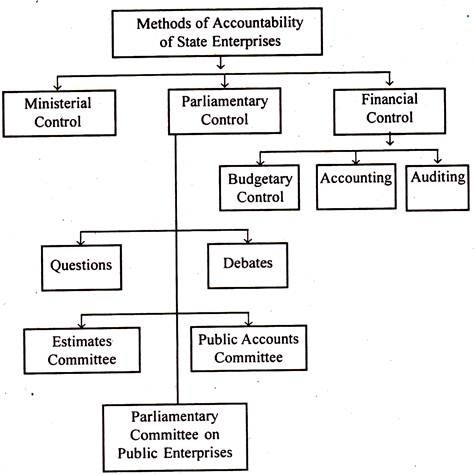

In considering the issue of public accountability of State enterprises we shall consider the following methods of making them answerable to public authorities and ensuring their compliance with criteria of commercial principles: 1. Ministerial Control 2. Parliamentary Control 3. Financial Control.

Following chart shows the different methods to make State Enterprises accountable to the public:

Method # 1. Ministerial Control:

Ministerial control over the State undertakings is considered essential aspect of their public accountability. If under the name of autonomy they are exempted completely from the purview of Ministerial control, it will not be possible to correlate their working with the national plans and policies.

ADVERTISEMENTS:

Since state enterprises operate in the critical spheres of the economy and are expected to develop as ‘lead-sector’ with enormous capital provided by the State, they cannot be left free from their obligation of accountability to the Minister-in-charge.

In fact even the Parliament holds the concerned Minister responsible for the efficient performance of the enterprises and the integration of their policies with the national objectives. Autonomy means in India non-interference in day-to-day operations but total freedom devoid of any ministerial direction is inconceivable in a country like India wedded to socialistic planning.

“Complete freedom from ministerial control”, says Tyagi “may defeat the whole purpose of having a public corporation as it may lead to economic confusion and social anarchy.”

Hence it is necessary to maintain ministerial surveillance over State enterprises while avoiding undue tempering with their autonomy.

ADVERTISEMENTS:

How to Control?

Minister being the prime instrument of Government control exercises powers in the following forms:

(i) Appointment and removal of the members of the Board of Enterprises. The right of the Government to appoint members of the Governing Board of Public enterprises is found in all countries. In India most of the Acts concerning Public Corporations empower the Government to appoint Chairman, members of the Board and Managing Directors or General Managers and in case of some Corporations to appoint Financial Advisors.

(ii) Any member of the Board can be removed if in the opinion of the Government he has failed to fulfil his responsibility or has any financial interest in the transactions, contracts made with the undertaking or in other industries competing with the State enterprise on the Board of which he is appointed as a member.

ADVERTISEMENTS:

(iii) No person whose honorarium or the salary exceeds a certain limit (viz., Rs 2000 p.m.) shall be approved by the Board except with the consent of the Government.

(iv) The Minister may call upon the Board to furnish returns or statements in any prescribed manner, regarding the existing or proposed programmes of production or service as the case may be.

(v) The Board is also required to submit to the Government after the end of each year (within the specified time) a report giving a true and full account of its activities, policies and programmes during the previous year.

(vi) The consent of the Government is essential for any rules to be framed by the enterprises for discharge of its functions. It has also the power to rescind any rules or regulations if it deems fit.

ADVERTISEMENTS:

(vii) The minister has the authority to issue directives to the Board and cause the Board bound by such directives in the discharge of its functions.

Since the Minister is responsible for planning the activities of the enterprise and their integration to fit in the national economic plan, he should have power to give specific directions on matters of policy and guide the Board in implementing the policies implied in the directions. Directions are also issued by the Minister in order to protect and promote the interests of workers and the consumers as well as on matters affecting national security.

In case of any dispute on the question of policy and allied matters the Government’s decision is final. If the Board fails to carry out the instructions on the matters of policy as specified by the Minister, the Government may supersede the Board and replace it by a new Board.

(viii) The minister is also vested with powers to regulate certain categories of financial transactions of the State enterprises.

