After reading this essay you will learn about:- 1. Meaning of Insurance 2. Fundamental Principles or Features of an Insurance Contract 3. Types 4. Double Insurance 5. Re-Insurance 6. Advantages/Utilities/Importance.

Essay on Insurance

Essay Contents:

- Essay on the Meaning of Insurance

- Essay on the Fundamental Principles or Features of an Insurance Contract

- Essay on the Types of Insurance

- Essay on Double Insurance

- Essay on Re-Insurance

- Essay on the Advantages/Utilities/Importance of Insurance

Essay # 1. Meaning of Insurance:

Risk and uncertainty are incidental to life. These risks and uncertainties are increasing day by day due to increase in fastness of life. Man may meet an untimely death. He may suffer from accident, destruction of property from fire, sea, floods, earthquakes and many other causes. Whenever there is uncertainty, there is risk as well as insecurity.

ADVERTISEMENTS:

It is to provide against risk and insecurity that insurance came into being. The main principle underlying insurance is the pooling of risks. It is a co-operative device to spread the loss caused by a risk (which is covered by insurance) over a large number of persons who are also exposed to the same risk and insure themselves against that risk.

According to W.A. Dinsale, “Insurance is a device for the transfer of risks of individual entities to an insurer, who agrees, for a consideration (called the premium), to assume, to a specified extent, losses suffered by the insured.

According the Mehr and Cammack, “Insurance is a social device for reducing risk by combining a sufficient number of exposure units to make their individual losses collectively predictable. The predictable loss is then shared proportionately by all those in the combination.”

According to D.S. Hansell. “Insurance is a social device providing financial compensation for the effects of misfortune, the payments being made from the accumulated contributions of all parties participating in the scheme.”

ADVERTISEMENTS:

According to Schultz and Bradwill, “Insurance in its technical sense is a social device which employs the use of pooling technique to eliminate uncertainty,”

According to Justice Tindal, “Insurance is a contact in which a sum of money is paid by the assured in consideration of insurers incurring the risk of paying a large sum upon a given contingency.”

The agency which helps in entering into this arrangement is called Insurer or insurance company. The person who gets his life/property insured is called Insured/Assured. The agreement or contract, which is put in writing, is called Policy. The thing on property insured is called the subject-matter of insurance and the interest of the assured in the subject-matter is called his insurable interest.

To conclude, a contract of insurance is a contract by which a person, in consideration of a sum of money, undertakes to make good the loss of another against a specified risk, e.g., fire, or to compensate him or his estate on the happening of a specified event, e.g.. accident or death.

Essay # 2. Fundamental Principles or Features of an Insurance Contract:

Insurance contract is based on certain fundamental principles.

ADVERTISEMENTS:

These principles are:

(i) Essentials of a Valid Contract:

The contract of insurance must have all the essentials of a valid contract.

According to Indian Contract Act, 1872, a valid contract must possess the following essentials:

ADVERTISEMENTS:

(t) Offer and acceptance

(ii) Capacity to contract

(iii) Free consent of parties

(iv) Lawful consideration and object

ADVERTISEMENTS:

(v) Contracts not specifically declared void.

(ii) Utmost Good Faith:

The contract in insurance is uberrima fides, e.g., both the parties must disclose all material facts. Concealment of any fact will entitle the insurer to deprive the assured of benefits of the contract.

Each party mush reveal to other party all information which would influence the other’s decision to enter into the contract. Although a party must not make any false statement, he is not bound to disclose to the other party all that he knows or ought to know about the transaction.

But there are certain cases where the knowledge of facts is almost exclusively on one side. In such cases, the contract is vitiated by non-disclosure of any material fact or a misstatement. Such contracts are known as contracts of uberrima fides or contracts based on ‘utmost good faith’.

ADVERTISEMENTS:

The rule of caveat empter, i.e., let the buyer beware, does not apply to the contracts of insurance.

The assured knows more about the subject-matter of the contract than the other party (the insurer). Consequently he is under a duty to disclose correctly all material facts known to him to the insurer, so that insurer may be in a position to make an accurate estimate of the risk that he is undertaking.

It is not easy to define material fact. It depends upon the circumstances of each case. A material fact is one which goes to the root of contract of insurance, and which must be stated with perfect degree of accuracy. If the utmost good faith is not observed by either party the contract may be avoided by the other.

