Here is a compilation of essays on ‘Banks’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Banks’ especially written for college and banking students.

Essay on Banks

Essay Contents:

- Essay on the Meaning of Banks

- Essay on the History of Bank

- Essay on the Types of Banks

- Essay on the Electronic Modes of Payment Used by Banks

- Essay on the Process of Credit Creation by Banks

- Essay on the Credit Instruments Used by Banks

Essay # 1. Meaning of Banks:

Bank is a financial institution that provides banking and other financial services to their customers. It is generally understood as an institution which provides fundamental banking services such as accepting deposits and providing loans. A banking system referred as a system provided by the bank which offers cash management services for customers, reporting the transactions of their accounts and portfolios, throughout the day.

The banking system in India should not only be hassle free but it should be able to meet the new challenges posed by the technology and any other external and internal factors. Before the establishment of banks, the financial activities were handled by money lenders and individuals. At that time the interest rates were very high. Again there were no security of public savings and no uniformity regarding loans.

The bulk of all money transactions today involve the transfer of bank deposits. When a depositor writes a check against his account, his bank must surrender that amount in reserves to the payee’s bank for the check to clear.

Reserves are constantly moving from one bank to another as checks are written and cleared. At the end of the day, some banks will be short of reserves and others long. The supply of reserves changes whenever base money enters or leaves the banking system.

Those who are new to banking or who have lived in other countries where the banking system can’t be trusted might be wondering why they would want to use a bank at all.

It’s certainly possible to operate on a cash-only system, but that isn’t the best idea for several reasons:

(a) Security;

(b) Convenience; and

(c) Saving and investing.

Essay # 2. History of Bank:

The first regular institution resembling what we call a Bank was established at Venice, nearly seven hundred years ago. The Republic being engaged in war, and falling short of funds, had recourse to a forced loan. The contributors to that loan were allowed an annual interest of four per cent on the sums they had been obliged to lend; certain branches of the public revenue were assigned for the payment of that interest.

The Bank of Venice long remained without a rival; but about the beginning of the fifteenth century, similar institutions were established at Genoa and Barcelona, cities, at that time the pride of Europe, and second only to Venice in extent of trade.

The Bank of England, first chartered in 1694, is the prototype and grand exemplar of all our modern banks; its history, will deserve the more particular attention. The original capital of bank was 1,200-0001 sterling. The original capital of this bank was 1,200,000 sterling. This capital did not consist in money, but in government stock.

The subscribers to the bank had lent the government, the above sum of 1,200,000 at an interest of eight per cent, besides an additional annuity of 4,000 and the privilege of acting as a banking company for the term of twelve years. These hard terms are a pretty clear proof how low was the credit of King William s government in the first years of its establishment.

With the increase of wealth and commerce in Europe, private bankers established themselves in all the principal cities and towns. They received money on deposit; they managed the money affairs of states and individuals; they lent money to such borrowers as could give the necessary security; and they bought and sold bills of exchange, bullion, and coin.

Two banks were established in Scotland by charter from the king; one the Bank of Scotland, in 1695; the other, the Royal Bank of Scotland, in 1727. These two banks have branches in most of the principal towns of Scotland; but as they never obtained any exclusive privileges, a multitude of private banks sprung up to dispute the business with them, and to divide its profits.

Essay # 3. Types of Banks:

Bank can be classified in various ways on the basis of their functions, ownerships etc.

Some of them are:

i. Central Bank:

Central bank is the apex institution that controls, regulates and supervises the monetary and credit system of the nation. In India Reserve Bank of Indi is the central bank. Guiding principles of the RBI are to operate its most instruments in a way that serves the objectives of economic policy laid down by the Government and Planning Commission. The central bank has the monopoly of issuing notes or paper currency to the public.

Another important function is to act as the banker to the government. The central bank is the lender of the last resort for other banks in difficult times because there is no hope of getting help from any competing institution. The chief function of central bank is to maintain price and economic stability. Another important function is to maintain the exchange rate of the national currency.

ii. Commercial Bank:

It is such bank that performs all types of banking activities and finance for industry and business. They collect savings from people and give loans when needs. They give loans for short term, medium term and long term. Majority of commercial banks in India are in the bank of the public.

