Here is an essay on ‘Letter of Credit’ for class 11 and 12. Find paragraphs, long and short essays on ‘Letter of Credit’ especially written for school and banking students.

Essay on Letter of Credit

Essay Contents:

- Essay on the Definition of Letter of Credit

- Essay on the Operations of Letter of Credit

- Essay on the Parties of Letters of Credit

- Essay on the Risks Relating to Letter of Credit Transactions

- Essay on the Types of Letters of Credit

- Essay on the Documents under Letter of Credit (LC)

- Essay on the Standby Letter of Credit (LC)

- Essay on the Uniform Rules for Bank-to-Bank Reimbursement

Essay # 1. Definition of Letter of Credit:

A Letter of Credit/Documentary Credit is a very common and familiar instrument, used for trade settlements across the globe. It is a link between buyers and sellers, reinforcing the buyer’s integrity by adding to it, his banker’s undertaking to pay, while sellers need to make shipments of goods specified and present shipping documents to banks, before getting the payment.

Thus, for international trade, where buyers and sellers are far apart in two different countries, or even continents, the letter of credit acts as a most convenient instrument, giving assurance to the sellers of goods for payment and to the buyers for shipping documents, as called for under the credit.

In order to bring uniformity in matters pertaining to letters of credit documents and transactions, International Chambers of Commerce (ICC), established in 1919 and headquartered in Paris, has framed uniform rules and procedures for issuance and handling of transactions under letters of credit, so that parties to letters of credit transactions uniformly interpret various terms and are bound by a common rule.

These rules and procedures are called Uniform Customs and Practices for Documentary Credits (UCPDC). The UCPDC was first brought out in 1933, and has been revised from time to time in 1951, 1962, 1974, 1983, and 1993 with the last revision in 2007. The current update of UCPDC is the publication No. 600 of ICC, which has been implemented with effect from 1.7.2007.

A documentary credit or/and letter of credit, (DC or LC) can be defined as a signed or an authenticated instrument issued by the buyer’s banker, embodying an undertaking to pay to the seller a certain amount of money, upon presentation of documents, evidencing shipment of goods, as specified, and compliance of other terms and conditions.

An LC can also be defined as an undertaking issued by the bank, on behalf of the importer or the buyer, in favour of the exporter or the seller, that, if the specified documents, showing that a shipment has taken place, or a service has been supplied, are presented to the issuing bank or its nominated bank, within the stipulated time, the exporter/seller will be paid the amount specified.

Thus, in an LC transaction, following parties are involved:

(i) The buyers/importers or the applicant – on whose behalf LC is opened,

(ii) The sellers/exporters or the beneficiary of the LC,

(iii) The opening bank (buyers bank), who establishes the LC,

(iv) The advising bank (bank in sellers country), who acts as an agent of the issuing bank and authenticates the LC,

(v) The confirming bank – who undertakes to pay on behalf of the issuing bank,

(vi) The negotiating bank (sellers bank or bank nominated by the opening bank),

(vii) Reimbursing bank – who reimburses the negotiating or confirming bank.

The advising bank, confirming bank and the negotiating bank could be the same.

Essay # 2. Operations of Letter of Credit:

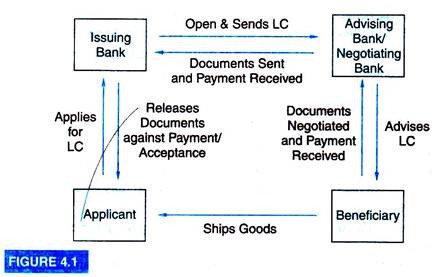

With the involvement of the several parties, the LC transaction operates between the two nations, as explained in the following diagram:

As shown in the diagram above, the transaction flows as under:

(i) The buyer and seller enter into the sales contract, for purchase/sale of certain amount of specified goods at specified rates, but agree to cover the transaction under Letter of Credit.

(ii) The buyer in country a (applicant/opener) requests his bank, to open LC in favour of the seller in country B (beneficiary) for the specified amount.

(iii) The buyer’s bank, i.e. opening bank, issues the LC and sends the same to the beneficiary in country B, through its own branch or correspondent (or at times directly, if the beneficiary is known).

(iv) The advising bank in country B, advises the LC after authenticating the signatures/swift message. The bank, in country B, which advises the LC to the beneficiary, is called Advising Bank.

