In this essay we will discuss about:- 1. Investors’ Worries about Indian Stock Market 2. Investors’ Opinion on Certain Aspects of Capital Market Regulation 3. Investors’ Suggestions to Create Awareness about SEBI 4. Investors’ Expectations of Further Reforms.

Investors’ Worries about Indian Stock Market:

The stock market is a sub-system of the economic system and it itself is made up of many subsystems. The problem that may arise in any sub system may affect the whole system in the end. Hence identifying and solving the problem requires a proper understanding of the nature, extent, seriousness and the root cause of the problem.

Economic liberalisation envisaged a growing role for the stock market in the economy. However, this vision went awry because its implementation did not pay adequate attention to individual investors’ concern. We are witnessing the phenomenon of retail investors gradually withdrawing from the stock market.

To find out the possible causes behind this withdrawal and to get some idea of the specific causes the analysis tried to find out from the investors’ their greatest worries about the stock market. Their replies pinpoint the problems, which pinch them the most.

The investors were requested to indicate their two most important worries about Indian stock market. Their responses were ranked according to the number of investors identifying the particular worry as their greatest. The greater the number of respondents ticking a particular worry as their greatest worry, the more important should that worry be regarded for the investors as a whole. A good idea about the root causes underlying the erosion of investors’ confidence in the stock market is provided by an analysis of the investors’ responses.

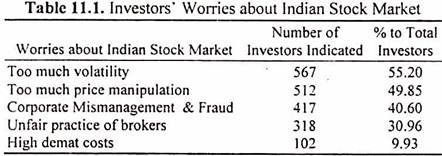

The investors’ worries about Indian stock market are given below in Table. 11.1:

The Table 11.1 ranks the investors’ greatest worries of the Indian stock market. It can be seen that their biggest worry is ‘too much volatility’.

Volatility plays a key role in assessing the risk/return trade-offs and forms an important input in asset allocation decisions. It is widely accepted that large fluctuations in market returns carry important negative effects on risk-averse investors.

Besides, they have important economic implications, especially for the overall domestic investment, and for the flow of funds from abroad. Volatility is caused by a number of factors ranging from technical or short-term to fundamentals.

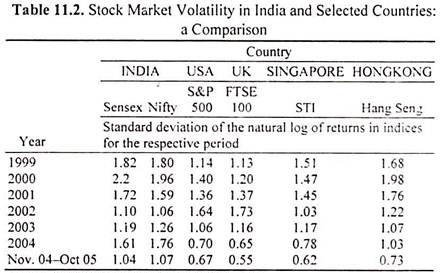

The Table 11.2 brings out the stock market volatility across indices of different countries. Historic data shows that traditionally, stock market volatility in India has been higher than in other countries. High volatility attracts speculators and drive away genuine investors. It can be seen that Indian stock market’s volatility is on the decline. However, still it is far high compared to the other countries given in Table.

More than half of the investors of this analysis have indicated the problem of volatility as their top most worry. The intra-day volatility during the year 2005-06 reached peak magnitude of 600 to 800 points in BSE Sensex. This has caused much indignation among investors.

To contain this volatility SEBI has taken several measures. As a step in this direction it has introduced an index-based market wide circuit breaker system, which applies at three stages of the index movement either way at 10, 15 and 20 percent. These circuit breakers monitor the movement of equity and equity derivative markets.

The next major worry among investors is ‘too much price manipulation of stocks’. SEBI has an extensive Stock Watch System, a system with a common framework across all the stock exchanges in place. The objectives of this system are to give suitable indicators for the detection of potential illegal or improper activities to protect investor confidence and integrity of the securities market and its players.

This system also generates on-line and off-line alerts based on order and trade related information during the trading hours and the trade related information at the end of the day respectively. Despite the presence of these protective systems, persons with stakes are able to manipulate the price of stocks. The two issues ‘too much volatility’ and ‘too much price manipulation’ when considered together are the greatest worries of the Indian investors.

