Here is an essay on ‘Cash Assets Management’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Cash Assets Management’ especially written for school and college students.

Essay # 1. Introduction to Cash Assets Management:

Cash assets management is rapidly emerging as a vital area in any business organization. Cash assets management implies making sure that all the business generated revenues are effectively controlled and utilized in the best possible manner to result in gains for the organization.

The management of cash resources holds a central position in the area of short-term financing decisions. Holding of cash carries the opportunity cost of profits which could be made if the cash was either used in the company or invested elsewhere.

The company has to balance the advantages of liquidity against profitability. Cash should be held until the marginal value of the liquidity it gives is equal to the value of the interest lost. Cash assets management is concerned with optimizing the amount of cash available to the company, and maximizing the interest on any spare funds not required immediately by the company.

The fundamental objective of cash assets management is ‘optimization’ of liquidity through an improved flow of funds. All companies in advanced countries are planning to use the services of banks to help them collect payments on monthly bills they issue to consumers and other types of cash management services.

Cash assets management has gained importance due to uptrend in interest rate that increased the opportunity cost of holding cash. This encouraged Finance manager to search for more efficient ways of managing cash. Another reason is the technological developments, particularly computerised electronic funds transfer mechanism changed the way of cash assets management.

The basic objectives of cash assets management are:

a. To ensure availability of cash as per payment schedule, and

b. To minimize the amount of idle cash.

To achieve the above objectives, proper planning and forecast of cashflows is needed. The expected cash inflows and cash outflows are to be presented in the form of cash budget. This will help in efficient management of cash assets. Most cash assets management activities are performed jointly by the firm and its banks.

Effective cash assets management encompasses proper management of cash inflows and outflows which entails:

a. Improving forecasts of cash flows

b. Synchronizing cash inflows and outflows

c. Using floats

d. Accelerating collections

e. Getting available funds to where they are needed

f. Controlling disbursements

Cash is a non-earning asset, therefore, the Finance Manager should take care to minimize the assets in the form of cash. Surplus balance of cash can be suitably be invested in liquid, short-term and long-term investments as per the policy of the company. The cost of holding cash is the loss of interest that if cash is invested profitably elsewhere.

The cost of surplus cash is the cost of interest/opportunities foregone. The cost of shortage of cash is measured in the cost of raising finance or ultimately in the cost of bankruptcy or restructuring. The cash shortages can result in suboptimal investment decisions and suboptimal financing decisions.

Since the basic purpose of any cash management system is to reduce the cost (cost of interest payments, cost of collection, cost of disbursement of funds etc.). Cost involved any cash management system like any other system may broadly be divided into fixed cost and variable costs. Fixed costs of maintaining any system may be like depreciation on hardware used, fixed employee cost etc. The variable cost of a cash management system normally depends on the volume of funds handled by the company.

Essay # 2. Cash Surplus and Cash Deficit:

Reasons for Cash Surplus:

Cash surpluses arise for many reasons and last for varying time periods. The treasurer will need to consider opportunities for short-term investment in order to put any cash surpluses to work.

Some of the reasons for cash surplus are:

a. Profitability from operations

b. Low capital expenditure

c. Absence of profitable avenues of investment

d. Sale of a part of business

e. Raising of funds from issue of stock and bonds for long-term capital projects, temporary fund is not used

f. Conservative dividend distribution policy

The firm may keep surplus funds in liquid form for the following reasons:

a. To buy back shares in near future

b. To enhance the dividend payment to shareholders

c. Waiting for strategic opportunity to arise like acquisition and takeover of weak units

d. When the return on reinvestment is lower than the bank deposit rate

Reasons for Cash Deficit:

The continuous deficit in cash flow will show the signal for forthcoming situation of financial distress.

The cash flow problems may arise from the following reasons:

I. Continuous operating losses will cause deficit in cash flows. A company which cannot able to cover the depreciation charge but is in the surplus state of cash, is the potential unit for cash starvation.

II. When the rate of inflation is higher, the need for cash also increases and it will cause excessive outflow of cash over the inflow.

III. Non-recurring expenditure or payments may cause cash flow problems. The situation may arise in times of repayment of long-term debt, purchase of capital goods out of internal accruals, payment of dividends and corporate tax etc.

IV. When the seasonal or cyclical sales are higher, then such firms may require more funds than in the off-season which will also create cash flow problem.

V. Over trading is one of the reasons which cause cash flow problems. A firm which do business more than its working capital can absorb, will create cash flow problems.

VI. Continuous growth in business of a firm may lead to continuous cash requirements to support its production and working capital shortages.

VII. Inefficient working capital management like poor collection of debtors, failure to raise invoices in time, excessive holding of inventory, payments without proper sanction, managing without cash planning and cash budgeting, failure to recognize the requirements of working capital for purchase of capital equipment, failure to get working capital limits and its enhancement in time etc., will lead to cash flow problems.

