Financial services refer to a variety of services that deal with money management and allied services. It includes Merchant banking, Portfolio management services, Credit rating agencies, Factoring, leasing, etc. This article includes the various financial services provided by the Non-Banking Financial Companies like Lease Financing, Hire-Purchasing, etc.

Essay on Financial Service # 1. Lease:

The Transfer of Property Act defines a lease as a transaction in which a party owning the asset provides the asset for use over a certain period of time to another for consideration either in form of periodic rent and/or in the form of periodic rent and/or in form of down payment.

In other words, Lease is a contract between two parties for the hire of a specific asset wherein the lessor retains ownership of the asset while the lessee has possession and use of the asset on payment of specified rentals over a period of lime. Leasing is suitable for financing most investments in productive equipment and is available to a broad range of business and other organizations, such as hospitals, educational institutions, associations and government agencies.

Advantages:

(1) For Lessee:

(a) It is an easy source of financing capital asset having a heavy cost because the lease rentals can be structured as per the needs of the lessee.

(b) It frees working capital for more productive use.

(c) It could provide 100% funding as opposed to other sources of raising funds like hire purchase or installment system that usually provide only 60-70 percent funding.

(d) Lease rentals are deductible expense for the purpose of tax.

(e) A leasing arrangement is simple to negotiate and administer.

(f) It is an ‘Off Balance Sheet’ method of financing and thus helps in window dressing.

(g) The lessee is protected from technological obsolescence particularly during operating lease arrangement.

(h) Debt financing is not possible for small equipments, for those equipment, lease is a good option.

(i) The borrowing capacity of the lessee is not affected due to leasing of assets.

(2) For Lessor:

(a) It is a safe asset based financing for a productive purpose

(b) The lessor enjoys tax benefit due to depreciation on the assets

(c) Lease rentals provide regular cash flow to the lessor.

(d) Most expenses associated with the leased equipment can be incorporated into the lease and amortized over the lease period.

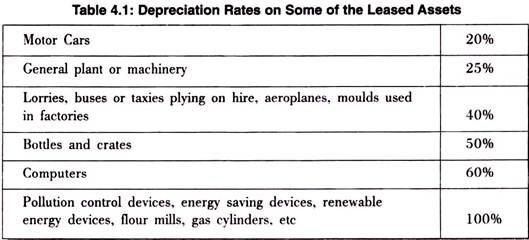

Rates of Depreciation:

Depreciation is allowed in India on a Pooling Basis (Block of Asset Method) for Tax Purpose:

All assets eligible for the same rate of depreciation under a particular class of assets will be treated as one pool, or block of assets. Acquisition of fresh assets is treated as addition to the block, and the sale or transfer is treated as reduction in the block of assets. Therefore, this has no bearing on the profit or loss on sale of an individual asset.

Rates of Depreciation are listed in the Schedule XIV to the Income-Tax Rules:

Similar to the British system, India makes distinction between “plant or machinery” and other assets based on the functional test. The age-old functional test in Yarmouth v. France holds in India. Based on this test, any assets that the lessor leases out are obviously income-earning tools in his business, and would therefore, be regarded as plant or machinery for his business.

Depreciation rates on some of the generally leased assets are given in the Table 4.1 below:

Some of the well-known Leasing and Hire Purchase companies in India are listed below:

i. First leasing in India

ii. Birla Global Asset Fin Co Ltd., Ahmedabad

iii. Cholamandalam Dist Ser Ltd., Ahmedabad

iv. Bhudrani Finance Ltd., Mumbai

v. Forvol Investment & Trading Co P L, Mumbai

vi. Sakthi Finance, Kerala

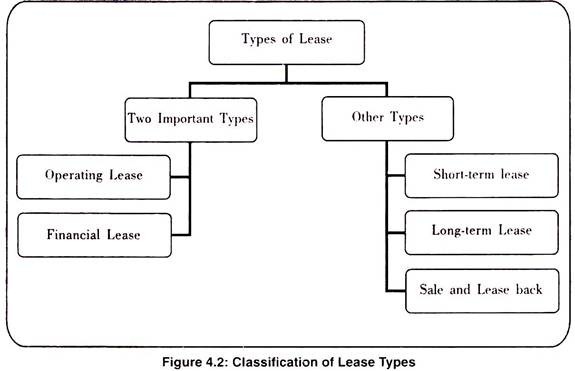

Types of Leasing:

Lease can be classified in different categories as displayed in figure 4.2.

