Essay on Inflation:- 1. Meaning of Inflation 2. Features of Inflation 3. Types 4. Demand-Pull and Cost-Push Inflation 5. Causes 6. Factors Causing Decrease in Supply 7. Inflation in Underdeveloped Countries 8. Inflation and Economic Development 9. Inflation Tax.

Essay on the Meaning of Inflation:

For a layman, inflation means a substantial and rapid increase in the general price level which causes a decline in the purchasing power of money. Inflation is statistically measured in terms of percentage increase in the price index per unit of time (usually a year or a month).

There is no generally accepted definition of inflation and different economists define it differently. Broadly, the phenomenon of inflation has been understood in three ways- (a) in the popular sense, (b) in the Keynesian sense, and (c) in the modern sense.

Common View:

Generally, inflation has been defined either (a) as a phenomenon of rising prices, or (b) as a monetary phenomenon:

1. As a Phenomenon of Rising Prices:

Definitions given by the economists like Crowther, Gardner Ackley, H.G. Johnson regard inflation as a phenomenon of rising prices. According to Crowther, inflation is a “state in which the value of money is falling, i.e., the prices are rising.” In the words of Gardner Ackley, “Inflation is a persistent and appreciable rise in the general level or average of prices.” Harry G. Johnson states, “I define inflation as substantial rise in prices.”

2. As a Monetary Phenomenon:

Economists like Friedman, Coulborn, Hawtrey, Kemmerer, define inflation as a monetary phenomenon. According to Friedman, “Inflation is always and everywhere a monetary phenomenon.” Coulborn defines inflation as “too much money chasing too few goods.” Hawtrey defines inflation as the “issue of too much currency.” According to Kemmerer, “Inflation is too much money and deposit currency, that is, too much currency in relation to the physical volume of business being done.”

Keynesian View:

Keynes defined inflation as a phenomenon of full employment. According to him, inflation is the result of the excess of aggregate demand over the available aggregate supply and true inflation starts only after full employment. So long there is unemployment, employment will change in the same proportion as the quantity of money and when there is full employment, prices will change in the same proportion as the quantity of money.

Keynes does not deny that prices may rise even before full employment, mainly due to the existence of certain bottlenecks in the expansion of output. But, he termed such a rise in prices as semi-inflation. It is the true inflation (after full employment), which poses a real threat to the economy and is to be worried about.

Modern View:

Modern economists analyse inflation in a comprehensive and unified manner.

The modern view of inflation can be summarised in the following way:

(i) Generally two types of inflation are distinguished demand pull inflation and cost push inflation. In the demand pull inflation, inflation and falling unemployment are supposed to go together, while in cost push inflation, inflation and rising unemployment are supposed to occur simultaneously.

(ii) During late 1950’s A.W. Phillips empirically supported the idea that there existed a permanent long-run tradeoff between inflation and unemployment which implied that less inflation meant more unemployment and less unemployment would coexist with a higher rate of inflation.

(iii) In the late 1960’s the monetarists held the view that the tradeoff between inflation and unemployment existed only in the short-run and not in the long-run. In the long-run when anticipated inflation is equal to actual inflation, inflation and unemployment will simultaneously increase.

(iv) The monetarists, like Friedman, Phelps, Leijonhufvud, also combined demand-pull and cost-push inflation as one integrated whole. According to them, inflation is a unified phenomenon in which demand and cost elements appear as a part of one integrated cycle and in which expectations of future price level movements play a prominent role.

Essay on the Features of Inflation:

Following are the main features of inflation:

(i) Inflation is always accompanied by a rise in the price level. It is a process of uninterrupted increase in prices.

(ii) Inflation is a monetary phenomenon and it is generally caused by excessive money supply.

(iii) Inflation is essentially an economic phenomenon as it originates in the economic system and is the result of action and interaction of economic forces.

(iv) Inflation is a dynamic process as observed over the long period.

(v) A cyclical movement of prices is not inflation.

(vi) Pure inflation starts after full employment.

(vii) Inflation may be demand-pull or cost-push.

(viii) Excess demand in relation to the supply of everything is the essence of inflation.

Essay on the Types of Inflation:

There are different types of inflation which can be classified as under:

A. On the Basis of Speed:

On the basis of speed, inflation can be classified as:

(1) Creeping inflation,

(2) Walking inflation,

(3) Running inflation, and

(4) Galloping or hyperinflation.

1. Creeping Inflation:

It is the mildest form of inflation. It is generally regarded as conducive to economic development because it keeps the economy away from stagnation. But, some economists consider creeping inflation as potentially dangerous. They are of the view that, if not properly controlled in time, creeping inflation may assume alarming proportions. Under creeping inflation, prices rise about 2 per cent annually.

