Here is a compilation of essays on ‘Foreign Capital’ for class 11 and 12. Find paragraphs, long and short essays on ‘Foreign Capital’ especially written for school and college students.

Essay on Foreign Capital

ADVERTISEMENTS:

Essay Contents:

- Essay on the Meaning and Need of Foreign Capital

- Essay on the Types of Foreign Capital

- Essay on the Importance of Foreign Capital

- Essay on the Role of Foreign Capital in India

- Essay on the Overseas Investment Policy of India

- Essay on the Foreign Collaborations and Government Policy in India

- Essay on the Impact of Foreign Capital in India

- Essay on the Limitations of Foreign Capital

- Essay on the Recent Developments and Investments by India

Essay # 1. Meaning and Need of Foreign Capital:

The term ‘foreign capital’ is a comprehensive term and includes any inflow of capital in home country from abroad. It may be in the form of foreign aid or loans and grants from the host country or an institution at the government level as well as foreign investment and commercial borrowings at the enterprise level or both. Foreign capital may flow in ally country with technological collaboration as well. It is interesting to note that even in Russia and East European countries foreign capital has been allowed to flow in.

In countries like China, Thailand, Malaysia and Singapore contribution of foreign capital has been extremely encouraging. But in Latin America and African Countries foreign capital flow has not been satisfactory. Foreign capital is useful for both developed and developing countries. Advanced countries try actively to invest capital in developing countries. In India, foreign capital has been given a significant role, although it has been changing overtime.

ADVERTISEMENTS:

In the early phases of planning, foreign capital has been used as a means to supplement domestic investment. Later on there were technological collaborations between foreign and Indian entrepreneurs. But since July 1991, there has been a tremendous change in government’s policy (commonly called liberalization policy) about foreign investments.

Need for Foreign Capital:

Following arguments are advanced in favour of foreign capital:

1. To Sustain a High Level of Investment:

ADVERTISEMENTS:

For the industrialisation of underdeveloped countries, it is necessary to raise the level of their investments substantially. This requires in turn a high level of savings. Because of general poverty, the savings are often very low. Hence there is a gap between investments and savings. This gap can be filled up through foreign capital.

2. To Fill the Technological Gap:

The underdeveloped countries have very low level of technology as compared to the advanced countries. This raises the necessity for importing technology from the developed countries.

In the case of India, technical assistance received from abroad has helped in filling up the technological gap in the following three ways:

ADVERTISEMENTS:

(i) Provision of expert services

(ii) Training of Indian personnel abroad

(iii) Provision of educational, research and training institutions in the country.

3. To Undertake the Initial Risk:

ADVERTISEMENTS:

Many underdeveloped countries suffer from acute scarcity of private entrepreneurs. This creates obstacles in the programmes of industrialisation. But once the programme of industrialisation gets started with the initiative of foreign capital, domestic industrial activity starts picking up, as more and more people of the host country enter the industrial field.

4. To Exploit the Natural Resources:

A number of underdeveloped countries possess huge mineral resources which await exploitation. These countries themselves do not possess the required technical skill and expertise to accomplish this task. As a result, they have to depend upon foreign capital to undertake the exploitation of the resources.

5. To Develop Basic Economic Infrastructure:

ADVERTISEMENTS:

The economic infrastructure includes the system of transport and communications generation and distribution of electricity, development of irrigation facilities etc. ‘The domestic capital of the underdeveloped countries is often too inadequate to build up the economic infrastructure of country on its own. Thus they require the assistance of foreign capital to undertake this task.

6. To Improve the Balance of Payments Position:

In the initial phase of the economic development, the underdeveloped countries need much larger imports in the form of machinery, capital goods, raw materials, spares and components etc., as compared to their exports. As a result, the balance of payments generally turns adverse. This creates a gap between the earnings and

expenditure of foreign exchange. Foreign capital presents a short term solution to the problem.

This shows that the economic development of an under-developed country should obviously receive a boost as a result of foreign capital.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 2. Types of Foreign Capital:

Foreign capital can be divided into two types:

1. Foreign Aid

2. Private Foreign Investment

Foreign aid may consist of loans and grants.

