Many B2B companies have adopted a market-based customer management structure, variously called key account management, national account management, regional account management or global account management.

We use the term key account management (KAM) to cover all four forms. KAM is a structure that facilitates the implementation of CRM at the level of the business unit. A key account is an account that is strategically significant. This normally means that it presently or potentially contributes significantly to the achievement of company objectives, such as profitability.

It may also be a high volume account, a benchmark customer, an inspiration, or a door opener. Companies choose one of two ways to implement KAM. Either a single dedicated person is responsible for managing the relationship. The team membership might be fully dedicated to a single key account or may work on several accounts. Generally, this is under the leadership of a dedicated account director.

The motivation to adopt a KAM structure comes from recognition of a number of business conditions:

ADVERTISEMENTS:

1. Concentration of buying power lies in fewer hands. Big companies are becoming bigger. They control a higher share of corporate purchasing. Smaller companies are cooperating to create purchasing power and leverage purchasing economies. Even major competitors are collaborating to secure better inputs. For example, Procter and Gamble and Unilever, rivals on the supermarket shelf, are cooperating to buy raw materials and input goods such as chemicals and packaging.

2. Globalization as companies become global they want to deal with global suppliers, if only for mission critical purchases. Global companies expect to procure centrally, but require goods and services to be provided locally.

3. Vendor reduction programmes customers are reducing the number of companies they buy from, as they learn to enjoy the benefits of improved relationships with fewer vendors.

4. More demanding customers customers are demanding that suppliers become leaner. This means they eliminate non-value adding activities .The corollary is that they want suppliers to supply exactly what they want. This may mean more reliable, more responsive customer services and just-in-time delivery.

ADVERTISEMENTS:

A supplier may decide that it wants to introduce a KAM system, but it is generally the customer who decides whether to permit this sort of relationship to develop. If customers feel that their needs are better met outside of a KAM-based relationship, they are unlikely to participate in a KAM programme. According to one study, suppliers are finding considerable benefits in the adoption of KAM.

i. doing large amounts of business with a few customers offers considerable opportunities to improve efficiency and effectiveness

ii. selling at a relationship level can spawn disproportionately high and beneficial volume, turnover and profit

iii. repeat business can be considerably cheaper to win than new business

ADVERTISEMENTS:

iv. long-term relationships enable the use of facilitating technologies, such as EDI and shared databases

v. familiarity and trust reduce the need for checking and make it easier to do business. Although the research suggests major benefits for sellers, the companies that succeed at KAM are those that perform better at a whole range of management activities, including selecting strategic customers, growing key accounts and locking out the competition.

Companies that are most effective at developing strategic customer relationships spend more time and effort thinking about their customers profiles, direction and future needs than the least effective . (They spend relatively less time and effort considering how their strategic customers will benefit themselves as suppliers ‘ Concentration of buying power has lead to buyers taking charge of relationships. Many companies have supplier accreditation and certification processes in place.

To be shortlisted as a potential supplier, vendors often have to invest in satisfying these criteria. Buyers increasingly have documented processes that compel vendors to deal with specific members of a decision-making unit at specific times in the buying process. Under these circumstances, sellers may not have the chance to exhibit their exceptional selling capabilities. What they must do, however, is demonstrate their relationship management capabilities.

ADVERTISEMENTS:

KAM differs from regular business-to-business account management in a number of important ways.

First, the focus is not on margins earned on each individual transaction; rather the emphasis is on building a mutually valuable long-term relationship. The effect of this is that a more trusting, cooperative, non-adversarial relationship develops.

Secondly, key account plans are more strategic. They look forward five or more years. Non-key accounts are subjected to more tactical campaigning designed to lift sales in the short term.

Thirdly, the KAM (team) is in continuous contact, very often across several functions and at multiple levels of hierarchy. Special access is often provided to customer senior management. Contact with non-key accounts tends to be less frequent and less layered.

ADVERTISEMENTS:

Fourthly , suppliers make investments in key accounts that serve as structural bonds. Indeed, even the allocation of a dedicated key account manager or team represents an investment in the customer. Additionally, suppliers are much more likely to adapt elements of their value proposition such as products, inventory levels, price, service levels and processes for key accounts. Some additional elements might be added to the value proposition for key accounts.

This might include vendor-managed inventory, joint production planning, staff training and assistance with the customer’s product development and marketing strategies. KAM can be thought of as a form of investment management, where the manager makes decisions about which accounts merit most investment, and what forms that investment should take.

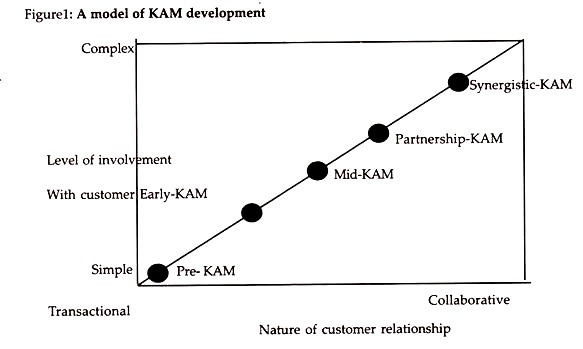

Researchers have made efforts to understand how KAM develops over time.(Figure 1) shows KAM developing through several stages as suppliers and customers become more closely aligned. As the relationship becomes more collaborative, and as the level of involvement between the two parties grows, the commitment to more advanced forms of KAM grows .In the pre- KAM stage, a prospective key account – one that shows signs of being strategically significant has been identified.