2. Walking Inflation:

Walking inflation occurs when the price rise becomes more marked as compared to creeping inflation. Under walking inflation, prices rise approximately by 5 per cent annually.

3. Running Inflation:

Under running inflation, the prices increase at a still faster rate. The price rise may be about 10 per cent per annum.

4. Galloping or Hyper-Inflation:

This is the last stage of inflation which starts after the level of full employment is reached. Keynes considers this type of inflation as the true inflation. Under the galloping inflation, the prices rise every moment and there is no upper limit to the price rise. The classical examples of hyper-inflation are- (a) the Great Inflation of Germany after the World War I, and (b) the Great Inflation of China after the World War II.

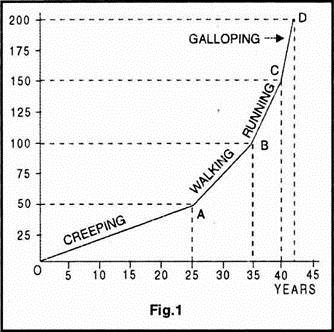

The classification of inflation on the basis of speed is represented in Figure 1. In the first period of 25 years, the price level has gone up by 50 percent. The OA line represents creeping inflation. In the second period of 10 years prices have risen by 50 per cent; the AB line shows walking inflation.

In the third period of 5 years, the prices have increased by 50 per cent; the BC line denotes running inflation. In the fourth period of 2 years, the prices have risen by 50 per cent; the CD line represents galloping inflation.

B. On the Basis of Inducement:

Inflation may be classified on the basis of factors inducing or causing rise in prices, such as:

(1) Wage-induced,

(2) Profit-induced,

(3) Scarcity-induced,

(4) Deficit-induced,

(5) Currency-induced,

(6) Credit- induced, and

(7) Foreign trade-induced inflation.

1. Wage-Induced Inflation:

When inflation rises due to a rise in wages, it is called wage-induced inflation. In modern times, trade unions are able to secure higher wages for workers unaccompanied by a simultaneous increase in labour productivity. This increases the cost of production, and, in turn, the price level.

2. Profit-Induced Inflation:

If the producers, due to their monopoly position, tend to mark-up their profit margin, it will lead to profit-induced inflation. Higher profits raise the cost of production which, in turn, pushes up the prices.

3. Scarcity-Induced Inflation:

When the supply of goods does not increase on account of natural calamities, the prices tend to rise. This may be called scarcity-induced inflation.

4. Deficit-Induced Inflation:

When a government covers the deficit in its budget through creating new money (a method known as deficit financing), the purchasing power of the community increases without a simultaneous increase in production. This leads to a rise in the price level which is referred to as deficit-induced inflation.

Deficit-induced inflation is more common in less developed countries, where, due to lack of adequate resources, the government resorts to deficit financing to finance its development plans.

5. Currency-Induced Inflation:

When the supply of money exceeds the available output of goods and services, it leads to an inflationary increase in prices. This is a case of currency- induced inflation.

6. Credit-Induced Inflation:

When prices increase on account of an expansion of credit without increasing the quantity of money it is known as credit-induced inflation.

7. Foreign Trade-Induced Inflation:

(a) When a country experiences a sudden rise in the demand for its exportable against the inelastic supply of exportable in the domestic market, this increases the demand and price level at home.

(b) Trade gains and sudden inflow of exchange remittances increase the demand and prices in the domestic market. Both these factors lead to foreign trade-induced inflation.

C. On the Basis of Time:

On the basis of time, inflation may be classified into:

(1) Peace-time inflation,

(2) War-time inflation and

(3) Post-war inflation.

1. Peace-Time Inflation:

By peace-time inflation we mean the rise in prices during normal period of peace. This type of inflation occurs when, in a less-developed economy, the government increases expenditure on development projects which normally have longer gestation periods. It means a gap arises between the generation of money income and the final availability of goods. This leads to a rise in prices.

2. War-Time Inflation:

War-time inflation occurs during a period of war. During war time, unproductive government expenditure increases and the prices rise because the increase in output does not keep pace with the expansion of expenditure.

3. Post-War Inflation:

Post-war inflation occurs after the end of the war when the pent-up demand finds open expression. Heavy taxes, which were imposed on the people during war time, are withdrawn during postwar period. As a result the disposable income of the people abruptly increases without increase in the output. Hence the prices shoot up.

D. On the Basis of Scope:

On the basis of scope, inflation can be comprehensive or sporadic:

1. Comprehensive Inflation:

When the prices of all goods and services increase throughout the economy, it is the case of comprehensive inflation. This leads to a rise in the general price level.

2. Sporadic Inflation:

Sporadic inflation is sectoral inflation, since, instead of affecting whole economy, it affects a few sectors. In this case, the prices of some goods increase due to certain physical bottlenecks which adversely affect the production of these goods. Sporadic or sectoral inflation can be checked by resorting to direct price control on the sale of the affected goods.

