Here is an essay on ‘Consumer Finance’ for class 8, 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Consumer Finance’ especially written for school and college students.

Essay on Consumer Finance

Essay Contents:

- Essay on the Introduction to Consumer Finance

- Essay on the Meaning and Concept of Consumer Finance

- Essay on the Features of Consumer Credit

- Essay on the Forms/Types of Consumer Credit

- Essay on the Advantages of Consumer Finance

- Essay on the Disadvantages of Consumer Finance

- Essay on the Individual Credit Rating

- Essay on the Cost Aspects of Consumer Finance

- Essay on the Consumer Credit Portfolio Management

- Essay on the Recent Trends in Consumer Finance

Essay # 1. Introduction to Consumer Finance:

During earlier times the trend of people was to save first and spend later. But today it has been changed to spend today and pay later. The culture, life style, spending pattern, priority of needs etc. have been changed far and wide. Earlier people used to borrow money for construction of a house, to start a business or to purchase some land, or needs of that order. But today people need money for acquiring consumer durables also.

It is felt sometimes that people give more emphasis to amenities than for permanent assets like land, house etc. A stylish house in a posh area, a car, computer, television, stereo system, a cooking range, washing machine, grinder, mobile phone etc. which only a minority used 10 years back have become part of life (or ambition) of an average civilian. As they need money for satisfying these needs naturally facilities to finance also emerge.

The branch of banking which facilitate finance for purchasing consumer durables is called ‘consumer finance’ or ‘consumer credit’. Today it has become part of life of an average Indian as they need credit in large quantity to meet their needs of various kinds. This emerging set of wants and consequent need for funds multiplies the scope and role of consumer finance.

Considering the busy nature of borrowers, fanciers provide customer friendly products and services at their doorstep on easy terms. As India is a country with billions of spend thrift untapped population, who are competing each other in acquiring newer and newer consumer durables and as an element of prestige is linked in owning these assets, it is sure that, without any set back, ‘Consumer Finance’ will have brighter future and will hit better targets in the forthcoming era of consumerism.

Essay # 2. Meaning and Concept of Consumer Finance:

Consumer finance refers to the raising of finance by individuals for meeting their personal expenditure or for the acquisition of durable consumer goods. It is an important asset based financial service in India. This include credit merchandising, deferred payments, installment buying, hire purchase, pay-out of income scheme, pay-as-you earn scheme, easy payment, credit buying, installment credit plan, credit cards, etc.

Consumer durables include Cars, Two Wheelers, LCD TVs, Refrigerators, Washing Machines, Home Appliances, Personal Computers, Cooking Ranges, and Food Processors etc. Under consumer finance scheme, the consumer or buyer pays a part of the purchase price in cash at the time of the delivery of the asset, the balance with interest over a predetermined period of time.

The objective of consumer finance is to provide credit easily to the consumer at his door steps. Both private and public sector finance companies provide consumer finance to purchase ‘consumer goods and construction of such goods (building materials, iron rods, cement etc.). Multinational finance companies are also engaged in consumer finance in India. Usually the credit/finance is extended for a period of 2 to 5 years.

Definitions:

According to E.R.A. Seligman, “The term consumer credit refers to a transfer of wealth, the payment of which is deferred in whole or in part, to future, and is liquidated piecemeal or in successive fractions under a plan agreed upon at the time of the transfer”.

According to Reavis Cox, consumer credit is ‘”a business procedure through which the consumers purchase semi-durables and durables other than real estate, in order to obtain from them a series of payments extending over a period of three months to five years, and obtain possession of them when only a fraction of the total price has been paid”.

Essay # 3. Features of Consumer Credit:

Following are the features of Consumer credit:

1. Consumer credit is a method of financing semi-durables and durables.

2. It assists consumers to acquire assets.

3. Consumers get possession of the assets immediately when a fraction of the price is paid.

4. The balance payment is payable in installments over an agreed span of time.

5. The duration of the finance normally ranges between three months to five years,

6. It is an agreement between parties to the contract.

7. When there are only two parties to the contract, it is called a Bipartite Agreement (the customer and the dealer cum financier) and where there are three parties, such agreements are called Tripartite Agreements (the customer, the dealer and the financier.)

8. The structure of financing may by way of hire-purchase, conditional sale or credit sale. In the case of both hire purchase and conditional sale, ownership of the asset is transferred only on completion of all the terms of agreement. But in the case of credit sale ownership is transferred immediately on payment of first installment.

