After reading this essay you will learn about:- 1. Meaning of Capital Structure 2. Classification of Capital Structure 3. Trading on Equity 4. Determinants 5. Merits 6. Demerits.

Essay on Capital Structure of a Company

Essay Contents:

- Essay on the Meaning of Capital Structure

- Essay on the Classification of Capital Structure

- Essay on the Trading on Equity

- Essay on the Determinants of Capital Structure

- Essay on the Merits of Capital Structure

- Essay on the Demerits of Capital Structure

Essay # 1. Meaning of Capital Structure:

Capital of a business enterprise includes different types of shares, debentures, long-term loans and retained earnings. It lies in the discretion of the management to plan the capitalisation of the firm solely on the basis of shares or balance it with shares, debentures and surplus earning.

The choice of ratios between different types of securities to be comprised in the capital structure is called capital-gearing. It represents the ratio between the equity or ordinary share capital and the total capital. The capital structure consists of ownership securities and creditor-ship securities.

The management first estimates aggregate financial needs of the undertaking and then decides about the forms in which the required, capital is to be mobilised. The nature of industry, regularity of profits, size of the enterprise, the trend of the capital market would be considered by the management in determining the composition or pattern of its capital.

This process of determining the composition of the capital of an undertaking is known as “Capital-gearing”.

Then term ‘gearing’ refers to high or low proportion of equity capital to the aggregate capital in the capital structure. If equity shares constitute relatively smaller proportion of total capital, it is said to be geared high (high gearing)’, on the other hand, it is said to be low geared if equity shares occupy a predominant position in the total capital.

The security mix in the capital structure is usually related to the income generating capacity of the company. The most important factor in capital gearing is the concept of ‘trading on equity’.

Essay # 2. Classification of Capital Structure:

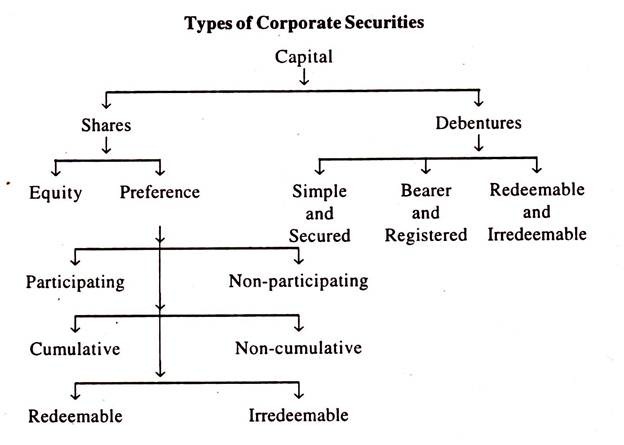

They can be classified as exhibited in the following chart:

Essay # 3. Trading on Equity:

Trading on equity is a primary consideration behind the diversification of the capital structure. If funds are borrowed in different form to a larger degree supported by relatively lesser equity capital it is said to be trading on equity. In the words of Guthmann and Daugall “the use of borrowed funds or preferred stock for financing is known as trading on equity”.

According to Hastings, “the degree to which debt is used in acquiring assets is called trading on equity.” As Gerestenberg said “when a person or a corporation uses borrowed capital as well as owned capital in the regular conduct of its business, it is said to be trading on equity.”

The aim of ‘trading on equity’ is to evolve an optimal capital structure involving minimum cost of capital and ensuring maximum possible return and control to equity shareholders who are the real risk-bearers. To use fixed charge- shareholders implication of trading on equity.

If more borrowings are relied upon for financing the company it is said to be trading on thin equity. If more equity shares are issued with lesser proportion of debts and preferred shares, then it is said to be trading on thick equity. Usually, trading on equity is understood in terms of trading on thin equity.

Considerations behind Trading on Equity:

The considerations prompting the practice of trading equity may be summarised as under:

1. Equity shares carry voting rights.

2. Preference shares carry fixed rate of dividend payable out of net profits in preference to equity shareholders. Preference shareholders usually have no voting rights except in circumstances affecting their interest.

3. Debentures bearing fixed interest have no voting rights. Interest is payable to debenture-holders irrespective of the profit or loss of the company.

Keeping in view the above-mentioned facts a firm may decide to raise its funds partly by issue of equity shares and partly in the form of preference shares and debentures. If the capital structure of a company is with greater weightage on preference shares and debentures, the earnings leftover after paying fixed charges of dividend and interest on preference shares and debentures respectively will be claimed by relatively a smaller section of equity shareholders.