E. On the Basis of Government Reaction:

On the basis of Government reaction, inflation can be open or suppressed:

1. Open Inflation:

If the government takes no steps to check the price rise and the market mechanism is allowed to function without any interference, it is called open inflation. Under open inflation, market mechanism performs the function of allocating scarce resources among competing industries.

If there is shortage of any particular resource, the market mechanism would raise its price and allocate it to those industries which can afford to pay a higher price for it. The hyper-inflation in Germany after the World War I is an example of open inflation.

2. Suppressed Inflation:

If the government actively makes efforts to check the price rise through price control and rationing, it is called suppressed inflation. These measures can check inflation as long as their effect continues. Once these measures are withdrawn, the demand for goods increases and the suppressed inflation becomes open inflation.

Thus, suppressed inflation means to defer current demand or to divert demand from controlled goods to uncontrolled goods. Suppressed inflation results in many evils, such as profiteering, black marketing, hoarding, corruption, etc. It also leads to the diversion of economic resources from more essential goods to less essential goods.

F. On the Basis of Employment Level:

On the basis of employment level, inflation can be Partial or full inflation:

1. Partial Inflation:

The price rise as a result of expansion of money supply in the pre-full employment stage is called partial inflation. The increase in the money supply before full employment tends to mobilise the idle resources of the economy and thus leads to the expansion of output and employment. There is only a slight rise in the price level under partial inflation.

2. Full Inflation:

The increase in the money supply after the full employment level leads to full inflation. In this case, output and employment will not increase and there will be an uninterrupted rise in prices.

G. Other Types:

1. Ratchet Inflation:

Under ratchet inflation, the prices in certain sectors are not allowed to fall even though there is every reason for the price to fall. Sometimes, it so happens that in certain sectors the aggregate demand is excessive and in others, it is quite low. In the excess-demand sectors, the prices will rise, while in the deficient-demand sectors, the prices should decline.

But the prices are not allowed to fall in the deficient- demand sectors due to the resistance from industrialists and trade unions. Thus, while the prices rise in the excess-demand sectors, they are not allowed to fall in the deficient-demand sectors. The net result is a general rise in prices. This is known as ratchet inflation.

2. Stagflation:

The simultaneous existence of high rates of inflation and of high unemployment is called stagflation. After World War II, in those countries which pursued stabilisation policies with an objective to achieve full employment, unemployment remained relatively high while inflation rate increased.

This new phenomenon of stagflation which started in the developed countries towards the close of 1960’s, has now become a worldwide problem. This has also caused a serious crisis in the Keynesian and the Phillips curve theories of inflation.

Demand-Pull and Cost-Push Inflation:

Broadly speaking, there are two main causes of inflation:

(a) Increase in aggregate demand for goods and services, and

(b) Increase in cost of production.

The former results in demand-pull inflation and the latter leads to cost push inflation.

Demand-Pull Inflation:

According to the theory of demand-pull inflation, the general price level rises because the demand for goods and services exceeds the supply available at current prices. Demand-pull inflation or excess demand inflation occurs when aggregate demand for goods and services is greater than the available supply of these goods and services at the existing prices level.

Excess demand means aggregate real demand for output in excess of maximum feasible, or potential or full employment output at the going price level. Thus, demand- pull inflation may be defined as a situation where the aggregate demand exceeds the economy’s ability to supply the goods and services at the current prices, so that the prices are pulled upward by the upward shift of demand function.

(1) The Monetarist theory, and

(2) The Keynesian theory.

1. The Monetarist Theory:

The monetarist theory of demand-pull inflation is based on the quantity theory of money. According to the quantity theory of money, increases in the supply of money, given its velocity, lead to an increase in the total money expenditure. Assuming full employment, the increased demand will pull prices higher. Thus, according to the monetarists, inflation is a monetary phenomenon.

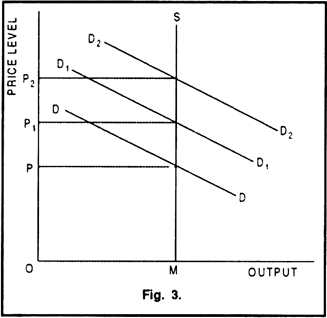

Figure 3 depicts the monetarist demand-pull inflation using aggregate demand and aggregate supply approach. The monetarists assume a vertical aggregate supply curve (SM curve) at full employment output level (OM). This indicates that money is neutral; changes in money supply do not affect total output of the economy.

Increases in the money supply cause the aggregate demand curve to shift upward from DD to D1D1 and D2D2. The aggregate supply being unchanged (i.e., OM), increases in money supply raise the price level alone from OP to OP1 and OP2.

