standard time specified (for actual output labour hours) and actual time taken by labour. Its computation is —

i. If standard output and actual output are same. LEV = (Standard time – Actual time) x standard rate

ii. If standard output and actual output are not same.

LEV = (Standard time for actual output (STAO) – actual time) x standard rate

In the above example Standard output and Actual output are not same.

∴ LEV = (STAO – Actual time) x Standard Rate

LEV = (360 – 500) x 12

= 140×12

= 1680(A)

LCV = LRV + LEV 3180(A)

= 1500(A) + 1680(A)

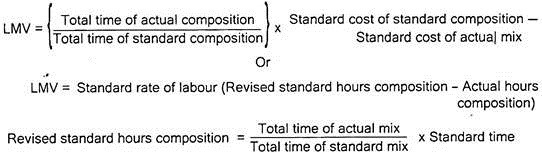

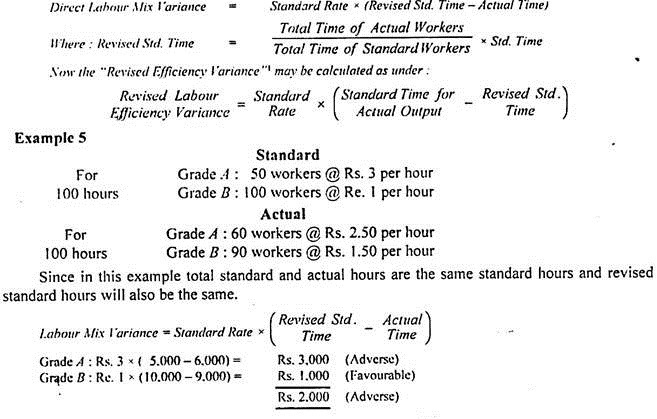

iv. Labour Mix Variance:

LMV arises due to change in composition of labour force (like mix in material). It tells the management how much labour efficiency variance occurs due to change in its composition and thus it is a part of labour efficiency variance.

Its computation is:

Or

i. If standard composition/mix of time and actual composition of time (time spent by them) is same.

LMV = Standard cost of standard composition – Standard cost of actual composition

Or

Total actual time spent by labour (standard rate per hour of standard mix – Standard rate per hour of actual mix)

Or

ii. If standard composition/mix of time and actual composition of time is not same.

If the standard composition of labour force is revised due to shortage of particular type of labour and total standard time and total actual time is equal.

v. Idle Time Variance:

Idle time means abnormal wastage of time due to strikes, power failure, and breakdown of machinery. If idle time occurs, the actual hours worked by labour are less than standard hours specified for them. Due to this reason, idle time variance is always adverse.

Its computation is:

Idle time Variance = standard rate (idle hours)

If idle time occurs labour efficiency variance is the sum of LEV and idle time variance.

Total labour efficiency variance = LEV + LIV

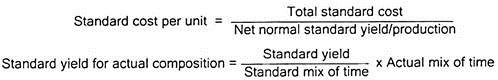

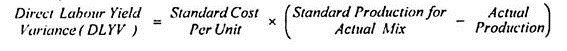

vi. Labour Yield Variance:

LYV is that portion of labour efficiency variance which reveals the variance in labour cost due to difference between actual yield or production output and standard yield/production.

i. If standard composition and actual composition of labour time are same.

LYV = Standard cost per unit (Actual yield – Standard yield)

ii. If standard composition and actual composition of labour time is not same.

LYV = Standard cost per unit (actual yield – Standard yield for actual composition)

Type # 6. Overhead Variance:

Overhead is the aggregate of indirect expenses viz., indirect material, and indirect labour and indirect expenses. Further overheads are divided into fixed and variable overheads. Overhead variance arises only due to under or over absorption of overheads.

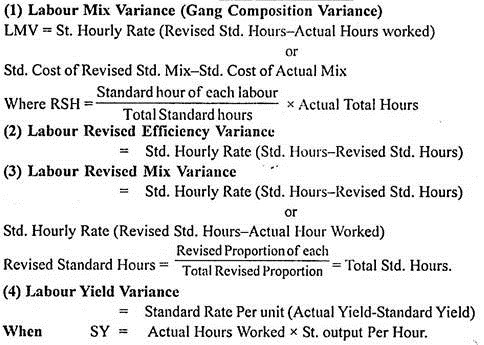

Type # 7. Calendar Variance:

It is a part of capacity variance. This variance arises due to the difference between actual working days than the working days in a standard period. Standard overheads are computed generally for a fixed number of working days. But practically, all the calendar months do not have same number of days. One reason for this is holidays per month.