A proposer should disclose all material facts at the time of making the proposal not only those facts which he honestly thinks to be material but every fact which a reasonable man would have thought to be material.

(iii) Insurable Interest:

ADVERTISEMENTS:

The assured must have an actual interest called the insurable interest in the subject-matter of the insurance. A person is said to have an insurable interest in the subject-matter (property or life) if he is benefitted by its existence and is prejudiced by its destruction. Without insurable interest the contract of insurance is void. It is the existence of insurable interest in a insurance contract that differentiates it from a wagering contract.

A banker has an insurable interest in the property mortgaged to it against a loan. A person has insurable interest in his own life. A creditor can insure the life of his debtor. A person has insurable interest in the building he owns.

An employer can insure the lives of his employees because of his pecuniary interest in them. A businessman has insurable interest in his stock, plant and machinery, building, etc. Husband has interest in the life of his wife and wife in the life of her husband.

Is it necessary in all forms of insurance?

Insurable interest is necessary to support every insurance contract. In case of Life Insurance, insurable interest must be present at the time when the insurance is effected. It is not necessary that the assured should have insurable interest at the time of maturity also.

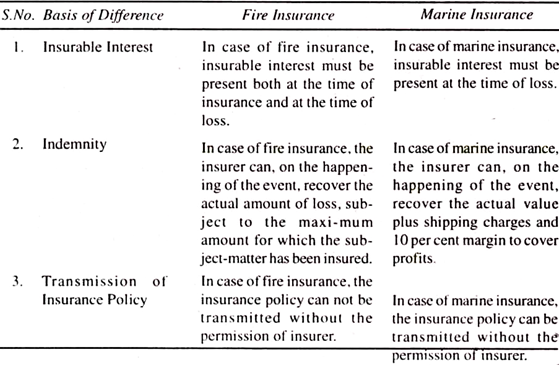

In case of Fire Insurance, insurable interest must be present both at the time of insurance and at the time of loss. In case of Marine Insurance, insurable interest must be present at the time of loss. It may or may not present at the time of insurance.

(iv) Indemnity:

ADVERTISEMENTS:

A contract of insurance is a contract of indemnity. The principle of indemnity is applicable to all types of insurance except life, personal accident and sickness insurance. That means that the assured in the case of loss against which the policy has been made shall be fully compensated and never more than the value of the policy. The insurer agrees to make good the loss but the insured, however, is not entitled to make a profit out of the loss.

A contract of insurance does not remain a contract of indemnity if a fixed amount is to be paid by the insurer to the insured on the happening of the event insured against, whether he suffers a loss or not. A contract of life insurance is not a contract of indemnity. In life insurance, the insurer is liable to pay the sum mentioned in the policy upon the happening of the contingency (death, or expiry of a certain period).

(v) Mitigation of Loss:

The next essential principle of insurance is that in the event of some mishap to the insured property, the assured must take all necessary steps to mitigate the loss. The insurer must act in a prudent manner as if he were in-insured.

However, he should do his best: yet in case of his own death he is not required to do so. If he does not do so the insurer can avoid the payment of loss attributable to his negligence. In nutshell, he is bound to do his best under the circumstances, but he is not bound to do at the risk of his life.

(vi) Risk Must Attach:

A contract of insurance is enforceable if and only if the risk has been attached. If the risk is not run the consideration fails, and therefore the premium received by the insurer must be returned The premium is to be returned even where the risk is not run or could not be run due to the fault, will or pleasure of the assured.

A policy is not attached till the risk begins and is not attached after the risk is determined one way or the other, except in those special insurance where both the parties being ignorant of the position of the thing insured, contract to insure it lost or not lost.

(vii) Contribution:

ADVERTISEMENTS:

Sometimes a property is insured with more than one company. Where there are two or more insurances on one risk, the principle of contribution applies between insurers. The objective of contribution is to distribute the actual amount of loss among different insurers who are liable for the same risk.

In case of loss, any one insurer may make the payment to the assured the full amount of loss covered by the policy. After paying this amount, he is allowed to claim a contribution from his co-insurers in proportion to the amount which each has undertaken to pay in case of loss.

The principle of contribution is applied to any insurance which is a contract to indemnity. It does not apply to life and personal accident insurance.