(v) the seller desires for the LC to be confirmed by some bank, in his own country, the bank, which agrees to do so, at the request, and as per arrangement and on behalf of the opening bank, is called the Confirming Bank.

The seller now prepares the goods, and ships as per instructions in the LC, submits the documents called for in the LC to the confirming bank, which examines the same and if found in conformity to the LC terms, negotiates the documents and pays to the beneficiary.

This bank now becomes the negotiating bank, and steps into the shoes of the issuing bank, and by this act of negotiation, becomes rightful owner of the documents and claimant of the amount under LC from the opening/issuing bank.

The negotiating bank sends the documents to the opening bank, and claims reimbursement from the reimbursing bank, for the amount paid, to the beneficiary, from the designated bank. The bank, which reimburses the amount to the negotiating bank, is the reimbursing bank, and is usually the Nostro/Vostro bank of the opening bank.

The issuing bank, on receipt of the documents, presents the same to the openers/importers and gets the payment of the same on presentation/acceptance or due date, as the case may be.

Upon payment by the applicants/openers, to the issuing bank, and release of documents to the title of goods, as also other documents, as called for under the LC, the LC transaction is complete.

Essay # 3. Parties of Letters of Credit:

1. The Applicant:

The applicant of the L/C must give complete and precise instructions for issuance of Letter of Credit and any amendment thereof. The LC must not include excessive details or give any reference of credit previously issued, to avoid any confusion or misunderstanding (Article 5). The applicant should indemnify banks against any obligations imposed by foreign laws (Article 18).

2. The Issuing Bank:

Issuing bank is the party acting on behalf of the applicant and should, therefore, ensure itself about the creditworthiness of the applicant. The issuing bank gives a definite undertaking to make payment in case of sight and accept and pay on maturity in case of acceptance or deferred payment, to authorize bank to negotiate and to reimburse the negotiating bank, provided that the stipulated documents are presented under the Letter of Credit (Articles 2, 9).

The LC or amendment issued must be precise and there should be no ambiguity in the instructions and details mentioned in the LC (Articles 5, 20, 21). It is the responsibility of the issuing bank to examine the documents with a reasonable care and determine by international standards whether the documents appear on face, to be complying the terms of the credit.

If it wishes to refuse the documents, it should do so in a reasonable time, i.e. within five banking days following the date of receipt of documents (Article 16). The issuing bank, solely on its own judgement, can approach the applicant for waiver of discrepancy.

The discrepancies pointed out should also be reported to the bank, from which the documents were received, by expeditious means. The notice must state as to documents are being held pending further instructions from the negotiating bank or being returned (Article 16).

3. Advising Bank:

The advising bank has option to choose as to whether it wishes to advise a LC or not. If it agrees to advise the LC, then it must do so by taking reasonable care in checking the authenticity of the credit. In case, it decides not to advise a LC, then it must inform the issuing bank immediately. If the advising bank is unable to establish the authenticity of LC then it must immediately inform the issuing bank and must also inform the beneficiary about the same (Article 9).

4. Confirming Bank:

A confirming bank gives a definite undertaking in addition to that of issuing bank, at the request of the issuing bank, to make payment on presentation of documents as per the terms and conditions of the LC. The confirming bank, advising bank and nominated bank can be the same.

In case, it does not agree to add its confirmation, it must inform the issuing bank without delay. It may also choose to advise amendments without adding its confirmation, however, intimation must be sent to the issuing bank and the beneficiary (Article 8).

5. Negotiating Bank:

It is the responsibility of the negotiating bank or nominated bank to examine the documents as per UCP or International Standard Banking Practice (ISBP), and take a decision to negotiate the documents, only if they appear on their face to be in compliance with the terms and conditions of the LC (Articles 12, 14).

6. Reimbursing Bank:

Article 13 deals with Bank-to-Bank Reimbursement clause. Reimbursing bank shall reimburse the claiming bank, the amount of claim lodged, subject to the condition that it has received reimbursement authorisation from the issuing bank and having accepted the same. The reimbursements and all the parties concerned are bound by Uniform Rules for Bank-to-Bank Reimbursements (URR-525).

7. Beneficiary:

The beneficiary of the LC also has various rights and responsibilities under Letter of Credit transactions. A beneficiary can in no case avail himself of the contractual relationship existing between the banks or between the applicant and the issuing bank (Article 4).

