This article throws light upon the top ten techniques of decision-making. The techniques are: 1. Marginal Analysis 2. Financial Analysis 3. Break-Even Analysis 4. Ratio Analysis 5. Operations Research Techniques 6. Linear Programming 7. Waiting-line Method 8. Game Theory 9. Simulation 10. Decision Tree.

Decision-Making: Technique # 1. Marginal Analysis:

This technique is used in decision-making to figure out how much extra output will result if one more variable (e.g. raw material, machine, and worker) is added. In his book, ‘Economics’, Paul Samuelson defines marginal analysis as the extra output that will result by adding one extra unit of any input variable, other factors being held constant.

Marginal analysis is particularly useful for evaluating alternatives in the decision-making process.

Decision-Making: Technique # 2. Financial Analysis:

This decision-making tool is used to estimate the profitability of an investment, to calculate the payback period (the period taken for the cash benefits to account for the original cost of an investment), and to analyze cash inflows and cash outflows.

Investment alternatives can be evaluated by discounting the cash inflows and cash outflows (discounting is the process of determining the present value of a future amount, assuming that the decision-maker has an opportunity to earn a certain return on his money).

Decision-Making: Technique # 3. Break-Even Analysis:

This tool enables a decision-maker to evaluate the available alternatives based on price, fixed cost and variable cost per unit. Break-even analysis is a measure by which the level of sales necessary to cover all fixed costs can be determined.

Using this technique, the decision-maker can determine the break-even point for the company as a whole, or for any of its products. At the break-even point, total revenue equals total cost and the profit is nil.

Decision-Making: Technique # 4. Ratio Analysis:

It is an accounting tool for interpreting accounting information. Ratios define the relationship between two variables. The basic financial ratios compare costs and revenue for a particular period. The purpose of conducting a ratio analysis is to interpret financial statements to determine the strengths and weaknesses of a firm, as well as its historical performance and current financial condition.

Decision-Making: Technique # 5. Operations Research Techniques:

One of the most significant sets of tools available for decision-makers is operations research. An operation research (OR) involves the practical application of quantitative methods in the process of decision-making. When using these techniques, the decision-maker makes use of scientific, logical or mathematical means to achieve realistic solutions to problems. Several OR techniques have been developed over the years.

Decision-Making: Technique # 6. Linear Programming:

Linear programming is a quantitative technique used in decision-making. It involves making an optimum allocation of scarce or limited resources of an organization to achieve a particular objective. The word ‘linear’ implies that the relationship among different variables is proportionate.

The term ‘programming’ implies developing a specific mathematical model to optimize outputs when the resources are scarce. In order to apply this technique, the situation must involve two or more activities competing for limited resources and all relationships in the situation must be linear.

Some of the areas of managerial decision-making where linear programming technique can be applied are:

i. Product mix decisions

ii. Determining the optimal scale of operations

iii. Inventory management problems

iv. Allocation of scarce resources under conditions of uncertain demand

v. Scheduling production facilities and maintenance.

Decision-Making: Technique # 7. Waiting-line Method:

This is an operations research method that uses a mathematical technique for balancing services provided and waiting lines. Waiting lines (or queuing) occur whenever the demand for the service exceeds the service facilities.

Since a perfect balance between demand and supply cannot be achieved, either customers will have to wait for the service (excess demand) or there may be no customers for the organization to serve (excess supply).

When the queue is long and the customers have to wait for a long duration, they may get frustrated. This may cost the firm its customers. On the other hand, it may not be feasible for the firm to maintain facilities to provide quick service all the time since the cost of idle service facilities have to be borne by the company.

The firm, therefore, has to strike a balance between the two. The queuing technique helps to optimize customer service on the basis of quantitative criteria. However, it only provides vital information for decision-making and does not by itself solve the problem. Developing queuing models often requires advanced mathematical and statistical knowledge.

