Here is an essay on ‘Risks in Banking Business’ especially written for school and banking students.

Essay # 1. Risk Identification in Banking Business:

Banking business lines are many and varied. Commercial banking, corporate finance, retail banking, trading and investment banking and various financial services form the main business lines of banks. Within each line of business, there are sub-groups and each sub-group contains variety of financial activities.

Bank’s clients may vary from retail consumer segment to mid-market corporate to large corporate to financial institutions. Banking may differ appreciably for each segment even for the similar services.

For example, lending activities may extend from retail banking to specialized finance. Again, specialized finance may extend from specific fields with standard practices, such as exports and commodities financing to structure financing implying specific structuring and customization for making large and risky transactions feasible, such as project financing or corporate acquisitions.

Banks also assemble financial products and derivatives and deliver them as a package to its clients as a part of specialised financing commensurate with the needs of its clients.

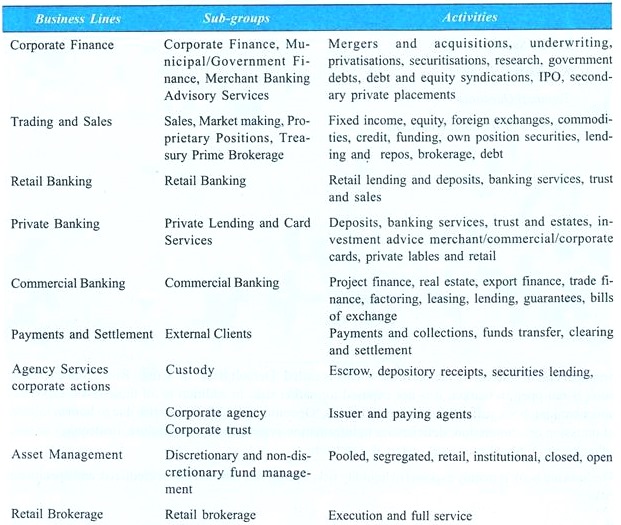

We may have a fair idea of the wide array of business lines of the banking industry from Table 9.1:

TABLE 9.1 Business Lines of the Banking Industry

Product lines also vary across client segments. Standard lending products include short-term and long- term loans with specified repayments, demand loans and various other lines of credit, such as bill purchase and bills discounting facilities, cash credit etc. In the retail segments banks have variety of consumer loans such as auto loans, house-building loans, etc.

Banks also offer guarantees, letters of credit, etc., which are in the nature of off-balance sheet transactions. There are various deposit products that vary for different segments and different needs. Banks also offer market products, such as fixed income securities, shares, foreign exchange trading and derivatives like standard swaps and options.

The key driver in managing all the business lines are enhancing risk adjusted expected return. This is the common factor for all business lines. But management practices vary across business lines and subgroups and activities within each business lines as profitability of various business lines/activities differ and so does the risk factors associated with them.

From the risk management point of view, banking business lines may be grouped broadly under the following major heads:

i. The Banking Book,

ii. The Trading Portfolio, and

iii. Off-Balance Sheet Exposures.

Risks associated with each of them are discussed in the following:

i. The Banking Book:

The banking book includes all advances, deposits and borrowings, which usually arise from commercial and retail banking operations.

All assets and liabilities in banking book have following characteristics:

a. They are normally held until maturity

b. Accrual system of accounting is applied

Since all assets and liabilities in the banking book are held until maturity, maturity mismatch between assets and liabilities result in excess or shortage of liquidity. This is commonly known as ‘Liquidity Risk’. In addition, interest rate changes take place during the period, such assets and liabilities are held in the banking book.

Therefore interest rates on assets as well as liabilities change on their maturity. This affects net interest margin, i.e., interest received net of interest paid. This is called ‘Interest Rate Risk’. Further, the asset side of the banking book generates credit risk arising from defaults in payments of principal and/or interest by the borrowers.