A brief discussion of the various types of lease is presented below:

1. Short-Term Lease:

Short-term Leases are typically for assets that have high depreciation eligibility like computers, windmills etc. Such leases are generally for a period of 2-3 years. These type of leases tend to be useful to corporate entities who have capital requirements for products that have high obsolescence, high taxable income in the near future.

2. Long-Term Lease:

Long-term Leases are for assets that have low depreciation eligibility like plant and machinery, cars, furniture and fixtures etc. and have a long economic life. Corporate entities interested in leveraging the balance sheet to achieve a higher operational profit prefer this product.

3. Operating Lease:

An Operating lease is a contract between the lessor and lessee such that the cost of the asset is not fully recovered from a single lessee. This means that the period of the lease will be shorter since the lessor will recover the cost of the asset from multiple lessees. Repair and maintenance of the asset is the lessor’s responsibility.

4. Financial Lease:

A financial lease is a contract between the lessor and lessee such that the cost of the asset (90% of the Fair Value of the asset) is recovered from a single lessee by the lessor as lease rental. This means that the period of the lease will be longer (almost the 90% of the Life of the asset). At the end of the lease period, generally, the lessor agrees to transfer the tide of the asset to the lessee at a nominal cost.

5. Sale and Leaseback:

Sale and Leaseback is a transaction where the lessee already owns the asset he wants to leverage. The lessee sells the asset to the lessor who pays for the asset and immediately leases it back to the lessee. This transaction enables a lessee to release large amounts of cash blocked in the asset, for further expansion / other uses and could bring down the debt equity ratio affording additional borrowing capacity to the lessee.

Types of Lease Rentals:

1. Step-Up Lease Rental:

A type of lease providing for specified rent increases at certain future dates. Opposite of step-down lease

2. Step-Down Lease Rental:

A lease providing for specified rent decreases at certain future dates. Opposite of step-up lease

3. Deferred Lease Rental:

Lease rentals are charged during an initial gap of say 2-3 years and then recovered during the remaining lease period

4. Ballooned Lease Rental:

Lease rentals are recovered in a lump sum (may be 3 or 4 times the normal lease rental) either in the beginning or at the end of the lease period.

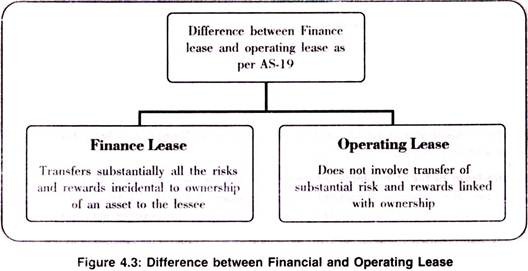

Accounting Standard 19 (AS 19):

AS 19 prescribes the accounting policies to be followed by lessor and lessee, in lease transactions, and the relevant disclosures to be made.

Legislation of Leases:

The Hire-Purchase Act, 1972 governed the lease deals but it was withdrawn in 1973. Lease is now governed under the section 105 to 117 Transfer of Property Act, which deals with immovable properties and section 126 to 180 of the Indian Contract Act of 1872. But these are not specific to lease contracts which have their own characteristics. Thus, the need arises for a separate Act for leasing Contracts.

Essay on Financial Service # 2. Hire Purchase:

Hire Purchase (HP):

A method of buying goods in which the purchaser takes possession of (hem as soon as an initial installment of the price (a deposit) has been paid and obtains ownership of the goods when all the agreed number of subsequent installments has been paid. A hire- purchase agreement differs from a credit-sale agreement and sale by installments (or a deferred payment agreement) because in these transactions ownership passes when the contract is signed. It also differs from a contract of hire, because in this case ownership never passes.

In other words, during the repayment period the buyer has the possession and use but not the ownership (title) to the item. Only upon the full payment of the loan, the title passes to the buyer.

Types of Hire Purchase:

1. Consumer Installment credit for hire and sale of consumer durables.

2. Industrial and Commercial Credit for hire and sale of industrial goods, plant, machinery, equipment, etc.

3. Hire-Purchase by the dealer or producer to consumer.

4. Hire-Purchase by the finance company, as in case of auto finance.

Essay on Financial Service # 3. Factoring:

There is a lime gap between the sale of goods and when payments are made. This interval between the date of sale and the date of payment has to be financed out of working capital. It involves opportunity cost as well as risk that the payment may not be received in future or will be received after many efforts by the seller. To solve this problem of managing, financing and collecting receivables, Factoring proves to be an efficient mechanism.

Factoring is a type of supplier financing in which firms sell their credit-worthy accounts receivable at a discount (equal to interest plus service fees) and receive immediate cash. Factoring is not a loan. There is no debt repayment and no additional liabilities on the film’s balance sheet, although it provides working capital financing.