Calendar Variance = Extra/Deficit days worked x Standard Overhead Rate per day

OR

Calendar Variance = (Actual no. of working days – Standard no. of working days) x Standard Overhead Rate per day

Where,

Standard Overhead Rate per day = Budgeted Hours/Standard no. of working days x Standard Overhead Rate per hour.

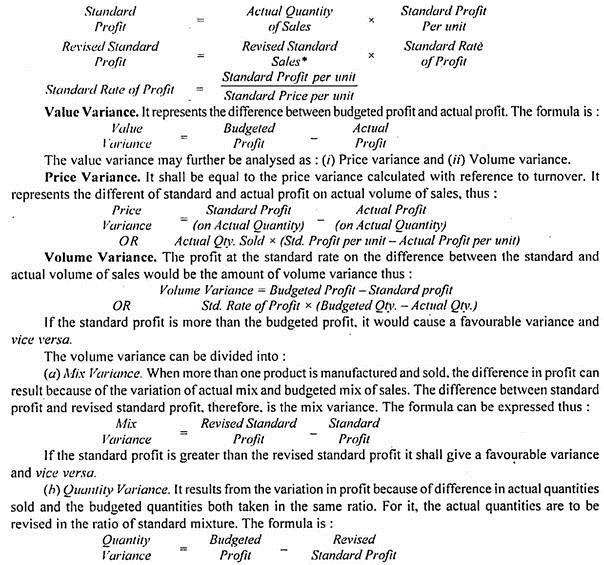

Type # 8. Sales Variance:

Sales Variance is also an important variance to analyze the difference between the actual profit and the standard profit i.e., the profit variance. Management also favors sales variance to get full advantage of budgetary control and standard costing system.

There are mainly two methods of computing sales variance:

(A) Value Method (Turnover Method)

(B) Margin Method (Profit Method)

Types of Variance – Favourable and Unfavourable Variances, Controllable and Uncontrollable Variances

1. Favourable and Unfavourable Variances:

Variances may be favourable (positive or credit) or unfavourable (or negative or adverse or debit) depending upon whether the actual resulting cost is less or more than the standard cost.

Favourable Variance:

When the actual cost incurred is less than the standard cost, the deviation is known as favourable variance. The effect of the favourable variance increases the profit. Again, favourable variance would result when the actual cost is lower than the standard cost. It is also known as positive or credit variance and viewed only as savings.

Unfavourable Variance:

When the actual cost incurred is more than the standard cost, there is a variance, known as unfavourable or adverse variance. Unfavourable variance refers to deviation to the loss of the business. It is also known as negative or debit variance and viewed as additional costs or losses.

When the profit is greater than the standard profit, it is known as favourable variance. When the profit is less than the standard profit, it is known as unfavourable variance. This favourable variance is a sign or efficiency of the organisation and the unfavourable variance is a sign of inefficiency of the organisation.

2. Controllable and Uncontrollable Variances:

Variances may be controllable or uncontrollable, depending upon the controllability of the factors causing variances.

Controllable Variance:

A variance is said to be controllable if it can be identified as the primary “responsibility of a specified person or department. That is, it refers to a deviation caused by such factors which could be influenced by the executive action. For example, excess usages of materials, excess time taken by a worker, etc., are examples for controllable variance. When compared to the standard cost it becomes controllable because the responsibility can be fixed on the in-charge or foreman of the department.

Uncontrollable Variance:

When variance is due to the factors beyond the control of the concerned person (or department), it is said to be uncontrollable. Cost variance is due to outside factors, for example, the wage rate increased on account of strike, Government restrictions, change in market price etc. No person or department can be held responsible for uncontrollable variances. Here revision of standards is required to remove such variances in future.

The size of controllable variance reflects the degree of efficiency of the person or department concerned. Actually, it is the controllable variance with which the management is concerned because it is here where corrective action is required. That is, the management gives attention to the controllable variances and it is known as management by exception. Variances can be expressed in absolute (in money) or in relative terms (on percentage).