The monetarist theory can be studied with respect to static and dynamic conditions:

(i) In a static economy, with a given level of output, according to the equation of exchange- MV = PT, increases in the supply of money (M) alone are responsible for increases in the price level (P), assuming the velocity of money (V) constant; P increases in the same proportion as M increases. Thus, the rate of inflation is given by

Ṗ = Ṁ

That is, the rate of change of prices (Ṗ) is proportionate to the rate of change of money supply (Ṁ). Since M is a policy variable, the rate of inflation also becomes policy determined.

(ii) In a growing economy, real national income (Y) is increasing over time due to the operation of various growth factors. Again, in such an economy, the real demand for money will also be growing over time. According to the Cambridge equation of the quantity theory of money (i.e., M = KPY), the rate of growth of real demand for money will be equal to the rate of growth of real national income because the income elasticity of demand for money is necessarily unity.

The growth rate of real demand for money tells us the rate at which new money can be absorbed in the economy at constant prices. The excess increases in the stock of money will lead to increase in prices and will become inflationary. Thus, for a growing economy, the rate of inflation is given by

Ṗ = Ṁ – Ẏ

That is, the rate of increase in prices (P) is proportionate to the excess rate of increase in the supply of money (Ṁ – Ẏ).

2. The Keynesian Theory:

According to the Keynesians, inflation occurs when aggregate demand for final goods and services exceeds the aggregate supply at full (or nearly full) employment level.

The Keynesian approach differs from the monetarist approach in the following manner:

(i) Both the approaches regard potential output as given with the difference that whereas in the monetarist approach, the actual output is always equal to potential output, in the Keynesian approach potential output serves only as the notional short run maximum of feasible output.

(ii) Whereas in monetarist approach, excess increases in the quantity of money is responsible for increases in the price level, in the Keynesian approach, the excess increases in the total expenditure (e.g., investment expenditure and government expenditure) are the source of excess demand and hence inflation.

(iii) For the monetarists, inflation is a monetary phenomenon; for the Keynesians, it is a non-monetary phenomenon.

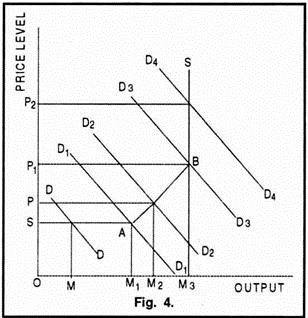

Figure 4 illustrates the Keynesian demand-pull theory of inflation. SS is the aggregate supply curve which is horizontal (SA portion) until nearly full employment is reached. It becomes vertical after full employment is reached (after point B indicating full employment output OM3) because then no more output can be supplied.

If aggregate demand curve is DD, output is OM. If aggregate demand increases to D1D1, then output increases to OM1, without any increase in the price level (i.e., OS). If aggregate demand increases further to D2D2 there is some increase in the price level (from OS to OP) as well as output (from OM1 to OM2). If the aggregate demand increases to D3D3, output reaches the full employment level OM3 and the price level rises to OP1.

After full employment output, any further increase in the aggregate demand in the vertical portion of the SS curve (such as D4D4) will merely produce inflation (rise in the price level to OP2), with no increase in output. Thus, as long as the economy is beyond the flat range (SA portion) of the aggregate supply curve, increases in demand will pull the prices up i.e. create demand-pull inflation.

Cost-Push Inflation:

The theory of cost-push inflation (also called sellers’ or mark-up inflation) became popular after the mid 1950s. It attempts to explain the rise in prices when the economy is not at full employment. According to this theory, the prices, instead of being pulled up by excess demand, may also be pushed up as a result of rise in the cost of production.

The basis of cost-push theory is that organised groups, both business and labour fix higher prices for their products or services than would prevail in perfectly competitive market. Cost-push inflation is characterised by insufficiency of aggregate demand, unemployment of resources and excess capacity.

In nut shell, the cost-push theory of inflation maintains- (a) that the true source of inflation is the increase is cost of production, (b) that the increase in cost of production is autonomous of the demand conditions, (c) that the push forces operate through important cost components, such as, wages, profits or material costs, so that cost push inflation may take the form of wage-push inflation, or profit-push inflation or material-push inflation, (d) that the increase in cost of production is not absorbed by the producers and is passed to the buyers in the form of higher prices.

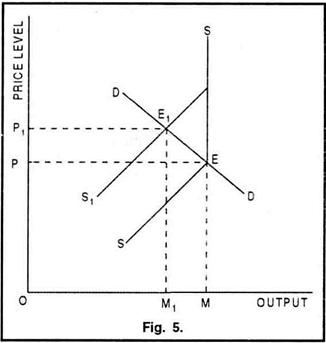

Figure 5 shows the cost-push inflation with the help of aggregate demand function and supply function. Initially, aggregate demand curve (DD) intersects aggregate supply curve (SS) at point E, determining the price level OP at full employment output OM. Now, either due to wage rise or profit rise, the cost of production increases, shifting the aggregate supply curve from SS to S1S.