This is called ‘Default Risk’ or ‘Credit Risk’. Since banking book is not open to market, it is not exposed to market risk. In addition to all these risks, exposures under banking book suffer from what is termed as ‘Operational Risk’. These arise due to human failures of omission or commission, deficiencies in information system and system failure, inadequacy or non-adherence to internal processes, external events etc.

The banking book is mainly exposed to liquidity risk, interest rate risk, default or credit risk and operational risks.

Summary:

All assets and liabilities in the banking book are normally held until maturity and accrual system of accounting is applied on them. The banking book is mainly exposed to liquidity risk, interest rate risk, default or credit risk and operational risk.

ii. The Trading Book:

The trading book includes all the assets that are marketable, i.e., they can be traded in the market.

Contrary to the characteristics of assets and liabilities held in banking book, trading book assets have following characteristics:

1. They are normally not held until maturity and positions are liquidated in the market after holding it for a period

2. Mark-to-Market system is followed and the difference between market price and book value is taken to profit and loss account.

Trading book mostly comprises of fixed income securities, equities, foreign exchange holdings, commodities, etc., held by the bank on its own account. Derivatives that are held for trading in the market or over the counter (OTC) and for hedging exposures under trading book would also form a part of trading book.

Trading book is subject to adverse movement in market prices until they are liquidated. This is termed as ‘Market Risk’. Trading book may have market overseas as well if it is so permitted by laws of the land. This adds to the demand and hence adds to the market liquidity. Instrument having lower demand have lower trading volume and are exposed to liquidation risk where trading may trigger off adverse price movement.

Trading book is also exposed to Credit Risk or Default Risk, which arises due to failure on the part of the counter party to keep its commitment. Trading book is also exposed to operational risks that arise from human failures of omission or commission, deficiencies in information system and system failure, inadequacy or non-adherence to internal processes, external events, etc.

Trading book is mainly exposed to market risk, including liquidation risk, default or credit risk and operational risk.

Summary:

The positions in the trading book are normally held for liquidating them in the market after holding it for a period. The difference between market price realized and book value is accounted for as profit/loss.

Trading book is mainly exposed to market risk, market liquidity risk, default or credit risk and operational risk.

iii. Off-Balance Sheet Exposures:

Off-balance sheet exposures are contingent in nature. Where banks issue guarantees, committed or backup credit lines, letters of credit, etc., banks face payment obligations contingent up on some event. These contingencies adversely affect the revenue generation of banks.

Banks may also have contingency receivables. Here banks are the beneficiaries subject to certain contingencies. Derivatives are off-balance sheet market exposures. They may be swaps, futures, forward contracts, foreign currency contracts, options, etc.

Contingent exposure may become a fund-based exposure. Such exposures may become a part of the banking book or trading book, depending upon the nature of off-balance sheet exposure. Therefore, off- balance sheet exposures may have liquidity risk, interest rate risk, market risk, default or credit risk and operational risk.

Summary:

Off-balance sheet exposures may become fund-based exposure based on certain contingencies. Both, contingencies given (where bank provides benefit) and contingencies receivable (where bank is the beneficiary) may form off-balance sheet exposure. Off-balance sheet exposures may have liquidity risk, interest rate risk, market risk, default or credit risk and operational risk.

Essay # 2. Risks Encountered in Banking Business:

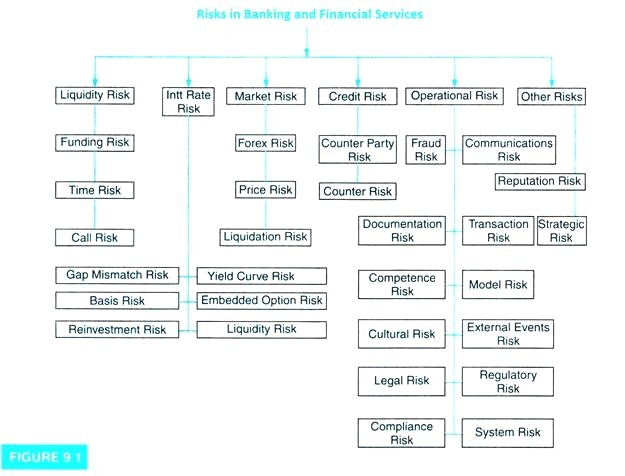

We may summarise the major risks in banking business or ‘Banking Risks’. They are as follows:

1. Liquidity Risk

2. Interest Rate Risk

3. Market Risk

4. Default or Credit Risk and

5. Operational Risk.

1. Liquidity Risk:

The liquidity risk of banks arises mainly from funding of long-term assets by short-term liabilities, thereby making the liabilities subject to rollover or refinancing risk. Liquidity Risk is defined as the inability to obtain funds to meet cash flow obligations at a reasonable rate.

