After reading this essay you will learn about:- 1. Meaning of Capitalisation 2. Theories of Capitalisation 3. Types.

Essay # Meaning of Capitalisation:

A.S. Dewing says, “the term capitalisation or the valuation of capital includes the capital stock and debt.” Attention is focused on the quantitative aspect only. In this sense, it includes ownership capital and the borrowed capital as represented by long-term indebtedness. Surplus in the business in the form of free reserves is also considered as an integral and expected part of capitalisation.

There are three ingredients of capitalisation:

1. The value of all kinds of shares.

2. The value of bonds outstanding.

3. The value of surpluses-capital or earned surpluses not meant for distribution.

In the formulation of a financial plan of a corporation, we have to make the decision relating to the total amount of securities to be issued. Capitalisation indicates the total par value of the outstanding amount of securities in the form of share capital, debenture capital and the face value of other long-term obligations. Short-term loans or temporary bank loans are usually excluded from the capitalisation.

Capitalisation = Ownership capital + long-term loan capital

= Share capital + free reserves + debenture capital + long-term loans

Essay # Theories of Capitalisation:

There are two concepts of capitalisation:

1. Cost Theory of Capitalisation:

The value of a corporation is determined by the sum-total of various estimated costs.

In financing business, funds must be provided for the following purposes:

(a) To finance acquiring of fixed assets, i.e., investment of plant and equipment,

(b) To supply working capital, i.e., investment in liquid or current assets,

(c) To defray the costs of organising,

(d) To cover the cost of establishing the business.

The cost concept is usually favoured as a basis of studying capitalisation of a newly started concern and the capital plan of a new project may be based on the cost concept. The cost concept is not satisfactory in the case of a growing concern.

The principal objection to the cost concept is that capitalisation amount will not change with the changes of earning power of the corporation. Hence, it cannot reveal the true worth of the corporation.

The true value of an enterprise is judged by it? Earning power rather than from the capital investment, e.g., some assets may be obsolete and the earning power may fall, but such a fall will not reduce the book value of the investment made in the business, the book value of the investment made in the business.

2. Earning Theory of Capitalisation:

The true value of the enterprise depends upon two factors:

(a) The earning power or capacity; and

(b) Earnings every year.

Capitalisation of a business, i.e., the determination of the amount of securities to be issued, is not arrived at on the basis of cost concept. Capitalisation should be based on the earning power. In other words, the process of capitalisation begins with an estimate of the future earnings of the business. No one puts money into a business without expecting return on it in the shape of dividend or interest.

The value of a business is determined by its ability to earn return on capital invested. The higher the rate and regularity of its earnings, the greater the value of the business and the greater the amount of capital which may be safely invested in it. Another-way of saying the same thing is that a business is worth that amount upon which a fair return may be realised.

Suppose, for instance, in the promotion of a manufacturing business, it is determined that Rs.20 L. a year can be earned with regularity and that earnings in this type of business are usually 20% on invested capital.

The business may be capitalized at 20% Dividing Rs.20 L. by 0.20 gives the quotient of Rs.100 L. which would represent the total par value of the share capital to be issued. The capitalisation on the basis of 20% earning power would be Rs.100 L.

In other words, we have assumed that this business is worth five times its earnings. If it is decided to issue the share capital at Rs.100/- per share, the earnings per share, if the share capital is to sell five times the earnings, must be Rs.20/-. By dividing Rs.20 L. by Rs.20/-, we have one L. shares as the number to be issued.

Real value of the share capital = the value of its estimated earnings, i.e., the earning power of assets.

For example:

Average Profits Rs.20 L. Return on Investment = 20% which is also paid by competitors.

Capitalisation = 100 L. (100 × 20L)

(Capitalized value of earnings) 20

A company is worth what it is able to earn. Capitalisation is the estimate of its present value.

Essay # Types of Capitalisation:

1. Over-Capitalisation:

When a company is consistently (regularly) unable to earn the prevailing rate of return on its outstanding securities (considering the earning of similar companies in the same industry and the same degree of risks involved), it is said to be overcapitalized.

Causes of Over-Capitalisation:

1. Promotion with inflated assets. Book value of company more than its real value.

2. High promotion expenses, high remuneration of promoters; high price of patent, goodwill, etc.

3. Floatation of companies in inflationary period and when boom subsides earnings fall, leading to over-capitalisation.

4. Inadequate owned capital, defective financial plan, chooser of capital becomes beggar of capital, top heavy borrowing; high interest charges, shareholders starved — falling dividends, falling market value of shares.