Types of Variance – 4 Important Types: Direct Material Variances, Direct Labour Variances, Overhead Variances and Sales Variances (With Formulas for Computation)

When the actual costs are compared with the standard costs, some deviations normally occur. The deviation of actual from the standard is known as variance. The variance may be favourable or unfavourable (i.e., adverse) according to the circumstances, if the actual cost is more than the standard cost, the variance shall be adverse or unfavourable.

In case the standard cost is more than the actual cost, a favourable variance would result. Variances are to be computed distinctly for different elements of cost. They are further analysed as to their causes and thereafter separate cost variances for each element are calculated. The main determinants of cost are price and quantity and hence the variances are to be determined both as to price and quantity, separately.

A. Direct Material Variances:

1. Direct Material Cost Variance:

It is the difference between the standard cost of direct materials specified for the output achieved and the actual cost of direct materials used. The standard cost of materials is computed by multiplying the standard price with the standard quantity and the actual cost computed by multiplying actual price with the actual quantity.

The formula for its computation may be put as follows:

The material cost variance may arise either on account of change in price or change in quantity or both. Thus, material cost variance may be further analysed as to material price variance and material usage variance.

2. Direct Material Price Variance:

It is that portion of the direct material cost variance which is due to the difference between the standard price specified and the actual price paid.

The formula for its computation may be put as follows:

If the actual price is more than the standard price, the variance would be adverse and in case the standard price is more, it shall result in a positive variance.

3. Direct Material Quantity or Usage Variance:

It is that portion of direct material cost variance which is due to the difference between the standard quantity specified (for the output achieved) and the actual quantity used.

The formula for its computation may be put as follows:

The actual quantity, if more than the standard quantity, would cause an unfavourable variance arid vice versa.

As stated above, usage variance may further be classified as:

(a) Material Mix (or Mixture) Variance and

(b) Material Yield Variance.

(a) Direct Material Mix Variance:

Mix variance arises only when different raw materials are actually mixed in order to obtain a product. Such a situation arises normally in case of process industries. According to the Chartered Institute of Management Accountants, London mix variance is, “that portion of the direct materials usage variance which is due to the difference between the standard and actual composition of a mixture”.

Thus, material mix variance represents the variation in cost arising as a result of change in the ratio in which the different materials are used, compared to the standard fixed for the purpose. This variance may be as a result of temporary shortages or rising costs etc., of a particular type of material.

The formula for calculating material mix variance can be put as under:

When the actual quantity is less than the revised one, there is a favourable variance and vice versa.

(b) Direct Material Yield Variance:

“It is that portion of direct material usage variance which is due to the difference between the standard yield specified and the actual yield obtained”.

This variance may be due to abnormal contingencies like spoilage, chemical reactions etc. The term standard yield here means the production which shall result in by putting in the standard quantity of materials. This variance is a measure of the loss or waste in production and hence it can also be designated as ‘material loss or waste’ variance.

The formula for calculating the yield variance can be expressed, thus:

Alternatively, the yield variance in the form of material loss or waste variance can be computed by using the following formula:

B. Direct Labour Variances:

The deviations in cost of direct labour may occur because of two main factors – (i) difference in actual rates and standard rates of labour and (ii) the variation in actual time taken by workers and the standard time allotted to them for performing a job or an operation.

Labour variances are very much similar to material variances and they can be very easily calculated by applying the same techniques as used in calculation of material variances.

The various labour variances may be put as follows:

1. Direct Labour Cost Variance:

It is the difference between the standard direct wages specified for the activity achieved and the actual direct wages paid.

The formula for its computation may be put as follows:

Direct labour cost variance may arise on account of difference in either rates of wages or time. Thus, it may be further analysed as (i) Rate Variance, and (ii) Time or Efficiency Variance.