ADVERTISEMENTS:

The Board of the enterprise shall not spend money unless the expenditure is covered by a specific provision in the budget approved by the Government. The annual budgets of the enterprises are to be submitted for sanction of the Government.

The prior approval of the Government is generally essential for increase of capital, borrowing of money, its terms and conditions, issue of bonds, debentures etc., programmes of capital expenditure beyond a specified limit say Rs. 20 lakhs to Rs. 40 lakhs.

The accounts of the corporate body shall be audited by the auditors appointed by the Government and also by the Comptroller and Auditor General as may be required by the governing Act or rules made there under.

Conclusion:

ADVERTISEMENTS:

While ministerial control is necessary to enforce discipline in the working of State enterprises, it should be ensured that ministers do not exert undue pressure on the Boards to grind their personal or political axe. Ministerial control should not mean continuous interference in the functioning of the Boards.

The directives should be issued only when it is absolutely justified by their bearing on economic policy pursued by the State. Moreover, the Ministers should not abuse their power resulting in nepotism or favouritism.

Minister should not bypass the Parliament nor should he evade his responsibility to the Parliament by issuing unofficial oral directives. Hence it is suggested that Minister should strictly observe the statutory provisions, rules and regulations framed by the Government or approved by the Parliament in exercising his control. Whenever he departs from the usual procedure, he should report it to the Parliament.

Any special directives that he may like to issue should be in writing and he should, if necessary, be bound to explain and justify the reasons or circumstances necessitating the issuance of such directives. He should also be held responsible for the instructions issued by the Secretary or other officers attached to his Ministry.

ADVERTISEMENTS:

The Minister should respect the autonomy of the Board at all cost except in circumstances where the Board has failed to manage the affairs efficiently as per the aims of national policy. Thus there should be a golden mean between managerial autonomy and Governmental control.

Method # 2. Parliamentary Control:

Parliament means the fountain of authority in a democratic set-up. It represents the people, as the tax-payers, consumers, employees and as general citizens. It is enjoined to safeguard the interests of the people who, in case of public enterprises, can be compared to shareholders of an undertaking in the private sector.

Public enterprises are financed out of State funds which are mobilised from the taxpayers. The Parliament owing its allegiance to the electorate should have the opportunity to discuss the functioning of the State enterprises and ensure that the tax-payers’ money is being utilised properly and the affairs are being directed to serve public interests.

State enterprises are brought under the purview of the public review through the Parliament. Parliament is a determinative and controlling institution as far as the Government policies and executive actions are concerned.

Minister also is accountable to the Parliament in respect of the powers he exercises over and directives he issues to the Public enterprises. The Parliament can lay down major policies about the State enterprises and Minister and the Public enterprises are expected to honour the Parliament’s mandates.

Objectives:

ADVERTISEMENTS:

Parliamentary control has following objectives:

1. Review of the working of Public enterprises and evaluation of their results with reference to national economic policy, progress and public welfare.

2. Seeking information and explanations from the Minister about any aspect of their working whenever necessary.

3. Exercising control over the expenditure incurred or proposed to be in curried by the enterprises on capital projects.

4. Examining the regularity and correctness of financial dealings of the enterprises with reference to their accounts and audit reports.

5. Inquiring into any instances of malpractices, misuse of funds, administrative lapses and other improprieties likely to injure public welfare, national security and statutory policies.

ADVERTISEMENTS:

Parliament can exercise surveillance over the State enterprises through the following methods:

1. Questions.

2. Debates.

3. Parliamentary Committees.

1. Questions:

Parliament can elicit information about public enterprises during the Question Hour which is significant part of the day’s deliberations in the Parliament. Any member of Parliament can put forth his questions to the Minister concerned of any of the matters concerning the policy and working of the State undertakings. Questions in Parliament make the Ministers alert and keep close contact with the enterprises.

ADVERTISEMENTS:

Questions may cover the wide range of matters but the Speaker of Parliament admits only such questions as are of public importance provided they relate to Minister’s only responsibility. Minister’s replies are usually informative but sometimes they are evasive. Supplementary Questions are asked on Minister’s replies to get clarification.