They will also have greater control in the management of the company because preference shareholders and debenture holders have no voting rights. The return on equity shares will be higher even though their contribution to the capital structure is relatively less than that of preferred shares and debentures and other long-term lenders. Following illustration gives a clear idea of Trading on Equity.

If a company is able to acquire assets through the use of debt, it may be able to increase its earning without increasing ownership (equity) investment. If the business is financed largely out of debts and preference shares and the company is able to increase the earnings more than the cost of the debt (interest) and fixed dividend on preference shares then the percentage of return on equity shares will increase without rise in total equity capital.

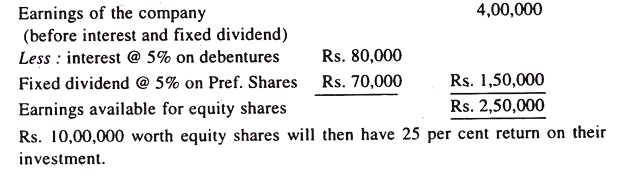

Suppose the capital of a company is Rs. 40,00,000 entirely raised in the form of equity shares and its earnings are Rs. 4,00,000 contributing 10 per cent on capital.

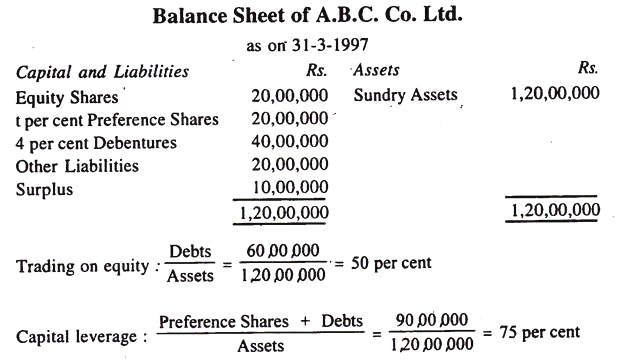

In order to trade on equity and operate on capital leverage, the company raises:

Rs. 10,00,000: Equity Shares

Rs. 16,00,000: 5 per cent Pref. Shares

Rs. 14.00,000: 5 per cent Debentures

Rs. 40,00,000

The net earnings of the company will then be Rs. 4,00,000 minus interest on debentures and fixed dividend on preference shares, which is at follows:

Essential Conditions for Trading on Equity:

To take the benefits of trading on equity, organisations must take into account the following conditions:

1. Earnings of the company must be sufficient and fairly constant so that interest and other fixed charges on the debentures or loans can be regularly paid leaving larger profits available for dividend equity shareholders.

2. The business of the company must be free from temptations of speculation and risks of wide fluctuations in demand.

3. The company should have fairly large investments in fixed assets which serve as a security for debts to be raised. Unless the company have suitable securities to mortgage as collateral it may not be able to borrow.

4. There should be a shrewd limit to growth financed by debts. Further expansion should be financed out of retained earnings or surplus.

There are few conditions applicable for trading on equity.

Following conditions must be fulfilled in order to give profits to share holders:

(i) The interest rate on debentures (or loans) should be less than the rate of profits or earring.

(ii) The interest should be tax deductible.

Let’s make things crystal clear with the help of an easy example.

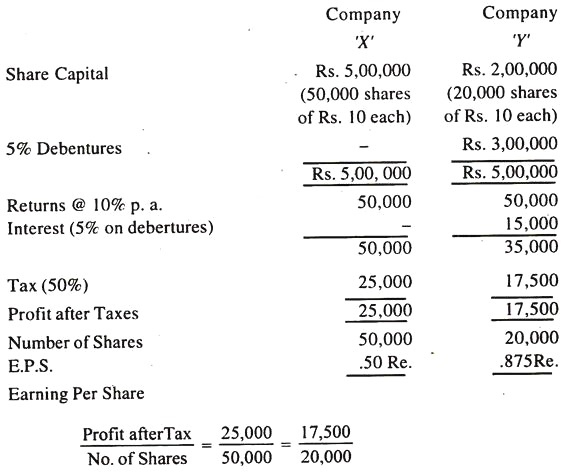

Suppose there are two companies X and Y requiring the same amount of capital in order to finance its assets, say Rs. 5 lakhs. Company X calls for subscribing 50,000 shares of Rs. 10 each. On the other hand company Y issues 20,000 shares of Rs. 10 each and the rest 5 lakhs obtained by issue of debentures which carry interest rate of 5 per cent.