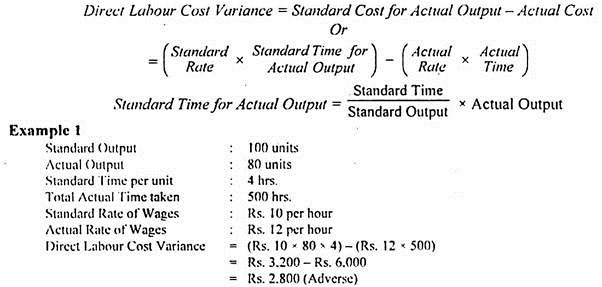

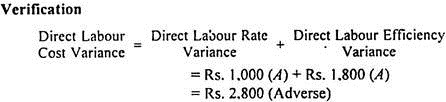

2. Direct Labour (Wages) Rate Variance:

It is that portion of direct labour (wages) variance which is due to the difference between the standard rate of pay specified and actual rate paid.

The formula is:

If the standard rate is higher than the actual rate, it shall result in a favourable variance vice versa.

The labour rate variance will be computed as follows taking the figures given in Example 1 above:

Example 2:

Direct Labour Rate Variance = 500 hrs. x (Rs. 10 – Rs. 12)

= Rs. 1,000 (Adverse)

Direct Labour Efficiency (Time) Variance:

It is that portion of the direct labour (wages) variance which is due to the difference between the standard labour hours specified for the activity achieved and the actual labour hours expended.

The formula for its computation is as follows:

Example 3:

Taking the figures as given in Example 1, the labour efficiency variance will be computed as follows:

Direct Labour Efficiency Variances = Rs. 10 x (320 hrs. – 500 hrs.)

= Rs. 1,800 (Adverse)

Thus, it is clear that because of inefficiency of workers, the work has been finished in 500 hours only instead of 320 hours—the standard time set for the production. This is why, this variance is known as Labour Efficiency Variance. The total of labour rate and efficiency variances is equal to Labour Cost Variance.

Idle Time Variance:

Due to abnormal wastage of time on account of strikes, lockouts, power failure etc., the actual hours worked may be much less than the standard hours fixed. The variance on account of abnormal circumstances is segregated from the time of efficiency variance.

It can be computed as under:

Idle Time Variance = Standard Hourly Rate x Idle Hours.

Direct Labour Mix (or Gang Composition) Variance:

This variance arises if during a particular period, the grades of labour used in production are different from those budgeted. It is calculated to reveal to the management how much of the labour variance is due to the change in the composition of labour force. The calculation is similar to material mix variance.

The formula for its computation may be put as follows:

In case of this example revised labour efficiency variance will be zero.

When the actual rates of pay, the number of employees in different grades and the hours of work, all are different from the standard, there would be price, mix and efficiency variances in respect of labour so as to give the total labour cost variance.

Note – The two other formulae, which have been given for Direct Material Mix Variance earlier can also be used for calculating Direct Labour Mix Variance. The only difference will be that the word “time” will replace the word “quantity”.

Substitution Variance:

This is a type of Labour Mix or Gang Composition Variance. It arises in those cases where one grade of labour is substituted by another due to non-availability of the labour desired as per standards. The variance represents the difference between actual hours at standard rate for standard workers and the actual hours at standard rate for actual workers.

The formulae for its computation may be as follows:

Substitution Variance = Actual hours x (Standard rate for standard workers – Standard rate for actual workers)

For example, the standard time for a job was fixed at 50 hours. Semi-skilled workers were required for this job and the standard rate was Rs. 10 per hour. However, due to non-availability of semi-skilled workers were employed whose standard rate was Rs. 12 per hour. The job was completed in 45 hours. Calculate Labour Substitution Variance.

Substitution Variance = Actual hours x (Standard rate for standard workers – Standard rate for actual workers)

= 45 (10-12)

= 45 x (-2)

= Rs. 90 adverse.

Direct Labour Yield Variance:

Just as material yield variance is calculated similarly labour yield variance can also be known. It is the variation in labour cost on account of increase or decrease in yield or output as compared to the relative standard.

The formula for its computation is as follows:

If the actual production is more than standard production, it would result in a favourable variance and vice versa (though the figure would be in negative in case of favourable variance.)

Sometimes the standards may have to be revised by the management due to reasons beyond their control. The revision may be due to increase in wage rates on account of agreement with the workers’ union, change in mix of labour due to a shortage of a certain type of labour or steep rise in the price of raw materials due to an acute shortage of supply caused by a poor harvest etc.

In order to study the variance on account of revision of standards, revision variance is calculated. It can be regarding direct materials, direct labour or overheads. The variance is the difference between the revised standard cost and original standard cost of actual production.

