Here is an essay on ‘Interest Rate Risk Management’ for class 11 and 12. Find paragraphs, long and short essays on ‘Interest Rate Risk Management’ especially written for school and banking students.

Interest Rate Risk Management

Essay Contents:

- Essay on the Introduction to Interest Rate Risk

- Essay on the Essentials of Interest Rate Risk

- Essay on the Sources of Interest Rate Risk

- Essay on the Effects of Interest Rate Risk

- Essay on the Measurement of Interest Rate Risk

- Essay on the Interest Rate Risk Measurement Techniques

- Essay on the Strategies for Controlling of Interest Rate Risk

- Essay on the Controls and Supervision of Interest Rate Risk Management

- Essay on the Sound Interest Rate Risk Management Practices

Essay # 1. Introduction to Interest Rate Risk:

ADVERTISEMENTS:

Till 1970, the regulatory restrictions on banks greatly reduced many of the risks in the financial system. The deposits were taken in at mandatory rates and loaned out at legally established rates. Interest rates therefore remained unaffected by market pressures. The phrase ‘3-6-3’ i.e., bankers bring in short-term deposits at 3%, lend long at 6% and be home for the day by 3 p.m. became a common reference about the bankers.

In the 50s and 60s, banks considered only the credit and liquidity risks as major constraints on profitability. Deregulation of the banking system in the 70s, however, got many bankers unprepared to manage interest rate risk to which their institutions were suddenly exposed. Many bank failures in the world during 70s, 80s and 90s were triggered out of poorly managed interest rate risks.

Many financial institutions funded their long-term fixed assets with short-term volatile liabilities. So long as deposits and lending rates remained regulated, such funding mismatches were not at all a problem. However, today insulating interest spread against frequent interest rate changes has become the major strategic objective of banks’ management.

The deregulation of the financial system in India has put in place a lot of operational freedom to the financial institutions and the pricing of various assets and liabilities has been left to their commercial judgement. The earning of assets and the cost of liabilities are therefore closely related to interest rate volatility. Thus, interest rate risk, a term totally unknown to the banking industry in India has suddenly becomes relevant.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 2. Essentials of Interest Rate Risk:

Interest rate risk is the exposure of a bank’s financial condition to adverse movements in interest rates. Accepting this risk is a normal part of banking and can be an important source of profitability and shareholder value. However, excessive interest rate risk can pose a significant threat to a bank’s earnings and capital base.

Changes in interest rates affect a bank’s earnings by changing its net interest income and the level of other interest sensitive income and operating expenses. Changes in interest rates also affect the underlying value of the bank’s assets, liabilities, and off-balance-sheet (OBS) instruments because the present value of future cash flows (and in some cases, the cash flows themselves) change when interest rates change.

Market value of an asset or liability is conceptually equal to the present value of current and future cash flows from that asset and liability. Therefore, the rising interest rate increases the discount rate on those cash flows and decreases the market value of that asset or liability. Conversely falling interest rates increase the market value of assets or liabilities.

ADVERTISEMENTS:

Moreover, mismatching maturities by holding longer term assets than liabilities means that when interest rates rise, the market value of assets falls by greater amount than liabilities. This exposes the bank to the risk of economic loss and potentially the risk of insolvency.

Interest rate risk refers to volatility in Net Interest Income (NII) or in variations in Net Interest Margin (NIM), i.e., NII divided by Earning Assets due to changes in interest rates. In other words, interest rate risk arises from holding assets and liabilities with different principal amounts, maturity dates or repricing dates, i.e., ‘rollover rates’.

Accordingly, an effective risk management process that maintains interest rate risk within prudent levels is essential to the safety and soundness of banks. Most of the banks have already identified interest rate risk as a drag on their profitability and have started assessing the magnitude of interest rate risk embedded in their balance sheets.

Interest rate risk is broadly classified into mismatch or gap risk, basis risk, net interest position risk, embedded option risk, yield curve risk, price risk and reinvestment risk.

ADVERTISEMENTS:

Essay # 3. Sources of Interest Rate Risk:

ADVERTISEMENTS:

1. Gap or Mismatch Risk:

A gap or mismatch risk arises from holding assets and liabilities with different principal amounts, maturity dates or repricing dates, thereby creating exposure to changes in the level of interest rate. The gap is the difference between the amount of assets and liabilities on which the interest rates are reset during a given period. In other words, when assets and liabilities fall due to repricing in different periods, they can create a mismatch. Such a mismatch or gap may lead to gain or loss depending upon how interest rate in the market tend to move.