However the Question Hour is limited and vague answer by the Minister may reduce the effectiveness of accountability. In general, the questions relating to matter of policy, act or omission of an act on the part of a Minister, an issue of public interest are admitted for an oral answer. Similarly, questions calling for information of statistical or descriptive nature are also accepted while those dealing with day-to-day administration are disallowed.

2. Debates:

Debates are wider and better method of exercising parliamentary control over state undertakings. In a debate a larger number of members can participate and express their views on varied aspects of the State enterprises.

Useful suggestions may emerge from the debates in order to improve the tone of administration of the enterprises. Through debates, the Parliament compel the Government to provide information, offer explanations on the issues raised by the members during the debate.

Members can avail themselves of the opportunity of debating the affairs of the State enterprises on different occasions such as:

ADVERTISEMENTS:

(i) When the President’s address is being debated;

(ii) When the budget is taken up for general discussion and also when demands for grants, under the budget for various ministers are being voted;

(iii) When annual reports and accounts of the enterprises are tabled before the House; and

(iv) Special debates can also be requisitioned by the members of Parliament on any issue concerning an enterprise which in the opinion of the members is of public importance. If the enterprise is following a wrong policy, the interests of the workers or consumers are being adversely affected by the lapses of the undertaking.

The members may raise the issue on the floor of the House and seek half an hour or an hour’s discussion during which Minister concerned can be made to offer explanations about the lapses complained.

Debates are helpful to know the parliamentary opinion on the working of the enterprises. They also help in pinpointing specific irregularities observed in the functioning of the undertakings.

ADVERTISEMENTS:

But the time allotted for discussion is limited and it may not be possible for the members to discuss threadbare the policies and operations of the undertaking. Even the annual reports have not been properly discussed in Parliament so far due to dearth of time and the increasing number of enterprises and the delay in submitting the reports.

Debate on annual accounts submitted after considerable delay would be of no effective use, while during the limited time allotted for discussion only fringe of the problems can be touched. Besides, many debates are turned into futile inter-party rivalry rather than an opportunity for constructive exchange of views.

Even then debates are important media available to Parliament for airing its views and suggestions about the working of the State undertakings as well as for pointing out defects, improprieties, faulty policies, etc. observed in their administration. Minister concerned also has to be equipped with full facts and figures to reply to the issues raised in the debate.

3. Parliamentary Committees:

Parliament can exercise greater degree of control over the State enterprises through the committees where opportunity exists for further discussion of the working results of the concerned undertakings. The committees are constituted from amongst the members of Parliament to review the financial proposals and dealings of the Government and submit evaluator or critical appraisal about their justifiability or otherwise and offer suitable suggestions to regulate their costs, avoid wastages, and to improve their performance. “A detailed discussion can take place in a smaller forum and therefore the institution of financial committees has been evolved”.

The affairs of the State enterprises are scrutinized by the following three parliamentary committees:

(a) Estimates Committee;

(b) Public Accounts Committee; and

(c) Parliamentary Committee on Public Enterprises

(a) Estimates Committee:

The Estimates Committee was first set up in 1950 to keep a continuous watch over the financial dealings of the Government. The primary function of the committee is to suggest measures of economy consistent with efficiency. The committee selects the subjects concerning the estimates of Ministry to be examined during the year and collects information from the Ministry in a standard form in support of the estimates.

The committee examines the possibilities of effecting economies, improvements in organisation, efficiency or administrative reform consistent with the policy underlying the estimates. It considers whether the money is well laid- out within the limits of the policy implied in the estimates. It can make suggestions regarding the alternative policies for improvement of efficiency and economy in administration and also about the forms in which the estimates shall be presented to the parliament.

The committee can bring into its analysis the estimates and expenditure incurred by state enterprises also. This committee consists of not more than 30 members elected by the Lok Sabha every year. It has to submit the report on the estimates it has reviewed during the year to the House through its Chairman, appointed by the Speaker from amongst the committee members.

(b) Public Accounts Committee:

Public Accounts Committee is formed with the main purpose of examining the accounts showing appropriation of sums granted by Parliament to meet the expenditure of the Government and such other accounts as are laid before the Parliament.