9. Generally advances are made on the security of the asset itself and

10. It involves down payment normally ranging from 20 to 25% of the asset price.

Essay # 4. Forms/Types of Consumer Credit:

Following are the different forms for financing consumers:

1. Revolving Credit:

It is an ongoing credit arrangement. It is similar to overdraft facility. Here a credit limit will be sanctioned to the customer and the customer can avail credit to the extent of credit limit sanctioned by the financier. Credit Card facility is an excellent example of revolving credit.

2. Cash Loan:

In this form, the buyer consumer gets loan amount from bank or non- banking financial institutions for purchasing the required goods from seller. Banker acts as lender. Lender and seller are different. Lender does not have the responsibilities of a seller

3. Secured Credit:

In this form, the financier advances money on the security of appropriate collateral. The collateral may be in the form of personal or real assets. If the customer makes default in payments, the financier has the right to appropriate the collateral. This kind of consumer credit is called secured consumer credit.

4. Unsecured Credit:

When financier advances fund without any security, such advances are called unsecured consumer credit. This type of credit is granted only to reputed customers.

5. Fixed Credit:

In this form of financing, finance is made available to the customer as term loan for a fixed period of time i.e., for a period of one to five years. Monthly installment loan, hire purchase etc. are the examples.

Essay # 5. Advantages of Consumer Finance:

1. Compulsory Savings:

Consumer credit promotes compulsory savings habit among the people. To make periodical installments knowingly or unknowingly, people cut short their other expenditures and save. These savings ultimately fetch them ownership of an asset in course of time. Thus consumer credit adds to the savings habit of people.

2. Convenience:

Considering the nature and type of customers, consumer credit facility offers schemes to the convenience and satisfaction of the customers. Walk in and drive out, pay as you earn, everything at the door step, one time processing etc. are examples.

3. Emergencies:

Consumer credit facility is available to meet personal requirements like family requirements, festival requirements, emergencies etc. The credit facility is not strictly restricted to purchasing of consumer durables alone. In ordinary course of life people come across number of urgent financial requirements, for which consumer credit offers a better solution.

4. Assists to Meet Targets:

In all business activities, there will be targets to be achieved by the executives. Most people abstain/ postpone purchasing for want of sufficient fund. When the dealer themselves arrange for fund people get attracted and purchase take place in large quantity. Thus it assists to meet sales targets and profit targets.

5. Assists to Make Dreams to Reality:

A car, a TV, a washing machine, a computer, a laptop, a mobile phone, etc. is undoubtedly a dream of an average human being. But people may not purchase because of fund problem. In those cases consumer credit facilitates an opportunity to possess and own those dreams on convenient terms.

6. Enhances Living Standard:

Consumer credit enhances living standard of the people by providing latest articles and amenities at reasonable and affordable terms.

7. Accelerates Industrial Investments:

Demand for consumer durables enhances further investment in the consumer durables industry. Thus provides more and more employment opportunities in the country.

8. Promotes Economic Development:

Demand for consumer durables, further investments in consumer durables industry, increased living standard of people, improved employment opportunities and income etc. improves economic development of the country.

9. Economies of Large Scale Production:

Increased demand leads to large scale production. Large scale operations lead to the economies of large scale operation. This in turn leads to lower prices.

10. National Importance:

Consumer credit is of national importance in India. Unless there is such a convenient mode of financing, total demand for consumer durables will be far lesser. Poor demand lead to lower production, which in turn lead to poor employment opportunity and lower income level. All these finally land the economy in trouble.

Essay # 6. Disadvantages of Consumer Finance:

Following are the disadvantages of consumer finance:

1. Promotes Blind Buying:

Facility to purchase at somebody else’s money tempts people to buy and buy goods blindly. This may land these people to debt trap within a short while.

2. Leads to Insolvency:

Blind buying of goods make these people insolvent/bankrupt within a shorter span of time. This ultimately spoils their life in the long run.

3. Consumer Credit is Costlier:

Along with the convenience that it offers it charge the customer for all these conveniences offered. Thus it becomes costlier when compared to other forms of finance.

4. Artificial Boom:

The economic development posed by the impact of consumer credit is not real but artificial. Economy will take years to stabilize the artificial boom claimed by the proponents of consumer credit.

5. Bad Debts Risk:

By whatever name called credit is always risky so is the case with consumer credit as well. Defaults are a major threat to consumer credit. Once there is a default, repossession and other legal formalities are difficult.

6. Causes Economic Instability:

Artificial boom and depression leads to economic instability and causes chaos in the economic progress. It will be difficult for the real ordinary business man to identify real progress and artificial progress.

