After reading this essay you will learn about:- 1. Meaning and Definition of Budgets 2. Objectives of Budget 3. Types 4. Requisites 5. Principles 6. Classification 7. Summaries 8. Advantages 9. Limitations.

Essay Contents:

- Essay on the Meaning and Definition of Budgets

- Essay on the Objectives of Budget

- Essay on the Types of Budgets

- Essay on the Requisites for the Preparation of Budgets

- Essay on the Principles for the Preparation of Budgets

- Essay on the Classification of Budgets

- Essay on Budget Summaries

- Essay on the Advantages of Preparing Budgets

- Essay on the Limitations of Budgets

Essay # 1. Meaning and Definition of Budgets:

Budget is derived from French word ‘Baguette’ meaning a small leather bag. Budget is an instrument used by management in planning its future activities.

Some important definitions of budget are given below:

According to George R. Terry, “Budget is an estimate of future needs arranged according to an orderly basis covering some or all of the activities of an enterprise for a definite period of time.”

According to the Institute of Cost and Works, Accountants, England, “A budget is a financial and/or quantitative statement, prepared prior to a definite of period of time, of the policy to be pursued during that period for the purpose of attaining a given objective.”

According to this definition, the essential features of a budget are:

1. Budget is a financial statement, but it can be statement of quantities also with or without financial figures.

2. Budget is prepared for a specific period, and it is prepared generally before the period begins.

3. Budget is a plan of the policy to be pursued during the budget period.

4. The purpose of the budget is to attain a given objective.

It is a tool of management for planning its future activities including estimate of sales, expenditure production etc. It is done for indicating the expected results of the business and the possible future line of action to be followed for the attainment of such results.

Expected results are projected in financial terms or in other numerical terms like units of products, man hours, machine hours etc. Budgeting or Budget making may be defined as “a forecast of programme of operations based on expected operating efficiency.”

Budget should be based on estimated future requirement for a definite period of time. It should be prepared by taking the help of previous statistical data. Thus, budgeting can be defined “as forecasting and preplanning for the next period using past experience, market trends and present position”.

Budget provides predetermined standard of performance for the guidance of the efforts and activities in the business. As budgets provide standards of performance, they usually become the basis for control.

Control used for the execution of budgets is what is called “budgetary control”. Thus budgeting is concerned with the planning function of management, while “budgetary control” involves the function of controlling in the organisation.

Budget as a Means for Planning, Coordination and Control:

Since planning is looking ahead and anticipate difficulties expected and their solution. Budget plans and forecast the expenditure and performance as regards production, sales, purchases, plant utilisation etc.

As coordination means weaving together the segments of the organisation so as to operate at the most efficient level and produce maximum profit. This is achieved as all the sections like sales, purchase, production, finance, personal etc. work together to achieve common goals as defined in the budget.

Controlling means by systematic appraisal of results to ensure that actual and operations coincide, and remedial actions are taken if there is any deviation. The budget means, by which plans are regularly compared with actual results regarding expenses and performances.

Essay # 2. Objectives of Budget:

A system of budget is necessary to plan and control the activities pertaining to production and sales.

The objectives of preparing a budget are as follows:

(i) To Formulate a Plan of Action:

The plan of action depends upon the policy that the business decides to execute.

(ii) To Facilitate Central Control:

Budget is a means for the top management to control the business operations centrally. For the proper implementation of the policy and achieving the objectives, here is a need for delegation of authority and responsibility to the executives, based on the blue-print and directions required for execution. Budgets grow from below but are controlled from above.

(iii) To Provide a Means of Co-Ordination:

Although different budgets may be prepared for different activities, e.g., raw material budget, production budget, sale budget, etc., yet co-ordination between the different activities is provided by the master budget.

Essay # 3. Types of Budgets:

The following are the different types of budgets:

(i) Sale Budget:

In budgetary programme, sale is a starting point, as sales factor becomes the key factor in the ordinary course in majority of cases.

According to W.W. Bigg, “This is probably the most important budget, as it is usually the most difficult to forecast or attain.”

This budget is prepared by the sales manager.

The budget is prepared to show which finished products can be sold in what quantities and at what prices. And it may be prepared (a) product-wise, (b) territory-wise (c) customer-wise, (d) period-wise, etc.

The sale budget should show the following:

(i) Sales estimate for the period;

(ii) Area-wise analysis of estimated sales;

(iii) The methods of increasing sales if the sales are shown decreased over the past period; and

(iv) Cost of additional sales-promotion activities etc.

(ii) Production Budget:

It is based on sales budget, as it has to provide for the output needed to meet the requirement of the sales budget. Production budget is prepared in two parts—one showing the estimates in volume or quantities, and the other showing production costs.