Private foreign investment takes two forms:

ADVERTISEMENTS:

(a) Foreign Direct Investment (FDI)

(b) Foreign Portfolio Investments (FPI).

In India foreign direct investment may further take the form of (i) wholly owned subsidiary (ii) joint venture and (iii) acquisitions, Foreign portfolio investment may be (i) Investment by Foreign, Institutional Investors (FIIs) including Non-Resident Indian (MRIs) (ii) Investment in (a) Global Depository Receipts (GDRs) and (b) Foreign Currency Convertible Bonds (FCCBs).

Private foreign investment in India can be further classified as follows:

1. Foreign Aid:

ADVERTISEMENTS:

It consists of loans and grants. Loans may be taken from individual countries or from institutional agencies like World Bank, IMF and International Financial Corporation. Usually loans are taken for medium and long term capital needs of a country. Loans impose a heavy burden on the borrower country because they are to be repaid, along with interest, called surviving of loans. Loans may be tied because of restrictions. Such restrictions may be in the form of end use or in the form of source. Grants are given by public or private charitable organisations.

They are given for relief purposes and immediate use grants may be time bound and can be used only for specific purpose. Loans involve repayment obligations, whereas grants are non-refunded. It is important to see that grants are properly utilized for the specified purpose. Any foreign capital in the form of aid should be pledged on the basis of its purpose, mode of repayment, cost to the borrower and political considerations. For it is not only uncertain, usually not extended for public sector but for consumer goods industries and do not create means for its repayment. It is therefore better to create ‘trade’ rather than ‘aid’ from a foreign country.

2. Private Foreign Investment:

It is of two types – (i) Foreign Direct Investment (ii) Foreign Portfolio Investment.

Foreign investment and collaboration with a forcing nation are closely interrelated, but they are different from each other. Capital investment is participation of a foreign country in capital of recipient country’s enterprises. Collaboration, on the other hand means providing technical and managerial knowhow, licensing franchise, trade-marks and patents by a host country to home country.

Essay # 3. Importance

of Foreign Capital:

ADVERTISEMENTS:

In the early stages of industrialization in any country foreign capital plays an important role.

Their importance can be better understood under the following heads:

(1) Increase in Resources:

Foreign capital not only provides an addition to the domestic savings the resources, but also an addition to the productive assets of the country. The country gets foreign exchange through FDI. It helps to increase the investment level and thereby income and employment in the recipient country.

(2) Risk Taking:

Foreign capital undertakes the initial risk of developing new lines of production. It has with it experience, initiative, resources to explore new lines. If a concern fails, losses are borne by the foreign investor.

ADVERTISEMENTS:

(3) Technical Know-How:

Foreign investor brings with him the technical and managerial know how. This helps the recipient country to organise its resources in most efficient ways i.e. the least costs of production methods are adopted. They provide training facilities to the local personnel they employ.

(4) High Standards:

Foreign capital brings with it the tradition of keeping high standards in respect of quality of goods, higher real wages to labour and business practices. Such things not only serve the interest of investors, but they act as an important factor in raising the quality of product of other native concerns.

(5) Marketing Facilities:

Foreign capital provides marketing outlets. It helps exports and imports among the units located in different countries financed by same firm.

ADVERTISEMENTS:

(6) Reduces Trade Deficit:

Foreign capital by helping the host country to increase exports reduces trade deficit. The exports are increased by raising the quality and quantity of products and by lower prices.

(7) Increases Competition:

Foreign capital may help to increase competition and break domestic monopoly. Foreign capital is a good barometer of world’s perception of a country’s potential. It is rightly said that a satisfied foreign investor is the best commercial ambassador a country can have. To sum up, foreign capital helps three important areas that are necessary for the economic development of a country.

These three areas are savings, trade and foreign exchange and technology. Foreign capital performs three gaps filling function i.e., (i) savings gap (ii) trade gap (iii) and technological gap in the recipient country’s economy. It encourages development of technology, managerial expertise, and integration with other economies of the world, export of goods and services and higher growth of country’s economy.

