Here is an essay on ‘Dematerialisation’ for class 11 and 12. Find paragraphs, long and short essay on ‘Dematerialisation’ especially written for school and college students.

Essay on Dematerialisation

Essay Contents:

- Essay on the Introduction to Dematerialisation

- Essay on the Need for Dematerialisation

- Essay on the Depository of Dematerialisation

- Essay on the Benefits of Dematerialisation

- Essay on the Reasons for Investors’ Reluctance to Dematerialisation

Essay # 1. Introduction to Dematerialisation:

ADVERTISEMENTS:

Dematerialization or “Demat” is a process whereby securities such as shares, debentures etc., are converted into electronic data and stored in computers by a Depository. Physical form securities registered in an investor’s name are surrendered to depository participant (DP) and these are sent to the respective companies who will cancel the physical paper after “Dematerialization” and credit investor’s depository account with the DP.

The securities on Dematerialization appear as balances in investor’s depository account. These balances are transferable like physical shares. Later, if an investor wishes to have these “demat” securities converted back into paper certificates the same can be done with the help of the Depository.

Essay # 2. Need for Dematerialisation:

Dematerialisation was introduced to overcome the problems associated with physical form of securities. Most of these problems arose due to the intrinsic nature of paper based trading and settlement like theft or loss of share certificates, delay in transfer of shares, possibility of forgery on various documents leading to bad deliveries and legal disputes, prevalence of fake certificates in the market mutilation or loss of share certificates in transit, etc.

ADVERTISEMENTS:

The physical form of holding and trading in securities also acts as a bottleneck for broker community in capital market operations. This system requires handling of huge volumes of paper leading to increased costs and inefficiencies.

The introduction of National Stock Exchange and Bombay Stock Exchange On Line Trading systems has increased the reach of capital market manifolds. The increase in number of investors participating in the capital market has increased the possibility of being hit by a bad delivery. The cost and time spent by the brokers for rectification of these bad deliveries tends to be higher with the geographical spread of the clients.

The increase in trade volumes lead to exponential rise in the back office operations thus limiting the growth potential of the brokering members. The inconvenience faced by investors (in areas that are far flung and away from the main metros) in settlement of trade also limits the opportunity for such investors, especially in participating in auction trading. This has made the investors as well as brokers wary of Indian capital market. In this scenario dematerialization was introduced.

The Depositories Act, 1996 enacted by the Indian Parliament has facilitated paperless trading by way of dematerialisation of shares Securities and Exchange Board of India (SEBI) and the Government of India together have endeavored from time to time to ensure that the concept of paperless trading is effectively implemented for the benefit of the investors at large.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 3. Depository of Dematerialisation:

Depository functions like a securities bank, where the dematerialized physical securities are traded and held in custody. This facilitates faster, risk free and low cost settlement. Depository is much like a bank and performs many activities that are similar to a bank. At present, there are two depositories in India, National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

National Securities Depository Ltd.:

NSDL is the first Indian depository; it was inaugurated in November 1996. NSDL was set up with an initial capital of US$28 million, promoted by Industrial Development Bank of India (IDBI), Unit Trust of India (UTI) and National Stock Exchange (NSE). Later, State Bank of India (SBI) also became a shareholder.

ADVERTISEMENTS:

Central Depository Services Limited:

The other depository is Central Depository Services (India) Limited (CDSL). CDSL was promoted by the Mumbai Stock Exchange, in association with Bank of India, Bank of Baroda, State Bank of India and HDFC Bank, as the second depository in India for dealing in securities, in the electronic form.

These depositories have appointed different Depository Participants (DP) for them. An investor can open an account with any of the depositories’ DP. However, transfers arising out of trades on the stock exchanges can take place only amongst account-holders with NSDL’s DPs. This is because only NSDL is linked to the stock exchanges (nine of them including the National Stock Exchange and Bombay Stock Exchange).

