Here is an essay on the ‘Derivative Products Used by Bank Treasuries’ for class 11 and 12. Find paragraphs, long and short essays on ‘Derivative Products Used by Banks’ especially written for school and banking students.

Essay on the Derivative Products

Essay Contents:

- Essay on Derivative Products

- Essay on OTC and Exchange Traded Products

- Essay on Forwards, Options, Futures and Swaps

- Essay on Interest Rate and Currency Swaps

- Essay on the Development of Derivatives in the Indian Markets and RBI Guidelines on Risk Exposure

Essay # 1. Derivative Products:

Derivatives are market products widely used by bank treasuries. Treasury uses derivatives chiefly (a) to manage risk, including ALM risks, (b) to cater to the requirements of the corporate customers and (c) to trade, i.e. to take a trading position in derivative products. While cross currency derivatives existed for long, Rupee derivatives are of fairly recent origin, and use of certain derivative products is still regulated by RBI.

A derivative, as its name suggests, does not have an independent value. The value of a derivative is derived from an underlying market. The market may be financial market, or commodity market, or an index of market prices. Financial markets relate to products such as foreign exchange, bonds and equities. Commodity markets may cover any commercial product, ranging from oil and gold to cotton and wheat.

Of late, derivative products have been developed relating to events such as rain fall or weather, as they in turn affect demand for say, agro-products and utilities such as air-conditioners respectively. Forward contracts for exchange rates, conventionally used by exporters, importers, traders and banks are also part of derivative family.

A derivative is a financial contract, specifying an underlying which is a price or rate or an index related to a financial product or market, based on a notional amount and/or specific payment provisions, with clear settlement terms. By definition, derivatives always refer to a future price and the value of derivative depends on spot market.

Essay # 2. OTC and Exchange Traded Products:

Banks may structure a derivative product to suit the requirement of an individual client – based on his risk appetite, size of transaction and maturity requirements. For instance, a bank may offer to a client a forward contract or option for sale of USD on a future date, for whatever period or amount desired by the client. The derivative products that can be directly negotiated and obtained from banks and investment institutions are known as Over-the-Counter (OTC) products.

There are also standardized derivative contracts, for a specified sum and for specified period, which are purchased or sold on an exchange. These are exchange traded derivatives, traded on a futures exchange. A forward contract traded on a futures exchange is called a futures contract. Exchange traded derivatives include currency futures, interest rate futures, commodity futures, stock and index futures, as well as options.

Some of the futures exchanges are organized independently (e g Chicago Mercentile Exchange, Eurex, London Financial Futures and Options Exchange – now Euronext.lfffe, MCX of India), or at times associated/or merged with stock exchange (e.g. Hong Kong Exchanges & Clearing, SGX of Singapore, NSE in India).

Essay # 3. Forwards, Options, Futures and Swaps:

In India, derivatives are used for hedging underlying currency, interest rate and commodity risks. Trading in currency and interest rate derivatives is restricted to authorized banks, except in futures market, where individuals, corporates and other entities can freely participate (subject to restrictions on non-resident entities). We shall confine this discussion to currency and interest rate derivatives only.

Derivatives are basically of three kinds:

1. Forward contracts,

2. Options and

3. Swaps.

Futures are part of forwards, where execution of contract at a fixed rate is obligatory.

1. Forward Contract:

Forward contract is a contract to deliver foreign currency on a future date at a fixed exchange rate. This is an OTC product where the counterparty is always a bank. An exporter enters into a forward sale contract of his export proceeds denominated in USD. A 3-month forward sale contract at 49.00 implies that on expiry date, the exporter can sell the contracted amount to the bank at Rs. 49 per dollar, irrespective of prevailing market rate.

The exporter is protected from the exchange risk, even if, Rupee in the meantime appreciated to say, Rs. 45. Similarly, a forward purchase contract protects importers from depreciation of Rupee. Forward purchase or sale contracts can be used to hedge currency risks in cross-currency deals also, as forward contract being simplest of the derivatives, is available in most currencies.

Delivery of currency must be given or taken, as per contract terms, on the expiry date of the contract, otherwise the contract will be cancelled and the difference between spot rate and forward rate will be credited to or recovered from the counterparty. On request banks may allow delivery to take place within a month before the expiry date. This facility is known as forward option, where bank would quote forward premium (discount) applicable to either start date or end date of the option period, whichever is worse to the client.