(viii) Subrogation:

The principle (or doctrine) of subrogation is a corollary to the principle of indemnity and applies only to fire and marine insurances. It does not apply to life and personal accident insurances. If the insured party gets a compensation for the loss suffered by him, he cannot claim the same amount of loss from any other party.

Subrogation is a substitution of one person in place of another in relation to the claim, its rights, remedies or securities. Whenever, an assured has received full indemnity in respect of his loss, the insurer is subrogated to only the rights and remedies available to the assured in respect of the thing to which the contract of insurance relates. The insurer’s right to subrogation arises only when he pays the loss for which he is liable under the policy.

(ix) Causa Proxima or Proximate Cause:

The insurer can recover the loss only if it is proximately caused by any of the perils insured against. This is known as the principle of Causa Proxima. “Every loss that clearly and proximately results whether directly or indirectly from the event insured against is within the policy.”

ADVERTISEMENTS:

The rule of proximate cause runs as Causa Proxima Non-Remote Spectator, i.e., the proximate and not the remote cause is to be looked to, and if the proximate cause of the loss is a peril insured against, the assured can recover the amount of the loss from the insurer.

The question, which is the causa proxima of a loss, can only arise where there are a succession of causes. When a result has been brought about by two or more causes, you must, in insurance law, look to the nearest cause, although the result would, no doubt, not have happened without the remote cause.

Proximate does not mean the nearest in time. The cause which is truly proximate is that which is proximate in efficiency. If the loss is the result of such an efficient cause, it will be regarded as having been caused by the proximate cause.

Section 55 of the Marine Insurance Act, 1963 lays down that unless the policy otherwise provides, the insurer is liable for any loss proximately caused by a peril insured against.

Essay # 3. Types of Insurance:

There are a number of types of insurance, but the following types stand out as being of special importance:

(i) Life insurance

ADVERTISEMENTS:

(ii) Fire insurance

(iii) Marine insurance

(i) Life Insurance:

In life insurance contract the amount of the policy is definitely paid, it is a question of time only. The amount becomes payable on the death of the assured or on the expiry of a certain fixed period, whichever is earlier. Life insurance contract is not a contract of indemnity.

Life insurance is a contract by which the insurer, in consideration of a premium, undertakes to pay a certain sum of money on the death of a person whose life is insured, or on the expiry of a certain period, whichever is earlier. Life insurance contract is not a contract of indemnity. The loss of life cannot be compensated and only a specified sum of money is paid.

Fundamental Principles/Features/Essentials of Life Insurance Contract:

Life insurance contract is based on certain fundamental principles.

ADVERTISEMENTS:

These principles are:

1. Essentials of a Valid Contract:

The life insurance contract must have all the essentials of a valid contract.

According to Indian Contract Act, 1872, a valid contract must contain the following essentials:

(i) Offer and acceptance.

(ii) Capacity to contract.

(iii) Free consent of parties.

(iv) Lawful consideration of object.

(v) Contracts not specifically declared void.

2. Utmost Good Faith:

The contract of life insurance is a contract of utmost good faith. The insured should be honest and truthful in giving information to the insurance company. He knows more about the subject-matter of the contract than the other party (the insurer).

Consequently, he is under a duty to disclose accurately all material facts known to him to the insurer. Concealment of any fact will entitle the insurer to deprive the assured of the benefit of the contract.

3. Insurable Interest:

In life insurance, the insured must have insurable interest in the life assured. Without insurable interest the contract of insurance is void. In case of life insurance, insurable interest must be present at the time when the insurance is Affected. It is not necessary that the assured should have insurable interest at the time of maturity also.

In the following three cases insurable interest is presumed and no proof is necessary, viz.:

(i) Own life

(ii) Husband in the life of wife, and

(iii) Wife in the life of husband.

The following persons have been held to have insurable interest:

(i) A person is presumed to have an interest in his own life and every part of it.

(ii) A creditor has an insurable interest in the life of his debtor,

(iii) A proprietor of a drama company has an insurable interest in the lives of actresses.

(iv) A servant engaged for a term of years has insurable interest in the life of his employer.

4. Contract of Indemnity:

A contract of life insurance is not a contract of indemnity. The loss of life cannot be compensated and only a specified sum of money is paid. That is why the amount payable in life insurance on the happening of the even is fixed in advance. Once the ‘sum of money’ payable is fixed, it is constant invariable. A contract of insurance, therefore, is not a contract of indemnity.