Effects of Cash Deficit:

The cash shortages can result in making of sub-optimal investment and sub-optimal financing decisions.

I. Sub-Optimal Investment Decisions:

These decisions would include disposal of profitable lines or divisions, inability to undertake profitable investment projects, and failure to maintain an adequate level of working capital etc.

II. Sub-Optimal Financing Decisions:

These decisions would include the taking out of very expensive loans and being granted overdraft facilities subject to restrictive covenants which could include personal guarantees from directors, restrictions on investment, restrictions on additional finance, restrictions on directors’ remuneration, restrictions on dividend payments etc.

Methods of Improving Liquidity:

Many industries face the problem of cash deficit. When the basic operation itself cannot be improved to make a profit, nothing can be done to improve the situation. Other than such a situation of desperation, there are a few methods that are worth trying.

I. Good Inventory Management:

The size of inventory should be kept to the minimum. By proper planning and coordination with the suppliers, we can ensure that the supply arrives directly to the production floor without entering the store room (called Just In Time Inventory Management). Japanese automobile manufacturers like Toyota and Suzuki perfected this technique.

II. Rapid Stock Turnover:

If stock turnover is increased, cash required is less. Therefore, arranging exhibitions, sales melas, special sales week etc. should accelerate the selling activity. Textile manufacturers generally resort to this.

III. Negotiating with Suppliers:

Negotiation can be started with the suppliers for longer periods of credit and better cash discounts.

IV. Better Accounts Receivable Management:

Sales ledgers should be managed well. There should be an efficient system of debt collection through timely reminders and well-planned tactics. If possible, open account credit should be avoided. In every case, it should be backed by a bill of exchange. Through a discount limit with a bank, every bill of exchange can be discounted and cash obtained immediately.

V. Invoice Discounting:

A permanent arrangement can be made with one or more factors to sell the book debt as soon as it arises. Though it increases the expenses, cash is made available immediately after cash sale.

VI. Disposal of Unnecessary Assets:

There are many assets that become totally useless in every organization for various reasons. If no use is attributable to the assets in the near future, it is better to dispose them either normally or at scrap value. The resulting cash will be handy.

VII. Sale of Loss Making Divisions and Brands:

Where there are divisions or brands incurring losses, it is better to sell them. This has twin advantages: the losses are avoided resulting in better cash position, and the cash received on sale further improves cash position.

VIII. Conversion of Debt into Shares:

Sometimes, there is a big cash outflow in the form of interest on debentures, bonds or term loans (loans from term-lending institutions like IFCI, SIDBI etc). By negotiating with the lenders, they can be converted into preference shares or equity shares. Thus, the compulsory payment of interest is avoided. However, the lenders may accept this proposal only when the company has a good promoter and has a potential future.

IX. Becoming Growth Oriented Company:

There are two types of companies based on rewarding the shareholders: dividend-paying companies and growth-oriented companies. The first category pays regular dividend to the shareholders. The second category does not pay any dividend, and retains all the income in the company itself. The shareholders are rewarded through higher market price for shares and bonus issues.

X. Dealer Deposits/Customer Deposit:

Wherever it is possible, a security deposit can be insisted upon from the authorized dealers. Again, where there is time difference between ordering for the goods and actual delivery, an advance or customer deposit may be insisted upon. Customer advance is possible in case of job industries like printing, fabrication work. Customer deposit is possible in case of automobile industry (cars, two wheelers, trucks, containers, tankers).

Essay # 3. Marketable Securities:

Objectives of Investment in Marketable Securities:

The cash surplus built up in excess of daily cash requirements can be invested in readily marketable short-term securities. These securities are also called as ‘cash equivalents’.

The investment in short-term marketable securities is made keeping in view the following objectives:

a. To earn interest for the holding period of investment.

b. To convert the marketable securities into cash by disposing off in the market as and when the need arise to meet the situations of cash shortage.

c. To increase return on investment by earning interest on idle funds.

d. To maintain mix of investments in various short-term instruments and modes.

The short-term marketable instruments are sometimes referred as ‘money market instruments’, which include, Government treasury bills, Certificates of deposits, Repurchase agreement, Commercial paper, Inter corporate deposits, Short-term deposits, Money market mutual funds, Money at call and short notice, Bankers acceptance etc.

Principles in Selecting Marketable Securities:

The primary criteria a firm should use in selecting short-term marketable securities in its portfolio should consider the following principles:

i. Default Risk:

The funds invested in short-term marketable instruments should be safe and secure as regards repayment of principal and interest as and when it matures since the return on short-term investments is offered less than long-term investments, the acceptable risk level is required to be lesser commensurate with lower return. Some of the investments like commercial paper are offered with credit ratings.