Forward rate, as we stated earlier, represents interest rate differential of the two currencies. The forward rate is either at premium or discount to the spot rate. The currency carrying higher rate of interest is always at a discount. For instance, domestic interest rate of Rupee is generally higher than interest rate of USD, hence Rupee is at a discount to Dollar, or Dollar is at premium vis-a-vis rupee.

By implication, forward rate of USD/INR is higher than spot rate, or, dollar on a forward date is worth more rupees than today. Same is case with Euro/USD – interest rate of EURO is higher than interest rate of USD, hence forward EURO is at a discount to USD.

In case of free currencies, forward premium or discount is exactly equal to the difference between risk- free interest rates of the two currencies. However, in case of USD/INR, it is not always so, as Rupee is not yet fully convertible. The forward exchange rate of USD/INR therefore is also affected by supply and demand for forward dollars.

Forward contract is ideal as a hedging instrument to achieve zero risk, as the contracted rate fixes the value of forward dollars, irrespective of market movement. However, the holder of a forward contract cannot get the benefit of market rate, if it is better than the contracted rate, on the date of utilization – which is a disadvantage known as opportunity cost.

2. Options:

Options refer to contracts where the buyer of an option has a right but no obligation to exercise the contract. Options are either put options or call options. Call option gives a right to the holder to buy an underlying product (currency/bonds/commodities) at a prefixed rate on a specified future date. Put option gives a similar right to the holder to sell the underlying at a prefixed rate on a specified future date 01 during a specified period. The prefixed rate is known as the strike price. The specified time is known as expiry date.

Options are divided into two types according to their mode of settlement. An American type option can be exercised any time before the expiry date. European type option can be exercised only on the expiry date. In India we use only European type of options.

A currency option gives the holder option to buy or sell a currency at strike price on expiry date. Put option is a right to sell the currency at strike price, and call option is a right to purchase the currency at strike price, the options being exercisable on their expiry date. A Dollar put/JPY call option, for USD 1 million with strike price at 105 and expiry after 3 months, gives the holder right to sell USD or purchase JPY, at the rate of 105 JPY per dollar, on expiry date.

If on expiry date market rate is 108, the option holder will not exercise put option, as he can get more yen per dollar in the open market. If the exchange rate on the expiry date is 100, the option buyer will definitely exercise the option on the expiry date, as the strike price is better than market price. In the latter case, the option will be net settled, i.e., the counter-party pays the holder 5 yen per dollar, being the difference between strike price and spot rate.

The option is known to be at-the-money (ATM) if the strike price is same as the spot price of the currency. In the context of European option, the spot rate is the rate prevailing on the maturity date, hence it is actually forward rate as on the date of buying the option. The option is at-the-money, therefore, when the strike price is same as forward rate on the start date.

The option is in-the-money (ITM), if the strike price is less than the forward rate in case of a call option, or, if the strike price is more than forward rate in case of a put option. The option is out-of-money (OTM), if the strike price is more than the forward rate in case of a call option, or, if the strike price is less than forward rate in case of a put option. To put simply, ITM is when the strike price is better than the market price, and OTM is when the strike price is worse than the market price.

Premium is the price of an option payable upfront. Option premium has two components. Intrinsic value of an ITM option is the difference between the strike price and current forward rate of the currency, or zero whichever is less. Intrinsic value cannot be negative. The ATM and OTM options do not have any intrinsic value. The option price less the intrinsic value is time value of the option. The time value is maximum for an ATM option, and decreases with the option becoming more and more ITM or OTM, as the expiry date approaches.

Some of the important features of options are:

i. The buyer of an option has the right (but no obligation) to exercise the option at strike price, irrespective of market price prevailing on the expiry date. Hence his profit potential is unlimited. The seller of the option is obliged to buy/sell to the holder of the option at the strike price, irrespective of market price; the option-seller’s potential loss is therefore unlimited.

ii. The option is based on an amount which is only notional, as only difference in rates is exchanged in net settlement. The price of an option is much smaller than the notional value; the traders and speculators therefore do not require large investments to trade in options (known as high leverage)

iii. The buyer of an option pays premium to the seller for purchase of the option. Option premium is the price of the option, payable to the option-seller upfront. The premium depends on the volatility of the underlying market, the expiry date (maturity), interest rates and the strike price – the factors that determine the risk to the seller. Option premium increases with the volatility of the markets, maturity and intrinsic value of the option.