The loss resulting from the death of life assured cannot be estimated in terms of money and only a fixed amount is paid.

How to Effect Life Insurance (I.E., Procedure)?

A number of steps are taken to effect life insurance policy.

These steps are:

a. Proposal:

Before taking a life insurance policy, it is important to take proposal for which is available free from the office of Life Insurance Corporation. Agents also supply this form. The form contains a number of questions about the health of the person, family background, and the mode of paying premium.

As we know that the contract of insurance is based on utmost good faith. So the proposer must answer all the questions correctly. He should not conceal any factual information. Concealment of any fact will entitle the insurer to deprive the assured of the benefits of the contract.

b. Medical Examination:

After the proposal form has been submitted, a medical examination of the person to be insured is arranged. Such examination can be conducted only by a doctor approved by the insurance company. The medical report of the applicant is directly forwarded by the doctor to the office of the company.

c. Acceptance of Proposal:

The proposal form is sent to the company along with medical report and the comments of the insurance agents. The proposal form is scrutinised by the company and if the company is satisfied, the proposal is accepted.

d. Proof of Age:

The applicant has to furnish satisfactory proof of his age to the insurance company.

The proof of the age can be furnished through any one of the following:

(i) A certificate from the Municipal Birth Register

(ii) A certificate of High School

(iii) The horoscope of the assured

(iv) Service Book

(v) Certificate relating to the Baptism ceremony among Christians.

e. Premium:

When the proposal is accepted, it is intimated to the applicant and he is asked to make the payment of premium. On the payment of premium the policy comes into operation and the risk is covered then onwards.

f. Insurance Policy:

After receiving the installment of first premium, the insurance company prepares the insurance policy. The policy is in the form of an agreement between the insurance company and the assured to pay a certain sum of money to the assured on the happening of the event mentioned in the policy.

It bears the signatures of the officials of the insurance company. When the policy is ready, it is sent to the assured by registered post. It contains the assureds’ name, address, occupation, age, amount of insurance, number of installments, amount and date of premium, etc.

Different Kinds of Life Insurance Policies:

The life insurance policies are of the following types:

1. Whole Life Policy:

Under this policy, premium is payable throughout the life time of the life assured. The sum assured becomes payable only on the death of the insured. These policies are taken out to make provision for the dependants. This policy is also called ‘Ordinary Life Policy’.

2. Endowment Policy:

This is most popular form of life insurance. This policy is taken up for a specific period known as ‘endowment period’. The sum assured is payable either on the death of life assured or on the expiry of a fixed period, whichever is earlier. If the person does not die upto the maturity of the policy, he shall get back the insured amount after the maturity of the policy.

3. Joint Life Policy:

This policy implies to husband and wife or the partners of a business. They can have a joint policy. It is like Endowment Policy. The sum assured under a Joint Life Policy (on two or more lives) is payable at the end of the endowment term or on the first death of any one the lives assured, whichever is earlier. Such policies are usually taken by partnership firms to provide for the payment of the capital of the deceased partner.

4. With or Without Profit Policy:

Life insurance policy may be ‘with profit’ or ‘without profit’. The assured is entitled to the share in the profits of the insurer if the policy is a ‘with profit’ policy. Contrary to this, in case of ‘without profit’ policies, such a question does not arise.

5. Annuity Policy:

Under annuity policy, the amount is payable by the insurer not in lump sum but by monthly, quarterly, half-yearly or annual installments which are paid either until death or for a specified number of years. This policy is very useful to those persons who desire to provide a regular income for themselves and their dependants after the expiry of a specified period.

6. Sinking Fund Policy:

These policies are mostly taken by firms and companies to accumulate funds to pay off a liability or for making a provision for the replacement of an asset after a period of time.

7. Convertible Whole Life Policy:

This policy is issued as a whole life policy with a provision to convert it into an Endowment Policy after the expiry of a specified period (say 5 years). If this option is not exercised, the policy continues as a whole life policy with premiums ceasing at a certain age.

8. Group Insurance Policy:

This policy may be taken out for the protection of lives of all employees in a business concern. One policy is issued to the employer with individual certificates indicating the amount of insurance protection of each employee. Dependants of the employees are entitled to the benefits of these insurances.

