Here is an essay on ‘Forex Market’ for class 11 and 12. Find paragraphs, long and short essays on ‘Forex Market’ especially written for college and management students.

Essay on Forex Market

Essay Contents:

- Essay on the Introduction to Forex Market

- Essay on Quoting in the Forex Market

- Essay on Currency Symbols

- Essay on Cross Currency Quotes

- Essay on the Factors Affecting the Exchange Rate

- Essay on Interest Rate Parity (IRP) Theory

- Essay on Purchasing Power Parity Theory

- Essay on International Fisher Effect

- Essay on the Risk in Foreign Exchange Transactions

- Essay on the Hedging Tools for Managing Exchange Risks

Essay # 1. Introduction to the Forex Market:

ADVERTISEMENTS:

With the globalization taking place all over the world, it becomes imperative to study International Financial Management. Nowadays, the business firms raise and lend money in the domestic as well as international market. The study of International Financial management is important not only for the importers and exporters but also other entities like non-residents Indians (NRIs), banks, brokers, tourists, international investors, etc.

The transactions at the international level take place in the foreign exchange (forex) market. Forex Market is a market for buying and selling currencies. Though the forex markets are located all over the world, the largest centers are in London (UK), New York (USA), Tokyo (Japan), Hong Kong, Singapore and Frankfurt (Germany).

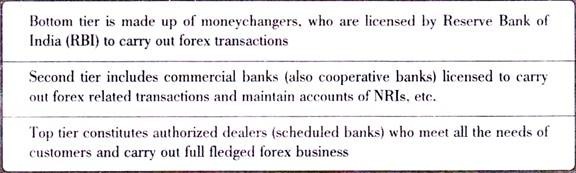

The major players in the forex market are banks. Besides dealing with business firms for trade related transactions and investors, banks deal with the Central bank and also other banks (Interbank trade). Thus, the forex market could be segregated into three tiers.

Domestic Currency (Home Currency):

ADVERTISEMENTS:

The currency of the home country for an entity is called domestic currency. For example, for a business operating in India, ‘Rupee’ is the domestic currency. For an entity in Japan, it is Yen and Euro for a German Company.

Foreign Currency:

It means any currency other than the home currency. For example, for an Indian company, US$ is a foreign currency and GBP is a foreign currency for a German company.

ADVERTISEMENTS:

Exchange Rate (Forex Rate):

Rate for which the currency of a country can be exchanged (bought or sold) for another country’s currency. For example, the exchange rate between Indian Rupee (INR) and the Australian Dollar (AUD) is Rs. 49 (Quoted on 1st Sept. 2011). This means that one AUD can be purchased or say exchanged for Rs. 49. The other way of quoting the same can be one rupee can be sold or say exchanged for 0.0204 AUD.

In the foreign exchange market, two rates are quoted in pairs by market makers (or dealers). Exchange rate – Foreign Exchange rate (or FX rate) is the rate at which the one currency is valued in terms of another currency. For e.g., 1USD = 76.52 (Quoted on 1st Sept. 2011) JPY. This is the exchange rate between the US Dollar and Japanese Yen, which means that 1 US dollar is equal to 96.62 Yen.

Essay # 2. Quoting in the Forex Market:

ADVERTISEMENTS:

Direct and Indirect Quote:

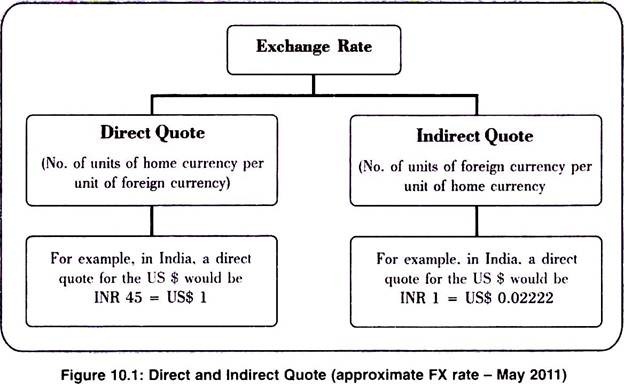

There are two types of quotes, direct and indirect quote as displayed in figure 10.1.

Forex currency are quoted in pairs. The first currency of a currency pair is called the ‘Base currency’ and the second currency is called the ‘Quote currency’. The base currency has always the value 1. E.g. 120.01 quote for the pair USD/JPY shows that one U.S. dollar costs 120.01 Japanese yen.

ADVERTISEMENTS:

Bid Price, Ask Price (Spread):

Currency pairs have their “bid” and “ask” price like any other financial instrument like stocks, bonds or futures does. This is also called as a two way quote.