iv. Option premium or the price of option is higher or lower based on intrinsic value and time value of the option. In the money options are costlier than out-of-the money options. Time value is linked to residual maturity – longer the maturity, costlier is the option.

v. The option always has two legs. A put option on USD at USD/JPY strike (right to sell USD against JPY at rate X) is also a call option on JPY (right to buy JPY against USD payment at X rate). The option may thus be described as USD put or Yen call at, say, 105.

vi. In financial markets, the underlying product may relate to currency, bonds or equity. A call option on a bond gives right to buy the bond at a prefixed price (strike price). Since the price of a risk-free bond reflects the prevailing interest rate, the bond option also becomes an interest rate option – just as currency option is in effect, an exchange rate option.

vii. Options are primarily used as a hedge against price fluctuations. It is similar to insurance against adverse movement of prices, where the risk is transferred to others who are more tolerant of the risk or who have an opposite kind of risk to mitigate. For instance, an exporter would like Rupee to depreciate so that his Rupee income would increase; while the importer would benefit from appreciation of Rupee so as to reduce his Rupee cost. A bank as an intermediary sells a USD put option to the exporter, and a USD call option to the importer, fully or partially mitigating the risk. Forex traders who have USD/ Rupee payment obligations, or who have taken positions in the exchange market may likewise buy protection through options.

viii. A stock option is the right to buy or sell equity of a company at the strike price. For instance, a put option on 1000 Maruti equity shares at Rs. 500 with expiry on 30th June 2010, means if the stock is trading below Rs. 500 on the expiry date, the option-holder can still sell his Maruti shares to the seller of the option, at Rs. 500 per share. If the price on the expiry date is above the strike price of Rs. 500, the option-holder would naturally prefer to sell his shares in the open market and does not exercise the option. Options are also available on the stock index. A put option on BSE SENSEX offers protection to the holder against a fall in the index. A call option on the index, on the other hand, protects a potential buyer of stocks, from rise in the index.

ix. An option without any conditionalities is called plain vanilla option, which is ideal for hedging. However, there are various combination of options (option products), which effectively reduce the premium by sacrificing some upside benefit, or by adding an element of market risk acceptable to the holder. Some of the basic structures are zero cost options, where there is no premium payable, but there is a corresponding risk, e g the holder (importer) agrees to pay a higher rate if market rate rises beyond a specified level (range forwards), or the option protection is lost if market moves in a specific direction (barrier options).

There are complex structured products making use of different types of options, often combining with other derivatives, and covering different markets simultaneously, to suit requirements of some customers. Such products, often called exotics as they bundle together different risks, are highly risky and are generally not suitable for hedging market risk.

As a hedge, currency options are similar to forward contracts.

3. Futures:

Futures are forward contracts traded in a futures exchange. Under a futures contract the seller agrees to deliver to the buyer a specified security/currency or commodity on a specified date, at a fixed price. Futures relating to exchange rates (currency futures), Interest rates (bond futures) and equity prices (stock/index futures) are known as financial futures, as distinct from commodity futures (oil/metal/ agro-products etc.). Futures contracts are of standard sizes with prefixed settlement dates.

Currency futures are traded for major currencies (EURO, GBP, JPY, CHF, AUD and CAD) in terms of USD. A contract of GBP 25000 is traded at LIFFE for delivery on 28 March, say at 1.6650, as against spot exchange rate of 1.60. The contract implies that on 28th March the seller would deliver to the holder of the contract, GBP 25000 against payment of equivalent USD at the rate of 1.6650.

On the settlement date, if the market rate of GBP is 1.70, the seller will pay to the holder the difference in contracted price and spot price on that date (1.70 – 1.6650 = USD .035 per Pound). If the market price is less than the contracted price, the buyer of the contract will bear the loss. Unlike in options, the contract must be executed by both the parties.

While the futures contract works like a forward contract, there are three important differences:

(i) The buyer and seller of the contact do not deal with each other but they deal with the Futures Exchange as counter party – the Exchange guarantees performance of the contract,

(ii) Technically, the contract is settled each day, in the sense the contract is marked-to-market daily, and losses if any are recovered from the holder by way of margin. Gains if any are also credited to the margin account, and

(iii) Unlike forwards, futures contracts are actively traded on the exchange, the contracts are bought and sold several times during the day.