8. Protection to Banks:

Banks do not assume any responsibility for genuineness of the documents submitted or any discrimination in the contents mentioned in the documents (Article 34). Banks are not responsible for any loss arising due to delay in transmission or loss of messages, documents, or telecommunication.

No responsibility is taken by the banks for errors in translation/interpretation of technical terms (Article 35). Banks also do not take responsibility for any loss arising due to close of their business by the acts of god, commotions, civil riots, floods or any other causes beyond their control (Article 36).

Banks do not take any responsibility for the acts of the correspondent banks, whether the bank was chosen by the applicant or by itself. The applicant is liable to pay the charges, if the charges were on account of the third party and could not be collected. Further, the applicant is liable for any acts done or losses occurred due to foreign laws (Article 37).

Essay # 4. Risks Relating to Letter of Credit Transactions:

Letter of Credit is considered to be the most convenient mode of settlement of payment in international trade. The mode secures the payment for the opener/seller, as the payment is received from the negotiating/paying bank on tendering of the documents evidencing shipment of goods, and other documents called for under the LC, while the buyer/beneficiary is secured, as the payment will be made only after receipt of documents conforming to the terms and conditions of the Letter of Credit (i.e., shipment taking place).

However, like every other trade transaction, this mode of international trade also has certain inherent risks. The risks involved mostly are rejection of documents due to discrepancies, law of land ruling over the UCPDC, embargoes, currency restrictions, etc.

There have been instances, where the payments under the Letter of Credit was stopped, even after acceptance of documents by the bank, through stay orders from court of law, non-acceptance of documents till the arrival of goods, raising disputes for the quality of goods, even after accepting the documents and taking possession of goods and taking the matter to court, etc. Such instances have raised a question on the safety of LC transactions. However, Letter of Credit continues to be favourable mode for settling trade transactions.

Banks should, therefore, open Letter of Credit on behalf of their regular customer only and ensure that he is well-versed with the trade. The bills of Lading should be called for in the name of the bank indicating the name and address of the importer.

Letter of credit should not be opened for import of goods, which are in the restricted item list and wherever the item is licenced, Exchange Control copy of the licence in favour of the importer should be obtained before opening the LC.

All precautions applicable to fund-based limits should be applied while sanctioning Letter of Credit (non-funded) facility. In case, the importer is offering adequate cash margin covering the transaction, still enquiry regarding trade activities and his actual requirements should be made.

A satisfactory report on the overseas seller should be called and kept on records. Banks should ensure that importers hedge their large value transactions by booking forward contract, thereby minimising the exchange risk.

The buyer, before entering into trade relation should enquire about the creditworthiness of the overseas seller. He should prefer to obtain a satisfactory report on the overseas party from a reputed credit-rating agency.

He should ensure to incorporate adequate clause in the Letter of Credit, so that safety of import of goods is assured and the documents are received as per his requirement. He should be well-versed with the Exchange Control requirements of the seller country and the goods being imported are permitted to leave the shores of that country.

The seller of the goods is equally concerned about the safety of his payment. He should make sure that documents are prepared strictly as per the terms of the Letter of Credit, leaving no chance for the issuing bank to point out any discrepancy. He should ensure that goods dispatched are as per the contract/ requirement of the buyer, particularly where the documents are drawn under usance Letter of Credit.

He should also be aware of the related trade control guidelines prevailing in the country of the buyer and also the legal procedures being followed in that country for Letter of Credit transactions, to save himself of any mishaps.

Above risks, in no way degrade the reputation enjoyed by the Letter of Credit related trade transactions but as the saying goes ‘A burnt child dreads the fire’, few instances in the international market, creating bad examples, pave way for the precautions to be taken even while adopting the safest mode.

Essay # 5. Types of Letters of Credit:

UCPDC are universally recognized set of rules framed by ICC, governing LC business, and have over the years become an indispensable tool for international business. Since LC ensures payment to the exporter against constructive delivery, by way of handing over the documents to the title to goods, to the paying or negotiating bank, it is a comfort to the sellers (exporters) and buyers (importers) that has been a backbone of international trade.

The UCPDC gives guidance and assistance to all concerned parties to LC transaction, specifically emphasizing upon the duties and responsibilities of the opening bank, buyers and sellers, advising, negotiating and the reimbursement bank, as also specifying the acceptable practices, in case of no specific instructions in the LC. UCPDC-600, i.e. the publication no. 600 of ICC, is the latest version of UCPDC and was made effective 1 July 2007. We shall learn further about the clauses of the UCPDC and how they help the parties to the transaction, let us first go through the types of Letters of Credit, that are in use in the international market.