Commercial banks are the single most important source of institutional credit in India. Modern commercial banking begins with the setting up of the first Presidency bank, The Bank of Bengal in 1806 in Calcutta. Two other Presidency banks were set up in Bombay and Madras in 1840 and 1894 respectively. They were amalgamated in Imperial bank in 1921.

iii. Exchange Bank:

Such bank deals with the foreign exchange and international trade. They involve international payments through the sale and purchase of bills of exchange and helps for promoting the foreign trade.

iv. Saving Bank:

Such bank plays vital role for improving the savings habits among people. People can easily save money and also get interest and other benefits.

v. Agricultural Bank:

Agricultural bank specially set-up for agriculture development. In India, co-operative institutions and land development banks are more important among those. Farmers needs more credit from scheduled banks so that they not depends on moneylender and others people who exposits them by higher rate of interest.

Essay # 4. Electronic Modes of Payment Used by Banks:

i. Swift:

SWIFT stands for Society for Worldwide Interbank Financial Telecommunications. This is a cooperative society, owned by member banks and financial institutions, providing secured telecommunication and one point contact with 8,300 member financial institutions, spread over 209 countries.

The system has built in security system with an automatic authentication of financial messages, through bilateral key exchange (BKE), and is available 24 hours a day and 365 days in a year. The system is cost effective with cost of an average message grossly lower by almost one-fourth than the conventional telex systems.

SWIFT has since introduced new system of authentication of messages between banks, whereby banks are required to have a authentication key exchanged between themselves, through a set format by use of Relationship Management Application (RMA), (also called Swift BIC, i.e. Bank Identifier Code).

ii. Chips:

CHIPS (Clearing House Interbank Payment System), is a major payment system in the USA, operating since 1970. It is a fully automated; computer based messaging and net settlement payment system used by major banks for settlement of a large part of US dollar payments in the USA. CHIPS were established by New York Clearing House, as a substitute to paper checks. Over the period, CHIPS has grown both in volumes, with a membership of 48 currently.

The participating banks use the system throughout the day for sending and receiving electronic payment instructions, which at the end of the day are netted and net payment received/paid by each bank to the clearing house. The net position is then debited or credited to each bank’s account with Federal Reserve.

The system uses CHIP participant codes to identity the participants and UID numbers to identify the beneficiary account. The banks maintaining US dollar Nostro accounts with any of the US based banks are given a specific UID number, which facilitates Straight through Processing (STP) of most of the interbank payments and receipts, through the system.

CHIPS are operative only in New York, and as such, are mainly used for foreign exchange interbank settlements and Euro Dollar settlements.

iii. Fedwire:

This is another US payment system operated by Federal Reserve Bank, operated all over the US states since 1918, and handles majority of domestic payments. It is an automated computer-based messaging and payment system, working on gross settlement basis. All US banks maintain accounts with Federal Reserve Bank, and are allotted an ‘ABA numbers’ to identify the senders and receivers of payments.

As compared to CHIPS, this is a large system, with over 8,000 participants, and handles a large number of payments across USA, covering Interbank transfers out of New York, local borrowings and lending, commercial payments, and also some securities transaction related payments for domestic banks.

iv. Chaps:

Clearing House Automated Payments System (CHAPS), is a British equivalent to CHIPS, handling receipts and payments in LONDON. This system works on the same principles as CHIPS, working on the net payment settlement system. CHAPS is used by a large number of banks in UK, with about 16 member banks and over 400 indirect members, using the system through some large bank.

v. Target:

Trans-European Automated Real-Time Gross Settlement Express Transfer system is a EURO payment system comprising 15 national RTGS systems working in EUROPE. These are interconnected by common procedures and uniform platform for processing high value payments by over 30,000 participating institutions across EUROPE. This facilitates receipts and payments of funds across the Euro zone (all member countries).

vi. RTGS-Plus and EBA:

These are other Euro clearing systems, with RTGS plus, being a German hybrid clearing system and operating as an European-oriented real time gross settlement and payment system. RTGS plus has over 60 participants.

The EBA-EURO 1, with a membership of over 66 banks, in all EU member countries, works as a netting system with focus on cross border Euro payments. For retail payments, EBA has another system, called STEP 1, with around 200 members across EU zone.

STEP 2 is also in use in EU zone, which facilitates straight through processing (STP) to member banks, using industry standards.

vii. RTGS/NEFT in India:

RTGS:

Reserve Bank of India has implemented Real Time Gross Settlement (RTGS) system for the banks in India, where banks can remit funds to other banks through this mechanism. The RTGS system is managed by IDBRT, Hyderabad, which connects all banks to a central server maintained at RBI.