Once the Revision Variance has been calculated, the new revised standards would become the real standards for calculating the variances.

The formula for calculating “Revision Variance” can be put as follows:

Revision Variance = Original Std. Cost of Actual Output – Revised Standard Cost of Actual Output

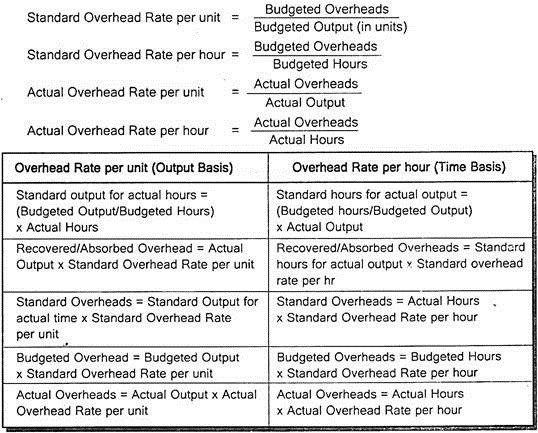

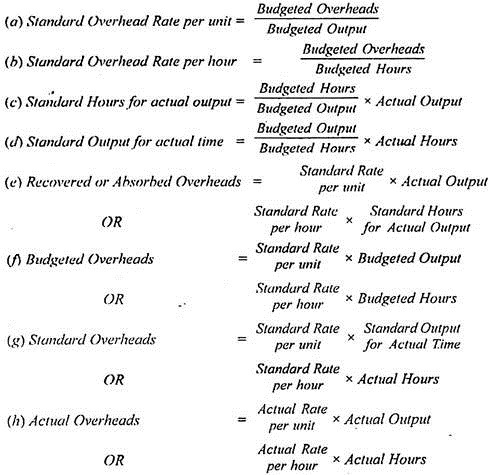

C. Overhead Variances:

The term overhead includes indirect material, indirect labour and indirect expenses. Overhead variances may relate to factory, office or selling and distribution overheads. For the purposes of variance analysis, overheads are divided broadly into two categories viz., fixed and variable.

However, before we proceed to study these variances, we should get familiar with certain terms:

It is to be noted that the terms budgeted overhead rate per unit and standard overhead rate per unit, budgeted overhead rate per hour and standard overhead rate per hour, budgeted output and standard output, budgeted hours and standard hours have been used as synonymous.

But the terms ‘budgeted overheads’ and ‘standard overheads’ have not been used in the same sense. It has been assumed here that ‘budgeted overheads’ are for budgeted time or budgeted output but ‘standard overheads’ are for actual time or budgeted output in actual time. It is just a matter of what terminology one adopts.

Overheads Cost Variance (OCV):

It is the difference between standard overheads for actual output i.e., Recovered Overheads and Actual Overheads. It is the total of both fixed and variable overhead variances.

Overhead Cost Variance (OCV) = Recovered Overheads – Actual Overheads

Classification of Overhead Cost Variance:

Overhead variances can be classified as:

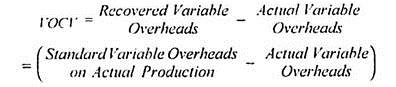

(1) Variable Overheads Cost Variance (VOCV)

(2) Fixed Overhead Cost Variances (FOCV)

(1) Variable Overhead Cost Variance (VOCV):

Variable overheads, may be manufacturing, administration or selling and distribution. Such variance may therefore be calculated separately for each of these overheads.

It is the difference between the standard variable overheads for actual output (or Recovered Variable Overheads) and the Actual Variable Overheads).

The formula for its computation can be put as follows:

Standard variable overhead on actual production is the product of standard variable overhead rate per unit multiplied by the actual production for the period.

Standard variable overhead rate per unit can be computed with the help of the following formula:

On the basis of data given in Example 1, the variable overhead cost variance will be calculated as follows.

Standard variable overheads can also be calculated on the basis of multiplication of standard hourly rate for overheads with the standard hours for actual production.

This variance may be due to advance payment of expenses, or outstanding expenses or payment of past outstanding expenses during this period or on account of certain abnormal expenses incurred such as—repairs of machinery due to breakdown, expenses due to spoilage or defective workmanship or excessive overtime work etc.

