Here is an essay on the three main components of a bank’s balance sheet especially written for school and banking students.

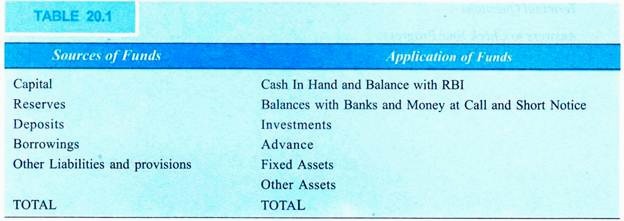

Essay # 1. Components of Liabilities:

A. Capital:

ADVERTISEMENTS:

Capital represents the owner’s stake in the bank and it serves as a cushion for depositors and creditors to fall back in case of losses. It is considered to be a long-term source of funds. Minimum capital requirement for the domestic and foreign banks is prescribed by Reserve Bank of India.

B. Reserve and Surplus:

The components under this item include statutory reserves, capital reserves, share premium, revenue and other reserves and balance in profit and loss account.

C. Deposits:

ADVERTISEMENTS:

Main source of funds for the banks is the deposits. The deposits are broadly classified as deposits payable on demand which includes current deposits, overdue deposits, call deposits, etc. Second category is savings bank deposits and lastly the term deposits which are repayable after a specified period, known as fixed deposits, short deposits and recurring deposits.

D. Borrowings:

Borrowings in India consist of borrowings/refinance obtained from the RBI, other commercial banks and other institutions and agencies like IDBI, EXIM Bank of India, NABARD, etc.

E. Other Liabilities and Provisions:

ADVERTISEMENTS:

The other liabilities of the bank are grouped into the following categories:

i. Bills Payable:

This includes drafts, telegraphic transfers, traveller’s cheques, mail transfers payable, payslips, bankers’ cheques and other miscellaneous items.

ii. Inter-Office Adjustments:

ADVERTISEMENTS:

The credit balance of the net inter-office adjustments.

iii. Interest Accrued:

The interest accrued but not due on deposits and borrowings.

iv. Others:

ADVERTISEMENTS:

All other liability items like provision for income tax, tax deducted at source, interest tax, provisions, etc.

Essay # 2. Components of Assets:

A. Cash and Balances with RBI:

All cash assets of the banks are listed under this account and it forms the most liquid account held by any bank.

The cash assets consist of the following:

ADVERTISEMENTS:

i. Cash in Hand:

This asset item includes cash in hand, including foreign currency notes and cash balances in the overseas branches of the bank.

ii. Balances with RBI:

Cash account also includes the balances held by each hank with RBI in order to meet statutory cash reserve requirements (CRR).

ADVERTISEMENTS:

iii. Balances with Banks and Money at Call and Short Notice:

The bank balances include the amount held by the bank in the current accounts and term deposit accounts with other banks. Money at Call and Short Notice includes all loans made in the interbank call money market that are repayable within 15 days’ notice.

2. Investments:

A major asset item in the balance sheet of a bank is investments in various kinds of securities. These include, government securities, approved securities, shares, debentures and bonds, subsidiaries and/or joint ventures, other investments.

3. Advances:

The most important of the asset items on the bank’s balance sheet are advances. These advances which represent the credit extended by the bank to its customers, forms a major part of the assets for all the banks.

ADVERTISEMENTS:

i. Cash Credits, Overdrafts and Loans Repayable on Demand:

Items under this category represent advances – which are repayable on demand though they may have a specific due date.

ii. Term Loans:

All term loans extended by the bank are included here. These advances also have a specific due date, but they will not become payable on demand.

iii. Bills Purchased and Discounted:

This item includes the bills discounted/purchased by banks from the client irrespective of whether they are clean/documentary or domestic/foreign.

ADVERTISEMENTS:

iv. Secured/unsecured Advances:

Based on the underlying security, advances are classified into the following categories:

a. Secured by Tangible Assets:

All advances or part of advances, within/outside India, which are secured by tangible assets will be considered as secured assets.

b. Covered by Bank/Government Guarantees:

Advances in India and outside India to the extent they are covered by guarantees of Indian and foreign governments/banks and DICGC and ECGC will be included here.

ADVERTISEMENTS:

c. Unsecured Advances:

All advances that do not have any security and which do not appear in the above two categories will come under this category.

4. Fixed Assets:

All fixed assets of the bank, e.g., immovable properties, premises, furniture and fixtures, hardware, motor vehicles are classified into fixed assets.

5. Other Assets:

The remainder of the items on the asset side of the bank’s balance sheet are categorised as other assets.

ADVERTISEMENTS:

The miscellaneous assets that appear are:

i. Inter-office Adjustments:

Debit balance of the net position or the interoffice accounts, domestic as well as overseas.

ii. Interest Accrued:

This will be the interest accrued, but not due on investments and advances and interest due, but not collected on investments.

iii. Tax Paid in Advance/tax Deducted at Source:

ADVERTISEMENTS:

This includes amount of tax deducted at source on securities and the advance tax paid to the extent that they are not set-off against relative tax provisions.

iv. Stationery and Stamps:

Stock on hand of stationery is considered under this head of account.

v. Non-Banking Assets Acquired in Satisfaction of Claims:

Items under this account include immovable properties/tangible assets which are acquired by the bank in satisfaction of bank’s claims on others.

vi. Others:

Other items primarily include claims that are in the form of clearing items, unadjusted debit balances representing additions to assets and deductions from liabilities and advances provided to the employees of the bank.