Essay # 7. Individual Credit Rating:

Always the financier should assess the repaying capacity of the customer before advancing money. To assess the credibility and repayment capacity of a customer several methods are made use of. Those methods which are used to assess the credit worthiness and repaying capacity of a customer are called consumer credit scoring methods or credit rating methods.

These methods provide standards for accepting or rejecting a customer and assess the credit worthiness of a customer. Some of the commonly used methods are Dunham Greenberg Formula, Specific Fixed Formula and Machinery Risk Formula. In India, the largest credit rating agency for individual consumer finance is Credit Bureau of Information India Ltd. (CBIL)

A. Dunham Greenberg Formula:

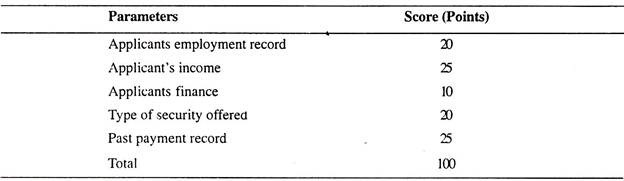

This method is based the customer’s i) Employment Record, ii) income level, iii) Financial Position, iv) Type of Security Offered and v) Past Payment Record. It gives more importance to the customer’s income level and past records. Under this method points are allotted to the various aspects/parameters of the customer. It is ranked out of a total of 100. An applicant scoring more than 70 points is considered as one with good credit standing.

The points allotted to various aspects are:

B. Specific Fixed Formula:

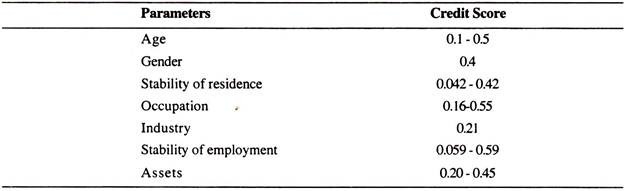

This method is another credit rating formula. It give emphasis to i) Age, ii) Gender, iii) Stability of Residence, iv) Occupation, v) Type of Industry, vi) Stability of Employment and vii) Assets of the Customer in assessing the credit worthiness of a customer. Specific scores are allotted to each of these parameters. The borrowers getting a score more than 3.5, is ranked as ‘excellent borrower’ and those getting more than 2.5 but less than 3.5 is ranked as ‘marginal borrower’.

The method of scoring is as follows:

C. Machinery Risk Formula:

This method is based upon the amount of down payment, monthly income and length of service. Basically this method is based upon the present financial position and future income earning capacity of the customer. Generally this method is used in government Departments to advance loans to its employees. The loan amount to be sanctioned is calculated using the following formula.

Loan amount = Down payment + (0.124 x monthly income) + (6.45 x length of service in months)

Essay # 8. Cost Aspects of Consumer Finance:

Like any other mode of finance, consumer finance also has certain costs. Normally financiers charge interest for the capital, service charges for the services rendered and other charges. The financiers used to charge the customer for all the services rendered to the customer. Generally service charges will be collected as percentage of borrowings. Interest will be disclosed either on flat rate of interest or yearly declining balances rate, net interest rate, etc.

The effective rates of interest for consumer finance are higher than other modes of finance. This is because consumer finance is provided based on the integrity and credibility of the customer alone. As the banker is undertaking higher risk, a higher rate of interest is charged as a premium for the extra risk undertaken.

Interest comprises of risk free rate of interest for the capital and a premium for default in future payment of premium. In India there is no ceiling as to the maximum rate of interest. Financiers charge different rate of interest as per the policies and practices of their organization. On an average, in India, the effective rate of interest on consumer finance ranges from 20 percent to 30 percent.

Other charges include documentation fees, processing fees, management fees, examination fees, service charges, brokerage, collection costs etc. Moreover financiers used to take deposits/ guarantee as a precaution against possible default in payment of installments. Interest, service charges, other charges, security deposit, guarantee etc. makes consumer finance costlier. However because of the practical convenience and feasibility of schemes attracts more and more people to consumer credit schemes.

Essay # 9. Consumer Credit Portfolio Management:

Consumer credit portfolio refers to the combination of various consumer credits granted by an organization. Consumer credits may be classified according to the tenure of repayment, amount of credit, type of customers, mode of credit, type of security offered, etc. The degree of risk and return varies in each case. The total of all consumer credit granted by an organization to various parties under various forms upon different terms and securities is called its consumer credit portfolio.