(ii) Fire Insurance:

Fire insurance covers losses caused by fire. A fire insurance is an agreement between the two parties, i.e., insurer and insured, whereby the insurer undertakes to indemnify the loss suffered by the insured in consideration for his (insured) paying of certain sum called premium. Fire Insurance is a contract of indemnity. This contract does not help in controlling or preventing fire but it is a promise to compensate the loss.

A contract of fire insurance is a contract whereby the insurer, in consideration of the premium paid, undertakes to make good any loss or damage caused by fire during a specified period. Normally, the fire insurance policy is for a period of one year after which it is to be renewed from time to time.

A claim for loss by fire must satisfy the following two conditions:

(i) There must be actual loss; and

(ii) Fire must be accidental and non-intentional.

The risk covered by a fire insurance contract is the loss resulting from fire or some cause which is the proximate cause of the loss. If damage is caused by overheating without ignition, it will not be regarded as a fire loss within the meaning of fire insurance contract and the loss will not be recoverable from the insurer.

Fundamental Principles/Essentials/Features/Characteristics of Fire Insurance Contract:

Fire insurance contract is based on certain fundamental principles.

These principles are:

a. Insurable Interest:

In fire insurance, the assured must have insurable interest in the subject-matter of the insurance. Without insurable interest the contract of insurance is void. In case of fire insurance, insurable interest must be present both at the time of insurance and at the time of loss. In case of goods, insurable interest arises on account of (i) ownership, (ii) possession, and (iii) contract.

The following persons have insurable interest in the subject-matter of insurance in case of a fire policy:

(i) A person has insurable interest in the property he owns.

(ii) A businessman has insurable interest in his stock, plant and machinery and building.

(iii) Agent has an insurable interest in the property of his principal.

(iv) Partner has insurable interest in the property of partnership firm.

(v) Mortgagee has insurable interest in the property which is mortgaged.

b. Utmost Good Faith:

The contract of fire insurance is a contract of utmost good faith. The insured should be truthful and honest in giving information to the insurance company. Insured knows more about the subject-matter of the insurance.

He is under a duty to disclose accurately all factual information known to him. The insurance should also disclose the facts of the policy to the proposer. So utmost good faith on the part of both the parties is a must.

c. Indemnity:

The contract of fire insurance is a contract of indemnity. The assured can, in the event of loss, recover the actual amount of loss from the insurer. This is subject to the maximum amount for which the subject-matter is insured. The value of the policy undertaken is fixed at the time of contract. The actual amount of loss suffered is compensated and the value of policy is only the maximum limit.

If a person has insured his house for Rs. 40,000 the insurer is not necessarily liable to pay that amount, although the house may have been totally destroyed by fire; but he will pay the actual loss within the maximum limit of Rs. 40,000.

Kinds of Fire Insurance Policies:

The fire insurance policies are of the following kinds:

i. Valued Policy:

It is a policy in which the amount payable in case of loss is fixed at the time when the policy is taken. In the event of loss, the fixed amount is payable irrespective of the actual amount of loss. Valued policy is not a contract of indemnity. It can be legally challenged.

ii. Specific Policy:

The specific policy provides for the payment of a specific sum in respect of loss to the property and does not penalise under-insurance. This policy is also known as ‘Average Policy’ because the insurer usually inserts the average clause in the policy.

iii. Floating Policy:

The floating policy covers several lots of goods lying at different places under one insurance cover. It is always subject to average clause.

iv. Comprehensive Policy:

It covers the risks of the fire arising out of any cause that is civil, communication, riots, thefts, labour disturbances and strikes, etc.

v. Consequential Loss Policy:

In certain cases fire can’ cause the loss of business of the insured. Such persons to cover the risk of business due to fire, undertake the consequential loss policy.

vi. Re-installment or Replacement Policy:

In such a policy, the insurer has the right to reinstate or replace the property destroyed instead of paying cash. The modes of discharge by the insurer are alternative. If the insurer selects one, he cannot afterwards change to the other. If the insurer offers to pay, he cannot afterwards claim to re-instate and vice versa.

vii. Sprinkler Leakage Policy:

This policy covers the loss arising out of water leakage from sprinkles which are set up to extinguish fire.

viii. Average Policy:

In this policy, the average clause is inserted which means the insured will have to bear proportionate loss with the insurer in case where policy is taken for a certain amount greater than the value of the property.

