Here is an essay on ‘Treasury’ for class 11 and 12. Find paragraphs, long and short essays on ‘Treasury’ especially written for school and banking students.

Essay on Treasury

Essay Contents:

- Essay on the Concept of Treasury Function

- Essay on the Functions of Integrated Treasury

- Essay on the Contribution of Globalisation towards the Integration of Treasury Activity

- Essay on the Evolving Role of Treasury as Profit Centre

- Essay on the Organisation of Treasury

Essay # 1. Concept of Treasury Function:

Conventionally, the Treasury function was confined to funds management – maintaining adequate cash balances to meet day-to-day requirements, deploying surplus funds generated in the operations, and sourcing funds to bridge occasional gaps in cash flow.

In the context of a bank, the Treasury is also responsible to meet reserve requirements, viz. holding with Reserve Bank of India minimum cash balances required as per Cash Reserve Ratio (CRR), and investing funds in approved securities to the extent required under Statutory Liquidity Ratio (SLR). Thus, Treasury function was essentially liquidity management, and from an organizational point of view, Treasury was considered as a service centre.

To date, liquidity management continues to be an important function of Treasury. However, owing to economic reforms and deregulation of markets over the last decade, the scope of Treasury has expanded considerably. Treasury has since evolved as a profit centre, with its own trading and investment activity.

Treasury connects core activity of the bank (deposit taking and lending) with the financial markets – which is also true of corporate treasuries in non-banking companies – by continuously accessing the markets for lending, borrowing, investing and trading in financial assets. And owing to the interface with markets, managing market risk for the entire bank has become an integral part of Treasury.

The Treasury plays an active role in Asset-Liability Management (ALM), and with its constant exposure to markets, is well placed to advise the management of bank in internal decisions, say in product pricing and strategic investments.

Till late 90’s, investment in securities and foreign exchange business constituted two separate departments in most of the Indian banks. For reasons that we would explore later, these two functions have now become part of the integrated Treasury, thus adding a new dimension to treasury activity.

Treasury essentially deals with short-term funds-flow (i.e. with less than one year maturity), with the exception that as part of SLR requirement, investment in some securities is held to maturity exceeding one year. Risk management function, however, covers underlying assets and liabilities across short, medium and long-term maturities.

Essay # 2. Functions of Integrated Treasury:

Integrated Treasury, in a banking set-up, refers to integration of money market, securities market and foreign exchange operations.

Integrated Treasury, in the Indian context, is the direct result of reforms in the financial sector, the most important reforms being deregulation of interest rates and partial convertibility of Rupee. Rupee is already freely convertible on current account, and to a large extent, also convertible on capital account, owing to major relaxations allowed by the Reserve Bank, in the area of foreign direct investment (FDI), external commercial borrowings (ECB) and overseas direct investment (ODI) by Indian corporates, and foreign currency operations of resident Indians. Banks have also been allowed large limits, in proportion to their net worth, for overseas borrowing and investment.

As a result, banks look for interest arbitrage across the currency markets and are in a position to shift swiftly, say, a placement in Rupee denominated commercial paper to lending in USD in global inter-bank market. Banks can also source funds in global market and swap the funds into domestic currency, or vice versa, depending on the market opportunities.

Banks have gained wider access to foreign currency funds through their off-shore operations, NRI deposits, and resident foreign currency accounts such as EEFC and float funds from external commercial borrowings (ECB) of corporate customers. The banks, do no longer distinguish between Rupee cash flows and foreign currency cash flows, and an integrated cash flow has become the basis for treasury operations.

The process of globalisation contributing to integration of treasuries is explained below in greater detail:

To this, we may add the development of domestic financial markets – equity as well as debt – with new institutional structure, facilitating instant payment and settlement systems. As a result, funds can be transferred with ease from long-term to short-term investments or from securities market to money market or from one currency to another currency. Integrated Treasury therefore is in a position to operate across the sectors and across the currency markets, either in search of higher returns, or in order to mobilize low cost funds for liquidity needs.

Just as cash flow is a cash flow irrespective of the currency in which it is denominated, the risk attached to market operations also needs a common approach cutting across different markets. When we operate in different currencies and deal with different segments of debt and equity markets, we generate currency and interest rate risks or price risks, which together are generally referred to as market risk.

It is hence imperative that Integrated Treasury is also fully involved in risk management, in particular, management of market risk, often using derivative products. Derivatives help development of financial markets, as availability of a wide variety of derivative tools is key to managing currency and interest rate risks. The use of such products is a result of growing link between domestic and global markets.

