Here is a compilation of essays on ‘Financial and Banking Risks’ for class 11 and 12. Find paragraphs, long and short essays on ‘Financial and Banking Risks’ especially written for school and college students.

Essay on Financial and Banking Risks

Essay Contents:

- Essay on Introduction to Financial and Banking Risks

- Essay on Credit Process in Banks

- Essay on Credit Administration in Banks

- Essay on Credit Risk Management in Banks

- Essay on Usual Risks in Banks

- Essay on Interest Rate in Banks

- Essay on Process of Credit Risk Management in Banks

- Essay on Probability Analysis in Banks

- Essay on Risk Measurement in Banks

- Essay on Measures to Reduce Credit Risk in Banks

- Essay on Credit Risk Assessment/Measurement in Banks

- Essay on Ratio Analysis of a Bank

- Essay on Liquidity Risk in Banks

- Essay on Central Bank Role

- Essay on Interest Rate Risk in Banks

- Essay on Market Risk in Banks

- Essay on Operational Risk in Banks

- Essay on Asset Liability Management in Banks

- Essay on Counterparty Risk in Banks

- Essay on Environmental Risk in Banks

- Essay on Currency (Foreign Exchange) Risk in Banks

- Essay on Settlement Risk in Banks

- Essay on Legal/ Regulatory Risk in Banks

Essay # 1. Introduction to Financial and Banking Risks:

ADVERTISEMENTS:

The most important business of the bank is to extend credit to industries, business enterprises, institutions and individuals for different purposes. Lending (credit) is extended by way of cash credit, demand loans, overdrafts, term loans, letters credit, guarantee and investment in debentures and bonds of corporates.

The inherent risk involved in lending is default risk i.e. the borrower or the counterparty failure to repay the amount on the due date either in part or full. It will include nonpayment of interest as well. The failure to fulfill the obligations may be intentional or unintentional. It could be triggered by internal reasons or external causes.

Default in loan repayment is a loss to the bank. Large scale default will pose serious problem to the bank in many ways. The purpose of credit risk management is to reduce the default to the barest minimum if not to zero for the continued health of the bank and maintain its profitability.

Essay # 2. Credit Process in Banks:

ADVERTISEMENTS:

In order to assess the risk particularly default risk on lending to a person, data on credit worthiness and credit need should be collected and thoroughly analysed so as to find out whether the loan applied for is for genuine need based on the business plan and other relevant information. Borrower should project cash flow and profit to establish his ability to repay.

These data should be carefully checked by the bank in order to assess his ability to repay. The problem areas of the borrower should be ascertained from him and also his plan of action to manage them. The customers of the borrower should be studied regarding the nature of business and its stability. The quality of customer relationship besides the image of the borrower in the community should be studied.

Essay # 3. Credit Administration in Banks:

The primary source of credit risk is poor credit management. It may be traced at pre-sanction stage or post sanction stage or both. Credit risk management involve two different and distinct functions. One is credit administration and the other is credit risk management.

ADVERTISEMENTS:

Credit administration involves:

(1) Identification of the industry/business activity for lending.

(2) Selection of borrower, gathering information on the credit score etc. from credit rating company like Crisil other or similar organizations.

(3) Structuring the loan proposal and pre-sanction inspection.

ADVERTISEMENTS:

(4) Analysis and appraisal of the loan proposal, its viability on technical, financial, marketing, social, environmental and management angles.

(5) Recommending the sanction or rejection of the proposal based on risk/ reward analysis.

(6) Sanction by the appropriate authority and advising the terms and conditions to the applicant.

(7) Loan documentation.

ADVERTISEMENTS:

(8) Obtaining collateral, after assessing its value, marketability, liquidity and securing it firmly.

(9) After disbursement periodical inspection – monitoring, reviewing and reporting.

(10) Checking concentration of exposure.

(11) Rating of the borrower internally which is compulsory and also externally, if possible.

ADVERTISEMENTS:

(12) Regular checking of usage of funds for the right purpose.

(13) Monitoring of deterioration in credit quality, if any and taking necessary action.

(14) Reporting to CIBIL and also gathering information on concurrent borrowings of the customer.

In order to facilitate good credit administration a sound plan is necessary and it involves:

ADVERTISEMENTS:

(1) Setting parameters to ensure credit quality, taking into account Basel norms and the R.B.I, guidelines.

(2) Creating and documenting a sound credit sanction process, including identification of right type of borrowers/activities, appraisal standards, approval mechanism, monitoring and follow up process, procedure to avail credit insurance, wherever available and norms for collateral security and its valuation method.

(3) Compliance of legal and regulatory requirements including know your customer (KYC) guidelines and directives on large value cash transactions.

(4) Compliance of RBI guidelines on terrorism finance and suspected terrorist connections.