It intersects the aggregate demand curve at point E1. The price level rises from OP to OP1, and the output decreases from OM to OM1. It shows that the price level and unemployment increase simultaneously. If the government wants to maintain full employment under cost-push inflation, it is possible only at a higher price level.

Essay on the Causes of Cost-Push Inflation:

There are essentially three causes of cost-push inflation:

1. Wage-push due to union monopoly power,

2. Profit-push due to business monopoly power, and

3. Increasing raw material prices. Accordingly, cost-push inflation can take the forms of wage-push or profit-push or material-push inflation.

1. Wage-Push Inflation:

Wage-Push has been considered the main determinant of cost-push inflation because, in the modern times, the trade unions have become very strong and they succeed securing higher wages for their members.

This increases the cost of production and, to maximise their profits, the businessmen raise the prices of their products. Critics of wage-push inflation theory put forward the arguments against wage rise as a sufficient and independent cause of inflation.

(i) In a number of cases, wage increases are not autonomous, but are induced by the operation of demand-pull factors.

For example:

(a) Wage rise may be induced by an excess demand for labour, which may be the result of excess demand conditions in the commodity market.

(b) Wage rise may be induced by an increase in the cost of living. Such wage rise is the result and not the cause of inflation.

(c) Wage rise may be induced by increases in the productivity. Such wage rise is price stabilizing rather than inflationary.

(ii) For wage-push inflation to occur, it is necessary that trade unions have substantial control over the supply of labour. In a country like India, where the major portion of the labour force is not unionised, trade unions do not have much influence on wages.

(iii) Even in countries where trade unions are strong, their wage demands are net totally independent of demand conditions and are influenced positively by the level and growth of employment as well as profits.

To, conclude, there is general agreement to the view that only the wage increases in excess of increases in the labour productivity can be an autonomous cause of wage-push inflation. Thus, the rate of inflation (p), according to the wage-push inflation theory, is determined by the excess of rate of wage increase (w) over the rate of increases in labour productivity (x). Symbolically, p = w – x.

2. Profit-Push Inflation:

Cost-push inflation also occurs when the monopoly power of the businesses enables them to raise prices to increase their profits. Once started by a few powerful firms, the smaller firms also tend to mark-up their profit margins, partly following the example of leading firms and partly through inter-industry relations, because their material costs have gone up. This kind of price increase is called profit- profit spiral.

3. Material-Push Inflation:

Cost-push inflation is also caused by increase in the prices of some key materials, such as steel, basic chemicals, oil, etc. Since, these materials are used, directly or indirectly, in almost all the industries, the increases in their prices affect the whole of the economy and the prices everywhere tend to increase.

Demand-Cum-Cost Inflation:

In the actual world, it is difficult to say precisely whether the rise in prices is due to demand-pull factors or cost-push factors. In fact inflation is a combination of both demand-pull and cost-push rise in prices; it may be termed as demand-cum-cost inflation.

The demand-pull inflation has the tendency to generate forces of cost- push inflation; when prices rise due to excess increase in aggregate demand, the workers demand higher wages in view of a rise in cost of living.

Similarly, the cost-push inflation generates demand-pull elements of inflation; when wages are pushed up, the workers’ monetary demand for consumption goods increases due to their higher incomes. Thus, it is wrong to dichotomies the inflationary process into demand-pull and cost-push rise in prices. As H.G. Johnson has remarked, “The two theories are, therefore, not independent and self-contained theories of inflation but rather theories concerning the mechanism of inflation in a monetary environment that permits it.”

The actual working of the inflationary process is like this- If aggregate demand increases with given output, the prices will rise. As a result, the cost of living will rise and the workers will demand higher wages. When they succeed in it, their incomes will go up and thus aggregate demand will increase. But, on the other hand, higher costs due to rise in wages will push up the prices. Thus, inflation means demand-cost-price spiral.

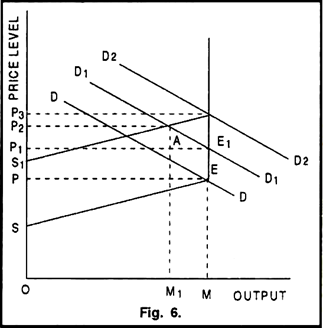

The combined demand-cum-cost inflation is illustrated in Figure 6. SS and DD are the original aggregate supply and demand curves respectively. They intersect each other at point E, indicating the full employment output level OM. The initial price is OP. When aggregate demand increases from DD to D1D1, it intersects the SS supply curve at point E1 and the price level rises from OP to OP1.