Example 1:

ADVERTISEMENTS:

i. A bank holds Rs. 100 crore liabilities at 9% of one year maturity to fund assets of Rs. 100 crore at 10% with two year maturity. Over the first year, bank is getting a profit spread of 1% amounting to Rs. 1 crore. However, its profits for second year are not certain. If interest rate remains unchanged, the profits will continue to be the same. However, since the liabilities are for one year and need to be rolled over for second year, bank is exposed to interest rate risk.

ii. If the interest rate on liabilities increases to 11% in second year, bank would be incurring a loss of 1%, i.e., Rs. 1 crore in the second year. Conversely bank is again exposed to interest rate risk if it holds shorter term assets relative to liabilities, i.e., liabilities maturing in two years against assets maturing in one year. It then faces the uncertainty of interest rate at which it can reinvest funds after the first year for further one year matching the liabilities maturity.

Example 2:

i. Consider that a bank has invested the proceeds of a 91 days 8% deposit in 91 days T-Bill earning 10% and maturing on the same day as the deposit, the bank will have a matched gap, and there would be no interest rate risk. If the interest rate rises by 100 basis points during the 91-days term of the deposit, the deposit will be renewed at 9% and T-Bill will also mature and the proceeds can be reinvested at the new yield of 11%.

ADVERTISEMENTS:

ii. Thus, the 200 basis points NII will be preserved.

iii. If the proceeds of the 91 days deposit are reinvested in a floating rate loan (repriced at every monthly interval) with an initial rate of 10%, the interest rate earned on the loan will change twice during 91 days, while deposit rate remains unchanged. Since the assets are repriced much more rapidly than the liability during this period, the bank is asset sensitive. The asset sensitive bank can produce a large NII if the interest rate rises in the market because interest rate on floating rate loan moves higher during the 91 days period, while interest is being paid on the deposit remains at 8%. Conversely asset sensitive gap position would cause compression in the NII as interest rates decline.

iv. If bank uses a 91 days 8% term deposit to fund a 5 year fixed rate mortgage loan at 10%, the loan will continue to earn 10%, while the deposit gets repriced at every 91 days interval. The bank is now liability sensitive because the interest paid on its deposit is reset more rapidly than the rate being charged on the loan. A rise or fall in interest rate in a liability sensitive situation has the opposite effect on the NII than on an asset sensitive bank. Any increase in interest rate will cause erosion in the liability sensitive bank’s NII.

Mismatched repricing periods of assets and liabilities is only one form of interest rate risk. There are other forms of interest rate risk, which are inherent in every bank’s balance sheet that can severely affect their earnings.

ADVERTISEMENTS:

2. Basis Risk:

In a perfectly matched gap position there is no timing difference between the repricing dates; the magnitude of change in the deposit rates would be exactly matched by the magnitude of change in the loan rate. However, interest rate of two different instruments will seldom change by the same degree during the same period of time. The risk that the interest rate of different assets and liabilities may change in different magnitudes is called basis risk. The under noted table shows how the basis risk occurs.

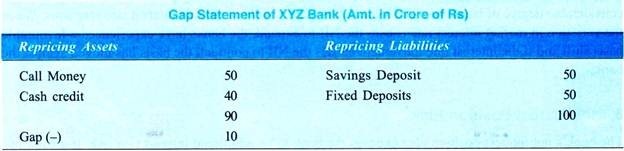

The bank has now a negative gap of Rs. 10 crore. In case the interest rate falls by 1%, which traditional

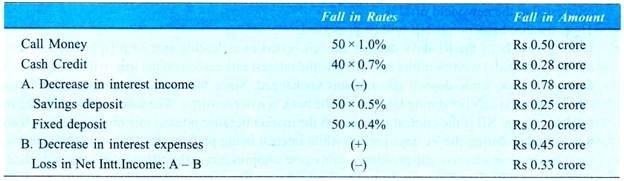

Gap management (assuming rates on all assets and liabilities change by 1%) indicates should improve the bank’s NII by Rs. 1 crore. Instead of falling in the same magnitude, assume that when the rate on call money lending falls 1%, the rate on cash credit falls 0.7%, the rate on savings deposit falls by 0.5% and rate on fixed deposits falls by 0.4%. The undernoted calculations indicate that the bank’s NII would deteriorate rather than improving in terms of the assumption of gap management.