The government treasury bills, bankers acceptance, certificate of deposits carry minimum default risk.

ii. Marketability:

The liquidity is the basic objective of investment in these instruments. It should offer the facility of quick sale in the market as and when need arises for cash, with low transaction cost, without loss of time and no erosion of amounts invested with fall in price of investments.

iii. Maturity Date:

Firms generally invest in marketable securities that have relatively short maturities. The maturity periods of different investments should match with the payment obligations like dividend payment, tax payment, capital expenditure, interest payments on debt instruments etc. Investments with long-term maturity periods are subject to fluctuations due to changes in interest rates, and are considered as risky than short-term instruments.

Many firms restrict their temporary investments to those maturing in less than 90 days. Short-term investments relatively carry lesser return than long-term investments, since the default risk and interest rate risk are minimized with short-term instruments.

Essay # 4. Management of Float:

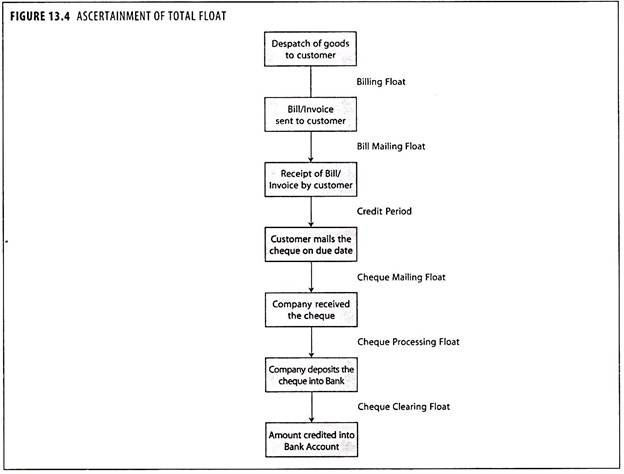

Float refers to ‘the amount of money tied up between the time a payment is initiated and cleared funds become available in the company’s bank account’. The efficiency of firm’s cash management can be enhanced by having knowledge and use of various procedures aiming at accelerating cash inflows and controlling cash outflows. Float refers to the period that passes before a payment or receipt is made by a bank. It is the transit time of receipt or payment. The float should be managed efficiently to reduce the length of cash cycle.

Sources of Float:

The sources of float are discussed below:

a. Billing Float:

After the goods are dispatched to the customer, an invoice is raised by the seller for the goods consigned. It is a formal document asking the customer to pay the amount mentioned in the invoice document. The time elapse between the sale of goods and mailing of invoice is called as ‘billing float’.

b. Bill Mailing Float:

It is the delay between the bill/invoice despatched by the company and receipt of it by the customer.

c. Credit Period:

In business practice, the customers are allowed certain credit period, say 30 days after the receipt of the bill/invoice by the customer.

d. Cheque Mailing Float:

It is the delay between the time the cheque is sent by the customer through mail and the time that the cheque arrives at the seller’s office.

e. Cheque Processing Float:

When the firm receives amounts in the form of cheques, there is usually a time gap between the receipt of cheque and deposit of that cheque into the bank account. This time gap is called ‘cheque processing float’.

f. Cheque Clearing Float:

There is a delay between the time a cheque is deposited and the time the funds are available to be spent. The cheques are processed through the clearing system which takes 2 days, for receipt of funds in spendable form. It is called the ‘cheque clearing float’.

Types of Float:

The float is of three types:

(a) Collection float,

(b) Payment float and

(c) Net float.

(a) Collection Float:

The term ‘collection float’ means the time between the payment made by the debtors or customers and the time when funds available for use in the company’s bank account. In other words, the amount tied-up in cheques and drafts that have been remitted by the customers to the company but has not converted into cash for use in the company’s operations.

The reasons for the lengthy float are as follows:

i. The delay or time taken in postal transmission from customer to company’s head office.

ii. The delay in presentation of cheques and drafts into the bank for collection.

iii. The time needed by the bank to clear a cheque.

To reduce the float, the company can adopt the techniques like concentration banking, lock box system, zero balance accounts, computerised cash management services etc., which will improve the efficiency in cash management of a company.

(b) Payment Float:

Cheques issued but not paid by the bank at any particular time is called ‘payment float’. The company can make use of the payment float called ‘playing the float’, in the sense that the company can issue cheques, even it means as per books of account an overdrawal beyond permissible bank limits. The payment float can be used to the advantage of the firm in times of shortage of funds as it helps to stretch resources in times of necessity.

But the company should be very cautious in playing the float in view of the stringent provisions regarding dishonour of cheques, loss of reputation etc.

(c) Net Float:

The net float at a point of time is simply the overall difference between the firm’s available bank balance and the balance shown by the ledger account of the firm. If the net float is positive, i.e., payment float is more than receipt float, then the available bank balance exceeds the book balance.