This difference in bid and ask prices is known as the spread.

For example, a dealer in New Delhi may quote:

ADVERTISEMENTS:

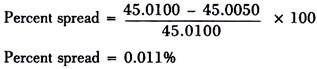

US$ 1 = Rs. 45.0050 – Rs. 45.0100

This means that he will buy dollars from an exporter at US$1 = Rs. 45.0050, and sell dollars to an importer at US$1 = Rs. 45.0100. Thus, the lower rate is the buy (bid) quote and the higher rate is the selling (ask) quote.

Here, the spread is of 50 points or 50 pips. (A pip is the smallest unit by which a Forex cross price quote changes)

The spread can also be expressed as a percentage.

Most currencies are expressed to four decimal places. Italian Lira and Japanese Yen are examples of such currencies.

Essay # 3. Currency Symbols:

Every country, with some small exceptions, has its own currency, and most of them can be traded. However, the currencies of a few countries are the most actively traded, and constitute, by far, the largest volume of trades.

The big 5 are:

i. The United States dollar (USD),

ADVERTISEMENTS:

ii. Euro (EUR),

iii. Japanese yen (JPY),

iv. The British Pound (GBP), and

v. The Swiss Franc (CHF).

Each currency is symbolized using a 3-letter ISO (International Organization for Standardization) code: the first two letters designate the country; the third letter designates the currency. The most famous illustration of this is for the United States dollar—USD. Other countries that call their currency dollars include the Canadian dollar (CAD), the Australian dollar (AUD), and the New Zealand dollar (NZD). As you can see, each of these symbols ends in “D”, which designates the dollar name.

However, sometimes the country name or currency that is symbolized is not the most common name. Thus, the symbol for the Swiss franc is CHF, where CH stands for Confederation Helvetica, which refers to Switzerland, and MXN stands for the Mexican Nuevo Peso, even though the most common name for Mexico’s currency is simply the peso.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 4. Cross Currency Quotes:

Cross rates is the currency exchange rate between two currencies, both of which are not the official currencies of the country in which the exchange rate quote is given in. This phrase is also sometimes used to refer to currency quotes which do not involve the U.S. dollar, regardless of which country the quote is provided in.

For example, if an exchange rate between the US$ and the Japanese Yen was quoted in an Indian newspaper, this would be considered a cross rate in this context, because neither the US$ or the yen is the standard currency of India.

If an Indian Business firm has imported certain goods from Japan, it needs to pay it in Yen. So the firm needs to buy Yen from the Bank. But, there is no quote available for INR/Yen. The banker would obtain Yen/$ rate from Tokyo and then apply the Rs./$ rate obtained from the local Indian market to arrive at the exact rupees to be given for purchase of Yen. Since, this transaction involves more than two currencies; we call such a rate as cross rate.

While finding the cross rates, the following points are important:

Spot Rate:

ADVERTISEMENTS:

It is the rate that is applicable for immediate settlement (i.e. T + 2 working days). For example, if a spot transaction is done on a Friday, the settlement will be done on Tuesday, since Saturday and Sunday are holidays and Monday is the first working day.

Forward Rate:

It is the rate contracted today for exchange of currencies at a specified future date. Thus, the price is decided today but the delivery and settlement is made on a specified future date. Both the parties, i.e. customer and the dealer banker are obliged to perform the contract on the specified date irrespective of the exchange rate prevailing on that date.

Forward at Par:

When the forward rate is same as the spot rate for the currency, then it is said to be at ‘par’

ADVERTISEMENTS:

Forward Premium:

When a currency is costlier in forward, it is said to be at premium.

Forward Discount:

When a currency is cheaper in forward, it is said to be at discount.

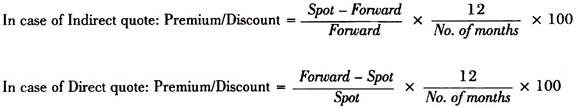

Calculation of premium or discount percentage

Essay # 5. Factors Affecting the Exchange Rate:

ADVERTISEMENTS:

1. International Trade:

Trade of goods and services is the major reason for demand and supply of foreign currencies. If a country’s imports are high, the demand for foreign currency will be high and vice versa.

2. Capital Movements:

Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII) are important factors affecting exchange rate. Large capital inflows in the country will result into appreciation of the domestic country and large capital outflow will result into depreciation of the domestic currency.