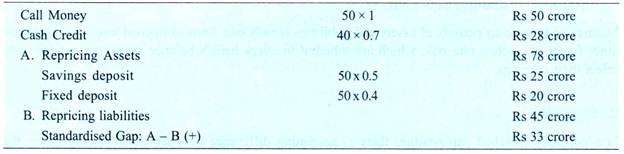

In case the bank believes that the magnitude of change in the interest rate of various assets and liabilities as shown above will be more representative of the future reality than equal changes in all the rates, then it should standardise the gap by multiplying the rupee amount by how much they will change for a given percentage change in one rate.

ADVERTISEMENTS:

The standardised gap of XYZ Bank can be reworked as under:

Thus, the adjusted gap has turned into a positive gap of Rs. 33 crore, against a negative gap of Rs. 10 crore under the traditional gap model. Thus, one or several assumptions of standardised gaps seems more consistent with the real world than the traditional gap.

The degree of basis risk is fairly high in respect of banks that create composite assets out of composite liabilities. The Loan book in India is funded out of a composite liability portfolio and is exposed to a considerable degree of basis risk. The basis risk is quite visible in volatile interest rate scenarios. When the variation in market interest rate causes the NII to expand, the banks have experienced a favourable basis shift and if the interest rate movement causes the NII to contract, the basis has moved against the bank.

3. Net Interest Position Risk:

ADVERTISEMENTS:

The bank’s net interest position also exposes the bank to an additional interest rate risk. If a bank has more assets on which it earns interest than its liabilities on which it pays interest, interest rate risk arises when interest rate earned on assets changes while the cost of funding of the liabilities remained the same.

Thus, the bank with a positive net interest position will experience a reduction in NII as interest rate declines and an expansion in NI as interest rate rises.

A large positive net interest position accounts for most of the profit generated by many financial institutions.

4. Embedded Option Risk:

Large changes in the level of market interest rates create another source of risk to banks profit by prepayment of loans and bonds (with put or call options) and/or premature withdrawal of deposits before their stated maturity dates. In cases where no penalty for prepayment of loans, the borrowers have a natural tendency to pay off their loans when a decline in interest rate occurs. In such cases, the bank will receive only a lower NII.

Example:

ADVERTISEMENTS:

Take the case of a bank which has disbursed a 90 days loan at the rate of 10% which is funded through a 90-day CD at the rate of 8%.

In case the rate of interest decline to 9% after 30 days and the borrower prepays his loan immediately and the bank receives only 200 basis points NII for 30 days rather than the anticipated 90 days. In the remaining 60 days of the 90 days term, the NII will be only 100 basis points.

The embedded option risk is becoming a reality in India and is experienced in volatile situations. The faster and higher the magnitude of changes in the interest rate, the greater will be the embedded options risk to the bank’s NII.

5. Yield Curve Risk:

A yield curve is a line on a graph plotting the yield of all maturities of a particular instrument. Yield curve changes its slope and shape from time to time depending upon repricing and various other factors. As the economy moves through business cycle, the yield curve changes rather frequently. At the intervention of Reserve Bank of India, the yield curve can be twisted to the desired direction by altering the yields on government stocks or different maturities.

Example:

ADVERTISEMENTS:

i. To illustrate how a change in the shape of yield curve affect the banks NII, let us assume that XYZ Bank, used 3 years floating rate fixed deposits for funding 3 year floating rate loans (the deposits and loans are repriced at quarterly intervals). If the bank pays 100 basis point above the 12.50% (91 days Treasury Bills rate), i.e. 13.5% to fixed deposits and charges 300 basis point, above the 364 days Treasury Bills rate of 13%, i.e., 16% on its loans, a NII of 250 basis points is produced.

ii. If the yield curve turns inverted during the next repricing date with the 91 days TBs rate increasing to 14% and 364 days TBs rate remaining at 13°/o and the spread relationship or deposits and loans to TBs remains constant, the NII will be reduced to 100 basis points.

6. Price Risk:

Price risk occurs when assets are sold before their maturity dates. In the financial market, bond prices and bond yields are inversely related. For example, the price of 10-year 14% Government of India stock will receive only lower price than originally paid for, when coupon or stocks of similar maturity has gone upto 15% in the market. The price risk is closely associated with the trading book which is created for making profit out of short-term movements in interest rates.

7. Reinvestment Risk:

Uncertainty with regard to interest rate at which the future cash flows can be reinvested is called reinvestment risk.

ADVERTISEMENTS:

Example:

i. Suppose, XYZ Bank has a zero coupon deposit of Rs. 10,000 and it promises to double the amount with 7 years and uses the funds for investing in a 7-year bonds at an annual coupon of 12%.

ii. In case, the interest rate falls to 5% after one year, the bank could reinvest the coupon cash flows only at 5% against the anticipation of reinvesting the coupon at a fixed rate of 12%. Due to this reinvestment risk, the bank will not be able to repay the entire amount of deposits on maturity.

