Here is an essay on ‘Risk Regulations in Banking Industry’ for class 11 and 12. Find paragraphs, long and short essays on ‘Risk Regulations in Banking Industry’ especially written for school and banking students.

Risk Regulations in Banking Industry

Essay Contents:

- Essay on the Regulation of Banking Industries – Necessities and Goals

- Essay on the Need for Risk-Based Regulation in a Changed World Environment

- Essay on 1988 Basel Accord

- Essay on the 1996 Amendment to Include Market Risk

- Essay on Basel-II Accord – Need and Goals

- Essay on BASEL-II Accord

- Essay on the Capital Charge for Credit Risk

- Essay on Pillar 2 – Supervisory Review Process

- Essay on Pillar 3 – Market Discipline

- Essay on Simplified Standardised Approach

- Essay on the Impact on Emerging Markets and Smaller Banks

Essay # 1. Regulation of Banking Industries – Necessities and Goals:

Banking and financial services, all over the world, are regulated usually by Monetary Authority of the land. This is because banking and financial services are the backbone of an economy. A healthy and strong banking system is a must for any economy to function smoothly and to prosper. Banks have risks and risk taking is their business.

But if risk-taking is not regulated properly, banks may fail and it would have a disastrous effect on the economy. Therefore, Monetary Authorities across the world regulate functioning of the banks. In India, this function, as we all know, is with Reserve Bank of India, Country’s monetary authority.

Regulations have a decisive impact on risk management. The regulatory framework sets up the constraints and guidelines that inspire risk management practices, and stimulates the development and enhancement of the internal risk models and risk management processes of banks.

Regulations promote better definitions of risks, and create incentives for developing better methodologies for measuring risks. Regulations have several goals.

They are:

1. Improving the safety of the banking industry, by imposing capital requirements in line with bank’s risks.

Note:

Regulatory Authorities impose recognition of the core concept of the capital adequacy principle and of ‘risk-based capital’, which means banks’ capital should be in line with risks. This implies a quantitative assessment of risks as well.

2. Levelling the competitive playing field of banks through setting common benchmarks for all players.

3. Promoting sound business and supervisory practices.

4. Controlling and monitoring ‘Systemic Risk’.

5. Protecting interest of depositors as depositors cannot impose a real market discipline on banks.

Systemic Risk:

Systemic risk is the risk of failure of the whole banking system. Individual bank’s failure is one of the major sources of the systemic risk. This happens because of high interrelations that exist on an ongoing basis between banks through mutual lending and borrowing and other commitments.

The failure of a single bank generates a risk of failure for all the banks that have ongoing commitments with the defaulting bank. Receivables from the failed bank become non-available putting the counterparty bank into a cash or fund crunch. In fact, because of contagion effect, all banks may be affected, triggering off a systemic risk. Systemic risk is a major challenge for the regulator.

Essay # 2. The Need for Risk-Based Regulation in a Changed World Environment:

A number of factors helped stabilise the banking environment in the seventies. Strong and constraining regulations weighed heavily on the banks’ management. Commercial banking meant essentially collecting resources and lending. Limited competition facilitated a fair and stable profitability.

Concerns for the safety of the industry and monetary management were the main priorities for regulators. The rules limited the scope of the operations of the various credit institutions, and limited their risks as well. There were low incentives for change and competition.

Deregulation in economy came to promote faster growth as a regulated environment hardly provides any incentive for competition and change. Deregulation increased competition between players unprepared by their past experiences, thereby resulting in increasing risks for the system. Competition also promoted globalisation.

Cross-border transactions, which resulted from global competition created by multinational enterprises. A regulatory framework, on a cross-country basis, for reconciling risk control and yet maintaining a level playing field for fair competition became necessary. This was undertaken by the Basel Committee on Banking Supervision (BCBS).

Why BCBS?

On 26th June 1974, a number of banks had released Deutschmarks to Bank Herstatt in Frankfurt in exchange for dollar payments that were to be delivered in New York. Due to differences in time zones, there was a lag in dollar payments to counterparty banks during which Bank Herstatt was liquidated by German regulators, i.e., before the dollar payments could be effected.