3. Speculations:

When people speculate a fall in the value of a currency in the near future, they will sell that currency and start buying the other currency that they expect to appreciate. The selling will increase the supply of the former currency and lead to its depreciation and the appreciation of the other currency.

4. Government Policies:

The Central bank of a country plays an important role in case when there is fixed exchange rate system or managed float. The Central Bank influences the exchange rate by buying and selling of bills and currencies.

5. Political Stability:

If the Political status of a country is uncertain, international investors would stay away from such countries. Whereas, a stable political environment leads to capital inflows in the country.

6. Balance of Payments:

A surplus in the Balance of payment would lead to a strong currency and a deficit would lead to a weak currency. A deficit in the current account shows the country is spending more on foreign trade than it is earning, and that it is borrowing capital from foreign sources to make up the deficit.

In other words, the country requires more foreign currency than it receives through sales of exports, and it supplies more of its own currency than foreigners demand for its products. The excess demand for foreign currency lowers the country’s exchange rate

7. Inflation:

As per the Purchasing Power Parity theory, high inflation in one country as compared to the other will lead to depreciation in the currency of that country.

8. Interest Rate Parity:

When interest rates go up in a country, so do yields for assets denominated in that currency; this leads to increased demand by investors and causes an increase in the value of the currency of this country. If interest rates go down, this may lead to a flight from that currency to another.

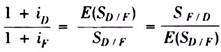

Essay # 6. Interest Rate Parity (IRP) Theory:

Interest Rate Parity (IPR) theory is used to analyze the relationship between at the spot rate and a corresponding forward (future) rate of currencies.

The IPR theory states interest rate differentials between two different currencies will be reflected in the premium or discount for the forward exchange rate on the foreign currency if there is no arbitrage – the activity of buying shares or currency in one financial market and selling it at a profit in another.

The theory further states size of the forward premium or discount on a foreign currency should be equal to the interest rate differentials between the countries in comparison

Thus, Interest rate differential = Exchange rate differential

Where,

r = Rate of interest

f = Forward rate

S = Spot rate

D/F = Exchange rate between direct and foreign currency

F/D = Exchange rate between foreign and direct currency

The exchange rate, a year later (also known as Future spot rate) can be computed as follows:

Arbitrage Opportunity:

It can be identified with the help of the above formula.

i. Compute the theoretical forward rate and compare it with the actual forward rate. If the two are not equal, then there is arbitrage opportunity

ii. Compute the theoretical domestic interest rate and compare it with the actual interest rate. If the two are not equal, then there is arbitrage opportunity.

Limitations of Interest Rate Parity Model:

In recent years, there has been limited usefulness by using the interest rate parity model. In many cases, countries with higher interest rates often experience it’s currency appreciate due to higher demands and higher yields and has nothing to do with risk-less arbitrage.

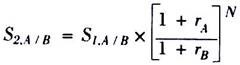

Essay # 7. Purchasing Power Parity Theory:

The Purchasing Power Parity (PPP) Theory of Exchange Rate theory, establishes the fact that the exchange rates between currencies are in equilibrium in the event of equality in the purchasing power of each of the countries. It means that the exchange rate between the currencies of two countries equals the ratio between the prices of goods in these countries.

The exchange rate must change to adjust to the change in the prices of goods in the two countries. The PPP theory states that the expected inflation differential equals to the current spot rate and expected spot rate differential.

If the inflation rate within a country’s economy increases then the value of the currency needs to depreciate to maintain the purchasing power parity. In the absence of transportation and other similar expenses, the competitive market will equalize the price of an identical object in two countries when the prices are expressed by the same currency.

Thus, Inflation rate differential = current spot rate and expected spot rate differential

Where,

i = inflation rate

E(S) = expected spot rate differential

S = spot exchange rate

D/F = Exchange rate between direct and foreign currency

F/D = Exchange rate between foreign and direct currency

The spot exchange rate after a period (N) can be found out by using the following formula

S1, A / B = Spot rate between domestic and foreign country

S2, A / B — Spot rate after N period between domestic and foreign country

rA = inflation rate in country A

rB = inflation rate in country B

N = No. of years

Calculation of PPP:

The PPP is calculated by comparing the price of an identical good in both the countries. The “Hamburger Index” in The Economist magazine presents the index by comparing the price of a McDonald’s hamburger around the world. But the calculation is not free from problem because consumers in every country consume different types of products. Another index is the iPOD Index. The iPOD is considered to be one of the standard consumer products these days. Hence PPP can be calculated by comparing its price.

Limitations of PPP Theory:

The theory places too much emphasis on purchasing power as a determining factor of rate of exchange. The result may change with the change in the goods taken for comparison. It also considers only trade merchandise but there are other factors also like capital, unilateral transfers, etc., which affect the exchange rate.