Essay # 4. Role of

Foreign Capital in India:

In the planned economy of India, foreign capital has been assigned a significant role, although it has been changing over time. In the earlier phase of planning, foreign capital was looked upon as a means to supplement domestic investment. Many concessions and incentives were given to foreign investors. Later on, however, the emphasis shifted to encouraging technological collaboration between Indian entrepreneurs and foreign entrepreneurs. In more recent times, efforts are on to invite free flow of foreign capital. It would be instructive in this background to examine the Government’s policy towards foreign capital.

Government Policy towards Foreign Capital:

Foreign investment in India is subject to the same industrial policy as all other business ventures, plus some additional policies and rules specially governing foreign collaboration. The first articulate expression of free India’s attitude towards foreign capital was embodied in the Industrial Policy Resolution, 1948 (IPR, 1948). The IPR, 1948 emphasised the need for carefully regulating as well as inviting private foreign capital. It laid special stress, inter-alia, on the need to ensure that in all cases of foreign collaboration, the majority interest was always Indian.

This was followed by the Fiscal Commission of 1949-50 which recommended that foreign investment may be permitted, first, in the public sector projects needing imported capital good, and secondly, in new capital industries where no indigenous capital or technical know- how was likely to be available. This was followed by a statement on policy towards foreign capital made by the Government on April 6, 1949. The underlying principles of the policy by and large are valid even now.

These may be enumerated as follows:

(i) Foreign capital once admitted will be treated at par with indigenous capital.

(ii) Facilities for remittance of profits abroad will continue.

(iii) As a rule, the major interest in ownership and effective control of an undertaking should be in Indians hands.

(iv) If an enterprise is acquired, compensation will be paid on a fair and equitable basis.

(v) The Government would not object to foreign capital having control of a concern for a limited period and each individual case will be dealt with on its merits.

In short, the Government promised non-discriminatory treatment of foreign investment and free remittance facilities for both profits and capital. An emphasis was laid down on the employment and training of the Indians in higher positions. In keeping with these guidelines, the general policy was to allow such foreign investments and collaborations as were in line with the priorities and targets of the Five-Year Plans. The policy was to restrict foreign collaboration to these cases which would bring technical know-how into the country such as was not available indigenously for developing new lines of production.

These principles define the broad contours within which the state policy towards foreign capital has been framed all through the different five-year plans.

Beginning with the First Five-Year Plan in 1951, three distinct phases as follows can be marked:

The First Phase lasted till 1965 and was characterized by a liberal attitude towards foreign capital. Many concessions and incentives were given to foreign capital participation in the industrial development of the country.

In the Second Phase beginning with the mid 1960s, the liberal attitude of the state yielded place to strict controls and the broad policy was to restrict the area of operation of foreign capital.

The Third Phase, beginning with the adoption of economic reforms programme since July, 1991 has adopted a more liberal attitude towards foreign capital and has aimed at attracting a free flow of FDI.

Policy Changes 1991-2005:

The Mew Industrial Policy, 1991, can be described as a minor revolution as far as decisions concerning foreign investment and foreign technology agreements are concerned.

The various changes in the policy can be broadly classified into four categories as follows:

(1) Choice of Product – The number of products in which foreign investment is freely permitted has been significantly increased.

(2) Choice of Market – The foreign investors is now free to compete with the domestic producers in the Indian market.

(3) Choice of Ownership Structure – In most cases, the foreign investor is free to own a majority share in equity.

(4) Simplification of Procedure – India has opened two routes for FDI inflows. First, the RBI route (or the Mumbai route) is transparent in the sense that the guidelines are clear. If projects satisfy the guidelines, the approvals are practically automatic.

FDI proposals which fall under the automatic route are listed in Annexure III of the industries list; it consists of 42 industries. This annexure has four categories – industries where foreign equity capital limit is pegged at 50 per cent, 51 per cent, 74 per cent and 100 per cent, respectively. 50 per cent through the automatic route is allowed in the mining sector. 51 per cent through the automatic route is allowed in 51 industries, whereas 9 industries quality for 74 per cent equity. 100 per cent foreign equity through the automatic route is allowed only in a handful of industries, such as power, roads and ports. In this category, there is a maximum foreign investment limit of Rs. 1,500 crores.