The increase in price level will force the trade unions to secure higher wages for the workers. This will raise the cost of production. As a result, a higher aggregate supply curve S1S will intersect D1D1 curve at point A, showing a reduction in employment (from OM to OM1) and a rise in price level (from OP1 to OP2). In order to achieve full employment, the aggregate demand must increase to D2D2. It means that full employment is achieved only at a higher price level OP3.

To conclude:

(a) Demand-pull inflation and cost-push inflation move together and lead to cumulative rise in prices.

(b) The forces behind demand-pull inflation are increases in money supply and aggregate expenditure, while the causes of cost-push inflation are mainly rise in wages, profits and material costs,

(c) Of the two types of inflation, cost- push inflation is much more difficult to control than demand-pull inflation. Demand-pull inflation can be controlled by adopting proper monetary and fiscal measures. But, it is not easy to reduce cost of production through such measures; a reduction in wage rate, for example, will be strongly opposed by the workers.

Essay on the Causes of Inflation:

Inflation is the result of disequilibrium between demand and supply forces and is attributed to- (a) an increase in the demand for goods and services in the country, and (b) a decrease in the supply of goods in the economy.

Factors Causing Increase in Demand:

Various factors responsible for increase in aggregate demand for goods and services are as follows:

1. Increase in Money Supply:

An increase in the money supply leads to an increase in money income. The increase in money income raises the monetary demand for goods and services. The supply of money increases when- (a) the government resorts to deficit financing i.e. printing of more currency or (b) the banks expand credit.

2. Increase in Government Expenditure:

An increase in the government expenditure as a result of the outbreak of war, developmental and welfare activities causes an increase in the aggregate demand for goods and services in the economy.

3. Increase in Private Expenditure:

An expansion of private expenditure (both consumption and investment) increases the aggregate demand in the economy. During the period of good business expectations, the businessmen start investing more and more funds in new enterprises, thus increasing the demand for factors of production. This results in an increase in factor prices. The increased factor incomes raise the expenditure on consumption goods.

Reduction in taxation can also be an important cause for the generation of excess demand in economy. When the government reduces taxes, it increases the disposable income of the people, which, in turn, raises the demand for goods and services.

5. Increase in Exports:

When the foreign demand for domestically produced goods increases, it raises the earnings of exporting industries. This, in turn, will increase demand for goods and services within the economy.

6. Increase in Population:

A rapid growth of population raises the level of aggregate demand in the economy because of the increase in consumption, investment, government expenditure and net foreign expenditure. This leads to an inflationary rise in prices due to excessive demand.

7. Paying off Debts:

When the government pays off its old debts to the public, it results in an increase of purchasing power with the public. This will be used to buy more goods and services for consumption purposes, thus increasing the aggregate demand in the economy.

8. Black Money:

Black money means the money earned through illegal transactions and tax evasion. Such money is generally spent on conspicuous consumption, while raising the aggregate demand and hence the price level.

Essay on the Factors Causing Decrease in Supply:

Various factors responsible for reducing the supply of goods and services in the economy are given below:

1. Scarcity of Factors of Production:

On the supply side, inflation may occur due to the scarcity of factors of production, such as, labour, capital equipment, raw materials, etc. These shortage are bound to reduce the production of goods and services for consumption purposes and thereby the price level.

2. Hoarding:

At a time of shortages and rising prices, there is a tendency on the part of the traders and businessmen to hoard essential goods for earning profits in future. This causes scarcity and rise in prices of these goods in the market.

3. Trade Union Activities:

Trade union activities are responsible for inflationary pressures in two ways:

(a) Trade union activities (i.e. strikes) often lead to stoppage of work, decline in production, and rise in prices.

(b) If trade unions succeed in raising wages of the workers more than their productivity, this will push up the cost of production, and lead the producers to raise the prices of their products.

4. Natural Calamities:

Natural calamities also create inflationary conditions by reducing the production in the economy. Floods and draughts adversely affect the supply of products and raise their prices.

5. Increase in Exports:

An increase in exports reduces the stock of goods available for domestic consumption. This creates a situation of shortages in the economy giving rise to inflationary pressures.

6. Law of Diminishing Returns:

The law of diminishing returns operates when production is increased by employing more and more variable factors with fixed factors and given technology. As a result of this law, the cost per unit of production increases, thus leading to a rise in the prices of production.

7. War:

War during the war period, economic resources is diverted to the production of war materials. This reduces the normal supply of goods and services for civilian consumption and this leads to the rise in the price level.

8. International Causes:

In modern times, a major cause of inflationary rise in prices in most of the countries is the international rise in the prices of basic materials (e.g. petrol) used in almost all the industrial materials.

Essay on Inflation in Underdeveloped Countries:

Structuralist View of Inflation:

Usually it is assumed that the stage of development makes no difference to the nature and causes of inflation and the theories of inflation relevant to the developed economies can also be used to explain inflation in underdeveloped countries.