In India, futures market for USD/INR commenced in August 2008. The contract size is USD 1000 and all settlements take place in Rupees. Trading in cross-currency – Rupee contracts (Euro/INR, GBP/ INR and JPY/INR) has also commenced from last quarter of 2009. Currency futures are traded actively in the futures segment of NSE, and in the MCX-SX (promoted by the commodity exchange, MCX), with aggregate daily turnover exceeding USD 7 bn (March 2010). However, there is little liquidity in contracts maturing beyond 3 months.

Interest rate futures are contracts written on fixed income securities (Treasury bills, bonds etc.) of specified size. Contracts written on treasury bills trade in short-term interest rates, while contracts on treasury bonds or corporate bonds deal in medium and long-term interest rates. Interest rate futures are most popular instruments to hedge interest rate risk.

Treasuries, being risk free instruments, indicate movement in market rate of interest. The Treasuries are traded at a discount, the discount being equal to interest rate for the period. A futures contract of USD 1 million, for 1 year on a Treasury bond trades at 96 if the expected interest rate at the end of the period is 4% (i.e. 100-4 = 96, futures price).

The price of the contract fluctuates daily according to the perception of interest rates for the residual maturity. T-bill futures are traded with US treasury bills and notes as underlying instruments, while Euro Dollar bonds are traded on the basis of LIBOR, or inter-bank deposit rates outside USA. The contract size, delivery terms and trading practices differ from exchange to exchange.

Interest rate futures help hedge interest rate risk. The hedge is based on the inverse relationship between the interest rates and bond prices, i.e. if the interest rate goes up, bond prices come down, and bond prices would move up if interest rates decline. If a corporate expects to borrow USD after 3 months, but would like to lock into the current interest rate, the corporate will short sell the 90-day treasury futures contract of comparable size. If the interest rates rise on the date of availing the loan, the bond price would have correspondingly fallen, and the profit earned on the T-bill futures would compensate for the higher interest on loan amount.

Rupee interest rate futures market in India was originally launched in 2003, but the attempt failed for various reasons. With the initiative of RBI and SEBI, the interest rate futures market was relaunched in Aug 2009. The contract size is Rs. 2 lacs and is based on a 7% synthetic 10-year Government security. However, liquidity continues to be low and the market is yet to take off, mainly on account of delivery related problems.

All futures contracts are of standardized size; hence several contracts need to be purchased to hedge an underlying exposure fully. If an exporter needs to hedge receivables of USD 560,700, he would need to buy 561 forward sale contracts of USD 1000 each, aggregating to USD 561,000. The small difference between the face value of the contracts and the exposure constitutes what is called ‘a basis risk’.

Essay # 4. Interest Rate and Currency Swaps:

Interest Rate Swaps:

A swap is an exchange of cash flow. An interest rate swap is an exchange of interest flows on an underlying asset or liability, the value of which is the notional amount of the swap. In a swap, basis for calculation of interest is changed according to the requirement of the borrower (or, lender).

An interest rate swap is shifting of basis of interest rate calculation, from fixed rate to floating rate, floating rate to fixed rate or floating rate to floating rate (based on a different benchmark rate). The cash flows representing the interest payments during the swap period are exchanged accordingly.

To illustrate, assume a company is paying a fixed rate of interest at 7% on its 5-year debenture. As the interest rates are on a declining trend, the company would benefit if the interest rate is linked to market rate of interest. The company enters into an interest rate swap with their bankers exchanging the fixed rate with floating rate, with 3 month T-bill rate as benchmark rate. If the swap equivalent of 3-month bill rate is 5%, the fixed rate will be swapped into floating rate based interest of T-bill + 2%.

Every three months bank pays the company interest at 7% (which neutralizes the interest payable on the debenture) and the company pays back to the Bank interest at T-bill + 2% (which will henceforth be actual cost to the company). Assuming that the 90-day T-bill rate next quarter is 4%, the company will pay to the bank 6% (= 4 + 2), and receives from the bank 7%. The saving to the company is 1%, reflecting the fall in the market rate of interest.

The T-bill is a risk-free instrument, issued by Government of India and is widely quoted; hence is accepted as a bench mark for pricing corporate debt instruments. When we say T-bill + 2%, the T-bill is the risk-free market rate and 2% is the credit premium added to it, to make it equal to the fixed rate of 7% originally committed by the company on the debentures.