Note:

The risk of settlement that arises from time-difference came to be known as ‘Herstatt Risk’.

The Herstatt incident prompted the G-10 countries (the G-10 is today 13 countries; Belgium, Canada, France, Germany, Italy, Japan, Luxembourg, Netherlands, Spain, Sweden, Switzerland, United Kingdom and United States) to form, towards the end of 1974, the Basel Committee on Banking Supervision (BCBS), under the auspices of the Bank for International Settlements (BIS), comprising of Central Bank Governors from the participating countries.

BCBS has been instrumental in standardising bank regulations across jurisdictions with special emphasis on defining the roles of regulators in cross-jurisdictional situations. The committee meets four times a year. It has around 30 technical working groups and task forces that meet regularly.

Essay # 3. 1988 Basel Accord:

The period 1980 was the post-deregulation era (in India deregulation started in nineties). Deregulation inspired competition indeed resulted in increasing the risks of the bank and it translated in several bank failures. This outlined the need for risk control and linking banking risks with banks’ capital.

In 1988, the Basel Committee published a set of minimal capital requirements for banks, known as the 1988 Basel Accord. These were enforced by law in the G-10 countries in 1992. The Japanese banks were permitted an extended transition period.

The 1988 Basel Accord primarily sought to put in place a framework for minimum capital requirement for banks that was linked to credit exposure. Keeping in view different accounting practices in vogue across the world, it also defined the capital for the purpose of capital adequacy.

Bank assets were classified into five buckets, i.e., grouped under five categories according to credit risk carrying risk weights of 0, 10, 20, 50 and 100%. Assets were to be classified into one of these risk buckets based on the parameters of counterparty (sovereign, banks, public sector enterprises or others), collateral (e.g., mortgages of residential property) and maturity. Generally, government debt was categorised at 0%, bank debt at 20%, and other debt at 100%.

Off-balance sheet exposures such as performance guarantees and letters of credit were brought into the calculation of risk-weighted assets using the mechanism of variable credit conversion factor. Banks were required to hold capital equal to 8% of the risk-weighted value of assets. Since 1988, this framework has been progressively introduced not only in member countries but also in almost all other countries having active international banks.

The accord provided a detailed definition of capital. Tier 1 or core capital, which includes equity and disclosed reserves, and Tier 2 or supplementary capital, which could include undisclosed reserves, asset revaluation reserves, general provisions and loan-loss reserves, hybrid (debt/equity) capital instruments and subordinated debt.

Essay # 4. 1996 Amendment to Include Market Risk:

In 1996, BCBS published an amendment to the 1988 Basel Accord to provide an explicit capital cushion for the price risks to which banks are exposed, particularly those arising from their trading activities. This amendment was brought into effect in 1998.

Salient features of the amendment are given below:

1. Allows banks to use proprietary in-house models for measuring market risks

2. Banks using proprietary models must compute VAR daily, using a 99th percentile, one-tailed confidence interval with a time horizon of ten trading days using a historical observation period of at least one year.

3. The capital charge for a bank that uses a proprietary model will be the higher of the previous day’s VAR and three times the average of the daily VAR of the preceding 60 business days.

4. Use of ‘back-testing’ (ex-post comparisons between model results and actual performance) to arrive at the ‘plus factor’ that is added to the multiplication factor of three.

5. Allows banks to issue short-term subordinated debt subject to a lock-in clause (Tier 3 capital) to meet a part of their market risks.

6. Alternate standardized approach using the ‘building block’ approach where general market risk and specific security risk are calculated separately and added up.

7. Banks to segregate trading book and mark to market all portfolio/position in the trading book.

8. Applicable to both trading activities of banks and non-banking securities firms.

Does BCBS have Powers to Enforce?