(5) Anti-Money laundering measures announced by the government.

The credit administration is implementation of credit policy in conformity with the banks internal procedures and practices. Many lapses can occur in these aspects and each one of them individually and collectively enhance the credit risk. Banks asset consist of loans and investments, wherein credit risk and market risk are interrelated and the combined effect counts in risk management.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 4. Credit Risk Management in Banks:

Default may be due to inability or unwillingness of the borrower to meet the contractual and moral commitments either for financial reason or for non-financial reason. It calls for a detailed enquiry and analysis of causes and reasons on the borrower side. Lapses on the part of the bank officials may be perfunctory credit analysis, inadequate credit appraisal, Imperfect or incomplete follow up and supervision of borrower, lack of data integrity, timelines of data and its availability, faulty rating system, sketchy enquiry on the borrower’s credibility and capability.

Unsecured loans are more risky than secured loans. Loan limit is a potential risk but spot loan is actual risk. In most of the banks car and home loans interest rate is same for all borrowers, although their credit rating may be different and hence there may be undue risk in certain cases. However, the emphasize here is on product risk and not borrower risk. But in all other cases borrower specific information on risk has to be collected.

The leverage i.e. borrower’s own capital and total loans ratio should be worked out since high leverage is risky. Quantum and volatility in earning differ from borrower to borrower so also value of collateral. In addition the market specific issues that are relevant shall be taken into account for credit scoring or rating.

The balance sheet and profit and loss account statements although duly audited, received in time and carefully analysed and examined they alone may not be sufficient to predict the potential risks. The reason being that these financial documents reveal the past and not future. The banks control mechanism should be futuristic. So is the case with credit rating. It is a lagging and not leading indicator.

The banker like the driver of a car has to be forward looking and rear view mirror cannot help it, although rear view mirror is essential and useful. The driver has to look ahead and be watchful and also have a rear view. Likewise balance sheet is necessary and useful but the banker has to go beyond.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 5. Usual Risks in Banks:

Lapses on the part of the borrower may be non-submission of financial documents or submission of financial documents that are un-current or unaudited. Loan default can be due to unexpected problems in the business unit or in the economy or environment or diversion of funds. The problems may be common to entire industry or only to the particular borrowing unit.

They have to be viewed appropriately. Concentration or overexposure to a particular industry (say Sugar, Cotton, etc.) or group companies is certainly a source of risk. The other risks are business risk, management risk and financial risk.

Business risk relates to market status of the borrowing unit and its operating efficiency. Management risk relates the company’s track record, and corporate credibility. Financial risk will cover existing and future financial position, payment record accounting standard, financial flexibility etc.

Essay # 6. Interest Rate in Banks:

a. Internal Rating:

ADVERTISEMENTS:

Taking into account all these factors credit rating would be decided for each account. The ratings will range from AAA to B–. ‘AAA’ means zero risk and ‘B–‘ means high risk. Other ratings fall in between.

b. Risk Based Interest Rate:

In deciding interest rate the following risks should be taken into account:

(i) Default risk

(ii) Liquidity risk

(iii) Market risk

ADVERTISEMENTS:

(iv) Maturity risk

(v) Inflation risk.

The significance and implications of the companies having unused assets, patent or on the verge of restructuring, merger or acquisition should also be taken into account in risk assessment.

Credit risk measurement will take into account internal rating and also external rating if available. External rating is not compulsory but internal rating is compulsory. Rating procedure and models have been circulated by the Reserve Bank of India. In view of computerization of banking operations it is easy to collect data relating to the borrowing unit, industry level, whole bank level etc. on real time basis for the rating exercise.

Essay # 7. Process of Credit Risk Management in Banks:

The process of credit risk management involves:

ADVERTISEMENTS:

(1) Deciding on parameters of credit quality

(2) Efficient credit sanction process

(3) Sound credit appraisal standard

(4) Approval process of high standard

(5) Competency of lending / operating staff

(6) Credit expertise of approving authority

(7) Monitoring process of loans – periodic inspection – follow-up

(8) Thorough understanding of Credit derivatives viz., nature, complexity and extent

(9) Credit insurance, if any

(10) Collateral security – value, liquidity, marketability

(11) Regulatory compliance – Anti-money laundering / KYC norms

(12) Monitoring of suspicious transactions / high value transactions

(13) When interest on loans are charged at a concession rate and not on credit risk basis loss of interest income should be borne in mind

(14) Change in interest rate affects net interest income, economic value of assets and also underlying assets value of derivatives.

(15) Establishment of credit audit review mechanism

(16) Credit rating of individual risk and industry risk

(17) Internal credit rating along with external credit rating wherever possible.