Now let us assume that rate of return in market is 10 per cent (i.e., more than interest rate payable an debentures). The earnings of both the companies would be Rs. 50,000 each. Now interest of Rs. 15,000 is paid by Y company to its debenture holders and they are left with Rs. 35,000. The rate of taxation may be assumed to be 50 per cent so as to make calculations easier.

After paying taxes of Rs. 25,000 and Rs. 17,500 respectively, company X and company Y are left out with Rs. 25,000 and Rs. 17,500 respectively. Now the number of shareholders of X and Y are 50,000 and 20,000 respectively. Thus, earning per share for X company’s shareholder is Re. .50 or 50 paise while that for company Y’s share holder is .875 paise which is undoubtedly more than the X company’s shareholder.

It should be clear from above example that shareholders of the company Y have a higher rate of return than those of company X due to loan component in total capacity of company Y.

Essay # 4. Determinants of Capital Structure:

The mix of securities constituting the capital structure depends on the managerial policy of trading on equity, conditions in money market and the temperament of the investors.

These factors are briefly discussed here:

(i) Trading on Equity:

Subject to stability of earnings and suitability of collateral assets, a firm may trade on equity and include more of debentures and preference shares in the capital structure with ‘low gearing’ as far as proportion of equity shares is concerned.

(ii) Idea of Retaining Control:

Idea of retaining control in a few hands may prompt the company to issue less of equity shares and raise more funds through preference shares and debentures. Without sharing the control, more funds can be raised by issuing non-equity securities like preference shares and debentures which have no voting rights attached thereto.

In India, companies used to issue deferred shares carrying disproportionate voting rights to a small section of promoters and their friends and relatives in order to monopolise control. However this practice has been discontinued since the Companies Act, 1956 came into effect.

The desire to vest control in a small group of equity shareholders and possible avoidance of new issue of equity shares to outsiders lie at the root of capital structure. Gerestenberg says. “New securities should not be issued in such a way that control will be given away.” New equity share issues may be offered to existing members on priority basis. If the existing members are not in a position to buy the new issues offered, then the company has to raise funds by issue of debentures with no voting rights and preference shares with restricted voting rights.

(iii) Stability of Earning:

Stability of earnings is a crucial factor in planning the security mix of the capital structure. If the earnings are regular and sumptuous then fixed interest bearing securities can be issued. A company in such a case should have a large assured market without undue oscillations. It can have a high ratio of funded debt because of its ability to pay the fixed charges out of the net earnings and limit the equity issues.

(iv) Elasticity:

Elasticity of the capital structure is another significant criterion of sound capital composition plan. Preponderance of debentures and preference shares would make the capital structure rigid because of the need for paying fixed charges (interest or dividend) which may not be within the range of earnings particularly in the initial years.

Hence at the inception equity shares should be issued because they do not involve fixed liabilities. Debentures and preference shares may be held in stand-by in times of emergencies or for further expansion.

If the business enterprise requires additional capital for a specified period, then redeemable preference shares or debentures which can be repaid after the specified period may be issued to lend flexibility to the capital structure.

(v) Attitudes of Investors:

Attitudes of investors also are reckoning factors in the issue of different types of securities. The company seeks to raise funds from all categories of investors.

Investors are classified into following three categories on the basis of their attitudes:

(a) Bold or Venturesome:

They are prepared to take risks in return for participation in corporate management, as well as capital appreciation. Equity shares can best be issued to mobilise funds from this class of investors.

(b) Cautious:

They prefer relatively fixed income on their investments as well as safety of their capital. They do not wish to link their income with profits but are interested in regular return on their funds. They are also not interested in management of the company. To such investors debentures with fixed interest appeal most. More timid among them desire some security to ensure safety of their capital. Mortgage debentures are therefore issued to cover their debts.

(c) Less Cautious:

These investors also care for safety of their capital and for relatively assured rate of return on their investments. They do not however insist on mortgage of assets etc. Preference shares with fixed dividend are issued to such types of investors.

Out of the available net profits they will be first paid their guaranteed rate of dividend and in the event of the company going into liquidation, the preference share capital will be returned in preference to equity capital.