In order to facilitate transfers between investors having accounts in the two existing depositories in the country the Securities and Exchange Board of India has asked all stock exchanges to link up with the depositories. SEBI has also directed the companies’ registrar and transfer agents to effect change of registered ownership in its books within two hours of receiving a transfer request from the depositories.

ADVERTISEMENTS:

Once connected to both the depositories the stock exchanges have also to ensure that inter-depository transfers take place smoothly. It also involves the two depositories connecting with each other. The NSDL and CDSL have signed an agreement for inter-depository connectivity.

NSDL carries out its activities through various functionaries called business partners who include Depository Participants (DPs), Issuing corporates and their Registrars and Transfer Agents, Clearing corporations/Clearing Houses etc. NSDL is electronically linked to each of these business partners via a satellite link through Very Small Aperture Terminals (VSATs).

The entire integrated system (including the VSAT linkups and the software at NSDL and each business partner’s end) has been named as the “NEST” [National Electronic Settlement & Transfer] system. The investor interacts with the depository through a depository participant of NSDL. A DP can be a bank, financial institution, a custodian or a broker.

Essay # 4. Benefits of Dematerialisation:

ADVERTISEMENTS:

With the depositories in place, effective online trading mechanism is available for the retail investors to transact in the paperless form. Effectively all leading stock exchanges including Mumbai Stock Exchange and National Stock Exchange have moved towards online trading. Transacting through the depository way has several advantages over the traditional system of transacting using share certificates.

Some of the benefits are:

a. Trading in Demat completely eliminates the risk of bad deliveries, which in turn eliminates all cost and wastage of time associated with follow up for rectification. This reduction in risk associated with bad delivery has lead to reduction in brokerage to the extent of 0.5% by quite a few brokerage firms.

b. In case of transfer of electronic shares, an investor saves 0.5% in stamp duty.

ADVERTISEMENTS:

c. The investor also avoids the cost of courier/notarization/the need for future follow-up with his broker for shares returned due to company objection.

d. In case the certificates are lost in transit or when the share certificates become mutilated or misplaced, to obtain duplicate certificates, the investor has to spend at least Rs.500 for indemnity bond, newspaper advertisement etc., which can be completely eliminated in the demat form.

e. The investor can also receive his bonuses and rights into his depository account as a direct credit, thus eliminating risk of loss in transit.

f. He can also expect a lower interest charge for loans taken against demat shares as compared to the interest for loan against physical shares. This could result in a saving of about 0.25% to 1.5%. Many banks have implemented this.

g. The investors can now do their transactions on the Internet also.

Essay # 5. Reasons for Investors’ Reluctance to Dematerialisation:

ADVERTISEMENTS:

Despite these advantages of dematerialization there are investors who still hold their shares in physical form. Blue chip companies like HLL, ITC, Bajaj Auto and Hero Honda are some of the notable examples where shareholders hold 36-58 percent of equity capital in the physical form, according to shareholder details filing of these companies for the quarter ended June 30, 2006 with the Bombay Stock Exchange.

The percentage of physical shares is significantly high among public sector undertakings (PSUs) in which majority of equity capital are held by the government. The government stakes in PSUs are mostly in physical form and locked for a prolonged period.

As per a recent study, genuine long-term investors have a lot of faith in their companies and so are unwilling to sell their investments even if returns are significantly high. This tendency is seen particularly in case of shareholders of established, profit making companies, which have been maintaining track record of good dividend payout over the past many years. HLL, ITC, Bajaj Auto and Hero Honda are examples of this phenomenon.

Interestingly, a few companies like Gujarat State Fertilizer Corporation and Gujarat Narmada Fertilizer Corporation have done a lot of rural marketing and offered their shares to people from villages. The problem with such investors is that they may not be able to trade easily in the market due to lack of knowledge about securities trading or non-availability of demat facilities in these areas.

For some investors, there is sentimental value attached to their shareholding and so having shares in physical form is a matter of pride for them. Because of the above reasons still a large quantum of shares of various companies remain in physical form.

