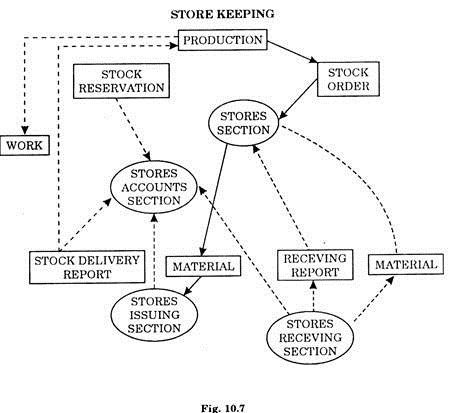

Read this essay to learn about the five important activities of stores department in an organisation. The activities are:- 1. Receiving 2. Stores Section 3. Issue Section 4. Accounting Section 5. Stock Taking or Checking.

1. Essay on Receiving:

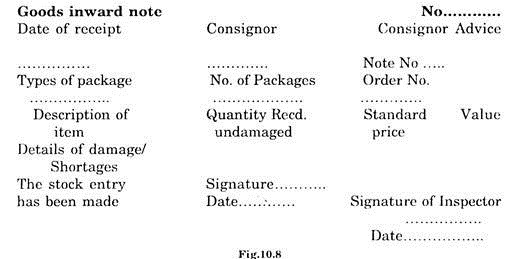

The items ordered by purchase department are received by this section. The supplier delivers the items along with other documents to receiving section of stores department. The consignment is properly checked and entered in goods inward note. The discrepancy if any is also recorded in this note.

Receipt System:

When a purchase order is placed, a copy of it is sent to the stores department indicating quantity and delivery date. The purchase orders should be arranged chronologically so that total volume of receipts at any time may be estimable.

Outside Suppliers:

On dispatching items, normally send an advice note to the stores showing date of dispatch, carrier details, description of the consignment and the value of items. This ensures quick and easy clearance of bills etc.

The purchase copy, suppliers note and transporter information/consignment note enables the store’s manager to organize and plan for expeditious clearance of materials and minimise costly demurrage.

Internal Suppliers:

Whenever materials are received from internal divisions or returned from user departments transfer notes and returns to stores documents are usually used for this purpose.

The format of the goods inward note is shown below:

Receiving section in stores department can be centralised, semi- centralised or decentralised. In a centralised receiving department all categories of items are received, checked and inspected at one common place. In semi-centralised light weight items are received, checked and inspected at one common place whereas heavy weight or items of unmanageable size are received, checked and inspected at the place of storage.

In both cases the records are maintained in the same stock book. In a decentralised system all items are received, checked and inspected by their respective departments.

The building where receiving section is located should have sufficient space for loading, unloading and inspection of the consignments. Receiving and dispatching sections should be at a distance from each other to avoid- confusion among incoming and outgoing items.

In case of stores keeping of finished goods, the up to date position of stocks inside the stores should be regularly communicated to marketing department of the organisation.

2. Essay on Stores Section:

This is a place where all materials received by the stores department are kept with protection against deterioration and pilferage. They are stored in such a way that their location is easily identified at the time of issue. According to Kimball and Kimball, “A well developed stores system necessitated a system of identifying nomenclature so that location of all materials is easily found.”

Now the various stores operation viz. location, procedure layout, equipment and identification of stores section are described in detail:

(a) Location in Stores Section:

Stores are to provide space to the materials till these are issued to the, respective departments of the enterprise. Stores are in the form of covered sheds, buildings and open space. Generally the storing place should be situated near the operating departments but there are many other considerations, which influence their location, e.g. certain categories of items like explosives or other sensitive items should not be stored with general class of items.

Gaseous items like oxygen cylinders etc. should be stored in more protective sheds. Some items may require air-conditioned space or space at some desired level of temperature.

(b) Working Procedure:

The stores in-charge receives the materials from receiving sections along with goods inward note. The material is classified and coded according to their nature and use. The coded sign is inscribed on the items for identification. Items may also be identified by different colours.

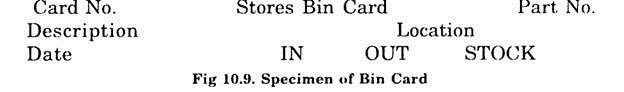

The items are then stored at assigned shelves or places inside the store. For quick and easy identification of the item’s category, a bin card is tagged with each shelf.