The second route is the Foreign Investment Promotion Board (FIPB) route (or the Delhi route). Foreigners are welcome to make proposals that do not fit into the first case. Such proposals are considered case by case. Detailed guidelines covering this route were issued on January 20, 1997. The Government has also set up Foreign Investment Implementation Authority, independent of the FIPB, to act as a single point interface between the investor and Government agencies.

The above changes are pointers to the fact that, lately, the Government is keen to attract more of foreign investment.

It seems it has come to be believed that:

(i) It is better to allow equity than to go out to borrow. For one thing, dividend remittance on equity will start only when the unit starts producing.

(ii) Capital is generally never repatriated. Profit also is normally reinvested. The company meanwhile makes a substantial contribution to GNP and domestic market becomes competitive.

(iii) FDI brings technology – This technology spills over into other sectors which supply components and inputs. Also when FDI firms produce cheaper and better capital goods or intermediate products, the competitiveness of sectors which use these, improves. The competitive edge will spur development and accelerate the growth process.

Essay # 5. Overseas Investment Policy of India:

Till 1991, India’s economic integration with the rest of the world was very limited. But the new economic policy and the liberalization measures so introduced made way for the globalisation of Indian businesses. Earlier, exports were a predominant way of expanding business abroad and hence the emphasis was on export promotion strategies with restrictions on cash outflows so as to conserve our foreign exchange reserves.

But over the year, its being realised that for expansion and growth of Indian companies, it is necessary that they increase their share in the world market not only by exporting their products but also by acquiring overseas assets and establishing their presence abroad. Accordingly, the policy for outward capital flows has evolved, marked by phased liberalisation.

The first policy in the form of guidelines for overseas direct investment was issued in 1969 by the Government of India. These guidelines defined the extent of participation of Indian companies in projects abroad. They permitted minority participation by an Indian party with no cash remittances. Association of local parties, local development banks, financial institutions and local Governments, wherever necessary was also favoured for promoting such investments.

The Government modified these guidelines by issuing a set of more comprehensive measures in 1978. These measures included provision for the approval, monitoring, evaluation of investment proposals at a focal point by the Ministry of Commerce. These guidelines also recognised the need of vesting the necessary powers with the Reserve Bank of India (RBI) for the release of foreign exchange to meet the preliminary and subsequent expenses of an Indian company relating to its investments abroad.

Such guidelines were subsequently revised in 1986, 1992 and 1995. The policy on Indian investments overseas was first liberalized in 1992. Under it, an Automatic Route for overseas investments was introduced and cash remittances were allowed for the first time with restrictions on the total value. The basic rationale for opening up the regime of Indian investments overseas has been the need to provide Indian industry access to new markets and technologies with a view to increasing their competitiveness globally and help the country’s export efforts.

Further liberalisation and streamlining of procedures was undertaken in 1995. The guidelines of 1995 provided for a detailed framework by transferring the work relating to overseas investment from Ministry of Commerce to Reserve Bank of India (RBI), which became the nodal agency for administering the overseas investment policy. This provided a single window system for overseas investment approvals. Since then, all proposals for direct investment abroad are being made to and processed by the Reserve Bank of India (RBI).

Also, these guidelines aimed at providing transparency in the framework of overseas investment policy with the following basic objectives:

(i) To provide a framework for Indian industry and business to access global networks;

(ii) To ensure that trade and investment flows, though determined by commercial interests, are consistent with the macroeconomic and balance of payment compulsions of the country, particularly in terms of the magnitude of the capital flows;

(iii) To give liberal access to Indian business for technology-sourcing or resource- seeking or market-seeking;

(iv) To indicate that there is a change in the approach of the Government, from one of regulator or controller to one of facilitator;

(v) To encourage the Indian industry to adopt a spirit of self-regulation and collective effort in order to improve its image abroad.

Subsequently, in 2000, introduction of FEMA (Foreign Exchange Management Act) changed the entire perspective on foreign exchange particularly those relating to investments abroad. It changed the emphasis from exchange regulation to exchange management. It aimed to facilitate external trade and payments as well as to promote an orderly development and maintenance of foreign exchange market in India.

Over the years, the liberalisation measures for overseas investment by Indian companies have continued.