‘The Committee does not possess any formal supranational supervisory authority, and its conclusions do not, and were never intended to, have legal force. Rather, it formulates broad supervisory standards and guidelines and recommends, statements of best practice in the expectation that individual authorities will take steps to implement them through detailed arrangements – statutory or otherwise which are best suited to their own national systems.

In this way, the Committee encourages convergence towards common approaches and common standards without attempting detailed harmonization of member countries’ supervisory techniques. One important objective of the Committee’s work has been to close gaps in international supervisory coverage in pursuit of two basic principles: that no foreign bank establishment should escape supervision; and that supervision should be adequate.’

Essay # 5. Basel-II Accord – Need and Goals:

Linking of risks with capital in terms of the Basel I Accord needed a revision for the following reasons:

1. Credit risk assessment under Basel I was not risk-sensitive enough. Capital need assessment under the Basel 1 accord was not being able to differentiate between banks with lower risks and banks with higher risks.

For example, exposure on a company with AAA rating and a company with B rating were treated identically for the purpose of capital adequacy. Both would be placed in 100% risk weight category although, risks associated with them would be quite different.

2. It promotes financial decision-making on the basis of regulatory constraints rather than on the basis of economic opportunities. Capital requirement for all corporate accounts being the same, it encouraged financing of assets with more risks for higher returns.

Whereas a sound decision should take into account risk and return characteristics of an asset, it was discouraged, as capital requirement was not differentiated based on risk characteristic of assets.

3. It did not recognize the role of credit risk mitigants, such as credit derivatives, securitizations, collaterals and guarantees, in reducing credit risk.

4. It did not take into account operational risks of banks.

The fundamental objective to revise the 1988 Accord has been:

1. To develop a framework that would strengthen the soundness and stability of the international banking system.

2. To ensure that it does not become a source of competitive inequality among internationally active banks and yet have a capital adequacy regulation that is sufficiently consistent.

3. To help promote the adoption of stronger risk management practices by the banking industry.

Essay # 6. BASEL-II Accord:

The revised accord is also called Basel II. The BCBS has since released the document, “International Convergence of Capital Measurement and Capital Standards: A Revised Framework” on 26 June 2004.

Its significant features are:

1. Significantly, more risk-sensitive capital requirements take into account operational risk of banks apart from credit and market risks. It also provides for risk treatment on securitisation.

2. Greater use of assessment of risk provided by banks’ internal systems as inputs to capital calculations.

3. Provides a range of options for determining the capital requirements for credit risk and operational risk to allow banks and national regulators to select the approaches that are most suitable.

4. Capital requirement under new accord is the minimum. It has a provision for supplementary capital that can be adopted by national regulators.

5. The accord in fact promotes stronger risk management practices by banks by providing capital incentive for banks with better risk management practices.

Note:

Capital requirement under Basel II does not include liquidity risk, interest rate risk of banking book, strategic and business risks. These risks would be under ‘Supervisory Review Process’, if supervisors feel that the capital held by a bank is not sufficient, they could require the bank to reduce its risk or increase its capital or both.

In the matter of interest rate risk on banking book it has put in place a criteria for ‘Outliers’. Where a bank under 200 basis point interest rate shocks faces reduction in capital by 20% or more, such banks would be outliers.

The Basel II Accord is based on three pillars:

1. Minimum capital requirement

2. Supervisory review process

3. Market discipline

Structure of Basel-II:

Pillar 1 – Minimum Capital Requirement:

1. Capital for Credit Risk

i. Standardised Approach

ii. Internal Ratings Based (IRB) Foundation Approach

iii. Internal Ratings Based (IRB) Advanced Approach

2. Capital for Market Risk

i. Standardised Approach (Maturity Method)

ii. Standardised Approach (Duration Method)

iii. Internal Models Method

3. Capital for Operational Risk

i. Basic Indicator Approach

ii. Standardised Approach

iii. Advanced Measurement Approach

Pillar 2 – Supervisory Review Process:

1. Evaluate risk assessment

2. Ensure soundness and integrity of banks’ internal process to assess the adequacy of capital

3. Ensure maintenance of minimum capital – with PC A for shortfall

4. Prescribe differential capital, where necessary – i.e., where the internal processes are slack.

Pillar 3 – Market Discipline:

1. Enhance disclosure

2. Core disclosures and supplementary disclosures

3. Timely – semi annual

Pillar 1 – Minimum Capital Requirement:

Basel I Accord and the 1996 amendment thereto has defined capital requirement as:

Capital = Min. Capital Ratio (8%) × (Credit Risk + Market Risk)

The Revised Capital Accord or Basel II defines the capital requirement as:

Capital = Min. Capital Ratio (8%) x (Credit Risk + Market Risk + Operation Risk)

It is to be noted that there is no change:

i. In the definition of capital

ii. In the minimum capital ratio, which remains 8%?

iii. In the calculation of market risk and it remains as per 1996 Amendment

The changes are in:

i. Method of calculating risk in credit exposures

ii. By way of capital charge on operational risk

Essay # 7. Capital Charge for Credit Risk:

a. Standardised Approach:

The standardised approach is similar to the current accord in that banks are required to slot credit exposures into supervisory categories based on observable characteristics of the exposures (e.g., whether the exposure is a corporate loan or a residential mortgage loan).

The standardised approach establishes fixed risk weights corresponding to each supervisory category and makes use of external credit assessments to enhance risk sensitivity compared to the current accord. The risk weights for sovereign, inter-bank, and corporate exposures are differentiated based on external credit assessments. The risk weights are inversely related to the rating of the counter party.

An important innovation of the standardised approach is the requirement that loans considered ‘past due’ be risk weighted at 150% unless, a threshold amount of specific provisions has already been sent aside by the bank against that loan.

The standardized approach also stipulates special treatment of certain exposures on a portfolio basis viz. ‘retail’ and ‘SME’ exposures. The exposures to these sectors attract a uniform risk weight of 75% irrespective of the individual risk rating of the component exposures.

Credit risk mitigants (collaterals, guarantees, and credit derivatives) can be used by banks under this approach for capital reduction, based on the market risk of the collateral instruments or the threshold external credit rating of recognised guarantors.

Reduced risk weights for retail exposures, small and medium size enterprises (SME) category and residential mortgages have been proposed. The approach draws a number of distinctions between exposures and transactions in an effort to improve the risk sensitivity of the resulting capital ratios.

b. Internal Rating Based Approach:

One of the most innovative aspects of the New Accord is the IRB approach to measurement of capital requirements for credit risk. The IRB Approach offers the following two options: Foundation IRB Approach (FIRB) and Advances IRB Approach (AIRB) version.

The IRB approach differs substantially from the standardised approach to the extent that banks’ internal assessments of key risk parameters serve as primary inputs to capital calculation. Since the approach is based on banks’ internal assessments, the potential for more risk-sensitive capital requirements is substantial.

The salient features of IRB Approach are as under:

i. The IRB Approach computes the capital requirements of each exposure directly before computing the risk-weighted assets.

ii. Capital charge computation is a function of the following parameters:

(a) Probability of Default (PD)

(b) Loss Given the Default (LGD)

(c) Exposure at Default (EAD)

(d) Maturity (M)

iii. The risk-weighted assets are derived from the capital charge computation.

The IRB approach does not allow banks to determine all of the elements needed to calculate their capital requirements. Instead, the risk weights and thus capital charges are determined through the combination of quantitative inputs provided by banks and formulae specified by the Committee.

The IRB approach uses banks’ internal assessments of key risk drivers as primary inputs to the capital calculation. The risk weights and resultant capital changes are determined through the combination of quantitative inputs provided by banks and formulae specified the Committee.

The IRB calculation of risk weighted assets for exposures to sovereigns, banks, or corporate entities relies on the following four parameters:

1. Probability of default (PD), which measures the likelihood that the borrower will default over a given time horizon.

2. Loss given default (LDG), which measures the proportion of the exposure that will be lost if a default occurs.

3. Exposure at default (EAD), which for loan commitment measures the amount of the facility that is likely to be drawn in the event of a default.