Essay # 8. Probability Analysis in Banks:

Probability of default of the borrower involves study of:

(i) Current profitability of business

(ii) Future / long term profitability of business

(iii) Interest cover

(iv) Rate of return on business

(v) Liquidity position (Cash Management)

(vi) Leverage (ratio between own funds and borrowed funds)

(vii) Size of the borrowings of the company (limit sanctioned and the outstandings),

(viii) Concentration of business

(ix) Lack of diversification of business

(x) Indication of incipient sickness.

Essay # 9. Risk Measurement in Banks:

Risk measurement tools are:

(i) Internal rating

(ii) External rating

(iii) Stress testing.

Stress testing is the analysis of the effect and consequences of increase in intensity of adverse situations on the risk profile.

In addition to calculating probability of default, it is also recommended to measure exposure at default (limit sanctioned or outstanding in the loan account whichever is higher), and loss given default i.e. Money that would be lost in the event of default. Expected loss is calculated taking into account all the above factors. When actual loss is more than expected loss the difference is called unexpected loss.

Essay # 10. Measures to Reduce Credit Risk in Banks:

(i) Sanction of appropriate loan limit to every borrower (that means neither more nor less)

(ii) Assessment of borrower’s surplus cash position

(iii) Getting collateral security – mortgage of land, building, machinery, etc. or pledge of shares, securities, guarantee, etc.

(iv) Monitoring bank’s exposure as a whole to industry, group, area and companies with lower rating.

(v) Diversification of loan portfolio of the bank

(vi) Attracting large number of small and medium amount loans in the bank books

(vii) Regular collection and analysis of relevant data on borrower and business

(viii) Watch on moral hazard

(ix) Avoiding security oriented lending and instead adopting purpose oriented lending

(x) Assessment of credit worthiness of the borrower before sanction of credit

(xi) Ensure whether the loan applied for is for genuine need

(xii) Whether the cash flow of the borrowing unit and the profit generated is adequate to run the business smoothly and also repay the loans

(xiii) Exercise careful watch over the problems faced by the borrower in his business and engage in an ongoing discussion with the borrower including a thorough inspection of his operations

(xiv) Understand the customers of the borrower their nature and stability of their business

(xv) Level of customer relation and standard of customer service

(xvi) The borrower image in the community

In other words know more about borrowers, character / capacity / capital / collateral offered / conditions stipulated and accepted, his commitment, his customers and his image in the community.

Essay # 11. Credit Risk Assessment/Measurement in Banks:

In understanding and assessing the credit risk several methods are adopted by banks in different countries and they are not 100% fail safe method but certainly very useful in judging risk factors. One such method is based on the study of the following aspects of company operation.

The analysis will cover:

(1) Recent profitability

(2) Long term profitability

(3) Interest cover

(4) Rate of return on assets

(5) Liquidity

(6) Leverage

(7) Size

(8) Concentration

(9) Diversification

(10) Early identification of sickness/failure

(11) Sale of loans by securitization

(12) N.P.A. level

(13) Credit information level

The data based on the analysis will be compared with:

(i) Industry average

(ii) Best performing firm in the bank’s book

Bank’s internal norms including Reserve Bank norms, if any in order to judge whether the borrower in question is below average, average or above average.

Essay # 12. Ratio Analysis of a Bank:

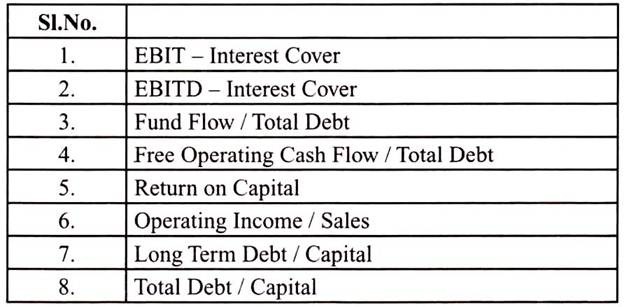

Another method is the study of ratio analysis on eight parameters which is risk focused. The data may give a fair idea of the best performing (AAA), not so well performing (BBB) and badly performing (CCC) companies. It is interesting to study such ratios and decide on rating; as an indicator of risk. All the eight ratios will be individually rated numerically say 3, 2, 1 for high, medium and low risk. This is in addition to usual ratio analysis which banker does in credit appraisal.

The number under eight parameters give a broad indication of the best (AAA) Average (BBB) and below average (CCC) performance. The above ratios are relevant in most situations.

These ratios may be compared with the figures relating to:

(i) Industry average and

(ii) The best performer in the bank books or elsewhere.

Altman ‘Z’ Score:

There is another scoring method known as Altman ‘Z’ score which takes into account five parameters and in that scoring a ratio of less than 1.81 is treated as high risk category. This is an old method and also may not apply in all situations. However it has atleast a limited utility.