RBI vide their A.P. (DIR Series) Circular No. 66 dated 13.01.2003 (in partial modification of Notification No. FEMA 19/2000-RB dated 3rd May 2000) has liberalised the policy under automatic route:

Corporates:

Listed Indian companies are permitted to invest abroad in companies, (a) listed on a recognised stock exchange and (b) which has the shareholding of at least 10% in an Indian company listed on a recognised stock exchange in India (as on 1st January of the year of the investment). Such investment shall not exceed 35% as of the Indian company’s net worth, as on the date of latest audited balance sheet.

Individuals:

Reserve Bank of India, under the “Liberalised Remittance Scheme for Resident Individuals” permits resident individual to remit up to US $ 100,000 per financial year for any permitted current or capital account transactions or a combination of both, such as bank deposits, purchase of immovable property, investment in equity and debt abroad. Similarly, resident individuals are permitted to remit for current account transactions such as gift, donation, medical treatment, education, employment, emigration, import of medicines, books and periodicals subject to foreign trade policy.

Indian corporates/Registered partnership firm are allowed to undertake agricultural activities either directly or through an overseas branch.

The stipulation of minimum net worth of Rs. 15 crores for Indian companies engaged in financial sector activities in India removed for investment abroad in the financial sector.

However, an Indian party seeking to make investment in an entity engaged in the financial sector should also fulfill the following additional conditions:

(a) Be registered with the appropriate regulatory authority in India for conducting the financial sector activity;

(b) Have earned net profit during the preceding three financial years from the financial service activities;

(c) Have obtained approval for investment in financial sector activities abroad from regulatory authorities concerned in India and abroad; and

(d) Have fulfilled the prudential norms relating to capital adequacy as prescribed by the regulatory authority concerned in India.

Further liberalisation measures introduced in the fiscal year 2005-06 are as follows:

Guarantees:

The scope of guarantee has been enlarged under the automatic route.

Indian entities may offer any forms of guarantee i.e. corporate or personal/primary or collateral/guarantee by the promoter company/guarantee by group company, sister concern or associate company in India, provided that:

(a) All “financial commitments” including all forms of guarantees are within the overall prescribed ceiling for overseas investments of the Indian party i.e. currently within 300% of the net worth of the investing company;

(b) No guarantee is ‘open ended’ i.e. the amount of the guarantee should be specified upfront; and

(c) As in the case of corporate guarantees, all guarantees are required to be reported to Reserve Bank of India (RBI), in Form ODR.

Disinvestment:

In order to enable companies to have operational flexibility according to their commercial judgment, the automatic route of disinvestment has been further liberalised.

Indian companies are permitted to disinvest without prior approval of the RBI in the following categories:

(a) In cases where the JV/WOS is listed in the overseas stock exchange;

(b) In cases where the Indian promoter company is listed on a stock exchange in India and has a net worth of less than Rs. 100 crore;

(c) Where the Indian promoter is an unlisted company and the investment in overseas venture does not exceed US$ 10 million.

Proprietorship Concerns:

With a view to enabling recognized star exporters with a proven track record and a consistently high export performance to reap the benefits of globalisation and liberalisation, proprietary/unregistered partnership firms are allowed to set up a JV/WOS outside India with prior approval of RBI.

Essay # 6. Foreign Collaborations and Government Policy in India:

In India, foreign collaboration agreements are being made between Indian and foreign companies through its sale of technology, spare parts and use of foreign brand names for its final products. In India, almost all the new industries in the large and medium scale category, set up in the post-independence period, had some foreign collaboration agreement.

Foreign collaborations are of two types:

(i) Technical approvals involving payments for technology

(ii) Financial approvals involving equity capital of an existing or new undertaking.

Upto Rs. 600 crore, the industry ministry accords approval on the advice of Foreign Investment, Promotion Board (FIPB) but larger projects over this limit are approved by Cabinet Committee on Foreign Investment (CCFI).

During the eighties, liberalisation process resulted in a considerable spurt in foreign collaborations. Accordingly, out of the total 12760 foreign collaboration agreements approved during the period between 1948 and 1988, 6165 agreements were approved during the period 1981 to 1988. Again with the liberalisation of foreign investment policy announced during the post 1991 period, the number of foreign collaborations in India increased considerably. Moreover, there is a shift from technical approvals to financial approvals during the post liberalisation phase.