The integration of market activities, with particular reference to foreign exchange and use of derivatives, has brought Treasury in direct contact with customers who regularly require such services from the bank. Large corporate clients now prefer to deal with Treasury directly, rather than through bank branches or through other functional departments.

The Treasury’s transactions with customers are known as merchant business, as distinct from bank’s own trading and investment business. Many corporate customers have their own treasury departments, and they expect to receive an integrated service from the bank, in areas such as hedging export receivables, raising foreign currency loans and overseas investments.

We may now restate the driving force of Integrated Treasury as:

i. Integrated Cash Flow Management

ii. Interest Arbitrage

iii. Access to global resources

iv. Corporate demand for high-end services, and

v. Risk Management.

We may summarise the functions of Integrated Treasury as:

i. Meeting reserve requirements (CRR and SLR)

ii. Global cash management

iii. Efficient merchant services, which include foreign exchange (forex) and advisory services

iv. Optimising profit by exploiting market opportunities in

a. Forex market

b. Money market

c. Securities market (debt, equity and credit derivative markets)

v. Risk management

vi. Assisting bank management in ALM.

Treasury activity thus encompasses fund management, investment, forex operations, trading and risk management services in a multi-currency environment. To this, we may further add the evolving role of Treasury in managing the balance sheet risks, in coordination with other banking departments.

It is necessary to understand and appreciate the three distinct roles treasury is expected to play:

(a) Liquidity Management:

Treasury is responsible for managing short-term funds across currencies, and also for complying with reserve requirements (CRR and SLR).

(b) Proprietary Positions:

Treasury may trade in currencies, securities and other financial instruments, including derivatives, in order to contribute to Bank’s profits.

(c) Risk Management:

Treasury will aid Management in bridging asset-liability mismatches (ALM), will provide derivative tools to manage risks in client’s business, and will also manage risks inherent in its own proprietary positions.

The multiple roles necessitate Treasury to manage an ALM Book for internal risk management, a Merchant Book for client-related currency and derivative transactions, and a Trading Book for managing its proprietary positions. ALM Book also includes traditional role of Treasury in liquidity management.

Essay # 3. Contribution of Globalisation towards the Integration of Treasury Activity:

Globalisation refers to interaction between domestic and global markets, and may generally be defined as:

The process of integrating domestic market with global markets, characterised by free capital flows and minimum regulatory intervention.

The capital flows referred to above are in addition to regular flow of foreign exchange on account of trade (exports and imports) and miscellaneous remittances by business entities and individuals. The capital flows represent direct and indirect investments, with the ultimate motive of repatriating returns on such investments. Capital flows in this sense, involve transfer of wealth, which, sovereign countries, being sensitive to uneven capital flows, tend to regulate through their central banks.

Over the last two decades, emerging market countries have realised that rapid economic growth is not possible without free capital flows, which not only supplement capital available in the domestic market, but also result in exchange of technology and human (managerial) resources. As the economies develop, capital flows are necessarily multi-dimensional, with overseas companies investing in domestic economy and domestic companies expanding their overseas operations.

Funds flow on capital account may take one or more of the following routes:

i. Portfolio investment: Foreign investors investing in domestic equity and debt markets

ii. Direct investment: Foreign companies and foreign institutional investors investing long term funds in domestic companies, new projects, manufacturing facilities, business process outsourcing etc.

iii. External commercial borrowings

iv. Issue of equity/debt in global markets

v. Mergers & acquisitions – involving domestic and foreign entities

vi. Payment for technology transfer, royalties, financial services etc.

All the above transactions involve payment or receipt of interest, fees, dividends and repatriation of capital denominated in foreign currency – sometimes cumulatively referred to as transfer of savings.

The capital flows impact money supply, interest rate, exchange rate, inflation expectations and balance of payment in domestic economy. Though the capital inflows supplement domestic resources, the impact is not always benign. Sudden rise or fall in portfolio investments may lead to increase in volatility of stock prices, interest rates and exchange rates – thereby increasing the risks to investors.

Domestic economy becomes susceptible to systemic risks – owing to factors like inflation, change in business cycles, regulatory issues and system failures in foreign countries. The East Asian crisis – the systemic failure of financial markets and erosion of value of currencies in East Asian countries in late ’90s – partly caused by massive withdrawal of funds by foreign investors, has since alerted the Governments and central banks to place some regulation on cross-border movement of capital.