This committee consists of not more than 15 members elected every year by Parliament and its Chairman is appointed by the Speaker from amongst its members. Since 1954 the number of members of the committee has been raised to 22 (15 from the Lok Sabha and 7 from the Rajya Sabha).

Functions:

The functions of the Public Accounts Committee are intended to exert control over the accounts of the Government Departments, including Railways, Posts and Telegraphs, Broadcasting, etc. and the accounts of Public Corporations and semi-autonomous bodies.

The committee is concerned with the examination of the formality of expenditure and its proper utilisation. It goes through the accounts only after the expenditure is actually incurred by the Government or the State Enterprises concerned. It conducts its scrutiny on the basis of the Report of the Comptroller and Auditor General who is also expected to play the role of Adviser and expert guide to the committee.

It is the duty of the committee to satisfy that the moneys shown in the accounts as disbursed were legally permissible to be applies and that they have been spent on the service or purpose for which they were meant. It sees that money spent is an authorised expenditure, that the relevant procedures are followed in appropriating for re-appropriating any money for the approved expenditure.

It scrutinises all instances of losses, nugatory expenditures, financial irregularities, as revealed in the Audit Report. It can comment on the justifiability or otherwise of any item of expenditure incurred by the Government although it cannot disallow it.

The committee has adequate powers to discharge its functions. It can call for any information, examine the officers, record, evidence and to report its findings on matters under its purview. It can point out irregularities in administrative actions of the Government and curb irrational methods of spending public money.

Thus these two committees act as watchdogs of public expenditure and their reports are of educative value since they create interest in the public about the functioning of Government departments and enterprises and their financial deals.

(c) Parliamentary Committee on Public Undertakings:

The review conducted by Public Accounts Committee and Estimates Committee is considered inadequate. Since the above committees are concerned with all the administrative departments of the Government, the State enterprises (industrial, commercial and public utility services) may not get sufficient attention of these committees.

Hence in England a Select Committee on Public Enterprises was constituted in 1954 to exercise continuous control over them. It examines the reports and accounts, obtain further information about the nationalised enterprises and keeps Parliament informed about the aims, activities and problems of the enterprises. In India the need for constituting a separate Committee of Parliament on Public Enterprises was first emphasised by Dr. Lanka Sundaram in 1953. It would confirm the competence of Parliament to investigate into the working of any public enterprise. But the Government then did not agree to the proposal.

In 1958, in the light of the LIC episode and critical remarks made by the Chagla Commission on Parliamentary control, the Congress party set up a committee under the Chairmanship of Shri V.K. Krishna Menon to report on the issue of Parliamentary supervision over the public enterprises.

The Menon Committee recommended the setting up of a select committee to keep up continuous contact with the State undertakings. It has to be well informed committee about all the circumstances in which the concerns function. Of course, it is neither an expert committee nor a fault-finding commission of inquiry. It is in the nature of a keen observer of the enterprises. The committee of public undertakings was accordingly set up in May 1964 as per the Resolution passed by the Lok Sabha in 1963.

The committee consists of 15 members (10 from amongst members of the Lok Sabha and 5 from the Rajya Sabha). This committee, subject to the jurisdiction of the Speaker of the Lok Sabha, has the authority to examine whether the affairs of public undertakings are being managed in accordance with sound “business principles” and “prudent commercial practice”.

Matters of day-to-day administration and issues of major policies of the Government are beyond the purview of this committee. While recognising, the autonomy of the undertakings, the committee can examine the extent of efficiency achieved by them. It can examine the reports and accounts of the specified public undertakings. It can examine the reports of the Auditor and Comptroller General on public undertakings.

It can undertake other functions as may be entrusted to it by the Speaker. Usually the committee examines about ten undertakings every year and submits reports to Parliament which can seek replies from the Government on matters raised in the reports. The committee collects preliminary material and calls for replies to a detailed questionnaire concerning all the aspects of the working and performance of the undertaking during three to five years.

It may also visit the enterprise for on-the-spot study. It examines the Chief Executive Officers of the undertakings and records evidence of their statements, it may also collect the views of non-official experts or other individuals and organisations about the working of the undertaking.