Each bank maintains a pool account with the RBI for inflow and outflow of funds received/paid through RTGS. The bank has to monitor the balances in the account throughout the day, so as to keep it sufficiently funded, to take care of outward remittances. For customer remittances, the minimum amount for RTGS transfers is Rs. 1.00 lac.

NEFT:

This is another funds transfer facility for banks in India, which runs on a batch process method. This is used for small remittances by customers from an account with one bank to another account in another bank. The funds adjustment for NEFT is also done through the pool accounts maintained by individual banks.

Both RTGS and NEFT have facilitated faster funds transfer for bank customers, across the country, leading to a great reduction remittances/payments sent earlier through cheques/drafts.

Essay # 5. Process of Credit Creation by Banks:

We know that it is a primary function of the banks to accept deposits from public keep a certain part of this deposit with them and distribute the rest as loans and advances. If banks don’t distribute the money received as deposits in the form of loans, there will be no credit formation. So Prof. Sayers has said, “Banks are not merely purveyors of money, but also, in an important sense, manufacturers of money.”

Thus it is clear that banks create credit through deposit. The money created by banks is called ‘bank money.’ Now there is a need to highlight how banks create credit.

Credit is created by banks in the following ways:

(1) By Issuing Paper Money:

These days in almost every country, the Central Bank retains the authority of issuing paper notes. In India, too, the Reserve bank of India monopolises the process of issuing paper notes. Banks create credit by issuing bank notes also because, there is no need of maintaining a cent percent metallic reserve for issuing paper notes.

After a certain metallic reserve, the remaining parts of paper notes are issued on the credit and bonds of the central bank. It is worth mentioning here that only the central bank can create credit in this way.

(2) By Primary and Derivative Deposits:

Banks create credit by increasing deposits.

Bank deposits are of two types:

(a) Primary Deposits:

Primary deposits refer to those deposits which are made by the people directly in banks in the forms of cash. There is no role of banks in such deposit. It totally depends on the will of the customers. That is why Lord Keynes has called it Idle or Passive Deposits.

(b) Derivative Deposits:

When somebody applies to the bank for loans and the bank accepts it the whole amount of loan is not issued as cash in one go, but the bank opens a loan account and deposits money in that. Then the borrower is authorised to withdraw it in installments through cheque according to his needs.

This way every loan granted by banks creates deposits, but this deposit is not a cash deposit but a credit deposit. Thus loans create deposits. On the other hand loans given by the banks are on the basis of initial deposits. If banks don’t have initial deposits, they can’t give loans. Thus deposits create loans.

So, Prof. Keynes has said, “Loans are the Children of deposits and deposits are the children of loans.”

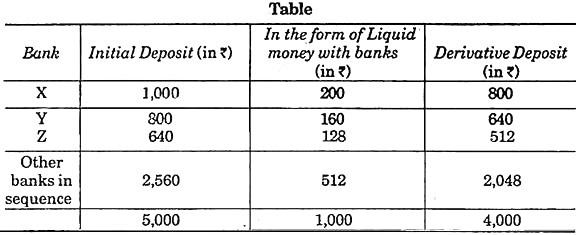

The Credit of Derivative Deposits created by banks can be, presented with the help of an example. Suppose a customer named Satyam deposits Rs. 1,000 with bank X. This will be called the initial deposit of bank X. Now suppose bank X keeps 20 percent of this deposit as liquid money and gives Rs. 800 as loans to another customer named Pragati.

In this amount Rs. 800 will be deposited in the account of the customer to whom the loan is being granted and she will have the right of withdrawing money using Cheque. This way this Rs. 800 is the derivative deposit of the bank. Now if Pragati wants to pay some money to somebody, she would issue a cheque in his name.

Suppose, Pragati gives a cheque for Rs. 800 to Aman, Aman deposits that cheque in bank Y. Bank Y also keeps 20 percent as liquid money and the remaining 80 percent i.e. Rs. 640 will be distributed as loans. Similarly Rs. 640 will the initial deposit of any other bank let it be bank Z. This way the sequence would keep going on.

This system of credit creation can be clarified with the help of following table:

In this way on the basis of initial deposit of Rs. 1,000, deposits of Rs. 5,000 and loans of Rs. 4,000 are created by different banks.

Limitations of Credit Creation by Banks:

Though banks possess the capacity of credit creation, but it is not unlimited.