The economic and financial reforms, initiated by India since the early 90’s, have given impetus to capital markets and the Reserve Bank of India has been progressively relaxing the exchange controls. RBI now permits large movement of capital – both inflows and out flows – either by automatic route or by delegation of powers to commercial banks, who are authorized dealers.

Foreign Exchange Management Act (FEMA) of 2000 has replaced the earlier Foreign Exchange Regulation Act (FERA) facilitating many such reforms. The Exchange Control Department of RBI was aptly renamed as Foreign Exchange Department w.e.f. January 2004. Foreign currency transactions on current account, which include payment on account of export-import trade and miscellaneous payments, are fully liberalized.

Government of India has largely removed sectoral caps for foreign investment, and most of the capital flows now take place by automatic route, with minimum regulatory intervention. However, recognizing the risks of uninhibited capital flows, RBI has not yet permitted full convertibility of currency on capital account.

The immediate impact of globalisation is three-fold. Firstly, the interest rates which are central to treasury activity – whether it is lending, borrowing or investment – are influenced by global interest rate trends, owing to cross border capital flows, which in turn also influence exchange rates.

Though India has a managed exchange rate regime, Rupee exchange rate is effectively a free-float, with minimum intervention by the central bank. In an open economy, exchange rates are further influenced by macro-economic factors like relative inflation, GDP growth rate, stock markets and commodity markets.

Secondly, since the domestic markets need to compete with global markets, new institutional structure (resembling similar institutions in other developed markets), consisting of regulatory agencies like SEBI and IRDA on one hand, and public/private institutions like Clearing Corporation of India Ltd. (CCIL), National Securities Depository Corporation Ltd. (NSDL), Credit Information Bureau Ltd. (CIBL) and credit rating agencies on the other hand, has come in to existence to support financial markets.

Over the last five years, a number of primary dealers, mutual funds and investment institutions – both domestic and foreign – have become active players in the financial markets. The new institutions have contributed to deepening the debt and equity markets and eliminating counterparty risks in treasury dealings. Today we have a payment and settlement system – courtesy RBI, CCIL and depository institutions – comparable to any global system, which has greatly facilitated foreign exchange, money market and securities transactions of Treasury.

Thirdly, with RBI allowing Rupee derivatives in a phased manner, the range of products offered by treasury have widened, with innovative product structures. There is widespread use of swaps, forwards and options, not only to hedge currency and interest rate risks, but also for trading and generating profits in a dynamic market. Simultaneously, equity derivatives such as stock futures and options have also become popular with investors, although the bank treasuries have as yet not been permitted to use equity derivatives.

More recently, currency and interest rate futures have been introduced under the combined stewardship of RBI and SEBI. Currency futures are being traded in two major exchanges, with fairly good liquidity in 1 to 3 month contracts. Interest rate futures market is also being activated. Regulators are seriously discussing introduction of new products such as credit derivatives, exchange traded options and cross currency futures.

RBI has permitted banks to borrow and invest through their overseas correspondents, in foreign currency subject to a ceiling of 50% of their tier-1 capital, or USD 10 million, whichever amount is higher. Effectively, this relaxation has placed banks’ Treasuries in command of substantial funds which are freely convertible and which can be deployed in domestic market or global markets subject to certain restrictions.

The globalisation has thus expanded the scope of Treasury and has thrown open the domestic markets, at least partially, to the winds blowing across the global currency markets. Incidentally, we may clarify that the impact of globalisation is in no way confined only to banks having overseas branches, but is equally felt by all other banks and financial institutions who are engaged in foreign currency transactions or cross-border investments, either directly or on behalf of their clients.

Essay # 4. Evolving Role of Treasury as Profit Centre:

Treasury was a service centre, primarily intended to attend to cash flow requirements of the bank, and hence operated only in money market. Merchant business was attended through the foreign exchange department, while bank’s investment assets were managed through a separate department.

The wider scope of integrated treasury has afforded banks an opportunity to generate surpluses, to supplement profits from its core banking activity. Treasury profits have become attractive for two reasons: firstly, Treasury largely operates in inter-bank markets which are almost free of credit risk, and hence requires very little capital allocation (though this must be qualified by recent developments in global market where institutional credit risk has become quite significant).

Secondly, the treasury activity is highly leveraged – the risk capital allocated to Treasury may range between 2% to 5% of the size of transactions handled, hence the return on capital is quite high. Thirdly, operational costs in Treasury are low as compared to branch banking, whether retail or wholesale. The Treasury is run by a few specialist staff, engaged in high-value transactions, per transaction size generally not being below Rs. 50 million. The Treasury also trades in narrow spreads; hence profit is generated from high volumes of business.