The bin card contains upto date information about the receipt, issue and balance of the respective item in the stock. The materials from store section are issued to respective departments on the instructions from dispatch section.

(c) Layout of Stores Section:

The layout of the stores section should be conducive to the materials to be stored and equipment viz. shelves, racks, almirah, handling equipment etc. There should be enough space for materials handling and labour movement.

A good stores layout is characterised by:

(i) Flexibility in arrangement.

(ii) Convenience in physical counting of materials.

(iii) Items used sparingly should be easy to locate.

(iv) Efficient protection against deterioration and pilferage of materials.

(v) Better stock control but minimum routine work like record maintenance etc.

(vi) Efficient use of floor space and height.

(vii) Safety from hazards, insurance etc.

(viii) Proper illumination and ventilation.

(ix) Proper security arrangements, so that no person other than stores staff can enter the store.

(x) Heavy and bulky items should be stored as low as possible.

(xi) Shelves and bins should not be very deep.

(xii) Minimum handling and transportation of materials.

(d) Stores Equipments:

A good store is equipped with various tools/equipments for handling, measuring and weighing the materials. The equipment should be such that stores investment and operating- expenses are reduced.

The various modes of storing are open and closed shelves, cabinets, stacking, pallets and skids, bins, stacking boxes, gravity feed racks, outdoor platforms etc. The facilities can be of wood or steel. Wooden equipment is safe for delicate items and can be installed quickly. It is inexpensive but is rather inflexible. Steel equipment is more flexible with advantages of more strength, fire resistance and easy maintenance.

(e) Material Handling Facilities:

These basically depend upon the nature of items as well as the size and shape of the storage space. It also depends on how much frequently an item is used in production operations. The material handling equipment’s in stores can be trolleys, mobile jigs, cranes, conveyer belts etc.

There should also be proper weighing and measuring instruments at the time of receiving and issuing the materials.

(f) Identification of Materials in Stores:

“There should be a ace for everything and everything should he in its place“. Provision of a good identification system in stores assists those who try to keep everything place. Depending on the size and nature of the organisation, the store can be a variety of items in stock.

It may not be possible to remember and locate these items inside the store simply by their names. The task can be simplified proper coding of the items as well as their location.

Identification can be one by:

(i) Tagging some piece of paper or cloth with the items.

(ii) Labels may be fixed on the items.

(iii) The coded number or any other identification mark may be embossed on the items.

(iv) Painting or colour coding of items.

Advantages of coding items:

(i) An asset in keeping records.

(ii) Facilitates quick identification.

(iii) Mechanized accounting is possible.

(iv) Eliminates the chances of duplication of items. Methods of Coding:

Generally alphabets, numerals or a combination of the two is used for codification of items.

The following methods can be used for code construction:

(a) Mnemonic Method:

Here alphabets closely associated with name of the item are used e.g. MT can be used for some metallic item. This method is useful when few type of items are to be stored.

(b) Random Method:

Here both alphabets or numerals can be used randomly. But the method is rather arbitrary.

(c) Scientific Method:

The items are divided into a number of groups and each group is given some code. Then further sub-grouping is done on the basis of classification of item in any group, its shape, function etc. Then complete code of the item is written by combining the sub-codes of groups and sub-groups for that item.

Location Coding:

Storeroom is divided in blocks of storage units and each block is identified by lateral block letter and a longitudinal block letter Within each block every row of shelves is given a number. Each row divided vertically into columns and horizontally into shelves. Blocks and Rows are identified by painted signs.

Sometimes items requiring special protection for storages viz. rust/corrosion proof space for metal parts are stored in dry areas. It is an asset for easy and quick location of items when the size of the store is very big. Each place is coded by alphabets or numerals. The location can be identified in terms of the number of the warehouse, row number, column number, rack number, shelf or bin number etc.

Location of any item inside the store can also be decided in three ways:

(i) Fixed Location:

Here some fixed place is designated to each class of item.

The basis can be:

(a) Supplier wise

(b) item wise

(c) utility of the item etc.

(ii) Random Location:

Items are placed according to the availability space in store at the time of receiving the items. This method can be applied when the number of items to be stored is few and storekeeper is efficient in remembering the location of each item.