Under the Depositories Act of 1996, an investor can hold shares either in physical or electronic form. However, SEBI has notified that settlement of trades in all listed securities should take place only in the demat mode. While investors can trade in up to 500 shares in physical form, it is hardly being done due to fears of bad delivery on account of mismatch of signatures, forgery of signatures and bogus certificates.

ADVERTISEMENTS:

The depository system in the country has seen a good progress with a growing number of companies and investors adopting the demat culture. In this article an attempt has been made to bring out the demat related information of the investors. The following present the information.

Investors having Demat Account:

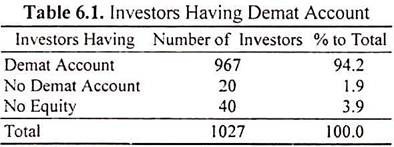

The investors were enquired whether they have a demat account? Table 6.1 gives investors’ demat account details.

The Table 6.1 reveals that nearly 94 percent of the investors have a demat account and nearly 2% of the investors did not have a demat account even though they owned equity shares. This means they still hold their shares in physical form. Rest, nearly 4 percent of the investors did not have any equity shares during the period January 2005 to March 2006.

Number of Companies Shares Held in Portfolio:

ADVERTISEMENTS:

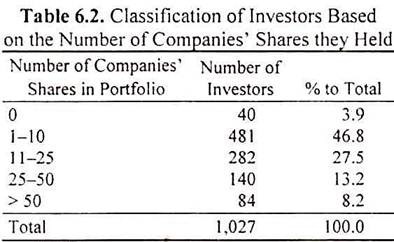

The investors were classified based on the number of companies’ shares they held in their portfolio. The following Table 6.2 brings out the classification.

The Table 6.2 reveals that more than half of the sample investors held up to 10 companies’ shares in their portfolio. Twenty seven percent of the investors held between 11 & 25 companies’ shares and 21.4 percent of the investors have more than 25 companies’ shares in their portfolios.

Percentage of Shares in Demat Form:

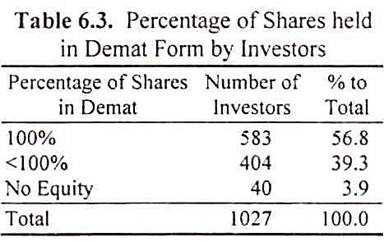

The investors were enquired whether they have all their shares in the demat form. Their responses are given in Table 6.3.

Only 56.8 percent of the sample investors had all their shares in demat form, whereas 39.3 percent of the investors had at least some shares in the physical form.

ADVERTISEMENTS:

Reasons for Partial Demat of Shareholdings:

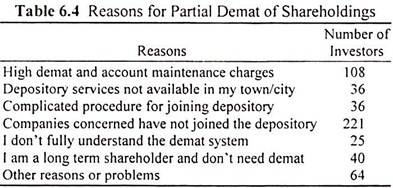

The investors have not dematerialised their entire share holdings. The reasons for partial demat varies for the investors. The responses of the investors for this are given in Table 6.4.

The Table 6.4 reveals that the companies concerned have not joined depository is the main reason cited by a large number of the physical form shareholders. Hence, they are compelled to retain those companies’ shares in the physical form. The next major reason cited for partial dematerialisation of shareholdings is high demat and account maintenance charges.

Thirty-six of the physical form shareholders have pointed that depository services are not available in their area. A similar number of investors have indicated the complicated procedure involved in joining depository as the reason for not joining depository. Some of the investors have more than one reason for partial dematerialization of their shares.

ADVERTISEMENTS:

Sixty-four investors have given other reasons too for partial dematerialization of their shares. Thirty-two investors have said that many of their physical form shares companies have vanished.

Twenty-two physical form shareholders have said that those shares have become worthless or the fall in price of those shares has made dematerialization not beneficial. Some of the investors said their companies have been delisted and some have cited that their shares are not quoted in stock exchanges.