But, the economists, like Myrdal, Streeten and several other Latin American economists hold the view that the developing countries need separate theory of inflation due to their structural backwardness.

The traditional aggregative analysis of aggregate demand and aggregative supply works well in the developed economies where markets are efficient and integrated and the substitutions in consumption and production and intersectoral resource mobility are smooth and fast. But the situation is different in underdeveloped countries which are structurally backward, unbalanced and highly fragmented due to market imperfections and various rigidities.

As a result, under utilisation of resources in some sectors and over-utilisation of resources in others coexist in these economies. Thus, what the underdeveloped economies need is not aggregative analysis but disaggregated sectoral analysis which can highlight the structural constraints and sectoral bottlenecks largely responsible for generating and perpetuating inflationary tendencies in these countries.

The structuralist view of inflation as advocated by the Latin American economists can be summed up in the following two propositions:

(i) Whereas inflation in developed countries is associated with full-employment policies and the labour market response to these policies, inflation in the developing economies is associated with the developmental effort and the structural response to the effort.

(ii) The socio-economic-political structure of the developing countries ultimately determines the sources and nature of inflation by determining various kinds of sectoral demand and supply gaps and bottlenecks that emerge in the process of development.

In short, to understand the nature and causes of inflation in an underdeveloped or developing economy, a study of the bottlenecks and gaps which obstruct the growth process is essential.

Bottlenecks in Growth Process:

Different bottlenecks and gaps in the growth process of underdeveloped or developing economies which generate inflationary tendencies in these economies are discussed below:

1. Resources Gap:

The underdeveloped countries generally try to industrialise themselves through public sector. But the socio- economic-political structure of these economies is such that the government is not able to raise enough resources from taxes, public borrowing and profits of the public sector undertakings to meet the expenditures on the developmental programmes.

The government has to resort to deficit financing which makes these economies inflation-prone. Similarly, the resource gap in the private sector, caused by low voluntary savings and high costs puts further pressure for excess expansion of money supply and bank credit, which, in turn, accelerates the inflationary spiral in the economy.

2. Food Bottlenecks:

Due to various structural factors, such as, defective land tenure system, primitive methods of cultivation, lack of irrigation facilities, low level of investment in agriculture, growing pressure of population on land, agricultural output (especially food supply) fails to keep pace with the increase in demand for food arising from growing population and urbanisation. This food bottleneck first leads to a rise in the prices of food grains, and then affects the whole of the structure of prices.

3. Foreign Exchange Bottlenecks:

The underdeveloped countries suffer from a structural disequilibrium in the balance of payments due to high imports and low exports. These economies, during their development phase, on the one hand, require the import of capital goods, essential raw materials and semi-manufactured goods and, in many cases, food grains and other consumer goods, and on the other hand, have low export earnings due to small exportable surplus, trade restrictions the world over, and relatively poor competitive power of their exports.

Due to this foreign exchange bottleneck, the domestic availability of goods in short supply cannot be easily improved through imports. As a result, the prices of these goods increase and the increase spreads to other prices.

4. Infrastructural Bottlenecks:

Due to resource and foreign exchange gaps, widespread inefficiency and corruption, and faulty planning and plan implementation, most of the underdeveloped countries face infrastructural, bottlenecks in the field of power and transport. This restricts the growth process in other sectors and causes underutilisation of productive capacity of the economy. Under-utilisation of resources does not absorb the full increase in money supply and leads to an inflationary rise in prices.

Various imperfections, such as, factor immobility, price rigidity, ignorance of market conditions, rigid social and institutional structures, lack of training and socialization, etc., in the underdeveloped economies do not allow an optimum allocation and utilisation of resources. Hence, an increase in money supply is not accompanied by the increase in the supply of output, thereby raising the prices.

6. Capital Bottlenecks:

Underdeveloped countries are characterised by low rate of capital formation which is both the cause and consequence of poverty in these economies. In fact, these economies are caught in the vicious circle of poverty; low income leading to low investment, low investment leading to capital deficiency, capital deficiency leading to low income.

Thus, monetary expansion in such economies, instead of breaking this vicious circle, tends to become inflationary because of structural inability of these economies to increase saving and investment.

7. Entrepreneurial Bottlenecks:

Entrepreneurial bottleneck in the underdeveloped countries arises due to the lack of entrepreneurial skill and the spirit of boldness and adventure. These economies have only a small class of merchants and traders who mostly deal in consumer goods and act as money lenders and real estate agents.

They do not attempt productive and innovational activities. Thus, increased money supply makes little impact on real output and causes rise in prices.

8. Labour Bottlenecks:

A peculiar feature of the underdeveloped countries is the large magnitude of disguised unemployment which is not responsive to the increase in money supply. Thus, due to the existence of disguised unemployment, the increase in money supply docs not increase employment and output, and often generates inflationary pressure.