(vi) Trends in the Money Market:

Trends in the money market influence the management in planning the pattern of capital structure. Market mirrors the current temper of investors. When the business cycle is on the up-swing, investors are interested in equity shares; during the depression phase of the cycle, they go in for debentures and similar fixed interest securities. During boom period rate of interest is high due to strain on resources.

Security prices will be rocketing high because of inflationary psychology. During depression businessmen are pessimistic and there is less demand for funds. Thus the securities will be available for low prices. During boom, therefore, equity shares have better market.

During depression, preference shares or debentures may appeal to the investors because business is dull and the prospects of profit are uncertain. Hence investors desire to be assured of fixed rate of return. During the recovery period when business confidence is restored the company can think of raising its capital through suitable securities.

(vii) Cost of Financing:

The cost of financing is obviously the vital factor in determining the types of securities to be issued. Interest, dividends, underwriting commission, brokerage, listing charge, etc. constitute the cost of financing. Those securities which involve minimum costs should be preferred.

The undertaking incurs the lowest expense in selling debentures and highest in raising equity capital. The capital structure therefore should be judiciously diversified with suitable mix as to minimise the aggregate costs of financing.

(viii) Kinds of Assets to be Acquired:

The purpose of financing and the nature of the assets to be acquired also influence the capital structure. Funds required for starting a company are raised through equity shares and preference shares. Funds required for expansion, purchase of new fixed assets may be raised through debentures, if assets contribute to the earning capacity of the company.

(ix) Legal Requirements:

Legal requirements as to the proportion of securities have to be observed.

(x) Nature of Business:

Nature of the business of the company also counts in determining the capital structure. Manufacturing industries operating under competitive conditions may have to adopt equity financing since their earnings are not stable to warrant issue of debentures with fixed interest.

Public utilities having assured market and being immune from competition may find debentures as suitable medium of financing because their stable and certain earning enable the company to make regular payment of fixed interest and provision for repayment of debt after the specified period. Service and merchandising enterprises having fewer fixed assets cannot afford to raise funds by long-term debentures because of their inability to offer their assets in mortgage for the loans.

(xi) Simplicity:

Desire to keep the capital structure simple avoids the idea of multiplicity of securities. Only one class of shares and debentures would be issued so as to be easily intelligible to investors and easily manageable by the company.

(xii) Provision for Future:

Financial planners always think of keeping their best security to the last instead of issuing all types of securities at one stretch. Financial managers should have the readily marketable securities to be issued in items of contingencies. General rule is to keep the best security or some of the best securities till the last.

At the inception or in normal times equity shares may be issued: in times of emergencies debentures carrying fixed interest may be issued, if necessary, by creating charge on the assets of the company.

Essay # 5. Merits of Capital Structures:

1. Capital Structure with equity shares only:

a) Fixed capital without charges on assets.

b) No fixed liabilities.

c) Freedom to declare dividends etc.

d) Need not refund capital raised.

e) Encourages investors believing risk-capital.

2. Capital structure with equity and preference shares:

a) Appeals investors of different interests.

b) Control over the company in the hands of equity shareholders.

c) Better demand for preferences shares.

d) Scope for issuing debentures in future available.

3. Capital structure with equity, preference shares and debentures:

a) Relatively cheaper.

b) Benefits of trading on equity.

c) Control on company remains with equity shareholders.

d) Interest on debenture is part of expenditure for income tax purpose.

e) Attractive to conservative investors.

Essay # 6. Demerits of Capital Structures:

1. Capital Structure with equity shares only:

a) Financing more costly.

b) No benefits of trading on equity.

c) Restricted control over the company.

d) Cautious investors not attracted.

e) possibility of over capitalisation.

2. Capital structure with equity and preference shares:

a) Costlier than the issue of debentures.

b) Advantages of trading equity not fully available.

c) Costlier than the issue of debentures.

d) Advantages of trading equity not fully available.

3. Capital structure with equity, preference shares and debentures:

a) Pressure on the management of the company.

b) Possibility of exploitation of preference shareholders.

c) Equity shareholders get higher rate of dividends.

d) Payment of interest on debenture and repayment of debenture on due date.

e) Charge on the assets of the company in case of mortgaged debenture.

f) Company with debenture capital is notable to meet needs of technological changes etc.

g) Difficulty in facing emergencies.