This was done specifically in interest of investors from Oil Exporting Developing Countries with a well-defined package of exemptions:

(i) Investors from Oil Exporting Countries could make investments upto 40% in equity of new ventures in specified segments without being linked to technology transfer.

(ii) Non-Resident Indians could make investments in Indian industrial units under the defined scheme within the framework of conditions laid down by the government.

This was followed by Technology Policy Statement in January 1983. The objective of the policy was to acquire imported technology and ensure that it was of the latest type appropriate to the requirements and resources of the country.

Under this policy, a number of policy measures were announced liberalising the licensing provisions:

(i) All but 26 industries were exempted from licensing in case of non MRTP and non FERA Companies

(ii) Private sector was allowed to participate in the manufacture of telecommunications equipment

(iii) A number of electronic items were exempted from the MRTP Act

(iv) Foreign companies were allowed to manufacture electronic components

(v) MRTP companies were allowed to set up industries in backward areas

(vi) A number of new items were added to the list of industries to be set up by FERA and MRTP units

(vii) Broad banding of a license for a number of industries were allowed and

(viii) MRTP companies could commercialize the results of their Research and Development or those of national laboratories.

The technical collaborations were allowed on the financial criteria i.e. on the payment of royalty or lump-sum or both. The liberalisation process resulted in a larger inflow of foreign direct investment. During the decade 1981-90, the number of approvals reached a record figure of 7436 involving a total investment of Rs. 1274 crores. Country-wise distribution reveals that USA topped the list of foreign collaborations with Rs. 322.7 crore investments. USA was followed by Federal Republic of Germany, Japan, U.K, Italy, France and Switzerland. An industry wise analysis reveals that Electricals and Electronics (including telecommunications) had the highest priority followed by industrial machinery. Foreign collaborations in chemicals were third in importance. By and large, the priority sector accounted for about 70% of the total approvals. It proves that the foreign collaboration approvals were more or less in conformity with the general climate towards foreign capital in the country at that time.

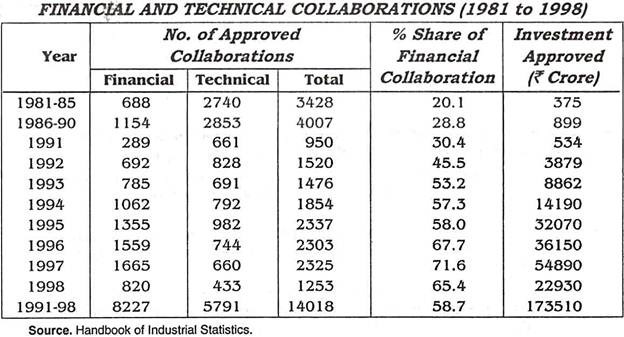

The following table shows the foreign collaboration figures in the country:

Financial collaborations were just 20.1% during 1981-85 their share improved to 28.8% during 1985-90 but rose sharply to 58.7% during 1991-98. The amount of approved investment also increased sharply from Rs. 899 crore during 1985-90 to Rs. 173510 crore in 1998. Obviously there is a shift from technical approvals to financial approvals during the post liberalisation phase. However, the government has been successful in attracting more foreign investment in the post liberalisation phase as compared to the earlier period.

Critical Evaluation of Policies towards Foreign Investments and Collaborations:

The economic reforms have, undoubtedly improved the foreign investment environment in India. As a matter of fact, the success of the new economic policy hinges in a large measure on the liberal response of the foreign capital.

An assessment of the policy reveals the following points:

(i) The share of India in direct foreign investment when compared with China, Brazil and Mexico etc. is very low. India has not been able to benefit much from foreign direct investment despite the red carpet treatment given by it to the foreign investors.

(ii) About 55% of the FDI is in the nature of portfolio investment which only strengthens speculative trading in shares. Critics are of the view that although we feel jubilant over the strengthening of the share market, we do not realise the fact that we may be sitting on a volcano. After budget 2002-03 was presented to the parliament, the activities of MNCs resulted in wild fluctuations in BSE sensitive Index which came tumbling down. The Government had to intervene so that the confidence in the market could be revived. This only emphasises the fact that MMCs are able to manipulate the stock market to suit their goals.