Because the prospect is supplied by other vendors, the major task is to motivate a modified re-buy, most likely by identifying ways in which the new solution meets customer requirements better. In the early KAM stage, the new supplier has won a small share of customer spend, and is on trial.

ADVERTISEMENTS:

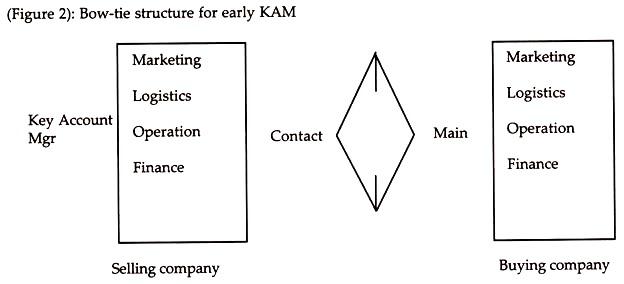

The early KAM structure often takes the form of a bow-tie (Figure.2), in which the only contact is between single representatives of each company, typically account manager and buyer. These contacts act as gate keepers, liaising with their own colleagues as needed.

The bow-tie is a very fragile arrangement. If either party doesn’t get on well with the other, the relationship might not evolve. If either moves on or retires, the relationship may be severed. The ability of the supplier company to understand the customer depends on the skills of one personal one. If that person doesn’t record what is known in a customer database ,it might be lost forever. Customers will sometimes refuse vendors access to other contacts.

ADVERTISEMENTS:

This is often designed to demonstrate power. As it becomes clearer that the relationship is paying off for both parties, it may migrate to mid-KAM status. The customer has come to trust the supplier, and the supplier has shown commitment to the customer.

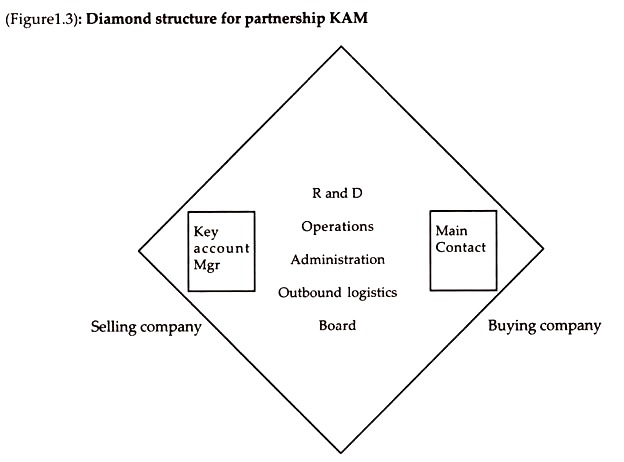

The supplier is now a preferred, though not sole supplier. There are other, more senior, contacts between the organizations. As the relationship heads towards partnership KAM status, the relationship becomes more established.

The customer views the supplier as a strategic resource. Information is shared to enable the parties to resolve problems jointly. Customers might invite suppliers to go’ open book ‘so that cost structures are transparent. Pricing is stable and determined by the tenure and value of the relationship. Innovations are offered to key accounts first before being introduced to other customers.

There is functional alignment, as specialists talk to their counterparts on the other side. There is much more contact between the companies at every level. The job of the key account manager is to coordinate all these contacts to ensure that the account objectives are achieved. This sort of relationship is often represented as a diamond (Figure.3)

The most advanced form of KAM, identified as synergistic KAM, occurs when a symbiotic relationship has developed, the boundaries between the two organizations are blurred as both sides share resources and people to work on mutually valued projects. These might be cost reduction projects, new product development projects, quality assurance projects or other ventures beyond the scope of their present relationship.

ADVERTISEMENTS:

This developmental model does not suggest that all KAM arrangements migrate along the pathway towards synergistic KAM. KAM will only advance as far as the parties want. If either party finds they are not benefiting from the arrangement, it can be reversed and become more transactional.

Key account status might be withdrawn if the customer ceases being strategically significant, purchases from a major competitor of the supplier, becomes financially unstable, displays unethical behaviours or demands too many concessions, making the relationship unprofitable.

There are also situations that can lead to relationship dissolution. This might happen if the customer finds that the supplier has acted opportunistically, thereby breaking trust. Opportunistic behaviours might include ramping up price, betraying confidences to third parties, supplying the customer’s major competitors or artificially restricting supply. Suppliers can also ‘ sack ‘ customers, for example, when it is clear that there is no prospect of making a profit from the relationship even if it were to be re-engineered to reduce cost.

Progress along the KAM pathway may also be limited by either party’s relationships with other companies. It may be impossible for a wending machine company to develop a strong relationship with PepsiCo, if it already has a strong relationship with Coca Cola.