It helps in the best utilisation of the business resources available for production, reduction in production costs by eliminating wastage, etc.

(iii) Raw Material Budget:

Raw material budget is based upon production budget, as this budget provides for the materials needed for production.

The budget is useful from the following points of view:

(i) It helps the purchase department in planning for the purchases.

(ii) It helps in fixing minimum, maximum and ordering limits of materials.

(iii) It helps to keep inventory under control.

(iv) Labour Budget:

It is also a part of production budget like raw material budget. The labour requirement is first ascertained in terms of grades and trades of workers and their supply through the personnel department. The labour budget should be prepared both for direct and indirect labour.

(v) Overhead Budget:

This budget helps in the preparation of production budget. All the indirect expenses pertaining to production, office and administration, selling and distribution are shown separately under the budget and their information are collected from their concerned departments.

(vi) Development and Research Budget:

This budget is a long-term budget prepared to meet the expanding needs of the business and to keep in line with the latest developments and techniques of production.

(vii) Cash Budget:

Cash budget is based on cash forecasts or estimates which give information as to what funds would be available at what times, and whether the funds so available would meet the requirement of the time. So before preparing cash budget, a statement of cash forecast should be prepared.

(viii) Master Budget:

A master budget is prepared for the business as a whole, combining all the budgets for a period into this budget. In other words, a master budget is the co-ordinated and summarised budget of the entire enterprise.

(ix) Fixed Budge:

Fixed budget is one which remains unchanged in spite of changes in volume of output or level of capacity. This budget is prepared for a specific planned activity and it is not adjusted to activity level attained.

(x) Flexible Budget:

Flexible budget is one which is prepared in such a manner as to facilitate determination of the budgeted cost for any level of activities. It is also known as Variable Budget.

Essay # 4. Requisites for the Preparation of a Budget:

For budget preparation following considerations must be made:

(a) Allotting Authority and Responsibility:

For proper budgeting suitable arrangements for allowing responsibility and authority are made. For this purpose a Budget Committee consisting of representatives from all the departments is formed. A Budget officer is appointed as co-ordinator. He is responsible for getting periodic reports from various departments and to see that all departments prepare estimates with sufficient supporting data.

(b) Clearly Defined Business Policies:

To prepare a good budget, it is essential to know about the business policies. After knowing the policies, budget is prepared considering their effects in each department.

(c) Information about Forecast:

Information about the future activities of the business should be available to facilitate the budget preparation.

(d) Cost Information:

While preparing budget all the information regarding costs are essential. Budget can only be prepared after knowing the manufacturing cost of product and other policies regarding margin of profit etc.

Essay # 5. Principles for the Preparation of Budgets:

Following principles should be adopted while budgeting for any kind of organisation, and for budgets of any kind:

(a) Budget should be related to the organisational objectives, and should be linked with the organisational structure.

(b) Budget should be flexible.

(c) Budget should contain realistic estimates.

(d) There should be norms, standards and productivity indices for inputs and outputs for the budget activity.

(e) There should be a system of periodical, review and follow up.

(f) For effective budgeting, management compliments and involvement of all concerned executives is necessary.

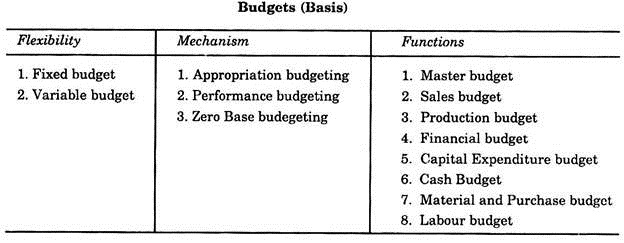

Essay # 6. Classification of Budgets:

(A) On the Basis of Flexibility:

These are classified with reference to the approach adopted in their preparations:

1. Fixed Budget:

If the level of activity (capacity utilisation) can be fixed for a budget period, and if all the functional budgets are prepared based on this level of activity, then such a budgeting method is termed as fixed budgeting. In such budgeting no provision is made for any changes which might occur during the budget period.

2. Variable or Flexible Budget:

In the variable or flexible budgeting the level of activity (capacity utilisation) is variable. Where because of uncertainty of market, or material or skilled labour availability or machine capacity availability, it is not possible to fix up a level of activity during the budget period, variable budgeting is adopted. In such case different budgets are prepared for different levels of activity.

In flexible budgeting method, the budget for fixed costs is static (per unit production), but the budget for variable costs will vary with the level of activity (volume of production).

