Here is an essay on ‘Capital Budgeting’ for class 11 and 12. Find paragraphs, long and short essays on ‘Capital Budgeting’ especially written for school and college students.

Essay on Capital Budgeting

Essay Contents:

- Essay on the Definition of Capital Budgeting

- Essay on the Meaning of Capital Budgeting

- Essay on the Importance of Capital Budgeting

- Essay on the Difficulties in Capital Budgeting

- Essay on the Techniques of Capital Budgeting

Essay # 1. Definition of Capital Budgeting:

Capital budgeting refers to the process a firm uses to make decisions concerning investments in the long-term assets of the firm. The general idea is that the capital, or long-term funds raised by the firms are used to invest in assets that will enable the firm to generate revenues several years into the future.

Some of the definitions of capital budgeting are:

Capital budgeting is the process by which the financial manager decides whether to invest in specific capital projects or assets.

OR

Capital budgeting (or investment appraisal) is the planning process used to determine whether a firm’s long-term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing.

OR

Capital budgeting is a method of evaluating investment proposals to determine whether they are financially sound, and to allocate limited capital resources to the most attractive proposals.

Essay # 2. Meaning of Capital Budgeting:

The term ‘capital budgeting’ is used interchangeably with capital expenditure decisions, capital expenditure managements, long-term investment decision, management of fixed assets and so on.

The budget provides a guidance as to the amount of capital that may be needed for procurement of capital assets during the budget period. The budget is prepared after taking into account the available productive capacities, probable reallocation of existing assets and possible improvement in production techniques. If necessary, separate budgets may be prepared for each item of assets, such as a building budget, a plant and equipment budget, etc.

The capital budgeting decision, therefore, involves a current outlay or series of outlays of cash resources in return for an anticipated flow of future benefits. In other words, the system of capital budgeting is employed to evaluate expenditure decisions which involve current outlays but are likely to produce benefits over a period of time longer than one year.

Capital expenditure management includes addition, disposition, modification and replacement of fixed assets.

Following are the basic features of capital budgeting:

(a) It has potentially large anticipated benefits.

(b) It has a relatively high degree of risk.

(c) It has a relatively long-time period between the initial outlay and the anticipated return.

Essay # 3. Importance of Capital Budgeting:

1. Capital budgeting decisions are of paramount importance in financial decision-making. Such decisions affect the profitability of a firm. They also have a bearing on the competitive position of the enterprise. Capital budgeting decisions determine the future destiny of the company.

An opportune investment decision can yield spectacular returns. On the other hand, an ill-advised and incorrect investment decision can endanger the very survival even of the large-sized firms. A few wrong decisions and the firm may be forced into bankruptcy.

2. A capital expenditure decision has its effect over a long time-span and inevitably affects the company’s future cost structure.

3. Capital investment decisions, once made are not easily reversible without much financial loss to the firm. It is because there may be no market for secondhand plant and equipment and their conversions to other uses may not be financially feasible.

4. Capital investment involves costs and the majority of the firms have scarce capital resources this underlines the need for thoughtful, wise and correct investment decisions, as an incorrect decision would not only result in losses but also prevent the firm from earning profits from other investments which could not be undertaken for want of funds.

Essay # 4. Difficulties in Capital Budgeting:

Capital expenditure decisions are of considerable significance to the firm as the future success and growth of the firm depends heavily on them. Unfortunately, they are not easy to take.

There are a number of factors responsible for this:

1. The benefits from investments are received in some future period. The future is uncertain. Therefore, an element of risk is involved. A failure to forecast correctly will lead to serious errors which can be corrected only at considerable expense.

2. Problems also arise because costs incurred and benefits received from the capital budgeting decisions occur in different time periods. They are not logically comparable because of the time value of money.

3. It is not often possible to calculate in strictly quantitative terms all the benefits or the costs relating to a particular investment decision.

Capital budgeting decisions can be of two types:

(i) Those which expand revenues;

(ii) Those which expand costs;

A fundamental difference between the above two categories of investment decisions lies in the fact that cost-reduction investment decisions are subject to less uncertainty in comparison to the revenue-affecting investment decisions.

Thus, capital budgeting refers to the total process of generating, evaluating, selecting and following up on capital expenditure alternatives. The firm allocates or budgets financial resources to new investment proposals. Capital budget is a statement of expenditure on fixed assets or long-term projects and the benefits of which are likely to accrue in future.