Following are the basic types of Letters of Credit:

1. Revocable LC:

Revocable LC is the one which can be amended or cancelled at any moment by the issuing bank without the consent of any other party, as long as the LC has not been drawn or documents taken up.

The value of such revocable LC is very limited and therefore these are very rarely issued and accepted. In case the negotiating bank has taken up the documents under revocable LC, prior to receipt of cancellation notice, the issuing bank is liable to compensate/reimburse the same to the negotiating bank.

2. Irrevocable LC:

Irrevocable LC is the one, which holds a commitment by the issuing bank to pay or reimburse the negotiating bank, provided conditions of the LC are complied with. Such an LC cannot be amended or cancelled without the consent of all parties concerned.

The Irrevocable Letter of Credit is an unconditional undertaking by the issuing bank to make payment on submission of documents conforming to the terms and conditions of the LC. All LCs issued, unless and otherwise specified, are irrevocable Letter of Credit.

3. Irrevocable Confirmed Letter of Credit:

Irrevocable Confirmed Letter of Credit is an L/C, which has been confirmed by a bank, other than the issuing bank, usually situated in the country of the exporter, thereby taking an additional undertaking to pay on receipt of documents conforming to the terms and conditions of the Letter of Credit.

The confirming bank can be the advising bank, which on receipt of request from the issuing bank takes this additional responsibility. The confirming bank has to inform the issuing bank if it does not agree to add its confirmation and has no obligation to add confirmation to the amendments issued thereafter. The confirming bank looks into various risks involved and takes a decision to add its confirmation.

In short, the confirming bank steps into the shoes of the issuing bank and perform all functions of the issuing bank.

4. Transferable LC:

A transferable Letter of Credit is available for transfer in full or in part, in favour of any party other than the beneficiary, by the advising bank at the request of the issuing bank. There can be more than one second beneficiary, i.e. the LC can be split and transferred in favour of more than one second beneficiary. However, such second beneficiary cannot further transfer the LC in favour of another third party. To be transferable, a credit must specifically be made transferable.

5. “Red Clause” LC:

Such an LC enables the beneficiary to avail pre-shipment credit from the nominated/advising bank. The LC bears a clause in “Red Letter” authorising the nominated bank to grant advance to the beneficiary, prior to shipment of goods, payment of which is guaranteed by the opening bank, in case of any default or failure of the beneficiary to submit shipment documents.

6. Sight/Acceptance, Deferred Payment, or Negotiation LC:

Within the above types of LCs, the LCs can be Sight LC, Acceptance LC, Deferred Payment LC or Negotiation LC.

Under a Sight LC, the beneficiary is able to get the payment on presentation of documents conforming to the terms and conditions of the LC at the nominated bank’s counters.

In an Acceptance Credit, the bill of exchange or drafts are drawn with certain usance period, and are payable, upon acceptance, at a future date, subject to receipt of documents conforming to the terms and conditions of the Letter of Credit. The usance period may be certain number of days from the date of shipment or date of bill of exchange, etc.

i. Deferred Payment Credit:

A Deferred Payment Credit is almost similar to acceptance credit, except that there is no bill of exchange or draft drawn and is payable on certain future date, subject to submission of credit conformed documents. The due date is generally mentioned in the Letter of Credit. The absence of bill of exchange saves the beneficiary from the cost of stamp duty or other levies, as applicable in certain countries.

ii. Negotiation Credit:

In a Negotiation Credit, the issuing bank undertakes to make payment to the bank, which has negotiated the documents, i.e. give the value for draft and/or documents drawn under the Letter of Credit. The documents negotiated should be strictly as per the terms and conditions of the LC. The LC may be freely negotiable or may be restricted to any bank nominated by the LC issuing bank.

7. Back to Back LC:

When an exporter arranges to issue an LC in favour of local supplier to procure goods on the strength of export LC received in his favour, it is known as Back-to-Back Letter of Credit. Generally, Back-to-Back LC is for procurement of goods locally or for import of goods for meeting the export LC commitments.

Essay # 6. Documents under Letter of Credit (LC):

1. Bill of Exchange:

Bills of exchange, being one of the most important financial documents, are drawn by the beneficiary on the LC issuing bank. It envisages the issuing bank to make the payment immediately, if it is drawn at sight and accept and pay on due date, if it is drawn on acceptance basis.