Then detailed reports are compiled by the committee for presentation to Parliament. Parliament thus is kept well-informed about the ‘going’ in public undertakings. The reports may expose any irregularities and instances of mismanagement. The fear of such exposure serves as a deterrent to the Government and management of the undertakings and keeps them alert.

Method # 3. Financial Control:

It is essential to keep a close check on the financial issues and dealings that arise in the management of the concerned enterprises. It should be ensured that the funds are utilised in a proper manner as per regular procedure for achieving fruitful or productive results.

Financial control is exercised through budgeting, accounting and auditing for introducing orderliness in receipts and expenditure from the point of regularity of procedure and justifiability of spending.

Budgeting:

It is an initial step in financial management and a process whereby estimates are prepared for executing the proposed plan and programmes of development and operations of the enterprises. Budget is a schedule of estimated expenditure and expected receipts over a given period.

Capital outlay and financial operations would be exposed to risk of loss if there is no budgetary control. Budget is regarded as a plan of action, a criterion of reviewing progress and standard of comparing actual performance with the expected targets. Budget through its estimates of projected expenditure and expected receipts gives a sense of direction for financial operations of an undertaking.

Budget should be comprehensive so as to touch upon all the critical aspects of the undertaking. It should consist of:

(a) Production estimates,

(b) Sales estimates,

(c) Cost of production budget, estimating cost of labour, materials, overhead, plant maintenance, etc.,

(d) Manpower budget,

(e) Research and development estimates,

(f) Welfare estimate,

(g) Capital expenditure budget,

(h) Profit and loss estimate,

(i) Cash flow estimates and

(J) Capital employed budget.

Revenue Budget containing forecast about income and expenditure is a base for devising financial policy and to prescribe standards of performance. If it reveals a deficit which Government is to make up then it should be sent to the Government for prior approval with full knowledge of Parliament.

Capital Budget has to be finalised after due consultation with the Government. It should be ensured that capital expenditure is incurred as per the budget estimates and the works are completed as per schedule.

Cash Budget is important to plan, forecast and regulate the flow of funds required to cover payments on revenue or capital account.

Any delay or deviations should be inquired into and concerned officials are to be accountable for consequences arising from disparity between the estimates and actual. Budgeting will give opportunity to the Parliament to take a prior view of the current and projected expenditure on the schemes before they are undertaken.

It also informs the Parliament and the Government about the extent to which the plans are completed according to estimates. It makes it possible to spot out the slackness or otherwise in the performance of the administrative officers concerned.

Once the budget is framed, authority to spend should be delegated to the subordinate officers along with precise responsibilities devolving upon them for quick implementation of the plans within the budget framework.

Accounting and Auditing:

Public enterprises are bound to maintain systematic record of money received and spent on various heads provided in the budget.

Accounting:

Accounting ensures through recorded figures in a set form that public money is spent for a public purpose. Accounting system should be in conformity with the provisions. Accounts should be correlated to budget estimates to exert a total control on public finances. They should reveal a correct picture of accrued, available funds, securities, property and the liabilities incurred or committed.

Accounting system should also be designed to aid in planning and direction and to bring about the necessary corrections or adjustments. Apart from arithmetical accuracy and procedural compliance, accounting should be based on criteria of accurate financial planning providing for interest on capital at charge, depreciation on assets, reserves for contingent expenditure or liability, etc. so that the accounts at the end reflect a true position of the undertakings.

It should provide a full disclosure of financial achievements, by realistic measurement of costs and revenues.

Audit:

By Audit we mean the examination of the accounts with a view to ascertain the correctness of the financial transactions of the enterprises.

The audit of the accounts of departmentally manage enterprise is conducted by the Comptroller and Auditor General of India. Regarding Public Corporations, the basic Acts provide for the audit of accounts by qualified auditors or by Auditor and Comptroller General or by both.

For example:

Air Corporations (IAC and All) are audited by Comptroller and Auditor General; RBI, LIC, IFC are audited by professional auditors though Auditor General may by requested under special circumstances to conduct the audit. In case of Government companies, the auditors are appointed by the Central Government on the advice of the Auditor and Comptroller General. The Companies Act authorises him to direct the auditor and also, himself conduct the supplementary audit, if need be.