(iii) FDI is basically catering to the needs of the upper middle and affluent classes in the Indian economy. There is an utter neglect of the wage goods sector. Both from the point of view of pattern of production and employment, the unrestricted entry of MMCs in soft areas have serious implications. The fast food culture developed by the MMCs is rapidly displacing labour working in the small sector since such units are faced with the stark prospects of closure being unable to compete with the MNCs.

(iv) Portfolio investment is not a stable factor in our growth. This investment is in the nature of hot money which may take flight if the market signals indicate any adverse trends.

(v) A large flow of FDI in the financial sector leads to building of reserves which in turn expand domestic money supply. As a result, inflationary trends in prices get strengthened.

(vi) Foreign financial companies and mutual funds may render any efforts of monetary management by the RBI ineffective.

(vii) MNCs have been rapidly swallowing Indian Companies by increasing their shareholdings. The process of Indianisation of the corporate sector initiated by Jawaharlal Nehru has been totally reversed. This has given a serious set-back to the Indian Private Sector. Thus, foreign capital is being wooed at the cost of indigenous capital.

(viii) It has recently come to light that MMCs such as Cadbury Schweppes, Gillette, Proctor and Gamble, GEC, Timex, Unisys etc. have decided to expand their business in India by adopting the wholly owned (100%) subsidiary route at the cost of their established and listed subsidiaries. Thus, thousands of Indian minority shareholders in the listed affiliate subsidiaries (Joint Ventures) feel cheated by this move of the MNCs. Indian industrialists feel that this move is a kind of day light robbery because the MNCs want to profit on established brand names.

Essay # 7. Impact of Foreign Capital in India:

(a) India offers three basic advantages to the foreign investors:

(i) Availability of inexpensive manpower

(ii) Existence of vast domestic market

(iii) Easy availability and lower costs of inputs.

Foreign investors have their own apprehensions regarding each of these:

(i) Manpower may be available in abundance in India but labour productivity in India is one of the lowest in the world; productivity in China is 30% higher than here. Thus, low wage levels are offset by low productivity level to a large extent.

(ii) As regards vast domestic market, India does not score very high in foreigners projections. For taking hard investment decisions consumption patterns are more relevant than classifications based on income.

(iii) As regards the inputs, the numbers of industries where India can offer such input advantages are few and not all of them will be considered by foreign companies that are sensitive to the possibility of these technologies being copied in an environment where patent laws are weak. For such companies, India’s trained manpower may even be a liability, as this manpower has the ability to recreate technology they have worked on. The benefit of increased cost can also be eroded if increased demand raises prices.

(b) The foreign investors also wish to be assured of the liberalisation policy in the future. The absence of trust provides formidable obstacles to the creation of public institutions.

(c) Disinvestment by foreign partners in Joint Ventures in India is at present under a highly restrictive control by the government. Required approvals are both cumbersome and time consuming and the sale price of equity shares to be disposed of by foreign investors are virtually dictated by the RBI. In this respect, the country seems to be erecting hurdles in the investor’s path. They become more cautious in considering investment proposals in India.

(d) Foreign investors would have to be convinced that the existing comparative advantages are not offset by the comparative disadvantages they have to cope with:

(i) Foreigners like to be assured of the security situation and living conditions in India

(ii) They are also concerned about the availability, quality and reliability of local vendors producing parts and components

(iii) They also want to be sure of infrastructural facilities and services including telephone and telecommunication services, water and power supply, transportation etc.

(iv) They are of the view that the cost of doing business in India is high

(v) Because of the bureaucratic red-tapism the regulatory system in India is still non transparent.

(vi) Intellectual property right laws are weak.

Suggestions:

(i) Infrastructure in the country is an important factor considered by the prospective investors. Things can worsen if quick action is not taken to improve quality and size of all infrastructure components such as transport, communication and energy

(ii) There should be a complete restructuring of education in the country-right from the primary education upwards. Emphasis should be on absorption of appropriate skills and upgradation

(iii) Quality standards need to be promoted in the country. The present mind set favouring cheapness at the cost of quality needs a change

(iv) The existing framework of legislation and practices relating to industrial action should be reorganised so as to make it conducive to the promotion of productivity oriented measures.