Decision-Making: Technique # 8. Game Theory:

This is a systematic and sophisticated technique that enables competitors to select rational strategies for attainment of goals. Game theory provides many useful insights into situations involving competition. This decision-making technique involves selecting the best strategy, taking into consideration one’s own actions and those of one’s competitors.

The primary aim of game theory is to develop rational criteria for selecting a strategy. It is based on the assumption that every player (a competitor) in the game (decision situation) is perfectly rational and seeks to win the game.

In other words, the theory assumes that the opponent will carefully consider what the decision-maker may do before he selects his own strategy. Minimizing the maximum loss (minimax) and maximizing the minimum gain (maximin) are the two concepts used in game theory.

Decision-Making: Technique # 9. Simulation:

This technique involves building a model that represents a real or an existing system. Simulation is useful for solving complex problems that cannot be readily solved by other techniques. In recent years, computers have been used extensively for simulation. The different variables and their interrelationships are put into the model.

When the model is programmed through the computer, a set of outputs is obtained. Simulation techniques are useful in evaluating various alternatives and selecting the best one. Simulation can be used to develop price strategies, distribution strategies, determining resource allocation, logistics, etc.

Decision-Making: Technique # 10. Decision Tree:

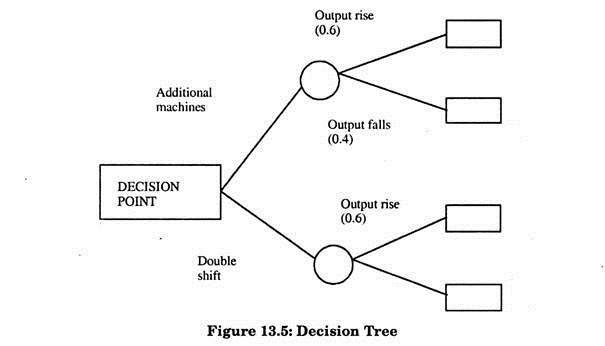

This is an interesting technique used for analysis of a decision. A decision tree is a sophisticated mathematical tool that enables a decision-maker to consider various alternative courses of action and select the best alternative. A decision tree is a graphical representation of alternative courses of action and the possible outcomes and risks associated with each action.

In this technique, the decision-maker traces the optimum path through the tree diagram. In the tree diagram the base, known as the ‘decision point,’ is represented by a square. Two or more chance events follow from the decision point. A chance event is represented by a circle and constitutes a branch of the decision tree. Every chance event produces two or more possible outcomes leading to subsequent decision points.

The decision tree can be illustrated with an example. If a firm expects an increase in the demand for its products, it can consider two alternative courses of action to meet the increased demand:

(a) Installing new machines,

(b) Introducing a double shift.

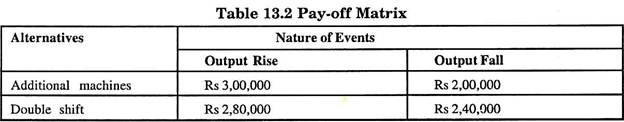

There are two possibilities for each alternative, i.e. output may increase (positive state) or fall (negative state). The probabilities associated with each state are taken as 0.6 and 0.4 respectively. This information can be presented in a tabular form, known as a pay-off matrix (see Table 13.2).

Additional machines

= (Rs. 3,00,000 × 0.6) + (Rs. 2,00,000 × 0.4)

= Rs. 2,60,000

Double shift

= (Rs. 2,80,000 × 0.6) + (Rs. 2,40,000 × 0.4)

= Rs. 2,64,000

Since the pay-off from introducing a double shift is higher, it may be selected. Though, the decision tree does not provide a solution to the decision-maker, it helps in decision-making by showing the alternatives available and their probabilities.

The decision tree allows the decision-maker to see the application of most of the steps in the decision-making process in one single diagram. The effectiveness of this decision-making technique depends on the assumptions and the probability estimates made by the decision-maker.