Contingent Liabilities:

Bank’s obligations under issuance of letter of credit, guarantees and acceptances on behalf of constituents and bills accepted by the bank on behalf of its customers are reflected under contingent liabilities. Other contingent liabilities include claims against the bank not acknowledged as debts, liability for partly paid- up investments, liability on account of outstanding forward exchange contracts and other items like arrears of cumulative dividends, bills rediscounted, underwriting, commitments, estimated amount of contracts remaining to be executed on capital account and not provided for, etc.

Essay # 3. Bank’s Profit and Loss Account:

A bank’s profit and loss account has following components:

I. Income:

Which includes Interest income and other income?

II. Expenses:

Which includes Interest expended, Operating expenses and Provisions and Contingencies.

These components are explained hereunder:

I. Income:

The bank’s income is broadly classified as interest income and other income.

A detailed break up is provided below:

(1) Interest income:

Interest income forms the major and most important revenue for the bank. The bank thrives on this income as spreads are essentially generated out of this income.

i. Interest/Discount on Advances/Bills:

This item includes interest and discount on all types of loans and advances like; cash credit demand loans, overdraft, term loans, export advances, domestic and foreign bills purchased and discounted/rediscounted, overdue interest and interest subsidy, if any relating to such advances/bills.

ii. Income on Investments:

The dividend and interest income earned on investment portfolio of the bank is entered under this head.

iii. Interest on Balances with RBI and Other Interbank Funds:

This item includes the interest earned by the bank on balances with RBI and other banks, call loans, money market placements, etc.

iv. Others:

All other types of interest discount income that not included above will appear in this head of income.

(2) Other Income:

Apart from the interest income, banks have certain income in the form of fees, commission, exchange, etc., derived in the following ways:

i. Commission, Exchange and Brokerage:

Charges of services such as commission on collections, letters of credit and guarantees, government business and other permitted agency business including consultancy and, other services. It also includes rent on lockers, commission/exchange on remittances and transfers, brokerage, etc., on securities.

ii. Profit on Sale or Investments:

The items that are included here are profit/loss on sale of securities, furniture, land and buildings, motor, vehicles, gold, silver, etc.

iii. Profit on Revaluation of Investment:

The net position that appears after the revaluation of investments will be considered here. In case there is a loss after netting the profits against the losses, it will be shown as a deduction.

iv. Profit on Sale of Land, Building and Other Assets:

The net profit-loss on revaluation of assets will also be included under this head.

v. Profit on Exchange Transactions:

This includes profit/loss on dealings in foreign exchange, all income earned by way of foreign exchange, commission and charges on foreign exchange transactions, excluding interest which will be shown under interest income.

vi. Income Earned by Way of Dividends, etc.:

This will include the dividends from subsidiaries/companies and/or joint ventures abroad or in India.

vii. Miscellaneous Income:

The miscellaneous income comprises of recoveries from constituents for godown rents, income from bank’s properties, security charges, insurance, etc.

II. Expenses:

The expenses of the bank can be broadly classified into interest expenses, other operating expenses and provisions and contingencies. The detailed break up of these expenses is provided below.

(1) Interest Expended:

Since banks will have to mobilise funds regularly to meet the credit demands, the major expenses of the bank arise from the interest expended on deposits and borrowings.

i. Interest on Deposits:

Interest paid on all types of deposits raised by the bank, from banks, institutions and others will appear under this head.

ii. Interest on RBI/Interbank Borrowings:

This includes the discount/interest on all borrowings/refinance from RBI and other banks.

iii. Others:

Discount/Interest on all borrowings/refinance from FIs and other payments like interest on participation certificates, penal interest, etc., are included here.

(2) Operating Expenses:

The operating expenses will generally include the cost of running the bank.

Components of operating expenses are listed below:

i. Payments to and Provisions for Employees:

Staff salaries/wages, allowances, plus, other staff benefits like provident fund, gratuity, liveries to staff, leave fare concession, staff welfare, medical and house rent allowance to staff, etc.

ii. Rent, Taxes and Lighting:

Rent paid by the bank on building and vehicles, municipal taxes and other taxes (excluding income tax and interest tax) and other charges on electricity, etc.

iii. Printing and Stationery:

Books and forms and stationery used by the bank and other printing charges which are not incurred by way of publicity expenditure are included here.

iv. Advertisement and Publicity:

All expenditures incurred by a bank for advertisement and publicity and the related printing charges.

v. Depreciation on Bank’s Property:

Includes depreciation on bank’s own property, motor cars and other vehicles, furniture, electric fittings, vaults, lifts, leasehold properties, non-banking assets, etc.

vi. Director’s Fees, Allowances and Expenses:

Expenses relating to sitting fees and all other expenditure incurred on behalf of directors.

vii. Auditors’ Fees and Expenses:

Fees paid to the statutory/branch auditors for their professional services and all expenses incurred in this regard.

viii. Law Charges:

All legal expenses and reimbursement of related expenses are reflected under this heading.

ix. Postage:

Postal charges like stamps, telegrams, telephones, etc., will be the expenses appearing under this head.

x. Repairs and Maintenance:

Repairs to bank’s property, their maintenance charges, etc., are included here.

xi. Insurance:

This includes insurance charges on bank’s property, insurance premium paid, to Deposit Insurance and Credit Guarantee Corporation (DICGC), etc.

xii. Other Expenditure:

Other expenses like License fees, donations, subscriptions to papers, periodicals, entertainment expenses, travel expenses, etc., are all included here.

(3) Provisions and Contingencies:

Provisions made for bad and doubtful debts, taxation, diminution in the value of investments, transfers to contingencies and other similar items will appear under this category of expenses.