After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions.

Essay Contents:

- Essay on the Introduction to Financial Management

- Essay on the Definition of Financial Management

- Essay on the Scope of Financial Management

- Essay on the Role of Financial Management in a Business

- Essay on the Financial Goals and Objectives

- Essay on the Functions of Financial Management

Essay # 1. Introduction to Financial Management:

A business organisation seek to achieve their objectives by obtaining funds from various sources and then investing them in different types of assets, such as plant, buildings, machinery, vehicles etc. Financial management is managing the finances through scientific decision-making.

For making right decisions, financial management needs to understand financial environment within which these decisions operate. Financial management will then be able to analyse these financial information’s to predict likely future results and to plan more carefully their proposed course of action.

ADVERTISEMENTS:

Financial management is concerned with the acquisition (investment), financing (arranging funds), and management of assets with some overall goal in mind. Investment decisions begin with a determination of the total amount of assets required by the firm and to determine the money value of the same. Assets that cannot be economically justified, may be reduced, eliminated or replaced.

Financing decisions include decisions regarding mix of financing, type of financing employed, dividend policy and method of acquiring funds i.e., getting a short term loan, or a long term lease arrangement, sale of bonds or stock.

Asset management decisions means managing the assets efficiently after their acquisition.

Success of a firm depends on the ability to raise funds, invest in assets and manage wisely.

Essay # 2. Definition of Financial Management:

Financial management is an internal part of overall management and not a staff function of the organization. It is not only restricted to fund raising process but also covers utilization of funds and monitoring its uses. The finance function is concerned with the process of acquiring an efficient utilization of funds of a business system, in order to maximize the value of the enterprise.

ADVERTISEMENTS:

Financial management involves the application of principles of general management to the finance function. These functions influence the operations of other crucial functional areas of the enterprise or firm such as marketing production and personnel. Thus the overall survival of the firm is effected by it financial operations.

“The financial management deals with how the corporation obtains the funds and how it uses them.” —Hoagland

“The financial management refers to the application of skills in the manipulation, use and control of funds.” —Mock, Schultz and Schuckectat

ADVERTISEMENTS:

Financial management can also be defined as that part of management, which is related mainly with raising or acquiring the funds for the enterprise or firm in the most economical way, utilizing those funds as profitably as possible, for a given risk level, planning the future investment of those funds and controlling the current performance plus future development by adopting budgeting, cost accounting and financial accounting.

Essay # 3. Scope and Functions of Financial Management:

The main objectives of financial management are to arrange the sufficient funds for meeting short term long term requirements of the enterprise. These finances are procured at minimum cost in order to maximize the profitability.

In view of these factors the financial management scope concentrates on the following areas of finance function.

(i) Estimating the Financial Requirements:

The first job of the finance manager of an enterprise is to estimate short term and long term financial requirements of his business. He will prepare a financial plan for present as well as future for this purpose.

ADVERTISEMENTS:

The finance required for procuring fixed assets as well as the working capital needs will have to be ascertained. The estimations should be based on sound financial principles so that funds available with the firm are neither inadequate nor excess.

(ii) Determining the Capital Structure:

After estimating the financial requirements, the finance executives have to decide about the composition of capital. The capital structure refers to the type and proportion of different securities for raising funds. After deciding the quantum of funds needed it should be decided which type of securities should be raised.

The finance executives have to determine the relative proportions of owner’s risk capital and borrowed capital along with short term and long term debt equity ratio.

A decision regarding various sources of funds should be linked with the cost of raising funds. A decision about the kind of securities to be employed and the proportion in which these should be utilized is an important decision which affects the short term and long term financial planning of an enterprise.

(iii) Choice of Sources of Finance:

ADVERTISEMENTS:

After preparing a capital structure an appropriate source of finance is chosen. Various sources from which finance may be raised include: shareholders’ debenture holders, banks and other financial institutions and public deposits etc. Finance executive has to evaluate each source or method of finance and select the best source keeping in view the various factors.

The need, purpose, objective, cost involved may be the factors affecting the selection of a suitable source of financing, for instance, if the finances are required for short periods then banks, public deposits and financial institutions may be appropriate, and for long term financial requirements, the share capital and debentures may be useful.

(iv) Investment Decisions:

When the funds have been poured then a decision regarding pattern of investment has to be taken. The funds raised are to be intelligently invested in various assets so as to optimize the returns on investment. The funds will have to be used first for the purchase of fixed assets and then an appropriate part will be retained as working capital.

The utilisation of long term funds requires a proper assessment of different alternatives through capital budgeting and opportunity cost analysis. While spending on various assets, management should be guided by three important principles of safety, liquidity and profitability. A balance should be struck even in these principles for the purpose of optimum returns on investment.