Treasury profits are generated from the following sources:

1. Conventional:

i. Foreign Exchange Business:

Buying and selling foreign currency to customers constitutes a major source of ‘other income’ for the banks. The difference between ‘buy’ ‘sell’ rates – known as ‘spread’ – is the profit for the bank. The banks buy foreign currency from customers (mainly exporters) and sell the same in inter-bank market.

The banks also sell foreign currency to customers (importers), which they buy from inter-bank market. The banks may sell foreign currency, which they have bought from exporters, to importers on the same day, squaring up the residual position in the inter-bank market. Banks generally do not maintain a stock of foreign currency for the purpose of merchant business, as it is more convenient to buy and sell from inter-bank market.

Any residual position of a bank at the end of day – overbought or oversold – is known as ‘open’ position, which involves exchange risk, as the value of foreign currency may change overnight (may in fact, change from moment to moment, hence the dealers are careful to maintain only a limited position during the day time also).

ii. Money Market Deals:

Conventional banking operation in money market was confined to lending surplus funds and borrowing funds when required. Interest on funds lent in the market is a source of income, but it can hardly be called profit – as such funds come from deposits, where interest cost is higher than the interest earned in money market. Till fairly recently, banks were circumspect in borrowing funds in inter-bank market only for the purpose of lending with a profit.

iii. Investment Activity:

Banks have always been investing in government securities to satisfy the SLR requirement, but otherwise were not very active in investing in non-government securities. Income from risk-free investments was not considered to be significant. Banks have also been investing in strategic assets – such as subsidiary and associate companies – where returns on investment were only of secondary importance. The development of corporate debt market in fact, is a recent phenomenon, which followed removal of RBI restrictions on bank investments, and dematerialisation of securities in the late 90’s.

2. Profits for Contemporary Treasury:

Buying and selling foreign exchange to customers and interest on investments and money market lending, continues to be primary source of income for bank treasuries. However, Treasury profits are increasingly derived from market operations, involving buying and selling, or borrowing and lending, or investing in tradable assets, taking a proprietary position – not with the intention of meeting customer requirements, or for meeting Reserve requirements of the bank, but only to generate profits. At the same time the range of services the bank offers to customers has also widened with introduction of new products.

The Treasury profits arise mainly from the following sources:

i. Interest Arbitrage:

The Treasury operates across the currency and security markets; hence is in a position to find where the interest differentials are in its favour. The Treasury may borrow in USD and lend in Rupee inter-bank market, or vice versa, depending on the domestic and foreign interest rates. Or, the Treasury may borrow in money market and invest short-term in commercial paper or T-bills.

Banks with good credit standing may borrow large amounts in money market and lend to other banks/highly rated corporates and other institutions, using market instruments, at marginally higher rates. As the futures market continues to develop, Treasury also has the opportunity to arbitrage between OTC (over- the-counter) and futures markets.

Treasury today uses a variety of money market instruments, such as commercial paper, certificates of deposit, treasury bills and CBLO to optimize return on funds. The Treasury thus has a choice of different currencies and market segments, to borrow or lend or invest short-term funds.

ii. Trading:

Trading is a speculative activity, where profits arise out of favourable price movements during the interval between buying and selling. Currency trading since long has been at the core of forex dealing in bank treasuries. Banks holding AD 1 license are permitted by RBI to trade in currencies within preset limits. Treasury may go long (buy currency) or short (sell currency) on currencies to profit from exchange rate movements.

Treasury may also swap currencies, buying and selling currencies at different points of time, to benefit from changes in forward rate movements (which reflect changes in interest rates). Till the position is squared, the treasurer has an ‘open position’ value of which changes as per movement of exchange rates.

The Treasury may take similar proprietary positions in securities, where, in a rising market, securities are bought and sold with a profit when the yields fall. Bank treasuries are fairly aggressive in buying and selling Government securities (G-sec), as the banks in any case need to hold approved securities, in excess of their SLR requirement, in order to manage their liquidity.

G-sec constitute the most liquid segment of debt market and are traded on wholesale debt market (WDM) of National Stock Exchange. Active treasuries deal not only in Government securities, but also in corporate bonds (non-SLR) and equity instruments so as to contribute to bank profits.

Treasuries over the last decade have also become active in equity markets. Equity trading is highly profitable in rising stock markets, despite the volatility of equity prices, as Indian economy has been witnessing a steady growth. However, in terms of volume, banks participation in stock market is peripheral, as RBI restricts banks’ direct and indirect exposure to capital markets.