It should, in normal due course, satisfy the following requirements:

(i) It should be drawn by the beneficiary on the issuing bank and payable at tenor mentioned in the Letter of Credit.

(ii) It should indicate the number of Letter of Credit along with issuing bank’s name, under which it is drawn.

(iii) It should, unless and otherwise specified, be drawn in the currency of Letter of Credit and should not exceed the amount of Letter of Credit.

(iv) Any corrections should be duly authenticated.

2. Invoice:

An invoice is a commercial document and is a basic necessity of trade documents. It is prepared by the beneficiary giving details of goods, quantity and value in unit terms, weight and total value of goods.

Following specific points should be kept in mind, while preparing or examining the invoice:

(i) It should be made out by the seller/beneficiary, as stipulated in the Letter of Credit.

(ii) It should, unless and otherwise specified in the Letter of Credit, be made out in the name of the applicant/openers of the LC.

(iii) Description of goods must correspond with the description of goods given in the LC.

(iv) Invoice must indicate the order number/contract number/proforma invoice number and number of LC along with issuing bank’s name.

(v) The invoice value should not, invariably, exceed the LC value.

(vi) Terms of sale contract, such as FOB, C&F, CIF, etc., should be indicated in the invoice. Other particulars like Bill of Lading number, shipping marks, import license number (if any), gross weight, net weight, packing details, etc., should also be mentioned in the invoice.

(vii) If invoice is issued for an amount in excess of the amount permitted by credit (when not specifically prohibited by terms of LC), as per Article 18 b of UCPDC, the drawing should not exceed the amount of credit.

3. Bill of Lading:

Bill of lading is a transport document evidencing movement of goods from the port of acceptance to port of destination. It is a receipt issued by the ship owner or its authorized agent, stating that the goods indicated therein (quantity, quality, description, etc.) are shipped on specific date and through specific vessel and deliverable to the person mentioned therein as the consignee or to his order, after payment of all dues to the shipping company.

(i) The bill of lading should be in sets with the number of non-negotiable copies, as stipulated in the Letter of Credit.

(ii) It should bear the signature of the ship owner or its authorised agent.

(iii) The description of goods should correspond with the requirements in terms of Letter of Credit and as mentioned in the invoice.

(iv) Bill of lading should bear the Letter of Credit number along with the name of the issuing bank.

(v) Payment of freight should be clearly indicated in the Bill of Lading, as per the requirement of the Letter of Credit.

(vi) The Letter of Credit should call for “shipped on board” Bill of Lading, and accordingly, the BL should bear such clause.

(vii) It should be drawn to the order of the shipper, blank endorsed or in favour of the issuing bank, as stipulated in the Letter of Credit.

(viii) The date of shipment should be within the date stipulated in the Letter of Credit.

(ix) Partial shipments or trans-shipment, if permitted in the Letter of credit should be clearly indicated in the Bill of Lading.

(x) The gross weight, net weight should be as indicated in the invoice.

(xi) The BL should not generally be dated prior to the date of issuance of LC, unless specifically provided therein.

(xii) The BL should not be claused, unless specified permitted under the LC.

4. Insurance Policy/Certificate:

(i) It must be issued and signed by the insurance company or their agents. (Article 34a)

(ii) It should not be issued by the broker. (Article 34b)

(iii) The date of issuance of insurance must be on or before the date of shipment or it must be endorsed by specific notation that the cover is effective from the date of shipment. (Article 34c)

(iv) The currency of issuance must be same as the currency of LC. [Article 34f(i)]

(v) Unless otherwise specified, it should be issued for an amount of 110% of CIF/CIP value of goods. (Article 34f(ii))

(vi) The policy should clearly indicate the voyage it is covering, i.e., the port of shipment, port of destination and should also mention the point of termination of insurance coverage.

(vii) Claims should be made payable in the country of applicant.

(viii) All originals (if issued more than one) must accompany the documents.

(ix) The policy must be blank endorsed.

(x) The description of goods in the insurance policy/certificate should be in conformity with that given in the LC.

5. Certificate of Origin:

Certificate of origin determines the origin of goods. It must be issued and signed by an independent authority, such as Chamber of Commerce, informing origin of goods, value, invoice number, Bill of Lading number, etc. Details appearing in the certificate of origin must be consistent with other documents. It must be ensured that origin of goods is not from any war-fighting country, i.e., consisting of banned hazardous goods.