(v) Management of Profits:

ADVERTISEMENTS:

The utilisation of surpluses or earnings is also an important factor in financial management. A judicious utilisation of earnings is essential for expansion and diversification plans of the enterprise.

A certain amount out of the total profit may be kept as reserve voluntarily, a portion of surplus may be distributed among the ordinary and preference shareholders, yet another portion may be reinvested. The finance executive must take into consideration the merits and demerits of the alternative scheme of utilizing the funds generated from the enterprise’s own earnings.

(vi) Management of Cash Flow:

Cash flow management is also an important task of finance executive. He has to assess the various cash requirements at different times and then make arrangements for cash needed. Cash may be required to (i) make payments to creditors (ii) for purchase of materials (iii) to meet wage bill (iv) to meet everyday expenses.

The cash management should be such that neither there is shortage of it and nor it is idle. Any shortage of cash will damage the credit worthiness of the firm. The idle cash with the enterprise will mean that it is not properly utilized. In order to know the cash requirements during different periods, the management should arrange for the preparation of cash flow statement in advance.

(vii) Implementation of Financial Controls:

ADVERTISEMENTS:

An efficient system of financial management needs the use of various control of devices. Financial control devices generally adopted are (i) Return on Investment (ii) Budgetrary Control (iii) Cost control (iv) Break Even analysis (v) Ratio analysis. The use of various control techniques by the Finance Manager will help him in evaluating the performance in different areas and take corrective action whenever needed.

Essay # 4. Role of Financial Management in a Business:

An effective financial management plays a dynamic role in a modern company’s development.

In earlier days, financial managers were primarily engaged in:

(a) Raising funds, and

(b) Managing the firms cash flow.

But now-a-days with the developments and increasing complexities in the business, responsibility of the financial managers have increased and they are now concerned with the decision-making process involving finance, i.e., capital investment.

ADVERTISEMENTS:

Today external factors, like competition, technological change, economic uncertainty, inflation problem etc., create financial managers problem more complicated. He must have flexibility to adopt to the changing external environment for the survival of his firm.

Thus in addition to the job of acquisition, financing and managing the assets, the financial manager is supposed to contribute to the fortunes of the firm and to the optimal growth of the economy as a whole.

He is required to take decisions on:

(i) Investing funds in assets, and

(ii) Obtaining best mix of financing and dividends.

ADVERTISEMENTS:

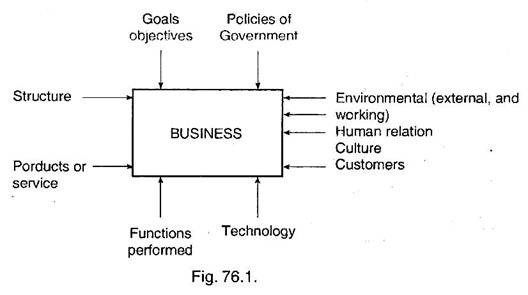

In order to understand the environment in which a finance manager is required to take decision, a sketch indicating business system is given hereunder:

The Financial Management’s main role is therefore to create profit on the capital invested (fixed as well as working capital). Each and every decision related to finance/economy must be optimal. Every business enterprise is set up to earn profit, and no one is interested in taking risk unless he is assured of fair return on the investment. However government organisations have no profit motive but are created to serve the public.

The profit earned by a firm is used for:

(a) Future expansion.

(b) Distributing profit as rewards to owners/shareholders.

Profit earned also serves as an indicator of efficiency and performance of the firm. So as to enable to perform the role of financial management, financial managers must be given proper authority, autonomy, freedom of actions, supporting staff, system for providing necessary information. He should be accountable also for his role.

Essay # 5. Financial Goals and Objectives:

There may be various objectives of a firm, but the goal of a firm is to maximise the wealth of the firm’s owners. Thus we can say that, “the improvement of shareholders value is the one mission that continually guides all corporate decisions and actions” or “the goal of a firm is maximizing the shareholders’ value”. This maximisation of value should be achieved from long term point of view.

ADVERTISEMENTS:

The financial goal can be expressed as:

(a) Required profit levels,

(b) Earnings per shares, and

(c) Required rate of return on investment.

For a large firm, where shareholders do not have direct say and the firm is managed by the management, an ordinary shareholder can judge the performance by the market price of the firm’s share. Market price serves as a gauge for business performance, it indicates how well management is doing on behalf of its shareholders.

ADVERTISEMENTS:

Management is the agents of the owners or shareholders, and financial management acts for achieving the goal of profit maximization in the shareholders’ best interests.

