Here is an essay on ‘Bonds’ for class 11 and 12. Find paragraphs, long and short essays on ‘Bonds’ especially written for college and management students.

Essay on Bonds

Essay Contents:

- Essay on the Meaning of Bonds

- Essay on the Types of Bonds

- Essay on Bond Valuation

- Essay on Current Yield of Bonds

- Essay on the Bond Pricing Theorems

- Essay on Bond Risks

- Essay on the Duration of a Bond

Essay # 1. Meaning of Bonds:

Organizations may borrow funds by issuing debt securities named as bonds, having a fixed maturity period (one year or more) and pay a specified rate of interest (coupon rate) on the principal amount to the holders. Bonds have a maturity period of more than one year which differentiates it from other debt securities like commercial papers, treasury bills and other money market instruments.

A bond is a debt instrument, usually tradable, that represents a debt owed by the issuer to the owner of the bond. Most commonly, bonds are promises to pay a fixed rate of interest for a number of years, and then to repay the principal upon maturity.

Bond Cash Flows:

A bond typically makes a series of annual or semi-annual interest payments and then, at maturity, pays back the face value.

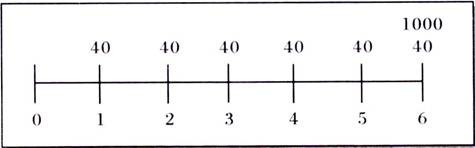

Let’s look at an example:

In the following time line for a 3-year bond with a coupon rate of 8% per year paid semiannually. The bond has a face value of Rs.1000. The bond has three years until maturity and it pays interest semiannually, so the time line needs to show six periods. The bond will pay 8% of the Rs.1000 Face value in interest every year.

However, the annual interest is paid in two equal payments each year, so there will be six coupon payments of Rs. 40 each. Finally, the Rs.1000 will be paid at maturity (i.e. at the end of year 6).

Therefore, the time line looks like the one below:

The value of any asset is the present value of its cash flows.

Therefore, we need to know two things:

i. The size and timing of the cash flows.

ii. The required rate of return (discount rate) that is appropriate given the risky nature of the cash flows.

Essay # 2. Types of Bonds:

1. Coupon Bonds:

It pays a stated coupon at periodic intervals prior to maturity. It also pays the bond’s face value at maturity.

2. Perpetual Bonds:

It has no maturity date. It pays a stated coupon at periodic intervals.

3. Zero Coupon Bonds:

Zero Coupon Bonds are issued at a discount to their face value and at the time of maturity, the principal/face value is repaid to the holders. No interest (coupon) is paid to the holders and hence, there are no cash inflows in zero coupon bonds. The difference between issue price (discounted price) and redeemable price (face value) itself acts as interest to holders.

The issue price of Zero Coupon Bonds is inversely related to their maturity period, i.e. longer the maturity period lesser would be the issue price and vice-versa. These types of bonds are also known as Pure Discount Bond or Deep Discount Bonds. Generally speaking, deep discount bonds have a comparatively lengthy maturity period.

4. Convertible Bonds:

The holder of a convertible bond has the option to convert the bond into equity (in the same value as of the bond) of the issuing firm (borrowing firm) on pre-specified terms. This results in an automatic redemption of the bond before the maturity date.

The conversion ratio (number of equity of shares in lieu of a convertible bond) and the conversion price (determined at the time of conversion) are pre-specified at the time of bonds issue. Convertible bonds may be fully or partly convertible. For the part of the convertible bond which is redeemed, the investor receives equity shares and the non-converted part remains as a bond.

5. Amortising Bonds:

Amortising Bonds are those types of bonds in which the borrower (issuer) repays the principal along with the coupon over the life of the bond. The amortising schedule (repayment of principal) is prepared in such a manner that whole of the principle is repaid by the maturity date of the bond and the last payment is done on the maturity date. For example – auto loans, home loans, consumer loans, etc.

Essay # 3. Bond Valuation:

Bond Valuation refers to calculation of intrinsic value of the Bonds. It means finding out the present value of all the future cash flows.

Bond valuation is not as attractive for two reasons:

First, the returns from investing in bonds are less impressive and fixed.

Second, bond prices fluctuate less than equity prices.

The uncertainty associated with cash flows occurring to a bond holder is less; the emphasis is more on fine-tuned calculations and analysis. Small differentials in prices and returns are also very important from the investors’ perspective.

For the purpose of valuation of bonds the following terms need to be understood:

(a) Face Value:

It is also called as par value. Generally, bonds are issued at par value. Interest is paid on this face value.

(b) Coupon Rate:

This is also known as interest rate. It is the nominal rate of interest fixed and printed on the bond certificate. It is calculated on the face value of the bond. It is the rate at which interest is payable by the issuing company to the bondholder. For example, if the coupon rate on the bond of face value Rs.1000 is 11%, Rs.110 is payable by the company to the bondholder annually till maturity.

(c) Coupon Payments:

The coupon payments represent the periodic interest payments from the bond issuer to the bondholder. The annual coupon payment is calculated by multiplying the coupon rate by the bond’s face value. Since most bonds pay interest semi-annually, generally one half of the annual coupon is paid to the bondholders every six months

(d) Maturity Date:

The maturity date represents the date on which the bond matures, i.e the date on which the face value is repaid. The last coupon payment is also paid on the maturity date.

(e) Original Maturity:

The time remaining until maturity date when the bond was issued.