The bond pricing formula assumes that all coupon payments are reinvested at the bond’s Yield to Maturity (YTM). If the interest rate increases over the life of a bond, coupons will be reinvested at higher yields thereby increasing the reinvestment income. The increase in reinvestment income will increase the realised yield of the bond.

When the interest rate goes up, the bonds price decreases but the bond’s realised compound yield while increase due to higher coupon reinvestment income. On the other hand, when the interest rate declines the bond price increases resulting in a capital gain but the realised compound yield decreases because of lower coupon reinvestment income. Thus, price risk and reinvestment risk partially off-set one another.

The short-term bonds have more investment risk since proceeds of the bonds must be reinvested more and more times. Alternatively, long-term bonds have more price risk. In order to reduce reinvestment risk, banks try to match the duration of their assets and liabilities and not their maturities.

Essay # 4. Effects of Interest Rate Risk:

In this article we will discuss about the changes in interest rates affecting bank’s earnings and its economic value.

This has given rise to two separate, but complementary, perspectives for assessing a bank’s interest rate risk exposure, i.e.:

1. Earnings perspective,

2. Economic perspective, and

3. Embedded losses.

1. Earnings Perspective:

In the earnings perspective, the focus of analysis is the impact of changes in interest rates on accrual or reported earnings. This is the traditional approach to interest rate risk assessment taken by many banks. Variation in earnings is an important focal point for interest rate risk analysis because reduced earnings or outright losses can threaten the financial stability of an institution by undermining its capital adequacy and by reducing market confidence.

In this regard, the component of earnings that has traditionally received the most attention is net interest income (i.e., the difference between total interest income and total interest expense). This focus reflects both the importance of net interest income in banks’ overall earnings and its direct and easily understood link to changes in interest rates. However, as banks have expanded increasingly into activities that generate fee-based and other non-interest income, a broader focus on overall net income – incorporating both interest and non-interest income and expenses – has become more common.

Non-interest income arising from many activities, such as loan servicing and various asset securitisation programmes, can be highly sensitive to, and have complex relationships with market interest rates. For example, some banks provide the servicing and loan administration function for mortgage loan pools in return for a fee based on the volume of assets it administers.

When interest rates fall, the servicing bank may experience a decline in its fee income as the underlying mortgages prepay. In addition, even traditional sources of non-interest income such as transaction processing fees are becoming more interest rate- sensitive. This increased sensitivity has led both bank management and supervisors to take a broader view of the potential effects of changes in market interest rates on bank earnings and to increasingly factor these broader effects into their estimated earnings under different interest rate environments.

2. Economic Value Perspective:

Variation in market interest rates can also affect the economic value of a bank’s assets, liabilities and off- balance-sheet (OBS) positions. Thus, the sensitivity of a bank’s economic value to fluctuations in interest rates is a particularly important consideration of shareholders, management and supervisors alike.

The economic value of an instrument represents an assessment of the present value of its expected net cash flows, discounted to reflect market rates. By extension, the economic value of a bank can be viewed as the present value of the bank’s expected net cash flows, defined as the expected cash flows on assets minus the expected cash flows on liabilities plus the expected net cash flows on OBS positions. In this sense, the economic value perspective reflects one view of the sensitivity of the net worth of the bank to fluctuations in interest rates.

Since the economic value perspective considers the potential impact of interest rate changes on the present value of all future cash flows, it provides a more comprehensive view of the potential long-term effects of changes in interest rates than is offered by the earnings perspective.

This comprehensive view is important since changes in near-term earnings – the typical focus of the earnings perspective – may not provide an accurate indication of the impact of interest rate movements on the bank’s overall positions. Increase in the rate of interest on assets like bonds will reduce the market price of the bonds and when marked to market, its value will be reduced resulting in depreciation in investment.

In this way, ultimately net worth of the bank will be reduced resulting in loss of economic perspective. For example, a 5-year government bond of 10% is held by the bank and now market rate of interest is increased to 12%. It will result in the price of the existing bond on discount, i.e., a Rs 100 bond may fetch a price of Rs 95 only, causing a loss of Rs 5.

3. Embedded Losses:

The earnings and economic value perspectives discussed thus far focus on how future changes in interest rates may affect a bank’s financial performance. When evaluating the level of interest rate risk, it is willing and able to assume, a bank should also consider the impact that past interest rates may have on future performance. In particular, instrument that are not marked to market may already contain embedded gains or losses due to past rate movements. These gains or losses may be reflected over time in the bank’s earnings.