A = Working capital / Total assets

B = Retained earning / Total asset

C = Earning before interest and tax / total assets

D = Market value of equity / book value of L.T. Debt

E = Sales / Total Assets

The multiplication factor for A, B, C, D, E is 1.2, 1.4, 3.3,. 6 and. 1, respectively.

Z = 1.2 x A + 1.4 x B + 3.3 x C +. 6 x D +. 1 x E

Score:

Figures for A, B, C, D, E will be based on company balance sheet figures.

‘Z’ Score:

Less than 1.81 indicates high risk category.

Modified zeta analysis takes into account seven parameters:

1. Cumulative Profitability – (Retained Earning / Total Assets)

2. Stability of Earnings – (for Ten Years)

3. Capitalisation (Equity / Total Capital including Equity, preference shares, long term debt and capitalized leases)

4. Assets Size (Total Assets as per Balance Sheet)

5. Liquidity (Current Assets / Current Liabilities)

6. Debt Service (EBIT / Total Interest Payment)

7. Overall Profitability (EBIT / Total Assets)

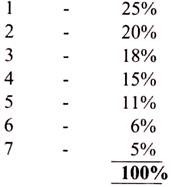

The weightage for items one to seven

The study of the above ratios will give an indication of the strength, or the weakness of the firm which is tending towards insolvency. But the old format on five parameter is still valid and useful.

In addition the borrower’s financial ratios and current status are compared with similar companies, particularly with the best ones, in certain aspects such as growth, cash flow, dividend, earnings, return on assets, return on capital, interest cover, earnings before interest and tax, interest expenses to find out how the company fares with the competitor.

Essay # 13. Liquidity Risk in Banks:

Definition of Liquidity Risk:

Liquidity risk is the inability to meet day to day payments for want of liquid cash. Ill managed liquidity in banks results in loss of reputation and loss of good customers, distress sale of investments/assets, and high cost of raising funds, adverse comment or even penalty by the regulators.

The liquidity problem arises because, the source of funds for banks (deposits and call money) is short term in nature and the deployments of funds (lending and investments) are relatively long term in nature. Managing the mismatch risk is inevitable but it can be managed. Management plan for liquidity and the ability to raise alternative source of funds at short notice at reasonable cost are the signs of good liquidity management.

Liquidity risk is also caused by the bank’s inability to sell the assets in the market to raise cash due to lack of depth in the market or disruption in the market. Liquidity risk may also arise on account of severe loss arising out of credit risk, market risk or operation risk.

Liquidity Management:

Asset liability management techniques help to control liquidity risk. A simple way to assess liquidity risk is to forecast day to day cash inflow and outflow supplemented with stress testing. Stress testing is a method to assess possible cash crunch based on assumptions of heavy withdrawals of cash and large reduction in cash inflow and the impact thereof. And for this purpose, Inflow and outflow of cash will be worked out separately and also net flow by combining inflow and outflow based on historical data to arrive at the optimum quantum.

It will enable the bank to know the cash need and also draw liquidity risk management strategies. Luckily in all banks most of the time there is more inflow of cash than outflow. When the liquidity risk is confined to one bank (unsystemic risk) it is relatively easy to manage. But if it is systemic risk, i.e. widespread and contagion it is very difficult to manage.

An appropriate liquidity management policy and contingency funds plan with techniques to measure and manage liquidity stress shall be drawn to manage the likely impact on day to day operations and on bank’s balance sheet. The net potential gap between inflow and outflow over a period of three months should be compiled regularly for this purpose.

In view of its critical nature the Basel committee has circulated specific recommendations to banks to manage liquidity risk.

Accordingly the bank should:

1. Arrive at liquidity risk tolerance level

2. Try to maintain liquidity with a cushion for emergency

3. Work out liquidity cost and recover it from customers

4. Measure the quantum of risk and carry out periodical stress test

5. Put in place the policy, strategy and process for liquidity management including reporting system

6. Draw contingent plan for funding

7. In this regard Regulator’s oversight and assistance to banks in distress is important.

8. In order to improve liquidity management Basel III framework suggested two standards for funding liquidity. One is short term liquidity (30 days) management and the other is long term net stable funding. Both will operate concurrently.

Accordingly the banks should draw a robust liquidity risk management framework, determine liquidity tolerance level and also develop strategies and procedures to be followed. Banks need a sound plan for identifying, controlling, monitoring, measuring the risk and also actively manage it. There should be a contingent plan and a cushion of unencumbered assets to tackle critical situation as and when it arises.

Essay # 14. Central Bank Role:

The Central Bank of the country viz. Reserve Bank of India supplement the efforts of the bank by regular assessment and monitoring and support the bank in crisis situation. Frequent occurrences of crisis clearly indicate poor liquidity management and portend solvency risk. In the long run banks liquidity depends on its capital plus reserves.