The limitations of credit creation by banks are as follows:

(1) Total Amount of Cash in the Country:

The Creation of Credit depends on the availability of cash money in the country. If the Central bank of the country issues paper notes in large amount, the commercial banks will have bigger volume of money and they will be able to create more credit. On the Contrary, if the Central Bank issues less amount of paper money, the credit creation power of banks will be less. Thus cash is the basis of creation of credit.

(2) Volume of Primary Deposits:

Banks receive deposit in two ways:

(i) Primary deposits, and

(ii) Derivative deposits.

But the main basis of Credit Creation is the primary or actual deposit. If there will be more primary deposit, there will be more credit creation. On the Contrary, the less would be the primary deposit, the less would be the ability of credit creation.

(3) Popularity of Banking Habits:

The credit Creation depends to a large extent on the popularity of banking habit among people. If people use cheque more and more in their transactions there would be more cash deposits with banks and they can create more credit. Opposite to it, if people use cash for most of transactions, there would be less cash deposits with banks and the credit creation ability would reduce.

(4) Cash Reserve Ratio:

According to banking regulations, every bank has to keep a certain part of their deposits as Cash reserve. Only the remaining sum can be advanced as loans. Thus if the Cash Reserve Ratio is less then there would be more credit creation and in the condition of a higher Cash Reserve Ratio there would be less Credit Creation.

(5) Deposit with Central Bank:

Every commercial Bank has to keep a certain part of its deposits with Central Bank. What part of the deposit should be kept with the Central bank is decided by the Central Bank. This rate is changed from time to time. When the Central bank increases this rate, the credit creation ability of commercial banks decreases because there is less cash availability.

(6) Situation of Trade and Industry:

The development of Trade and Industry in the country also affects the credit creation in the country. The demand of loans by trade and industrial world decreases during economic depression. This lowers down the credit creation ability of banks.

(7) Credit Policy of Central Bank:

The Credit policy is determined by the Central Bank of the Country. There is change in it from time to time. The increase or decrease in the credit creation by banks depends to a large extent on the credit policy of the Central Bank.

(8) Basis of Securities:

Loans are given by banks on the basis of Collaterals. The better the collateral, the more will be the credit creation. On the other hand, in the situation of ordinary collateral, there would be less credit creation. This way, it can be concluded that the banks don’t have the infinite ability of credit creation. But, even within the limits of credit creation banks help in the economic development.

Essay # 6. Credit Instruments Used by Banks:

Credit instruments mean those papers or documents which are not money but which act as money. Credit instruments as used in place of money, so these are also called credit money.

Types of Credit Instruments:

Different types of credit instruments are as follows:

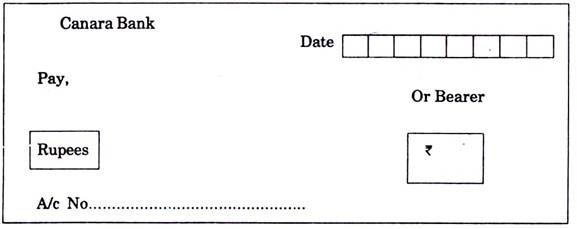

(1) Cheque:

A cheque is an official paper instructing a bank to pay a specific amount from the person’s account to the person in whose name the cheque has been made. This is a popular credit instrument which a person deposits with a bank, instruct the bank to pay the specified amount to the bearer of the cheque or the person in whose name the cheque is written.

Thus a cheque has three parties:

(i) Drawee i.e. the person, who writes the cheque,

(ii) Drawee i.e. the bank that has to pay, and

(iii) Payee i.e. who will be paid.

Kinds of Cheque:

Different kinds of cheques are:

(i) Bearer Cheque:

A bearer cheque is that the payment for which is given to the person who produces the cheque at the counter of the bank. It is not essential to know whether the person receiving the payment is proper or not. The bank is not responsible for an improper payment. However, it is not essential to get the signature of the payee of this Cheque, but the banks take the signature of the payee at the back of the cheque with respect of safety.

(ii) Order Cheque:

An Order Cheque is that the payment for which can be obtained by that person only whose name is written as payee on the cheque or an endorsement has been made in the name of that person according to rules.

(iii) Crossed Cheque:

When two oblique parallel lines are drawn at the top of the left side of a cheque it is called a Crossed cheque. It is the safest Cheque. This cheque is not paid directly at the bank counter. Instead, the specified amount is first credited in the account of the person in whose name the cheque has been written and then he/she can withdraw it according to his/her own convenience.