Essay on Inflation and Economic Development:

The economists generally agree that the underdeveloped countries are particularly prone to inflationary pressures and that the policies available to the underdeveloped countries are more limited than those in a developed country. But it remains controversial whether the inflationary pressures promote or inhibit economic development. The theoretical basis of the relationship between inflation and development is provided by the two systems of economic thought:

1. The Keynesian Income Theory, and

2. The Quantity Theory of Money.

1. The Keynesian Approach or Redistribution Argument:

According to the Keynesian approach, inflation will promote growth in two ways- (a) by redistributing income from wage-earners (with low marginal propensity to save) to profit earners (with high marginal propensity to save and invest); and (b) by raising the nominal rate of return on investment relative to the rate of interest and. thereby, promoting investment. Both these arguments are based on the arbitrary and empirically unsupported assumption that the profit-earners fully anticipate inflation while others do not.

2. The Quantity Theory Approach or Inflation Tax Argument:

According to the quantity theory approach; (a) during sustained inflationary period, the behaviour of all sectors of economy will become adjusted to the expectations of inflation, and consequently, (b) the effect of inflation will be, not to redistribute income from wage-earner to profit-earners, but to redistribute it from the holders of money balances to the monetary authorities who issue money.

Inflation, thus, imposes an ‘inflation tax’ on holding of money, which consists in the real resources that the holders of money have to forgo in order to restore the real value of their money holdings.

Inflation Tax:

The inflation tax makes available to the monetary authorities real resources for development programmes. And if these resources are used for investment, the inflationary policy may accelerate economic growth. The amount of resources transferred by the inflation tax is a function of the rate of inflation and the elasticity of demand for real cash balances.

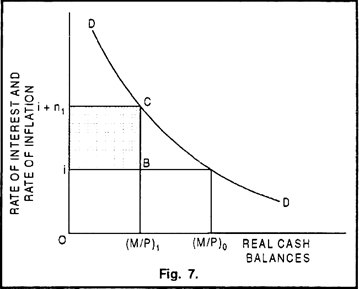

Figure 7 and a numerical example explains the process of transfer of resources through inflation tax. It is assumed that only the government issues money ; that the initial price level is stable; that the level of real income is constant; that the interest rate is Oi and that real balances (M/P)0 are equal to Rs. 5 crores at price level P0 =1.00.

So long as real income is constant, each issue of currency to finance a government budget deficit will raise prices proportionately. If the government issues Rs. 1 crore, the nominal supply of money will rise to Rs. 6 crores and there will be a 20% rise in prices.

This rise in prices will cause the real value of money stock to fall back to Rs. 5 crores and the original stock of money (M/p)0, will now only purchase Rs. 4 crores worth of goods and services. Thus, the issue of Rs. 1 crore worth of new currency serves to take away an equivalent amount of purchasing power from the existing stock. It is as though that the government has confiscated 20% of the existing stock of money, (M/P)0.

The amount of resources transferred by the inflation tax is a function of the rate of inflation and the elasticity of demand for real cash balances. The level of real cash balances held represents the tax- base and the rate of inflation (or the rate of monetary expansion) is the tax rate.

If the inflation rate is 2% and the money balances are equal to 20% of national income, then 4% of the national income is transferred to the government through inflation tax. By- decreasing the purchasing power of the stock of money balances, inflationary issues of money serve to transfer the lost purchasing power to the government.

In Figure 7, DD is the stable demand curve for real cash balances. This curve shows that the quantity of real cash balances demand is a function of the expected rate of inflation for a given level of population and real income. If inflation is proceeding at a steady rate of π1 and is fully anticipated, then real cash balances will be at the level of (M/P)1 as compared to the level (M/P)0 if the inflation rate is zero and interest rate is i.

If neither real income nor population is growing, the rate of inflation will be equal to the rate of growth of money supply. The issuers of money supply obtain resources equal to the real cash balances O (M/P)1 or iB or the tax base multiplied by the rate of inflation (ii + π1) or the tax rate.

The shaded area in Figure 7 represents the resources obtained by the issues of money which is equal to IB Ci + π1. The reason for this transfer of resources is that since inflation continuously erodes the real value of a given quantity of nominal money balances, it will be necessary for the public to save (i.e., to give up resources) out of their incomes to obtain nominal balances sufficient to keep their real cash balances constant.

It should be noted that during the transitional stages of inflationary development policy, the growth contribution of an inflationary tax may be outweighed by the wastage of resources or the collection cost of such a tax.

Inflation tax may encourage the public to evade the tax by reducing their holdings of money, shortening payment periods, holding inventories of goods instead of cash, etc. All these efforts involve wastage of real resources and a reduction of real income.