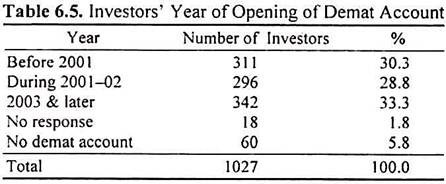

Investors’ Year of Opening of Demat Account:

The investors were enquired about the year of opening of their demat account. The responses are tabulated in Table 6.5.

Table 6.5 brings out that nearly one third of the sample investors have opened their account during 2003 or latter and nearly 60% of the sample investors have opened before that. It can be interpreted that the bull run in the stock markets from 2003 has induced many investors to open demat accounts.

It was further enquired that whether the investors have ever closed the demat account? Nearly 10 percent of the investors said “yes”. Of them 94 investors have given the reasons for closing the demat account. The following are the reasons cited by the investors for closing their demat account. Fifty-two investors who have closed their demat account had multiple accounts with DPs.

Many of these investors have stated that they closed multiple demat accounts due to high maintenance cost. In addition, they closed the multiple accounts to avoid confusion and to have one consolidated account.

Twenty-six investors have closed their demat accounts due to switching over from one DP to another to save on cost aspects. Remaining investors have given the reasons like proximity to residence and to get cash incentive through DP as their reasons for closure of Demat accounts.

Demat Charges:

When Depositories Act was enacted in 1996, SEBI expected that as the network of depository participants expand, and the proportion of securities dematerialized in the depository increases, the benefits of reduced risk and lower transaction costs will extend to majority of market participants.

The SEBI Working Group on Framework for Depository System envisaged a competitive system of multiple depositories as it would be too risky to have a single depository in the initial stages. The Depositories Act 1996 recognized the competitive principle by keeping the door open for multiple depositories.

However, the bulk of the depository system in India came to be controlled by NSDL, because, during the period from November 1996 to February 1999, SEBI made trading through depository compulsory and NSDL was the sole depository at that time. This gave NSDL monopoly power by placing any later entrant, like CDSL, at enormous disadvantage. The CDSL could garner only the ‘left over’ depository business because switching from one depository to another is too costly to be workable in practice.

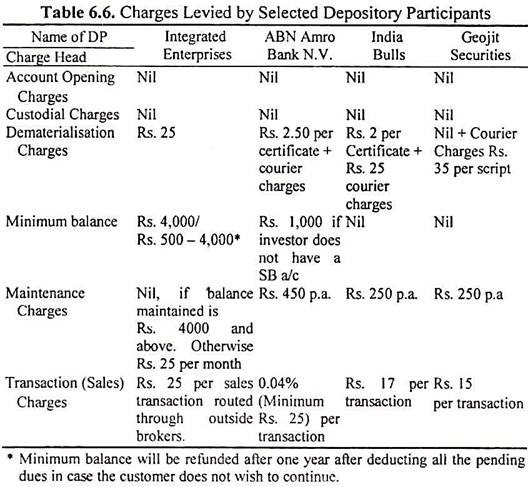

The Depositories leaves DPs completely free to decide in what manner and how much they will charge to the investors for the depository services. Most DPs require a minimum balance and charge for dematerialization of scrips, account maintenance, transaction settlement, etc.

Many DPs levy several miscellaneous types of charges too, such as courier charges, interest and penalties, Stamp paper charges, etc. The charges levied by various DPs vary a great deal, both with respect to the heads under which they are made and with respect to the level of charges.

Investors have great difficulty in comparing the charges of various DPs to find out the lowest charges on an overall basis. This makes the system very opaque and obstructs competition. Even though investors incurred stamp duty and courier charges earlier, too under the physical form, the minimum balance requirement, account maintenance charges etc. surely add a heavy burden to investors under this dematerialistion system.

Given the Indian situation, our suggestion is that it would be appropriate for the policy making and market regulatory authorities to consider the provision of an economical paperless system for providing purely ‘safe-keeping’ facility for the huge number of small investors. This is an urgent need in the interest of the whole lot of small and middle class investors.