4. Maturity (M), which measures the remaining economic maturity of the exposure.

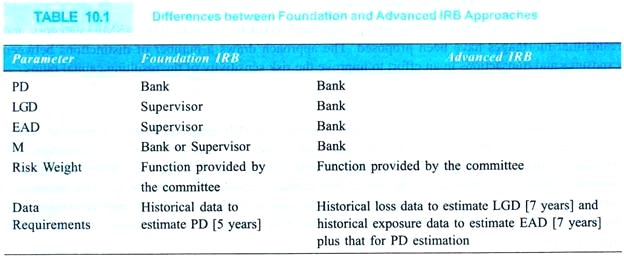

The differences between foundation and advanced IRB approaches are captured in the Table 10.1 based on who provides the inputs on the various parameters:

For retail exposures only advanced IRB is prescribed where, obviously, the maturity parameter is omitted. Securitization, provisions and specialized lending have been accorded special treatment.

Essay # 8. Capital Charge for Operational Risk:

Operational risk is an important risk faced by banks and according to BCBS banks need to hold capital to protect against losses from this. This is a new area where the Committee has developed a regulatory capital approach.

As in the case of credit risk, the committee has reckoned banks’ rapidly developing internal assessment techniques and seeks to provide incentives to banks for improving upon those techniques, and more broadly, banks’ management of operational risk over a period of time.

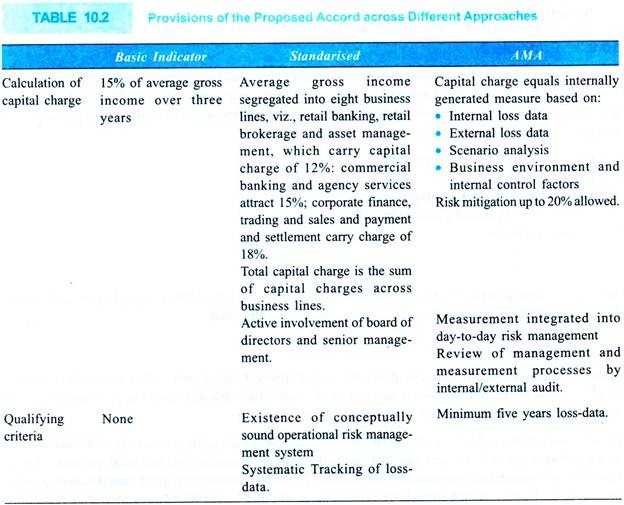

The New Framework provides three options for computing capital charge for Operational Risk with increasing sophistication and risk sensitivity. Base II encourages banks to move along the spectrum of available approaches as they develop more sophisticated operational risk measurement systems and practices. Internationally active banks and banks with significant operational risk exposures are expected to use an approach that is more sophisticated.

Within the Basel II framework, operational risk is defined as the risk of losses resulting from inadequate or failed internal processes, people and systems, or external events. Operational risk identification and measurement is still in an evolutionary stage as compared to the maturity that market and credit risk measurements have achieved.

As in credit risk, three alternate approaches are prescribed:

1. Basic Indicator Approach

2. Standardized Approach

3. Advanced Measurement Approach (AMA).

Table 10.2 captures the provisions of the proposed accord across different approaches:

Compliance of BCBS’ “Sound Practices for Management and Supervision of Operational Risk” is also required.

Essay # 9. Pillar 2 – Supervisory Review Process:

Pillar 2 introduces two critical risk management concepts: the use of economic capital, and the enhancement of corporate governance, encapsulated in the following four principles:

Principle 1:

Banks should have a process for assessing their overall capital adequacy in relation to their risk profile and a strategy for maintaining their capital levels.