(B) On the Basis of Mechanism:

1. Appropriation Budgeting:

This is mostly applicable to government departments, where output measurement of all the activities is difficult. Activities like health, education, agriculture etc. are not susceptible to performance evaluation on an yearly basis. In such cases, maximum limit on expenditure for a given activity is fixed. This type of budget is also termed as a conventional budget.

In industry, appropriation budgeting is adopted in research and development, management training, and for some categories of administrative expenses.

This budget has following characteristics:

(a) Oriented towards the financial or money aspects.

(b) Emphasis is mainly on inputs like salaries, rent, stationary and not on the purpose of expenses.

(c) Efforts are on exhausting the funds provided in the budget rather than on the performance or on the end results of the money spent.

2. Performance Budgeting:

In short performance budgeting is a comprehensive operational document, conceived, presented and implemented in terms of functions, programmes and activities with their financial and physical aspects, closely interwoven.

The performance budget links physical targets with financial outlays, and presents for the next year. Its focus is on the work and the result expected of the money to be spent in the next year.

Performance budget serves the following purposes:

(a) Correlates the physical and financial aspects of programmes and activities.

(b) Brings together the annual objectives and the developmental plans.

(c) Measures progress towards long term objectives as envisaged in the plan.

(d) Improves budget formulation review and decision making at all levels of management in the organisation and thus serves as an effective instrument of planning and control for the managers.

Steps for Developing Performance Budgeting System:

(i) Classify the total quantum of work in terms of functions, programmes and activities. A function is a broad grouping of operation that are directed towards the accomplishment of the goals or the objectives of the organisation. The programmes imply broad category with in function that identifies the end products. Activity is a division of a programme in terms of the nature of the work.

(ii) Develop physical targets and financial resources required in terms of the function, programmes and activities. Establish also select work load factors like productivity indices and performance ratios, suitable for physical achievements.

(iii) Devise an accounting system suitable for keeping records according to the function, programme and activity classification rather than the usual heads of expenditure.

(iv) Have periodical reviews to see whether the performance is according to physical targets laid out and what is the financial variance.

3. Zero-Base Budgeting (Z.B.B.):

Appropriation budgeting and performance budgeting is a planning process, and are primarily based on past years’ records, and therefore based on the principle of ‘incrementalism’. Zero Base Budgeting (Z.B.B.) on the other hand analyses each issue i.e. whether the current ongoing activity is efficient and effective, and whether it should be eliminated or changed. Thus it is required to justify the funds requirement for every activity,

(C) On the Basis of Functions:

1. Master Budget:

For large organisation, complete budget is very big. Therefore, a separate summary is prepared giving summaries about all the plans, policies and their effects over the business. The summarised budget of the entire concern is known as the “Master Budget”. This outlines expected performances in different areas of the business.

The object of the budget is to secure an overall co-ordination in the budgetary programme and accordingly it is utilized by the top management for exercising effective control over the business. First of all, departmental budgets are developed for integrating them into a master budget.

2. Sales Budget:

This budget gives income from the products likely to be sold and the sales expenditure. Sales forecast can be done on the basis of the reports received from the salesman, who will give the approximate quantity of products likely to be sold in his area.

Sales expenditure budget is prepared by estimating the expenses on advertising, market analysis, salesman’s salaries, office expenses etc. for the budget period. Past records are very helpful for preparing sales budget.

The sales budget is the starting point in a budgetary programme since sales are basic activities which give shape to all other activities in a business. Sales and production are the basic activities of a manufacturing concern and all other activities play an auxiliary role in the business.

Without planning sales, no future estimate can be made about auxiliary activities in the organisation. Even between two basic activities of sales and production, it is sales that regulate the flow of production in all businesses.

The primary objective of the business is good market standing and the market standing demands that sales should be placed as number one budget.

3. Production Budget:

This budget is prepared to assure that demands of sales department can be met. It gives the time for producing and for despatching them. It also includes the expenditure likely to occur on the maintenance of these produced articles. It is prepared by considering sales, demand and capacity of plant.

In addition to these production budget aims at securing economical manufacture of product and the maximum utilization of production facilities through a smooth operation. The cost of production is an important question in manufacturing and determines the effectiveness of planning efforts.

The principal way of reducing costs is to secure the maximum utilization of production facilities and to obtain perfect co-ordination in their working relationships. This is just what is done in production budgeting.

4. Financial Budget:

This budget gives the summary about the money to be received and spent during the budget period. The financial budget forecasts the profit and loss statement and the financial position of the concern at the end of the budget period. Thus, it helps the management for long term planning.