(2) Fixed Overheads Variances:

Fixed overheads do not vary with the production but vary with the time and hence there will be different rates of overhead expenses per unit at different levels of production. The standards in respect of fixed overheads may be set according to rate per unit of output or per hour. Fixed overhead variances may be calculated separately in respect of factory, office and administration, selling and distribution, if so desired.

The different fixed overhead cost variances are as follows:

Fixed Overhead Cost Variance (FOCV):

The difference between standard overheads recovered (or absorbed for actual output) and the actual fixed overheads is the Fixed Overhead Cost Variance.

Its formula is:

Fixed Overhead Cost Variance (FOCV) = Recovered or Absorbed Fixed Overheads – Actual Fixed Overheads

Fixed Overheads Expenditure or Budget Variance:

The difference between actual expenditure and budgeted expenditure is termed as expenditure or budget or level variance.

It may be put in the form of the following formula:

FOEXPV = Budgeted Overheads – Actual Overheads

If actual overheads are more, it shall result in an adverse variance and vice versa.

Fixed Overhead Volume Variance (FOVV):

The difference between fixed overheads absorbed on actual output and those on budgeted output is termed as volume variance. It is thus the result of the difference in the volume of production at the standard rate.

The formula for its computation may be put as follows:

FOVV = Recovered Fixed Overheads – Budgeted Fixed Overheads

If the budgeted overheads are more than the recovered overheads, it shall cause an unfavourable variance and vice versa.

The total of budget and volume variances would be equal to overhead cost variance.

The volume variance can further be analysed as under:

(a) Fixed Overhead Efficiency Variance (FOEFFV):

The actual quantity produced and standard quantity fixed might be different because of higher or lower efficiency of workers employed in manufacturing goods. The over or under-recovery of overheads on this account is sometimes separated from volume variance. The efficiency with which the productive operations are carried out with the aid of utilised facilities is pointed out by this variance.

The formula is:

FOEFFV = Recovered Fixed Overheads – Standard Fixed Overheads

The standard overheads, if more than the recovered overheads, would lead to an adverse variance and vice versa.

(b) Fixed Overhead Capacity Variance (FOCAPV):

Actual capacity of the machine or plant may vary from the planned capacity or expected capacity due to idle time, strikes and lock-outs, breakdown, labour shortage, absenteeism, under-or-over customer demand etc. It may also be due to overtime work, changes in number of shifts of one or more machines etc. The variance is an indicator of the degree of utilisation of available capacity.

The capacity variance is calculated by the following formula:

FOCAPV = Standard Fixed Overheads – Budgeted Fixed Overheads

If the standard overheads are more than the budgeted overheads, a favourable variance would result and vice versa.

The total of efficiency and capacity variance would give the overhead volume variance.

To take an example, in a day, a man sets his task of completing 100 units in 10 hours, whereas he could work only for 9 hours, and completed 95 units. There is a decline of 5 units of output. It will cause an adverse volume variance at the standard rate per unit of overhead cost. But it is on account of two reasons. As regards the man’s capacity is concerned it has been reduced by 1 hour; hence an adverse capacity variance of 10 units; however as for his efficiency, it has increased.

At the standard rate, he should have completed only 90 units in 9 hours (actual hours of work) whereas he has been able to complete 95 units resulting in a favourable variance of 5 units. Thus 10 units unfavourable and 5 units favourable give a total of 5 units unfavourable.

Fixed Overhead Yield Variance (FOYV):

Just as labour and material yield variances are calculated, similarly overhead yield variance can be known. The variance indicates the gain or loss incurred by way of overhead cost incidence, due to loss or wastage in production.

The variance is calculated as under:

FOYV = Recovered Fixed Overheads – Expected Fixed Overheads

(Expected overheads, if more, would give and adverse variance and vice versa)

Expected output takes into account the standard loss on actual input and not the actual loss on actual input. Thus, it is normally obtainable output.

When the yield variance is calculated, efficiency variance is computed as under – (since yield variance is a part of efficiency variance) –

Efficiency Variance (Revised) = Expected Overheads – Standard Overheads

If standard overheads are less than the expected overheads, a favourable variance would be caused and vice versa.