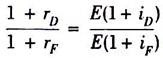

Essay # 8. International Fisher Effect:

It is an exchange rate model designed by economist Irving Fisher in the 1930s. The Fisher hypothesis states that the real rate of interest is constant. Consequently, the nominal rate moves with inflation.

The real rate of interest would be determined by the time preferences of the public and technological constraints determining the return on real investment.

The Fisher Equation is Simply:

Nominal rate of interest = real rate of interest + inflation

(1 + nominal rate) = (1 + real rate) × (1 + inflation rate)

If inflation rate is higher in a country, nominal interest rate is also higher and vice versa. If the international capital markets are perfect, then the equivalent risk in two countries should offer same expected real rate of return.

If the expected real rate of return is higher in one country than in another, capital would flow from the latter to the former country and investors would have opportunity to make riskless arbitrage profit. The arbitrage will exist till an equilibrium is established in the expected real returns in the two countries.

Thus, nominal interest rates in the two countries would adjust for the change in the inflation rates. The International Fisher Effect reinforces the Interest Rate Parity and Purchasing Power Parity Theory, by considering the ‘inflation’ element in nominal interest rates.

As per the theory,

(a) A country with higher interest rate will also be inclined to have a higher inflation rate.

(b) The future exchange rate can be estimated based on the nominal interest rate relationships

(c) The free movement of capital across the borders will equalize the real interest rate.

Thus, nominal interest rate differential = Expected inflation rate differential

Where,

rD = Rate of interest in domestic country

rF = Rate of interest in foreign country

E (1+ iD) = Expected inflation in the domestic country

E (1 + iF) = Expected inflation in the foreign country

Essay # 9. Risk in Foreign Exchange Transactions:

An entity dealing in forex transactions has to face many risks as follows:

(a) Transaction Risk:

It refers to the effect of exchange rate movement associated with the time gap between the date of the transaction and the date on which the consideration is settled. It is also referred as ‘Transaction exposure’. For example, a transaction takes place on 1st April 2011 but the settlement (payment) takes place on 31st May 2011. The exchange rates may be different on both the dates giving rise to transaction risk.

(b) Translation Risk:

It refers to the profit or loss associated with converting foreign currency denominated assets/liabilities, income/expenses into reporting currency. It is also referred as ‘Translation exposure’. The reporting of foreign currency transactions are done as per Accounting Standard 11, issued by ICAI. For example, XYZ Ltd. is an Indian company having branch in Australia.

It has bought a machinery on 15th September 2010 for AUD 10,000, when the exchange rate was Rs. 35 per AUD. On 31st March 2011, the exchange rate is Rs. 38 per AUD. This has to be reported in the home currency i.e. Rs. This leads to translation risk.

(c) Economic Risk:

It is an unanticipated change in exchange rate, which has an impact on the potential of an organization to perform. It is also referred as ‘Economic exposure’. For example, ABC Ltd. of USA invests large funds in India, in manufacturing of medicines. If the rupee strengthens against US$, and the margins turn out to be low, the project may ultimately have to be wound up.

(d) Political Risk:

It refers to the effects that political activities in a country may have on the forex transactions of an entity. For example, compulsory acquisition of business by Government, tax related controls, discrimination against foreign goods.

Essay # 10. Hedging Tools for Managing Exchange Risks:

The above mentioned risks cannot be totally eliminated, but they can be managed. To manage the exchange risks mentioned above, there are various options that are available with the entity dealing in forex transactions.

1. Home Currency Invoicing:

The business entity simply prices everything in home currency. For example, an Indian exporter would invoice his bills in INR and Indian importer would insist his supplier to invoice in INR.

This method of managing exchange risk is most effective when the product line is unique and not price driven, like Pharmaceuticals, etc. Home currency invoicing should be continuously monitored because it invites competition from countries with weaker currencies.

2. Foreign Currency Accounts/EEFC Account:

An entity which engages into both import and export can maintain account in the currency of trade, through which all transactions are routed. Since exports can pay for imports, he is exposed to exchange risk only for the net balance. In India, the Exchange Earners Foreign Currency (EEFC) account scheme exists for those who earn foreign exchange for the country.