Excess reserves if any, cash on hand, cash with RBI, cash with other banks and bank float funds. Funds are available from the call money market. To manage the temporary shortfall in addition to repo facilities, securitization of assets is another important source of funding. Reserve Bank of India have opened several windows Liquidity Adjustment Facility (LAF) collateralized lending and borrowing obligations (CBLO) etc. for the banks to manage liquidity crisis.

Essay # 15. Interest Rate Risk in Banks:

Definition of Interest Rate Risk:

Interest rate risk is the risk of decline in earnings due to movements of interest rate. Change in interest will cause mismatch in interest income and interest payment and the net earning of the bank. The situation may arise on account of market condition, demands/supply position of money, inflation, fixed and variable rates on loans and deposits, etc.

Interest Income:

Banks earning and profit largely depends on interest income. Market situation, economic situation and the Reserve Bank and also the Government policies influence the change in interest rate. It is not as simple as increase in interest rate increases the income of the Bank and decrease in rate reduces income of the Bank. The bank pays interest on deposits and earns interest on loans and other obligations.

Increase in interest rate will have contrary impact between deposits and advances. In case of deposits it will increase cost of funds i.e. operation cost and in respect of advances it will augment the income. The effect will not be uniform and simple because of varieties of deposits and loans with different rates. It is a complex situation that requires skillful management.

Ultimately what counts is maintaining or even improving the surplus of interest income over payments. Banks have substantial investments in Government securities to meet statutory requirements and also for its own safety and liquidity. In addition they also invest in debentures and bonds which have fixed coupon rate.

Any change in the interest rate affect investment portfolio both in terms of income and market value of assets. When the interest rate goes up bonds held with the bank at fixed rate will cause notional loss of income, it is a loss of opportunity cost.

For every increase in the interest rate market value of fixed income securities decreases and if they are sold for some reasons it will cause capital loss. Of course if the rate goes down it will have opposite effects. That means market value of the asset goes up and income compares better with market rate.

Incidentally non-interest bearing deposits carry only liquidity risk but interest bearing deposits, in addition to liquidity risk will also have interest rate risk. When the interest rate goes up the customers may withdraw the money for investment elsewhere at a higher rate which is called embedded risk.

Fixed and Variable Rate:

Another dimension to the problem is fixed and variable rate of interest. On the liability side, deposits are on fixed rate and call money borrowings are on variable rate. On the asset side almost all loans are on variable rates. Fixed rate is not fixed for life time of the loan. But changes less frequently than variable rate.

Therefore banks will not be able to change the rate on liability side (Existing Deposits), but it can change on the asset side viz. loans (existing and future). Consequently the net interest income calculation goes awry.

It calls for reworking or change in business mix to maintain profitability. It is pertinent to note that in floating rate interest regime to some extent risk is passed on to the customer. But on fixed rate the bank carries the risk.

Factors that Count:

(i) Interest rate has a bearing on default risk of loans and bonds. If the probability of default is more on loans or bonds, it attracts higher rate.

(ii) If the assets are highly liquid the rate is low.

(iii) If the interest income is tax free the rate is low.

(iv) Short term loans generally carry a lower rate than long-term loans. Interest rate is higher on unsecured loans than secured loans.

This is relevant in bank’s investments in government securities, which are risk free, and therefore the interest rate is low and so also ‘AAA’ rated bonds issued by corporates carry a lower coupon rate than the bonds that are lowly rated and junk bonds which carry higher coupon rate and it is due to risk perception. In other words default risk, liquidity risk, tax and maturity of loans have an influence on the interest rate.

Thus interest risk has several dimensions which the banker should take care of while managing interest rate risk.

Essay # 16. Market Risk in Banks:

Definition of Market Risk:

Market risk signifies changes in interest rate, currency exchange rate, commodity price, price of securities viz., bonds and shares. Market rates change on account of demand and supply positions and very often compounded by external factors, to which market responds.

Market risk affects the bank’s earnings and asset value and consequently the capital requirements on account of the adverse movements in market price/ rate viz. interest rate, foreign currency rate, prices of securities and shares and commodities. The volatilities of the changes are assessed in terms of value of assets and duration of impact. Hedging is one way to manage the risk arising out of change in the market determined interest and price of currency or commodity.

Classification of Market Risk:

Market risk is classified as delta risk, gama risk, indirect risk, settlement risk and pre-settlement risk.

a. Delta Risk:

Delta risk is fall in bond price when the interest rate goes up. Large fall in bond price on account of large change is gama risk.

b. Indirect Risk:

Fall in the present value of cash on account of adverse change in interest rate although contract is duly fulfilled is called indirect risk.