The interest rates are calculated on a notional amount, which in the above case is equal to face value of the debenture. The bank pays fixed rate as if it has borrowed the notional amount from the company; similarly company pays floating rate as if it has borrowed from the bank, thus the notional amount is never exchanged. The actual payment of the interest is also netted out on interest payment date. If the T- bill rate is higher than 5% at any point of time, the net cash flow would be negative and the Company would be paying the difference to the bank.

If the company already has a floating rate payment, say a 3-month LIBOR related loan, and has a view that the interest rates are going to rise, it would buy a swap paying fixed rate equivalent of 3-month LIBOR for the loan period, and the swap works in the same way illustrated above. Conventionally, the fixed ratepayer is known as the buyer of swap and the fixed rate receiver is the seller of the swap.

The floating rate of interest is always linked to a benchmark rate. A benchmark rate is a risk free interest rate determined by the market, and is widely accepted by market players for its objectivity and transparency. The issuers of debt paper and the lending banks link the interest rate to a benchmark rate acceptable to investors/borrowers, so that the actual interest paid by them reflect the market trends.

For USD, the benchmark rates are generally LIBOR (London Inter-bank Offered Rate) for term lending and Fed Rate (rate charged by US Federal Reserve for lending to banks) for overnight lending. In Indian Rupee market, the most popular benchmark rate is O/N MIBOR (overnight Mumbai Inter-bank Offered Rate) which is the one-day money market rate in the inter-bank market.

The MIBOR is announced daily at around 9.50 a.m. by NSE, who polls the rate from several banks and take an average rate, after deleting extreme top and bottom rates. Though O/N MIBOR is a overnight rate, it is used as a base rate for short- term and medium-term lending also.

In term lending, constant maturity swaps (CMU) based on G-sec yields are also popular. The INBMK swap rates are available on Reuter screen. Other benchmark rates used in Indian markets are 90 day T-bill and CP rate index. Market practices on adopting different benchmark rates are standardized by FIMMDA (Fixed Income, Money Market and Derivatives Association) which is a self-regulatory agency for debt market.

MIFOR for 3 months/6 months is also a benchmark rate, announced daily by Reuters, for term lending. MIFOR is a combination of LIBOR and forward premium of USD/INR, and is particularly suitable for foreign currency borrowings swapped into Rupees. However, RBI has permitted MIFOR to be used as a benchmark rate only for inter-bank dealings. Corporates are not permitted to use MIFOR as benchmark rate.

A floating to floating rate swap (also known as basis swap) involves change of benchmark rate. If a company, having opted for a T-bill linked rate, later prefers to have a base rate of MIBOR, they can enter into a swap whereby they receive T-bill rate and pay MIBOR linked equivalent rate.

Interest Rate Swap (IRS) is an OTC instrument normally issued by a bank. There is a variety of interest rate swaps and swap structures. Quanto swaps refer to paying interest in home currency at rates applicable to a foreign currency (now prohibited in India). Coupon swaps refer to floating rate in one currency exchanged to fixed rate in another currency. There are also swaps which collapse at a knockout level of market rates and swaps with built-in options, known as swaptions. In Indian Rupee market only plain vanilla type swaps are permitted.

The type of IRS depends on the client’s requirement – if they have to pay a fixed rate on a long-term borrowing, which funds are used to meet working capital requirement, the working capital typically being a 3 month cycle, they may need to convert fixed rate borrowing into floating rate.

There may be other clients who have opposite requirement, i.e. to convert floating rate into fixed rate. The Treasury also uses IRS for the internal requirement of the Bank, to bridge asset – liability mismatches. The Treasury hedges the residual risk, that is, net position after entering into various swaps, through futures market.

A product closely linked with IRS is forward rate agreement (FRA), where the interest payable for a future period is committed under the agreement. While IRS covers a series of periodical interest payments, FRA is for a single payment in future. If a loan carries interest rate linked to LIBOR, and the interest for next half year is due to be fixed on 29th June, we run a risk that the LIBOR in June may be much higher than today’s LIBOR. We would hence like to fix the interest rate for 29th June now, based on today’s rate.

For this purpose, we need to buy a 6/12 FRA (i.e. to fix interest rate 6 months hence, for the next 6-month period). It is normal practice that the floating rate (LIBOR) for an interest rate payment period is decided in advance, on the last day of the previous period/or (one day before last day, as in the case of LIBOR), but interest is paid at the end of the interest payment period. In case of FRA, the market convention is, the interest settlement takes place at the beginning of the period on 1st July in the above illustration. The interest is duly discounted for the period, and hence the effective rate remains same.