6. Packing List, Weight List and Other Documents:

All other documents like packing list, weight list, Phytosanitory Certificate for goods meant for human consumption (eatables), shipping company’s certificate, beneficiary’s certificate, etc., should be made out as per the terms of the LC. All documents must be consistent with each other.

Essay # 7. Standby Letter of Credit (LC):

International trade has been dominated by LC transactions, whereby the seller is assured of payment by submitting documents in compliance and conformity with the terms and conditions of the letter of credit. Standby Letter of Credit has often been used in situations where there is ‘non-performance’ or to put it in a layman’s word, almost a substitute of guarantee.

The usage of standby LC is mostly witnessed in countries like the USA, where guarantees are not used, and standby LC acts as a substitute for guarantee. This type of Letter of Credit is opened by banks in countries, where there is restriction on issuance of guarantees and therefore stand-bys provide a suitable substitute for performance or financial guarantees. The documents required are bare minimum, like proof of delivery of goods, proof of nonperformance or simple claim form.

However, until very recently, its usage was very much restricted in India, but, with several measures being adopted to liberalise the trade regulations and simplify procedures for imports, the Reserve Bank of India, has approved to adopt International Standby Practices (ISP- 98), a set of rules, relating to standby LCs, formulated by International Chamber of Commerce in 1998. A such, it is now in order for the authorised dealers to issue stand by LCs, either under ISP-98 or UCPDC-600, as agreed upon mutually by the parties concerned.

Usage of Standby LC by Authorized Dealers:

Banks can establish stand-by LC for the following transactions:

As a document of promise in respect of ‘non-performance’ situation especially as a substitution to the guarantees which Authorized Dealers are permitted to issue under FEMA, 1999, such as issuing a guarantee in respect of any debt, obligation or other liability incurred by:

(a) An exporter on account of exports into India

(b) Owed to a person resident in India by a person resident outside India for a bona fide trade transaction, duly covered by a counter guarantee of a bank of international repute/resident abroad.

(c) Exporters may also opt to receive stand by LC in respect of exports from India.

Commercial Standby LC for Import of Goods:

Banks have been permitted by Reserve Bank of India, to issue standby LCs towards import of goods into India. Since standby LCs covering import of goods are susceptible to certain attendant risks in the absence of evidence of shipment/insurance cover, importers should be advised and explained of the risk factors involved/chances of abuse in acceding to the request for establishment of standby LCs for import of goods into India.

The following safeguards may be taken where standby LCs is issued:

(a) The facility of issuing commercial standby shall be extended on a selective basis and to the following categories of importers only:

(i) Where such standbys are required by applicants, who are independent power producers/importers of crude oil and petroleum products.

(ii) Special category of importers, viz., Export Houses/Trading Houses/Star Trading House/Super Star Trading Houses/100% EOUs

(iii) Public Sector Units/Public Limited Companies with good track record.

(b) Satisfactory credit report on the overseas supplier should be obtained by the issuing bank, prior to issue of Standby LC.

(c) Invocation of the Commercial Standby LC by the beneficiary should be supported by proper evidence. The beneficiary of the credit should furnish a declaration to the effect that the claim is made on account of failure of the importer to abide by his contractual obligations.

Following documents must also be presented:

1. Copy of invoice

2. Non-negotiable set of documents including a copy of non-negotiable bills of lading/transport document.

3. A copy of Lloyds/SGS inspection certificate, wherever provided for, as per the underlying contract.

4. Incorporation of suitable clause to the effect that in the event of such invoice/shipping document has been paid by the authorised dealer earlier, provisions to dishonour the claim quoting the date/manner of earlier payment of such document may be considered.

5. The applicant of a commercial stand by (Indian importer) shall undertake to provide evidence of imports in respect of all payments made under standby (Bill of Entry).

6. Authorized dealer shall follow up evidence of import as provided for under FEMA, in all cases of payments made under such stand-by.

Essay # 8. Uniform Rules for Bank-to-Bank Reimbursement:

The International Chamber of Commerce has brought out the uniform rules for bank-to-bank reimbursement, set out in ICC Publication No. 525. The responsibilities of issuing bank, claiming bank, reimbursing bank and all other related parties, as incorporated in the Letter of Credit, have been specified in said rules.