5. Defective depreciation policy affecting adversely company’s efficiency and leading to low profits — Depreciated assets.

6. Manipulation of accounts to inflate profits and declare liberal dividends and no retained profits.

7. High taxation policy.

Effects of Over-Capitalisation:

(A) Effects on the Company:

1. Low dividend rates,

2. Low market price of shares and loss of investors confidence.

3. Manipulation of accounts to show prosperity on paper.

4. Inadequate provision for depreciation, replacement and reserves.

(B) Effects on the Shareholders:

1. Depreciation in share value.

2. Low, uncertain and irregular income.

3. Low loan value of shares.

4. Unhealthy speculation and exploitation of real investors.

5. Reduction and re-organisation of capital-burden on shareholders.

(C) Effects on Society:

When a company is over-capitalized, it tries to increase the prices and reduce the quality of products. But to adopt both these practices, company has to face one great difficulty and there is keen competition in the market. The result is that sooner or later the concern may have to face liquidation.

Panic may be created due to failure of such an over-capitalized concern. Members lose on both fronts due to lower dividends — on lower share prices in the market. Not only are the creditors of the company adversely affected but the workers also lose their employment.

Abad ethical atmosphere is created in the society and the whole economy may suffer from depressing effect. An over-capitalized company likes to effect economy by wage cuts and it may have to face strikes and labour unrest.

Over-capitalisation also leads to wastage and mis-application of scarce financial resources of the society. The cure for an over-capitalized company is reorganization of capital structure, if necessary, with reduction of share capital. Otherwise, sooner or later, the corporation may have to face insolvency and liquidation.

Remedies for Over-Capitalisation:

1. Redemption of debentures or repayment of loans.

2. Reduction in the rate of interest on debentures or on loans.

3. Reduction in the rate of dividends on preference shares.

4. Reduction of issued or paid-up share capital.

All these steps may be a part of re-organisation of capital to restore balance to its capital structure.

2. Under-Capitalisation:

A company is under-capitalized when its actual capitalisation (i.e. total long-term resources) is lower than its proper capital as warranted by its earning capacity.

We have over-capitalisation if — 1. earnings are overestimated, or 2. rate of capitalisation or return on investment is underrated by the company promoters. Hence, we have falling dividends and falling market values of shares.

We have under-capitalisation if — 1. earnings are underestimated, or 2. rate of capitalisation or return on investment is overrated by the company promoters. Hence, we have rising dividends and rising market values of shares.

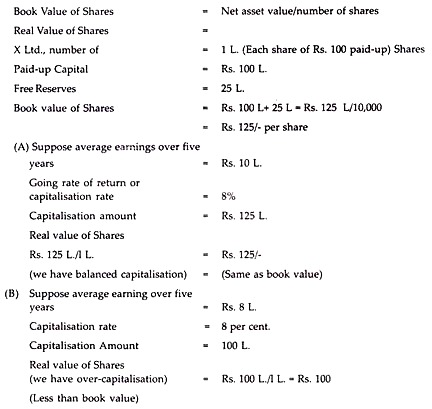

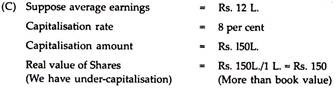

1. Over-capitalisation — (over-valued assets in B/S.) Book value of shares is more than the real value of shares (shares sold at a discount).

2. Balanced or proper capitalisation — Book value of shares is equal to the real value of shares (shares sold at par).

3. Under-capitalisation—(under-valued assets in B/S). Book value of shares is less than the real value of share (shares sold at a premium).

Causes of Under-Capitalisation:

1. Underestimation of future earnings by accident.

2. Companies floated in recession find themselves under-capitalized during prosperity because they have unexpected increase in earnings.

3. Conservative dividend policy adopted by the management providing liberal depreciation, liberal retained profits and emphasis on self-financing for growth — Appreciated assets.

4. Latest process of production and techniques, rationalisation, scientific management, finance out of past savings, maximisation of productivity and efficiency, increase in profits.

5. Built-up secret reserves.

Effects of Under-capitalisation:

1. Higher dividends on shares.

2. High prices of shares.

3. Cut-throat competition due to new rivals.

4. Liberal depreciation provision.

5. Demand for higher wage and bonus by employees.

6. Demand for lower prices by consumers.

Remedies of Under-capitalisation:

1. Capitalisation of reserves and issue of bonus shares.

2. Sub-division of share capital.

3. Increase of issued capital.