For example, a long-term, fixed-rate loan entered into when interest rates were low and refunded more recently with liabilities bearing a higher rate of interest will, over its remaining life, represent a drain on the bank’s resources.

Essay # 5. Measurement of Interest Rate Risk:

Before risk can be managed, it must be identified and quantified. Unless the quantum of risk inherent in a bank’s balance sheet it measured, it is impossible to measure the degree of risk to which bank is exposed. It is also equally impossible to develop effective risk management strategies/techniques without being able to understand the correct risk position of the bank.

In general, but depending on the complexity and range of activities of the individual bank, banks should have interest rate risk measurement systems that capture all material sources of interest rate risk and that assess the effects of rate changes on both earnings and economic value.

Measurement systems should:

i. Assess all material interest rate risk associated with a bank’s assets, liabilities, and OBS positions

ii. Utilise generally accepted financial concepts and risk measurement techniques

iii. Have well-documented assumptions and parameters

A number of techniques are available for measuring the interest rate risk exposure of both earnings and economic value. Their complexity ranges from simple calculations to static simulations using current holdings to highly sophisticated dynamic modeling techniques based on potential future business activities.

Essay # 6. Interest Rate Risk Measurement Techniques:

1. Repricing Schedules:

The simplest techniques for measuring a bank’s interest rate risk exposure begin with a maturity/repricing schedule that distributes interest-sensitive assets, liabilities, and OBS positions into a certain number of predefined time bands according to their maturity (if fixed-rate) or time remaining to their next repricing (if floating-rate).

Those assets and liabilities lacking definitive repricing intervals (e.g., sight deposits or savings accounts) or actual maturities that could vary from contractual maturities (e.g., mortgages with an option for early repayment) are assigned to repricing time bands according to the judgement and past experience of the bank.

2. Gap Analysis:

Simple maturity/repricing schedules can be used to generate simple indicators of the interest rate risk sensitivity of both earnings and economic value to changing interest rates. When this approach is used to assess the interest rate risk of current earnings, it is typically referred to as gap analysis.

Gap analysis was one of the first methods developed to measure a bank’s interest rate risk exposure, and continues to be widely used by banks. To evaluate earnings exposure, interest rate-sensitive liabilities in each time band are subtracted from the corresponding interest rate-sensitive assets to produce a repricing ‘gap’ for that time band.

This gap can be multiplied by an assumed change in interest rates to yield an approximation of the change in net interest income that would result from such an interest rate movement.

The size of the interest rate movement used in the analysis can be based on a variety of factors, including historical experience, simulation of potential future interest rate movements, and the judgement of bank management:

i. A negative or liability-sensitive gap occurs when liabilities exceed assets (including OBS positions) in a given time band. This means that an increase in market interest rates could cause a decline in net interest income.

ii. Conversely, a positive or asset-sensitive gap occurs when assets exceed liabilities. This means that a decrease in market interest rates could cause a decline in net interest income.

Although gap analysis is a very commonly used approach to assessing interest rate risk exposure, it has a number of shortcomings:

i. First, gap analysis does not take account of variation in the characteristics of different positions within a time band. In particular, all positions within a given time band are assumed to mature or reprice simultaneously, a simplification that is likely to have greater impact on the precision of the estimates as the degree of aggregation within a time band increases.

ii. Moreover, gap analysis ignores differences in spreads between interest rates that could arise as the level of market interest rates changes (basis risk).

iii. In addition, it does not take into account any changes in the timing to payments that might occur as a result of changes in the interest rate environment. Thus, it fails to account for differences in the sensitivity of income that may arise from option-related positions.

iv. For these reasons, gap analysis provides only a rough approximation of the actual change in net interest income which would result from the chosen change in the pattern of interest rates.

v. Finally, most gap analyses fail to capture variability in non-interest revenue and expenses, a potentially important source of risk to current income.

3. Duration:

A maturity/repricing schedule can also be used to evaluate the effects of changing interest rates on a bank’s economic value by applying sensitivity weights to each time band. Typically, such weights are based on estimates of the duration of the assets and liabilities that fall into each time band.

Duration is a measure of the percentage change in the economic value of a position that will occur, given a small change in the level of interest rates. It reflects the timing and size of cash flows that occur before the instrument’s contractual maturity. Generally, the longer the maturity or next repricing dates of the instrument and the smaller the payments that occur before maturity (e.g., coupon payments), the higher the duration (in absolute value). Higher duration implies that a given change in the level of interest rates will have a larger impact on economic value.