Another area which is almost exclusive to banking sector is trading in credit instruments. The only instruments currently available in this segment are securitized credit receivables and other assets, commonly known as pass-through certificates, issued by special purpose vehicles floated by the banks (or other specialized institutions) for the specific purpose of securitization.

Participation notes, though not traded, also fall under this category. The underlying assets are variously described as collateralized debt obligations, asset backed or mortgage backed securities (CDO, ABS, MBS) etc. While the securitized market provides for trading in credit risk, the market has not been liquid and trading takes place mostly over-the-counter.

RBI has since issued elaborate guidelines (most recently in March 2010) to regulate the securitisation process. RBI has also announced, in the latest review of monetary policy (April, 2010) introduction of credit default swaps, which may entirely change the shape of the market.

While trading in currencies and securities, Treasuries are open to market risk, or price risk, where they may incur a loss if price of the currency (exchange rate) or the security moves adversely. In order to minimize such losses, bank treasuries are subject to strict risk management controls, which we would study later.

Banks have also been permitted to trade in some of the derivative products, and some of the larger banks have been market makers in options and interest rate swaps. Derivatives have added to the range of products available to the Treasury for trading, as well as risk management.

iii. Treasury Products:

Treasury sells, in addition to foreign exchange services, derivatives and structured products to corporate customers. Large corporates have an appetite for new products in order to hedge their currency and interest rate risks, and at times, also to reduce their interest costs. For instance, a company may buy from the Treasury a Forward Rate Agreement (FRA) to fix interest rate for commercial paper they plan to issue after 3 months.

The Treasury may offer a currency swap to a corporate customer to convert their floating rate USD loan into Rupee loan carrying fixed interest rate, so that the customer no longer has currency risk or interest rate risk. The rates offered by Treasury for such products always have a built-in profit margin, or ‘a buy-sell spread’ in bank’s favour.

The significance of treasury as profit centre may be appreciated from the fact that treasury income constituted about 25% of gross income of major Indian banks for the year ending 31 March 2009.

Treasury also plays an important role in transfer pricing – i.e. allocation of costs to various departments/ branches of the bank on a rational basis. Traditionally, the cost of funds was accounted only as interest cost, ignoring the interest rate risk and maturity mismatches between sources and uses of funds.

Treasury adds the cost of hedging, or cost of risk to the cost of funds and helps ascertain profitability of banking activity more accurately. In the process, a small margin is added to the Treasury profits for acting as funding centre of the bank.

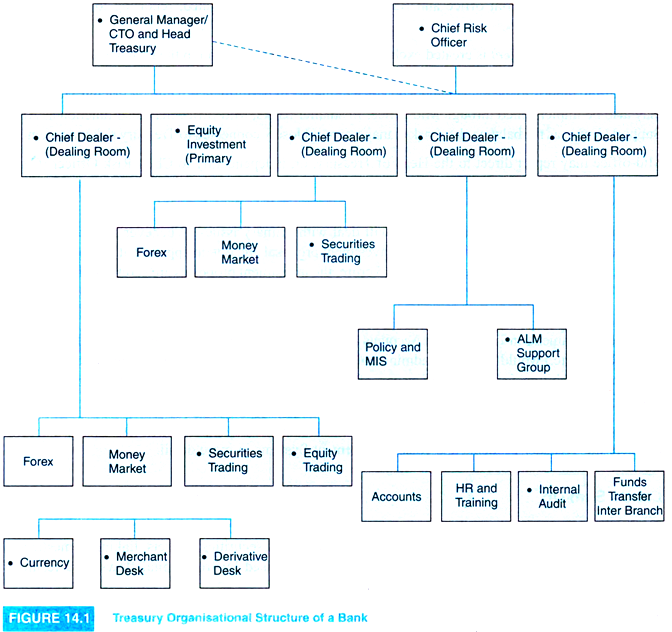

Essay # 5. Organisation of Treasury:

The Treasury is organised either as a Department of the bank, or as a Specialised Branch under direct control of the bank’s head office. In either case, the Treasury functions with a degree of autonomy, with its own accounting system. The branch status is preferred as the books of accounts of Treasury can be maintained independently (with its own P&L and GL accounts). On the other hand, the departmental form has the advantage of easier coordination with related departments at head office (such as Central Accounts and Planning Departments) in a line management.