Social Goals:

While profit maximisation is the primary goal for any business organisation, social responsibility is also important for them. In case of Government organisations and public sector organisations, social responsibility is the primary goal and profit is secondary.

Social responsibility includes service to the people, protecting the consumer, paying fare wages to the employees, upliftment of the weaker sections, welfare facilities like medical education, environment improvement programmes etc.

Financial Objectives:

In making financial decisions, it is important to set out clear objectives.

Following are the basic financial objectives:

(a) Profit maximisation.

ADVERTISEMENTS:

(b) Maximisation of shareholders’ owners’ wealth.

(c) Reduction in cost.

(d) Minimising risks.

(e) Sustained increase in the value of firm

(f) Wealth maximisation.

Essay # 6. Functions of Financial Management:

Financial manager is concerned with the following aspects:

1. Identifying the present strengths and weaknesses of the organisation, and the scope for improvement, by conducting the financial analysis.

2. Planning the financial strategies. This involves the consideration of methods and levels of funds raising, profitability and the financing of expansion plan of the organisation.

3. Arranging the funds when required, in the form needed in the most economical way.

4. Conducting financial appraisal of the possible courses of action. The appraisals are needed in respect of possible take overs and mergers, analysis of capital projects, or alternative methods of funding.

5. Advising about capital structure.

6. Consideration of an appropriate level for drawings by dividends to the owners/ shareholders.

7. Ensuring that assets are controlled and used in an efficient manner.

8. Cash management. Preparation of detailed cash budgets and/or forecast funds flow statement so that future problems can be foreseen and remedial measures taken in advance. These take care of both shortage and excess of cash. Finance managers must find ways of raising more funds needed, or investing excess funds for an appropriate length of time.

9. Finance managers are likely to draw attention on other disciplines also, like accounting and budgeting.

In order to enable financial managers to perform above functions satisfactorily, he must have good knowledge of accounting, economics, mathematics, statistics, law especially taxation, financial market etc.

The functions of finance thus involve three major decisions the firm must make:

(a) The investment decisions,

(b) The financing decisions, and

(c) The dividend decisions.

Each of these decisions are taken in relation to the objective of the firm, an optimal combination of these three will maximise the value of the firm to its shareholders. Since the decisions are interrelated, their joint impact on the market price of the firm’s stock must be considered.

(a) Investment Decisions:

This is the most important decision. Capital investment, i.e., allocation of capital to investment proposals is the most important aspect, whose benefits are to be realised in future. As future benefits are not known with certainty, the investment proposals involve risk.

These should, therefore, be evaluated in relation to expected return and risk. Considerable attention is paid to determine the appropriate required rate of return on the investment.

In addition to taking capital investment decisions, finance managers are concerned with the management of current assets efficiently in order to maximise profitability relative to the amount of funds tied up in asset. Investment decisions also include the decisions about mergers and acquisition of another company.

(b) Financing Decisions:

Finance manager is required to determine the best financing mix or capital structure. An optimal financing mix is one in which market price per share could be maximised. Financing decision are taken in relation to the overall valuation of the firm.

Various methods of obtaining short, intermediate, and long term financing are also explored, examined, analysed and a decision is taken. While taking financing decisions, the influence of inflammation on financial markets and on the cost of funds to the firm is also considered.

(c) Dividend Decision:

The dividend decision includes the percentage of earnings paid to stockholders in cash dividends, stock dividends and splits, and the repurchase of stock.

To Meet Funds Requirement of a Firm:

Funds requirement is assessed for different purposes, namely for feasibility study of a project, detailed planning of a project, and for operation and expansion of the business.

For feasibility study, only broad estimates are sufficient and are generally obtained from the past experience of the similar works by interpolating the present trends and the condition of the proposed project in comparison to the one whose figures are being adopted. While during detailed planning, estimated requirement is comparatively more realistic, and prepared after going into details more thoroughly.

Here we are discussing the funds requirement for a running business including its long term planning for expansion.

The main function of financial management is to ensure that the firm must have sufficient funds to meet financial obligations when they are needed and to take advantage of investment opportunities. To achieve this objective, a thorough study is conducted about ‘flow of funds’ i.e., statement of funds requirement indicating the amount of fund needed and at what time.

This ‘statement of funds’ is a summary of a firm’s changes in financial position from one period to another. This indicates that how the funds will be used and how it will be financed over specific period of time. This includes the cash as well as non-cash transactions.

Forecast, financial statements are prepared for selected future dates, generally for middle term and long term plans of the firm. Budgets are used for one year, and are prepared only to fulfill the firms’ objectives envisaged in the forecast for that particular year.

These forecast financial statements are based on the sales forecast and future strategies for expanding the business, and includes, forecast income statements, forecast assets, liabilities, shareholders, equity etc.