(v) The operating environment should be made investor friendly. At the entry level there are two routes viz. the Automatic Approval Route (AA) of RBI and the Foreign Investment Promotion Board (FIPB). An increased share of the AA route in the FDI approvals will concurrently reduce the pressures on the FIPB system.

(vi) Domestic market should be made ruthlessly competitive by doing away with discretionary FDI approvals. This will be the real way to get tough with the MNCs.

(vii) An appropriate policy framework must respond to two conflicting objectives the need to liberalise rules governing such investment in view of the growing integration of the world economy and the need to ensure that such investment has positive effects on the country’s economy and does not lead to negative welfare effects. FDI may actually be harmful to the recipient country if the economy is highly protected and foreign investment takes place behind high tariff walls.

Essay # 8.

Limitations of Foreign Capital:

Following criticisms are leveled against foreign capital:

(1) It may flow to the high profit area rather than the priority sector.

(2) The activities of foreign investors may be inimical to the national interest. It may interfere in the national politics or may engage in unfair trade practices or may impose restrictive conditions.

(3) It increases dependence on foreign resources. First in the use of foreign technology and second the foreign technology used requires import of goods for replacement maintenance that are costly. There may be intensity of foreign capital.

(4) Often the profit earned in early stages is high involving big remittances. Foreign investor may recover his amount in a relatively short time. Yet the payment on account of such things as technical services, royalty payment etc. continues.

(5) There may be adverse effects on income distribution in the country, transfer pricing and balance of payments.

Though there are arguments for and against foreign capital and statistics are available to support both points of view, yet the role for foreign capital cannot be ignored.

Essay # 9. Recent Developments and Investments by India:

For the month of January 2012, overseas investments by Indian companies stood at US$ 797 million, with Tata Group, infrastructure major 1L&FS and pharma major Lupin emerging as major investors.

(i) Tata Steel, Tata Chemicals, L&T and Aditya Birla group flagship Hindalco has recently inked separate in-principle agreements with Kizad (Abu Dhabi government-owned industrial zone) which is establishing one of biggest industrial zones in UAE and has signed 40 deals worth US$ 10 billion. Almost half of this capital is estimated to be from Indian investors.

(ii) NTPC, the Government-owned power generation entity, is ready to commence its first overseas project in Bangladesh by May 2012 when the company would work on a 1,320 MW (megawatt) power plant in Khulna.

(iii) Indian manufacturer Jindal Steel and Power intends to spend US$ 300 million in developing new and existing mines in Africa wherein the company’s subsidiary, Jindal Africa would invest US$ 250 million in developing a coalmine in Mozambique’s coal-rich. Moatize region and remaining funds would be used to enhance the capacity of its mine in Pie Retief. The move is part of the company’s strategy to source coal assets abroad to meet raw material demand of its steel and power plants in India.

(iv) Ethiopia – the world’s third fastest growing economy and an emerging hot-spot for Indian investments – is seeking trade tie-ups with India. The country is quite keen on investments from India in sectors such as plantation, farming, leather, textiles, steel, hospitality, food processing and education.

(v) Bharti Airtel has recently launched its highly innovative mobile money platform named ‘Airtel Money’ in Uganda. The service, accessible to all Airtel customers in Uganda, would allow them to top up their cellphones with airtime, send and receive money, pay utility bills, access their bank accounts and even withdraw Airtel money across all inter-switch ATMs countrywide.

(vi) India’s largest software services exporter Tata Consultancy Services (TCS) has entered into an alliance with Japan’s Mitsubishi Corporation for offering full service range of IT, BPO and infrastructures services. The US$ 5 million 60: 40 joint venture (JV) between TCS and Mitsubishi would lead to establishment of a near-shore delivery center in Japan.

Personal care and food products manufacture Dabur India plans to invest US$ 20 million to build plants in Africa in a bid to consolidate its global presence. The company already has capacities in Nigeria and Egypt and would invest Rs. 1 billion (US$ 20.3 million) over 2012-14 to build facilitites in Morocco and in southern and eastern Africa.