The formula for calculating average amount of claim is given below:

Amount of Claim or Average Loss = Insured Amount x Actual Loss/Actual Value of Property

ix. A Blanket Policy:

It is issued to cover all the fixed and current assets of an enterprise by one insurance.

x. Declaration Policy:

Under this policy, trader takes out a policy for the maximum value of stock which he may expect to hold during the year.

(iii) Marine Insurance:

It is one of the oldest forms of insurance. It covers all marine losses, that is to say, the losses incidental to marine adventure. Marine insurance may be called a contract whereby the insurer undertakes to indemnify the insured in a manner and to the extent thereby agreed upon against marine losses.

A contract of marine insurance is an agreement whereby the insurer undertakes to indemnify the insured in the manner and to the extent thereby agreed, against marine losses. Marine insurance is an arrangement by which the insurer undertakes to compensate the owner of a ship or cargo for complete or partial loss at sea.

The contract of marine insurance is a contract of indemnity. The assured can. on the happening of the event, recover the actual amount of loss, subject to the maximum amount for which the subject-matter has been insured.

Subject-Matter of Marine Insurance:

The following three things are covered in the subject-matter of marine insurance:

1. Cargo Insurance:

The goods to be sent through ship is called ‘Cargo’. For the safety of goods, insurance policy is taken. The goods are generally insured according to their value but some percentage of profit can also be included in the value. At the happening of the event insurance company is liable to pay both value of the goods plus profit percentage. The rate of premium depends upon the nature of goods, packing, etc.

2. Hull Insurance:

When the ship is insured against any type of danger, it is called ‘Hull Insurance’. The ship may be insured for a particular period or for a particular trip.

3. Freight Insurance:

The freight may be paid in advance or on the arrival of goods. The shipping company will not be entitled to get freight, if the goods are lost in transit. The shipping company may insure the freight to be received which is called ‘Freight Insurance’.

Marine Insurance Contract:

Marine insurance is an agreement by which the insurer undertakes to compensate the owner of a ship or cargo for complete or partial loss at sea.

In other words, under marine insurance, the insurer undertakes to indemnify the insured in the manner and to the extent thereby agreed against marine losses.

Among the subject-matter of marine insurance are included:

(i) Ship

(ii) Cargo, and

(iii) Freight.

Marine Insurance Contract is a Contract of Indemnity:

The contract of marine insurance is a contract of indemnity. The assured can, in the event of loss recover the actual amount of loss from the insurer. Under no circumstances, the insured is allowed to make profit out of the marine insurance contract.

However, it becomes difficult to determine indemnity when the loss occurs. That is why, most insurance policies provide a commercial indemnity rather than a strict legal indemnity. They promise to indemnify ‘in the manner and to the extent agreed’.

In case of ‘Hull Policy’, the amount insured is fixed at a level rather above the current market value and in case of ‘Cargo Policy’, the amount insured also includes an amount for certain charges and profit.

Marine Insurance Contract is a Contract of Good Faith:

The contract of marine insurance is a contract of uberrima fides, i.e., utmost good faith. Both the insured and insurer must disclose everything which is in their knowledge and can affect the insurance contract. The insured should be truthful and honest in giving information to the insurance company.

He is under a duty to disclose accurately all factual information known to him. The insurer should also disclose the facts of the policy to the proposer. If utmost good faith is not observed by either party, the contract may be avoided by the other party. So utmost good faith on the part of both the parties is a must.

Kinds of Marine Insurance Policies:

The marine insurance policies are of the following kinds:

1. Valued Policy:

The valued policy contains the insured value of goods which is made up of invoice price, charges like freight, shipping and insurance and 10 per cent margin to cover profits and other incidental expenses. That is, it is the C.I.F. price (Cost, Insurance and Freight Price) plus 10 per cent profit.

2. Open or Unvalued Policy:

In this policy the value of the goods insured is not mentioned and is to be calculated when the actual loss arises. Unvalued policies’ are rarely issued.

3. Floating Policy:

This policy is popular with those merchants who make regular and frequent shipment of goods through an established route. Instead of taking many individual policies, one running policy is taken and the necessary particulars relating to the voyage are given by subsequent declaration at the time of each separate shipment.