General Provisions and Definitions:

A. Application of URR:

Following standard clause should be incorporated in the reimbursement authorisation by the issuing bank that it sends to reimbursing bank, to bind all the parties concerned.

‘This reimbursement authorisation is subject to the Uniform Rules for Bank-to-Bank Reimbursements drawn under Documentary Credits, ICC Publication No. 525.’

This means that reimbursing bank is bound by all the rules set up in URR, by accepting reimbursement instructions. The claiming bank is, however, not a party to it and the arrangement of reimbursement is solely between the issuing bank and reimbursing bank.

B. Definitions:

(a) Issuing bank:

The bank that has issued the letter of credit and provided reimbursement authorisation.

(b) Reimbursing bank:

The bank having accepted the reimbursement authorisation instructions from the issuing bank provides reimbursement.

(c) Claiming bank:

The bank that pays and incurs a deferred payment undertaking accept draft(s) or negotiates under a credit and presents a reimbursement claim to the reimbursing bank.

(d) Reimbursement authorization:

Instructions/authorization, independent of the credit, issued by issuing bank to a reimbursing bank to reimburse the claiming bank.

C. Reimbursement Authorizations:

The reimbursing bank is no way concerned or bound by any provisions incorporated in the Letter of Credit even if any reference has been made in the reimbursement authorisation of any terms and conditions of the Letter of Credit. The reimbursement authorisation is totally a separate transaction from the credit.

Liabilities and Responsibilities:

i. The issuing bank is responsible for providing information required to the reimbursing bank under these rules.

ii. The issuing bank must not request a certificate of compliance to be submitted by the claiming bank to reimbursing bank.

iii. The reimbursement authority must not have an expiry date.

iv. The reimbursing bank is not obliged to honour a claim, except its undertaking.

v. Reimbursement authority must be issued by an authenticated means and no mail confirmation should be sent for such tele-transmission.

vi. Reimbursement authorisation must state that they are subject URR-525 and must contain:

(a) the credit number,

(b) the currency and amount,

(c) additional amount payable and tolerance, if any,

(d) the name of the claiming bank, and

(e) the party responsible for payment of charges – both claiming banks and reimbursing banks.

vii. Reimbursement authorisation must be precise and complete and should not accompany copy of documentary credit.

Authorizations, Amendments and Claims:

i. All reimbursement authorizations and amendments must be issued in the form of authenticated tele- transmission or signed letter and no mail confirmation should be sent.

ii. All authorizations and amendments issued must be complete and precise.

iii. The reimbursing bank has every right to accept or reject any amendments.

iv. Except in cases, where a reimbursement undertaking has been given, the issuing bank can, at any point of time, cancel or amend its reimbursement authorisation, by issuing notice to the reimbursing bank.

v. An irrevocable reimbursement authorisation cannot be amended or cancelled without the agreement of the reimbursing bank.

vi. The reimbursing bank cannot cancel or amend reimbursement undertaking without agreement with the claiming bank.

vii. The claiming bank must claim reimbursement in the form of tele-transmission unless specifically prohibited by the issuing bank or by signed letter.

viii. If a time draft is required to be submitted by the claiming bank, the same must be accompanied by the reimbursement claim.

ix. Reimbursing bank shall have reasonable time, not exceeding three banking days, to process the claims.

x. In case the reimbursing bank decides not to reimburse the claim, it must inform the claiming bank and the issuing bank by expeditious means (preferably tele-transmission).

xi. The reimbursement claims should not be presented more than 10 days prior to due date, if any, for claiming reimbursement.

Miscellaneous Provisions:

i. All claims for loss of interest, loss of value, due to any exchange rate fluctuations or claim of any charges, or any other loss resulting due to non-fulfillment of obligations by the reimbursing bank, should be settled between the claiming bank and reimbursing bank.

ii. The reimbursing bank’s charges should normally be for the account of the issuing bank. In case the charges are to the account of third party, information should be provided by the issuing bank in letter of credit and reimbursement authorisation.

iii. The issuing bank shall be bound by and should indemnify the reimbursing bank against all obligations and responsibilities imposed by foreign laws and usages.

iv. Reimbursing bank assumes no responsibility for the consequences arising due to delay or loss in transit of any message, interruption of their business by the act of god, riots, commotions, insurrections, wars or any other cause beyond their control or by strike or lock out.