The next big worry identified by the investors is fraudulent company managements. The regulatory measures against corporate malfeasance and mismanagement are absolutely inadequate. There is need for more drastic reform of the corporate governance system from the view point of its accountability to the ‘minority’ shareholders.

A special reason for this is that the government has allowed promoters of companies in India to hike their voting strength above 50 percent of a company’s share capital in easy ways, like creeping acquisition and buy back of shares, thus reducing all ‘outside’ shareholders, including financial institutions, to a minority status.

This has made it more difficult even for institutional shareholders to act as an effective check against excesses and abuses committed by promoters of Indian companies. Such excesses have continued to be everyday occurrence in India. The corporate mismanagement and fraud thus was one of the greatest worry indicated by nearly 41 percent of investors.

The unfair practices of brokers worried nearly 31 percent of investors. The information collected on ‘the problems investors face with brokers’ throws light on the various unfair practices being practiced by them. A large number of investors have said brokers maintain common pool account wherein they keep the shares of several of the clients.

Because of this delivery positions get confused, dividends declared are not accounted and delayed crediting of shares to demat accounts arise. Further there are also other complaints such as higher charges, wrong execution of instructions, fixing sudden margins etc. against the brokers. These practices of brokers are another source of worry to the investors.

The data reveals that investors are not that much worried about the cost of dematerialization. Only 10 percent of the investors have said it as one of their greatest worries.

Investors’ Opinion about Capital Market Regulation:

The Indian capital market with its regulator SEBI at apex level has seen several changes over the past decade. These changes have far-reaching consequences on the Indian stock market. The investors feel the regulations in their day-to-day dealings.

In this context, it is felt that it would be apt to enquire the investors’ perspective of the capital market regulations in our country. In this backdrop, the investors were asked to opine on the capital market regulation in India from five options ranging from excellent to very poor.

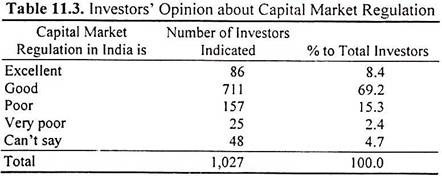

The investors’ response is given in Table 11.3.

It is obvious from the Table 11.3 that more than three fourths of the investors feel good about the capital market regulation in our country. Of them, nearly eight percent have given excellent rank and the rest nearly seventy percent have said the regulation is good. This is a congratulatory message for the SEBI for its remarkable regulatory service to the Indian capital market.

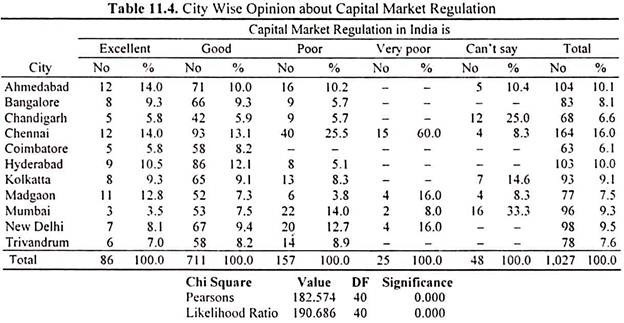

A little less than one sixth of the investors are not satisfied with the regulations. To further analyse this opinion across geographical area, the responses were classified based on the city of dwelling of investors. The resultant response is given in Table 11.4.

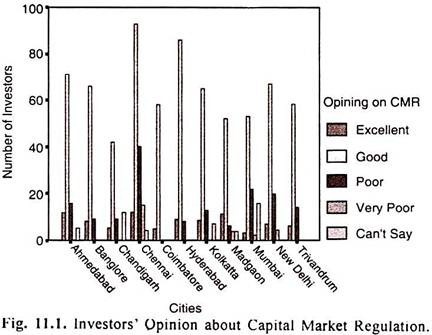

Table 11.4 reveals that investors from Ahmedabad have given a higher proportion of excellent rank and investors from Chennai have given a higher proportion of very poor rank to the capital market regulation. The investors from Bangalore, Coimbatore, Hyderabad and Trivandrum have not given any negative opinion for this question.