(iii) Zonal Location:

Generally the whole inventory is divided into three Zones namely:

(a) Bulk Zone,

(b) Reserve stock and

(c) Indirect material like spares and consumable items.

This approach fries to avail full benefit of the space and other storage facilities.

3. Essay on Issue Section:

This section handles the issue of materials when required by some department of the enterprise. A storeroom does not always issue a material in the same units in which it is purchased as the materials are purchased in gross and issued in dozen.

The standard unit of issue for a material is usually defined as the smallest quantity likely to be issued inventory is always recorded in standard units. Some items like powdered material, nails, screw etc. can be dispensed more efficiently of weight than by actual count.

Materials carry some money value and in order to avoid malpractices and to curb the tendency of waste, the items should be issued against proper requisition. The material requisition is a request to the stockroom to issue materials. It gives details of the type and quantity of the material, the use to be made of them and is duly signed by some authorised person.

The requisition should be properly checked and scrutinized before the issue of the material. The stock clerk puts the identification number of the desired materials on the requisition and passes it to the stock record clerk.

The record clerk subtracts the amount of material issued from the record card. Calculates the balance in stock and sends it to the accounting department. The accounts clerk subtracts the value of the account for which material is issued.

On the basis of the requisition, the stores staffs finally collects the items from the stores and send them to the requisitioning department. All requisitions must be posted daily on the bin cards and the stock control cards. The fresh balance is struck on every receipt or issue.

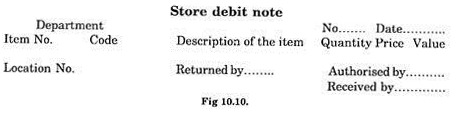

In some cases due to economy measures and convenience in handling operations the quantity of the material issued from the stores is more than the amount requisitioned from the concerned department. In such cases the charge is made for the actual quantity issued. Similarly when excess materials are returned to stores a stores debit note or shop credit note (fig. 10.10) is repaired to ensure the proper record and entry of the item in stores.

Methods for Pricing the Materials Issued:

Each item inside the inventory has some value associated with it. This value depends on the price, duration of the item inside the inventory, procurement cost, storage costs etc. Generally the time of purchase and time of issue of any item are different and the market prices of the items also vary with time.

Thus for costing purposes the problem of pricing at the time of issue is of great significance. The fundamental consideration in this problem is whether the price of the item in market at the time of purchase or price of the item in market at the time of actual issue or a compromise between the two should be adopted or not.

Before entries are made to the stores ledger for the materials issued, it is necessary to determine the price to be charged and the concerned departments are debited with it. When materials are made into products, their money value is taken out of the materials account and added into the account showing the value of the work in process. There are many methods of pricing.

Some of them are given below:

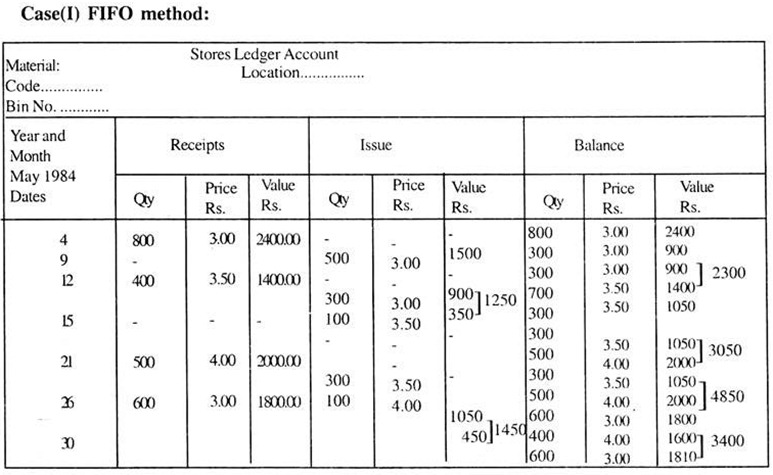

(1) First in First Out (FIFO) Method:

Here the materials are issued in the same order in which these arrived in the store i.e. first arrived item will be issued first. Thus the oldest price is applied first to value the issued material.

When the material having the oldest price is fully exhausted, the next oldest price items are issued and the corresponding price is used in valuation. This method of valuation is useful for the organisation in periods of fall in price of the material. The method is simple and easy to apply in practice. If there are frequent price fluctuations then there is possibility of clerical errors in this method.