A firm with a positive net float can use it to its advantage and maintain a smaller cash balance than it would have in the absence of the float. An efficient cash management requires to accelerate cash collection as much as possible and delay cash disbursements as much as possible.

Accelerating Cash Inflows:

I. Organizing an Effective Cash Department:

The function of Cash Department should be organized well. Arrangements should be made to bring in the mail early in the morning by opening a separate mail box. Instead of relying upon the employee of the postal department, an employee of the firm should collect it early in the morning.

It must be made clear that the cheques received should be recorded in the books and sent to the bank well before the time the banks carry the cheques for the clearing. Scanners can be installed to catch the digital image of cheques from which entries can be made in the books after sending the cheques to the bank.

II. Electronic Clearance of Cheques:

Arrangements must be made with the banks to get the cheques cleared through National Electronic Funds Transfer or Real Time Gross Settlement of the RBI. Making use of foreign banks or new generation private sector banks for clearing the cheques will reduce the time involved in collection of the cheques.

III. Quick Credit of Cheques:

Wherever allowed, arrangements must be made with the banks to credit the proceeds even before collection, or by way of getting the instrument discounted with the banker.

IV. Instruments Payable at Par:

Arrangements can also be made with the customers to receive the payments by way of Demand drafts drawn on the bank branch with which the firm has an account. Alternatively, after the adoption of core banking by the Indian banks whereby all the branches are networked, they have started issuing multi-city cheques or ‘at par cheques’. These cheques are payable at par at any branch of the bank immediately.

V. Cheque Truncation:

Accounts can be opened with banks, which are using cheque truncation for collecting the cheques. Truncation is a process whereby the collecting banker sends only the digital image of the cheque to the paying banker. Cheques are not sent physically for collection.

ATMs are also being developed so that cheques deposited into the ATMs for collection are accepted and the digital image is sent via the network to the paying banker immediately. The credit is given instantly as soon as the cheque is cleared by the paying banker.

VI. Using Lock Box System:

Arrangements are also made with the post office to open a lock box system from where the bank collects the cheques directly. The arrangement reduces the procedure of cheques received by the firm and sent to the bank for collection. The firm has to depend upon the banks periodical statements in the management of accounts receivable. Differences may also arise in accounting for the cheques. Disputes may arise and rectification has to be done periodically.

VII. Concentration Banking:

A corporate having branches spread throughout the country designates certain strategically located branches to collect the cheques on behalf of branches in different regions. The branches inform the customers to make payment directly to the designated branch; an effective system can be installed for quick and speedy collection of cheques.

This system removes the disadvantage of mailing delay involved in sending the customers’ cheques of all the branches to the head office. The designated branches are nearer to customers than the head office. At the same time, it avoids the inefficiency of each branch receiving the cheques and sending them for collection.

Decelerating Cash Outflows:

The payments made are delayed as much as possible without attracting any extra cost or penalty.

I. Payment on Last Date:

Payments are not made early. They are delayed as much as possible. For purchases, the payment is made on the last date allowed. If highest cash discount is available for payment within 15 days, payment is made only on the 14th day or 15th day. For power bill, payment is made on the last day without attracting penalty. Even for payment of taxes, they are paid only on the last permitted date.

II. Payment by Head Office:

Payments on behalf of all the branches should be made by the Head office. The branch heads are not given the powers to make payments. They have to deposit all the receipts into the accounts of the Head office opened with a bank in the locality of the branch.

For all payments, the Branch Manager must write to the Head office. The Head office in turn will draw cheques on the banks in the locality of the branch and send them to the Branch Manager even for the payment of salary; the same system should be followed. Naturally, it will entail delays resulting in conservation of cash.

III. Cheque Kiting:

Cheques can be sent to the supplier even if there is no balance in the bank. As it involves a float on the part of the payee, it will take anything between 7 days to 10 days for the cheque to be presented by the bank. By that time, either there will be some receipts to take care of it or we can make arrangement to deposit the amount.

There are many firms, which come to an understanding with the banker.

On receipt of cheques by way of presentation, the bank informs the firm. After that, the firm deposits the necessary amount into the bank account or uses the overdraft facility to make payment.

IV. Using Credit Cards for Payment:

Credit cards generally give a month’s time for making the payment to the bank. If payment is made within the date specified, the bank levies no interest. Payments need not be made in the month of purchase. In the second month, the bank sends the demand statement. By the end of second month, if the payment is made, interest is saved for almost two months.

V. Selection of Banks:

The bank may be selected in such a way that we get the maximum positive float. There are banks known for very inefficient system of collection. Every collection of outstation cheque takes more than 15 days. Cheques can be drawn on accounts maintained with such banks. Again, a bank may be selected specifically because it has only a small network of branches. This will make the cheque to come through more than one bank for collection. Naturally, delay is caused and cash is conserved.