One third of ‘cannot say’ opinion investors were from Mumbai. Thus, the investors from different cities were different in their opinions on capital market regulation in India. The Chi square value of 182.574 is significant at 0.000 levels indicates that the differences among the investors from different cities on the basis of their opinion on capital market regulation are highly significant.

Investors’ Opinion on Certain Aspects of Capital Market Regulation:

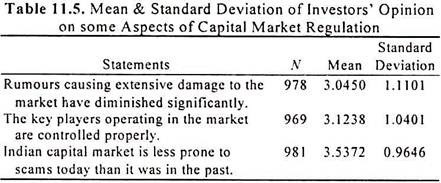

This analysis tried to bring out the investors’ opinion ‘from strongly agree to strongly disagree’ on three statements related to capital market regulation. Their responses were analysed using mean values. The mean values and the standard of deviation of the investors’ responses from mean values are given in Table 11.5.

The Table 11.5 reveals that the investors neither agree nor disagree to the statement ‘rumours causing extensive damage to the market have diminished significantly’. However, they slightly lean towards agreeing to the statement that key players such as issuers, merchant bankers, depository participants, brokers are controlled.

They move much more towards agreeing when it comes to the statement ‘Indian capital market is less prone to scams today than it was in the past’. This shows that they are getting confidence in SEBI and its regulation and they hope there is a lesser chance for the recurrence of scams like that of previous years.

Investors’ Grievance Redressal:

As regards grievance of investors, SEBI has a separate Investor Grievance and Guidance Division at Head Office. The grievance letters received by this Division are classified under different categories like non-receipt of dividend, non-receipt of bonus shares, collective investment schemes etc.

These letters are forwarded to the companies concerned with an advice to solve the investor’s grievance. An acknowledgment for the grievance received along with the action taken on the complaint is sent to the investor.

In order to strengthen investor confidence and market safety, the Central Coordination and Monitoring Committee (CCMC) has been set up as a joint mechanism of both SEBI and Department of Company Affairs (DCA), Government of India to initiate actions against companies which do not comply with the conditions of the listing agreement and which are not physically traceable at the registered office address. Both SEBI and DCA have referred the cases of defaulting companies to respective State Governments for strict action under the IPC or under the Investor Protection Act, if any.

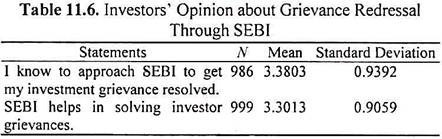

In this background, the investors’ knowledge to approach SEBI to get their grievance resolved and their opinion about SEBI in helping them to solve their grievances are discussed. The investors were asked to express their opinion on likert type statements with scales ranging from ‘strongly agree’ to ‘strongly disagree’. Their opinions were analysed. The mean values and standard of deviation of them are given below in Table 11.6.

The mean values of investors’ opinion indicate that they neither agree nor disagree with these two statements. However, these values can be interpreted that they are towards agreeing. The modal value is 4.00 for the first statement and the mean value coupled with this information indicate that a large number of investors know how to approach SEBI to get their investment grievance resolved.

The modal value for the second statement is 3.00 and its mean value put together with this modal value indicates that a large number of sample investors are not sure of SEBI helping them in getting their grievances solved. Some of the suggestions given by investors on ‘how to create awareness about SEBI?’ reflect their opinion on the second statement. A fair number of investors have said ‘SEBI should take steps to resolve the grievances of investors rather than acting like a post office only transmitting letters from investors to companies.’

Investors’ Suggestions to Create Awareness about SEBI:

With the information available through the above two statements it is imperative on the part of SEBI to reach the investors, to educate them and to help them in getting their grievances resolved. But how to reach them? The question was put to the investors themselves. The investors were asked to suggest ways to create awareness among investors about SEBI helping them to resolve their grievances. 42 percent of the sample investors gave some suggestions.

Their suggestions are listed below:

(a) Through media—newspapers, magazines and particularly through business channels of television.

(b) Through e-mail addresses available with Depository Participants.

(c) Holding investors’ meeting in various cities and small towns.