This budget is prepared for the use of top management members to know the profitability of a budgetary programme. This budget has no application in lower echelons of the organisation. Budgetary control cannot be exercised without the aid of the financial budget.

5. Capital Expenditure Budget:

The capital expenditure budget is prepared with the object of making a planned and timely capital investment in the-business. To ensure the availability of capital at the right time and to prevent disruption in the normal working of the enterprise, this budget maps out the future capital expenditure over a long period of time.

Additional investments are required to be made in acquiring new equipments, machines and other production facilities by an enterprise. Capital expenditures in the year ahead are planned and provided for the preparation of this budget. Because of this budget all stresses and strains are avoided and the enterprise is not forced to be caught unprepared for the situation.

6. Cash Budget:

The cash budget is prepared for projecting the possible cash receipts and payments over the budget period. This budget analyses the cash position month by month or even week by week in some cases. The object of cash budget is to ensure a steady supply of funds for meeting day-to-day requirements of working capital and for paying current obligations of the business.

The budget assists materially in making occasional heavy payments for the purchase of fixed assets, the disbursement of interest and dividend on the redemption of debentures and shares without causing any disturbance to the normal working of an enterprise.

Because of the advance estimate of cash position, the cash budget aids in timely raising of funds either through borrowing or through other means and utilizing surplus funds on the bulk purchase of materials or for short-term investment purpose.

7. Material and Purchases Budget:

Material budget shows the month wise quantities required for each major type of raw materials to produce the goods as per production budget, material quantities are assessed on the basis of past consumption records, or technical estimates.

Purchase budget is prepared with the help of material budget. It represents the quantities of the materials to be purchased (month wise or quarter wise) and the estimated costs of the materials. Purchase budget helps in making purchase plans in accordance with established inventory procedures to purchase the required materials sufficiently in advance so that materials are available in time.

8. Direct Labour Budget:

Direct labour budget, shows the estimate of direct labour needed to carry out the budgeted output. It is breakdown for each department and gives period wise labour requirement for each category of labour.

The labour requirement is assessed on the basis of work study and other norms of the organisation. On the basis of standard wage rates for that category of workmen, total expenses needed on direct labour is estimated and indicated in the direct budget.

Other Budgets:

In addition to the above, some other budgets are prepared in big industries. These may be training, research budgets etc.

Essay # 7. Budget Summaries:

Three different documents such as:

(i) The master budget,

(ii) The budget income statement, and

(iii) The budget balance sheet are utilized for preparing a “Budget Summary”.

The master budget assembles together the anticipated results of all supporting budgets and includes sales targets, production targets and targets of other activities.

The master budget alone, cannot show the profitability of budgetary programme. To ascertain the future income during the budget period, “Revenue and Expense” budget is developed in its proper form, both the trading results and net results are expressed in financial terms.

Alternatively a separate income statement is required to be compiled for estimating the future income of the business. The revenue and expense budget is required to be related to the financial position of the business, as expressed in the balance sheet.

A budget balance sheet is prepared to show the expected variation in assets and liabilities caused by the result of budgetary programme. The budget balance sheet as well as the budget income statement is prepared from the data included in the “Master budget”.

It means that “Master budget” is translated into an income statement and a balance sheet for the future and these three documents taken together form the budget summary for serving as a tool of top management control in the organisation.

Essay # 8. Advantages of Preparing a Budget:

Budgeting in any concern is very essential, because it has some of the following important advantages:

(i) Responsibility for the performance may be fixed. Therefore, it provides check over shifting of responsibility.

(ii) By budgeting, financial position of the concern is made clear.

(iii) A check on the performance and efficiency of the industry is provided.

(iv) It improves management by providing check at all levels. Thus, it helps in improving efficiency.

(v) It is essential to show budget while taking loan from banks so that they may know about the financial position of the concern.

(vi) It helps in making the policies for the coming period.

(vii) It is helpful to predetermine the price of product.

Essay # 9. Limitations of the Budget:

Too frequently too much is expected of a system of budgeting within a short period of time. It should be recognised that no budget is better than the people who operate it and people cannot be changed in their habits and interests overnight. The idea of budgeting must be told and furthermore, it must be demonstrated.

It may gain rapid acceptance and effectiveness in one department and only “half-hearted” acceptance in others. Some people will consider the budget as only a negative control and something to be resisted and postponed as-long as possible.

Some will give “lip service” to the endorsement of the idea but know in their own minds that it cannot work in that department. The chances are that, it will not work in that department until the desire to make it work has been established. That desire cannot be forced.

Budgeting, is an instrument of planning, control and co-ordination, and it must be co-operative budgeting. As such, time is an essential element.