The key elements of this rigorous process are:

1. Board and senior management attention

2. Sound capital assessment

3. Comprehensive assessment of risks

4. Monitoring and reporting

5. Internal control review

Principle 2:

Supervisors should review and evaluate bank’s internal capital adequacy assessments and strategies, as well as their ability to monitor and ensure their compliance with regulatory capital ratios. Supervisors should take appropriate supervisory action if they are not satisfied with the result of this process.

This could be achieved through:

1. On-site examinations or inspections

2. Off-site review

3. Discussions with bank management

4. Review of work done by external auditors

5. Periodic reporting

Principle 3:

Supervisors should expect banks to operate above the minimum regulatory capital ratios and should have the ability to require banks to hold capital in excess of the medium.

Principle 4:

Supervisors should seek to intervene at an early stage to prevent capital from falling below the minimum levels required to support the risk characteristics of a particular bank and should require rapid remedial action if capital is not maintained or restored.

Participations under Pillar 2 seek to address the residual risk not adequately covered under Pillar 1, such as a concentration risk, interest rate risk in banking book, business risk and strategic risk. ‘Stress testing’ is recommended to capture event risk. Pillar 2 also seeks to ensure that internal risk management process in the banks is robust enough. The combination of Pillar 1 and Pillar 2 attempt to align regulatory capital with economic capital.

Essay # 10. Pillar 3 – Market Discipline:

The focus of Pillar 3 on market discipline is designed to complement the minimum capital requirements (Pillar 1) and the supervisory review process. (Pillar 2). With this, the Basel Committee seeks to enable market participants to assess key information about a bank’s risk profile and level of capitalisation – thereby encouraging market discipline through increased disclosure.

Public disclosure assumes greater importance in helping banks and supervisors to manage risk and improve stability under the new provisions, which place reliance on internal methodologies providing banks with greater discretion in determining their capital needs.

It has been agreed that such disclosures will depend on the legal authority and accounting standards existing in each country. Efforts are in progress to harmonise these disclosures with Internal Financial Reporting Standards (IFRS) Broad Standards (International According Standards 30 and 32).

Essay # 11. Simplified Standardised Approach:

In order to assist banks and national supervisors where circumstances may not warrant a broad range of options, the Committee has developed the ‘simplified standardised approach’. The annex collects in one place the simplest options for calculating risk- weighted assets; salient features of the SSA are as below.

i. SSA uses only rating by Export Credit Agencies (ECAs) for sovereign exposures. Bank and CSU ratings are linked to the rating of the sovereign on the same lines as available in the SA.

ii. Risk weights for corporate borrowers depends upon the rating assigned to them by a rating agency approved for that purpose and varies from 20% in case of top rated company to 100% in case of an unrated corporate.

iii. In the case of domestic banks, the risk weight depends on the CRAR of the respective bank and in the case of foreign banks the risk weight is related to the rating assignment to the bank by international rating agencies.

Banks intending to adopt the simplified standardised methods are also expected to comply with the corresponding supervisory review and market discipline requirements of the New Framework. The Basel II document clarified that the SSA should not be seen as another approach for determining regulatory capital. Rather it collects in one place the simplest options for calculating risk-weighted assets.

Essay # 12. Impact on Emerging Markets and Smaller Banks:

In an attempt to assess the impact of Pillar 1 requirements of capital adequacy, BCBS did undertake a few quantitative impact surveys (QIS), the last of which is referred to as QIS – 10. The results indicated that, in general, banks’ required capital would decrease with respect to credit risks and increase with respect to operational risks.

However, in Asia and other emerging markets, several factors may raise the required capital even for credit risks, as real estate continues to be widely used as collateral for business loans, and the standardised approach, which is the most likely approach for many banks, places a 150% risk weight on non-performing loans.

Basel II will increase the level of capital that is required for banking institutions in the emerging markets, mainly owing to the new operational risk charge, which will be higher if the basic indicator approach is used.

By application of differential risk weights on the basis of sovereign rating as a benchmark, the capital inflows in emerging markets could be seriously attracted, as most of the borrowers in such markets will be categorised under the speculative grade.

Smaller banks would find the investments on Basel II compliance too big for their existing budgets.