(d) Investor care centers.

(e) Make it part of the curriculum at higher secondary level.

(f) SEBI must have a toll free number.

(g) Through fortnightly/monthly magazines for investors.

(h) Investor education through free CDs.

(i) Through brokers awareness about SEBI can be created.

A large number of investors want SEBI to put through the information relating to investor protection on newspapers, in local vernacular newspapers along with English and business dailies and in common local language magazines. They want this message to be put in business television channels such as NDTV Profit, Times Now, News Today, etc. during the trading hours.

Further, the job of spreading of the SEBI related information may be given to depository participants who have the email addresses of the investors. Some of the depository participants produce their own journals and circulate them among their investors free of cost. For example the Integrated Enterprises (I) Ltd., issues ‘SHARE NEWS’ to all its account holders. Thus, through depository participants this message can be spread effectively.

Some more interesting suggestions too have cropped up. This includes, SEBI to have a ‘Toll Free Number’ for investors to put through their problems across to SEBI directly, to include investor protection by SEBI as a part of curriculum at higher secondary or degree level, creation of investor care centers in various cities, distributing compact discs with SEBI’s investor protection measures and model forms if any free of cost through depository participants.

Also, SEBI can take the brokers help to disseminate this information. The brokers may be asked to display SEBI related information in their offices so that the investors dealing through them will get some knowledge about SEBI. The investors’ suggestions on the above lines if implemented may impart more knowledge about SEBI and its investor protection measures among investors.

Investors’ Expectations of Further Reforms:

Investors were requested to give their suggestions about further areas in which capital market reforms need to be introduced. They responded enthusiastically.

Some of their suggestions are grouped under suitable headings and listed below:

IPO Related:

I. IPO Pricing is arbitrary. Controller of Capital Issues be brought back.

II. IPO rating to be made mandatory.

III. Alternative process like auction method of issuing shares for Qualified Institutional Bidders and Book Building at 10% discount to QIB price for retail investors may be considered.

IV. Price protection (safety net) to retail investors may be given for at least 3 months, so that he can exit from the stock if he wishes to do so.

Promoter Related:

I. Accountability of promoters should be fixed.

II. Criminal proceedings and punishments must for promoters and directors for acts of fraud.

III. Buy back provisions should be removed. Delisting of securities must be stopped.

Broker Related:

(a) Effective monitoring of brokers and price manipulation in stocks.

(b) Brokers should not be allowed to maintain demat account of investors.

(c) Code of conduct for brokers should be developed.

(d) Service tax and turn over tax are to be borne by brokers not to be charged to clients.

Demat Related:

I. Reduction in demat costs.

II. Custodial charges, maintenance charges, holding charges etc. are charged in one way or other and no reduction was done.

III. Demat account should be made free of charges like Savings account with banks.

Company Related:

I. Accreditation based on progress over previous year’s performance of the company, complying with corporate governance code prescribed by SEBI by the company and service to the investors.

II. Sharing strategic planning and other vital information relating to company with shareholders.

III. Punctuality in publishing annual reports.

SEBI Related:

(a) Stringent action against directors of vanishing companies.

(b) Data on vanished companies must be made available along with action taken by SEBI.

(c) Based on stock exchange certification regarding non-traceability of a company, the share value destroyed should be treated as long-term capital loss, which should be allowed to be adjusted against short-term gains.

(d) A fund on the line of Trade Guarantee fund should be created for the protection of investors in the event of a company becomes defunct or disappeared or delisted or liquidated as of Global Trust Bank.

(e) Dependency of market on FIIs should be curtailed.

(f) Investment in IPOs be made tax free or least taxed.

(g) Introduction of T + 1.

(h) Direct credit and debit to and from a dedicated account.

(i) All listed companies shares must be traded at least once a week.

(j) Steps to take Capital market to semi-urban and rural areas.

(k) Prevention of publishing of tips, false news, and misleading analysis by newspapers and magazines.

(l) Protection to retail investors through Corporate Governance.

(m) Reforms should be introduced to restore investor confidence.