(f) Remaining Maturity:

The time currently remaining until the maturity date.

(g) Call Date:

For bonds which are callable, i.e. bonds which can be redeemed by the issuer prior to maturity, the call date represents the date at which the bond can be called.

(h) Call Price:

The amount of money the issuer has to pay to call a callable bond. When a bond first becomes callable, i.e. on the call date

Essay # 4. Current Yield of Bonds:

The current market price of a bond in the secondary market may differ from its face value.

The current yield relates the annual interest receivable on a bond to its current market price.

It can be expressed as follows:

Current yield = In/Po X 100

Where,

In = Annual Interest

Po = Current market price

Essay # 5. Bond Pricing Theorems:

The relation between bond prices and changes in the market interest rates have been stated by Burton G. Malkiel in the form of five general principles. These are known as Bond pricing theorems.

The five principles are:

i. Bond prices will move inversely to market interest changes.

ii. Bond price variability is directly related to the term to maturity; which means, for a given change in the level of market interest rates, change in bond prices are greater for longer- term maturities.

iii. A bond’s sensitivity to changes in market interest rate increases at a diminishing rate as the time remaining until its maturity increases.

iv. The price changes resulting from equal absolute increases in market interest rates are not symmetrical, i.e. for any given maturity, a decrease in market interest rate causes a price rise that is larger than the price decline that results from an equal increase in market interest rate.

v. Bond price volatility is related to the coupon rate. This implies that the percentage change in a bond’s price due to a change in the market interest rate will be smaller if its coupon rate is higher.

Essay # 6. Bond Risks:

Two types of risk are associated with investment in bonds, namely default risk and interest rate risk.

1. Default Risk:

Default risk refers to the possibility that a company may fail to pay the interest or principal on the stipulated dates. Poor financial performance of the company leads to such defaults.

2. Interest Rate Risk:

The risk denotes that an investment’s value may change as a consequence of a change in the market interest rates. Such changes usually inversely affect securities and can be reduced by diversifying or alternately by hedging.

Interest rate risk affects the value of bonds more directly than stocks, and it is a major risk to all bondholders. As interest rates rise, bond prices fall and vice-versa.

Essay # 7. Duration of a Bond:

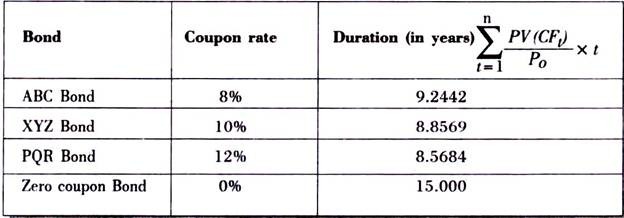

Duration of a bond refers to its weighted average life. Bond duration is a measurement of how long in years it takes for the price of a bond to be repaid by its internal cash flows. The duration is always lesser than its maturity period for coupon paying bonds as the coupons received can be reinvested and money can be generated.

The more frequent the coupon payments the lesser will be the effective life of a bond. For a zero coupon bond there are no intermittent coupon payment and hence the duration and maturity period are same.

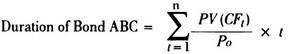

Where,

PV (CFt) = Present value of Cash Flows

t = year in which the cash flow (coupon or principal) is received

Po = Current Market Price of the Bond

n = remaining life of bond in years

Duration is a price sensitivity measurement and it tells us that how many years we should stay invested to get back the amount.

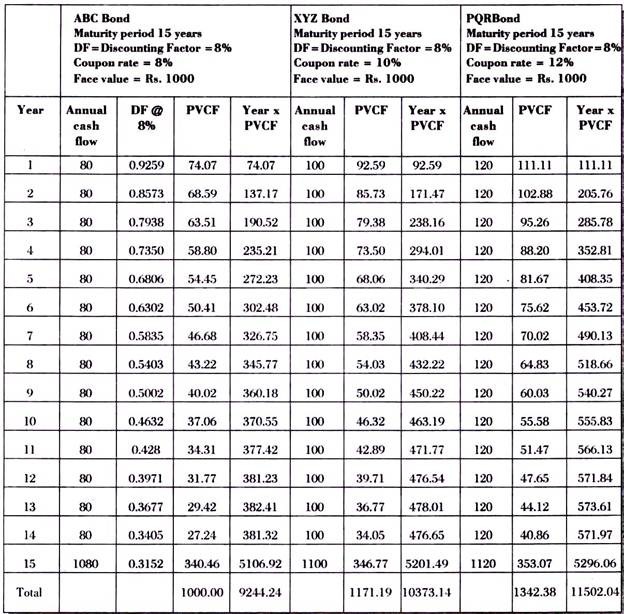

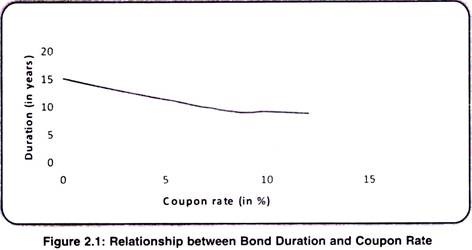

The above graph explains the relationship between coupon rate and duration. It’s self-explanatory that for zero coupon bonds the duration is maturity period (15 years in the graph) and as the coupon rate increases duration falls and stabilizes at a point.

We have considered 8% as discount rate for the life of the bond, but this rate varies depending on the market conditions. We should calculate duration for every change in discount rate.