Treasury as a specialized branch enjoys an additional advantage, as the Branch can act as Authorised Dealer for foreign exchange business and can participate in clearing and settlement systems directly, while Head Office Department can only act through a branch for its business operations. We may therefore conclude that in the context of integrated treasury operations, a Treasury Branch should be the preferred form of organisation.

The Treasury is headed by a senior management person – A General Manager, Chief Treasury Officer (CTO), Vice-President or with some such designation. Treasury being a key activity of the bank, Head of Treasury should be a person who would report direct to the CFO or CEO of the bank. However the level of reporting and delegation of powers would depend on the size of the bank and the importance attached to the treasury activity within the bank.

The Treasury is segregated into:

1. Dealing Room:

The dealing room is headed by Chief Dealer, who is in charge of the front office. The Dealers working under him buy and sell in the markets. Each Dealer specializes in one of the markets, i.e. foreign exchange, money market or securities market, although, in an integrated treasury, the dealers are generally familiar with all the markets.

Depending on the size of operations, there may be dealers dedicated to major currencies, or dealers specializing only in forward markets or derivatives. It is also common to have a separate corporate dealer, exclusively to attend to major corporate customers/merchant business. In larger banks, Treasury will also have an ALM desk, to exclusively manage Bank’s ALM risks.

The Securities Market is normally divided into two parts: primary and secondary markets. The securities dealer deals only with secondary market, i.e. buying and selling of securities already available in the market. On behalf of the bank, the dealer may also participate in auction of government securities and T-bills, conducted periodically by RBI. Treasuries, who are active in equities, may also have a separate equity dealer who would be dealing with equity instruments in secondary markets.

The primary market comprises of new issues of non-govt. debt paper (commonly referred to as non- SLR securities), issued by corporates (mostly placed privately with qualified institutional investors). The primary market issues are subscribed by Investment Department generally situated outside the Dealing Room, but as part of the Treasury.

This is so, because primary issues need appraisal of credit risk, thorough examination of issue terms and where so stipulated, documentation for secured debt paper (through a Trustee). Often banks require inputs from market research, for which, either they may have an in-house Research Dept., or may collect it from published material.

2. Back-Office:

The back-office is responsible for verification and settlement of the deals concluded by the dealers. The deals are verified on the basis of deal slips prepared by the dealers and also from the confirmation received from the counterparties. The back-office confirms the deals independently with the counterparties (banks and other institutions) over phone and verifies the authenticity of the confirmation document.

The Back-office takes care of all related book keeping and submission of periodical returns to RBI. Back-office also maintains Nostra accounts (foreign currency accounts with correspondent banks), funding and security accounts with RBI, and Demat accounts with depository participants and ensures that adequate margin money is held with Clearing Corporation of India for Rupee and dollar settlements.

Settlement refers to receipt and payment of amounts following deals made by dealers (i.e. sale and purchase of foreign currency, lending and borrowing, sale and purchase of securities etc.). Settlement is a key function of Back-office, as all payments and receipts must take place on value date. Any delay in settlement would not only result in financial loss to the bank, but delays in payment are considered as a default by the bank, severely affecting the bank’s reputation.

It is mandatory that Front office and Back Office are totally segregated, reporting to two different managers.

3. Middle Office (Mid-Office):

Middle office (Mid-office) is created exclusively to provide information to the management (MIS) and to implement risk management systems. Mid-office monitors exposure limits and stop loss limits of Treasury and reports to the management on key parameters of performance. Transfer Pricing Mechanism may also be implemented through Mid-office. In smaller banks, Mid-office may also function as ALM Support Group, as the balance sheet risk management is closely connected to Treasury risk management.

Mid-office may report direct to the Head of Treasury or, independently to Chief Risk Officer (CRO) where such position exists, so as to ensure compliance of Treasury with risk management policies and processes objectively.

4. Investment Department:

Investment department, deals with primary issues. Whenever a suitable offer is received, the Department would put up an investment proposal and obtain approval at appropriate level. Minimum marketable investment being Rs. 5 crore, the investment proposals are scrutinised closely and are generally considered by an Investment Committee, before the sanction is obtained at appropriate level.

The other departments in Treasury, viz. Accounts and Administration, Systems Administration, Remittances (swift/RTGS, etc.) would be mainly administrative in nature. Some banks may also prefer to have their inter-branch cash transfer department as part of Treasury, as the Treasury maintains the bank’s account with RBI.

Preferred form of organization for integrated treasury is by way of a specialised branch. Treasury is organized mainly as Front Office, Back Office and Middle Office, apart from an Investment Dept. dealing in primary markets. Other Departments are mainly administrative in nature.