Objects of Audit:

The objects of audit are to verify that expenditure is sanctioned by competent authorities, to check the cash book, to see that all receipts are accounted for, to ensure that all transactions are in accordance with the minutes of the meetings of the Board, to investigate any unusual transactions, to see that final accounts of commercial entrepreneurs.

Trading, Profit and Loss Account and Balance Sheet are correctly compiled and they reflect the true position of the enterprises. The audit men also comment upon the stock-taking, pricing, depreciation provisions, reserves, correctness of allocation to Capital Account, etc. It has been recommended that there should not only be post audit but an internal audit as an integral part of financial management.

Internal audit is defined as an independent appraisal continuously conducted within the enterprise. It aims at reviewing the soundness, accuracy and adequacy of accounting and financial checks, making constructive suggestions for improving the methods of accounting, and complying with the points raised in post-audit.

Technical dynamism (use of latest innovations) and project implementation are also watched by respective Ministries, Investment Boards, Public Enterprise Selection Board, Bureau of Public Enterprises.

A new system called Memorandum of Understanding (MoU) is being tried. Agreement shall be concluded with enterprises for making them committed to reaching specific goals and the Government also to fulfill its own obligations to the units regarding budgetary support, sanctions, input supplies, etc.

Under this system, autonomy is enhanced by:

(a) Granting greater delegation of power;

(b) Reducing multiple evaluation by different governmental agencies; and

(c) Reducing interference in day-to-day functioning of the public enterprises by substituting evaluation for monitoring.

On the other hand, accountability is increased by:

(a) Clear specification of performance criteria.

(b) Comprehensiveness of performance criteria.

(c) Monitoring performance criteria.

(d) Ex-ante agreements on judging deviation from performance targets (criteria value).

Latest Steps in Accountability:

Various committees and experts have stated that autonomous working of state enterprises should be subject to monitoring by Government, Parliament and audit agencies. Since public money is involved to massive extent in the capital and operational set up of the enterprises, they have to be answerable for their legitimate use and for fulfilment of prescribed goals.

Proposals for capital expenditure calling for reports on their performance, inquiring into their working and audit of their accounts etc. are the dimensions of public accountability advocated by the experts and study groups. Recently as per Sen Gupta Committee’s suggestion, accountability concept is further streamlined. It is now laid down that accountability should be in terms of evaluation of performance on the basis of gross margins on assets, net profit or net worth and gross margins on sales depending upon the core, non-core and service nature of enterprises.

Productivity and cost reduction should be monitored to ensure capacity utilisation, to link wage bill and value-added by personnel, materials-output ratio etc. Thus, post-audit and concurrent audit are essential for constant vigil over the utilisation of funds by the public enterprises. Audit gives concrete meaning to the accountability of the undertaking to Parliament and the Government.

Materials Management:

One of the defects observed in the working of public enterprises has been absence of proper check on the use of materials on which crores of rupees are spent.

Inventory Holdings:

Stores, spares, raw materials constitute major portion of the working capital of most of the public enterprises. In 1965-66, out of working capital of Rs. 384 crores relating to 40 undertakings, Rs. 361 crores were accounted by inventories. In 1968 the percentage ratio between inventories and turnover in 55 enterprises was 46. The inventory carrying costs were also estimated to be 15 to 20% of the value of inventories.

Thus it is essential to impose suitable checks on the materials-holdings of enterprises to prevent wastage, to secure their systematic utilisation and to reduce their maintenance costs. Large holdings in the form of inventories will mean locking of capital. It has been pointed out that inventories in Indian public undertakings have been unduly high, and they do not adopt scientific system of their handlings, storage and control.

Expert study of material requirements during a period should be undertaken to release the capital unjustifiably locked in pile up of inventories. The Administrative Reforms Commission has suggested the compilation of Materials Management Manual to lay down rules and procedures for estimating materials requirements and regulating their purchase, use, storage, handling and accounting. Bureau of Public Enterprises should provide consultancy services to the enterprises in materials management and devising standard forms and procedures of accounting, budgeting, internal audit, etc.