The LIBOR swap rates and rates for FRAs are derived from the risk free Treasury yield curve (G-sec yield curve in India) by interpolation. As the swap market becomes liquid, swap curves based on traded market rates are used for swap valuation.

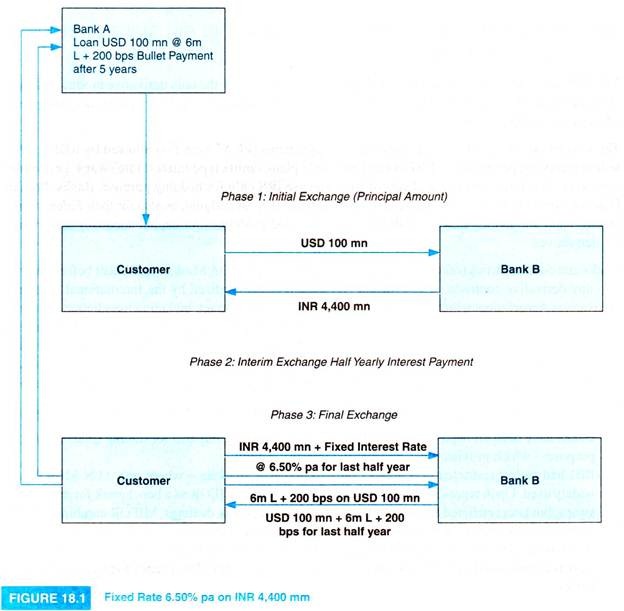

Currency Swap:

A Currency Swap is an exchange of cash flow in one currency, with that of another currency. The cash flow may relate to repayment of principal and/or interest under a loan obligation where the lender or the borrower intends to eliminate currency risk. If only currency is hedged, it will be Principal only Swap (PoS); if only interest rate is hedged, it would be Coupon only Swap (CoS). It is left to the discretion of the client to hedge currency and interest rate risks together, or separately.

The need for a swap arises when there is a currency mismatch. For instance, if a loan is denominated in a currency different from the currency in which revenue is accruing, there is a currency mismatch. Let us assume that an investor in Germany intends to invest in Indian market and hence is in need of Rupee funds. At the same time there is a well rated Indian company needing Euro funds for taking over a company in, say, France.

The German investor is in a strong position to raise Euro funds, at a relatively low rate, as compared to the Indian company seeking to raise a Euro loan. The position is reversed in case of a Rupee loan, where the Indian company, with a good domestic rating, is in a position to raise Rupee funds at a lower rate. It is hence logical that the two parties raise the loans in domestic currencies and swap the loans to serve their respective objectives.

However, it would be a great coincidence if the two parties with complementary requirements (in terms of amount and period of loan) meet each other to derive the advantage of lower rates of interest rates. Banks, as financial intermediaries, are well placed to offer currency swaps to interested clients, without waiting for a matching demand. Banks treasuries may also have their own requirement for currency swaps, either for investment or for trading.

Although interest rate advantage of a domestic company has been historically the logic behind currency swaps, lenders/borrowers enter into such swaps also to derive the benefits of interest rate arbitrage. Several Indian companies have been raising ECB (External Commercial Borrowings) in USD, Euro or JPY, only to swap the loans in to Rupees, the effective cost of loan being much less expensive as compared to a regular Rupee loan.

However there is no arbitrage between major currencies, as the swap cost represents the interest rate differential of currencies. That is because, a swap is a series of currency forwards (forward exchange contracts) and interest rate forwards (FRAs) corresponding to the payment dates. Net interest benefit accrues only if there is difference in credit spread (spread over the risk-free rate, e.g. 6-M LIBOR) of the borrower in the two currencies.

Operationally the three variants of currency swap function as under:

i. Principal Only Swap:

The borrower continues to pay interest in USD terms, but has the benefit of using the principal amount in home currency, without exchange risk. The repayment takes place in domestic currency, at a fixed rate of exchange; hence there is no exchange risk.

ii. Coupon Only Swap:

The USD loan is utilized in the same currency, but interest on USD loan is swapped into Rupee interest – the borrower has to pay interest in Rupees at swap rate; principal repayment is as per original loan terms. Such strategy is useful, if principal amount is hedged by using other derivative instruments (e g options), or if the borrower prefers to leave the position open, in anticipation of appreciation of paying currency (If Rupee appreciates, USD borrows will effectively pay fewer Rupees to settle the debt).

iii. P+I swap:

Without initial exchange – where the borrower has eliminated the currency risk and interest rate risk completely (zero risk) and will pay principal and interest in domestic currency (Rupees) to settle the foreign currency borrowing. The swap cost is included in the rupee interest rate.