Duration-based weights can be used in combination with a maturity/repricing schedule to provide a rough approximation of the change in a bank’s economic value that would occur given a particular change in the level of market interest rates:

i. Specifically, an ‘average’ duration is assumed for the positions that fall into each time band

ii. The average durations are then multiplied by an assumed change in interest rates to construct a weight for each time band

iii. In some cases, different weights are used for different positions that fall within a time band, reflecting broad differences in the coupon rates and maturities (for instance, one weight for assets and another for liabilities).

iv. In addition, different interest rate changes are sometimes used for different time bands, generally to reflect differences in the volatility of interest rates along the yield curve.

v. The weighted gaps are then aggregated across time bands to produce an estimate of the change in economic value of the bank that would, result from the assumed changes in interest rates.

Alternatively, an institution could estimate the effect of changing market rates by calculating the precise duration of each asset, liability and OBS position and then deriving the net position for the bank based on these more accurate measures, rather than by applying an estimated average duration weight to all positions in a given time band. This would eliminate potential errors occurring when aggregating positions/cash flows.

As another variation, risk weights could also be designed for each time band on the basis of actual, percentage changes in market values of hypothetical instrument that would result from a specific scenario of changing market rates. That approach – which is sometimes referred to as effective duration – would better capture the non-linearity of price movements arising from significant changes in market interest rates and thereby, would avoid an important limitation of duration.

Limitations of duration approach are:

i. Estimates derived from a standard duration approach may provide an acceptable approximation of a bank’s exposure to changes in economic value for relatively non-complex banks. Such estimates, however, generally focus on just one form of interest rate risk exposure – repricing risk. As a result, they may not reflect interest rate risk arising, for instance, from changes in the relationship among interest rates within a time band (basis risk).

ii. In addition, because such approaches typically use an average duration for each time-band, the estimates will not reflect differences in the actual sensitivity of positions that can arise from differences in coupon rates and the timing of payments.

iii. Finally, the simplifying assumptions that underlie the calculation of standard duration mean that the risk of options may not be adequately captured.

4. Simulation Approaches:

Many banks (especially those using complex financial instruments or otherwise having complex risk profiles) employ more sophisticated interest rate risk measurement systems than those based on simple maturity/repricing schedules. These simulation techniques typically involve detailed assessments of the potential effects of changes in interest rates on earnings and economic value by simulating the future path of interest rates and their impact on cash flows.

In some sense, simulation techniques can be seen as an extension and refinement of the simple analysis based on maturity/repricing schedules. However, simulation approaches typically involve a more detailed breakdown of various categories of on- and off-balance-sheet positions, so that specific assumptions about the interest and principal payments and non-interest income and expense arising from each type of position can be incorporated.

In addition, simulation techniques can incorporate more varied and refined changes in the interest rate environment, ranging from changes in the slope and shape of the yield curve to interest rate scenarios derived from Monte Carlo simulations. Simulations techniques could be static or dynamic.

(a) Static Simulation:

In static simulations, the cash flows arising solely from the bank’s current on- and off-balance-sheet positions are assessed. For assessing the exposure of earnings, simulations estimating the cash flows and resulting earnings streams over a specific period are conducted based on one or more assumed interest rate scenarios.

Typically, although not always, these simulations entail relatively straightforward shifts or tilts of the yield curve or changes of spreads between different interest rates. When the resulting cash flows are simulated over the entire expected lives of the bank’s holdings and discounted back to their present values, an estimate of the change in the bank’s economic value can be calculated.

(b) Dynamic Simulation:

In a dynamic simulation approach, the simulation builds in more detailed assumptions about the future course of interest rates and the expected changes in a bank’s business activity over that time. For instance, the simulation could involve assumptions about a bank’s strategy for changing administered interest rates (on savings deposits, for example), about the behaviour of the bank’s customers (e.g., withdrawals from sight and savings deposits), and/or about the future stream of business (new loans or other transactions) that the bank will encounter.

Such simulations use these assumptions about future activities and reinvestment strategies to project expected cash flows and estimate dynamic earnings and economic value outcomes. These more sophisticated techniques allow for dynamic interaction of payments streams and interest rates, and better capture the effect of embedded or explicit options.

i. As with other approaches, the usefulness of simulation-based interest rate risk measurement techniques depends on the validity of the underlying assumptions about future interest rates and the behaviour of the bank and its customers, and the accuracy of the basic methodology.

ii. One of the primary concerns that arise is that such simulations do not become ‘black boxes’ that lead to false confidence in the precision of the estimates.