Settlement Risk is the failure of counterparty to fulfill the obligation on due date and if it is announced even before due date, or it is evident that obligation will not be met it is called pre-settlement risk.

Market Risk Management:

Management of market risk is concerned primarily with the adverse movement in the value of banks assets arising out of the change in the market determined rate or prices such as interest rate, currency rate, equity prices, commodity prices without corresponding movements in the value of the liabilities to offset them. (Interest and currency rates have been dealt with separately) equity price change affects the investment portfolio and the commodities price change affect the bank when it is held for trading like gold and also for the loan given against commodities. It will be relevant to note that the banks in many other countries trade on commodities on their own account for profit.

The factors causing the changes in market prices are:

(i) Severe economic downturn

(ii) Collapse of market

(iii) Currency devaluation

(iv) Asset liability mismatch

(v) Fall in credit rating of assets.

In view of the serious consequence of the risk to banks the Basel committee issued guidelines on market risk and advised the banks on capital adequacy on account of market risk among other risks.

Basel II provides methods to measure market risk, by way of a simple standardized approach and a complex internal measurement model which use qualitative and quantitative tools of measurement.

It also provided detailed specifications on market risk factors and stress testing. Calculating, Value at risk (VaR) is the model suggested by Basel committee. VaR is a simple method based on the assumption that how bad things can go? For instance with 95 or 99 percentage of probability how much one can lose over a preset time horizon.

For example Rs.1,00,000/- monthly VaR at 90 percent confidence level indicate that there is 90% chance over next one month that loss will not be more than Rs.1,00,000/. In other word there is only 10 percent chance of loss over a month. Another popular method is standard deviation. They are easy and practical way to measure the risk but not perfect and fool-proof method.

However, these calculations will help to hedge the risk by using derivatives and more importantly to fix appropriate limit on exposure taking into account various risk factors. It is also necessary to use stress testing to decide on risk magnitude in unusual situations.

Essay # 17. Operational Risk in Banks:

The financial system is becoming more complex and diverse due to deregulation and globalization. Changes in computing and communication aided by technological changes coupled with international competition increased the complexity. Core banking solutions have become the order of the day.

The convergence of technology platforms and protocols made global banking and interbank operations easy. But changes did not come without a price. They increased the risk profile of the banks. Banks are now confronted with not only traditionally known credit risk and market risk but many more risks. Collapse of Barring Bros of U.K. and the Subprime crisis of USA speak volumes about operational risk.

Such crisis have occurred in India too like Harshad Metha episode and Ketan Parikeh episode. Emergence of newer risks, mitigation instruments like credit derivatives, securitization and other derivative instruments have given rise to hitherto unknown risks.

Human omissions and commissions in day to day operations exposed the banks to operational risk. The simple task of Bank’s interoffice reconciliation has fallen into arrears for years. In value terms it is running into hundreds and thousands of crores which is yet another time bomb waiting to explode. However, position has improved considerably in all the banks on account of full computerisation.

The true dimensions of the operational risk although huge did not evoke much concern among the bankers as in the case of credit risk and market risk. The operational risks are not systematically identified, assessed, analysed and action plan drawn to manage them.

It is in this context the Basel Committee on banking supervision published its paper on operational risk management in order to help the bank to recognise operational risk as a major risk. It has facilitated the banks to familiarize themselves with operational risks and take steps to contain or mitigate the risk loss.

Basel committee defined operational risk as “The risk of loss resulting from inadequate or failed internal process, people and systems or from external events”. They have also categorized important items of risk viz., Fraud, flawed products, irregular business process, system failure, business disruptions, wrong execution and delivery, employees failure, theft, terrorism, vandalism, failed reporting, illegal or unapproved access to operating system and assets (cash, gold, etc.) outsourcing etc.

In other words operational risks emanate from many directions. Operational risk refers to system failure, mismanagement of information, faulty process, laxity in monitoring and reporting action and activities, lack of or inadequate rules, lack of internal guidelines and procedures or non-observance of the rules and procedures. Remedial measures consist of effective supervision and control, proper follow up, audit and inspection, training and skill development for staff.

System and technology development and its application cover wide range such as storing external data, research data, trading desk operations, Asset liability management, General management, etc. it is a source of valuable support but there lies great risks in data security, system failure, disaster and the consequent operation break down, computer fraud etc.

Risks related to system and technology are one of the important areas of operational risk management. It relates to technology breakdown, security lapses, communication gap, computation error, valuation error, oversight and supervision laxity, accounting lapses, fraud and non-compliance of regulatory requirements.

Environmental risk is yet another operational risk which consist of violations of laws, injury or death on account of environmental hazards, pollutions of various kinds (Air, Water, Noise, etc.).