Exchange Earners’ Foreign Currency (EEFC) Account is an account maintained in foreign currency with an authorized dealer i.e. a bank dealing in foreign exchange. It is a facility provided to the foreign exchange earners, including exporters, to credit 50 to 100 per cent of their foreign exchange earnings to the account, so that the account holders do not have to convert foreign exchange into Rupees and vice versa, thereby minimizing the transaction costs. All categories of foreign exchange earners, such as individuals, companies, etc. who are resident in India, may open EEFC accounts. An EEFC account can be held only in the form of a current account. No interest is payable on EEFC accounts.

3. Leads and Lags:

Importers and exporters try to advance or delay their payments or receipts according to their estimation of movement of exchange rate. If the importer expects devaluation of the domestic currency, he will hurry to pay his foreign currency obligation (if he waits, then he need more of local currency to buy the foreign currency).

This is called as ‘Lead’ the payments. In the same situation, an exporter would delay in converting the foreign currency receipts into domestic currency (if he waits, then he will receive more of local currency after selling foreign currency). This is called as ‘Lag’ the receipts. In case of appreciation of the domestic currency, the importer would ‘Lag’ his payments and exporter would ‘Lead’ his receipts.

4. Netting:

A process that enables business firms, dealing in foreign transactions, to settle only their net positions with one another at the end of the day, in a single transaction, not trade by trade. In this process, debit balances are netted off against credit balances, so that only the net amounts remain due to be paid in actual currency flows. For such kind of transactions, the dates of settlement should match and the foreign currency involved should be the same for receipts and payments that are due.

There are two types of netting listed below:

(a) Bilateral Netting:

In this type, only two parties are involved. The lower balances are netted off against higher balances, and the remainder is paid or received.

(b) Multilateral Netting:

In this type, more than two parties are involved. It is used by large companies to manage their intercompany payment processes, involving many currencies. This has to be coordinated by a Treasury manager.

5. Money Market Hedge:

Money market is a market for short term instruments. In this market, borrowing and lending transactions are carried out with foreign currencies so that home currency value is established at a specific level, in a forex transaction. For example, an Indian company has to pay in 3 months to an Australian supplier.

The Indian company can use or borrow rupee, buy AUD and invest the AUD proceeds. The investment after 3 months should give an amount equal to the AUD obligation of the Indian company. This amount on maturity will be used to pay off the Australian supplier. Thus, the Indian company protected itself from an unfavorable movement in exchange rate after 3 months.

6. Forward Exchange Rate Contracts:

An entity can enter into currency forward contracts with banks. It is a negotiated agreement between two parties to exchange specific amounts of currency at a set rate on a particular date in future. The forward rate is decided based on the current exchange rate and other factors like inflation and interest rate differential.

Thus, the importer or exporter can manage risks by making such forward currency contracts with banks. But, since a forward contract is between two parties, there is no secondary market for the purchase and sale of such contracts.

7. Futures Contract:

Futures currency contract are similar to forward contracts. The futures contracts are traded on organized exchanges like, Chicago Mercantile Exchange (CME), or London International Financial Futures Exchange (LIFFE). Futures contract are not tailor made like forward contracts. They are standard in terms of expiration time and lot sizes.

8. Currency Option:

A currency option gives the holder the right, but not the obligation, to sell or buy a face amount of currency at a set price, on or before a given date. A currency option has a strike price — the amount for which the currency can be bought or sold — and an expiration date. U.S. options can be exercised at any time up to and including the expiration date, whereas European options can only be exercised on the expiration date.

The options can be over the counter options (OTC-O) or Exchange traded options (ETO). The major advantage of options over forward contracts is the existence of a liquid secondary market in case of exchange traded options. Further in currency options, one is not obliged to convert or exercise them. The loss is limited to the option premium paid.

There are two types of options:

i. Call options give the holder the right to buy a given amount of a currency at the strike price.

ii. Put options give the holder the right to sell a given amount of currency at the strike price.

9. Currency Swap:

A Currency Swap involves exchange of principal and/or interest payments on a loan or on an asset in one currency for principal and/or interest payments on an equivalent loan or on an asset in another currency, with a predetermined prevailing spot/predetermined forward rate (for forward start swaps) as agreed on the date the transaction is entered into.

For example, a customer in India with a long term USD borrowing is typically exposed to exchange rate risk between the USD and the Indian Rupee (INR). If the company wishes to eliminate the USD interest rate risk and the USD/INR currency risk it may do so by entering into a USD/INR currency swap with a bank (as per the prevailing regulations).

The customer does the swap with the bank by receiving USD floating interest rate payments and USD principal amortizations. Simultaneously, the customer pays INR fixed interest rate and the equivalent INR principal amortizations at an exchange rate based on the spot rate (or forward rate) prevailing on the transaction date and locked in for the entire tenor of the swap.