Advantages of FIFO method:

(i) Actual cost of the item is used in pricing.

(ii) Method is appropriate for those items, which are likely to deteriorate or become obsolete with time.

(iii) In case of falling price it inflates the issue price.

Disadvantages of FIFO method are:

(i) Issue price of the same item may be different if used by different departments and issued from different lots.

(ii) The price charged is not related to the current market price of the item.

(iii) Frequent price fluctuations may lead to increase in the work of stores department.

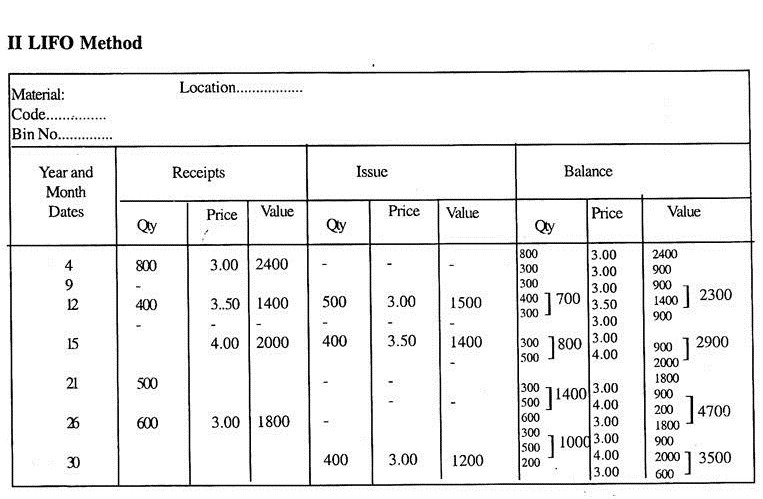

(2) Last in First Out (LIFO) Method:

It is just opposite of FIFO method. Here the item entered last in the store is issued first and the corresponding price is also charged from the department.

(3) Average Cost Method:

Here the average cost of the material in stock is calculated by dividing the total value of items available in stock by the number of items in stock. Here average cost is used for the valuation of issued material. The main disadvantage of this method is that whenever fresh lot of items arrives in the stock the average cost has to be revised again.

The following example illustrates the valuation of issued material under each of the issue strategies:

Example 1:

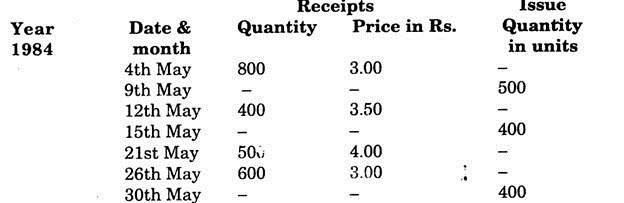

The following details about the receipt and issue of a certain item were recorded from the bin card in a store of an organisation during the month of May 1984.

Find the value of materials and their position in stocks if the method of issue is

(i) FIFO,

(ii) LIFO.

Solution:

The solution of the problem can be done in the following tabular forms.

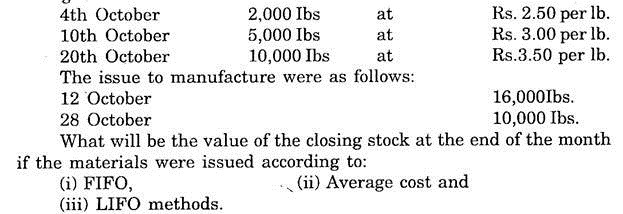

Example 2:

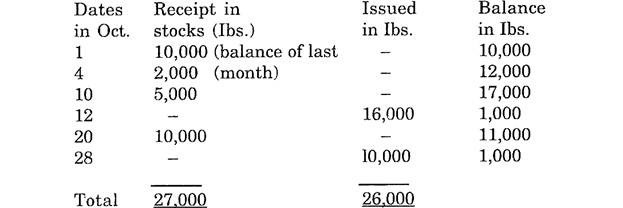

At the beginning of October, the Bombay tin company had 10,000 Ibs of tin at Rs. 2.00 per lb.

Further purchases were made during the month as follows:

Solution:

(i) FIFO Method:

The item issued at different dates and the corresponding balances can be determined in the following tabular form:

In FIFO method the balance of 1,000 units will be from the 10,000 lbs, received on 20th Oct. at a price of Rs. 3.50 per lb.