Generally banks and financial institutions may not be directly involved in environmental damages. But they arise on account of the customers, who are financed by the banks. Unenforceability of contracts, events such as war, natural calamities, political upheaval cause operational risk.

A broad canvass of operational risk can be summarized as under:

(1) Business environment

(2) Business strategy

(3) Business process

(4) People

(5) I. T. System

(6) Control system

In addition to Basel II and III norms for banks ISO 31000 and 31010 norms also provide operational risk management frame work.

The bank that take a strategic and holistic approach to operational risk management will be better placed than those who take tentative or reactive approach. In order to coordinate and control risk management there should be a chief risk officer with well-equipped staff contingent. They should assess the organization risk, prioritize them to facilitate action in time.

They have to identify key risk indicators and be futuristic in their approach and action. It is more important to anticipate intelligently and act promptly, than to react to risk situations post facto. To this end internal data has to be collected first and also external data relating to other organizations and compare it. The analysis can be quantitative and / or qualitative, while quantitative will be numerical qualitative will be impressionistic.

Generally there is no precise way to measure operational risk. However, it can be monitored and mitigated and the usual way to measure is based on audit report rating and actual loss.

ii. Operational Risk Management:

Every bank, like every person is unique. The age and size of the bank, geographical spread and branch network, volume of business, use of technology and its standard, top management policy and perception of businesses and risks, organizational cultural and values have a bearing on the risk profile of the bank.

A good management information system (MIS), strong internal control, and efficient planning are critical elements of effective operational risk management. Basel norms insist upon developing a sound policy and management practices to tackle operational risks.

The other significant risks like credit risk, market risk, interest rate risk, currency risk should be managed along with operation risk in an integrated fashion in the context of three pillars of Basel accord viz.

(i) Minimum capital requirement

(ii) Supervisory review process and

(iii) Market discipline.

To summarise causes and remedial measures of operational risk:

1. Inadequate control and supervision:

Here internal audit and external audit play important role, more particularly risk focused audit.

2. Incompetent staff:

Here institutional training and on the job training are the remedial action.

3. Inadequate / incomplete procedure and practices:

The auditors should point out the deficiencies and suggest corrective measures.

4. Technology failure:

It can be on account of internal or external causes. If technology is not cost effective it is also a risk.

5. Unreliable data:

Inefficient collection and storage of data. Need to improve the efficacy of MIS system.

6. Political changes / action:

Take new steps or modify the existing practice

7. Legal and regulatory lapses:

Being up to date and thorough in laws and regulations.

8. Staff dishonesty and fraud:

To a great extent depends on corporate culture, work ethics and corporate governance. To this end effective control system is also important.

Essay # 18. Asset Liability Management in Banks:

Asset Liability Management (ALM) is important for every organization and more so for banks. In simple terms asset liability management means ability to comply with regulatory requirements and meet customers’ demands out of the resources generated by way of deposits, borrowings and capital.

The main purpose of ALM is to generate surplus (Profit) by earning more by way of interest, commission etc. over the payments of interest and other charges by the bank. In other words critical issue is fixing right rate of interest on loans and deposits. It is also the means to increase net worth and net interest income. It therefore calls for efficient management of assets and liabilities viz. deposits, money market and other borrowings on the liability side and loans, investments, etc. on the asset side.

Another point is matching the maturity of loans and deposits. Large chunk of short term deposits with long term loans will cause strain on asset liability management on the other hand. Large chunk of long term deposits with substantial short term loans may cause reinvestment problems and may not be cost effective an ideal MIS is important.

The objective and scope of asset liability management cover duration of Loans and Deposits and interest sensitivity (overall impact of fail or rise in interest rate). ALM is therefore concerned with interest risk, liquidity risk, credit risk, currency risk, capital risk, etc. To manage all these issues in every bank there is asset liability management committee (ALCO).

Essay # 19. Counterparty Risk in Banks:

Counterparty risk is the inability or unwillingness of a customer or a counter party to meet the commitments in relation to lending / trading / hedging / settlement of any financial transaction. It can be for financial or non-financial reason and it can also be intentional or otherwise. When the counter party is a bank or financial institution it is called solvency risk.

The term counterparty is used in securities, shares and derivatives trade which refers to individuals or institutions who have to fulfill certain contractual obligations. It is not used to refer default of the borrower in a lending operation.

Essay # 20. Environmental Risk in Banks:

Worldwide there is growing concern on global warming and compelling need for environmental protection and sustainability. Most countries have passed laws on the subject and put in place regulations. These laws stipulate restrictions and restraints. They at the same time provides business opportunity for the banks to finance pollution control, generating renewable source of power, improving sustainability of environment.