If we look closely we find that the currency swap only combines the currency forward rates and interest swap rates for the relevant period, in a structure easily understood by the buyer of the swap.

Essay # 5. Development of Derivatives in the Indian Markets and RBI Guidelines on Risk Exposure:

Till 1998, conventional forward contracts in foreign exchange were the only derivative product available in Indian markets – although cross-currency products, without involving Rupee payments, were freely allowed for hedging purpose.

The interest rate swaps (IRS) and forward rate agreements (FRA) were first allowed by RBI in 1998. Indian banks are permitted by RBI to enter into only plain vanilla type interest rate swaps, i.e. without any exotic structures. Corporate clients of bank can use IRS only for hedging purpose. Banks, Primary Dealers, Financial Institutions and Mutual funds can use IRS for hedging, as also for their balance sheet management and market making. RBI has issued detailed guidelines for capital adequacy requirement for derivatives.

Banks and counterparties (other banks/clients) need to execute ISDA Master Agreement before entering into any derivative contracts. ISDA Master Agreement is standardized by the International Swap and Derivatives Association, which lays down various terms of the contract, including jurisdiction, valuation norms, netting out, credit enhancement, cross-default etc.

The Agreement has been cleared for use by Indian banks by FIMMDA and FEDAI, with the concurrence of RBI. The Master Agreement covers all the transactions between two counterparties globally, and there is no need for any other transaction wise agreement, except for the exchange of usual deal confirmation, specifying the terms of the transaction.

While introducing IRS, RBI has taken some bold steps to encourage the derivative market, including:

(a) Banks have been allowed to use the IRS not only for hedging, but also for trading (market making) purpose – which provision has boosted the treasury activity.

(b) RBI had earlier restricted benchmarks only to domestic markets – where only O/N MIBOR was widely used. Upon representation from banks, RBI allowed MIFOR as a benchmark for interest rate swaps, but later restricted the use of MIFOR only for inter-bank dealings. MIFOR combines LIBOR and forward premium, and is based on active forex market dealings.

(c) RBI has permitted banks under ISDA Agreement, to opt for dual jurisdiction, i.e. under Indian as well as common law jurisdiction. This provision is important for global banks to engage with Indian banks.

USD Rupee options were allowed in Indian market only from June 2003. Banks and corporates can use Rupee/USD options, as also cross currency options only as a hedge for underlying transactions. Banks who intend to trade in option products should meet with the minimum requirements prescribed by RBI (in terms of capital, NPA etc.) and should seek prior permission of RBI. Banks may however use options for their own balance sheet management without any restrictions.

RBI guidelines for use of options are on the same lines as their earlier guidelines for use of forward contracts. Exporters and importers can book, cancel and rebook options and forward contracts for their trade transactions. They are also permitted to book the contracts with the bank on declaration basis (without underlying) subject to a ceiling. Presently, the ceiling is 100% of previous year’s exports (or average of last 3 years whichever is higher) in case of designated exporters and 50% of such turnover in case of others. However options and forwards booked to hedge loans and other term liabilities, once cancelled, cannot be rebooked.

All trading positions in forwards, options and interest rate swaps must be marked to market daily and those hedging trading positions must be marked to market at the same frequency as the underlying position. Use of all derivatives is subject to internal policies of the bank approved at Board level.

During the period 2005-08, banks aggressively marketed structured products, which combined different kinds of options (barrier options, leveraged options, digital options etc.), currency and interest rate benchmarks and cross-currency derivatives. Corporates who could not appreciate huge risks present in these structures, lost heavily over the period. In order to avoid misuse of derivatives, RBI issued detailed guidelines for managing derivative risks, in April 2008.

RBI in particular stipulated that:

(a) Derivative products can be offered only to those corporates who have clearly laid down risk management policy approved at the Board level, and

(b) Banks must have a suitability & appropriateness policy so that they would avoid mis-selling of derivative products.

RBI has also permitted banks to use exchange traded derivatives (viz. currency and interest rate futures) and several banks are already active in the futures market.