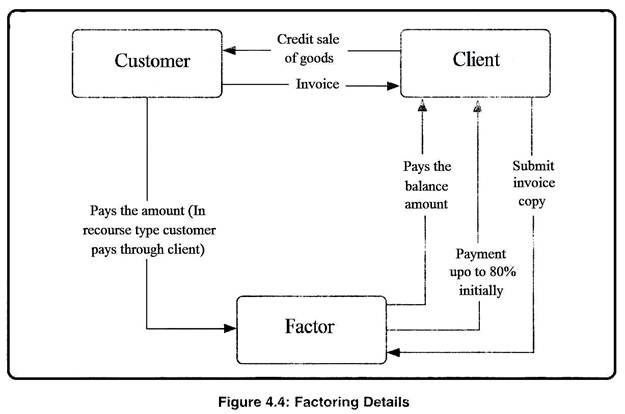

In simple definition factoring is a set of financial services the seller receives in exchange for transferring his receivables. In factoring, a financial institution (factor) buys the accounts receivable of a company (Client) and pays up to say 80%-85% of the amount immediately on agreement. The remaining amount is-the commission or the profit margin of the factoring company. The entire process can be briefly explained as shown in figure 4.4.

Advantages of Factoring:

1. No-Collateral Funding:

Invoices issued to debtors are transferred to factor which are immediately converted into ready cash. It is an alternative source of funding without creating any liabilities.

2. Insurance against Late Payment:

The supplier need not worry whether the buyer (customers) would pay on time or not, because they have already received the cash for transferring the account receivable.

3. Management of Accounts Receivable:

Factoring services helps in efficient management of the receivables and the seller can use his resources for core activities and functions of business like production, sales, marketing and other business processes.

4. Collection of Accounts Receivable:

Collecting the payments from the buyer or sending them reminders in case of delayed payments or suing them in case of no payment is looked after by the factoring agency. Thus, the seller is relieved from such activities.

Drawbacks of Factoring:

i. The basic disadvantage of factoring is that it may lead to ruined relations with the customers especially if factor engages in aggressive or unprofessional practices when collecting accounts

ii. Cost is another disadvantage. Cost involved in factoring agreement may be more than the cost of other methods of financing available in the business

Types of Factoring:

1. Disclosed and undisclosed factoring

2. Recourse and Non-recourse factoring

3. Domestic factoring and International Factoring

1. Disclosed Factoring:

In disclosed factoring client’s customers are notified of the factoring agreement. Disclosed type can either be recourse or non-recourse.

Undisclosed Factoring:

With undisclosed factoring, the seller has the right not to inform the buyer that factoring services are being used for the supply contract. The seller may continue to receive payments from the buyer, forwarding them to the factoring company.

Non-Recourse Factoring:

In non-recourse factoring, the factor not only assumes title to the accounts, but also assumes most of the default risk because the factor does not have recourse against the client (seller) if the accounts default.

2. Recourse Factoring:

Under recourse factoring, the factor has a claim (i.e., recourse) against its client (the seller) for any account payment deficiency. Therefore, losses occur only if the underlying accounts default and the borrower cannot make up the deficiency.

Note:

Usually, non-recourse factoring is disclosed; recourse factoring may be either disclosed or undisclosed:

3. Domestic Factoring:

Factoring is considered domestic if the seller and the buyer, as well as the factoring company, are based in the same country.

International Factoring:

Factoring is called international if the seller and the buyer are residents of different nations.

Factoring Companies in India:

Below are listed few factoring companies in India:

i. Canbank Factors Limited

ii. SBI Factors and Commercial Services Pvt. Ltd.

iii. The Hong-Kong and Shanghai Banking Corporation Ltd.

iv. Foremost Factors Limited.

v. Global Trade Finance Limited.

vi. Export Credit Guarantee Corporation of India Ltd.

vii. Citibank NA, India.

viii. Small Industries Development Bank of India (SIDBI).

ix. Standard Chartered Bank.

Essay on Financial Service # 4. Forfeiting:

In international trade transactions, forfeiting is a common form of financing export-related receivables.

Forfeiting is usually used for medium and long term debt (1-10 years). Similar to factoring the Forfeiting Company will take full responsibility for receiving the payments from the purchaser (importer) in exchange for a letter of credit, line of credit, or cash to the seller (exporter).

Forfeiting may be used for only one account or several accounts. The key difference between forfeiting and factoring is that Forfeiting companies keep a portion of the accounts receivable whereas a factoring company will return the balance minus their fees. This is an extract of the recent development related to exemption of factoring services from stamp duty.