Here is an essay on ‘Foreign Direct Investment’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Foreign Direct Investment’ especially written for school and college students.

Essay on FDI

Essay # 1. Introduction to Foreign Direct Investment:

Inbound FDI in developing countries is associated with positive spill overs for the host country, such as improvement in corporate governance standards, reduction in corruption, improvement in corporate reporting practices, greater efficiency of domestic firms, and increase in host country GDP.

Other benefits of FDI in developing countries are the inflow of cheap capital, advanced technology, and superior management capabilities. There is conflicting evidence from cross-country studies on whether FDI always delivers the promised benefits. The correlation between FDI and growth was positive in some Asian countries (Indonesia, Singapore, Taiwan) but not in others. Similarly, FDI generated growth in Peru, but not in Argentina and Chile.

In cross-border M&As, the host country government must ensure that existing FDI norms have not been violated. Some countries forbid acquisitions by companies from select countries, while others are concerned with ’round tripping’ (funds routed out of the country and brought back as FDI).

Mainstream arguments propound several benefits that spring from Western MNCs investing in developing countries and emerging economies. New avenues for economic development open up, employment is enhanced, the acquirer captures the benefits of cost saving and revenue enhancement, new management styles and ways of doing business, and new technologies are introduced in the host country.

There is an improvement in the standard of living, an increase in the depth, width and sophistication of capital markets, a decrease in market distortions. Increased competition results in lower prices while wider choices available to customers raises the level of efficiency in the industry, as local firms are forced to ‘learn’ in order to survive.

This ‘win-win’ view of FDI from developed countries into developing countries is hotly debated, not the least by the destination countries. There is a complex relationship between FDI and growth. Empirical evidence on the effect of FDI on the host country is mixed. One such study found that outbound FDI from UK was found to have a positive impact on economic growth of the host country; outbound FDI from Germany a positive impact on economic growth of the host country only when the latter’s institutions were robust, and educational levels were high; outbound FDI from Japan did not have a positive impact on economic growth of the host country irrespective of the host country’s economic and institutional characteristics.

The definition of FDI is contentious in terms of its scope (some countries such as India, exclude reinvested earnings, while other countries include it) and with respect to what percentage of equity endows the acquirer with ‘control’. FDI is the ownership and/or control of foreign enterprises, with the intent of developing a long-lasting interest in the foreign enterprises. The word ‘long-lasting interest’, implies that the parent company is willing to invest time and resources (both financial and managerial) to ensure that the foreign enterprise is financially successful.

According to the World Bank, when 10% or more of the voting equity shares are acquired, then the acquirer is deemed to have a ‘lasting management interest’ in the target company. The definition of what constitutes FDI varies from country to country, and this affects the comparability of FDI statistics. According to the IMF, FDI comprises of non-equity alliances and equity alliances overseas.

Non-Equity Alliances:

These are in the form of licensing agreements and partnerships with overseas firms. They enable the authorized use of assets such as proprietary rights (patents/trademarks).

Equity Alliance:

This represents a ‘lasting interest’ by the parent company and involves a long-term relationship.

On the basis of the equity holding, the affiliate is classified into three categories:

i. Overseas Branch:

It is an enterprise that is owned by the parent company, and incorporated in the home country of the parent company.

ii. Overseas Associate:

It is an enterprise in which the parent company owns more than 10 % but less than 51 % of the equity.

iii. Overseas Subsidiary:

It is an enterprise in which the parent company owns 51% or more of equity.

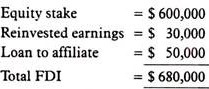

Equity holding consists of the purchase of an equity stake, that part of the earnings of the affiliate that have accrued to the parent company by virtue of the equity ownership and are reinvested in the affiliate, and loans made by the parent company to the affiliate. This can be illustrated through an example. An Indian company has one million equity shares issued and outstanding.

An American company purchases 600,000 shares at a price of $1 per share. The American company’s share of the post-tax earnings of the Indian affiliate is $30,000. It reinvests this in the Indian affiliate. During the course of the same year, the American company gives a loan of $50,000 to the Indian affiliate.

The FDI is calculated as:

However, not all countries use this definition of FDI. For instance, India’s definition excludes reinvested earnings. This would mean the FDI in the above example would be $650,000.

Essay # 2. FDI and Emerging Markets:

The term ’emerging markets’ first used in 1952 as a euphemism for Third World countries, was redefined in 1981 during a presentation by a financial services firm, to refer to countries which were on the brink of explosive growth. The list of emerging market countries is fluid. In the twenty-first century, the list of emerging market countries includes the BRIC countries (Brazil, Russia, India, and China), Mexico, South Africa, South Korea, and Taiwan.