Crossed Cheque is of two kinds:

(a) General Crossed Cheque:

When two oblique parallel lines are drawn at the top left side and the space between the two lines is left blank or ‘Account payee’, ‘& Co’, ‘Not Negotiable’ is written but the name of the bank is not mentioned it is called General Crossed Cheque.

(b) Special Crossed Cheque:

In this cheque the name of a bank is mentioned between two parallel lines. It means that this cheque can be cashed on the bank the name of which is mentioned there between these two lines.

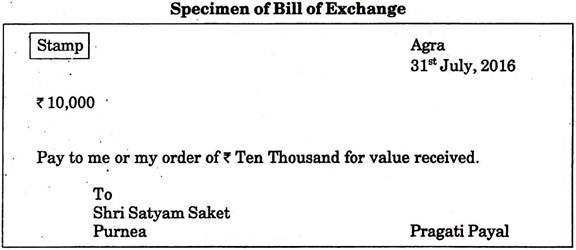

(2) Bill of Exchange:

According to the Section 5 of Indian Negotiable Instrument Act, 1881, “A Bill of exchange is an instrument in writing, containing an unconditional order, signed by the maker, directing to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.”

Thus, bill of exchange is a condition free instrument in which the writer instructs the drawee to pay a specific amount after a certain period. The right side of the bill of exchange retains the signature of the drawer and the name and address of the drawee is mentioned on the left side.

There are three parties of a bill of exchange:

(i) Drawer,

(ii) Drawee, and

(iii) Payee.

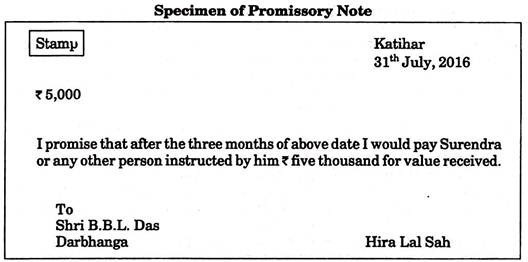

(3) Promissory Note:

According to the Section 4 of Indian Negotiable Instrument Act, 1881, “A Promissory Note is an instrument in writing (not being a bank note or a currency note) containing an unconditioned undertaking signed by the marker to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

In this way it is also a condition free written document like a bill of exchange. The only difference is that the bill of exchange is written by the drawer/creditor and accepted by debtor/drawee which the promissory note is written as well as accepted/promised to pay by the debtor only.

A promissory note has two parties:

(i) Maker/drawer/promisor, and

(ii) Drawee/payee/promisee.

Hundi is such a condition-free document written in one of the vernacular languages in which one person instructs the other to pay a specific amount after the completion of a certain period or on demand. It can be written in different languages, so there is not any definite format. There are various kinds of Hundis.

Some examples are as follows:

(i) Darshani Hundi:

Darshani hundis are like sight bills. They are paid immediately on presentation, sight or demand.

(ii) Muddati Hundi:

The muddati hundi is like a time bill. It becomes payable after a stipulated period from the date of the hundi.

(iii) Dhekhanhar Hundi:

The payment of dhekhanhar hundi can be made to any person who presents the hundi.

(iv) Shahjog Hundi:

Shahjog hundi is that hundi whose payment is made to a reputed person.

(v) Farmanjog Hundi:

The payment of this hundi is made to a person whose name is mentioned in the Hundi.

(vi) Dhanijog Hundi:

The payment of this hundi is made to the person mentioned in the hundi or to somebody else according to his instruction.

(5) Bank Draft:

It is a bill of exchange drawn by a bank on another bank or by itself on its other branch. It is very nearly allied to a cheque but it cannot be easily countermanded like a cheque and it cannot be made payable to bearer. In other words, it is a credit instrument in which the branch of a bank instructs the other branch to pay the specified amount to the person, organisation or institution mentioned in it.

When somebody wishes to send money to other places, he deposits the amount with a branch of a bank and gets a bank draft issued in favour of paying party. Then he sends the draft to the concerned person or place by post. The draft is then carried to the concerned bank and en-cashed there.

(6) Letter of Credit:

Letter of Credit refers to such a document through which a person, institution or bank requests the other person, institution or bank that the person specified in the document should be granted credit up to a certain limit or shares. A certain date is also mentioned in the letter of credit which is the period for which the credit is requested.

(7) Treasury Bills:

Treasury bills are promissory notes issued by the Central Government for a fixed period for raising short term funds. It is issued at a discount. Site period is 3 to 6 months. The Payment is made just after the completion of the period.