This essay provides a note on managerial economics:- 1. Introduction to Managerial Economics 2. Principles of Managerial Economics 3. Techniques.

Essay # Introduction to Managerial Economics:

Business Management and Economics have always been closely related; in fact, most schools of business have their origins in departments of economics. Yet, the viewpoints of the economist and the manager have, until recently, been different. The economist has been concerned chiefly with the functioning of the economy as a whole and social issues such as monopoly and competition, tax policy, the pricing system, and the distribution of income. The manager has been concerned primarily with maximization of profits, from the viewpoint of the individual firm, and with such company policies as pricing, wage payments, market share and employment of resources.

Both the economist and manager, nevertheless, face similar problems of using scarce resources in the satisfaction of human wants. Both concentrate on the analysis of demand characteristics and supply factors, but the manager must orient his thoughts to making decisions in business operations. Managerial Economics, therefore, may be defined as the management’s application of economic principles in the decision-making process.

Essay # Principles of Managerial Economics:

The four economic principles that managers should keep in mind daily are:

(1) The Incremental Principle:

A decision is sound if it increases revenue more than costs or if it reduces costs more than revenue.

(2) The Principle of Time Perspective:

A decision should take into account both the short-run and long-run effects on revenue and costs, giving appropriate weight to the most relevant time period in each individual decision.

(3) The Opportunity Cost Principle:

Decision-making involves a careful measurement of the sacrifices required by the various alternatives.

(4) The Discounting Principle:

If a decision affects costs and revenues at future dates, it is necessary to discount these costs and revenues to present values before a valid comparison of alternatives is possible.

Essay # Techniques of Managerial Economics:

The manager should have knowledge of the following:

(1) Break-Even Analysis:

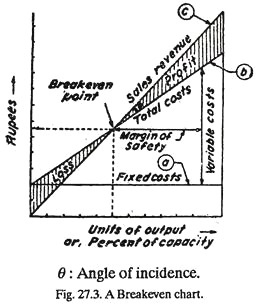

Revenue and cost can be studied by directing attention to total revenue and total cost. Breakeven analysis implies that at some point in the operations, total revenue equals total cost. Basically, breakeven analysis is concerned with finding the point at which revenues and costs agree exactly-hence the term BREAKEVEN (point).

The breakeven point is, therefore, the volume of output at which neither a profit is made nor a loss is incurred (Fig. 27.3).

The breakeven analysis can be carried out algebraically or graphically.

Breakeven analysis helps solving the following types of problems:

(a) What volume of sales will be necessary to cover:

(i) A reasonable return on capital employed;

(ii) Preference and ordinary dividends; and

(iii) Reserves.

(b) Computing costs and revenues for all possible volumes of output to fix budgeted sales.

(c) To find the price of an article to give the desired profit.

(d) To determine variable cost per unit.

(e) To compare a number of business enterprises by arranging their earnings in order of magnitude.

(2) Demand Analysis:

Demand:

A schedule that shows the amounts that would be sold at various prices, in a given place, and on a given date.

Forces that determine the demand for a firm’s product include:

(a) The desires of the customers,

(b) The income of the customers,

(c) The prices of substitutes, and

(d) The characteristics of the market.

Any estimate of demand for a given product must be based upon estimates of expected national and international activity and estimates of the factors that effect the demand of the industry.

The manager is interested in demand because of the need to understand the external factors that affect decisions and policies.

Specifically, three subjects are important as background for price decisions:

(a) Elasticity of Demand:

Keeping in mind that demand is a schedule of price-quantities, the most important concept in demand analysis is elasticity. In general, elasticity may be defined as the percentage change in a dependent variable determined by a given percentage change in an independent variable.

Price elasticity of demand is the most common application of this concept. it describes the effect of a given percentage change in price (P) on the percentage change in quantities (Q) that would be purchased, i.e.

where Q1 and Q2 are quantities that would be taken before and after a price change, and P1, and P2 are the corresponding prices. Price elasticity indicates the responsiveness of a change in quantity to change in price.

Elasticity of demand is an important concept in the determination of price policies.

(b) Determinants of Changes in Demand:

Elasticity describes the nature of demand at a given time; changes in demand refer to shifts during a period of time. Managers should be aware of those factors that cause changes in demand. A primary means by which a manager can attempt to increase demand is through advertising and sales promotion.

(c) Forecasting Demand:

The manager must forecast future demand.

Forecasting may be oriented to:

(1) Estimating economic conditions in the near future or

(2) It may be directed toward estimation of specific quantities that will be sold in various markets.

The individual demand for a given firm depends upon the health of the total demand in the economy; therefore a first step is to forecast the conditions of the economic environment. A second step in forecasting the demand for a given product usually concentrates on the total demand for the industry.

The demand for the industry can be analyzed by individual components such as:

(1) Sales of products to new customers (for example, sales of refrigerators to people who do not have it),

(2) Sales of additional products to old customers (for example, a second refrigerator),

(3) Replacement sales for products that have worn out, and

(4) Sales affected by recent technological developments (e.g., frost-free refrigerators).

A third step in forecasting the demand for a given company is the estimate of the market share of the particular company. Past shares of the market may serve as the basis for this step. Adjustments, however, should be made by forecasting the effect of new programs planned by the company, expected reactions of competitors to the company’s actions and to industry conditions and detailed reports by salesmen in different localities.