D. Sales Variances:

The sales are affected by two factors – (i) the selling price and (ii) the quantum of sales. The variations in the standards set in, and actuals for the purpose, may be mainly due to change in market trends. Normally, if the selling price goes high, the volume of sales will be lower than the standard.

It may result in a favourable variance as to price and unfavourable variance as to quantity. It is to be borne in mind that here higher price would be favourable (in case of material, higher price paid would cause an adverse variance) and lower volume of sales would be unfavourable (while in case of materials, the situation shall be reverse of it).

Demand and supply position would decide the quantity of sales as well as the selling price. The variations may be on account of controllable as well as non-controllable factors. Changes in market conditions and demand by customers are, of course, beyond the control of management but certain factors like non-accessibility to the buyers, lack of advertisement, submission of tenders at undesirable high price are controllable and an effort should be made to check adverse variations due to these factors.

There are two methods of calculating sales variances – (i) with reference to turnover and, (ii) with reference to profits. The first method shows the effect of variances in terms of turnover and the second shows the effect in terms of profits.

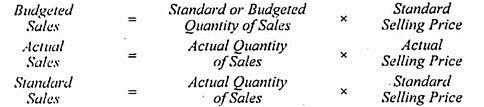

Before understanding the sales variances with reference to turnover, the following terms should be clearly understood:

The difference between budgeted sales and actual sales results in value variance.

The formula is:

Value Variance = Budgeted Sales – Actual Sales

If actual sales are more, a favourable variance would be shown and vice versa.

The difference in value would be on account of difference in price and volume of sales, which is analysed as under:

Just as material price variance is calculated, in a similar fashion, the sales price variance is known. It is on account of the difference in actual selling price and the standard selling price, for actual quantity of sales.

The formula is:

Volume Variance:

It can be calculated like material usage variance. Budgeted sales may be different from the standard sales. In other words, budgeted quantity of sales as standard prices may vary from the actual quantity of sales at standard prices. Thus, the variance is as a result of difference in budgeted and actual quantities of goods sold.

The formula is:

If the standard sales are more than the budgeted sales, it would cause a favourable variance and vice versa.

The total of price and volume variance would be equal to value variance.

The volume variance can further be classified into:

(a) Mix Variance

(b) Quantity Variance.

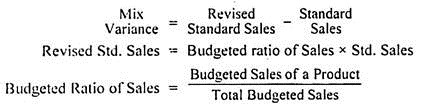

(a) Mix Variance:

When more than one product is manufactured and sold, the budgeted sales of different products are in a given ratio. If the actual quantities sold are not in the same proportion as budgeted, it would cause a mix variance.

The mix variance can be calculated according to two methods.

(i) Based on Quantity:

This method is followed in those cases where products are homogenous e.g., different qualities of clocks, cars or different makes etc. In such a case the formula for calculating sales mix variance is on the same pattern as is used in case of material mix variance.

Mix Variance = Sid. Price x (Revised Std. Qty. – Actual Qty.)

If actual quantity is more than the revised standard quantity it will result in favourable variance or vice versa.

Revised standard quantity is calculated as per the following formula:

(ii) Based on Value:

This method is followed in those cases where products are not homogenous e.g. products A, B, C may represent earnings, watches and shirts respectively. In such a case the actual sales at standard prices, i.e., standard sales are to be expressed in budgeted ratio so as to calculate revised standard sales and then these are compared with the actual sales at standard prices i.e. the standard sales.

The formula is:

If the standard sales are higher than the revised standard sales; it would give a favourable variance and vice versa. However, it may be noted that there would be no mix variance for all the products taken together. The revised standard sales is only a re-arrangement of standard sales in the budgeted ratio. The rearrangement has been done only with a view to find out mix variance regarding each product. In any case, the total of the revised standard sales for all the products would be equal to the total standard sales.

(b) Quantity Variance:

It is the difference between budgeted sales and the revised standard sales.

The formula is:

Quantity Variance = Budgeted Sales – Revised Standard Sales

If the revised standard sales exceed budgeted sales, a favourable variance would result and vice versa. The total of mix variance and quantity variance is equal to volume variance.

With Reference to Profit:

Understanding of the following terms is required for computation of sales variances with reference to profit:

In case the revised standard profit is more than the budgeted profit, it shall be a favourable variance and vice versa.