The process of capital budgeting involves:

(a) Evaluating investment proposals;

(b) Measuring the benefits, and

(c) Selecting a project on the basis of a pre-determined criterion.

Essay # 5. Techniques of Capital Budgeting:

The prime task of the capital budgeting is to estimate the requirements of capital investment of a business. There are a number of techniques/methods of capital budgeting available.

These are:

i. Traditional Methods:

a. Payback Period.

b. Average rate of Return.

ii. Discounted Methods:

a. Net Present Value.

b. Internal Rate of Return.

c. Profitability Index.

i. Traditional Methods:

a. Pay Back Period:

Payback period is the most widely used measure for evaluating potential investments. Payback period focuses on recovering the cost of investments. Payback period is the time required (months or years) for a company to recover its original investment in project.

There are two ways of calculating the payback period:

1. The first method can be applied when the cash inflows are uniform for each year of project’s life.

The formula for Payback Period (PP) is:

Example 1:

Determine the payback period for a project, if it costs Rs.200,000 and is expected to return Rs.20,000 annually.

Solution:

The Payback Period (PP):

2. The second method is used when a project’s cash flows or revenues are not equal, but vary from year to year.

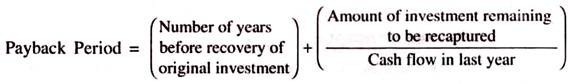

The formula for calculating payback period in this case will be:

The example 2 given below shows the calculation of payback period by this method:

Example 2:

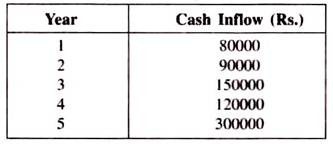

Determine the payback period for a project, if it costs Rs.600000 and generates the following cash inflows in jive years:

Solution:

Cost of project = 600000

Total cash inflow for the first 4 years

= 80000 + 90000 + 150000 + 120000 = 440000

Upto the 4th year the total cost is not recovered.

Total cash inflows for 5 years = 440000 + 300000 = 740000 i.e., 140000 (740000 – 600000) more than the cost of the project.

So the payback period is somewhere between 4 and 5 years.

PP = 4 + 160000/300000

= 4 + 0.53 = 4.53 years

ii. Discounted Methods:

a. Net Present Value (NPV):

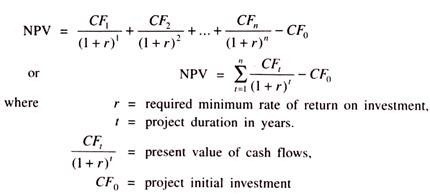

NPV is a way to decide whether or not to invest in a project by looking at le projected cash inflows and outflows. Net present value is a discounted cash flow technique i.e., it takes into consideration the time value of money while evaluating the costs and benefits of a project.

The Net Present Value (NPV) of an investment or project is the difference between the present value of cash inflows discounted at a predetermined rate and s amount which is initially invested.

Mathematically

Acceptance/Rejection Decision:

Accept the project if the net present value is positive and rejects the project if net present value is negative.

NPV technique can be explained with the help of following example:

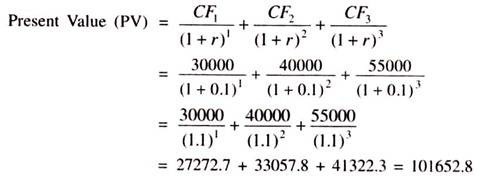

Example 3:

A company is expecting to make a profit of 10% on a 3 year project that will cost company Rs.100000. The cash inflows are Rs.30000, Rs.40000 and Rs.55000 in the first, second and third year respectively. Find the NPV of a project.

Solution:

The step by step procedure for calculating the NPV of a project is:

Step 1:

The first step is to calculate present value of each of those 3 cash flows that the company will be getting over next 3 years i.e., how much is Rs.30000 worth after one year from now? And so on.

Step 2:

The company expects to make a profit of 10% which is required rate of return.

This rate of return is used to calculate present values of all cash flows for 3 years:

Step 3:

The last step is calculation of net present value. NPV is calculated by subtracting project initial investment from present value of all cash flows.

NPV = Present value of all cash flows – Project initial investment = 101652.8 – 100000 = Rs.1652.8