4. Voyage Policy:

In such a policy the risk is covered for voyage of the ship or a specified route. Each voyage is made the basis of marine insurance for covering the related risks from the port of departure to the port of destination. Generally, the cargo owner takes the Voyage Policy for each separate shipment of goods.

5. Time Policy:

These policies are taken to cover all marine risks for a specified period, usually on the yearly basis, Cargo-owners may also take up time policies covering all shipments during a fixed period.

6. Mixed Policy:

These policies are issued by combining both the time and voyage features under one coverage. In this policy, the coverage is allowed for a particular time and for a particular voyage or a definite route.

Differences between Fire Insurance and Marine Insurance:

Essay # 4. Double Insurance:

When the same subject-matter is insured with two or more insurers and the total sum insured exceeds the value of the subject-matter, the assured is said to be over-insured by double insurance. As stated in Section 34 of the Marine Insurance Act, 1963, over-insurance and double insurance are valid unless the policy otherwise provides.

For instance, if Mr. X insures his factory worth Rs. 2 lakh with three insurers as—with A for Rs.90,000, with B for Rs. 80,000 and with C for Rs.70,000 there is a double insurance because the aggregate of all the policies exceeds the total value of Mr. X’s factory. If Mr. X insurers with A for Rs.80,000, with B for Rs. 70,000 and with C for Rs. 50,000 there is no double insurance.

A man may insure with as many insurers as he pleases. In case of loss, he may claim payment from the insurers in such order as he may think fit, but he will not get more than his actual loss, because a contract of insurance is a contract of indemnity. The insurers as between themselves are liable to contribute to the loss in proportion to the amount for which each one is liable.

If an insurer pays more than this proportion of the loss, he is entitled to recover the excess from his co- insurers. In India, Life Insurance Corporation of India being the only insurer of life there is no question of double insurance of life.

Essay # 5. Re-Insurance:

Every insurer has a limit to the risk that he can undertake. If at any time a profitable venture comes his way, he may accept a risk beyond his capacity, he may re-insure the same risk either wholly or partially with other insurers. This is known as re-insurance.

The re-insurer is not liable to the assured. This is because there is no private of contract between them. The re-insurance is subject to the clauses and conditions in the original policy, and is also entitled to any benefits which the Original policy is entitled to. The policy or re-insurance is co-extensive with the original policy.

If the original policy for any reason comes to end or is avoided, the policy of reinsurance also comes to an end. On payment of loss under the policy of re-insurance, the re-insurers are subrogated to all the rights of the original insurer including the rights of the assured to which the original insurer is subrogated.

Re-insurance can be resorted to in all kinds of insurance because the insurer has one insurable interest in the subject-matter insured to the extent of the amount insured by him.

Essay # 6. Advantages/Utilities/Importance of Insurance:

Immense are the benefits of insurance to the modern business. The goods may destroy due to fire beyond the control of man. The goods also destroy in transit. The workers are sometimes exposed to various risks which can cause death or permanent disability of some workers. Insurance has been helpful in solving these problems of business and private life.

Following are the advantages of insurance:

1. There is always a fear of sudden loss. Insurance provides security against such losses. Insurance gives security to both individuals and businessmen. Nowadays insurance covers various social welfare schemes also. There are schemes providing for sickness. Unemployment, health accident and old age insurances. These schemes are beneficial to poor people and also help in establishing social justice.

2. The fundamental principle of insurance is to spread risk among a large number of people. A large number of people get insurance policies and make the payment of premium to the insurer. Whenever a loss occurs, it is compensated out of funds of the insurer. The loss is spread among a large number of policyholders.

3. Insurance not only provides protection against risks but it is also a good form of investment. The insurance develops a habit of saving money by paying premium. In case of fixed time policies, the insured gets a lump-sum amount after the maturity of the policy.

4. Insurance helps in capital formation and economic development of the nation. Large funds are collected by way of premiums. These funds can be gainfully employed in industrial development of the country. The employment opportunities also increase by large investments made by insurance companies. So insurance has become an important source of capital formation.

5. These days large variety of policies have been designed for different purposes. Persons, by taking different types of life insurance policies, may provide against every type of his social and business obligation, i.e., for the education or marriage of the children, etc.

6. Insurance has helped the development of international trade on a large scale. Marine insurance provides protection against all types of sea-risks.