Like any other business, consumer financing is also a business set up to make profit. Thus profit maximization is its objective. The ultimate aim of portfolio management is to maximize profit. The portfolio must be perfect, balanced and well managed. The evaluation of the existing consumer credit portfolio, for its credibility, forms of credit, the amount of credit, the risk involved, and to make suggestions wherever necessary, so as to achieve the organizational objective can be termed as consumer credit portfolio management.

It shall not give much stress to any particular type of credit alone. It shall keep a balanced portfolio comprising of all types of credits. The tenure of the credits is to be closely watched. A prudential trade off shall be kept between secured and unsecured credits. Both have their own merits and demerits.

Secured credits are sure to get back but have lower rate return. Unsecured ones are risky but have higher return. The total credit to a single customer is to be checked frequently, as undue credit to one may land the customer in difficulty and thereby the financier as well. For assessing the credibility of the advances scientific tools may be used to analyze the credit worthiness of the customer.

Essay # 10. Recent Trends in Consumer Finance:

i. Rapid Growth:

Consumer finance market is growing rapidly in India. The last decade witnessed steady growth of consumer credit market in India. Growing consumer appetite for consumer durable goods like appliances and other convenience needs, developed and competitive market for such consumer goods, expectations of future income, potential for increase in future income, The tendency of people to borrow early in life and enjoy etc. are increasingly evident in emerging Indian consumer credit market.

ii. Reduced Rate of Interest:

Recently the reduction in the rate of interest and flexibility in the purchase schemes fueled the rapid growth of consumer credit industry. There are number of schemes with alternative payment schedules and rate of interest placed before the customer for selection. It is up to the customer which one to select.

iii. Increased Income Level:

Another change in the Indian economy is the increase in the startup salary scales and pay structure. The pay structure has been increased considerably when compared with what it was ten years back. This has changed the purchasing preferences of middle class families. Increased pay structure together with the DINK factor (Double Income No Kids), made a category of people more and more extravagant. People have started tasting the fruits of modern life which lands them to more and more needs.

iv. Changes in Life Concepts:

Changes in the life style, living standard and life perspective of Indian middle class families were another important recent change in the consumer durables industry. People have started dreaming and trying to convert their dreams to realism. Many have started visualizing a kingly life and wish to live with as many facilities possible. All these will land consumer durables industry and its financing industry to further heights within a short while.

v. Competition among Financiers:

Modern life has made people more and more mechanical and busy. People hardly have any time to spend on negotiation and settlement. They need everything to be settled right at their door step. Today everything has become customer centered/ oriented. So unless schemes are framed in accordance with customer requirements, it will be difficult even for financiers to survive. Today there is tough competition among financiers also. It is observed that financiers also compete with competitive schemes to attract potential customers.

vi. Tie-Ups and Collaborations:

Today is a period of tie ups and collaborations. Manufacturers make tie ups with financiers to market/finance their product and services. Similarly financiers arrange tie ups with dealers and manufacturers to market their services. It has become so that without appropriate tie ups and collaborations nobody could survive in the long run.

vii. Credit Cards:

The introduction of credit cards is another land mark in the consumer finance industry in India. Credit cards provide short term credit at no cost. Large numbers of credit cards with varied features to suit the individual requirements of customers are available in the market. The convenience and the economy of large scale purchases added to the popularity and use of credit cards even by ordinary customers.

viii. A Period of Schemes and Offers:

Luring schemes and tempting advertisements are other peculiar features emerged these days. Zero interest schemes, walk in and drive out, free test drive, exchange schemes, exchange bonus offers, festival offers, special schemes, yearend schemes, free packages, lucky draws, etc. offers brighter future for consumer credit market in India and thereby the market for consumer finance also.

ix. Development of Used Cars Market:

Another trend currently gained momentum in India is the market for used cars. Across the country large dealer network for used cars has been established. Most of them have financial backing also. It is interesting to note that financiers have come forward to finance used cars purchase also.

This shows the paradigm shift that took place in the consumer finance market. Practically this facility multiplied the market for consumer durables in India. It has gained much popularity among the common folk. It is felt that this second hand market is going to go beyond the first hand market in terms of number of transactions within no time.

The high-growth emerging market in India represents a significant opportunity for retail banks to seize market share as the growing middle-class seeks financing for durable goods. These emerging markets, also present significant challenges as credit history and data on the credit worthiness of most of the customers are not available.

Moreover mass availability of credit is new to the Indian financial culture with limited history on the consequences of non-payment of consumer credit. However use of controlled testing of different market segments and products to learn about consumer propensity, systematic approach over judgmental decisions, systems to track lending and pricing decisions, developing a ‘performance data reserve’ for individual consumers to establish customers’ credit profile etc. will make the role of consumer credit market in India imperative.