The environmental risk is defined as the likelihood or probability of injury, disease or death from environmental hazard, water pollution, air pollution, industrial waste management etc. while these lapses are not usually caused by banks, they are involved in financing those industries which cause such damages.

Banks should be careful in insisting upon the borrowing units to get environmental clearance and also maintain required standard in their operations. Violation of environmental laws and regulations attract penalty.

Essay # 21. Currency (Foreign Exchange) Risk in Banks:

Definition of Currency Risk:

Forex risk relates to loss in the earnings on foreign currency transactions. The loss arises out of fluctuations in the rates between domestic and foreign currency. It affects day to day earnings on foreign currency transaction and also value of assets denominated in foreign currency. The risk in foreign exchange transactions mainly consist of high volatility in the rate and counterparty risk generally known as settlement risk and pre-settlement risk.

Rate Fluctuations:

The currency value is influenced by real rate of interest, balance of international trade, inflation and the state of economy. Globalisation resulted in substantial increase in international trade, which has foreign exchange component and it is handed by banks.

Banking sector contribute substantial value of foreign currency dealings. In view of high volume, and worldwide operation covering countries in all time zones the risk involved in settlement is high. The risk is global. A serious crisis in any one country, big or small (USA or Greece) will have repercussion in all other countries even if they have very little dealings with the particular country.

Many companies have something to import or something to export and to some others substantial portion of business relate to import/export. Both big and small companies get affected due to adverse change in currency rate, more particularly small time exporters suffer badly.

They are relevant to bank because all of them will have bank borrowings and they Buy/ Sell foreign currency through banks who in turn buy it in the international market. It is pertinent to note that overwhelming portion of currency trade relates to trade for profit and somewhat speculative in nature and not related to genuine trade on commodities and services. This cause volatility in rates.

Stable Rate:

If the home currency depreciates it affects the country in different ways. The imports become costly but at the same time it may help the exporters to certain extent. If the home currency become strong and appreciates it affects export to some extent. So what is required is a relatively stable and steady exchange rate. It is important because it will enable the industry and business in planning and for-casting their cash flow and profit.

In our country Reserve Bank control and manages the currency rate fluctuations. However, the business community should be alert and make intelligent predictions. It is more important to banks who handle large volume in foreign currencies to be familiar with Forex Market.

Essay # 22. Settlement Risk in Banks:

Another risk is settlement risk. As the banks buy and sell in the international market there are always chances of one or more dealers failing in their obligations. In such cases if the banks’ exposure is large in a currency, and the market is unstable and turbulent, raising currency from alternative source to meet the obligation will pose serious difficulty.

In currency trade there are a number of speculators (not genuine importer or exporter) whose activities cause volatility in currency value. As currency (Dollar or Euro) is traded internationally banks in any one country cannot control or predict in advance the volatility in the value of currency.

Soverign risk or country risk is another dimension to the problem. Some countries for domestic reasons, impose restrictions on their citizens and business enterprises in fulfilling their contractual obligations to foreign counter parties. Similar situation can also arise on account of political disorder, instability and chaos. The risk is always managed by hedging the currency deals through derivative contracts viz, forward, option and swap.

Essay # 23. Legal/ Regulatory Risk in Banks:

Legal risk arise on account of legal action initiated against the borrowers by the bank or suits filed by customers / staff against the bank or legal action of appropriate authorities or affected individuals for violations of environmental laws, etc. Legal and regulatory risks cover the adverse impact of new rules and regulations as well as non-observance of rules and regulations. These risks are not unexpected happenings, it is more due to omissions and commissions of the bank / financial institutions.

Civil Laws:

Bankers at every level should be knowledgeable and up to date on the laws of the country more particularly those which exclusively govern the banking. Any violations and lapses will invite penalty. Legal issues can arise from customer lapses like non-payment of loans, non-fulfillment of contracts, forgery, fraud etc. Any legal case is a cost to the bank by way time loss and money loss. Therefore the legal risk is costly and perhaps avoidable. Bankers should be familiar with all laws and avoid as far as possible legal cases.

Criminal Laws:

In addition to civil laws there are laws governing criminal acts which affect the banks. The relevant acts are, Anticorruption laws, Anti-money laundering and Terrorism funding laws. More often the banks are victims of the crime. Sometime the bank staff knowingly or unknowingly violate the criminal laws. Meticulous observation of KYC norms, corporate governance, maintenance of accepted moral and ethical standard and good corporate culture are the preventive measures.

Regulations:

What applies to civil and criminal laws applies to regulations. Most countries have established regulatory bodies for banks, insurance companies and stock market operations. These bodies have power of supervision, monitoring and take penal action. Regulations are as important as laws and they have the force of law. Non-compliance or violations will attract penalty. It is needless to add that ignorance of law and regulations is not an acceptable excuse for lapses.