(c) Additional Issues:

One of the most difficult tasks when measuring interest rate risk is how to deal with those positions where behavioural maturity differs from contractual maturity (or where there is no stated contractual maturity).

On the asset side of the balance sheet, such positions may include mortgages and mortgage-related securities, which can be subject to prepayment. In some countries, borrowers have the discretion to prepay their mortgages with little or no penalty, which creates uncertainty about the timing of the cash flows associated with these instruments.

Although there is always some volatility in prepayments resulting from demographic factors (such as death, divorce, or job transfers) and macroeconomic conditions, most of the uncertainly surrounding prepayments arises from the response of borrowers to movements in interest rates.

In general, declines in interest rates result in increasing levels of prepayments as borrowers refinance their loans at lower yields. In contrast, when interest rates rise unexpectedly, prepayment rates tend to slow, leaving the bank with a larger than anticipated volume of mortgages paying below current market rates.

On the liability side, such positions include so-called non-maturity deposits such as sight deposits and savings deposits, which can be withdrawn, often without penalty, at the discretion of the depositor. The treatment of such deposits is further complicated by the fact that the rates received by depositors tend not to move in close correlation with changes in the general level of market interest rates.

The treatment of positions with embedded options is an issue of special concern in measuring the exposure of both current earnings and economic value to interest rate changes.

As with other elements of interest rate risk measurement, the quality of the estimates of interest rate risk exposure depends on the quality of the assumptions about the future cash flows on the positions with uncertain maturities. Banks typically look to the past behaviour of such positions for guidance about these assumptions.

For instance, econometric or statistical analysis can be used to analyse the behaviour of a bank’s holdings in response to past interest rate movements. Such analysis is particularly useful to assess the likely behaviour of non-maturity deposits, which can be influenced by bank-specific factors, such as the nature of the bank’s customers and local or regional market conditions.

In the same vein, banks may use statistical prepayment models either models developed internally by the bank or models purchased from outside developers – to generate expectations about mortgage-related cash flows.

Finally, input from managerial and business units within the bank could have an important influence, since these areas may be aware of planned changes to business or repricing strategies that could affect the behaviour of the future cash flows of positions with uncertain maturities.

Essay # 7. Strategies for Controlling Interest Rate Risk

:

Interest rate risk management process should begin with strategies which change the bank’s interest rate sensitivity by altering various components of the balance sheet. The actual management of banks’ assets and liabilities focuses on controlling the gap between Rate Sensitive Assets and Rate Sensitive Liabilities.

Some banks pursue a strategy of matching assets and liabilities maturities as closely as possible to reduce the gap to zero and insulate the NII from the volatility of interest rate. Aggressive bankers, however, vary the gap in tune with their interest rate forecasts. If they expect interest rate should increase, they widen the gap by repricing the assets more frequently than their liabilities.

The banks have been following various balance sheet, etc., strategies to limit the shocks of interest rate volatility. The basic strategy of the banks is focussed on bridging the gap position.

The strategies for reducing the assets and liabilities sensitivity are:

Reduce Asset Sensitivity:

i. Extend investment portfolio maturities,

ii. Increase floating rate deposits,

iii. Increase fixed rate lending,

iv. Sell floating rate loans,

v. Increase short-term borrowings, and

vi. Increase long-term lendings.

Reduce Liability Sensitivity:

i. Reducing investment portfolio maturities,

ii. Increase floating rate lendings,

iii. Increase long-term deposits, and

iv. Increase short-term lendings.

The basic balance sheet strategy to alter banks interest rate exposure is to effect changes in the portfolio composition. Any variation in portfolio potentially alters NII. The liability sensitivity situation can be tackled by pricing more loans on floating rate basis or shortening maturities of investment securities. The banks can also consider selling fixed income securities and reinvest the proceeds in securities with short-term maturity.

The other options available to the banks for managing interest rate risks are:

i. Match long-term assets preferably with non-interest bearing liabilities

ii. Match repriceable assets with similar repriceable liabilities

iii. Use Forward Rate Agreements, Swaps, Options and Financial Futures to construct synthetic securities and thus hedge against any exposure to interest rate risk

iv. Maturity mismatch is accentuated by proliferation of Performing Assets (NPAs) and loan renegotiations. Sound loaning policies and effective post-sanction monitoring and recovery steps can contain the volume of NPAs. Large volume of NPA in the balance sheet entail carrying of non-interest earning assets, funded out of volatile liabilities.