For banks, funding liquidity requirement is crucial and therefore any liquidity shortfall has to be met at times at a cost which is more than planned or normal costs. At the extreme, banks may even fail to fund the liquidity gap resulting in default with its serious consequences.

The liquidity risk in banks may be of the following types:

i. Funding Risk:

This arises from the need to replace net outflows due to unanticipated withdrawal/non-renewal of deposits (wholesale and retail);

ii. Time Risk:

This arises from the need to compensate for non-receipt of expected inflows of funds i.e. performing assets turning into non-performing assets; and

iii. Call Risk:

This arises due to crystallization of contingent liabilities. This may also arise when a bank may not be able to undertake profitable business opportunities when it arises.

2. Interest Rate Risk:

Interest Rate Risk (IRR) is the exposure of a Bank’s revenue to adverse movements in interest rates. Interest Rate Risk (IRR) refers to potential adverse impact on Net Interest Income or Net Interest Margin or Market Value of Equity (MVE), caused by changes in market interest rates.

Interest Rate Risk can take different forms. IRR can be viewed in two ways: Its impact is on the earnings of the bank or its impact on the economic value of the bank’s assets, liabilities and off-balance sheet positions.

a. Gap or Mismatch Risk:

A gap of mismatch risk arises from holding assets and liabilities and off-balance sheet items with different principal amounts, maturity dates or repricing dates, thereby creating exposure to unexpected changes in the level of market interest rates.

An example of this risk would be where an asset maturing in two years at a fixed rate of interest have been funded by a liability maturing in six months or a liability maturing over a period but getting repriced periodically. The interest margin would undergo a change after six months/repricing period, causing variation in net interest income.

b. Basis Risk:

The risk that the interest rate of different assets, liabilities and off-balance sheet items may change in different magnitude is termed as basis risk.

An example of basis risk would be to say in a rising interest rate scenario asset interest rate may rise in different magnitude than the interest rate on corresponding liability creating variation in net interest income.

The degree of basis risk is fairly high in respect of banks that create composite assets out of composite liabilities. The Loan book in India is funded out of a composite liability portfolio and is exposed to a considerable degree of basis risk.

The basis risk is quite visible in volatile interest rate scenarios. When the variation in market interest rate causes the NII to expand, the banks have experienced favourable basis shifts and if the interest rate movement causes the NII to contract, the basis has moved against the banks.

c. Yield Curve Risk:

In a floating interest rate scenario, banks may price their assets and liabilities based on different benchmarks, i.e. treasury bills’ yields, fixed deposit rates, call money rates, MIBOR, etc. In case the banks use two different instruments maturing at different time horizon for pricing their assets and liabilities, any non-parallel movements in yield curves would affect the NII.

The movements in yield curve are rather frequent. Thus, banks should evaluate the movement in yield curves and the impact of that on the portfolio values and income. It may be noted that yield curve risk is a type of basis risk and this arises with respect to different maturity sectors.

An example would be when a liability raised at a rate linked to say 91 days T Bill is used to fund an asset linked to 364 days Treasury Bills. In a rising interest rate scenario both, 91 days and 364 days Treasury Bills may increase but not equally due to non-parallel movement of yield curve creating a variation in net interest earned.

d. Embedded Option Risk:

Significant changes in market interest rates create the source of risk to banks’ profitability by encouraging prepayment of cash credit/demand loans term loans and exercise of call/put options on bonds/debentures and/or premature withdrawal of term deposits before their stated maturities.