Hence the value of the closing stocks at the end of the month will be:

1000 x 3.50 = Rs. 3500.00

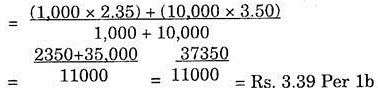

(ii) Average Cost Method:

The average price of receipts on October 10 will be

Now on 20th October 10,000 lbs. are received at Rs. 3.50 per lb and the balance in stock is 1000 lbs. at an average cost of Rs. 2.35. Hence the revised average cost on 20th October will be

No fresh stocks are received after 20th October, so the average cost of items in store till the end of the month will remain Rs. 3.39 per lb. Hence the value of closing stock of 1000 lbs. at the end of October is Rs. (1000 x 3.39) = Rs. 3390.

(iii) LIFO Method:

In this method the closing stock of 1000 Ibs will be from the balance in stock of previous month priced at Rs. 2.00 per lb. Hence the value of closing stock at the end of October will be

Rs. (1 000 x 2.00) = Rs. 2000

Other methods of valuation are:

(a) Standard Price Method:

Some standard price is fixed for each item without any consideration of its actual price. The standard price is then charged for the issued material. The fixation of standard price is based on the fluctuations in price of the item in past and expectation in future.

The procedure enables the organisation to have a costing of finished products such that possibility of losses due to price increase is minimised to a great extent.

The standard price is fixed after careful examination of the current market price, price trends and market conditions. It is fixed for some specific period, which can be a month, quarter or year. After the expiry of the period stipulated, standard price is again reviewed.

(b) Inflated Price Method:

Here the cost incurred by the stores department in receiving, encoding, storing, handling, inspection and expenses due to some normal wastages are added to the price of the material to get the inflated price.

(c) Replacement Price Method:

It is price at which the items issued can be replaced in stock at the time of issue i.e. the material issued is charged at the prevailing market price. The difference between charged price and the actual purchase price is adjusted to the “price fluctuations reserve account“. This difference reflects the performance of the purchase department.

4. Essay on Accounting Section:

The stores department has to maintain upto date account of the value of items in stock, so that correct price is charged at the time of issuing the material. Besides this the account of expenditure made on various stores operations and services is also to be properly maintained. The accounts section exercises financial control over stores.

The goods receipt book is maintained for all arrivals, making the receipt in triplicate, a copy of which is sent to accounts section and the other to the store section.

The stores section enters the details given in the receipt in stores ledger indicating date and amount of receipts as well as the price of the items. Similarly at the time of issue the details of the items are subtracted from the receipts entries in stores ledger and balance is recorded. Reputation slips are issued for each item issued from store.

5. Essay on Stock Taking or Checking:

This implies physical checking of items in store to see that these are in accordance with the entries of stores ledger. In the maintenance of store records mistakes are bound to occur due to human involvement in the process. The checking should be done by an individual not belonging to the stores department.

The checking provides a control on the activities of stores department.

The different methods of stock-checking are:

(a) Fixed Annual Inventory:

A special team is deputed to check and count the material inside the stores at the end of each financial year. The method is appropriate for organisations which have some vacations or which operate in some particular periods only e.g. sugar industry etc. In other cases this system is not desirable as there will be unwanted loss to the organisation closing the activities for stock verification.

(b) Perpetual Inventory:

In this system the stock control department maintains upto date and systematic records of each and every transaction made inside the stores department. There is system of continuous verification of stock. The entries on bin cards and stores ledger should tally with each other. In case of discrepancies thorough investigation is made.

A credit note in the case of shortage and a debit note in the case of surplus stocks is prepared and the records are adjusted accordingly.

The following are the advantages of this method:

(i) There is no need to stop the production for checking.

(ii) No dislocation in stores operations.

(iii) Checking is done in a systematic way thus reducing the chances of errors.

(iv) Mistakes, discrepancies are spotted more quickly. Important and expensive items can be checked more frequently.

(v) Facilitates the preparation of interim profit and loss accounts.

(vi) Avoids excessive inventory maintenance.

(c) Low Point Inventory Method:

In this system the verification of stocks is done during a period when the level of the inventory is at low level. The main merit of this method is that lesser number of items is to be counted which results in less effort and time is required for the checking operation. The disadvantage is that there is an unbalanced burden on the stores personnel.