Argentina, Malaysia, Kuwait and Hungary are expected to join the list. The scope of the term ’emerging markets’ is contentious. According to Standard and Poor’s, it excludes Australia, Canada, Japan, USA, New Zealand, and 19 western European countries. UNCTAD defines it as consisting of developing economies and those in transition. Both these groups consist of countries that do not belong to the ‘developed’ category— OECD countries and EU except Korea, Mexico and Turkey.

FDI became a sought after economic goal in the 1980s, and was viewed as an engine of growth. Asian economies were more open to FDI during that decade, clocking an average FDI stock to GDP ratio of nearly 14%, compared to 6% for developed countries. Foreign companies were actively encouraged to invest in Asia and enjoyed the ‘foreign privilege’.

The privilege was greater in host countries that ranked high in corruption. This was attributed to the fact that foreign companies were less likely to interfere in local political and social issues, and more often than not, forged ties with the political elite in the host country, helping the latter directly or indirectly to tighten its grip on the country.

Thus, authoritarian regimes were more open to FDI in the 1990s. In some countries, foreign companies were encouraged to reduce the clout of local companies controlled by specific ethnic groups, and was termed the ‘ethnic bypass’ strategy. Malaysia’s New Economic Policy of 1969 was designed to curtail the growth of local firms run by the minority Chinese community. Therefore, FDI had a ‘crowding out’ effect on domestic competition and investment. Thus, MNCs are accused of anti-competitive behaviour.

Political risk is high in emerging markets, and the regulatory environment with respect to protection of intellectual property, corporate governance, and corporate social responsibility is different from those in developed economies. But their young populations and large domestic markets (especially Brazil, China and India), offer enticing prospects for long-term growth and increased profitability for MNCs in mature industries, headquartered in countries with ageing, shrinking populations.

Since an MNC cannot rely on sustaining its business through favorable exchange rate movements, cross-border M&As permit a better geographical mix, increased scalability, process improvements, and an onshore-offshore mix that delivers superior value. FDI inflows into emerging markets rose from 28% in 2005 to 40% in 2009. UNCTAD data showed that the number of MNCs in emerging market economies (EMEs) rose from 3,000 in 1990 to 13,000 in 2006.

Annual FDI stock in Asian EMEs rose from $63,949 million in 1990 to $ 676,273 million in 2009. Asian EMEs account for more than one-third of FDI flowing into all EMEs. Within Asia, India, China, Hong Kong and Singapore are the most prominent FDI destination countries. China and India continued to attract the most FDI from MNCs in 2010. By 2009, the inward and outward FDI stock of the G20 countries ($ 9,741,878 million) exceeded that of the G8 ($ 7,451,778 million). This in itself reflected the G20’s louder voice in international negotiations and climate talks.

Beginning in the 1990s, outward FDI from emerging market economies through cross- border acquisitions gained pace. Asian firms were especially active and viewed this as a way to improve their competitive position, by gaining market access and cheap inputs. UNCTAD data revealed that outbound FDI stock from EMEs rose from $131 billion in 1990 to $929 billion in 2003, and EMEs share in the global outbound FDI grew from 7% to 11% during this period. Asian countries dominated outbound FDI from EMEs.

Thirty-two of the top 50 MNCs in EMEs during 2003 were Asian. M&A deals such as Tata Tea’s acquisition of UK’s Tetley, Tata Motors’ acquisition of the Jaguar, and Chinese company Lenovo’s acquisition of IBM’s PC division signify a new assertiveness among Asian MNCs, who look beyond the Southern hemisphere, to successfully bid for Western companies. This reflected the robust economic growth of Asian EMEs that had by and large escaped the financial devastation of the global recession in 2008.

Essay # 3. FDI Policy in India:

1. Inbound FDI Policy:

FDI policy is articulated by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry. According to its consolidated FDI policy (effective from October 1, 2010) the government sought to have a transparent, investor friendly and clear FDI policy. It defined FDI as investment by a non-resident (either entity or person) in the capital of an Indian company. Control is deemed to exist when nonresidents have the power to appoint a majority of the acquired company’s directors. An entity is deemed to be owned by non-resident entities if more than 50% of its capital is beneficially owned by non-residents.

Inbound FDI enters through the automatic route, and the approval route. Approval is required from the Foreign Investment Promotion Board (FIPB) in the Ministry of Finance. Inbound FDI comprises direct and indirect investment. Direct Investment is investment in an Indian company by non-resident Indian entities or individuals.

Indirect Investment is computed by taking into consideration investment by foreign institutional investors, NRIs, ADRs, GDRs, FCCBs, fully convertible preference shares, and fully convertible debentures. Downstream investment is a form of indirect investment. It is made by non-resident entities through funds brought from overseas. The acquired Indian entity may be an operating company (one which undertakes operations) or an investment company.