Risk averse banks management would always endeavour for a matched book. However, full match in repricing assets and liabilities is neither feasible nor prudent. The adverse impact on NII due to mismatches can be minimised by fixing appropriate tolerance limits on interest rate sensitivity gaps. The tolerance limit should be relatively smaller in the shorter end or proximate time bands.

Thus, the banks should constantly review the repricing structure of all the new debts raised or new assets financed with a view to protecting the interest rate margins. The banks should also evolve suitable in-house expertise for forecasting of interest rates so as to place the banks in a situation whereby it can exploit the advantages of favourable movements in interest rate.

Essay # 8. Controls and Supervision of Interest Rate Risk Management:

Banks are required to have adequate internal controls to ensure the integrity of their interest rate risk management process. These internal controls should be an integral part of the institution’s overall system of internal control. They should promote effective and efficient operations, reliable financial and regulatory reporting, and compliance with relevant laws, regulations, and institutional policies.

An effective system of internal control for interest rate risk includes:

i. A strong control environment

ii. An adequate process for identifying and evaluating risk

iii. The establishment of control activities such as policies, procedures, and methodologies

iv. Adequate information systems

v. Continual review of adherence to established policies and procedures.

With regard to control policies and procedures, attention should be given to appropriate approval processes, exposure limits, reconciliations, reviews, and other mechanisms designed to provide a reasonable assurance that the institution’s interest rate risk management objectives are achieved. Many attributes of a sound risk management process, including risk measurement; monitoring and control functions are key aspects of an effective system of internal control.

In addition, an important element of a bank’s internal control system over its interest, rate risk management process is regular evaluation and review. This includes ensuring that personnel are following established policies and procedures, as well as ensuring that the procedures that were established actually accomplish the intended objectives.

Management should ensure that all such reviews and evaluations are conducted regularly by individuals who are independent of the function they are assigned to review.

Banks, particularly those with complex risk exposures, should have their measurement, monitoring, and control functions reviewed on a regular basis by an independent party (such as an internal or external auditor).

Essay # 9. Sound Interest Rate Risk Management Practices:

Sound interest rate risk management involves the application of four basic elements in the management of assets, liabilities and OBS instruments:

i. Appropriate board and senior management oversight

ii. Adequate risk management policies and procedures

iii. Appropriate risk measurement, monitoring, and control functions

iv. Comprehensive internal controls and independent audits.

1. Board and Senior Management Oversight of Interest Rate Risk:

Effective oversight by a bank’s board of directors and senior management is critical to a sound interest rate risk management process. It is essential that these individuals are aware of their responsibilities with regard to interest rate risk management and that they adequately perform their roles in overseeing and managing interest rate risk.

2. Board of Directors:

In order to carry out its responsibilities, the board of directors in a bank should approve strategies and policies with respect to interest rate risk management and ensure that senior management takes the steps necessary to monitor and control these risks consistent with the approved strategies and policies. The board of directors should be informed regularly of the interest rate risk exposure of the bank in order to assess the monitoring and controlling of such risk against the board’s guidance on the levels of risk that are acceptable to the bank.

3. Senior Management:

Senior management must ensure that the structure of the bank’s business and the level of interest rate risk it assumes are effectively managed, that appropriate policies and procedures are established to control and limit these risks, and that resources are available for evaluating and controlling interest rate risk.

Management is also responsible for maintaining:

i. Appropriate limits on risk taking

ii. Adequate systems and standards for measuring risk

iii. Standards for valuing positions and measuring performance

iv. A comprehensive interest rate risk reporting and interest rate risk management

v. Review process

vi. Effective internal controls.

Interest rate risk reports to senior management should provide aggregate information as well as sufficient supporting detail to enable management to assess the sensitivity of the institution to changes in market conditions and other important risk factors.

Senior management should also review periodically the organisation’s interest rate risk management policies and procedures to ensure that they remain appropriate and sound.

4. Lines of Responsibility and Authority for Managing Interest Rate Risk:

Banks should clearly define the individuals and/or committees responsible for managing interest rate risk and should ensure that there is adequate separation of duties in key elements of the risk management process to avoid potential conflicts of interest.

Banks should have risk measurement, monitoring, and control functions with clearly defined duties that are sufficiently independent from position-taking functions of the bank and which report risk exposures directly to senior management and the board of directors. Larger or more complex banks should have a designated independent unit responsible for the design and administration of the bank’s interest rate risk measurement, monitoring and control functions.

Senior management should define lines of authority and responsibility for developing strategies, implementing tactics, and conducting the risk measurement and reporting functions of the interest rate risk management process.