A few examples of some of the charges levied by some selected DPs are given below:

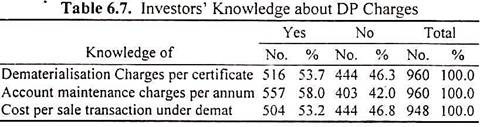

The investors were enquired whether they know the charges levied by their DP towards dematerialization charges per certificate, account maintenance charges per annum and per selling transaction under dematerialization? Their knowledge about DP charges is given below in Table 6.7.

The Table 6.7 reveals that more than two thirds of the investors do not have idea about the various charges levied by the DPs. At the maximum 58 percent of the investors had the knowledge about the account maintenance charges levied by the DPs. The remaining investors seem to be not interested in knowing about these charges.

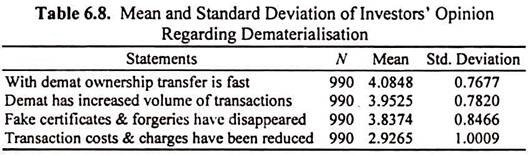

The investors’ opinions on likert type statements relating to dematerialization vary from strongly agree to strongly disagree. The level of agreement expressed by investors for various reasons was analysed. For analysis purposes, while entering the data strongly agree option was assigned a weight of five and the strongly disagree option was assigned a weight of one.

In between two extremes other levels of agreement such as agree, neither agree nor disagree and disagree were assigned weights of four, three and two respectively. Based on the mean value, the level of agreement of investors with these statements was identified.

Table 6.8 presents the mean value and standard of deviation of the values from the mean values.

The Table 6.8 reveals that the investors strongly agree with the statement, ‘with demat ownership transfer is fast’. They also agree to the statements that ‘demat has increased the volume of transactions on the bourses’ and fake certificates and forgeries have disappeared.

Thus one of the SEBI’s expectations with regarding to dematerialization ‘the reduced risk’ (possibility of forgery on various documents leading to bad deliveries, legal disputes, possibility of theft of share certificates, prevalence of fake certificates in the market, mutilation or loss of share certificates in transit etc.,) has been achieved and it is also well acknowledged by the investors.

However the investors neither agree nor disagree to the statement, that demat has reduced the transaction costs and other charges. But it can be interpreted that investors’ opinion is towards disagreement to the statement and they expect SEBI to take many more steps to bring down the transaction and other charges associated with dematerialization.

In fact, many of them expressed their wish to have a dematerialization process free of any DP charges. The smaller standard deviation from mean values of these statements indicates that the investors are identical in their opinion on dematerialization.

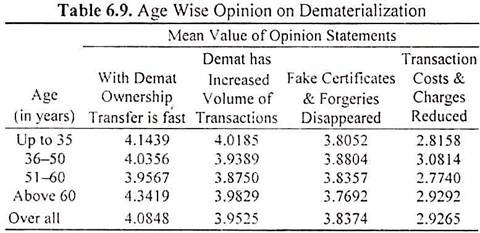

Age Wise Opinion on Dematerialisation:

The investors’ opinion on dematerialization was further analysed based on their age. The mean values of investors’ opinions are classified on the basis of their age is given in Table 6.9.

The Table 6.9 reveals that age wise mean value of investors’ opinion regarding the benefits of demat almost go with the opinion of the overall investors with one exception. The 36-50 age groups even though neither agrees nor disagrees with the statement that dematerialization has reduced the transaction costs and other charges it seem that the group slightly leans towards agreement. That is, they differ with the overall investors’ slight disagreement with that statement.

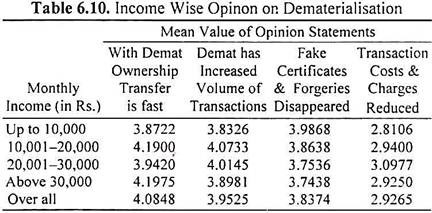

Income Wise Opinion on Dematerialisation:

The mean value of investors’ level of agreement with opinion statements were further classified based on their income. The classification is given in Table 6.10.