Salient aspects of FDI rules in India are:

i. FDI is not permitted in retail trading (with the exception of single brand product retailing), real estate firms, tobacco companies, lotteries, and sectors not open to FDI (such as atomic energy).

ii. 100% FDI is permitted through the automatic route in aquaculture, pisciculture and animal husbandry, mining of ores and coal and setting up of coal processing plants.

iii. In the tea sector, 100% FDI is permitted through the approval route, with the proviso that there is compulsory divestment of 26% equity in favour of resident Indians (individuals or entities) within five years.

iv. FDI caps in certain sectors such as insurance are contained in sector-specific statutes.

v. A non-resident (who is not a citizen of Pakistan), is permitted to invest in India.

vi. FDI can be in micro and small enterprises, sole trading concerns, partnership firms, and listed companies, either by purchasing newly issued shares, or through purchase of existing shares from Indian shareholders.

vii. A Non-resident Indian (NRI) is permitted to transfer or gift the shares and convertible debentures of an Indian company, to another nonresident Indian.

Similarly, residents can transfer or gift the shares and convertible debentures of an Indian company, to an NRI subject to the following stipulations:

a. The transfer or gifting of the financial instruments of an Indian financial services company, stock exchange, depository, and clearing corporation requires prior RBI approval.

b. The transaction should not attract the provisions of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997.

c. The FDI was through the automatic route.

viii. Indian companies are permitted to convert their External Commercial Borrowing in convertible foreign currency into equity shares and fully convertible preference shares, provided the FDI was through the automatic route and SEBI guidelines with respect to pricing of the securities are adhered to.

ix. Indian companies are permitted to issue equity shares, fully convertible debentures, and fully convertible preference shares under FEMA guidelines.

x. Listed Indian companies can raise overseas resources through the issue of ADRs, GDRs, and foreign currency convertible bonds. The funds received from such issue are considered FDI.

xi. Companies can offer two-way fungibility on ADRs and GDRs. Unlisted companies can raise overseas resources through the issue of ADRs, GDRs, and foreign currency convertible bonds, only by simultaneously listing on a domestic stock exchange.

xii. A company should issue the instruments within 180 days of receipt of funds from the non-resident investor. The price of the instruments should be in accordance with SEBI guidelines and RBI guidelines. Voting rights are in accordance with the provisions of the Companies Act (1956), and in the case of banking companies, the Banking Regulation Act (1949).

xiii. Indian companies are permitted to issue bonus shares and rights shares to non-residents provided:

a. Sectoral FDI caps are not violated by such issue.

b. The issue is in accordance with the guidelines in the Companies Act (1956), and SEBI (Issue of Capital and Disclosure Requirements) 2009.

c. When a rights issue is made by a listed company, the price can be determined by the company. In the case of rights issue by an unlisted company, it must be at a price paid by resident shareholders.

d. The issuing company can allot the unsubscribed portion of a rights issue to nonresidents, subject to the condition that the relevant FDI cap is not violated by such allotment.

xiv. Listed Indian companies can issue shares to shareholders of the non-resident acquirer, provided the sectoral FDI cap is not violated, and provided that the non-resident acquirer is not undertaking activity that is prohibited under Indian FDI policy.

xv. Listed Indian companies can issue shares under ESOPS (Employees Stock Option Scheme) to employees of its wholly owned overseas subsidiary, or overseas joint venture, provided the face value of the shares so allotted does not exceed 5% of the paid up capital of the issuing company.

xvi. Share swaps require approval of the Foreign Investment Promotion Board (FIPB).

According to RBI statistics, the cumulative FDI inflow into India between April 2000 and April 2010 was $163,715 million. During this period, Mauritius was consistently the top investing country, followed by Singapore, the USA, UK, and the Netherlands. The services sector (financial services and non-financial services) attracted the maximum FDI, followed by computer software and hardware, telecommunications, housing and real estate, and construction.

2. Outbound FDI Policy:

Under the automatic route, an Indian company can make investment in overseas JVs or overseas wholly owned subsidiaries up to 400% of the Indian company’s net worth.

The ceiling of 400% includes:

i. Contribution to the capital of the overseas entity

ii. Loan granted to the overseas entity

iii. 100% of the guarantees issued to or on behalf of the overseas entity

An Indian company is a company incorporated in India or a body created under an Act of Parliament or a partnership firm registered under the Indian Partnership Act, 1932. The Indian company can extend loan/guarantee only to an overseas concern in which it has equity participation.

The investment can be through a share swap, proceeds of External Commercial Borrowings, foreign currency funds raised through Foreign Currency Convertible Bonds, foreign exchange from an AD bank in India, or an ADR or GDR exchange. When foreign currency funds are raised through ADR or GDR issue, the 400 percent ceiling does not apply.