The embedded option risk is becoming a reality in India and is experienced in volatile situations. The faster and higher the magnitude of changes in interest rate, the greater will be the embedded option risk to the banks’ NII. The result is reduction of projected cash flow and income for the bank.

e. Reinvestment Risk:

Uncertainty with regard to interest rate at which the future cash flows could be reinvested is called reinvestment risk. Any mismatches in cash flows would expose the banks to variations in NII as the market interest rates move in different directions.

f. Net Interest Position Risk:

Where banks have more earning assets than paying liabilities, interest rate risk arises when the market interest rates adjust downwards. Such banks will experience a reduction in NII as the market interest rate declines and increases when interest rate rises. Its impact is on the earnings of the bank or its impact on the economic value of the bank’s assets, liabilities and OBS positions.

3. Market Risk:

Market risk is the risk of adverse deviations of the mark-to-market value of the trading portfolio, due to market movements, during the period of holding. This results from adverse movements of the market prices of interest rate instrument, equities, commodities and currencies. Market Risk is also referred as Price Risk.

Price risk occurs when assets are sold before their stated maturities. In the financial market, bond prices and yields are inversely related. The price risk is closely associated with the trading book, which is created for making profit out of short-term movements in interest rates.

The term market risk applies to:

(i) That part of IRR which affects the price of interest rate instruments,

(ii) Pricing Risk for all other assets/portfolio including commodities like gold that is held in the trading book of the bank, and

(iii) Foreign Currency Risk.

a. Forex Risk:

Forex risk, also termed as Exchange Risk, is the risk that a bank may suffer losses as a result of adverse exchange rate movements during a period in which it has an open position, either spot or forward, or a combination of the two, in an individual foreign currency.

b. Market Liquidity Risk:

Market liquidity risk arises when a bank is unable to conclude a large transaction in a particular instrument near the current market price.

4. Default or Credit Risk:

Credit Risk is most simply defined as the potential of a bank borrower or counterparty to fail to meet its obligations in accordance with agreed terms. For most banks, loans and corporate bonds are the largest and most obvious source of credit risk.

i. Counterparty Risk:

This is a variant of credit risk and is related to non-performance of the trading partners due to counterparty’s refusal and or inability to perform. The counter-party risk is generally viewed as a transient financial risk associated with trading rather than standard credit risk.

ii. Country Risk:

This is also a type of credit risk where non-performance by a borrower or counter-party arises due to constraints or restrictions imposed by a country. Here reason for non-performance is external factors on which the borrower or the counterparty has no control.

5. Operational Risk:

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. Strategic risk and reputation risk are not a part of operational risk. Operational risk may loosely be comprehended as any risk, which is not categorised as market or credit risk. Scope of operational risk is very wide.

It includes Fraud risk, Communication risk, Documentation risk, Competence risk, Model risk, Cultural risk, External events risk, Legal risk, Regulatory risk, Compliance risk, System risk and so on. Two of these, which are frequently used – transaction and compliance risk has been defined below, which form the part of operational risk.

a. Transaction Risk:

Transaction risk is the risk arising from fraud, both internal and external, failed business processes and the inability to maintain business continuity and manage information.

b. Compliance Risk:

Compliance risk is the risk of legal or regulatory sanction, financial loss or reputation loss that a bank may suffer as a result of its failure to comply with any or all of the applicable laws, regulations, codes of conduct and standards of good practice. It is also called integrity risk since a bank’s reputation is closely linked to its adherence to principles of integrity and fair dealing.

c. Strategic Risk:

Strategic Risk is the risk arising from adverse business decisions, improper implementation of decisions, or lack of responsiveness to industry changes. This risk is a function of the compatibility of an organisation’s strategic goals, the business strategies developed to achieve those goals, the resources deployed against these goals and the quality of implementation.

d. Reputation Risk:

Reputation Risk is the risk arising from negative public opinion. This risk may expose the institution to litigation, financial loss, or a decline in customer base. Risk faced by banking and financial services may be summarised as shown in Fig. 9.1.