The Table 6.10 reveals that investors with monthly income of Rs. 10,001-20,000 and above Rs. 30,000 strongly agree that with dematerialization the ownership transfer is done fast. The other two income groups agree on this opinion. Likewise the investors with monthly income of Rs. 10,001 – 30,000 strongly agree that demat has increased the volume of transactions on the bourses.

The income wise opinion on disappearance of fake certificates and forgeries is almost identical and they all agree with the statement. The Rs. 20,001 – 30,000 per month income group is undecided on the statement that demat has reduced the transaction costs and other charges and they lean towards agreement. Rest of the income groups lean towards disagreement with the statement.

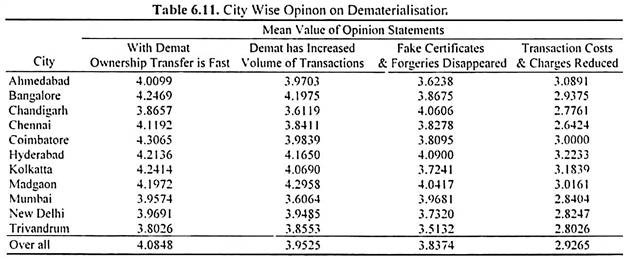

City Wise Opinion on Dematerialisation:

Does the opinion of investors on dematerialisation vary with their city of living? To answer this, the investors’ opinion was classified based on their city of living. Table 6.11 presents the classification.

The city wise classification of the mean value of investors’ opinion reveals that over all investors agree with the opinion that with demat ownership transfer is fast, the investors from Coimbatore seems to lean towards a strongly agree opinion and the investors from Trivandrum lean towards agree opinion.

Similarly the Madgaon investors lean towards a strongly agree opinion, the Mumbai investors has an agree opinion with regarding to the demat increasing the volume of transactions on bourses. Also, the Hyderabad investors’ opinion was above the agreeing level, the Trivandrum investors were below the agreeing level when it comes to their opinion of disappearance of fake certificates and forgeries.

Lastly, the Chandigarh investors leaned towards disagreeing and the Hyderabad investors leaned towards agreeing in their opinions on demat reducing transaction and other charges. Thus the investors from various cities differed in their opinions on dematerialization.

Conclusion:

To conclude, nearly 94 percent of the investors have a demat account. More than half of the investors held up to 10 companies’ shares in their portfolio and a little more than one fifth held more than 25 companies’ shares in their portfolio. Only 56.8 percent of the investors had all their shares in demat form.

The companies concerned have not joined depository, high demat and account maintenance charges are the major reasons cited for partial dematerialization of shares. The investors have various other reasons also. Many of them closed multiple demat accounts due to high maintenance cost. More than two thirds of the sample investors did not have idea about the various charges levied by the DPs.

The investors agree to the statements ‘with demat ownership transfer is fast’, ‘demat has increased the volume of transactions on the bourses’ and ‘fake certificates and forgeries have disappeared.’ They expect SEBI to take many more steps to bring down the transaction and other charges associated with dematerialization.

The age wise mean value of investors’ opinion with regarding to the benefits of demat almost go with the opinion of the overall sample. In the income wise classification, Rs. 20,001 – 30,000 per month income group is undecided on the statement that demat has reduced the transaction costs and other charges and they lean towards agreement.

Rest of the income groups lean towards disagreement with the statement. The city wise classification reveals that investors do not differ in their opinion that with demat ownership, transfer is fast and demat increase the volume of transactions on bourses.

The Hyderabad and Trivandrum investors were slightly different in their level of agreement on disappearance of fake certificates and forgeries. The Chandigarh investors were towards disagreeing and the Hyderabad investors leaned towards agreeing in their opinions on demat reducing transaction and other charges.